Goldman Sachs CEO Lloyd Blankfein Gets 75 Percent Raise: Report

Source: Huffington Post

Angry about your paycheck shrinking this year because the payroll tax cut expired? Well, this should cheer you right up: Goldman Sachs's CEO got a 75 percent raise this year.

Lloyd Blankfein made $21 million last year, including a $2 million salary and a $19 million bonus, CNN/Money reports. That bonus includes $5.6 million in cash. Bloomberg pegs the total pay at $19 million, but what's a couple of million dollars, really?

Blankfein's haul represents a 75 percent pay increase from the year before, CNN/Money notes. It is also nearly double the paltry $11.5 million that Jamie Dimon, CEO of the nation's biggest bank, JPMorgan Chase, took home.

Unlike Dimon, Blankfein's bank did not nightmarishly botch up a massive credit-derivatives trade that cost it $6 billion, as JPMorgan did (although JPMorgan still managed to turn in a record profit). Goldman Sachs's profit nearly doubled last year, and its stock price jumped 49 percent. And as we all know, Goldman Sachs does God's work, which apparently consists mainly of trading stuff as much as possible, notes CNBC's John Carney.

Read more: http://www.huffingtonpost.com/mark-gongloff/lloyd-blankfein-pay-raise_b_2507012.html

banned from Kos

(4,017 posts)They don't want your little deposit or mortgage or credit card.

They had NOTHING to do with the mortgage meltdown. I know this offends the bank greifers but it is true.

Sekhmets Daughter

(7,515 posts)brentspeak

(18,290 posts)http://articles.latimes.com/2010/apr/27/business/la-fi-goldman-senate-20100427

Citing company documents, investigators say the financial giant used its good reputation to sell toxic mortgage-related securities to investors and then bet against the overheated market it created.

April 27, 2010|By Jim Puzzanghera, Los Angeles Times

Reporting from Washington — In its aggressive pursuit of profits, Goldman, Sachs & Co. became a key enabler of the mortgage meltdown that triggered the global financial crisis, Senate investigators said Monday as they released new documents detailing the bank's controversial actions.

The excerpts of internal Goldman documents were made public on the eve of Tuesday's hearing before the Senate Permanent Subcommittee on Investigations, at which senators plan to question Goldman brass, including Chief Executive Lloyd Blankfein, and Fabrice Tourre, the trader who is the focus of a fraud suit by the Securities and Exchange Commission.

Senate investigators said the documents show how Goldman used its gold-plated reputation on Wall Street to sell toxic mortgage-related securities to investors, then reversed course and bet against the overheated market it helped create.

"The evidence shows that Goldman Sachs helped build and operate that conveyor belt that fed toxic mortgages and mortgage securities into the financial system, and then made large bets against the market it helped create … reaping the profits from it," said Sen. Carl Levin (D-Mich.), the subcommittee's chairman. "The ultimate harm here is not just to the clients who were not well-served by their investment bank. The harm here is to all of us."

banned from Kos

(4,017 posts)in 2008. Warren Buffett bought billions in their stock at the time.

Goldman outsmarted the market and watched Lehman, Bear, and Merrill Lynch bite the dust. Goldman has always been ahead of the cycle.

You want to stack cred against Buffett? Don't be a fool.

Sekhmets Daughter

(7,515 posts)Buffett made GS a loan at 9% interest.... GS paid off the loan, the shares were collateral. Not the same thing at all.

Goldman would have gone down the tubes, just like all the rest of them had the Treasury and Fed not made loans totaling $185 billion to AIG. GS had bought, sold and held billions in derivatives, backed by mortgages that had been sliced, diced and repackaged.....No one knew what the true value of those derivatives might be. It was NOT a mortgage meltdown, it was a credit meltdown...the banks stopped lending to each other. Even your vaunted GS was in a panic.

One last thing....GS is earning profits because it is now a "Bank Holding Company" which enables it to get money a .025% interest from the Fed and use that money to invest for itself.

banned from Kos

(4,017 posts)I agree. Yes, it was a credit crisis. LIBOR soared to historic levels (because of mistrust).

You can't blame that on Goldman though. Their MBS insurer was at fault - AIG. Still, no US bank has failed due to Credit Swaps. The big culprit was AIG all along.

Goldman MAY have gone down the tubes in a total catastrophe, no doubt. But they were last in line due to the vast capital in their balance sheet and their lack of consumer deposits. There will never be a "bank run" on Goldman like there was on WaMu.

Sekhmets Daughter

(7,515 posts)No bank failed because the tax payers bailed out both the banks and AIG. Goldman would have gone down without the Buffett loan, the AIG bailout...GS collected $8 billion from that AIG bailout I believe and access to the Fed window. There was no great bank run on WAMU...the FDIC stepped in and JPM bought it for a song with government backing for most of the bad debt. Lehman wanted the same deal offered to someone willing to buy them, but Lehman was not a commercial bank so that was never a possibility.

You seem to think that because Goldman operates as an investment bank it is somehow immune to failure. GS was in more danger of failure than either Wells Fargo or JPM, both of the latter have access to a daily inflow of deposits.

All of the banks who handled the MBOs and other derivatives were to blame, that includes GS. As Hank Paulson said, they were making so much money they kept pushing the mortgage lenders to make more loans that could be sliced, diced and packaged....

banned from Kos

(4,017 posts)and yes, AIG was the biggest fool of all.

Goldman common never fell below 50ish.

Morgan was solid as a rock. Wells Fargo too.

I follow Buffett and he is Super #1 of all time on balance sheets. Fools like Taibbi are ignorant jackoffs. Goldman was worth a few billion in hindsight. That is beyond dispute.

PoliticAverse

(26,366 posts)Cynicus Emeritus

(172 posts)Corporate, bankster and political corruption is many times more dangerous to the well being of us Americans than the hyped talk of propagandists, political pundits and politicians that blame it all because of the left or right.

They use that talk to divide us while we get plundered by those who buy off the politicians.

Progressive, populist, libertarian who supports the people, not the elite.

HowHasItComeToThis

(3,566 posts)Dont call me Shirley

(10,998 posts)Response to Dont call me Shirley (Reply #4)

Post removed

Response to Post removed (Reply #9)

Post removed

Response to Post removed (Reply #11)

Post removed

Fire Walk With Me

(38,893 posts)Lord Blankcheck is doing just fine, power-grab wise.

We_Must_Organize

(48 posts)until Americans demand real change on this front. Too many Americans genuinely think they're the ones who are upper middle class when they are really barely making the median income - they just keep getting fucked in the ass with ever increasing costs and reduced benefits/ pay. I work with educated, smart individuals and they have no idea how bad the income inequality is in this country. Most thought that the top one percent had 10-15 percent of all income in the US when in fact it's closer to 35% This page gives a quick snapshot of just how clueless people are when it comes to income distribution.

http://www.ritholtz.com/blog/2010/10/estimates-of-wealth-distribution-are-widely-wrong/

And what real fucking value does people like Blankfein add to our economy? He does nothing but move money around. Yet these idiotic, poor fucking hillbillies will still vote Republican to get that evil gubmint from taxing these poor "job creators" to death.

dreampunk

(88 posts)people and corporations/banks/bank holding companes/investment houses, whatever the hell one calls them. The thing IS, they do not produce ONE SINGLE ACTUAL PRODUCT. All they DO is shuffle pretend (electronic) money around. If they fleece LESS from JQ PUBLIC this year than they did LAST YEAR, they call it LOSING MONEY. They have been gaming the society and the "system" for generations. Obama? Hell, HE AINT GONNA STOP IT! Excuse me for being quaint, but I got NO USE FOR ULTRA RICH FOLKS, and SURPRISE, they got no use for me, except perhaps buying my art.

Cynicus Emeritus

(172 posts)Four years ago the same gang of thieves and Wall St bankers were bailed out by us taxpayers, all while we taxpayers received nothing in return except an illusion that everything is now good. They should have been jailed but instead they received a perpetual get out of jail free card.

Today we schmucks are mostly poorer and they are mostly much richer. They and Bloomberg etc succeeded in neutering the OWS movement because they own our politicians.

Make no mistake they will be coming for the everything the public thinks we own, like the Grand Canyon, Yellowstone, our pension funds, Social Security....but first they want your firearms.

The NY newspaper that published the names and addresses of legal NY gun owners should have instead published the names and addresses of those classified as financial terrorists.

Progressive, populist, and libertarian supporting the masses, but never a puppet to the elite

sakabatou

(42,152 posts)Cleita

(75,480 posts)OnyxCollie

(9,958 posts)Cleita

(75,480 posts)Progressive tax rates historically have improved the economy across the board. Redistributing wealth upwards to the top 1% is destroying the middle class and their ability to purchase goods and that in turn is creating recession. Huge salaries at the CEO level means rank and file workers will earn less and have less spending power. Go read your history.

OnyxCollie

(9,958 posts)I was referring to your suggestion about a maximum wage.

Cleita

(75,480 posts)My suggestion was more tongue in cheek than anything else.

bvar22

(39,909 posts)I know these guys, "and they are just savvy businessmen."

"Its the Free Market"

"I mean, look at all the Baseball Players!"

Yes, Virginia.

There ARE Two Americas.

... and I'm sorry to be the one to tell you,

but, like the Tooth Fairy, the Invisible Hand doesn't exist either.

The RICH made up all that shit about "Free Markets" & "Free Trade" to get more money.

They made up a whole new religion too.

Like other religions, this one also demands Complete Blind Faith Obedience to an invisible deity for which no proof exists!!!

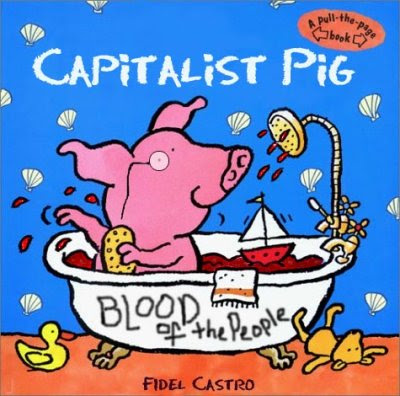

[font size=3]The Graven Image on the altar of

The New Church of the Invisible Hand![/font]

All Hail the Invisible Hand!

The Invisible Hand will save us all.

The Invisible Hand demands that we sacrifice our Working Class!

Make it SO!

All Hail the Invisible Hand!

OnyxCollie

(9,958 posts)After all, they're doing God's work.

JDPriestly

(57,936 posts)OnyxCollie

(9,958 posts)reeds2012

(91 posts)This is really happening...Take the money and run, take the money and run, take the money...

flamingdem

(39,313 posts)

Note: "Fidel Castro" means "Lloyd Blankfein" in Capitalpig Latin