JP Morgan in record $13bn settlement with US regulators

Source: BBC

US bank JP Morgan has agreed to a record $13bn (£8bn) settlement with US regulators for misleading investors during the housing crisis.

It is the largest settlement ever between the US government and a corporation.

About $4bn of the settlement is to go to homeowners hurt by JP Morgan's practices.

...

After the relief given to homeowners, $9bn will be paid to settle federal and state civil claims relating to misleading mortgage securities sold by the bank.

Read more: http://www.bbc.co.uk/news/business-25009683

I doubt it will stop them doing it again, if they can. As of this moment, their share price is up 1% today, so the market feeling is they've got away with it.

msongs

(67,405 posts)QC

(26,371 posts)Does anyone know how much of their fine will be subsidized by the taxpayers?

Eugene

(61,891 posts)Source: CNNMoney

By Jeanne Sahadi @CNNMoney November 19, 2013: 7:06 PM ET

NEW YORK (CNNMoney)

The majority of the $13 billion settlement JPMorgan struck with the government Tuesday is likely to be tax deductible, reducing the bank's financial hit.

Here's why: Many of the costs associated with corporate legal cases are treated as deductible under the tax code, in much the same way that a company's wages or equipment expenses are.

[font size=1]-snip-[/font]

And it's JPMorgan's understanding that the $2 billion is not deductible, the bank's chief financial officer said on an analyst call Tuesday.

[font size=1]-snip-[/font]

But here's the general bottom line: The compensation or restitution portions of a settlement like the one struck by JPMorgan (JPM, Fortune 500) may be deducted, but the penalties can't.

[font size=1]-snip-[/font]

Read more: http://money.cnn.com/2013/11/19/news/companies/jpmorgan-doj-deal/

Wilms

(26,795 posts)Love,

Jamie

Enrique

(27,461 posts)Katashi_itto

(10,175 posts)Tx4obama

(36,974 posts)DeSwiss

(27,137 posts)...we give them a $25 billion bailout gift which they simply ''invest'' instead of lending out to people and companies in order to ''help the economy'' as we were told these bailouts were designed to do and why we (and the next few generations) had to pay for them. And now they propose to ''pay their fine'' for wrongdoing -- with our own money, only not all of it. Less than half. And they get to keep the interest they earned. And just so's we keep things in perspective, you gotta appreciate the fact that they had actually set aside $17 billion for just this contingency. Only then can you see how monstrously huge and mutated a cancer on society, that they truly are. Plus the fact that they need to be chopped down to about 100-150 medium-sized companies.

- Or just nationalize it and be done with it......

- Or just nationalize it and be done with it......

JP Morgan Chase (JPM)

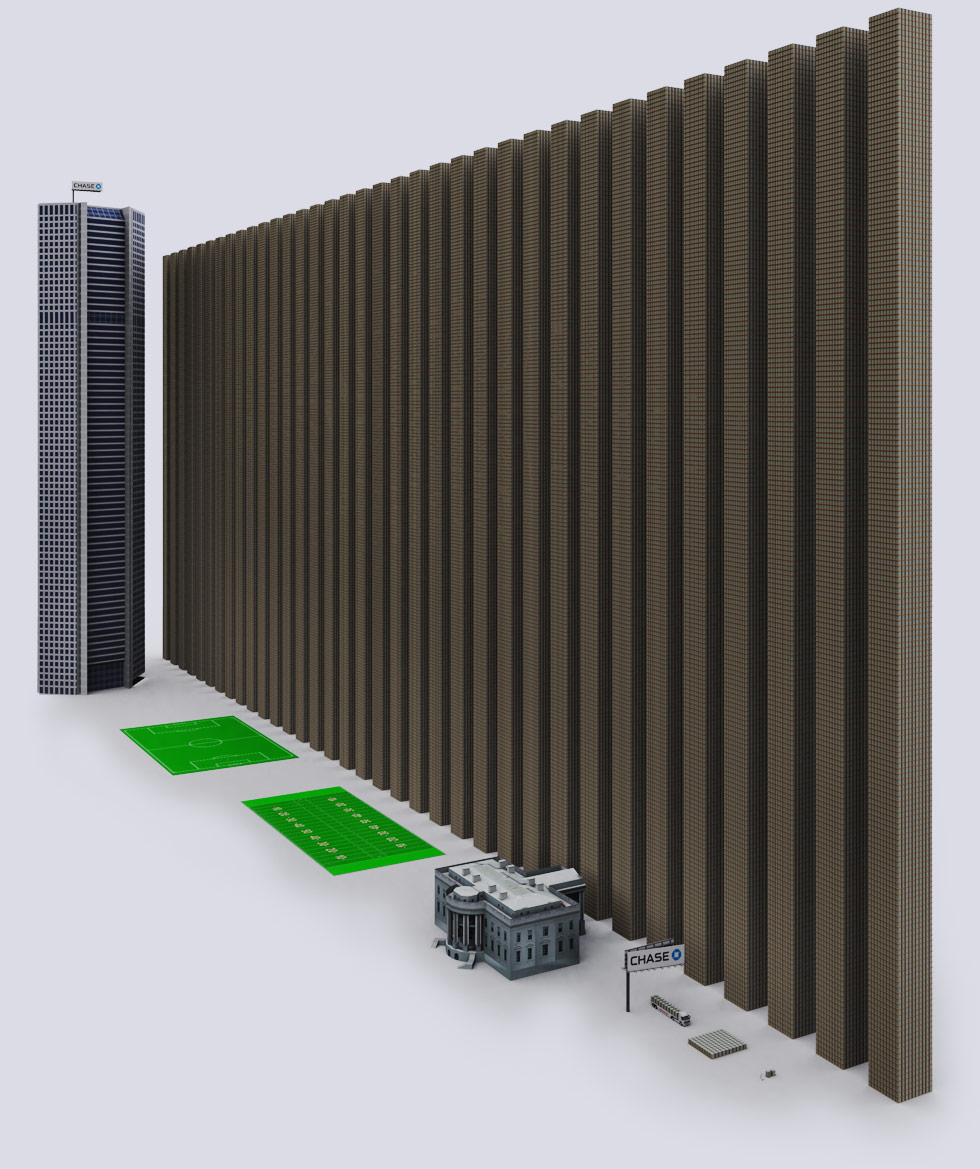

JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars.

$70 Trillion is roughly the size of the entire world's economy.

The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).

JP Morgan is rumored to hold 50->80% of the copper market, and manipulated the market by massive purchases. JP Morgan (JPM) is also guilty of manipulating the silver market to make billions. In 2010 JP Morgan had 3 perfect trading quarters and only lost money on 8 days. Lawsuits on home foreclosures have been filed against JP Morgan. Aluminum price is manipulated by JP Morgan through large physical ownership of material and creating bottlenecks during transport. JP Morgan was among the banks involved in the seizure of $620 million in assets for alleged fraud linked to derivatives. JP Morgan got $25 billion taxpayer in bailout money. It has no intention of using the money to lend to customers, but instead will use it to drive out competition. The bank is also the largest owner of BP - the oil spill company. During the oil spill the bank said that the oil spill is good for the economy.

JP Morgan Chase also received a SECRET $391 billion dollar bailout from the Federal Reserve.

In 2012, JP Morgan (JPM) took a $2 billion loss on "Poorly Executed" Derivative Bets.

MORE