Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 13 August 2012

Last edited Tue Aug 14, 2012, 10:33 AM - Edit history (2)

[font size=3]STOCK MARKET WATCH, Monday, 13 August 2012[font color=black][/font]

SMW for 10 August 2012

AT THE CLOSING BELL ON 10 August 2012

[center][font color=green]

Dow Jones 13,207.95 +42.76 (0.32%)

S&P 500 1,405.87 +3.07 (0.22%)

Nasdaq 3,020.86 +2.22 (0.07%)

[font color=red]10 Year 1.62% +0.02 (1.25%)

30 Year 2.73% +0.02 (0.74%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

[HR width=95%]

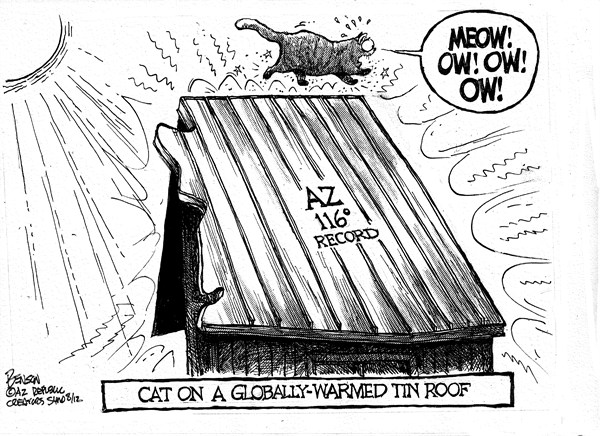

[center] toon removed due to copyright [HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,868 posts)

Demeter

(85,373 posts)No less than the Wall Street Journal (WSJ) posted a column on the history of putting to death those who engage in financial malfeasance. Jason Zweig, who wrote the WSJ essay, notes, "The history of drastic punishment for financial crimes may be nearly as old as wealth itself." Zweig takes the reader on a quick sweep of history concerning punishment for financial misdeeds, of which the following is an excerpt:

But financial crimes weren't merely punished; they were stigmatized. Dante's Inferno is populated largely with financial sinners, each category with its own distinctive punishment: misers who roll giant weights pointlessly back and forth with their chests, thieves festooned with snakes and lizards, usurers draped with purses they can't reach, even forecasters whose heads are wrenched around backward to symbolize their inability to see what is in front of them.

Counterfeiting and forgery, as the historian Marvin Becker noted in 1976, "were much less prevalent in Florence during the second half of the fourteenth century than in Tuscany during the twentieth century" and "the bankruptcy rate stood at approximately one-half the modern rate."

And in England,

But we are a civilized society for those of the top 1% who defraud customers, the nation, and engage in risk taking for profit that undermines the world economy. Perish the thought of capital punishment, we don't even put those who oversee Wall Street financial malfeasance in jail; heck, we don't even charge them. Yes, a few underlings, "guppies," are arrested now and then, but that is because their fraud was not large enough and was strictly personal (such as embezzlement). But if it is illegal activity on a massive firm-wide scale, then no one is held accountable. The financial giants just get a fine (if that even happens) that is less than the amount that they profited from their violation of regulations and the law, so they end up with a net revenue gain as a reward for their felonious behavior.

Zweig concludes,

"Wall Street offers its risk-takers the potential to earn tens of millions, even hundreds of millions of dollars, when bets pay off, with no real penalties when bets go bad. Until – or unless – that culture changes, nothing fundamental will change."But he remains skeptical that holding individuals responsible for "too big to fail" illegal behavior will work.

That's his opinion.

In our book, it's still worth a try. Enabling the current double standard of putting a person in jail for kiting a few checks, but not even charging anybody for pre-meditated actions that lead to billions of dollars in fraudulent activity, well that's not only unfair; it results in a nation committing financial suicide.

tclambert

(11,087 posts)Sen. Inhofe of Oklahoma says so. And he's a senator, so he should know.

(He doesn't. He's a complete idiot.)

Demeter

(85,373 posts)or as Indy would say: "I've got a really bad feeling about this."

xchrom

(108,903 posts)

xchrom

(108,903 posts)He writes...

Investors remain so addicted to the temporary high of monetary intervention that they continue to ignore very real downturn in global economic indicators, to an extent that we have not seen since the 2007-2009 recession. This is particularly evident in the deterioration of new orders and order backlogs, which are short-leading indicators of production, which in turn is a short-leading indicator of employment.

Trading volume has been unusually low, while a 14-handle on the CBOE volatility index also suggests unusual complacency. It’s understandable that people are reluctant to place trades in a weakening economy, yet one where quantitative easing is widely expected. Wall Street is scared to death of being out of the market when the perceived salvation of QE3 is announced, and at the same time is increasingly encouraged by negative economic data in the belief that this will accelerate delivery. In short, investors are practically begging to be shot, mauled by dogs, and diced by a Veg-O-Matic so they can get their next fix of pain-killers.

The chart below shows the average standardized value (mean zero, unit variance) of the overall, new orders, and order backlogs components of numerous regional surveys from the Federal Reserve and the Institute of Supply Management (ISM). We observe the same sustained deterioration in economic data across the world, including Europe and China (where the absolute values are higher, but the standardized values are similarly bad). The overall pattern reflects what Lakshman Achuthan of ECRI often describes as the “three P’s” – pronounced, pervasive, and persistent. Those three P’s help to distinguish signals from noise. Presently, our own noise-reduction methods suggest that a global recession is at hand.

Read more: http://www.businessinsider.com/hussman-investors-are-so-complacent-theyre-missing-that-a-global-recession-is-now-at-hand-2012-8#ixzz23PqRyhMq

Demeter

(85,373 posts)The reason why the eurozone is in trouble is they don't follow suit.

xchrom

(108,903 posts)Japan's economic growth slowed in the second quarter as the eurozone crisis hurt exports and domestic consumption remained subdued.

Gross domestic product grew by 0.3% during the period from the previous three months. That is down from 1% growth in the first quarter.

Compared with the same period last year, the economy expanded by 1.4%.

Analysts warned that Japan's growth may slow further in coming months amid an uncertain global economic climate.

just1voice

(1,362 posts)or any of the other links you posted citing analysts and their bullshit, kiss-ass, business insider propaganda. The brain dead, rote repetition of numbers from those self-serving mouthpieces for a corrupt system is meaningless drivel published exclusively for obsessively detailed and incompetent small minds who are incapable of seeing a bigger picture involving real people and societies overall.

If people want to know how today's markets work all they need to be aware of is corruption and how criminals behave on both personal and institutional levels. Criminals fake numbers, falsify research and basically lie about everything. Reciting their lies and acting as if the lies add something to a group of knowledge is absurd. All anyone can do is try to decipher why the criminals are lying about something at any given time because as George Soros said "we live in an era of corruption".

xchrom

(108,903 posts)China’s stocks fell by the most in almost a month after Bank of America Corp. cut its economic growth forecasts for China and on speculation the government won’t loosen monetary policy as property prices rebound.

Anhui Conch Cement Co. (SHCOMP) led declines for construction material stocks after Bank of America joined Deutsche Bank AG and Barclays Plc in reducing growth forecasts for China. China Vanke Co. and Poly Real Estate Group Co. slid more than 4 percent after the Financial News said the central bank is being “cautious” in reducing banks’ reserve-requirement ratios to prevent home prices from rising further. Citic Securities Co. and Haitong Securities Co Ltd. (600837) plunged more than 8 percent on concern that a weak stock market will hurt brokerage earnings.

“Investors lack confidence in the market,” said Xu Shengjun, an analyst at Jianghai Securities Co. in Shanghai. “With bad economic data last week and more bad earnings, the market is set to continue falling. People are disappointed there are no new stimulus measures and the chance of major measures are unlikely.”

The Shanghai Composite Index fell 1.5 percent to 2,136.08 at the close, the biggest decline since July 16. The CSI 300 Index (SHSZ300) lost 2 percent to 2,351.93. The Hang Seng China Enterprises Index (HSCEI) of Chinese companies traded in Hong Kong retreated 0.8 percent. The Bloomberg China-US 55 Index (CH55BN), the measure of the most-traded U.S.-listed Chinese companies, added 0.5 percent in New York.

xchrom

(108,903 posts)celand holds some key lessons for nations trying to survive bailouts after the island’s approach to its rescue led to a “surprisingly” strong recovery, the International Monetary Fund’s mission chief to the country said.

Iceland’s commitment to its program, a decision to push losses on to bondholders instead of taxpayers and the safeguarding of a welfare system that shielded the unemployed from penury helped propel the nation from collapse toward recovery, according to the Washington-based fund.

“Iceland has made significant achievements since the crisis,” Daria V. Zakharova, IMF mission chief to the island, said in an interview. “We have a very positive outlook on growth, especially for this year and next year because it appears to us that the growth is broad based.”

Iceland refused to protect creditors in its banks, which failed in 2008 after their debts bloated to 10 times the size of the economy. The island’s subsequent decision to shield itself from a capital outflow by restricting currency movements allowed the government to ward off a speculative attack, cauterizing the economy’s hemorrhaging. That helped the authorities focus on supporting households and businesses.

Demeter

(85,373 posts)for naive nations who believe the propaganda, or cowardly ones, who refuse to do what needs to be done.

xchrom

(108,903 posts)Italy sold 8 billion euros ($9.9 billion) of Treasury bills as borrowing costs rose amid speculation the European Central Bank’s plan to purchase the securities of indebted nations won’t be sufficient to curb the regional debt crisis.

The Rome-based Treasury sold the 364-day bills at 2.767 percent, up from 2.697 percent at the last sale of similar- maturity debt on July 12. Investors bid for 1.69 times the amount of bills offered, up from 1.55 times last month.

xchrom

(108,903 posts)ATLANTA (AP) -- Tea party activists in Georgia helped kill a proposed sales tax increase that would have raised billions of dollars for transportation projects. In Pennsylvania, tea partyers pushed to have taxpayers send public school children to private schools. In Ohio, they drove a referendum to block state health insurance mandates.

These and other battles are evidence of the latest phase of the conservative movement, influencing state and local policy, perhaps more effectively than on a national level. Tea party organizers are refocusing, sometimes without the party label, to build broader support for their initiatives. The strategy has produced victories that activists say prove their staying power.

"I call it Tea Party 2.0," said Amy Kremer, a Delta flight attendant who leads Tea Party Express. The California-based group, co-founded by GOP strategist Sal Russo, claims it's the largest tea party political action committee.

The movement first showed its strength in Washington in 2009 as an umbrella for voters angry over President George W. Bush's Wall Street rescue and President Barack Obama's stimulus package and auto manufacturer bailout, as well as the health care debate.

Demeter

(85,373 posts)This law applies specifically when there are two forms of commodity money in circulation which are required by legal-tender laws to be accepted as having similar face values for economic transactions. The artificially overvalued money tends to drive an artificially undervalued money out of circulation[2] and is a consequence of price control.

Gresham's law is named after Sir Thomas Gresham (1519–1579), who was an English financier during the Tudor dynasty. However, the law had been stated forty years earlier by Nicolaus Copernicus. In Poland it is known as the Copernicus-Gresham Law. The phenomenon had been noted even earlier, in the 14th century, by Nicole Oresme. This notion was developed also during the time of the Mamluk Empire. Specifically, it was developed by the Muslim jurist and historian Al-Maqrizi (1364–1442) who wrote about a particular period in the Mamluk dynasty when the rulers were simultaneously increasing the supply of a lower valued (copper) currency and hoarding the more valued (gold and silver) currencies.[3] This can be found in his work titled "Study of the Monetary System." The fact of bad money being used in preference to good money is also noted by Aristophanes in his play The Frogs, which dates from around the end of the 5th century BC.---wikipedia--

The concept can be traced to ancient works, including Aristophanes' The Frogs, where the prevalence of bad politicians is attributed to forces similar to those favoring bad money over good.

The referenced passage from The Frogs is as follows (usually dated at 405 BCE):

The course our city runs is the same towards men and money.

She has true and worthy sons.

She has fine new gold and ancient silver,

Coins untouched with alloys, gold or silver,

Each well minted, tested each and ringing clear.

Yet we never use them!

Others pass from hand to hand,

Sorry brass just struck last week and branded with a wretched brand.

So with men we know for upright, blameless lives and noble names.

These we spurn for men of brass...

dev·o·lu·tion/ˌdevəˈlo͞oSHən/ Noun:

1.The transfer or delegation of power to a lower level, esp. by central government to local or regional administration.

2. Descent or degeneration to a lower or worse state.

The principles of Gresham's law can sometimes be applied to different fields of study. Gresham's law may be generally applied to any circumstance in which the "true" value of something is markedly different from the value people are required to accept, due to factors such as lack of information or governmental decree.

xchrom

(108,903 posts)ATHENS, Greece (AP) -- The Greek statistical authority says the country's deep recession has eased slightly, although the economy still contracted 6.2 percent in the second quarter from the same period last year.

In the first quarter, the contraction was 6.5 percent.

No quarterly figures were provided in the figures published Monday.

Debt-crippled Greece has been in recession for five years, and the cumulative shrinkage is expected to reach 20 percent at the end of this year. The government has said the recession could exceed seven percent in 2012.

xchrom

(108,903 posts)PYONGYANG, North Korea (AP) -- North Korea says leader Kim Jong Un's uncle has left Pyongyang for talks in Beijing that will focus on economic cooperation with the country's most important ally.

North Korean state media said Monday that Jang Song Thaek will meet Tuesday with senior Chinese officials on joint development of the countries' special economic zones.

Kim Jong Un has promoted younger economists to key party positions as part of a stated push to resuscitate an economy that has lagged far behind the rest of Northeast Asia. Much of North Korea remains impoverished outside the capital Pyongyang.

Jang is married to late leader Kim Jong Il's sister, Kim Kyong Hui, and is a vice chairman of the powerful National Defense Commission. He is seen as a leading economic policy official.

xchrom

(108,903 posts)"Que se vayan todos," or "Away with all of them," became one of the slogans chanted by the tens of thousands of "Indignados" in Spain at protests last year. In addition to their eponymous outrage, many had one thing in common: Most were young and viewed themselves as victims of the crisis.

They might have been more specific and instead chanted: "All the old people must go!" This phrase would apply because, in many ways, the euro crisis is also a conflict between generations -- the flush baby boomers in their fifties and sixties are today living prosperously at the expense of young people.

Intergenerational equity -- measured among other things by levels of direct and hidden debts and pension entitlements -- is particularly low in Southern Europe. In a 2011 study of intergenerational equity in 31 countries by the Bertelsmann Foundation, Greece came in last place. Italy, Portugal and Spain didn't do much better, landing in 28th, 24th and 22nd place respectively. Currently, the unequal distribution of income and opportunities is particularly distinct:

The employment market collapse has hit young Europeans much harder than older generations. In Greece and Spain more than half of those under age 25 are unemployed -- twice the rate of older workers. Things are even worse in parts of southern Italy, where youth unemployment has risen above 50 percent.

One reason for this situation is unequal employment circumstances. Older Spaniards and Italians, for example, profit from worker protection laws preventing them from getting fired that are quite strong by international comparison. But almost half of young Italians and 60 percent of young Spaniards are on temporary employment contracts and can easily lose their jobs.

The burdens and risks of the euro bailouts are also mainly borne by young people. Ultimately, growing national debts and bailout funds worth billions will be financed through bonds that won't be due for many years to come.

xchrom

(108,903 posts)“Dire” is no longer the right word to describe the situation in Greece.

Unemployment hit 23.1% in May, according to ELSTAT, the Greek statistical agency, which released the report on August 9. That it takes over two months to do a job—producing unemployment numbers—that other countries accomplish in a couple of weeks may be symptomatic of Greece’s calamity economy.

And a calamity it is.

Youth unemployment (15-24) jumped to 54.9%—but even before the crisis, during the boom years so to speak, it had been high, ranging from 22% in 2007 to 32% in 1999.

Read more: http://www.testosteronepit.com/home/2012/8/10/is-the-greek-calamity-economy-headed-for-revolt.html#ixzz23QU8Lx1E

Demeter

(85,373 posts)Companies are set to pay $8 billion to settle charges of ripping off the government. No CEOs have been charged...This year, military contractors, banks, pharmaceutical companies and other corporations might end up spending more than $8 billion in settlements with the government, the New York Times reports. Though the lawsuits include accusations of overbilling, drug marketing, selling “dangerous and defective” equipment to the military, and price and security fraud, thus far no individual within the corporations involved has been held accountable.

The Justice Department does not rule out charging executives. However, a government enforcer official, who spoke on the condition of anonymity, told the Times that in many cases it’s too expensive and difficult to gather the evidence needed to prosecute high-positioned individuals.

THOSE POOR, DEFENSELESS LAWYERS!

Demeter

(85,373 posts)...Unfortunately, a federal appeals court just ruled that the United States government may wiretap American citizens without a warrant being necessary. This legal finding means that any of us may have our telephone conversations monitored and recorded by US intelligence and law enforcement agencies:

“This case effectively brings to an end the plaintiffs’ ongoing attempts to hold the executive branch responsible for intercepting telephone conversations without judicial authorization,” a three-judge panel of the 9th U.S. Circuit Court of Appeals wrote.

Although a separate suit by the Electronic Frontier Foundation aimed at striking down warrantless wiretapping is still active, right now the latest ruling is the law of the land. This means you have no guarantee that the government is not monitoring your conversations, and no recourse if they are.

If that makes you feel like the Constitution is being tossed out the window, you won't feel reassured to know that the Obama administration is still trying to legally be able to arrest US citizens without a writ of habeas corpus. According to an article in Business Insider,

Today feels super-creepy. NDAA's imprisonment without trial provisions are trying for a second chance at life. Remind me to put V For Vendetta back on the Netflix queue...

Here's what's up. As reported earlier today, The White House has filed an appeal in hopes of reversing a federal judge's ruling that bans the indefinite military detention of Americans because attorneys for the president say they are justified to imprison alleged terrorists without charge.

Manhattan federal court Judge Katherine Forrest ruled in May that the indefinite detention provisions signed into law late last year by US President Barack Obama failed to 'pass constitutional muster' and ordered a temporary injunction to keep the military from locking up any person, American or other, over allegations of terrorist ties. On Monday, however, federal prosecutors representing President Obama and Defense Secretary Leon Panetta filed a claim with the 2nd US Circuit Court of Appeals in hopes of eliminating that ban.

If this indefinite detention provision is eventually upheld, don't object to it too vociferously on the telephone: such an action might land you in jail without any charges being brought against you. That’s what the military governments in Argentina and Chile did, with US support, "during the dirty wars."

In Argentina, it led to at least 30,000 dead and thousands of more tortured.

Fascism creeps in slowly like a late evening fog.

Demeter

(85,373 posts)will Obama come out to repudiate any such thing? And can we believe him?

This boy's cried wolf too many times....

DemReadingDU

(16,000 posts)I think Romney/Ryan get voted in if the markets decline significantly.

Say goodbye to Medicare and Social Security

Demeter

(85,373 posts)The same problems that plagued the foreclosure process — and prompted a multibillion-dollar settlement with big banks — are now emerging in the debt collection practices of credit card companies.

As they work through a glut of bad loans, companies like American Express, Citigroup and Discover Financial are going to court to recoup their money. But many of the lawsuits rely on erroneous documents, incomplete records and generic testimony from witnesses, according to judges who oversee the cases.

Lenders, the judges said, are churning out lawsuits without regard for accuracy, and improperly collecting debts from consumers. The concerns echo a recent abuse in the foreclosure system, a practice known as robo-signing in which banks produced similar documents for different homeowners and did not review them.

“I would say that roughly 90 percent of the credit card lawsuits are flawed and can’t prove the person owes the debt,” said Noach Dear, a state civil court judge in Brooklyn, who said he presided over as many as 100 such cases a day.

MORE

Demeter

(85,373 posts)Terrill Meisinger agreed to pay the money to resolve allegations that he operated a fraud that targeted homeowners, renters and banks...Terrill Meisinger agreed to pay the money to resolve a lawsuit filed against him by the U.S. attorney's office in Los Angeles. Federal attorneys had accused Meisinger of contacting people who were facing foreclosure and making small cash payments, typically $500 to $1,500, to them if they deeded their homes to him and moved out before banks completed foreclosure. Meisinger then transferred the titles to third parties, whose identities he had stolen, and filed bankruptcies that triggered automatic stays on foreclosures. While banks tried to assess what had happened, Meisinger rented the homes, raking in huge profits, the U.S. attorney's office alleged. From 2000 to 2004, Meisinger collected more than $1.5 million in rents without making mortgage payments on the properties, most of which were in Riverside and San Bernardino counties, the U.S. attorney's office said.

ENTERPRISE! IT'S WHAT MADE AMERICA WHAT IT IS TODAY---A CRIMINAL CONSPIRACY

Demeter

(85,373 posts)HAPPINESS IS PRICELSS--IF THEY MEAN ECONOMIC SECURITY---WELL, $75K DID THAT 20 YEARS AGO, BUT I DOUBT IT'S ENOUGH NOW FOR COVERING HEALTHCARE, COLLEGE AND RETIREMENT SAVINGS.

http://www.alternet.org/does-happiness-cost-75000-year?akid=9204.227380.pInI2C&rd=1&src=newsletter691986&t=9

..the Woodrow Wilson School at Princeton University has concluded that they’ve calculated the cost of daily happiness—and it’s $75,000 a year.

According to the study, if you’re below this level of annual income, which the majority of Americans are, you’re more likely to feel unhappy on a daily basis. Meanwhile, if you’re in the minority earning above that bracket, you’ve hit the threshold for diminishing marginal returns on daily happiness...

The researchers didn’t specify if the sweet spot of happiness cost $75,000 before or after taxes, although it’s a safe bet to assume that everyone’shappiness levels drops around tax time, regardless of annual income.

The study, published by economist Angus Deaton and psychologist DanielKahneman, who has won a Noble Prize in Economics, did parse types of happiness, separating the emotion into two categories: “enjoyment of life” and “life satisfaction.” While discerning the difference might feel like the corner clue on a Sunday New York Times crossword puzzle, it’s actually quite simple. The former measures things like how often you smile and laugh and how happy you felt yesterday. The latter is supposed to be a more profound measure of your life overall, but it’s actually more like rating yourself on HotOrNot.com—except you’re not measuring your physical appearance but your total life domination. For the former measurement, daily happiness increases until $75,000 when it plateaus, suggesting that it costs, on average, about this amount to live free of financial stress in the United States...

Demeter

(85,373 posts)But it's more than life is worth to fix it...please read between lines and pardon the mess I'm making.

I must not be awake yet. Because blaming it on DU would be futile...

Tansy_Gold

(17,868 posts)They're in the right place!

![]()

Demeter

(85,373 posts)YOU MEAN, ASIDE FROM THE FACT THAT IT'S A GROWING SECTION OF THE ELECTORATE?

Only 10 percent of homeless Americans vote each year, but they can still make a difference in local elections...Having a home is not a prerequisite to vote in the United States. But activists and homeless service providers still face major challenges trying to help homeless Americans register.

Pitts v. Black (1984) and several subsequent cases in the 1980s and '90s established that homeless people could not be denied the right to vote because they did not live in a traditional residence. A shelter, park or street corner can be designated as a residence. In states that require a mailing address for voter registration, homeless voters can usually use the addresses of shelters, churches, friends’ houses, or P.O. boxes.

Still, turnout among homeless voters is one of the lowest for any demographic. In the 2008 presidential election, people with the lowest income (family annual income less than $20,000) and people with no reported income -- the groups most homeless Americans fall into -- had the lowest voter registration rate and the lowest voting rate. According to Neil Donovan, executive director of the National Coalition for the Homeless (NCH), only one-tenth of unhoused persons actually exercise the right to vote, and over the years, “the number has been fairly consistent.”

This is unfortunate, because homeless voters can make a difference. As the 2012 presidential election nears, issues that are relevant to homeless Americans, such as economic inequality, healthcare and job creation, will continue to shape the national debate. Although the homeless vote may not be a wild card for any candidate or party, with at least 1.6 million people experiencing homelessness nationwide, it does have the potential to change the game in some swing states...

MORE

Roland99

(53,342 posts)-6.2% vs. -6.5 - -7%

[font color="red"]S&P 500 -0.1%

DOW -0.1%[/font]

NASDAQ +0.0%

Roland99

(53,342 posts)Fuddnik

(8,846 posts)Demeter

(85,373 posts)the balls are all up in the air (mostly) and the plates still spinning, and the money washes back and forth in the bathtub...

No adults in the room.

Tansy_Gold

(17,868 posts)

Demeter

(85,373 posts)They must be anticipating the close of European markets.

Demeter

(85,373 posts)SOUNDS LIKE A SHERLOCK HOLMES STORY...

The case of the rigged Libor turns out to be the scandal that just keeps on giving. It reveals a great deal about the behavior of the Federal Reserve Board and central banks more generally.

Last month, Federal Reserve Board Chairman Ben Bernanke gave testimony before Congress in which he said that he had become aware of evidence that banks in England were rigging the Libor in the fall of 2008. According to Bernanke, he called this to the attention of Mervyn King, the head of the Bank of England. Apparently Mervyn King did nothing, since the rigging continued, but Bernanke told Congress there was nothing more that he could do. The implications of Bernanke’s claim are incredible. There are trillions of dollars of car loans, mortgages, and other debts, in the United States, tied to the Libor. There are also huge derivative contracts whose value depends on the Libor at a moment in time. People were winning or losing on these deals not based on the market, but rather on the rigged Libor rate being set by the big banks. Bernanke certainly had an obligation as Fed chair to expose and stop this rigging, which was interfering with the proper working of U.S. and world financial markets. But hey, Mervyn King didn’t want to take any action, what could Bernanke possibly do? It is truly incredible that Bernanke would make such a statement to Congress and the public. There was nothing he could do about the rigging?

Suppose that he told the head of the Bank of England that he had no choice but to stop the rigging. Bernanke could have said that if King doesn’t immediately take the necessary steps to end the rigging then he would hold a press conference in which he would publicly display the evidence of the rigging and report King’s failure to take action. Is it conceivable that this threat would have left King unmoved? Would King continue to tolerate the rigging even if could cost him his job and leave him open to public humiliation for failing to carry through his responsibilities to the people of the United Kingdom? That seems unlikely.

Of course such a threat would have been rude. It would have required Bernanke to tell a fellow central bank head that he was failing in his job and that Bernanke was prepared to ruin his career in order to force him to act responsibly. Apparently Bernanke never even considered this course of action. This should make everyone very angry. Whatever personal relationship Bernanke has with Mervyn King and other central bank heads should be subordinate to his responsibility to ensure the integrity of U.S. financial markets. If the latter requires that he be rude to the head of the Bank of England, then there is no question that his job requires that he be rude to Mervyn King. But that is not the way things get done in the central bankers’ club.

It is not just the Libor scandal that shows the bad effects of central banker clubbiness...

Demeter

(85,373 posts)Banks could be obliged to contribute to setting Libor benchmark interest rates after a rigging scandal prompted demands for an overhaul, the British financial regulator in charge of the review said on Thursday. In future, fewer transactions are likely to be based on the London interbank offered rate (Libor) and regulation could be tightened for all financial benchmarks, including those for oil, gold and stock prices, Martin Wheatley, managing director of the Financial Services Authority, told Reuters. On Friday, he is due to publish his review of Libor at the request of the British government.

Used as a benchmark for $500 trillion in contracts for everything from home loans to complex financial derivatives, Libor has been under intense scrutiny since British bank Barclays (BARC.L) was fined more than $450 million in June by U.S. and UK regulators for rigging it. Other international banks on the panel that sets Libor rates are also under investigation. Until now, membership of the panel has been the preserve of a small group of banks, which volunteer daily estimates for the rates at which they would borrow different currencies for different periods to come up with a set of benchmarks. But Wheatley said providing quotes for Libor could become mandatory to widen the number of banks taking part and improve Libor's credibility.

"Whatever the improvements made to Libor, we will want to consider alternative benchmarks for at least some of the types of transaction that currently rely on Libor," Wheatley said.

It was impossible to replace Libor straight away because so many contracts were linked to it and it might not be possible to replace completely because alternatives are not perfect, he said...

Demeter

(85,373 posts)Two US Border Patrol agents have been found guilty of running a profitable human smuggling ring that may have earned US$2 million.

The brothers Raul Villarreal, 42, and Fidel Villarreal, 43, were convicted of using their power for their own advantage, charging money to help hundreds of illegal immigrants enter the US from Mexico.

The two heard their verdicts after a five-week trial that was concluded by a one-day deliberation by the jury.

“They made the border work for them,” Assistant US Attorney Timothy Salel told jurors.

Demeter

(85,373 posts)On July 27, 2012, the National Association of Letter Carriers adopted a resolution at their national convention in Minneapolis to investigate the establishment of a postal banking system. The resolution noted that expanding postal services and developing new sources of revenue are important components of any effort to save the public post office and preserve living-wage jobs; that many countries have a long and successful history of postal banking, including Germany, France, Italy, Japan and the United States itself; and that postal banks could serve the nine million people who don't have a bank account and the 21 million who use usurious check cashers, giving low-income people access to a safe banking system. "A USPS [United States Postal Service] bank would offer a 'public option' for banking," concluded the resolution, "providing basic checking and savings - and no complex financial wheeling and dealing."

I CAN HEAR THE OUTRAGE---SOCIALISM! SOCIALISM!

DemReadingDU

(16,000 posts)kickysnana

(3,908 posts)and overseen by the post office. With addons that can have upcharges.

Same penalties for spam and fraud as postal mail.

Demeter

(85,373 posts)Why do the mega rich in the United States feel so put upon? Their incomes are rising, after all, and the taxes they pay have never been lower since the 1920s. In fact, even if lawmakers in Congress passed 100 percent of President Obama’s tax plan, America’s rich would still be paying taxes at less than half the top rate that America’s richest faced back in the 1950s. America’s wealthiest, given this ever so friendly political lay of the land, ought to be kicking back and living care-free. But that’s not happening. This election cycle appears to have America’s super rich in a feverish frenzy. They’re pouring money into the 2012 elections at all-time record rates.

What’s behind this deluge of campaign cash? A few frenzied super-rich political donors have apparently gulped the Kool-Aid of America’s delusional right wing. President Obama, these crazed deep pockets almost seem to believe, has tumbrils waiting to cart them off to the guillotines once he wins a second term. But most of our super rich remain eminently reality-based. They know full well that the rich in other major developed nations face political challenges far more unnerving than anything that confronts deep pockets in the United States.

In France, for instance, the lawmakers elected this past spring will be taking action this September to raise the tax rate on income over 1 million euros, the equivalent of $1.24 million, from 44 to 75 percent. The tax plan President Obama has announced, by contrast, will only hike the top-bracket U.S. rate from 35 to 39.6 percent — and no one in Congress has anything remotely close to a majority for going beyond what the President is proposing. So why do America’s super rich feel compelled to plow so many billions into politics? They already live in the most rich people-friendly developed nation in the world. What else could they possibly want? Well, they could want Singapore. To be more precise: Many of America’s richest see no reason why they shouldn't be able to live in a nation that treats the “successful” and their fortunes with as much respectful deference that locales like Singapore so openly display.

And just how much deference does Singapore extend to its resident rich? Last week, in a vividly detailed new paper on Singapore's tax system, three analysts from the Deloitte global financial consulting network described how extraordinarily rich people-friendly a modern economy can be. In Singapore, the Deloitte analysts relate, residents pay no more than 20 percent of any income dollar over $250,000 in taxes. And many income dollars over $250,000 face no tax carve-out at all — since Singapore levies no tax on capital gains, the profits from buying and selling stocks and other assets. Singapore also doesn’t bother taxing any income that its richest residents grab from abroad, even if these residents have that income remitted into Singapore. Residents instead only face taxes on their “Singapore-source income.” The rich who reside in Singapore don’t even have “to report their foreign bank accounts or other foreign financial assets” to Singapore’s version of the IRS. Nor do Singapore's wealthy have to worry about their grand fortunes shrinking once they pass on to the hereafter. Singapore hasn’t had an estate tax on the books since early in 2008. Some Americans seem to find this total tax package that Singapore offers absolutely irresistible. In 2009, the U.S. embassy in Singapore reports, 58 Americans renounced their citizenship and set up residence in Singapore. In 2010, that total apparently hit close to 100. Singapore certainly has its charms, but most tax break-hungry Americans of means don't seem particularly eager to take up residence for at least 183 days a year. Their alternate endgame: bring Singapore stateside. In places like Singapore, these Americans see a vision of what the United States could become....

Demeter

(85,373 posts)African countries are trying to shoo the U.S. dollar away, even if it means threatening to throw people who use greenbacks in jail...Starting next year, Angola will require oil and gas companies to pay tax revenue and local contracts in kwanza, its currency, rather than dollars. Mozambique wants companies to exchange half of their export earnings for meticais, hoping to pull more of the wealth in vast coal and natural-gas deposits into the domestic economy. And Ghana is seeking similar ways to reinforce "the primacy of the domestic currency," after the cedi plummeted more than 17% against the dollar in the first six months of this year.

The sternest steps come from Zambia, a copper-rich country in southern Africa where the central bank has banned dollar-denominated transactions. Offenders who are "quoting, paying or demanding to be paid or receiving foreign currency" can face a maximum 10 years in prison, the central bank said in a two-page directive in May.

That puts an uncomfortable squeeze on foreign mining companies and tour operators that shepherd thousands of travelers a year to Zambia's side of Victoria Falls. "No one has been prosecuted or jailed for contravening the law yet, but the monitoring process is in progress," Kanguya Mayondi, the Bank of Zambia's spokesman, said. The penalty for not using the kwacha is well within the bank's mandate, he added.

The moves aim to strengthen thinly traded currencies and steer more capital into isolated financial markets. But the new rules are an abrupt change for foreign and local companies used to doing business in U.S. dollars...

THERE GOES THE HEGEMONY!

Demeter

(85,373 posts)Demeter

(85,373 posts)Nations that undergo distressed debt exchanges risk defaulting a second time, Moody’s Investors Service said in a report that may presage challenges facing Greece.

Of 30 sovereign distressed exchanges since 1997, more than a third were followed by another default event, according to Moody’s. Losses to investors ranged from 5 percent to 95 percent with a mean of 47 percent, New York-based Moody’s said...

Demeter

(85,373 posts)Greece will issue additional T-bills to pay a government bond that matures later this month and avoid default while it awaits a delayed tranche of aid, a government official said on Tuesday.

Cash-strapped and behind targets agreed under a 130 billion euro ($160.4 billion) financial rescue package, Athens faces a 3.2 billion euro bond maturity on Aug. 20. The bond is held by the European Central Bank.

"There will be an announcement on Friday on the amount and details," the official told Reuters.

The additional sale of short-term debt will come on top of a three-month T-bill auction next week to roll over a previous 1.6 billion euro issue. Shut out of bond markets, Greece issues T-bills on a monthly basis to refund maturing short-term paper...

Demeter

(85,373 posts)A Greek departure from the eurozone would be “manageable” said a top Brussels policy-maker, as figures showed that its major economies are in painful slowdown.

Jean-Claude Juncker, the Luxembourg prime minister who leads the eurozone’s finance ministers group, yesterday addressed the prospect of that Greece’s exit from the currency bloc - making it the first country to do so.

“From today’s perspective, it would be manageable but that does not mean it is desirable,” he said. “Because there would be significant risks, especially for ordinary people in Greece.”

Asked if he could rule out a Greek eurozone exit, he said: “At least until the end of the autumn. And after that, too.”

DemReadingDU

(16,000 posts)5/9/11

Head Of Eurogroup Admits To Lying About "Secret Greek Meeting" Out Of Fears For Market Collapse - "When It Becomes Serious, You Have To Lie"

http://www.zerohedge.com/article/head-eurogroup-admits-lying-about-secret-greek-meeting-out-fears-market-collapse

Demeter

(85,373 posts)Because....they've been lying for YEARS!

Demeter

(85,373 posts)The Washington-based Carlyle Group on Thursday said it was acquiring TCW Group from Societe Generale.

TCW will become a Carlyle portfolio company in Carlyle Global Financial Services Partners, a $1.1 billion financial services fund, and Carlyle Partners V, a $13.7 billion U.S. buyout fund, according to the announcement.

The Los Angeles-based TCW Group, originally known as the Trust Company of the West, was founded in 1971 and is a diversified asset-management firm with about $130 billion under management.

Financial terms were not publicly disclosed, but Carlyle’s funds and TCW management and employees are believed to have paid about $700 million in cash, and some debt, according to people familiar with the transaction...

Demeter

(85,373 posts)The U.S. Securities and Exchange Commission has dropped an investigation into Goldman Sachs Group Inc's role in selling $1.3 billion worth of subprime mortgage securities, the investment bank said in a regulatory filing on Thursday.

In February, Goldman received a so-called Wells notice from SEC staff related to disclosures in the deal's offering documents. Such notices typically indicate the agency plans to take some kind of enforcement action, and gives firms a chance to respond.

On Monday, the SEC notified Goldman that the investigation had been closed and that it did not intend to recommend any enforcement action against the bank related to the offering, Goldman said in its quarterly 10-Q filing with the SEC.

The investment bank also lifted its estimate of "reasonably possible" legal losses to $3.4 billion from a previous estimate of $2.7 billion three months earlier. The estimate does not include potential losses from legal matters that are at an early stage or that are too difficult to predict...