Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 13 July 2012

Last edited Fri Jul 13, 2012, 03:38 PM - Edit history (1)

[font size=3]STOCK MARKET WATCH, Friday, 13 July 2012[font color=black][/font]

SMW for 12 July 2012

AT THE CLOSING BELL ON 12 July 2012

[center][font color=red]

Dow Jones 12,573.27 -31.26 (-0.25%)

S&P 500 1,334.76 -6.69 (-0.50%)

Nasdaq 2,866.19 -21.79 (-0.75%)

[font color=green]10 Year 1.47% -0.02 (-1.34%)

30 Year 2.56% -0.02 (-0.78%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Po_d Mainiac

(4,183 posts)On third thought, nevermind.

Tansy_Gold

(17,877 posts)Po_d Mainiac

(4,183 posts)by the time shit reaches the salvage/shredding yard, any and all items of value have been previously stripped/drained.

Brokerages re-hypothecate said value on the multiple and send the holders of said assets to the crusher.

Salvage yards have a term for vehicles that ain't been drained of fluids...they're called 'squishies' squishies=muppets

YMMV

tclambert

(11,087 posts)If you just want someone to do the transactions you order, and keep track of your account, most are OK. If you want guidance, well, they are all good at deflecting such requests--talking for a few minutes, tossing around cool-sounding buzzwords, yet ultimately saying nothing. They train them to make sure they never, ever take a firm position. They must always, always hedge what they say by humbly acknowledging that the exact opposite of what they just predicted could happen. Exception: If the brokerage itself needs to push a certain security in order to make money or avoid a loss, they may try to get you to buy one of their pets.

Do not trust them. Stay suspicious. A couple of my friends really trusted a broker they knew. Turned out he was running a Ponzi scheme.

AnneD

(15,774 posts)are called brokers. Any time I listened to them I just got broker. I simply refer to them as sharks in suits. I will listen to them but haven't really trusted one since the dot com fiasco. I didn't lose my shirt but I lost a sleeve and collar. I got it back when I started doing my own research and thinking for myself. Any more, I find I do better by being a contrairian. What ever they are hawking I avoid it but I look for the overlooked. I don't want to hunt the big elephants, I am happy with catching mice. It is easier and there are more available.

Po_d Mainiac

(4,183 posts)Paper got shredded the last few sessions, but the stackable stuff didn't shrink.

I expect some more gyrations as holders of digital metal realize they may not hold shit. NFA blessings are now words of worry.

Any doubt the paper markets are rigged? Any doubt that the physical in the banksters vaults, has been re-hypothecated (and salted)?

Pensions are marked to myth and the tax free muni market is ripe for an implosion.

Patience is going to be rewarded.

YMMV

ps...Look for a spike from a short squeeze (fuck u Blythe) near future.

DemReadingDU

(16,000 posts)Po_d Mainiac

(4,183 posts)This is a classic recording from a few weeks ago. Count the lies!

Fuddnik

(8,846 posts)Po_d Mainiac

(4,183 posts)They're far less likely to take a chunk outa u'r ass.

westerebus

(2,976 posts)Wickedness in all her forms and all that she conjures.

Po_d Mainiac

(4,183 posts)Cheers! First round is on Norm.

westerebus

(2,976 posts)Thanks Norm!

I was thinking more Adam's X girlfriend, the one that married the garden variety snake, but now that you mentioned it. OMFG!

Po_d Mainiac

(4,183 posts)Heidi is the proprietor of a bar in Detroit. She realizes that virtually all of her customers are unemployed alcoholics and, as such, can no longer afford to patronize her bar.

To solve this problem, she comes up with a new marketing strategy that allows her customers to drink now and pay later; keeping track of the drinks consumed on a ledger (thereby granting the customers ‘loans’).

http://www.ino.com/blog/2011/10/a-simple-humorous-look-at-bank-derivatives/

Boston/ Detroit WTF they both begin with an early consonant

Po_d Mainiac

(4,183 posts)westerebus

(2,976 posts)If he's doing blue, what color is the trim?

Hotler

(11,454 posts)DemReadingDU

(16,000 posts)7/12/12 JPMorgan Paid $190,000 Annually to Spouse of Bank's Top Regulator

On May 10 of this year, Jamie Dimon, Chairman and CEO of JPMorgan, announced that billions of insured deposits at his bank had been invested in high risk derivatives and had sustained at least a $2 billion loss. The Department of Justice and FBI have commenced investigations. Dimon is expected to announce the current extent of those losses this Friday in an earnings conference call.

Following the May 10 announcement, there were numerous calls for Dimon to step down from the Board of Directors of the Federal Reserve Bank of New York. That organization is the primary regulator of the firm. There was widespread public outrage that the CEO of a bank had no business serving on the governing body of his regulator. (The New York Fed has a long history of such conflicts.)

Now it has emerged that not only was Dimon conflicted in his role on the New York Fed but the President and CEO of the New York Fed had an equally dubious conflict of interest.

William C. Dudley has been employed by the New York Fed since January 1, 2007, first heading up the powerful Markets Group. That Group manages the supply of bank reserves in the banking system according to the mandate of the Federal Open Market Committee (FOMC). On January 27, 2009, Dudley was elevated to President and CEO of the New York Fed. Financial disclosure forms for 2008 through 2010 show that Dudley’s wife, Ann Darby, was a former Vice President of JPMorgan and had holdings of more than $1,500,000 in deferred income accounts at the firm as well as between $250,000 to $500,000 in a 401(K) plan there.

more...

http://www.alternet.org/story/156259/revealed%3A_jpmorgan_paid_%24190%2C000_annually_to_spouse_of_bank%27s_top_regulator

Po_d Mainiac

(4,183 posts)No need to take a close look-see under the sheets.

Good Catch!

Roland99

(53,342 posts)As a result of this, regulators who now are only 3 years behind the curve, are most likely snooping to inquire not only how JPM did it (call us: we can brief you in 2 minutes), but who else has been doing this? Hint: everyone.

Because in other words, we have just discovered that the two key components of the entire CDS market: the LIBOR base and market "marks" have been bogus at best, and realistically, fraud. And one wonders why no bank ever will let CDS trade on an exchange...

Full Filing

Demeter

(85,373 posts)

Roland99

(53,342 posts)Demeter

(85,373 posts)Economists were largely responsible — usually in their policy-making roles — for the huge credit bubble that took debt to GDP in the US from 112% in 1972 to 296% in 2008. They told the feds that they needed a “flexible” currency. What they got, of course, was one that was flexible in one way only — it stretched out…but never came back. Credit expanded 50 times in the last 50 years.

Then, when the debt bubble blew up in ’08-’09, economists stepped in again…this time to prevent the private sector from setting things right. Instead of letting a crash and quick depression wipe out the excess debt quickly, the feds engineered a “contained depression” which can go on for decades.

What contains the depression? More credit! Deficits…bailouts…subsidies…and the lowest interest rates ever. You can look throughout the developed world; the highest interest rate offered by central banks for short-term money is only 0.75%.

And now economists are warning that the US tax economy could fall off a ‘fiscal cliff’ at the end of the year. Tax rates will go up. Automatic spending cuts will come down hard. This will allow the depression to break out of its cage…or so they worry...Since the crisis began, private sector debt has gone down…but only to 250% of GDP. That’s still more than 2 times what it was when the US still had honest money. Much of that debt must be “bad” — in the sense that it couldn’t withstand a financial crisis…or wouldn’t still be on the books were it not for the feds’ clumsy meddling. That’s why nature, in her wisdom, provides us with natural debt-cleansing episodes…also known as depressions.

Read more: More Credit to "Contain the Depression" http://dailyreckoning.com/more-credit-to-contain-the-depression/#ixzz20T3Qppna

Demeter

(85,373 posts)...Obama urged Congress to extend for one more year all the Bush tax cuts for Americans with incomes below $250,000. The tax cuts at all income levels are scheduled to expire at the end of 2012.

Obama said his plan would cover 98 percent of the working public and 97 percent of small-business owners. Allowing the tax cuts to expire for higher-income earners, the president added, would bring additional revenue to help pay down the spiraling national debt.

Extending all the Bush tax cuts and restraining the growth of the alternative minimum tax would cost about $221 billion next year, according to the nonpartisan Congressional Budget Office. Extending the cuts only for families earning less than $250,000 would cost only slightly less - around $175 billion in 2013, according to rough CBO estimates.

Obama abandoned a similar push in 2010, when he supported a full extension of the Bush tax cuts after Republicans won a sweeping victory at the polls that fall. This time, however, White House press secretary Jay Carney said that Obama would reject any legislation that extends the tax cuts for all income levels.

"He would not support it. He would not sign that bill," Carney said.

I continue to believe that no matter what he promises today, Obama will sign another bill extending the Bush tax cuts at all income levels (either for a year or two, or perhaps permanently). As he did in late 2010, the president endorses the Republican message that we can't afford to let taxes go up in a weak economy. We've had several weak monthly job reports in a row, and I don't expect those to improve significantly before the end of the year.

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)In 2010, people cheered when Congress gave shareholders the right to vote on the pay of corporate CEOs. Too bad those nonbinding votes haven't embarrassed the greed out of the chief executives. In fact, CEO pay crept up another 5 percent last year, once again far outstripping wage gains for middle-class workers.

While some CEOs, such as GE's Jeffrey Immelt, took a modest pay cut in 2011, many continued drawing outsized checks. Here we list 10 of the most egregiously overcompensated executives. They're selected not just on the size of their pay packages, but how much more they were paid than their peers at similar companies, as well as the disparity between their personal fortunes and those of their employer. Collectively, they highlight the cozy relationships between today's corporate boards and their chief executives. "You don't suggest [corporate compensation] consultants who are Dobermans," Warren Buffet, a critic of excessive CEO salaries, quipped in this YouTube clip. "You get cocker spaniels and make sure that their tails are wagging."

Timothy D. Cook, Apple Compensation: $378 million

David Simon, Simon Property Group Compensation: $137.2 million

David M. Zaslav, Discovery Communications Compensation: $52.4 million

Michael S. Jeffries, Abercrombie & Fitch Compensation: $46.6 million

Rupert Murdoch, News Corporation Compensation: $29.3 million

Ian M. Cumming, Leucadia National Compensation: $29.3 million

Gregory W. Cappelli, Apollo Group Compensation: $25.1 million

Lloyd C. Blankfein, Goldman Sachs Compensation: $16.2 million

John T. Chambers, Cisco Systems Compensation: $12.9 million

Robert L. Antin, VCA Antech Compensation: $12.1 million

DETAILS AT LINK

Demeter

(85,373 posts)THE giant American conglomerate General Electric (GE) holds more assets abroad than any other non-financial firm in the world—over $500 billion worth. Its foreign assets make up over 70% of its total. Of the 100 companies with the most foreign assets, 17 hold over 90% of their assets abroad, including ArcelorMittal, Nestlé, Anheuser-Busch InBev and Vodafone. Their share of foreign sales is also substantially larger than GE's. More than half of GE’s 300,000-strong workforce is based outside America; Toyota, which has slightly more employees, only has 38% of its 326,000 workers abroad. The Japanese carmaker is one of only two Asian firms to make it into the top 20 transnational companies by assets; Honda, another carmaker, ranks 19th. Three of the top five firms are oil companies. Exxon Mobil had the largest foreign sales last year at $317 billion, 73% of its total. Transnational firms benefited from the more favourable economic climates in emerging markets, and some developed markets, like America. According to the latest World Investment Report from the UN Conference on Trade and Development (UNCTAD), production by foreign affiliates increased in 2011: sales rose by 9% to $28 trillion; employment rose by 8% to 69m; and total assets rose from around $75 trillion in the previous two years to $82 trillion. Thanks mainly to economic uncertainty, UNCTAD reckons transnational companies are hoarding some $5 trillion in cash. This could lead to a surge in foreign direct investment. Though firms might instead opt for liquidity, or to pay off debts or pay out dividends to maintain share prices.

tclambert

(11,087 posts)Some of them may even break a sweat.

Demeter

(85,373 posts)As Spain’s prime minister announced deep austerity cuts Wednesday in order to secure funds from the European Union to bail out Spain’s failing banks, the people of Spain have taken to the streets once again for what they call “Real Democracy Now.” This comes a week after the government announced it was launching a criminal investigation into the former CEO of Spain’s fourth-largest bank, Bankia. Rodrigo Rato is no small fish: Before running Bankia he was head of the International Monetary Fund. What the U.S. media don’t tell you is that this official government investigation was initiated by grass-roots action.

The Occupy movement in Spain is called M-15, for the day it began, May 15, 2011. I met with one of the key organizers in Madrid last week on the day the Rato investigation was announced. He smiled, and said, “Something is starting to happen.” The organizer, Stephane Grueso, is an activist filmmaker who is making a documentary about the May 15 movement. He is a talented professional, but, like 25 percent of the Spanish population, he is unemployed: “We didn’t like what we were seeing, where we were going. We felt we were losing our democracy, we were losing our country, we were losing our way of life. ... We had one slogan: ‘Democracia real YA!’—we want a ‘real democracy, now!’ Fifty people stayed overnight in Puerta del Sol, this public square. And then the police tried to take us out, and so we came back. And then this thing began to multiply in other cities in Spain. In three, four days’ time, we were like tens of thousands of people in dozens of cities in Spain, camped in the middle of the city—a little bit like we saw in Tahrir in Egypt.”

The occupation of Puerta del Sol and other plazas around Spain continued, but, as with Occupy Wall Street encampments around the U.S., they were eventually broken up. The organizing continued, though, with issue-oriented working groups and neighborhood assemblies. One M-15 working group decided to sue Rodrigo Rato, and recruited pro bono lawyers and identified more than 50 plaintiffs, people who felt they’d been personally defrauded by Bankia. While the lawyers were volunteers, a massive lawsuit costs money, so this movement, driven by social media, turned to “crowd funding,” to the masses of supporters in their movement for small donations. In less than a day, they raised more than $25,000. The lawsuit was filed in June of this year.

Olmo Galvez is another M-15 organizer I met with in Madrid. A young businessman with experience around the world, Galvez was profiled in Time magazine when they chose “The Protester” as the Person of the Year. Rato’s alleged fraud at Bankia involved the sale of Bankia “preferred stock” to regular account holders, so-called retail investors, since sophisticated investors were not buying it. Galvez explained: “They were selling it to people—some of them couldn’t read, many were elderly. That was a big scandal that wasn’t in the media.” Some who invested in Bankia’s scheme had to sign the contract with a fingerprint because they couldn’t write, nor could they read about, let alone understand, what they were sinking their savings into...

Demeter

(85,373 posts)If you’re in college or recently graduated, your financial prospects don’t look very good, according to The Associated Press.

Half of all recent graduates under 25 are jobless or underemployed, and many who are working are doing so in low-wage positions that don’t utilize their degrees, an analysis of government data for the AP has found. For those lucky enough to have landed a job in their field of study, the outlook still seems dim. Students are on the hook for an average of $20,000 in loan debt, which they’ll have to pay off on a starting salary in a still-sluggish economy.

Technological advancements and outsourcing further compound the problems that young graduates face. “By some studies, up to 95 percent of positions lost during the economic recovery occurred in middle-income occupations such as bank tellers, the type of job not expected to return in a more high-tech age,” says the AP. Even with these disturbing trends, colleges have decided to increase their tuitions and fees.

Students and graduates are realizing that hard work does not always lead to financial success, and that the jobs their educations were supposed to prepare them for are increasingly scarce. Yet the political establishment carries on, blind to the flaws in its economic solutions and, more fundamental, to its denial of the American dream to today’s youth....

Demeter

(85,373 posts)I'D SAY IT'S TOO LATE, NOW. UNLESS THEY GET HIM FIRED, THERE'S NO HOPE FOR THE ADMINISTRATION.

http://www.nationofchange.org/evidence-mounts-dc-insiders-worry-about-holder-s-inaction-wall-street-crime-1342012293

More and more Washington insiders are asking a question that was considered off-limits in the nation's capital just a few months ago: Who, exactly, is Attorney General Eric Holder representing? As scandal after scandal erupts on Wall Street, involving everything from global lending manipulation to cocaine and prostitution, more and more people are worrying about Holder's seeming inaction - or worse - in the face of mounting evidence.

Confidential sources say that the President's much-touted Mortgage Fraud Task Force is being starved for vital resources by the Holder Justice Department. Political insiders are fearful that this obstruction will threaten Democrats' chances at the polls. Investigators and prosecutors from other agencies are expressing their frustration as the ever-rowing list of documented crimes by individual Wall Street bankers continues to be ignored.

Meanwhile the scandals and revelations go on. The new LIBOR rate-fixing scandal led the bank-friendly and conservative magazine The Economist to run a cover about "Banksters" and to publish a piece entitled "The rotten heart of finance." People like Robert Reich are saying this could be the story that finally brings down the banks.

Where are the indictments?

But there have already been stories - lots of stories, terrible ones - about corruption, bribery, perjury, forgery, and a dozen different kinds of fraud. There have been stories about laundering money for the Mexican drug cartels, including a new lead that surfaced this week. There's already ample evidence that Wall Street bankers have defrauded cities, deceived investors, and cheated their own clients....The problem isn't a shortage of scandalous stories. We've seen a lot of those. What we haven't seen, at least here in the United States, is a single indictment of a senior Wall Street banker from the United States Department of Justice. And that's what has these political insiders concerned...A growing number of people are privately expressing concern at the Justice Department's long-standing pattern of inactivity, obfuscation, and obstruction. Mr. Holder's past as a highly-paid lawyer for a top Wall Street firm, Covington and Burling, is being discussed more openly among insiders. Covington & Burling was the law firm which devised the MERS shell corporation which has since been implicated in many cases of mortgage and foreclosure fraud...

AND THAT' MY FRIENDS IS PRECISELY WHY THERE ARE NO PROSECUTIONS!

Demeter

(85,373 posts)“Banksters,” the cover of the Economist magazine charges, depicting a gaggle of bankers dressed as extras off the “Goodfellas” lot. The editors were reacting to Libor-gate, the collusion among traders of major banks to fix the London interbank offered lending rate, the most recent, most obscure and the most explosive revelation from what seems a bottomless pit of corruption in global banks.

Once more the big banks are exposed in systematic fraudulent activity. When Barclays agreed to a $450 million fine for trying to rig the Libor, its CEO offered the classic excuse: Everyone does it. Once more the question remains: Will CEOs and CFOs, as well as traders, be prosecuted? Or will they depart with their multimillion dollar rewards intact, leaving shareholders to pay the tab for the hundreds of millions in fines?

The Barclays settlement exposed that traders colluded to try to fix the Libor rate. This is the rate used as the basis for exotic derivatives as well as mortgages, credit card and personal loan rates. Almost everyone is affected. Fixing the rate even a few hundreds of a percentage point could make Barclays millions on any single day — money taken out of the pockets of consumers and investors. Once more the banks were rigging the rules; once more their customers were their mark.

The stakes are staggering. The Libor should be as good as gold. It pegs the value of up to $800 trillion in financial instruments. The collusion was systematic and routine. Investigations are underway not only in the United Kingdom but also in the United States, Canada and the European Union. Those named in the probes are all the usual suspects: JPMorgan Chase, Citibank, UBS, Deutsche Bank, HSBC, UBS and others. This wasn’t rogue trading, as the Economist concludes; it was more like a cartel...

MORE

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)During questioning by British politicians over his role in the ongoing Libor-fixing scandal, the Bank of England’s Deputy Governor Paul Tucker admitted Monday that he couldn’t be sure that regulators had put an end to private sector manipulation of the key interest rate....After what we’ve witnessed and learned in the last five years, is there anyone who still trusts the integrity of the global banking system?

...On Monday, the Hill reported that the House of Representatives is expected to approve legislation that would end the requirement that bank ATMs include a physical sign warning that fees might be charged for bank withdrawals. Banking lobbyists claim that the change in the law is necessary because people are physically removing the signs and then “frivolously” suing the banks for not providing the legally mandated warning. But even Diogenes, some 2,500 years before ATMs were invented, could tell you that the real motivation is obviously to boost fee income.

And although there have been suspicions for years that the banks have been improperly manipulating Libor, the recent high profile of the scandal is directly tied to a $450 million settlement imposed by the Commodity Futures Trading Commission, the U.S. regulator entrusted with oversight over trading activities. In June, the House of Representatives passed an appropriations bill substantially cutting funding for the CFTC — one of the few arms of the U.S. government that has actually been executing its responsibilities in an aggressive fashion.

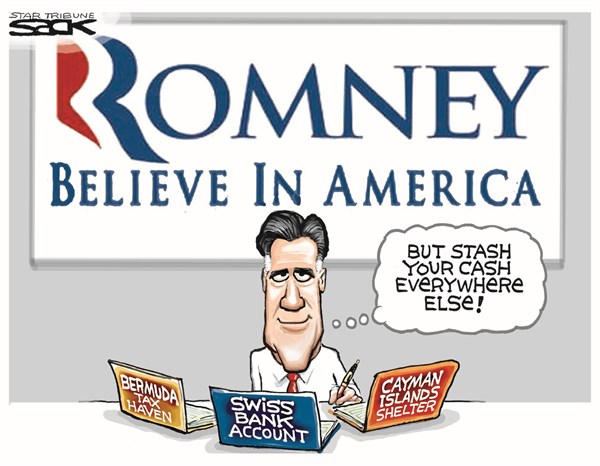

These two news items together go along way toward answering Nocera’s puzzlement at the American lack of response. The last four years have taught us that there is little connection between what bankers do and how our political system responds. Instead of prosecuting executives for fraud, Congress has dedicated itself to weakening laws aimed at regulating the financial sector. Instead of looking out for the consumer, the House is passing bills designed to hurt consumers. A presidential candidate who is running neck-and-neck with the incumbent is campaigning on a promise to repeal banking reform legislation. Indeed, one of Mitt Romney’s biggest campaign finance “bundlers” is a lobbyist for Barclays — and before the scandal blew up, Romney was scheduled to attend a London fundraiser hosted by the (now-resigned) Barclays CEO Bob Diamond.

When what we know about how bankers operate has no connection to how our political system reacts, it is hard to be outraged or shocked. It’s just business as usual.

Demeter

(85,373 posts)The British banking scandal reveals—again—just how wrong-headed our assumptions about finance are. Morality and self-interest are hopelessly at odds; add planetary crisis to the picture, and we're "lost," said one former JPMorgan executive I had a chance to interview last month.

Are banksters redeemable? The British rate-rigging scandal has been lying in plain sight. City of London bankers, upper crust, chummy types, were supposed to tell the truth about their own bank’s borrowing power and every day, based on those estimates, the London inter-bank borrowing rate or LIBOR was set. Now that regulators have spoken, it’s come to seem absurd that private bankers were expected to play fair, act responsibly and act in anything other their own self-interest—without oversight. But that’s just how the inter-bank lending rate setting worked.

As one former senior trader close to the scandal put it to The Economist, “There is no reporting of transactions, no one really knows what’s going on in the market…” The implications? “You have this vast overhang of financial instruments that hang their own fixes off a rate that doesn’t actually exist.”

Sans transparency, soaked in incentives, the bankers had every reason to hide their institution’s weaknesses, and that (it turns out), is all too often what they did. Now regulators have woken up, criminal investigations are about to start and Barclays chief Bob Diamond is likely to be only the first, not the last, chief executive hit. But what about the bigger story?

THIS INTERVIEW SEEMS POINTLESS TO ME....AND VERY LONG. AM I MISSING SOMETHING?

Demeter

(85,373 posts)bread_and_roses

(6,335 posts)are about. No, I'm not asking for an explanation - I could pick out key words and go educate myself if I were really interested. I'd forget it all tomorrow anyway, even if I had the time, which I don't.

I am grumpy this AM. I took really bad notes at a Board meeting and now have to figure out what the hell I meant so I can type them.

I did have the pleasure of catching Professor Wolfe on Alternative radio yesterday. "Capitalism Hits the Fan."

On LIBORGATE - if anyone living in the real world had any doubt that the entire financial "industry" is anything other than an out of control criminal cartel existing for the sole reason of robbing the people of their collective wealth - even mere sustenance! - LIBORGATE should settle that for all time.

Demeter

(85,373 posts)It's some kind of code designed to exclude us....sniff.

DemReadingDU

(16,000 posts)Tansy_Gold

(17,877 posts)Or catch the WEE thread and I'll clear up any lingering questions.

Demeter

(85,373 posts)but you may have to start without me...I'm still not sure whether I'm going to lose at euchre, or ogle men's knees tonight, but either one will delay WEE....

Po_d Mainiac

(4,183 posts)xchrom

(108,903 posts)

Demeter

(85,373 posts)As I was typing that, the Kid asked precisely the same question...

xchrom

(108,903 posts)

Tansy_Gold

(17,877 posts)RAIN!

xchrom

(108,903 posts)I think that's a good omen.

xchrom

(108,903 posts)Demeter

(85,373 posts)The price-fixing scandal involving the benchmark London interbank offered rate known as Libor is raising questions about the quality of another key market measure looked to for signs of market stress.

In a note to clients, Cumberland Advisors Chairman David Kotok observed that what is known as the TED spread–which measures the difference between short-term interest rates and Treasury yields–may have suffered collateral damage in the scandal having to do with the manipulation of the Libor.

Demeter

(85,373 posts)Oil price reporting agencies said the way they assess international spot oil prices is nothing like the method for calculating LIBOR, now at the centre of a scandal for having been rigged in the interests of some banks.

Platts, part of McGraw-Hill Inc, privately owned Argus Media and ICIS, a unit of Reed Elsevier, said in a joint statement on Thursday they were independent organisations (IPROs) and their role was quite different from the activity of banks involved in setting the London Interbank Offered Rate. There are "fundamental differences between the creation of LIBOR and the reporting and publishing of oil and energy market price assessments", they said.

"IPROs are independent of and have no vested interest in the oil and energy markets. Their ownership is transparent, and strict internal governance separates editorial and commercial functions. IPROs are not market participants, nor providers of transaction execution, clearing or settlement services."

Some financial industry bodies, including the International Organisation of Securities Commissions (IOSCO), have said they are worried that oil price assessments could be subject to pressure and may be at risk of manipulation...

Demeter

(85,373 posts)European Union authorities should directly oversee the euro interbank lending rate following the interest-rate manipulation scandal in London, the head of the banking group that administers Euribor said.

The European Securities and Markets Authority should supervise how banks submit estimates of interest rates to borrow or lend to one other, Guido Ravoet, the chief executive officer of the European Banking Federation, said in an interview today.

...Ravoet said he remains confident that Euribor rates weren’t successfully manipulated because of the difficulty of coordinating rates between the 44 banks on the panel. During the 2007 financial crisis, the Euribor rate “went dramatically up, reflecting the tensions in the euro interbank market,” he said.

There should be more scrutiny of Euribor, and the EBF has no problem sharing information on the rates, Ravoet said. The banking federation checks on banks that regularly appear among the highest or lowest 15 percent of quotes that are removed to calculate the daily average, he said. The organization’s members are national banking groups, including the British Bankers’ Association, which administers the Libor rate...

Demeter

(85,373 posts)While president of the Federal Reserve Bank of New York, Timothy F. Geithner pressed British regulators to reform the way a critical global benchmark called the London interbank offered rate, or Libor, is calculated, according to a June 1, 2008, e-mail obtained by The Washington Post.

Writing to the head of the Bank of England, among others, Geithner made six recommendations, which included eliminating incentives that could encourage banks to manipulate the rate and establishing a “credible reporting procedure.”

“We would welcome a chance to discuss these and would be grateful if you would give us some sense of what changes are possible,” Geithner wrote.

It’s unclear what other steps Geithner took and whether his efforts stopped any wrongdoing by banks. Last month, London-based Barclays, one of Europe’s largest banks, admitted that it schemed to manipulate Libor during the financial crisis — and its chief executive has asserted that regulators knew about its activities but didn’t do much to stop them. The scandal has led to the resignation of Barclays’s senior executives...

Hugin

(33,222 posts)Some scandal or another, I'm sure. ![]()

The scandal has to do with Standard & Poor's, a McGraw-Hill subsidiary and one of the three major credit ratings agencies blamed in part for causing the current economic crisis.

In fact, the corruptness of S&P's business model - being paid fees by the same Wall Street banks that underwrite the securities S&P rates - is one of the few issues that the left and right agree on.

Find this article at:

http://money.cnn.com/2009/04/16/news/companies/cohan_mcgraw.fortune

Demeter

(85,373 posts)http://money.cnn.com/2009/04/16/news/companies/cohan_mcgraw.fortune/

...The scandal has to do with Standard & Poor's, a McGraw-Hill subsidiary and one of the three major credit ratings agencies blamed in part for causing the current economic crisis.

In fact, the corruptness of S&P's business model - being paid fees by the same Wall Street banks that underwrite the securities S&P rates - is one of the few issues that the left and right agree on...

The Great American Textbook Scandal

http://www.forbes.com/forbes/2000/1030/6612178a_print.html

...A majority of the commission voted to reject the SRA McGraw-Hill texts. Approved were several of the other publishers' submissions, including those of Prentice Hall, whose books Tramiel had found so full of errors.

"I have to approve them," Schwartz told Tramiel privately. "The books we have now are so bad, and the new books are significantly better, that I can't in good conscience reject such an improvement."

"If you don't reject 'such an improvement,'Tramiel retorted, "we'll be stuck with them for the next six years until the next science adoption."

On Mar. 16, 2000 the California Board of Education, meeting in Los Angeles and acting on a unanimous recommendation of the Curriculum Commission, voted to approve three kindergarten-through-fifth and sixth-grade science programs, including those produced by Harcourt Brace and Houghton Mifflin, and three programs for sixth to eighth graders, including the programs of Holt Rinehart and Prentice Hall--a total of 6 programs from the 15 originally submitted.

Many of the books, the board acknowledged, still contained errors...

Buy McGraw-Hill: Bond Rating Scandal Will Blow Over THIS IS FROM 2008! TALK ABOUT EGG ON FACE

Goldman and Jeffries are both excited about McGraw Hill (MHP). Goldman added the stock to its Conviction Buy List and sees a 20%+ upside to their upwardly revised $51 price target. Goldman sees a particularly compelling risk/reward, citing these 3 areas as the source of opportunity:

(1) new issue volume trends (bonds) that appear to be getting “less bad”

(2) evidence that the company is successfully navigating the current financial market turmoil while protecting margins

(3) a valuation close to a multi-year low

Key risks to McGraw-Hill were cited by Goldman as:

(1) cyclical weakness in new issue bond volume

(2) regulatory/litigation risk given credit market turmoil

(3) educational funding

Goldman, however, believes none of these risks will significantly impact MHP in the near future. The firm believes that the headwinds facing rating agencies are cyclical in nature and that there will not be "a structural change in industry economics." Furthermore, Goldman believes the regulatory/legislative risks are overestimated and are creating more "headline risk" than actual risk.

Read more: http://articles.businessinsider.com/2008-05-13/wall_street/30082244_1_goldman-mcgraw-hill-credit-markets#ixzz20Vagf7Z9

Hugin

(33,222 posts)When as it turns out... They invented the Bond rigging scheme.

Shameless. This is why they should be put behind bars... It's not to reform them, it's not to punish them, it's to protect the General Public from them.

xchrom

(108,903 posts)Wells Fargo & Co. (WFC), the largest U.S. mortgage lender, will pay $125 million and set up a $50 million assistance fund to settle U.S. allegations that it discriminated against minority borrowers.

The bank will also stop using outside brokers to create mortgages, according to a statement yesterday from Wells Fargo. The accord settles U.S. accusations in court filings that the bank put creditworthy Hispanic and African-American borrowers into more expensive subprime loans from 2004 to 2007, and that mortgage brokers through 2009 added charges that caused minority borrowers to pay higher fees, costs and interest than similar white borrowers

The San Francisco-based bank, which controls about a third of the market for all new home loans, denied it engaged in illegal discrimination and said it agreed to settle solely to avoid litigation, according to a proposed consent order. The company reported a $15.9 billion profit last year.

“Wells Fargo asserts that throughout the period of time at issue in this proceeding and to the present, it has treated all customers fairly and without regard to impermissible factors such as race and national origin,” the bank said in the consent order, which must be approved by a federal judge.

Roland99

(53,342 posts)Roland99

(53,342 posts)* U.S. wholesale prices rise 0.1% in June

* Energy wholesale costs drop 0.9% in June

* PPI index up 0.7% over past 12 months

* U.S. producer prices climb 0.1% in June

* Wholesale prices minus food, energy rise 0.2%

Roland99

(53,342 posts)* Consumer sentiment 72 in July vs 73.2 in June (below expectations of 73)

* Consumer sentiment lowest since December

Stocks rally harder on news.

EURUSD melts up.

Demeter

(85,373 posts)...In May, Roubini predicted four elements – stalling growth in the U.S., debt troubles in Europe, a slowdown in emerging markets, particularly China, and military conflict in Iran - would come together to create a storm for the global economy in 2013...

Bill Smead, CEO of Smead Capital Management, agrees that there is little central banks can do to arrest the global slowdown.

Last week, he told CNBC that there is “virtually zero chance” that pump-priming by central banks will succeed, suggesting that policymakers should instead let the economic bust work itself through the system.

Roland99

(53,342 posts)So, now Hopium has a touch of Asian flavor.

Ghost Dog

(16,881 posts)U.S. Stock Futures Gain Amid China Stimulus Speculation

U.S. stock futures rose, indicating the Standard & Poor’s 500 Index will snap the longest losing streak in almost two months, as slowing expansion in China fueled speculation policy makers will boost stimulus measures.

JPMorgan Chase & Co. (JPM) swung between gains and losses in early trading after reporting a $4.4 billion trading loss that drove down second-quarter profit. Exxon Mobil Corp. (XOM) climbed 0.4 percent in Germany as oil traded near a one-week high. Dean Foods Co. declined 1.6 percent after Goldman Sachs Group Inc. cut its rating on the shares.

S&P 500 futures expiring in September added 0.3 percent to 1,333.3 as of 7:39 a.m. in New York. The benchmark gauge has lost 1.5 percent this week amid concern company earnings in the world’s largest economy may be lower than estimated. Dow Jones Industrial Average futures gained 42 points, or 0.3 percent, to 12,544 today.

“Chinese GDP came in as expected,” Markus Huber, head of German sales trading at ETX Capital in London, wrote in e-mailed comments. “Combined with inflation having fallen to the lowest level in close to 30 months this should leave plenty of scope for further cuts in interest and reserve rates and the implementation of additional stimulus measures.”

/... http://www.bloomberg.com/news/2012-07-13/u-s-stock-futures-gain-amid-china-stimulus-speculation.html

xchrom

(108,903 posts)Wells Fargo & Co. (WFC), the most valuable U.S. bank and largest home lender, reported a 17 percent rise in second-quarter profit on strength in mortgage banking and a drop in expenses.

Net income advanced to a record $4.62 billion, or 82 cents a share, from $3.95 billion, or 70 cents, a year earlier, the San Francisco-based company said today in a statement. The average estimate of 31 analysts surveyed by Bloomberg, excluding some special items, was 81 cents a share.

Chief Executive Officer John Stumpf, 58, countered record- low interest rates and narrower margins with more home lending and purchases of loan portfolios from European banks. Wells Fargo creates a third of all new U.S. mortgages and may seek as much as 40 percent of the market. The firm also plans to shave as much as $1.5 billion off quarterly costs by the end of 2012.

“On the mortgage front, Wells has built a massive lead in the origination business,” Kenneth Usdin, a Jefferies Group Inc. analyst, wrote in a July 9 report that assigned a buy rating and a $39 price target

xchrom

(108,903 posts)Even as the U.S. economy struggles to rebound from the worst recession since the Great Depression, Americans are living larger.

Larger, as in larger homes: two-story foyers, twin front staircases, children’s wings, dedicated man caves, coffee bars, four-car garages, and bedroom closets large enough for a fifth vehicle.

The percentage of new single-family homes greater than 3,000 square feet has grown by one-third in the last decade, according to data released last month by the U.S. Census Bureau. The increase has occurred even while 4.3 million homes have been foreclosed upon since January 2007, a result of the housing- bubble collapse and economic meltdown. Slightly more than 1 in 4 new homes built last year were larger than 3,000 square feet, the highest percentage since 2007.

“It’s about opportunity,” Jack McCabe, chief executive officer of Deerfield Beach, Florida-based McCabe Research and Consulting, said in a telephone interview. “It’s about interest rates. And it’s about short memories.”

DemReadingDU

(16,000 posts)I always wonder how people remember how to do anything at all nowadays.

Demeter

(85,373 posts)They steal your mind so you have peace of mind, and not a piece of mind left...

DemReadingDU

(16,000 posts)Fuddnik

(8,846 posts)How about total collective amnesia?

Where else in the world could a complete asshole like Mitt Romney have thought of being president? It's not like we have a choice, or anything, but the thought is beyond consideration.

A lady at the dog park told me yesterday, that the real estate market would recover soon. I said, "not in our lifetimes", and she looked at me like I was nutz. I told her there was too much fundamentally wrong with the economy for a recovery. I must have been speaking Farsi or something.

Then an asshole at the bar was talking about what a great thing Governor Blimp in New Jersey did telling the feds to stick their stimulus money.

What kind of an asshole country are we living in anymore?

xchrom

(108,903 posts)Italy and Ireland have more incentive to quit the euro than Greece, while Germany may have limited room to prevent departures from the currency union, according to Bank of America Merrill Lynch.

Using cost-benefit analysis and game theory, BofA Merrill Lynch foreign exchange strategists David Woo and Athanasios Vamvakidis concluded in a July 10 report that investors “may be underpricing the voluntary exit of one or more countries” from the bloc.

“Our analysis produces a few surprising results that even readers who may disagree with our conclusion are likely to find interesting,” the strategists wrote.

Italy, the euro area’s third-largest economy, would enjoy a higher chance of achieving an orderly exit than others and would stand to benefit from improvements in competitiveness, economic growth and balance sheets, they said.

While Germany is the nation deemed able to leave the euro zone most easily, it has the least incentive of any country to quit because it would face weaker growth, possibly higher borrowing costs and a negative hit to its balance sheets, the strategists said. Austria, Finland and Belgium also have little reason to quit, they said, while Spain has the weakest case for leaving among economies most directly affected by the crisis.

Demeter

(85,373 posts)WikiLeaks declared victory Thursday in the first round of its campaign against the financial blockade imposed by Visa and MasterCard after an Icelandic court ordered their local partner to resume processing credit card donations to the secret-spilling site.

Visa and MasterCard were among half a dozen major U.S. financial firms to pull the plug on WikiLeaks following its decision to begin publishing about 250,000 State Department cables in late 2010.

WikiLeaks says that the ensuing blockade has led to a 95 percent fall in revenue, something which founder Julian Assange says has forced him to focus on fundraising at the expense of his site's publication work...

xchrom

(108,903 posts)The Obama administration sanctioned the National Iranian Tanker Co. and four alleged front companies for Iran’s oil trade, the latest salvo in a U.S.-led campaign to curtail Iran’s petroleum sales until it abandons illicit aspects of its disputed nuclear program.

The U.S. Treasury Department announced yesterday it would freeze American assets belonging to the tanker operator, known as NITC, and block the company’s transactions from the U.S. financial system. The Treasury said Iran’s government controls the company, a former subsidiary of the state-owned National Iranian Oil Co. that was officially privatized 12 years ago.

The Treasury identified 27 entities affiliated with the tanker company and 58 vessels -- some of which have been reflagged in other countries to evade international sanctions on Iran’s petroleum sales.

The U.S. action doesn’t impose penalties on non-American companies that continue to do business with NITC. The move is intended to expose the tanker company’s links to the Iranian regime and discourage refiners, traders and shippers from dealing in Iranian oil that may be disguised as crude from another country, according to three officials in President Barack Obama’s administration who spoke on condition of anonymity because they were not authorized to be named.

Demeter

(85,373 posts)Demeter

(85,373 posts)Ghost Dog

(16,881 posts)SINGAPORE -- Oil rose to near US$87 a barrel Friday as economic growth in China, the world's second-largest crude consumer, slowed in the second quarter to a three-year low but in line with analyst estimates.

China said its gross domestic product expanded 7.6 per cent in the April to June period from a year earlier, the lowest since 2009. China also reported that retail sales and factory output growth slowed in June.

Crude has fallen from $106 in May amid signs of slowing economic growth in the U.S., Europe and China. Some analysts expect global policy-makers to continue to cut lending rates and boost fiscal spending, which should spur economic growth and oil demand.

"The likelihood of some stimulus measures keep the upside risk of the oil market tilted higher through month's end and possibly beyond," energy trader and consultant Ritterbusch and Associates said in a report.

Benchmark oil for August delivery was up 43 cents at $86.51 a barrel at late afternoon Singapore time in electronic trading on the New York Mercantile Exchange. Crude rose 27 cents to settle at $86.08 on Thursday in New York.

In London, Brent crude for August delivery was up 59 cents at $101.66 per barrel on the ICE Futures exchange.

Fresh U.S. sanctions against Iran aimed at stifling its nuclear program helped support oil prices. The new sanctions announced Thursday were aimed at companies and people affiliated with Iran's defence ministry. Previous sanctions were meant to curtail its ability to export oil.

/... http://www.ctvnews.ca/business/oil-rises-to-near-us-87-in-asia-despite-chinese-economic-slowdown-1.877271#ixzz20VRaFDmz

xchrom

(108,903 posts)

The yields on Spanish and Italian 10 year bonds have been falling lately, though not by much (Update: they're rising again already, even with a "good“ Italian auction). Why? Mainly because the Eurozone promised to ship €30 billion to Spain's banks. And partly because Spain got another year's time to comply with EU budget demands. And also partly because Spain announced its (hard to keep count) fourth - restructured - austerity package in a year (?!). There is a problem with all this. A big problem.

One thing is for sure: the ongoing and ever stricter austerity measures guarantee 100% that the economies of the austerity-hit countries will deteriorate. It might be possible to cut some costs here and there in a still relatively healthy economy without causing too much pain, but when you take a nation that already has 25% unemployment, with youth unemployment over twice that, measures such as raising sales taxes and cutting government jobs can only possibly lead to further trouble.

And that means Spain (and Greece, Portugal) will need to ask for more aid down the line. The financial markets don't care about that, at least not today. They were fed another €30 billion, and that's what counts in the short term. They can - and will - put back on the pressure tomorrow or next week, and expect another €30 billion, rinse and repeat. The pattern has long been set: press on the sore spots and they will pay up.

More money from the Eurozone for Spain's decrepit banking sector will mean more austerity for its people. Because that's how it works, step by hurtful and unjust grinding step: that is, despite recent EU summit "deals", there are still no direct bank bail-outs (and probably never will be), and the €30 million is still added to Madrid's sovereign debt.

Read more: http://theautomaticearth.org/Finance/europe-is-sliding-back-into-its-own-past.html#ixzz20VTSIEDn

Demeter

(85,373 posts)NOW, WHO DIDN'T SEE THIS COMING, BESIDES BILL CLINTON, WHO GAVE HER RACKETEERING EX-HUSBAND A PRESIDENTIAL PARDON AT HER REQUEST?

http://www.msnbc.msn.com/id/48118502/ns/business-personal_finance/#.UAAaa5HvxNM

Denise Rich, the wealthy socialite and former wife of pardoned billionaire trader Marc Rich, has given up her U.S. citizenship - and, with it, much of her U.S. tax bill. Rich, 68, a Grammy-nominated songwriter and glossy figure in Democratic and European royalty circles, renounced her American passport in November, according to her lawyer. Her maiden name, Denise Eisenberg, appeared in the Federal Register on April 30 in a quarterly list of Americans who renounced their U.S. citizenship and permanent residents who handed in their green cards. By dumping her U.S. passport, Rich likely will save tens of millions of dollars or more in U.S. taxes over the long haul, tax lawyers say.

Rich, who wrote songs recorded by Aretha Franklin, Mary J. Blige and Jessica Simpson, is the latest bold-faced name to join a wave of wealthy people renouncing their American citizenship. Facebook co-founder Eduardo Saverin gave up his U.S. passport to become a citizen of Singapore, an offshore tax haven, before the company's initial public offering in May. Nearly 1,800 citizens and permanent residents, a record since data was first compiled in 1998, expatriated last year, according to government figures.

Rich, who was born in Worcester, Massachusetts, has Austrian citizenship through her deceased father, said Michael Heidt, a lawyer in Hollywood, Florida, who represented her in a recent lawsuit. He said Rich had dumped her U.S. passport "so that she can be closer to her family and to Peter Cervinka, her long-time partner." Rich's two daughters live in London; Cervinka, a wealthy property developer, is an Austrian national. Rich plans to make London her main residence and does not intend to acquire other passports, Heidt said.

Marc Rich's pardon

Rich's ex-husband, commodities trader Marc Rich, fled the United States in 1983 when indicted on charges of tax evasion, fraud, racketeering and illegal trading of oil with Iran. They divorced in 1996. Marc Rich received a presidential pardon in 2001 on President Bill Clinton's last day in office. Federal prosecutors and Congress investigated the pardon, and in 2002 a House of Representatives committee concluded Denise Rich had swayed the action through donations to the Clinton library and campaign.

Dubbed "Lady Gatsby" by Yachting magazine, Rich owns multiple properties, including a mansion in Aspen, Colorado. She is a frequent habitue of Cannes, Monte Carlo and St. Tropez with celebrities and singers aboard her 157-foot yacht, Lady Joy.

xchrom

(108,903 posts)Germany says it will help Spain to launch German-style apprenticeships for its young people, half of whom are unemployed because of the debt crisis.

Spain's Education Minister, Jose Ignacio Wert, signed an agreement with his German counterpart in Stuttgart on Thursday, to give more Spaniards on-the-job training with German firms.

Spain's youth unemployment has soared to 52% - the highest rate in the EU.

Mr Wert said Spain must learn from German best practice to improve skills.

Tansy_Gold

(17,877 posts)xchrom

(108,903 posts)those are the future tax receipts.

everything that you think of as a resource is a nations young people.

it's all we ever have -- and they are pounding the hell out of these folks.

well, i don't know -- i really don't -- we seem as intent on growing more young and poor as anybody else.

Tansy_Gold

(17,877 posts)And again, I don't think They are doing this with anything but the absolute worst of intentions. They KNOW what they are doing, and it's what they want. Anyone -- like Paulie Krugman -- who thinks otherwise is living in cloud cuckoo land.

xchrom

(108,903 posts)and like you -- i don't see how they can't know.

DemReadingDU

(16,000 posts)Government Lack Leverage Over Banks, Barofsky Says

July 13 (Bloomberg) -- Neil Barofsky, former special inspector for the U.S. Treasury's Troubled Asset Relief Program and a Bloomberg Television contributing editor, talks about regulators' response to the rate-rigging scandal that led to Barclays Plc being fined a record 290 million pounds ($448 million). He speaks with Stephanie Ruhle, Scarlet Fu and Christine Harper on Bloomberg Television's "Market Makers."

video appx 7 minutes

http://www.bloomberg.com/video/government-lack-leverage-over-banks-barofsky-says-k3wR_pdpT9abwf8jR0eCIA.html

Barofsky says these things are going to happen over and over again until we break up the banks, and start putting people in handcuffs!

@ appx 4:45 minutes

Roland99

(53,342 posts)Tansy_Gold

(17,877 posts)Roland99

(53,342 posts)Ghost Dog

(16,881 posts)My computer's operating system appears to be doing things beyond my control.

So I'm getting out of here.

Music: