Latin America

Related: About this forumU.S. Taxpayer In Panama Papers Investigation Sentenced To 4 Years In Prison

U.S. Attorneys » Southern District of New York » News » Press Releases

SHARE

Department of Justice

U.S. Attorney’s Office

Southern District of New York

FOR IMMEDIATE RELEASE

Monday, September 21, 2020

Audrey Strauss, the Acting United States Attorney for the Southern District of New York, and Brian C. Rabbitt, Acting Assistant Attorney General of the Criminal Division of the U.S. Department of Justice, announced today that HARALD JOACHIM VON DER GOLTZ, a/k/a “H.J. von der Goltz,” a/k/a “Johan von der Goltz,” a/k/a “Jochen von der Goltz,” a/k/a “Tica,” a/k/a “Tika,” was sentenced in Manhattan federal court to 48 months in prison for wire fraud, tax fraud, money laundering, false statements, and other charges. VON DER GOLTZ, a former U.S. resident and taxpayer, was charged along with Ramses Owens, Dirk Brauer, and Richard Gaffey, a/k/a “Dick Gaffey,” in connection with a decades-long criminal scheme perpetrated by Mossack Fonseca & Co. (“Mossack Fonseca”), a Panamanian-based global law firm, and its related entities. VON DER GOLTZ previously pleaded guilty to the charges, and was sentenced today by U.S. District Judge Richard M. Berman.

Acting U.S. Attorney Audrey Strauss said: “Harald Joachim von der Goltz, a one-time U.S. resident, previously admitted to an elaborate scheme to evade millions in taxes owed to the IRS. Von der Goltz was abetted by the specialized criminal services of the law firm Mossack Fonseca to conceal income and assets in shell companies and off-shore bank accounts. Now von der Goltz has been sentenced to four years in federal prison for his conduct.”

Acting Assistant Attorney General Brian C. Rabbitt said: “Harald Joachim von der Goltz sought to conceal his considerable wealth through a sham foreign foundation and various shell companies. But his decades-long scheme to evade his tax obligations and defraud the U.S. government came to an end today thanks to the tireless efforts of U.S. law enforcement. No matter how complicated the scheme, the U.S. government will bring to justice those who attempt to evade their tax obligations under the law. In particular, I would like to recognize the outstanding work of the Internal Revenue Service in this case.”

According to the allegations contained in the Indictments[1], other filings in this case, and statements during court proceedings, including VON DER GOLTZ’s guilty plea and sentencing hearings:

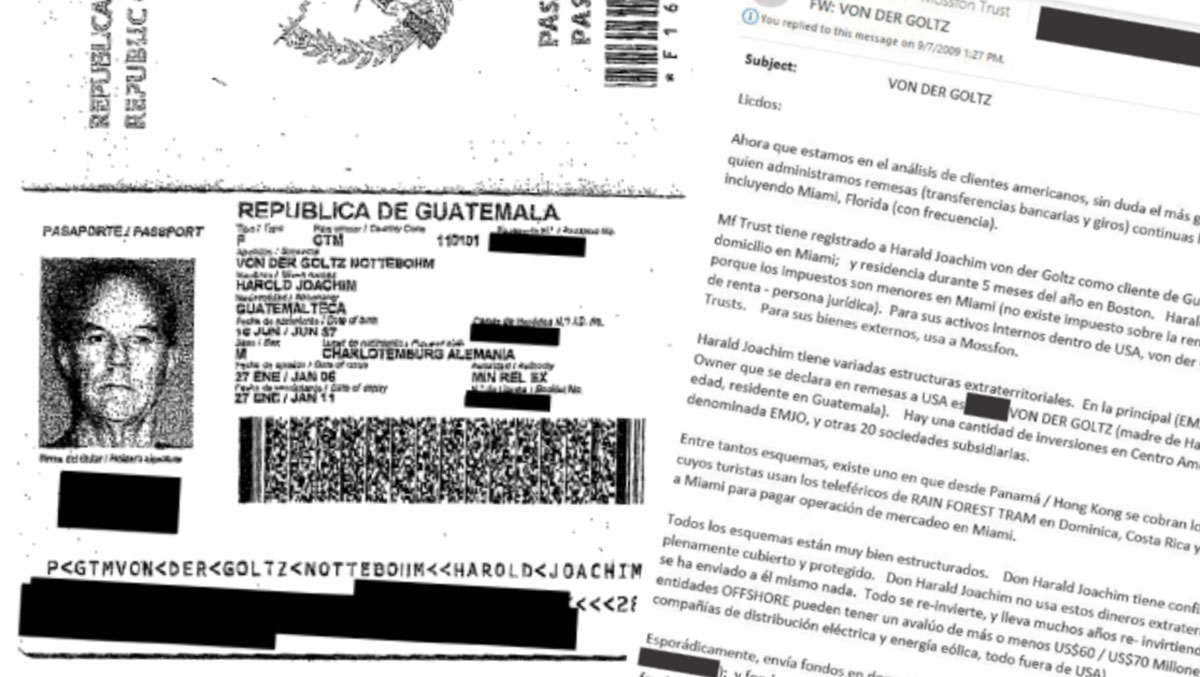

Since at least 2000 through 2017, VON DER GOLTZ conspired with others to conceal his assets and investments, and the income generated by those assets and investments, from the Internal Revenue Service (“IRS”) through fraudulent, deceitful, and dishonest means. During all relevant times, VON DER GOLTZ was a U.S. resident and was subject to U.S. tax laws, which required him to report and pay income tax on worldwide income, including income and capital gains generated in domestic and foreign bank accounts. Nevertheless, VON DER GOLTZ evaded his tax reporting obligations by setting up a series of shell companies and bank accounts, and hiding his beneficial ownership of the shell companies and bank accounts from the IRS. These shell companies and bank accounts made investments totaling tens of millions of dollars. VON DER GOLTZ was assisted in this scheme through the use of Mossack Fonseca, including Ramses Owens, a Panamanian lawyer who previously worked at Mossack Fonseca, and by Richard Gaffey, a partner at a U.S.-based accounting firm. Specifically, in furtherance of VON DER GOLTZ’s efforts to conceal his assets and income from the IRS, VON DER GOLTZ engaged the services of Mossack Fonseca, including Owens, to create a sham foundation and shell companies formed under the laws of Panama and the British Virgin Islands to conceal from the IRS and others the ownership by VON DER GOLTZ of accounts established at overseas banks, as well as the income generated in those accounts. VON DER GOLTZ, Gaffey, and Owens also falsely claimed that VON DER GOLTZ’s elderly mother was the sole beneficial owner of the shell companies and bank accounts at issue because, at all relevant times, she was a Guatemalan citizen and resident, and – unlike VON DER GOLTZ – was not a U.S. taxpayer.

More:

https://www.justice.gov/usao-sdny/pr/us-taxpayer-panama-papers-investigation-sentenced-4-years-prison

~ ~ ~

Earlier article:

February 11, 2020

U.S. poised to celebrate its first Panama Papers tax conviction

A U.S. taxpayer will plead guilty to tax evasion and money laundering offenses in relation to the 2016 investigation.

By Will Fitzgibbon

A German businessman charged with tax evasion and money laundering offenses following the publication of the Panama Papers investigation will plead guilty in New York, federal prosecutors said.

Harald Joachim von der Goltz, a former U.S. taxpayer, was indicted in December 2018 on charges that included wire fraud and making false statements as part of a “decades-long scheme to defraud the United States,” according to prosecutors.

Von der Goltz was a long-term client of the now-defunct Panama-founded law firm Mossack Fonseca. Prosecutors allege that von der Goltz, with the assistance of three other defendants, hid millions of dollars offshore, including through shell companies in Panama that he falsely claimed were owned by his centenarian mother in Guatemala.

. . .

“Once the name of a potential violator surfaces, law enforcement can then fill in the details, thanks in large part to this treasure trove of intelligence called the Panama Papers.”

More:

https://www.icij.org/investigations/panama-papers/u-s-poised-to-celebrate-its-first-panama-papers-tax-conviction/

Judi Lynn

(160,527 posts)

Upper left corner. Macri is the one who drove Argentina into a deep ditch in only 4 short years.

US citizen charged in worldwide fraud conspiracy discovered by Panama Papers investigation

Christal Hayes

USA TODAY

WASHINGTON - The Justice Department announced charges on Tuesday against four people, including a U.S. citizen, whose alleged role in a worldwide conspiracy was unearthed after the Panama Papers investigation.

Those charged include Ramses Owens, 50, a Panamanian citizen; Dirk Brauer, 54, a German citizen; Richard Gaffey, of Medfield, Mass.; and Harald Joachim Von Der Goltz, 81, a German citizen.

They face a slew of charges, including wire fraud, money laundering and conspiracy to commit tax evasion.

"They had a playbook to repatriate un-taxed money into the U.S. banking system," said U.S. Attorney Geoffrey S. Berman, a prosecutor for the Southern District of New York. "Now, their international tax scheme is over, and these defendants face years in prison for their crimes."

More:

https://www.usatoday.com/story/news/politics/2018/12/04/panama-papers-investigation-leads-charges-against-four-people-doj/2208534002/