Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

BloombergQuint.com: Who’s the Foxconn of Pharma? A Global Battle Spawns Two IPOs

http://www.bloombergquint.com/markets/2016/10/13/the-foxconn-of-pharma-two-asia-companies-aspire-to-do-just-that

Who’s the Foxconn of Pharma? A Global Battle Spawns Two IPOs

Natasha Khan

October 13, 2016, 2:00 pm, Updated on October 15, 2016, 2:08 am

(Bloomberg) -- Inside a factory in eastern China, vats of what might become some of the world’s newest and most sophisticated medicines are brewing.

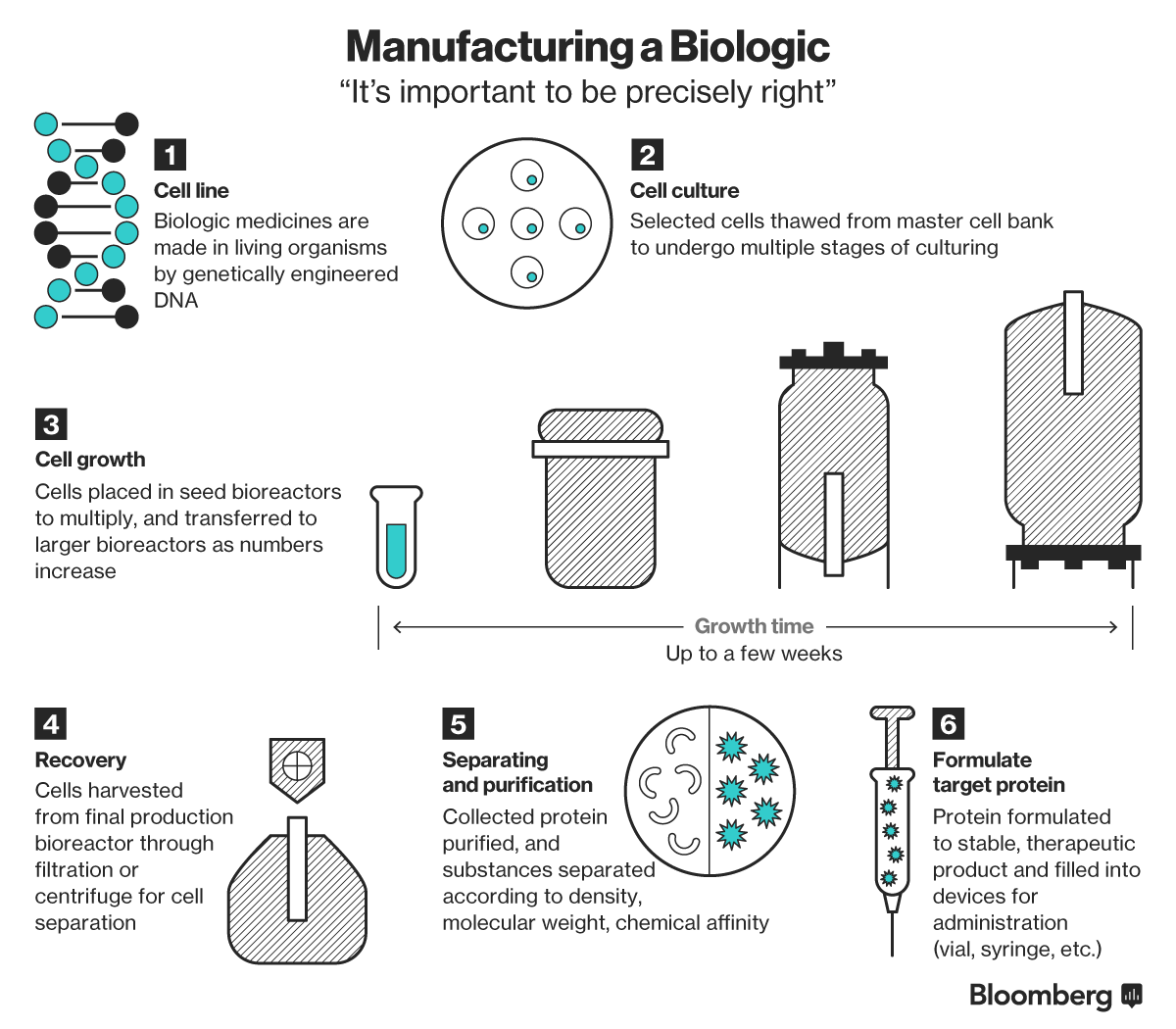

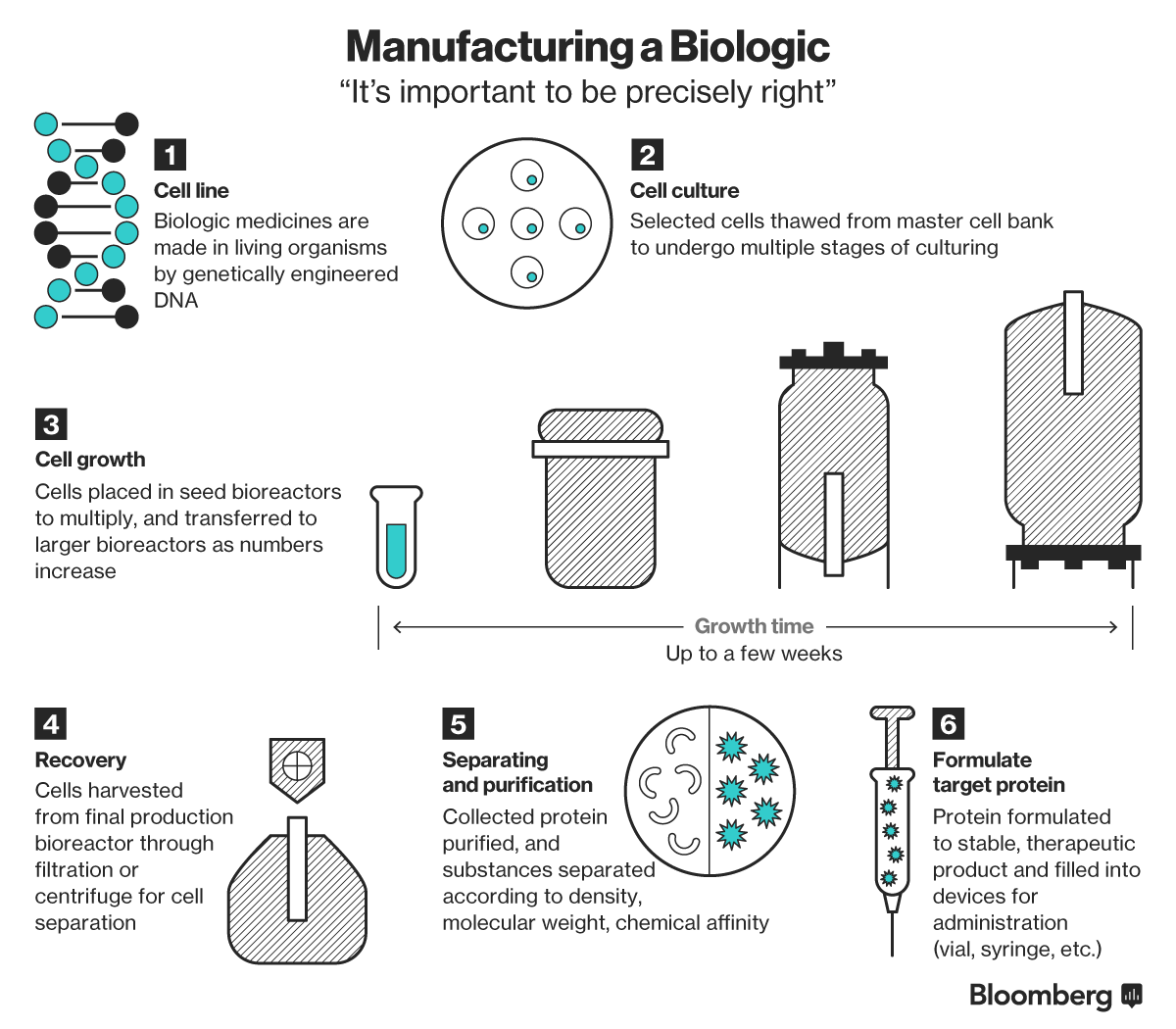

The owner, Wuxi Biologics, is among a handful of companies worldwide vying to be the outsourcer of choice to drugmakers selling biologic drugs: therapies made from proteins or a combination of biological matter to treat illnesses such as cancer and inflammatory diseases.

Last year, six of the world’s ten best-selling drugs were biologics, including Johnson & Johnson’s arthritis drug Remicade and Sanofi’s Lantus for diabetes, both blockbuster medicines. Seen as a rapidly expanding market in the decades ahead, companies are now beginning to line up to mass produce these therapies for the drugmakers developing them.

The reigning champions in the business of contract manufacturing biologics are both European: Switzerland’s Lonza Group and a unit of Germany’s Boehringer-Ingelheim GmbH. But two players in Asia are now racing ahead to gain a slice of the global business, with plans to raise billions in the coming months to bolster their capabilities.

Samsung Biologics, a unit of the Korean conglomerate, said last week it’s seeking to raise as much as 2.25 trillion won ($2 billion) from an initial public offering. And China’s WuXi Biologics -- a subsidiary of the recently privatized WuXi Apptec -- is planning to raise about $500 million in its own offering in coming months, according to a person familiar with the matter.

In doing so, the companies are venturing into a risky market that requires heavy investments and where global regulations are still in flux. If they succeed, they have the potential to become front runners -- much in the way Taiwanese manufacturer Foxconn Technology Group became the major product assembler for Apple Inc.

“The future of biologics manufacturing is only getting bigger,” said Frank Yu, head of the investment firm Ally Bridge Group which holds shares in WuXi. “It’s not a potential market anymore – it’s arrived and there’s hard cash we’re talking about here.”

<>

More at link.

Who’s the Foxconn of Pharma? A Global Battle Spawns Two IPOs

Natasha Khan

October 13, 2016, 2:00 pm, Updated on October 15, 2016, 2:08 am

(Bloomberg) -- Inside a factory in eastern China, vats of what might become some of the world’s newest and most sophisticated medicines are brewing.

The owner, Wuxi Biologics, is among a handful of companies worldwide vying to be the outsourcer of choice to drugmakers selling biologic drugs: therapies made from proteins or a combination of biological matter to treat illnesses such as cancer and inflammatory diseases.

Last year, six of the world’s ten best-selling drugs were biologics, including Johnson & Johnson’s arthritis drug Remicade and Sanofi’s Lantus for diabetes, both blockbuster medicines. Seen as a rapidly expanding market in the decades ahead, companies are now beginning to line up to mass produce these therapies for the drugmakers developing them.

The reigning champions in the business of contract manufacturing biologics are both European: Switzerland’s Lonza Group and a unit of Germany’s Boehringer-Ingelheim GmbH. But two players in Asia are now racing ahead to gain a slice of the global business, with plans to raise billions in the coming months to bolster their capabilities.

Samsung Biologics, a unit of the Korean conglomerate, said last week it’s seeking to raise as much as 2.25 trillion won ($2 billion) from an initial public offering. And China’s WuXi Biologics -- a subsidiary of the recently privatized WuXi Apptec -- is planning to raise about $500 million in its own offering in coming months, according to a person familiar with the matter.

In doing so, the companies are venturing into a risky market that requires heavy investments and where global regulations are still in flux. If they succeed, they have the potential to become front runners -- much in the way Taiwanese manufacturer Foxconn Technology Group became the major product assembler for Apple Inc.

“The future of biologics manufacturing is only getting bigger,” said Frank Yu, head of the investment firm Ally Bridge Group which holds shares in WuXi. “It’s not a potential market anymore – it’s arrived and there’s hard cash we’re talking about here.”

<>

More at link.

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

1 replies, 827 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (0)

ReplyReply to this post

1 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

BloombergQuint.com: Who’s the Foxconn of Pharma? A Global Battle Spawns Two IPOs (Original Post)

proverbialwisdom

Oct 2016

OP

Bloomberg: China Drug Sales to the U.S. Grow Despite Safety Concerns at Home

proverbialwisdom

Oct 2016

#1

proverbialwisdom

(4,959 posts)1. Bloomberg: China Drug Sales to the U.S. Grow Despite Safety Concerns at Home

Last edited Sat Oct 15, 2016, 03:29 PM - Edit history (2)

http://www.bloomberg.com/news/articles/2016-08-29/questions-linger-on-china-drug-safety-even-as-sales-rise-in-u-s

China Drug Sales to the U.S. Grow Despite Safety Concerns at Home

Bloomberg News

August 29, 2016 — 9:00 AM PDT

Chinese drugs and pharmaceutical ingredients are found in medicine cabinets as far away as New York and Chicago, and the country’s exports of pharmaceutical products and health supplements worldwide jumped 3 percent to $56 billion last year.

Yet even as China’s drug industry has grown in global stature, so have questions about the safety of its products.

Consider: Last year, about 700 Chinese firms were told by regulators in China to review their pending applications to sell new drugs and voluntarily withdraw any that were false or incomplete. Within months, about 75 percent had been retracted by the manufacturers or rejected by Chinese officials.

Among those were some medicines that were separately approved for sale in the U.S. by the Food and Drug Administration. Some of the companies say their data in China were flawed because of faulty information by local research firms, and their applications for the U.S. usually include tests done by research firms in North America -- indicating those drugs should be safe. Chinese pharma exports to the U.S. rose 4 percent last year.

The withdrawn applications in China show both the country’s progress and the scale of its task in cleaning up its sprawling pharmaceutical industry, which for years has been plagued by instances of substandard generics. At home, the government is seeking to elevate the standards of locally made medicines to curtail the use of expensive foreign-made drugs. At the same time, Chinese conglomerates with deep pockets are racing to ramp up quality to international levels to grab a bigger slice of the U.S. pharmaceutical market.

<>

China Drug Sales to the U.S. Grow Despite Safety Concerns at Home

Bloomberg News

August 29, 2016 — 9:00 AM PDT

> Large number of pending drug applications withdrawn last year

> Drug companies struggle to gain trust of patients, regulators

Chinese drugs and pharmaceutical ingredients are found in medicine cabinets as far away as New York and Chicago, and the country’s exports of pharmaceutical products and health supplements worldwide jumped 3 percent to $56 billion last year.

Yet even as China’s drug industry has grown in global stature, so have questions about the safety of its products.

Consider: Last year, about 700 Chinese firms were told by regulators in China to review their pending applications to sell new drugs and voluntarily withdraw any that were false or incomplete. Within months, about 75 percent had been retracted by the manufacturers or rejected by Chinese officials.

Among those were some medicines that were separately approved for sale in the U.S. by the Food and Drug Administration. Some of the companies say their data in China were flawed because of faulty information by local research firms, and their applications for the U.S. usually include tests done by research firms in North America -- indicating those drugs should be safe. Chinese pharma exports to the U.S. rose 4 percent last year.

The withdrawn applications in China show both the country’s progress and the scale of its task in cleaning up its sprawling pharmaceutical industry, which for years has been plagued by instances of substandard generics. At home, the government is seeking to elevate the standards of locally made medicines to curtail the use of expensive foreign-made drugs. At the same time, Chinese conglomerates with deep pockets are racing to ramp up quality to international levels to grab a bigger slice of the U.S. pharmaceutical market.

<>