Economy

Related: About this forumWeekend Economists Discover the Blue Men January 18-21, 2013

Ah, no, I didn't mean those people....(although they will do for the "art" theme), but these:

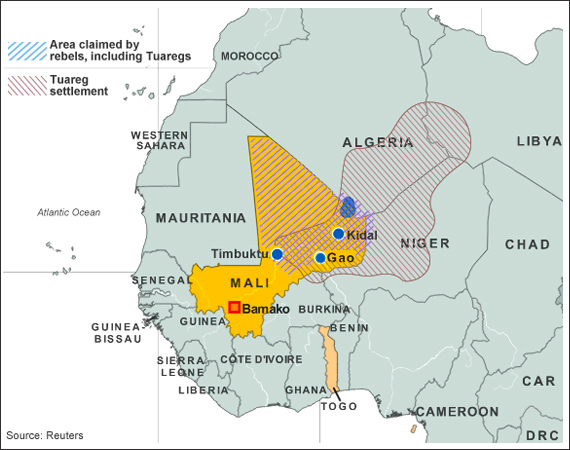

The Tuareg (also spelled Twareg or Touareg) are a Berber people with a traditionally nomadic pastoralist lifestyle. They are the principal inhabitants of the Saharan interior of North Africa.

The Tuareg language, or languages, have an estimated 1.2 million speakers. About half this number is accounted for by speakers of the Eastern dialect (Tamajaq, Tawallammat). Most Tuareg live in the Saharan parts of Niger and Mali but, being nomadic, they move constantly across national borders, and small groups of Tuareg are also found in southeastern Algeria, southwestern Libya and northern Burkina Faso, and a small community in northern Nigeria.

The name Tuareg is derived from Targa, the Berber name of Libya's Fezzan province. The name Tuareg thus in origin designated the inhabitants of Fezzan from the perspective of the Berbers living closer to the Mediterranean coast, and was adopted from them into English, French and German during the colonial period. The Berber noun targa means "drainage channel" and by extension "arable land, garden". It designated the Wadi al-Haya area between Sabha and Ubari and is rendered in Arabic as bilad al-khayr "good land".

The name of the Tuareg for themselves is Imuhagh (Imazaghan or Imashaghen, Imazighan). The term for a Tuareg man is Amajagh (var. Amashegh, Amahagh), the term for a woman Tamajaq (var. Tamasheq, Tamahaq, Timajaghen). The spelling variants given reflect the variety of the Tuareg dialects, but they all reflect the same linguistic root, expressing the notion of "freemen", strictly only referring to the Tuareg "nobility", to the exclusion of the artisan client castes and slaves. Another self-designation of more recent origin is linguistic, Kel Tamasheq or Kel Tamajaq (Neo-Tifinagh ⴾⴻⵍ ⵜⴰⵎⴰⵌⴰⵆ

Also encountered in ethnographic literature of the early 20th century is the name Kel Tagelmust "People of the Veil" and "the Blue People" (for the indigo colour of their veils and other clothing, which sometimes stains the skin underneath).

---wikipedia

One of the classic conflicts amongst people throughout history has been the struggles between settled people who depend on agriculture and ownership of land, and the nomads, who build no cities, own no land, but take their herds from place to place in search of food and water. Trading can also be a way of life for the unsettled peoples....or theft, for those who cannot or will not sustain themselves otherwise...another classic struggle has been between those who manufacture and accumulate wealth, and those who attack to loot and pillage the goods and populations: the pirates.

In the Sahel, as on the seas, or in the financial markets, individuals can play any or all of these roles. Except for our financial markets, the usual end game sees the nomads forcibly settled and the pirates wiped out by the more resourceful, settled people, who accumulate enough wealth and lust for their wealth to create superior armies and defenses.

With the turmoils of the Arab Spring, the rape of Libya and all the blowback, these isolated people have once again crossed the pages of history, and how the story ends, we do not yet know.

I'm betting it will end badly, however. It usually does.

Demeter

(85,373 posts)

Who has not thrilled at the romance of the desert song?

But the actual experience is something other than romantic.

The Tuareg people inhabit a large area, covering almost all the middle and western Sahara and the north-central Sahel. In Tuareg terms, the Sahara is not one desert but many, so they call it Tinariwen ("the Deserts"

The Tuareg adopted camel nomadism, along with its distinctive form of social organization, from camel-herding Arabs about two thousand years ago, when the camel was introduced to the Sahara from Arabia. Since that time, they had operated the trans-Saharan caravan trade connecting the great cities on the southern edge of the Sahara via five desert trade routes to the northern (Mediterranean) coast of Africa. The Tuareg once took captives, either for trade and sale, or for domestic labor purposes. Those who were not sold became assimilated into the Tuareg community. Slaves and herdsmen formed a component of the division of labor in camel nomadism.

They expanded southward from the Tafilalt region into the Sahel under their legendary queen Tin Hinan, who is assumed to have lived in the 4th or 5th century. Tin Hinan is credited in Tuareg lore with uniting the ancestral tribes and founding the unique culture that continues to our time. At Abalessa, a grave traditionally held to be hers has been scientifically studied.

At the turn of the 19th century, the Tuareg territory was organised into confederations, each ruled by a supreme Chief (Amenokal), along with a counsel of elders from each tribe. These confederations are sometimes called "Drum Groups" after the Amenokal's symbol of authority, a drum. Clan (Tewsit) elders, called Imegharan (wisemen), are chosen to assist the chief of the confederation. Historically, there are seven recent major confederations:

Kel Ajjer or Azjar: centre is the oasis of Aghat (Ghat).

Kel Ahaggar, in Ahaggar mountains.

Kel Adagh, or Kel Assuk: Kidal, and Tin Buktu

Iwillimmidan Kel Ataram, or Western Iwillimmidan: Ménaka, and Azawagh region (Mali)

Iwillimmidan Kel Denneg, or Eastern Iwillimmidan: Tchin-Tabaraden, Abalagh, Teliya Azawagh (Niger).

Kel Ayr: Assodé, Agadez, In Gal, Timia and Ifrwan.

Kel Gres: Zinder and Tanut (Tanout) and south into northern Nigeria.

Kel Owey: Aïr Massif, seasonally south to Tessaoua (Niger)

In the late 19th century, the Tuareg resisted the French colonial invasion of their Central Saharan homelands. Tuareg broadswords were no match for the more advanced weapons of French squadrons. After numerous massacres on both sides, the Tuareg were subdued and required to sign treaties in Mali 1905 and Niger 1917. In southern Morocco and Algeria, the French met some of the strongest resistance from the Ahaggar Tuareg. Their Amenokal, traditional chief Moussa ag Amastan, fought numerous battles in defence of the region. Finally, Tuareg territories were taken under French governance, and their confederations were largely dismantled and reorganised.

Demeter

(85,373 posts)Westside Community Bank, University Place, Washington, was closed today by the Washington State Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Sunwest Bank, Irvine, California, to assume all of the deposits of Westside Community Bank.

The two branches of Westside Community Bank will reopen on Monday as branches of Sunwest Bank...As of September 30, 2012, Westside Community Bank had approximately $97.7 million in total assets and $96.5 million in total deposits. In addition to assuming all of the deposits of the failed bank, Sunwest Bank agreed to purchase essentially all of the assets...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.3 million. Compared to other alternatives, Sunwest Bank's acquisition was the least costly resolution for the FDIC's DIF. Westside Community Bank is the first FDIC-insured institution to fail in the nation this year, and the first in Washington. The last FDIC-insured institution closed in the state was Bank of Whitman, Colfax, on August 5, 2011.

Demeter

(85,373 posts)The Federal Deposit Insurance Corporation (FDIC) today (JAN 4) issued its list of state nonmember banks recently evaluated for compliance with the Community Reinvestment Act (CRA). The list covers evaluation ratings that the FDIC assigned to institutions in October 2012. The CRA is a 1977 law intended to encourage insured banks and thrifts to meet local credit needs, including those of low- and moderate-income neighborhoods, consistent with safe and sound operations. As part of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), Congress mandated the public disclosure of an evaluation and rating for each bank or thrift that undergoes a CRA examination on or after July 1, 1990.

A consolidated list of all state nonmember banks whose evaluations have been made publicly available since July 1, 1990, including the rating for each bank, can be obtained from the FDIC's Public Information Center, located at 3501 Fairfax Drive, Room E-1002, Arlington, VA 22226 (877-275-3342 or 703-562-2200), or via the Internet at www.fdic.gov.

A copy of an individual bank's CRA evaluation is available directly from the bank, which is required by law to make the material available upon request, or from the FDIC's Public Information Center.

http://www.fdic.gov/regulations/community/monthly/2013/crajan13.html

Demeter

(85,373 posts)Twice as high as the Reagan years.

http://www.alternet.org/news-amp-politics/corporate-profits-have-grown-171-percent-under-obama-highest-rate-1900?akid=9933.227380.3aa7C5&rd=1&src=newsletter778847&t=8

Business executives like to portray the Obama administration as the “ most anti-business” in history, creating an “ increasingly hostile environment for investment and job creation.” However, the data tells a far different story. According to a Bloomberg News analysis, corporate profits have grown by 171 percent under Obama, the most in the post-war era:

Profits are more than twice as high as their peak during President Ronald Reagan’s administration and more than 50 percent greater than during the late-1990s Internet boom, measured by the size of the economy.

Average annual corporate profit growth under Obama is the highest since 1900, whereas profit growth declined during both Bush presidencies. As a share of the economy, corporate profits have never been higher.

Unfortunately, this profit deluge has not been shared by workers, whose wages as a percentage of the economy have fallen to all-time lows. Workers also got dinged by the recent increase in the payroll tax, which was large enough to wipe out a minimum wage increase in some states.

**********************************************************

Pat Garofalo is economic policy editor for ThinkProgress.org. His writing has also appeared in the Nation, the Atlantic, U.S. News & World Report, and other publications. Follow him on Twitter at @Pat_Garofalo.

Demeter

(85,373 posts)Here’s a thought experiment: What if a group of Social Security and Medicare recipients wanted to increase their benefits by, say, 1,000 percent, and proposed seizing rich people’s assets – houses, cars, boats, whatever – to pay for it? And whenever anybody suggested that was extreme, they rolled their eyes and said,

“We’re pragmatists.”But isn’t it unfair to to just take other people’s stuff?

“Ideologues like you are the reason Washington lacks the political will to adopt our practical solutions.”

Now imagine the reverse: Rich CEOs have used every tax loophole in the book to add to their own wealth, have been bailed out directly or indirectly by the American taxpayer, and have rigged corporate governance so that they make far more than they’re worth. Now, to make sure the milk and honey keeps flowing their way, they want to cut Medicare and Social Security benefits for the beleaguered American majority. Sounds crazy, right?

Meet the CEOs of the Business Roundtable.

They hate our

..................................................................................................................

Yesterday Gary Loveman, CEO of Caesars Entertainment Corporation and head of the Roundtable’s “health and retirement committee,” told Politico, “Any effort to address the country’s fiscal problems has to have as a centerpiece reform of its principal entitlement programs.” Added Loveman: “None of us CEOs – very few of us – are ideologically driven. We’re pragmatists …I am encouraged by how relatively easy these remedies really are,” said Loveman. “… (and) they have a tremendously sanguine effect on the government’s fiscal health.”

That’s true. It is pretty easy. Just kick in a few rich people’s doors, seize their belongings … oh, wait. That’s the other extremist scenario. Loveman’s is the one where people who have paid for Social Security and Medicare coverage throughout their working lives must give some of their benefits up – for him and his friends. Problem identified: There are just too many old people.

Loveman repeats the often-disproven canard that these programs are fiscally unsound because they “were put in place in a very different demographic reality.” Social Security’s finances were successfully balanced in 1983, when the last Baby Boomer had already reached maturity. And longevity hasn’t changed significantly or unexpectedly for people who reach retirement age. Social Security’s in much better fiscal shape than most corporate benefit plans, and any long-term problems it may have are driven by a) greater wealth inequity than even the most conservative economists could have imagined in 1983; and b) massive unemployment brought on by Wall Street greed. As for Medicare, its cost problems are caused by for-profit health companies inflating medical costs. Think the Business Roundtable will mention that? Its members include the CEOs of Johnson & Johnson, Pfizer, Sanofi-Aventis, Abbott Laboratories, the Tenet hospital system, Cardinal Health, ExpressScripts, CVS/Caremark and WellPoint.

Like hell it will.

Our long-term deficits are driven by America’s runaway health care costs, which in turn are driven by our profit-driven system. It’s barely an exaggeration to say that if some of these companies and their competitors didn’t exist the Federal government might not have a deficit problem at all.

............................................................................................................

If the CEOs of the Business Roundtable are corporate America’s Stalinists, to them the elderly are kulaks, those peasants who saved enough to buy a farm – and whose existence became an ideological offense. When working Americans approach retirement age, they see them as Enemies of the People.

The CEOs of the Business Roundtable claim the government can’t afford to redeem its Medicare and Social Security pledges. The government owes more than a trillion dollars to banks and mutual funds, and much of that debt is held by people like the CEOs of the Business Roundtable.

If they don’t think the U.S. can afford to keep its commitments anymore – if they want a United States of America that welshes on its debts – that would be a good place to start. But for the wealthy, pampered, and narcissistic CEOs of the Business Roundtable, sacrifice is always for someone else. They have luxurious lives to maintain – and a revolution to lead.

AN AMAZING DIATRIBE...SO MUCH MORE AT LINK

Demeter

(85,373 posts)cantbeserious

(13,039 posts)eom

Tuesday Afternoon

(56,912 posts)Demeter

(85,373 posts)We are always glad to see new faces in our little band

Demeter

(85,373 posts)A prolonged confrontation over the nation's debt ceiling — unlike the "fiscal cliff," which provoked many scary headlines — could truly be grave for both America and the world. While press coverage often mentions the possibility of lowered credit ratings for the U.S. Treasury (again), that might only be the mildest consequence if Republicans in Congress actually refuse to authorize borrowing and avoid default...Last time the nation prepared to face such an impasse, during the spring and summer of 2011, the chairman of the Treasury Borrowing Advisory Committee — a JPMorgan Chase official named Matthew Zames — laid out a disturbing scenario in a letter to Treasury Secretary Tim Geithner, in which he foresaw a rolling catastrophe that could inflict hundreds of billions in additional borrowing costs; spark a run on money funds, leading to a renewed financial crisis; severely disrupt financial markets and borrowing, killing fragile economic growth; and push the economy back into recession due to higher interest rates and tightened credit.

In short, the economy would contract sharply and the U.S. — along with the rest of the world — might well be plunged back into negative growth. If that was true in July 2011, it is equally true today, and there is no reason to dismiss that warning.

But the Republican leadership on Capitol Hill insists that they are willing to take these mind-boggling risks, solely for the purpose of enforcing an extreme austerity regime that has already done permanent damage in much of Europe. Between the "Boehner rule" demanded by House Speaker John Boehner, which requires a dollar in new spending cuts for every dollar increase in the debt ceiling, and the House Republican budget authored by Rep. Paul Ryan, Congressional Republicans evidently want not only to gut Medicare, Social Security and Medicaid, but to "eliminate more and more of the basic functions of government over time," according to the Center on Budget and Policy Priorities...No education aid, no food safety inspections, no environmental protection, no infrastructure repairs, no cancer research. From immediate economic jeopardy to long-term national decline, these prospects are obviously appalling — yet many Republican elected officials sound positively pleased about the debt ceiling crisis they have created. Senator Tom Coburn, Republican of Oklahoma, told a right-wing radio host recently that a government default would actually be a "wonderful experiment." He assured listeners, quite falsely, that their Medicare and Social Security checks would continue to arrive every month, no matter what, and that only "stupid" spending would be cut.

If Coburn — or any Republican senator — is so eager to test the debt ceiling, perhaps he should volunteer to bump up against it first. As the Tulsa World reported in 2011, federal spending in Oklahoma amounts to three times as much as the entire state budget, with Social Security alone accounting for almost a billion dollars a month there, and Medicaid and other medical assistance amounting to another $500 million-plus. Coburn's ultra-conservative, deep-red home state is highly dependent on federal employment and assistance, ranking 12th in retirement and disability payments and 11th in per capita federal payroll, despite its small size. So, by all means, let's find out, as Coburn suggested, whether we can live "on the money that's coming into the Treasury" without borrowing to finance those monthly pension checks and all those stupid federal jobs — and let's start in Oklahoma tomorrow. Then let's roll out the same experiment in every state whose senators and representatives are refusing to pay the bills they have already racked up over the years — especially states, like most of those below the Mason-Dixon line, where federal spending is far higher than the tax revenues remitted to Washington. Surely that would silence all the loud talk about this "wonderful" experiment in fiscal brinksmanship.

Demeter

(85,373 posts)Backing down from their hard-line stance, House Republicans said Friday that they would agree to lift the federal government’s statutory borrowing limit for three months, with a requirement that both chambers of Congress pass a budget in that time to clear the way for negotiations on long-term deficit reduction. The agreement, reached in closed-door negotiations at a party retreat in Williamsburg, Va., was a tactical retreat for House Republicans, who were increasingly isolated in their refusal to lift the debt ceiling. Speaker John A. Boehner of Ohio had previously said he would raise it only if paired with immediate spending cuts of equivalent value. The decision by Republicans seemed to significantly reduce the threat of a federal government default in coming weeks and was welcomed by Senate Democrats. The House will consider the plan next week.

“It is reassuring to see Republicans beginning to back off their threat to hold our economy hostage,” said Adam Jentleson, a spokesman for Senator Harry Reid of Nevada, the majority leader. “If the House can pass a clean debt ceiling increase to avoid default and allow the United States to meet its existing obligations, we will be happy to consider it. As President Obama has said, this issue is too important to middle-class families’ economic security to use as a ploy for collecting a ransom. We have an obligation to pay the bills we have already incurred — bills for which many House Republicans voted.”

The Republicans’ new tack is designed to start a more orderly negotiation with Mr. Obama and Senate Democrats on bipartisan ways to shrink the government’s trillion-dollar deficit. To add muscle to their efforts to bring Senate Democrats to the table, House Republicans will include a provision in the debt ceiling legislation that says lawmakers will not be paid if they do not pass a budget blueprint.

“The Democratic-controlled Senate has failed to pass a budget for four years. That is a shameful run that needs to end, this year,” Mr. Boehner said in a statement from Williamsburg. “We are going to pursue strategies that will obligate the Senate to finally join the House in confronting the government’s spending problem.”

The decision represents a victory — at least for now — for Mr. Obama, who has said for months that he will not negotiate budget cuts under the threat of a debt default. By punting that threat into the spring, budget negotiations instead will center on two other points of leverage: March 1, when $1 trillion in across-the-board military and domestic cuts are set to begin, and March 27, when a stopgap law financing the government will expire. Mr. Obama will unveil his own 10-year budget plan in February, laying out his tax and spending plans for his second term. But Senate Democrats, for the past four years, have refused to move a budget blueprint to the Senate floor, in violation of the 1974 budget act that laid out new rules for controlling federal deficits. House Republicans, for the past two years, have approved sweeping budget plans that would fundamentally remake Medicare and Medicaid, sharply reduce domestic spending, increase defense spending and order a wholesale rewriting of the federal tax code. But without Senate negotiating partners, those plans, written by Representative Paul D. Ryan of Wisconsin, the Republicans’ last vice-presidential nominee, have been more political statement than legislative program. House Republican leadership aides said Friday that by trying to force Senate Democrats’ hands, Mr. Boehner hoped to move budget talks from ad hoc negotiations between Congressional leaders and the White House to a more orderly process...But the proposal marks a significant retreat as well. In recent weeks, conservatives from the editorial board of The Wall Street Journal to the Tea Party-aligned Americans for Prosperity had called on House Republicans to drop their conditions for raising the debt ceiling. Business groups had joined in, and Republican Party elders were growing nervous about how House leaders were approaching the debt ceiling, as well as the deadlines for automatic spending cuts and refinancing the government.

DemReadingDU

(16,001 posts)Demeter

(85,373 posts)that counts for something

Demeter

(85,373 posts)Traditionally, Tuareg society is hierarchical, with nobility and vassals. Each Tuareg clan (tawshet) is made up of several family groups, led by their collective chiefs, the amghar. A series of tribes tawsheten may bond together under an Amenokal, forming a Kel clan confederation. Tuareg self-identification is related only to their specific Kel, which means "those of". E.g. Kel Dinnig (those of the east), Kel Ataram (those of the west). The position of amghar is hereditary through a matrilineal principle, it is usual for the son of a sister of the incumbent chieftain to succeed to his position. The amenokal is elected in a ritual which differs between groups, the individual amghar who lead the clans making up the confederation usually have the deciding voice.

Nobility and vassals

The work of pastoralism was specialized according to social class. Tels are ruled by the imúšaɣ (Imajaghan, The Proud and Free) nobility, warrior-aristocrats who organized group defense, livestock raids, and the long-distance caravan trade. Below them were a number of specialised métier castes. The ímɣad (Imghad, singular Amghid), the second rank of Tuareg society, were free vassal-herdsmen and warriors, who pastured and tended most of the confederation's livestock. Formerly enslaved vassals of specific Imajaghan, they are said by tradition to be descended from nobility in the distant past, and thus maintain a degree of social distance from lower orders. Traditionally, some merchant castes had a higher status than all but the nobility among their more settled compatriots to the south. With time, the difference between the two castes has eroded in some places, following the economic fortunes of the two groups.

Imajaghan have traditionally disdained certain types of labor and prided themselves in their warrior skills. The existence of lower servile and semi-servile classes has allowed for the development of highly ritualised poetic, sport, and courtship traditions among the Imajaghan. Following colonial subjection, independence, and the famines of the 1970s and 1980s, noble classes have more and more been forced to abandon their caste differences. They have taken on labor and lifestyles they might traditionally have rejected.

Client castes

After the adoption of Islam, a separate class of religious clerics, the Ineslemen or marabouts, also became integral to Tuareg social structure. Following the decimation of many clans' noble Imajaghan caste in the colonial wars of the 19th and 20th centuries, the Ineslemen gained leadership in some clans, despite their often servile origins. Traditionally Ineslemen clans were not armed. They provided spiritual guidance for the nobility, and received protection and alms in return.

Inhædˤæn (Inadan), were a blacksmith-client caste who fabricated and repaired the saddles, tools, household equipment and other material needs of the community. They were often, in addition to craftwork, the repository of oral traditions and poetry. They were also often musicians and played an important role in many ceremonies. Their origins are unclear, one theory proposing an original Jewish derivation. They had their own special dialect or secret language. Because of their association with fire, iron and precious metals and their reputation for cunning tradesmanship the ordinary Tuareg regarded them with a mixture of awe and distrust.

Tuareg peasants

The people who farm oases in Tuareg-dominated areas form a distinct group known as izeggaghan (or hartani in Arabic). Their origins are unclear but they often speak both Tuareg dialects and Arabic, though a few communities are Songhay speakers. Traditionally they worked land owned by a Tuareg noble or vassal family, being allowed to keep a fifth part of their produce. Their Tuareg patrons were usually responsible for supplying agricultural tools, seed and clothing.

Bonded castes and slaves

Like other major Ethnic groups in West Africa the Tuareg once held slaves (éklan / Ikelan in Tamasheq, Bouzou in Hausa, Bella in Songhai). The slaves called éklan once formed a distinct social class in Tuareg society. Eklan formed distinct sub-communities; they were a class held in an inherited serf-like condition, common among societies in precolonial West Africa.

When French colonial governments were established, they passed legislation to abolish slavery, but did not enforce it. Some commentators believe the French interest was directed more at dismantling the traditional Tuareg political economy, which depended on slave labor for herding, than at freeing the slaves. Historian Martin Klein reports that there was a large scale attempt by French West African authorities to liberate slaves and other bonded castes in Tuareg areas following the 1914–1916 Firouan revolt. Despite this, French officials following the Second World War reported there were some 50,000 "Bella" under direct control of Tuareg masters in the Gao–Timbuktu areas of French Soudan alone. This was at least four decades after French declarations of mass freedom had happened in other areas of the colony. In 1946, a series of mass desertions of Tuareg slaves and bonded communities began in Nioro and later in Menaka, quickly spreading along the Niger River valley. In the first decade of the 20th century, French administrators in southern Tuareg areas of French Sudan estimated "free" to "servile" Tuareg populations at ratios of 1 to 8 or 9. At the same time the servile "rimaibe" population of the Masina Fulbe, roughly equivalent to the Bella, made up between 70% to 80% of the Fulbe population, while servile Songhai groups around Gao made up some 2/3 to 3/4 of the total Songhai population. Klein concludes that roughly 50% of the population of French Soudan at the beginning of the 20th century were in some servile or slave relationship.

While post-independence states have sought to outlaw slavery, results have been mixed. Traditional caste relationships have continued in many places, including the institution of slavery. According to the Travel Channel show, Bob Geldof in Africa, the descendants of those slaves known as the Bella are still slaves in all but name. In Niger, where the practice of slavery was outlawed in 2003, a study found that almost 8% of the population are still enslaved.

Demeter

(85,373 posts)Last July was a good month for factory workers in Anderson, Ind., where a Honda parts supplier announced plans to build a new plant and create up to 325 jobs. But it was a grim month in the Cleveland suburbs, where an industrial plastics firm told the state of Ohio it was closing a plant and laying off 150 people.

Nearly all of the Ohio workers belonged to a labor union. Workers at the Indiana plant don’t. Their fates fit a post-recession pattern: American factories are hiring again, but they’re not hiring union members.

U.S. manufacturers have added a half-million new workers since the end of 2009, making the sector one of the few bright spots in an otherwise weak recovery. And yet there were 4 percent fewer union factory workers in 2012 than there were in 2010, according to federal survey data. On balance, all of the job gains in manufacturing have been non-union.

The trend underscores a central conundrum in the “manufacturing renaissance” that President Obama loves to tout as an economic accomplishment: The new manufacturing jobs are different from the ones that delivered millions of American workers a ticket to the middle class over the past half-century. It used to be that factory jobs paid substantially better than other jobs in the private sector, particularly for workers who didn’t go to college. That’s less true today, especially for non-union workers in the industry, who earn salaries that are about 7 percent lower than similar workers who are represented by a union...

MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)Tuareg women have high status compared with their Arab counterparts...The Tuareg are Islamic, but mixed with a "heavy dose" of their pre-existing beliefs including matrilineality.

Tuareg women enjoy high status within their society, compared with their Arab counterparts and with other Berber tribes: Tuareg social status is transmitted through women, with residence often matrilocal. Most women could read and write, while most men were illiterate, concerning themselves mainly with herding livestock and other male activities. The livestock and other movable property were owned by the women, whereas personal property is owned and inherited regardless of gender. In contrast to most other Muslim cultural groups, men wear veils but women do not: it may be the protection needed against the blowing sand while traversing the Sahara desert.

The most famous Tuareg symbol is the Tagelmust (also called éghéwed), referred to as a Cheche (pronounced "Shesh"![]() , an often indigo blue-colored veil called Alasho. The men's facial covering originates from the belief that such action wards off evil spirits. It is a firmly established tradition, as is the wearing of amulets containing sacred objects and, recently, also verses from the Qur'an. Taking on the veil is associated with the rite of passage to manhood; men begin wearing a veil when they reach maturity. The veil usually conceals their face, excluding their eyes and the top of the nose. The Tuareg are sometimes called the "Blue People" because the indigo pigment in the cloth of their traditional robes and turbans stained their skin dark blue. The traditional indigo turban is still preferred for celebrations, and generally Tuareg wear clothing and turbans in a variety of colors.

, an often indigo blue-colored veil called Alasho. The men's facial covering originates from the belief that such action wards off evil spirits. It is a firmly established tradition, as is the wearing of amulets containing sacred objects and, recently, also verses from the Qur'an. Taking on the veil is associated with the rite of passage to manhood; men begin wearing a veil when they reach maturity. The veil usually conceals their face, excluding their eyes and the top of the nose. The Tuareg are sometimes called the "Blue People" because the indigo pigment in the cloth of their traditional robes and turbans stained their skin dark blue. The traditional indigo turban is still preferred for celebrations, and generally Tuareg wear clothing and turbans in a variety of colors.

Food

Taguella is a flat bread made from millet, a grain, which is cooked on charcoals in the sand and eaten with a heavy sauce. Millet porridge is a staple much like ugali and fufu. Millet is boiled with water to make a pap and eaten with milk or a heavy sauce. Common dairy foods are goat's and camel's milk, as well as cheese and yogurt made from them. Eghajira is a thick beverage drunk with a ladle. It is made by pounding millet, goat cheese, dates, milk and sugar and is served on festivals like Eid ul-Fitr and Eid al-Adha. A popular tea, gunpowder tea, is poured three times in and out of a tea pot with mint and sugar into tiny glasses.

Religion

Traditionally Tuareg practiced Animism. Following suit with the spread of Christianity, much of North Africa became Christian although paganism was still widely spread in Vandal North Africa. Then with the onset of Arabs into North Africa, Islam came in and the Tuareg travelled south and mixed their animistic beliefs with Islam.

Arts

Much Tuareg art is in the form of jewelry, leather and metal saddle decorations called trik, and finely crafted swords. The Inadan community makes traditional handicrafts. Among their products are tanaghilt or zakkat (the 'Agadez Cross' or 'Croix d'Agadez'); the Tuareg sword (Takoba), many gold and silver-made necklaces called 'Takaza'; and earrings called 'Tizabaten'.

Astronomy

The clear desert skies allowed the Tuareg to be keen observers. Tuareg stars and constellations include:

Azzag Willi (Venus), which indicates the time for milking the goats

Shet Ahad (Pleiades (star cluster)), the seven sisters of the night

Amanar (Orion (constellation)), the warrior of the desert

Talemt (Ursa Major), the she-camel

Awara (Ursa Minor), the baby camel

Nomadic architecture

While living quarters are progressively changing to adapt to a more sedentary lifestyle, Tuareg groups are well known for their nomadic architecture (tents). There are several documented styles, some covered with animal skin, some with mats. The style tends to vary by location or subgroup. Because the tent is considered to be under the ownership of a married woman (and significantly, built during the marriage ceremony), sedentary dwellings generally belong to men, reflecting a patriarchal shift in power dynamics. Current documentation suggests a negotiation of common practice in which a woman's tent is set up in the courtyard of her husband's house. Old legend says Tuareg once lived in grottoes, akazam, and then they lived in foliage beds made on the top acacia trees, tasagesaget, to avoid numerous wild animal during old times and even to this day to escape from mosquitoes.

Many Tuareg today are either settled agriculturalists or nomadic cattle breeders, though there are also blacksmiths and caravan leaders.

Demeter

(85,373 posts)Crude-oil futures held their ground above $95 a barrel Friday, ready to end the week with a gain, after the International Energy Agency raised its forecast for oil demand this year and data showed that China’s economy grew more than expected in the fourth quarter.

Putting some pressure on oil, however, was a fall in U.S. consumer sentiment in January...

YA THINK?

Demeter

(85,373 posts)…which explains why the Canadian government is Hell-and-High-Water-bent on building a pipeline, any pipeline, anywhere.

First, the stats

Over the past few months, new stories have noted that Canada’s oil sector isn’t getting full price for its heavy oil — in large part because American pipelines are well-supplied with newly-flowing tight oil (“shale oil”) from North Dakota.

Western Canada Select is more refined, and more value-added, than the diluted bitumen that Enbridge has proposed to ship to the coast of British Columbia. The Kalamazoo River spill in 2010 that added $750+ million in cleanup costs to the local economy, involved diluted bitumen (and Enbridge).

The discount on Alberta heavy oil is measured relative to the North American benchmark price, which is for West Texas Intermediate (WTI) crude. And said discount has been growing faster than a pimple before prom reaching a jaw-dropping $40 per barrel this week. WTI sells for $96 per barrel, and Alberta heavy sells for … $56.

One barrel of oil is about 160 Litres, so this means that Alberta is giving up 25 cents per litre on its oil exports. By way of comparison, the current WTI price works out to a total price of only 60 cents per litre. We’re talking some serious discounting, here. Of course, the world benchmark price is Brent crude, traded in London. And for various reasons, West Texas Intermediate Crude trades at a discount to it! I’ve taken a snapshot of the Bloomberg Energy page below; you can see that the Brent price is $112 per barrel. We see that the price of Brent crude ($112/bbl) is exactly twice as high as the price we established for Alberta heavy ($56/bbl). Alberta heavy crude is selling for half-off — it’s like a BOGO (buy one, get one) sale!

MORE

Demeter

(85,373 posts)WELL, THAT ATTITUDE CERTAINLY HASN'T CHANGED SINCE...

http://www.nytimes.com/2013/01/19/business/economy/fed-transcripts-open-a-window-on-2007-crisis.html

WASHINGTON — Federal Reserve officials in August 2007 remained skeptical that housing foreclosures could cause a financial crisis, just days before the Fed was jolted into action, according to transcripts that the central bank published Friday.

Worries about the health of financial markets dominated a meeting of the Fed’s policy-making committee on Aug. 7, but officials decided there was not yet sufficient evidence that the problems were affecting the growth of the broader economy.

Just three days later, the Fed’s chairman, Ben S. Bernanke, convened an early-morning conference call to inform them that the central bank had been forced to start pumping money into a financial system that was suddenly seizing up. More than five years later, the system remains heavily dependent on those pumps.

“The market is not operating in a normal way,” Mr. Bernanke said on that August call, in a moment of historic understatement. “It’s a question of market functioning, not a question of bailing anybody out. That’s really where we are right now.”

The actual conversations from the Fed’s meetings are released once a year after a five-year delay. With a wealth of detail beyond the terse statements and formal minutes issued in the hours and weeks after the meetings, the transcripts provide fresh insights into the debates, actions and judgment of policy makers. ...

Demeter

(85,373 posts)Fuddnik

(8,846 posts)Maybe a glass of cabernet. As long as Anne D didn't stomp the grapes.

Demeter

(85,373 posts)Steak was last night.

Demeter

(85,373 posts)Tin Hinan is the name given by the Tuareg to a 4th-century woman of prestige whose monumental tomb is located in the Sahara at Abalessa in the Ahaggar or Hoggar region of Algeria. The name means literally "she of the tents", but may be metaphorically translated as "mother of the tribe" (or "of us all"![]() or even "queen of the camp" (the "camp" maybe referring to the group of tombs which surround hers).[1] She is sometimes referred to as "Queen of the Hoggar", and by the Tuareg as tamenoukalt which also means queen.

or even "queen of the camp" (the "camp" maybe referring to the group of tombs which surround hers).[1] She is sometimes referred to as "Queen of the Hoggar", and by the Tuareg as tamenoukalt which also means queen.

The tomb was opened by Byron Khun de Prorok with support from the French army in 1925, and archaeologists made a more thorough investigation in 1933. It was found to contain the skeleton of a woman on a wooden litter, lying on her back with her head facing east. She was accompanied by heavy gold and silver jewelery, some of it adorned with pearls. On her right forearm she wore 7 silver bracelets, and on her left, 7 gold bracelets. Another silver bracelet and a gold ring were placed with the body. Remains of a complex piecework necklace of gold and pearls (real and artificial) were also present.

A number of funerary objects were also found. These included a "Venus" statue in Aurignacian style (similar to the Venus of Hohle Fels), a glass goblet (lost during World War II), and gold foil which bore the imprint of a Roman coin of Constantine I issued between 308 and 324 CE. A 4th to 5th century date is consistent with carbon dating of the wooden bed and also with the style of pottery and other tomb furniture. The tomb itself is constructed in a style that is widespread in the Sahara.

An anthropological study of the remains published in 1968 concluded the skeleton was that of a woman 1.72 to 1.76 metres tall, belonging to a Mediterranean race, who had probably never had children and who was probably lame because of deformation of the lumbar and sacral areas. The body is now in the Bardo Museum in Algiers.

The Tuareg were well aware that the tomb contained a woman of prestige and a number of legends about her had long been in circulation before the tomb was opened. According to one legend, Tin Hinan was believed to have been a Muslim of the Braber tribe of Berbers who came from Tafilalt oasis in the Atlas Mountains in the area of modern Morocco accompanied by a maidservant named Takamat. In this legend, Tin Hinan had a daughter (or grand-daughter), whose name is Kella, while Takamat had two daughters. These children are said to be the ancestors of the Tuareg of the Ahaggar. Another version is that Tin Hinan had three daughters (who had totemic names referring to desert animals) who were the tribal ancestors. Her Muslim religion is anachronistic, as is the statement that Kella was her daughter or grand-daughter, because the historical figure and real tribal matriarch[2] Kella lived during the 17th century.

The 14th century historian Ibn Khaldun recorded a legend about a lame queen named Tiski who was ancestral mother of the Ahaggar tribes, which is somewhat closer to the archaeological record.

Notes

^ The material for this article is taken from the paper by Gabriel Camps which critically examines the evidence from the archaeological and historical record.

^ Tribal genealogies show male descent until her, after which descent was reckoned in the female line. Camps, p. 516.

References

Gabriel Camps, "L'âge du tombeau de Tin Hinan, ancêtre des Touareg du Hoggar". Zephyrus, vol. 25 (1974) 497-516.

See also Brett, Michael; Elizabeth Fentress The Berbers WileyBlackwell 1997 ISBN 978-0-631-20767-2 p. 208 [1]

Demeter

(85,373 posts)Demeter

(85,373 posts)Angry about your paycheck shrinking this year because the payroll tax cut expired? Well, this should cheer you right up: Goldman Sachs's CEO got a 75 percent raise this year. Lloyd Blankfein made $21 million last year, including a $2 million salary and a $19 million bonus, CNN/Money reports. That bonus includes $5.6 million in cash. Bloomberg pegs the total pay at $19 million, but what's a couple of million dollars, really? Blankfein's haul represents a 75 percent pay increase from the year before, CNN/Money notes. It is also nearly double the paltry $11.5 million that Jamie Dimon, CEO of the nation's biggest bank, JPMorgan Chase, took home.

Unlike Dimon, Blankfein's bank did not nightmarishly botch up a massive credit-derivatives trade that cost it $6 billion, as JPMorgan did (although JPMorgan still managed to turn in a record profit). Goldman Sachs's profit nearly doubled last year, and its stock price jumped 49 percent. And as we all know, Goldman Sachs does God's work, which apparently consists mainly of trading stuff as much as possible, notes CNBC's John Carney.

We know what you're thinking: Grrrr!! You may think that your job -- educating children, say, or fighting fires -- is maybe more valuable to society than Blankfein's job of fleecing muppets and moving money around until it magically turns into more money. It's not fair, you're thinking.

In fact, some of you might be thinking, maybe it's corrosive to pay so much money to people for doing nothing much more than magically turning money into more money. It might incentivize them at some point down the road to, I don't know, cram derivatives full of toxic mortgage assets and foist them on unsuspecting muppets. You know, God's work.

Can't argue with you.

Demeter

(85,373 posts)but you can see that Europeans would have nothing in common, and no point of reference in their dealings with the sons of the desert.

Good night, all! Stay warm and dry!

Mojorabbit

(16,020 posts)I saw them in Orlando last year or maybe the year before. They met in a refuge camp and the lead singer influenced by Hendrix.

Demeter

(85,373 posts)Caterpillar Inc uncovered "deliberate, multi-year, coordinated accounting misconduct" at a subsidiary of a Chinese company it acquired last summer, leading it to write off most of the value of the deal and wiping out more than half its expected earnings for the fourth quarter of 2012. Shares of Caterpillar fell 1.5 percent in afterhours trading following news of the fraud, which was discovered after problems were found with the Chinese company's inventory.

Caterpillar, the world's largest maker of tractors and excavators, said on Friday it would take a noncash goodwill impairment charge of $580 million, or 87 cents per share, in the quarter. Analysts had expected the company to report $1.70 per share when it reports its results on January 28, according to Thomson Reuters I/B/E/S.

Caterpillar closed the purchase of ERA Mining Machinery Ltd and its subsidiary Siwei last June, paying HK$5.06 billion, or $653.4 million. ERA had been publicly traded in Hong Kong, doing business through Siwei, which is known for making equipment to support roofs in mines. A member of the Caterpillar board during the course of the Siwei deal told Reuters the board was distracted at the time by a larger transaction and paid relatively little attention to the Siwei acquisition. "It came as a complete surprise to us," the former board member said of the fraud, speaking on condition of anonymity because of the sensitivity of the situation. "It was presented to us as a pretty straightforward transaction. It's a shame. It should have been investigated further." The source said the driving force behind the deal was Ed Rapp, the former Caterpillar chief financial officer who now serves as a group president with responsibility for China, among other operations. The source said it was Rapp who presented the deal to the board and pushed for its completion.

... In a statement, Caterpillar said an ongoing investigation launched after the deal closed "determined several Siwei senior managers engaged in deliberate misconduct beginning several years prior to Caterpillar's acquisition of Siwei." According to a question-and-answer dialog Caterpillar included in its statement, the company found discrepancies in November between the inventory in Siwei's books and its actual physical inventory, triggering the probe. The company also said it had replaced several senior managers at Siwei, adding that their conduct was "offensive and completely unacceptable."... Representatives for Citigroup and law firm Freshfields Bruckhaus Deringer LLP, which served as financial and legal advisers to Caterpillar on the transaction, could not be immediately reached for comment. Blackstone and DLA Piper, which acted as ERA's financial and legal advisers, were not immediately available for comment...

rusty fender

(3,428 posts)gets promoted for this bad deal? It seems that even when indispensable high-level management types lose hundreds of millions of dollars, they rise even further to the top in their fields. ![]()

Demeter

(85,373 posts)NOBODY COULD HAVE FORESEEN THAT COMING! ![]()

http://news.yahoo.com/consumer-sentiment-hits-low-january-145754093--business.html

Consumer sentiment unexpectedly deteriorated for a second straight month to its lowest in over a year in January, with many consumers citing fallout from the recent "fiscal cliff" debate in Washington, a survey released on Friday showed. The sharp drop in sentiment over the last two months coincides with rancorous federal budget negotiations that have led to higher taxes for many Americans. Just weeks after that deal, President Barack Obama and Republican lawmakers are expected to enter another tough round of negotiations over spending cuts, which could dent consumer confidence still further.

"The handling of the fiscal cliff talks and the realization that paychecks are going to be smaller due to the sunset of the payroll tax holiday are probably weighing on consumer attitudes at the moment," said Thomas Simons, a money market economist at Jefferies & Co. in New York. While most of the scheduled tax hikes and spending cuts forming the fiscal cliff were avoided when Congress struck a deal on January 1, most U.S. workers saw their take-home salary diminished by the expiry of two percentage-point cut in payroll taxes. "With the debt ceiling yet to be tackled and more political acrimony on the way, we suspect that confidence has room to deteriorate further," Simons said.

The Thomson Reuters/University of Michigan's preliminary reading on the overall index of consumer sentiment came in at 71.3, down from 72.9 the month before. The index was at its lowest since December 2011. It was also below the median forecast of 75 among economists polled by Reuters. "The most unique aspect of the early January data was that an all-time record number of consumers - 35 percent - negatively referred to the fiscal cliff negotiations," survey director Richard Curtin said in a statement. "Importantly, the debt ceiling debate is still upcoming and could further weaken confidence," he said...

Demeter

(85,373 posts)In the summer of 2007, as storm clouds gathered over the world's financial system, then-New York Federal Reserve President Timothy Geithner allegedly informed the Bank of America and other banks about the possibility the U.S. central bank would lower one of its critical interest rates, according to a senior Fed official. Jeffrey Lacker, the head of the Richmond Fed, originally raised the allegation during a Fed conference call in August 2007, and he stuck to his 5-year-old claim against the current U.S. treasury secretary in a statement provided to Reuters on Friday.

"From conversations I had prior to the video conference call on August 16, 2007, I was aware of discussions among a few large banks about borrowing from their discount windows to support the asset backed commercial paper market," Lacker said in the statement. "My understanding was that (New York Fed) President Geithner had discussed a reduction in the discount rate with these banks in connection with these initiatives."

According to transcripts of the call released by the Fed on Friday, Geithner at the time denied that banks knew the Fed was considering cutting the discount rate. The Fed regularly releases transcripts of its policy meetings with a five-year lag. "We don't have any comment beyond the transcript," said Treasury spokesman Anthony Coley. The Treasury declined to make Geithner available to comment.

Information about any planned interest rate move by the Fed is among the most sensitive as it can have a huge impact on a range of financial markets worldwide. That was particularly the case in the summer of 2007 when there were growing concerns about financial stability as a crisis that would reach fever pitch just more than a year later began to build. Private disclosure of confidential, market-sensitive information by the central bank would be highly unusual, but it was not immediately clear if it would be illegal. It also was not clear if strict Fed internal rules governing confidential information would have been breached, or whether any internal or external investigation was mounted. Lacker made no suggestion of wrongdoing by the banks as a result of getting hold of any information.

The central bank delivered a surprise cut in the discount rate, which governs direct loans it makes to banks, the day after the call. The action spurred a big stock market rally, with the Standard & Poor's 500 Index enjoying its best gain in 4-1/2 years. In his statement to Reuters, Lacker did not say which banks may have been privy to the information, although in the transcript of the August 16, 2007, call he said he had discussed the matter with Bank of America's then CEO, Ken Lewis, earlier that day. The Richmond Fed supervises the Charlotte, North Carolina-based bank.

Spokesmen for the Federal Reserve Board in Washington, the New York Fed and Bank of America all declined to comment, as did Lewis.

Demeter

(85,373 posts)Japan’s Liberal Democratic Party went all out late last year to re-grab the power it had held for 50 years before getting booted out in 2009. Its platform: print and borrow with utter abandon to create asset bubbles and inflation, and to weaken the yen. It even threatened to wrest control over the printing press away from the Bank of Japan. That verbiage has been phenomenally successful: the stock market is surging, and the yen is crashing from historic—under normal circumstances, inexplicable—highs....But now, US automakers are squealing. They want the government to fight back in the currency war. The American Automotive Policy Council (AAPC), a lobbying organization that represents only Ford, GM, and Chrysler, sent President Obama a letter, demanding retaliation against Japan’s NO EXIT strategy. Then it went public with it grievances.

“Here we go again,” said Matt Blunt, AAPC president and former Republican governor of Missouri. “Japan’s Liberal Democratic party is back in power and determined to repeat the ‘beggar thy neighbor’ policies that distort trade by cheapening the value of the yen to promote economic growth in Japan at the expense of its trading partners.”

He claimed that “these types of policies” had “inflicted tremendous harm” on manufacturing in the US. “We urge the Obama Administration to make it clear to Japan that such policies are unacceptable and will be met by reciprocal measures.”

The AAPC has been lambasting Japan, and rightfully so, for having “the most closed auto market in the developed world,” protected by “non-tariff barriers” that keep US automotive products out. But now it accused Japan of manipulating its currency “to boost its own exports at the expense of other nations, especially the United States.”...Alas, the biggest currency manipulator in the world is the Fed, not only with its verbiage but also with its endless and escalating waves of quantitative easing, to the point where it currently prints $85 billion a month to debase and demolish the dollar, or what is left of it, which isn’t much. It makes US wages more competitive with those in Mexico and China. It also makes imports more expensive for American consumers and exports cheaper for consumers elsewhere. Meanwhile, Japan’s infamous trade surplus has given way to a ballooning trade deficit (graph).

The automakers were whining to President Obama, ironically, as another announcement was made and received with hoopla: GM would invest $1.5 billion in plants in North America in 2013. While no further details emerged, hopes were swirling that this manna would rain down on Michigan. Yet North America, in addition to Michigan, also includes among other places Canada and Mexico, and how much of this money will land in the US is uncertain. Embarrassingly, the $1.5 billion was just a fraction of GM’s planned investments of $8 billion for 2013, of which $6.5 billion will be sent to countries outside North America—not Europe where GM is bleeding to death, but Asia. That has been the paradigm in manufacturing for decades. US corporations have invested prodigiously in China and other countries where labor is cheap and have thus contributed to their enormous economic growth, while only crumbs have fallen on US soil. In this manner, much of the US auto component industry has moved offshore.

Bitter irony: American automakers, after having sent their investments and manufacturing overseas, are using a Republican ex-governor to pressure the Obama administration to stop the Japanese from defending themselves in the currency war that the Fed has been waging relentlessly for years. MORE

Demeter

(85,373 posts)The world is on the brink of a fresh “currency war,” Russia warned, as European policy makers joined Japan in bemoaning the economic cost of rising exchange rates.

“Japan is weakening the yen and other countries may follow,” Alexei Ulyukayev, first deputy chairman of Russia’s central bank, said at a conference today in Moscow.

The alert from the country that chairs the Group of 20 came as Luxembourg Prime Minister Jean-Claude Juncker complained of a “dangerously high” euro and officials in Norway and Sweden expressed exchange-rate concern.

The push for weaker currencies is being driven by a need to find new sources of economic growth as monetary and fiscal policies run out of room. The risk is as each country tries to boost exports, it hurts the competitiveness of other economies and provokes retaliation...

THEFT BY ANY OTHER NAME...

Demeter

(85,373 posts)DEAR GOD, WHAT NEXT?

http://www.reuters.com/article/2013/01/11/us-usa-court-silence-idUSBRE90A13P20130111

The Supreme Court on Friday agreed to consider whether a suspect's refusal to answer police questions prior to being arrested and read his rights can be introduced as evidence of guilt at his subsequent murder trial.

Without comment, the court agreed to hear the appeal of Genovevo Salinas, who was convicted of murder and sentenced to 20 years in prison for the December 1992 deaths of two brothers in Houston. Salinas voluntarily answered police questions for about an hour, but he became silent when asked whether shotgun shells found at the crime scene would match a gun found at his home. An officer testified that Salinas demonstrated signs of deception. Ballistics testing later matched the gun to the casings left at the murder scene. Salinas was charged in 1993 but evaded arrest until his capture in 2007. His first trial ended in a mistrial. At his second trial, Texas was able to introduce evidence of his silence in the police station, over his lawyer's objections. Salinas' lawyer argued that his client deserved a Fifth Amendment protection against self-incrimination, even though he had not been under arrest or read his rights under the landmark 1966 decision Miranda v. Arizona.

Last April, the 5th U.S. Circuit Court of Appeals upheld the conviction but noted that federal appeals courts are split as to whether "pre-arrest, pre-Miranda silence is admissible as substantive evidence of guilt." Texas opposed the appeal, saying that the protection against compulsory self-incrimination is irrelevant when a suspect is under no compulsion to speak, as Salinas was because he was not under arrest and was speaking voluntarily. It also said that any error was harmless.

A decision is expected by the end of June.

Demeter

(85,373 posts)A Florida Senate panel says police should be banned from using drones to spy on citizens...A bill (SB 92) that would prohibit law enforcement agencies from gathering evidence or other information flew through the Criminal Justice Committee with a unanimous vote Tuesday...The bill also would ban government agencies from using drones for code enforcement. Sen. Joe Negron, a Stuart Republican who sponsored the bill, first agreed to some changes that made it more acceptable to police chiefs and sheriffs.

The panel amended the bill to make exceptions to the ban for search warrants signed by judges and for certain emergencies such as fires and hostage situations. The bill also includes an exception for terrorism-related searches. Negron said the measure would balance the need for security with privacy rights.

...The Daytona Beach Police Department is considering using drones for police work. Chief Mike Chitwood said last year that the department is in its infancy stage with the process and conducting research on companies that make various drones, or unmanned aerial vehicles...Last month, Chitwood commented on the bill. “There certainly are legitimate concerns about infringing upon our rights, but to say we're not going to use it, I think, is very shortsighted just because of the potential for something to go wrong,” Chitwood said. “If there's great technology that could help people, why not use it?”

Demeter

(85,373 posts)Economies around the world are still facing a struggle towards recovery, despite improved conditions in financial markets, the World Bank said Wednesday, as it sharply cut its global growth outlook for 2013....

SAY RATHER, BECAUSE OF IMPROVED CONDITIONS IN FINANCIAL MARKETS...

The bank, which mainly lends money at relatively low rates to developing countries, said that "real-side recovery" had yet to materialize. However, it issued a cautiously optimistic forecast for more affluent countries like the U.S. on Wednesday, and predicted "a slow acceleration in growth" between 2013 and 2015.

World Bank economists are now forecasting growth of 2.4 percent for the global economy in 2013, from 2.3 percent in 2012. In its last forecast in June, the bank projected global growth would reach 3.0 percent in 2013...The World Bank also cut its forecast for developing countries, which last year grew at their slowest pace in a decade, to 5.5 percent in 2013 from 5.9 percent in a June forecast. It said growth in these countries should slowly pick up, reaching 5.7 percent next year and 5.8 percent in 2015. The bank projected that growth in advanced economies should reach 1.3 percent this year weighed down by spending cuts, high unemployment and weak consumer and business confidence. Growth should strengthen next year to 2 percent and 2.3 percent in 2015. The World Bank called on the developing countries it helps fund to "emphasize internal productivity-enhancing policies" to try and kickstart growth. Several key fast-growing markets, including Brazil and China, disappointed in the third quarter of 2012. World Bank economists believe that growth improved in the fourth quarter of 2012 in East Asia & the Pacific, Europe & Central Asia and South Asia; but growth slowed further in Latin America & the Caribbean. They were more confident about Europe's future after the European Central Bank pledged to do "whatever it takes" to save the region. SURE THEY WILL

Demeter

(85,373 posts)The International Monetary Fund (IMF) has agreed to release the next installment of bailout money to Greece. The institution deemed the debt-stricken country's reform efforts "impressive."

The IMF executive board announced its decision late on Wednesday after a long delay drawn out by Greece's political crisis that arose from the economic recession. The next tranche scheduled to be disbursed is worth 3.24 billion euros ($4.31 billion).

"The program is moving in the right direction, with strong fiscal adjustment and notable labor-cost competitiveness gains," Managing Director Christine Lagarde said in a statement.

The bailout funds come from a four-year program worth 172 billion euros approved by the IMF early last year. Under the so-called Extended Fund Facility (EFF), Greece receives more in financial assistance than what it could normally borrow from the Washington-based institution. Including the tranche approved on Wednesday, Greece has thus far received 4.86 billion euros under the plan. Lagarde noted that the IMF had revised future criteria for the Greek government to continue receiving money.

"While the program has been adjusted to take account of the deeper recession and implementation capacity, the strategy remains focused on restoring growth, competitiveness, and debt sustainability," said Lagarde. Greece must make further overhauls to its banking and taxation systems in order to reduce its debt burden and, ultimately, protect public interests, she added.

SOUNDS LIKE THE SLAVES ARE TOTALLY SCREWED NOW

Demeter

(85,373 posts)"There is a gap according to our preliminary projections for 2015-2016" of up to "€9.5bn," Poul Thomsen, the IMF's mission chief for Greece, told a conference call.

The EU and IMF have committed a total of €240bn in rescue loans to Greece since 2010, but with its economy entering a sixth year of recession it is still having trouble making budget ends meet, AFP reported.

"The IMF's policy is that the programme needs to be fully financed for the 12 months ahead... What is key is that the Europeans know there is a gap and they'll have to fill it," he said.

Meanwhile, an IMF report into Greece has concluded that "the rich and self-employed have continued to evade taxes on an astonishing scale and bloated and unproductive state sectors have seen only limited cuts". MORE

xchrom

(108,903 posts)The suicide victims chose a location with symbolic significance. Last fall, only a few weeks apart, a businesswoman and a banker went to the Coq d'Argent, an upscale restaurant and hot spot in the world of London high finance, located on the top floor of a shopping complex, to end their lives.

The woman put down her purse and jumped from the restaurant's cozy rooftop terrace. The banker, an investment specialist, jumped into the building's atrium around lunchtime.

The "City," the casual term the financial center uses in reference to itself, was shocked. The suicides are the most glaring expression of an apocalyptic mood that seems to have gripped all of London. Hospitals are reporting a high incidence of patients with alcohol problems, while top restaurants are fighting for every customer.

The crisis has struck at the heart of the financial center. In 2012, banks began to downsize their investment banking activities. For years, the area had been seen as a playground for those seeking instant riches and guaranteed success, and it provided tens of thousands with sometimes exorbitant incomes.

xchrom

(108,903 posts)Despite strenuous efforts by the ruling Popular Party (PP) to distance itself from Luis Bárcenas, who is in trouble with the law over corruption allegations, the party’s former treasurer continues to maintain an office in the PP headquarters in Madrid even after having left the group, party sources said Friday.

Bárcenas is implicated in the Gürtel kickbacks-for-contracts scandal, which first broke in 2008. Under an ongoing investigation into the corruption ring, it emerged earlier this week that Bárcenas had a bank account in Switzerland in which he had deposited as much as 22 million euros. He also took advantage of a tax amnesty in place last year to declare 10 million euros, which had previously been kept hidden from the tax authorities.

The PP sources said that despite stepping down as a senator and leaving the party in April 2010, Bárcenas has continued to appear in its Madrid headquarters, seeking help from PP officials to find a solution to the legal quagmire in which he finds himself. He was last seen in the building – located in Génova Street in the center of Madrid – as recently as Wednesday of this week.

Bárcenas, who was treasurer of the PP for 20 years, faces possible charges of money-laundering and tax evasion.

xchrom

(108,903 posts)The former treasurer of the ruling Popular Party (PP), Luis Bárcenas, declared 10 million euros in a controversial tax amnesty decreed last year by the PP government of Prime Minister Mariano Rajoy, Bárcenas’ lawyer, Alfonso Trallero, told the television channel Cuatro on Thursday.

The tax agency, which was in charge of the amnesty, is under the direct control of Finance Minister Cristóbal Montoro. The amnesty allowed people to come clean on assets they had hidden from the taxman without questions asked by paying a fine of only 10 percent of the funds declared.

Bárcenas and his wife are facing charges of tax fraud and of receiving illegal payments from the ringleaders of the Gürtel kickbacks-for-contracts corruption. As part of an ongoing investigation into the case, it emerged on Wednesday that Bárcenas had a bank account in Switzerland in which at one point he had deposited as much as 22 million euros.

The tax amnesty, which was in place last year, took in only 1.2 billion euros when the government had budgeted for proceeds of 2.5 billion. The government subsequently tightened legislation against tax fraud.

xchrom

(108,903 posts)

For most goods, excluding food from superstores, few shops can hope to compete with online retailers, writes Ian Jack. Photograph: John Londei/Rex Features

Travelling through my part of London on the top of a bus this week I saw something on the street that came from another age, surprising me almost as much as the playwright and diarist Simon Gray was surprised when, from a taxi in Holland Park Avenue, he saw "a middle-aged man in a sensible suit walking along the pavement, smoking a pipe". The year was 2005. "It gave me quite a shock," Gray wrote in the last-but-one volume of his memoirs. "He must have been the first man I'd seen for years smoking a pipe, my instinct was to shout out to him through the window to be careful, there might be a policeman about, then it struck me he might have been the victim of a time accident … go home [I thought], go back to where you came from, the 1980s, the 1970s, whenever … "

What I saw wasn't a person but a sign. HARDWARE AND DIY STORE OPENING SOON it said, in nice, big capitals spread across the window of a narrow shop that I remember long ago was called SMOKES, and as well as cigarettes sold the kind of equipment – pipe knives, pipe cleaners, pouches of Condor ready-rubbed – that might have been in the pockets of the man Simon spotted in Holland Park. On this street, many similar shops – that is, everyday and utilitarian shops – have closed over the past 30 years, to be replaced by restaurants, cocktail bars and emporia for all sorts of little luxuries, from lemon and polenta cake to retro toys made of tin. A new little shop selling drain cleaner, broomsticks and floor sanders must surely be bucking every retail trend, even though hardware stores, formerly known as ironmongers, tend to survive in high streets long after bakers, greengrocers and butchers have been swept away. Perhaps that's because ironmongers have always been the A&E of shops – a blocked drain or a popped light bulb needing a more urgent remedy than a rotten sausage.

But it wasn't just odd to see such a sign; it was even odder to be slightly uplifted by it. Shops were until recently such a familiar and unexamined part of every townscape, and in childhood memory – at least of boys accompanying their mothers – places that brought on boredom and impatience. There were so many of them. The village I grew up in, which contained not many more than 1,000 people, was served by nearly a dozen shops, including a butcher's, a wool shop, a post office, a licensed grocer's with a sad-looking display of Keystone Burgundy bottles, and a sweetshop that was really no more than a tray of toffees that Mrs Fraser had placed in the window of her front room.

Every essential, with the exceptions of medicine, clothes and footwear, could be bought in the village, though villagers, including my mother, would take the bus to the nearest town once a week and return with two shopping bags filled mainly with baked goods and tins. The buses ran frequently and the shops in town, especially the several-storey co-op, were more inviting in the variety and quality of their stock. Consequently most village shops had closed by the early 1960s, and by the turn of the century only a post office and a general store endured. At first, the benefit went to the town, but then in the 1980s the town, too, began to de-shop itself by developing a parade of chainstores on its outskirts, where parking was easy, and then allowing superstores to be built near the motorway.

*** i am opposed to Sameness -- which is all that big box stores can ever bring us.

they spell the end of both small producers and retailers.

xchrom

(108,903 posts)xchrom

(108,903 posts)Greek politicians launched an inquiry yesterday into allegations of misconduct by George Papaconstantinou, the former finance minister and architect of the country’s first austerity programme.

Greek MPs voted overwhelmingly to investigate Mr Papaconstantinou after claims that he not only failed to crack down on tax evasion but erased relatives’ names from a list of people with holdings in the Geneva branch of HSBC. The economist faces prosecution – and jail – if, on the basis of their findings, investigators decide by the end of February to try him.

The politician vehemently denied the charges. “I did not tamper with the data. It is inconceivable that I would have acted in such a way that would so blatantly involve me,” he said in a speech to the house.

The list, a dossier of more than 2,000 Greeks with accounts in Geneva, was first handed to Mr Papaconstantinou in late 2010 by the then French finance minister, Christine Lagarde.

Demeter

(85,373 posts)The man in charge of America’s drone wars will face Senate questioning about perhaps their most controversial aspect: when the president can target American citizens for death. ONE WOULD HOPE THE ANSWER WAS "NEVER", BUT THAT'S SO RULE-OF-LAW!

Sen. Ron Wyden (D-Ore.) sent a letter on Monday to John Brennan, the White House’s counterterrorism adviser and nominee to be head of the CIA, asking for an outline of the legal and practical rules that underpin the U.S. government’s targeted killing of American citizens suspected of working with al-Qaida. The Obama administration has repeatedly resisted disclosing any such information about its so-called “disposition matrix” targeting terrorists, especially where it concerns possible American targets. Brennan reportedly oversees that matrix from his White House perch, and would be responsible for its execution at CIA director. “How much evidence does the President need to determine that a particular American can be lawfully killed?” Wyden, a member of the Senate intelligence committee, asks in the letter, acquired by Danger Room. “Does the President have to provide individual Americans with the opportunity to surrender before killing them?”

Wyden’s questions about the targeted-killing effort get specific. He wants to know how the administration determines when it is “not feasible” to capture American citizens suspected of terrorism; if the administration considers its authority to order such killings inherent in its Constitutional war powers or embedded in the 2001 Authorization to Use Military Force; and if the intelligence agencies can “carry out lethal operations inside the United States.” Wyden also expresses “surprise and dismay” that the intelligence agencies haven’t provided him with a complete list of countries in which they’ve killed people in the war on terrorism, which he says “reflects poorly on the Obama administration’s commitment to cooperation with congressional oversight.”

Thus far, senators on the intelligence panel have been more concerned about Brennan’s possible role in national-security information leaks and the CIA’s post-9/11 torture program than in using Brennan’s nomination to peer into the decision-making surrounding Obama’s counterterrorism strikes. Wyden writes that it is “critically important” for Congress to understand “how the executive branch understands the limits and boundaries of this authority.”

MORE

Demeter

(85,373 posts)...For centuries, a secret battle has raged over who should create the nation’s money supply – governments or banks. Today, all that is left of the US Treasury’s money-creating power is the ability to mint coins. If we the people want to reclaim that power so that we can pay our obligations when due, the Treasury will need to mint more than nickels and dimes. It will need to create some coins with very large numbers on them.