Economy

Related: About this forumSTOCK MARKET WATCH, Friday, 1 March 2013

Last edited Fri Mar 1, 2013, 09:45 AM - Edit history (1)

[font size=3]STOCK MARKET WATCH, Friday, 1 March 2013[font color=black][/font]

SMW for 28 February 2013

AT THE CLOSING BELL ON 28 February 2013

[center][font color=red]

Dow Jones 14,054.49 -20.88 (-0.15%)

S&P 500 1,514.68 -1.31 (-0.09%)

Nasdaq 3,160.19 -2.07 (-0.07%)

[font color=green]10 Year 1.87% -0.01 (-0.53%)

[font color=black]30 Year 3.10% 0.00 (0.00%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

otherone

(973 posts):kick:

tclambert

(11,085 posts)I have local branch offices of some of these near me. I drove three miles to a Scottrade office and opened an account there. (Actually 3 accounts--a rollover IRA, a Roth IRA, and saving-for-a-down-payment-on-a-house account). They will let you enter orders online and do all sorts of research on stocks. (Far too much information available.) Trades typically cost around $7 per, and I think they required a $500 minimum to open the account. For penny stocks, trades may cost a little more. (At Scottrade, for stocks under $1, the commission = $7 + 1/2% of principal.)

Every trade takes a few days to settle, so don't expect to make dozens of trades back and forth every day.

Ever since the "flash crash" I make only "limit" trades, never market trades. I keep thinking that if I had a market trade order in on that day, the trade might have gone through during the brief period everything went down to near zero.

otherone

(973 posts)I am interested in investing in http://www.medicalmarijuanainc.com/

Demeter

(85,373 posts)

Demeter

(85,373 posts)Demeter

(85,373 posts)Would a new record for the Dow Jones Industrial Average prove to be the bull market’s last gasp? That prospect has more than just a few investors worried, as the index gets within a 100 points of its all-time closing high of 14,164.53, hit on Oct. 9, 2007 — particularly when you consider how long the recovery rally has been going.

Assuming you consider the current major uptrend to have begun on March 9, 2009, this bull market is closing in on its fourth birthday and is therefore getting rather long in the tooth. Might the Dow’s finally eclipsing its previous high suck the few remaining skeptics back into the market? If so, contrarians would argue, the Dow’s new high might very well precipitate a contrarian sell signal...

Demeter

(85,373 posts)Margo Channing: All about Eve

The U.S. government hurtled on Friday toward making deep spending cuts that threaten to hinder the nation's economic recovery, after Republicans and Democrats failed to agree on an alternative deficit-reduction plan.

Locked in during a bout of deficit-reduction fever in 2011, the time-released "automatic" cuts can only be halted by agreement between Republican lawmakers and the White House.

That has proved elusive so far.

Both sides still hope the other will either be blamed by voters for the cuts or cave in before the worst effects - like air traffic chaos or furloughs for tens of thousands of federal employees - start to bite in the coming weeks.

Barring any breakthroughs in the next few hours, the cuts will begin to come into force at some time before midnight on Friday night. The full brunt of the belt tightening, known in Washington as "sequestration," will take effect over seven months so it is not clear if there will be an immediate disruption to public services...

DemReadingDU

(16,000 posts)No one wants these cuts now, so just delay them.

Demeter

(85,373 posts)Hugin

(33,135 posts)That'll scare them enough to stifle it.

Nobody knows what a 'sequester' is anyway. ![]()

Demeter

(85,373 posts)going for the eat, drink, and be merry option....

Demeter

(85,373 posts)Russell Wasendorf Sr., the former chief executive of Peregrine Financial Group, has begun serving a 50-year sentence at a high-security federal prison in Indiana for bilking $215 million from customers of the failed futures brokerage.

Wasendorf, who turned 65 on Monday, arrived on Wednesday at the U.S. Penitentiary in Terre Haute, Indiana, according to the Federal Bureau of Prisons. It is the same facility at which Oklahoma City bomber Timothy McVeigh was executed in 2001.

Now known as Inmate #12191-029, Wasendorf had been locked in a county jail in Cedar Rapids, Iowa, since he confessed in July to stealing from tens of thousands of clients over a period of two decades.

A federal judge in January sentenced Wasendorf, who had tried to kill himself just before the fraud was uncovered last year, to 50 years behind bars, the maximum allowed by law...

WONDER HOW LONG A BANKSTER COULD BE LOCKED UP...IF ANYONE HAD THE GUTS

Demeter

(85,373 posts)In several respects, Occupy Wall Street reminds me of the feminist movement. Corporate funded media has declared the women’s rights movement dead ad nauseam for four decades — and yet it thrives and reinvents itself. Similarly, corporate funded media has eulogized Occupy Wall Street from almost the moment of its nascent birth in the Fall of 2011. If there is a common thread connecting these movements and the dire media prognostications of their demise, it is likely that when either one advances, entrenched power — and its iron grip on the wealth of a nation — loses. Now, similar to the early court battles for women’s rights, Occupy Wall Street has tossed aside its encampments and bullhorns and donned its legal garb and pro hac vices. Occupy Wall Street’s brain trust, Occupy the SEC, just filed a Federal lawsuit that encapsulates the crony capitalist state that passes today for democracy.

The organization is suing every Federal regulator that resides in the pocket of Wall Street – which means they are suing every Federal regulator of Wall Street. And, spunky group that they are, they’re naming individuals too. Here’s the rundown: Ben Bernanke, Chairman of the Board of Governors of the Federal Reserve System, Martin Gruenberg, Chairman of the FDIC, Elisse Walter, Chair of the SEC, Gary Gensler, Chair of the Commodity Futures Trading Commission, Thomas Curry, Comptroller of the Office of the Comptroller of the Currency, Mary Miller, Under Secretary for Domestic Finance at the Treasury, Neal Wolin, Acting Secretary of the Treasury.

Occupy the SEC is serving a valiant public service in bringing this lawsuit. It explains to the court that one of the most critical components of the 2010 Dodd-Frank Act that was supposed to reform Wall Street has yet to be enacted by the regulators and this is in violation of law. The key component is the Volcker Rule, named after former Fed Chairman Paul Volcker, that would prohibit most forms of trading for the house on Wall Street, known officially as proprietary trading. The lawsuit informs the court that Dodd-Frank required that regulators adopt rules relating to this section “within nine months after the completion of a study by FSOC [Financial Stabilization Oversight Council] relating to the Volcker Rule. The FSOC completed that study in January 2011.” The complaint proceeds to explain that the legislative language “is unequivocal in setting this mandatory deadline, which the Defendants and the agencies under their control have missed.”

To bring a lawsuit of this nature, plaintiffs who have a legitimate stake in the outcome must be named on the suit. Occupy the SEC has wisely selected two individuals, Eric Taylor and Kristine Ekman, who live in Brooklyn and hold insured deposit accounts with two major Wall Street firms. That’s highly relevant because the Brooklyn residences allow this case to be filed in the Federal District Court for the Eastern District of New York rather than the Southern District that covers the Wall Street area and lower Manhattan. Wall Street has been getting extremely sweet deals in that District Court for the past two decades, raising concerns as to whether the 99 percent can ever obtain justice there...

Demeter

(85,373 posts)The Obama administration pushed through the full Senate vote on the nomination of Jack Lew for Secretary of the Treasury late yesterday afternoon, just one day after the Senate Finance Committee voted to confirm the nomination. One suspects the rush was to prevent further details of Lew’s lavish pay packages, loans and other perks at his previous employers, New York University and bailed out bank, Citigroup, from gaining traction in the press. But rest assured, this is no win for the President’s legacy or his party. The Democrats’ progressive base was just as adamant against Lew for U.S. Treasury Secretary as were most Republicans who took a careful look at Lew’s history.

Robert Scheer, writing at The Nation Magazine said:

“Rubin went to work at Citigroup, the world’s largest financial conglomerate whose legality was enabled by legislation he advanced while in government. He made off with a salary of $15 million a year during his decade at that bank, which specialized in toxic mortgage derivatives and had to be bailed out by taxpayers to avoid bankruptcy.”

Lew also cashed in his chips at Citigroup, taking a job there from 2006 through early 2009 that paid him millions, including a $940,000 bonus in early 2009 that was paid with bailout funds from the U.S. taxpayer after the company became insolvent from soured mortgage bets. Lew served as Chief Operating Officer of the very division that the SEC charged with hiding $39 billion of subprime debt off its balance sheet in Structured Investment Vehicles (SIVs).

But that bonus was hardly the end of Lew’s problems. He invested in a fund in the Cayman Islands at the very street address that the President had called a tax scam. He received a $1.4 million loan from endowment funds at New York University, a taxpayer subsidized nonprofit, to buy a lavish home in the Riverdale section of the Bronx; he accepted forgiveness of large amounts of the loan and a reimbursement of the interest charged on the loan from the University.

After negotiating a lush pay package to move to Citigroup, he somehow got a $685,000 “severance” payment from NYU. And, worst of all, when repeatedly asked in writing to explain the details of these transactions, he stonewalled the Senate Finance Committee. I’m not taking the word of Republican Senators on this; I did my own investigation and Lew was a master of intentional obfuscation, leading to the obvious question, what else is he hiding....

kickysnana

(3,908 posts)I wonder what he thinks now?

I am going to think really hard about voting for a Democrat who grew up without his biological Dad and who really wants to be "one of the guys" but cannot bring himself to admit until he has stolen our votes and is elected.

Hope the able bodied get out there and get us a Roosevelt next time. Heck I would settle for an Eisenhower at this point..That is if we still have elections.

Hotler

(11,420 posts)Demeter

(85,373 posts)Honoring Van Cliburn, no less.

AnneD

(15,774 posts)We share a common birth town...Ft.Worth AKA CowTown...go figure.

Demeter

(85,373 posts)When President Obama speaks, most Americans hear what he wants them to hear: lofty rhetoric and a "progressive" vision. But just below the surface the president has a subtly-delivered message for the 1%, whose ears prick up when their buzzwords are mentioned. Obama's State of the Union address was such a speech – a pro-corporate agenda packaged with chocolate covered rhetoric for the masses; easy to swallow, but deadly poisonous.

Much of Obama's speech was pleasant to the ears, but there were key moments where he was speaking exclusively to the 1%. Exposing these hidden agenda points in the speech requires that we ignore the fluff and use English the way the 1% does. Every time Obama says the words "reform" or "savings,” insert the word "cuts.” Here are some of the more nefarious moments of Obama's :

"On Medicare, I'm prepared to enact reforms [cuts] that will achieve the same amount of health care savings [cuts] by the beginning of the next decade as the reforms [cuts] proposed by the bipartisan Simpson-Bowles commission."

This ultra-vague sentence was meant exclusively for the 1%. What are some of the recommendations from the right-wing Simpson-Bowles commission? Obama doesn't say. Talking Points Memo explains:

There were many other subtly-delivered attacks on Medicare in Obama's speech, all ignored by most labor and progressive groups, who clung tightly to the "progressive" smoke Obama blew in their face. Obama's speech also included a frightening vision of a national privatization scheme to previously publicly owned resources. But it was phrased so inspirationally that only the 1% seemed to notice:

Obama's proposal plans to "rebuild America" in the image of the wealthy and corporations, who only put forth their "private capital" when it results in a profitable investment; resources that previously functioned for the public good will now be channeled into the pockets of the rich, to the detriment of everyone else...MORE AT LINK

Demeter

(85,373 posts)In societies across the globe, men demonstrate their manhood in different ways. There are many wonderful tracts on the topic. However, in the culture of Washington, D.C., the best way to demonstrate your manhood is to express your willingness to cut Medicare and Social Security. There is no better way to be admitted into the club of the Very Serious People. This is the reason that we saw White House spokesman Jay Carney tell a press conference last week that Barack Obama is a macho man. He told the reporters that President Obama is still willing to cut Social Security benefits by using the Chained CPI as the basis for the annual cost-of-living adjustment (COLA). This willingness to cut the benefits of retirees establishes President Obama as a serious person in elite Washington circles.

While most of the D.C. insiders probably don’t understand the Chained CPI, everyone else should recognize that this technical fix amounts to a serious cut in benefits. It reduces benefits compared with the current schedule by 0.3 percent annually. This adds up over time. After someone has been getting benefits for 10 years, the cut in annual benefits is 3 percent. After 20 years, people would be seeing a benefit that is 6 percent lower, and after 30 years their benefit would be reduced by 9 percent. (AARP has a nice calculator that shows how much retirees can expect to lose from the Chained CPI.)

We can debate whether the Chained CPI benefit cut should be viewed as “large,” but there is no debate that Chained CPI cut is a bigger hit to the typical retiree than the ending of the Bush tax cuts were to the typical high-end earner. Social Security provides more than half of the income for almost 70 percent of retirees. This means that the 3 percent cut in Social Security benefits amounts to a reduction in their income of more than 1.5 percent...

MORE

Demeter

(85,373 posts)BCTGM Local 218 member Mike Hummell, a Hostess/Wonder worker for 14 years, helps to tell the story of the Hostess bankruptcy through the eyes of dedicated Kansas bakers.

“You’ve heard the Mainstream Media read you the Hostess PR sheet, now hear the truth from the mouths of the people who had their pension stolen. As the mainstream media distracted America with misinformation about Unions, the Hedge Funds got away with theft. They collected $4.25 an hour from each and every worker for the Baker’s pension fund, then refused to send the money to the pension. In this 25 minute film you will hear about the causes and effects of this blatant, and apparently legal, theft. You will also learn the truth about the reason Hostess had to close. SPOILER ALERT: it’s not what you’ve been told by your favorite news source. They have ALL blown the story.”

VIDEO AT LINK

Demeter

(85,373 posts)Army Pfc. Bradley Edward Manning pleaded guilty Thursday to 10 charges that he illegally acquired and transferred U.S. government secrets, agreeing to serve 20 years in prison for leaking classified material to WikiLeaks that described U.S. military and diplomatic efforts in Iraq, Afghanistan and around the globe.

The 25-year-old soldier, however, pleaded not guilty to 12 more serious charges, including espionage for aiding the enemy, meaning that his criminal case will go forward at a general court-martial in June. If convicted at trial, he risks a sentence of life in prison at Ft. Leavenworth, Kan...

Demeter

(85,373 posts)Tuesday, the judge in the Bradley Manning case turned more than 1,000 days in prison, one-third of it in tortuous conditions in Kuwait and Quantico, into 90 days. The judge allowed excuses for the delays based on the complexity of the case and the secret documents involved so that it fell just under the 120 statutory limit for a speedy trial. Judge Denise Lind does not publish her opinions, (also outrageous) but read for two hours in court, making it almost impossible to analyze the basis of her making 1,000 = 90.

People are outraged at the treatment of Manning and in more than 70 cities, people protested.

- See more at: http://www.nationofchange.org/time-outrage-1362150816#sthash.P5IM3BEB.dpuf

THEY DON'T EVEN GET INTO THE TORTURE ISSUE

AnneD

(15,774 posts)I don't consider confessions from a tortured prisoner as truthful. I was in a PSYOP unit (We F#*k With Your Mind, not Your Village) and we practiced interrogating prisoners. This was in the good old days when we could quote the Geneva convention in our sleep. I believe his confession as much as I believe Snookie's baby was an Imacculate Conception.

Roland99

(53,342 posts)some profit taking? signs of a correction?

Demeter

(85,373 posts)I think the latest balloon is going down in flames.

bread_and_roses

(6,335 posts)I can't reproduce this - you'll have to go look

http://www.commondreams.org/further/2013/02/28-1

You can also see it at Al Jazeera here http://stream.aljazeera.com/story/201302282252-0022575 with reactive tweets

Demeter

(85,373 posts)Racism is fashionable, again. Thanks, St. Ronnie!

Demeter

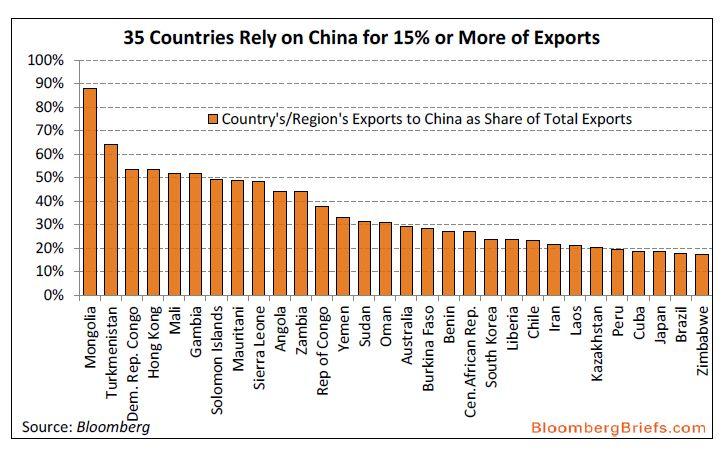

(85,373 posts)In 2004 the US military began to expand into Africa. In 2007 they created Africa Command (Africom). Since then they’ve accelerated and expanded operations. Africa has great natural resources, but why more interest now?

Here is one possible explanation: the great game. A rival great power expands its reach and things of no interest to us suddenly become worth contesting. China has become a major importer from many African nations, and the US replies to this challenge in the only way it knows how.

?w=600&h=382

?w=600&h=382

Note the contrast between US and Chinese grand strategy. China expands its influence through commercial ties. Development loans, usually at below-market rates, in exchange for contracts to sell resources. The US provides arms, military training, and strike forces. It’s a different way of seeing the world.

Whose grand strategy seems more likely to produce peace and prosperity for them, and for the world?

Demeter

(85,373 posts)WAS CREATING A BRAIN DRAIN IN EUROPE TO GERMANY THE WHOLE POINT?

http://www.spiegel.de/international/germany/elite-young-immigrants-could-provide-future-stability-for-german-economy-a-885647.html

A new generation of highly qualified immigrants from Southern and Eastern Europe is seeking a future in Germany. Young, well-educated and multilingual, they are precisely what the German economy needs to ensure success in the future. The country has its work cut out if it wants these "godsends" to stay.

STAY? THIS IS GERMANY; MY GUESS IS WORK THEM TO DEATH, DISCRIMINATE AGAINST THEM, AND DENY THEM THE RIGHT TO SETTLE AND NATURALIZE....

Demeter

(85,373 posts)Argentina’s credit-default swaps surged and bonds fell the most in emerging markets after the country said it would halt payments on its restructured bonds if a U.S. court ordered it to pay defaulted debt holders (IN FULL). Yields on the government’s benchmark bonds due 2017 surged 396 basis points, or 3.96 percentage points, to 19.67 percent at 3:48 p.m. in New York, the biggest jump on record. The yield is about four times the average borrowing costs in emerging markets. Argentina’s one-year credit-default swaps climbed 1,329 basis points to 6,510 basis points, the biggest jump in the world, according to data compiled by Bloomberg.

Speculation is soaring that the South American country will default for the second time since 2001 after Jonathan Blackman, Argentina’s attorney, said the nation would halt payments on its restructured debt before giving into holdouts who refused to accept prior renegotiations. Billionaire hedge fund manager Paul Singer’s NML Capital Ltd., a unit of Elliott Management Corp., is leading the group of investors pressing Argentina to pay them $1.33 billion for their defaulted bonds.

“If you could sell at current prices, I would sell,” Joe Kogan, the head of emerging-market debt strategy at Scotia Capital Markets who attended the hearing, said in a phone interview from New York. “I got the sense that the judges would really love to rule against Argentina. They just want to make sure they’ve covered all the arguments.”

Argentina says a ruling in the creditors’ favor would open it up to more than $43 billion in additional claims it can’t pay. The central bank had $41.7 billion of reserves yesterday. “Argentina won’t violate its own law on debt payments,” Argentina’s Vice President Amado Boudou said yesterday in an interview on television channel C5N after the hearing. The country said they would offer holdouts the same terms it offered creditors in its 2010 debt swap instead of the full amount they claim...

BUT OFF COURSE PAUL SINGER AND HIS FELLOW VULTURES WOULDN'T HEAR OF IT...THIS BEARS WATCHING!

Demeter

(85,373 posts)After he was fired Thursday, Andrew Mason wrote a note to his Groupon colleagues filled with the same offbeat humor, charm and candor that defined his tenure as chief executive of the daily deals company he co-founded.

"After four and a half intense and wonderful years as CEO of Groupon, I've decided that I'd like to spend more time with my family," the letter began. "Just kidding — I was fired today."

His ouster came as no surprise. Questions about his future have been swirling for months because of Groupon's poor performance since going public a little more than a year ago. The end of the road for the 32-year-old Mason came a day after the Chicago-based company posted disappointing fourth-quarter earnings that sent its stock reeling. But his exit was signaled three months ago when an anonymous leak to a well-read tech blog indicated that Groupon's board of directors was considering replacing Mason. Mason even alluded to his preordained departure in his farewell note: "If you're wondering why ... you haven't been paying attention. … As CEO I am accountable." Mason's firing also reflects a changing company with needs different than the skyrocketing startup that he helped create in 2008. His rapid rise and fall is hardly unusual in entrepreneurial circles. It's hard to transition from visionary to manager of a complex, global enterprise and the pace at Groupon was nearly unprecedented.

"I've always thought they got a bad rap in the press," Matt Moog, a Chicago tech entrepreneur, said of Groupon's leaders. "It's extraordinarily difficult to grow a company as fast as they did and get it all right the first time. The change in leadership will give them a chance to back away from that criticism a little bit and try to keep growing the company."..Groupon's red-hot growth attracted numerous imitators, from LivingSocial to Amazon. Google noticed the competitive threat to its local advertising sales and tried to purchase Groupon in 2010 for nearly $6 billion. Groupon's leaders said no deal...

- See more at: http://www.chicagotribune.com/business/breaking/chi-mason-out-at-groupon-shares-jump-20130228,0,7330802.story#sthash.3iPrYt9n.dpuf

Demeter

(85,373 posts)IT'S BEEN TRIED BEFORE...

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Oil/6212331

US Senator Tom Harkin, an Iowa Democrat, and Representative Peter DeFazio, an Oregon Democrat, on Thursday again introduced bills to place a 0.03% tax on futures, swaps and other derivatives.

Harkin and DeFazio have introduced bills calling for a similar tax in 2009, 2010 and 2011, but those bills never gained traction amid fierce opposition from Republicans and industry, particularly CME Group, parent company of NYMEX.

The companion bill introduced Thursday, known as the Wall Street Trading and Speculators Tax Act, would place a 0.03% levy on nearly all trading transactions, including stocks and bonds and all derivatives contracts, including swaps, options, puts and forward contracts.

"We need the new revenue that would be generated by this tax in order to reduce deficits and maintain critical investments in education, infrastructure, and job creation," Harkin said in a statement. "And there is no question that Wall Street can easily bear this modest tax."

The bills are cosponsored by Senators Bernie Sanders, a Vermont Independent, and Sheldon Whitehouse, Democrat-Rhode Island, and 19 other House Democrats.

FIGHT THE GOOD FIGHT, SENATORS!

Demeter

(85,373 posts)Or has Tansy started a "Find the Typo" Contest for our amusement and challenge?

![]()

Demeter

(85,373 posts)because I've been to and fro all morning, and it's expected to continue...

Demeter

(85,373 posts)when it dropped 100 pts. in 20 minutes at open...

Demeter

(85,373 posts)Sheila Bair, former chairman of the Federal Deposit Insurance Corp., said U.S. regulators lack the nerve to designate non-bank financial companies systemically important and aren’t doing their job.

“It’s lack of will, it’s lack of courage, it’s lack of spine,” Bair said in a telephone interview yesterday. “You can quote me on that and they’ll be angry with me, but I don’t care. This is outrageous.”

The Financial Stability Oversight Council, led by new Treasury Secretary Jacob J. Lew, met yesterday in Washington and discussed companies it is considering designating for Federal Reserve oversight. American International Group Inc. (AIG), Prudential Financial Inc. and General Electric Co.’s finance unit are in the final stage of review by the council, a group of regulators created by the Dodd-Frank law to prevent another financial crisis.

“What’s frustrating is the ones that we said were systemic during the crisis, like AIG and GE Capital, they can’t even say that they’re systemic,” said Bair, who led the FDIC during the 2008 financial crisis. “We seem to be able to decide in a nanosecond if it involves shoveling taxpayer money out the door to keep these guys afloat.” MORE

I THINK SHEILA WOULD MAKE AN EXCELLENT TREASURY SECRETARY IN ELIZABETH WARREN'S FIRST CABINET

Demeter

(85,373 posts)The Financial Stability Oversight Council, led by new Treasury Secretary Jacob J. Lew, met today in Washington and heard an update from the Securities and Exchange Commission on possible changes to rules governing money-market mutual funds.

Lew, who was sworn into office at the White House earlier today, also presided over a discussion on non-bank financial companies, which could be designated systemically important and subject to Federal Reserve oversight, Treasury spokeswoman Suzanne Elio said in a statement.

The council, created by the Dodd-Frank law to prevent another financial crisis, “has made significant progress to promote market stability by taking actions to issue rules, identify risks and increase oversight,” Lew said at the meeting.

As Treasury secretary, Lew heads the council, which also includes the chairmen of the Fed, SEC and Federal Deposit Insurance Corp. The panel, known as FSOC, missed former Treasury Secretary Timothy F. Geithner’s target of designating some non- bank financial companies as systemically important by the end of 2012...

Demeter

(85,373 posts)If you can get past how horrifying it is, the looming "sequestration cuts" crisis is fascinating. It's like watching a bunch of gambling addicts play craps by throwing dice into a four-dimensional wormhole. There are so many variables that neither side can possibly know the true outcome of a failure to make a deal – which means the only certainty is that what we're watching is irresponsibility on an epic scale, wherein both of our major political parties seem to prefer government by random outcome over one managed by sensible compromise.

Obviously, most of the problem was originally driven by the intractability of a Republican Party energized politically by its Tea Party base, which preferred the nuclear option of a default or a government shutdown to increased debt and/or new taxes. These fine folks taped sticks of dynamite to their chests and threatened to blow the government, its credit rating and our entire budget mechanism to the moon if we didn't make massive spending cuts – a wild ploy that may not have made a ton of patriotic sense given the catastrophic possibilities of, say, a default, but certainly helped the party solidify its relationship with its base...This "let's blow up the American credit rating" ploy impressed hardcore anti-spending types in the same way. It was crazy, but maybe only slightly more crazy than both of the parties have consistently been for most of the last 20 years, when the two sides have continually failed to hammer out workable budgets and instead have mostly just let the national airplane fly mindlessly forward using the laziness-enabling autopilot mechanism of a continuing resolutions, or CRs. Despite the fact that working out budgets is mostly what we hire members of Congress to do, they seem to have a terrible time doing it on time, and instead routinely rely upon the CR process (in which the two sides basically agree to put things off until later) to keep funding levels static for some ludicrously short-term period like six months.

The failure to work out sensible budgets makes it impossible for government agencies to make long-term plans, and instead leaves them scrambling to spend money in the short term. It's an incredibly stupid way of doing business and if these people weren't on television so often, ranting and raving like baseball managers arguing a safe call at the plate and playing to the home crowd by pointing fingers at the other side, they would probably just do what members of Congress traditionally did in the pre-mass-media age, which is quietly and (mostly) sensibly work things out, getting as much as they could for their own constituents without crossing the line into antipatriotic acts of self-destruction – like a national default, for instance...

In agreeing to this crazy deal a year and a half ago – a deal they were, admittedly, forced into – the Dems banked on the notion that the Republicans would never countenance deep cuts to the Pentagon and in that way leave themselves exposed politically to accusations of making the country less safe. But the Republicans – humorously if you can still find humor in this – have not yet blinked here, which is why the Obama administration is shamelessly rolling Homeland Security Secretary Janet Napolitano out this week to make sure Americans everywhere know that terrorists will be crawling through their children's bedroom windows as early as next week if the Republicans don't back down on this budget thing. ("I don't think we can maintain the same level of security . . . with sequester," she said, adding that the impact will grow over time, like "a rolling ball."

... the whole thing sucks. It's like being permanently stuck in the NFL lockout story. Do we really have to do this every three months for the rest of eternity?

GO READ THE COMPLETE ARTICLE FOR THE COLORFUL METAPHORS THAT I EDITED OUT FOR BREVITY...QUITE ENTERTAINING AND INSIGHTFUL, IF COLORFUL...

Hugin

(33,135 posts)To be posted later today. ![]()

Demeter

(85,373 posts)This must be history, repeating as farce, time.

Hugin

(33,135 posts)With only the illusion of control.

mahatmakanejeeves

(57,425 posts)You'll have to wait a week. The figures won't be released until March 8. ADP will release its figures on March 6.

http://www.bls.gov/schedule/news_release/201303_sched.htm

http://www.adpemploymentreport.com/common/docs/ADP-NER-Calendar-Future-Reports.pdf

Demeter

(85,373 posts)It is a great service.

mahatmakanejeeves

(57,425 posts)I make sure that the post is non-partisan, too. The numbers are posted without regard to making any particular politician or party look good or bad.

It's a 99 percent cut-and-paste operation. I make a few additions at the tail end, and hit "Post my reply!" Like this:

Demeter

(85,373 posts)Last year, JC Penney saw what every big retailer had been seeing for years: the threat of Amazon and other new competitors rising to destroy their business. So JC Penney brought in a bold new CEO. Ron Johnson had already created the Apple Store, a chain of physical stores where people flocked to shop. Before that, he had revamped Target. And Johnson had a plan for JC Penney: Tell customers that they don't have to spend time anymore clipping coupons or waiting for sales to happen. Instead, the store would offer fair prices on its merchandise every day.

"He sort of said sales were akin to drugs, and he was trying to wean customers off drugs," says retail analyst Rafi Mohammed.

The company redesigned its stores to try to make JC Penney a destination for a younger, hipper crowd. There are boutiques within the store featuring individual designers. It didn't work. The old customers really did love clipping coupons and waiting for sales.

"I come home and I cry over it, and my husband's looking at me, like, 'What's wrong?'" says Carol Vickery, who shopped at the store in Tallahassee, Florida. "I said, 'Penney's doesn't have sales any more. I need my store back!'"

Penney's has been putting new, fancy boutiques inside its stores, trying to appeal to a younger, hipper crowd. But that crowd hasn't really showed up yet...This week, JC Penney announced that its sales in the last three months of the year were down about 30 percent from the previous year. Now, the company is backing off its bold strategy a bit, and reintroducing sales and some coupons for shoppers in its loyalty program. But they won't be called them coupons. They'll be called "gifts."

WHAT A NOVEL IDEA! GIVE UP THE ADDICTIVE ASPECT TO SHOPPING...IS HE NUTS?!!

Demeter

(85,373 posts)I'M HOPING AND BETTING THAT ELIZABETH WARREN IS THE ONLY TOO BIG TO FAIL AROUND DC, AND THAT SHE AND LIKE-MINDED PEOPLE GET THE CHANCE TO PROVE IT, ALL THE WAY TO THE WHITE HOUSE AND A REAL DEMOCRATIC PARTY

http://www.truth-out.org/opinion/item/14834-warren-vs-bernanke-too-big-to-fail

Have no fear. While millions of Americans are struggling to survive day to day, and the economy is in the tank, the millionaire banksters on Wall Street are doing just fine. Just ask Jamie Dimon, CEO of JPMorgan-Chase. At JPMorgan's investor conference yesterday, Dimon bragged to a crowd of uber-wealthy investors that, "We actually benefit from downturns."

In other words, they've so rigged the system that when millions of Americans are without jobs, and struggling to put food on the table and provide for their families, Dimon and his Wall Street fat cat buddies are doing better than ever, making a profit off of your misery.

But such an appalling statement really shouldn't come as a shock. After all, numerous reports have suggested that JPMorgan-Chase and other big banks engaged in criminal and/or unethical activity, and it's possible that Dimon did too.

It's inexcusable that these banks continue to rake in millions, after destroying our economy and devastating the middle-class. One way or another, the rampant corruption on Wall Street needs to stop. That's where Sen. Elizabeth Warren comes in. Since Warren was sworn into the Senate fewer than two months ago, she's been kicking ass and taking names. Using her influential seat on the Senate Banking Committee, Warren has already called out the nation's top financial regulators for failing to take Wall Street firms who broke the law to trial. In a February 14 hearing, Warren told regulators that, "We face some very special issues with big financial institutions. If they can break the law and drag in billions and billions in profits, and then turn around and settle — paying out of those profits — they don't have much incentive to follow the law." Warren continued taking on this nation's corrupt financial industry yesterday, pressing Federal Reserve Chairman Ben Bernanke about the risks and fairness of having banks that are "too big to fail." Warren asked Bernanke, "We've now understood this problem for nearly five years. So when are we going to get rid of 'too big to fail?'" Warren also asked whether the big banks should have to repay taxpayers the whopping $83 billion a year they get from what is essentially a government subsidy. Interestingly enough, this amount nearly matches the big banks' annual profits, and without it, CEOs like Jamie Dimon wouldn't be able to get their multimillion-dollar bonuses and windfall payouts.

While Warren's efforts to point out the corruption and greed on Wall Street are great, she's only one woman, and she alone can't take down the big banks and successfully regulate them. The entire system needs to be changed...MORE

This article was first published on Truthout and any reprint or reproduction on any other website must acknowledge Truthout as the original site of publication.

Demeter

(85,373 posts)I'D CALL IT A "SCHOOL FOR NAZIS", MYSELF

http://truth-out.org/news/item/14858-homeland-security-the-trillion-dollar-concept-that-no-one-can-define

Imagine a labyrinthine government department so bloated that few have any clear idea of just what its countless pieces do. Imagine that tens of billions of tax dollars are disappearing into it annually, black hole-style, since it can’t pass a congressionally mandated audit.

Now, imagine that there are two such departments, both gigantic, and you’re beginning to grasp the new, twenty-first century American security paradigm.

For decades, the Department of Defense has met this definition to a T. Since 2003, however, it hasn’t been alone. The Department of Homeland Security (DHS), which celebrates its 10th birthday this March, has grown into a miniature Pentagon. It’s supposed to be the actual “defense” department -- since the Pentagon is essentially a Department of Offense -- and it’s rife with all the same issues and defects that critics of the military-industrial complex have decried for decades. In other words, “homeland security” has become another obese boondoggle.

But here’s the strange thing: unlike the Pentagon, this monstrosity draws no attention whatsoever -- even though, by our calculations, this country has spent a jaw-dropping $791 billion on “homeland security” since 9/11. To give you a sense of just how big that is, Washington spent an inflation-adjusted $500 billion on the entire New Deal.

Despite sucking up a sum of money that could have rebuilt crumbling infrastructure from coast to coast, this new agency and the very concept of “homeland security” have largely flown beneath the media radar -- with disastrous results. And that’s really no surprise, given how the DHS came into existence...

SEE LINK FOR DETAILS