Economy

Related: About this forumWeekend Economists Celebrate El Dia de los Muertos November 1-3, 2013

Last edited Sat Nov 2, 2013, 07:26 PM - Edit history (2)

http://s3.amazonaws.com/rapgenius/filepicker%2FWlyhPBxTScCffju47tmM_death_.I'm taking a semi-sidetrack from Simplicity this weekend....One could say, there's nothing simpler than Death. Oh, the details may vary, but it's a one-way door. Once a person passes, his story ends.

Death is the price of life, due from the first definable moment that the clock starts running. Different individuals, different species, barring an outside cause, will die at different times in different ways. So what does a person do? (The survivors, the temporarily alive, I mean)

Let's consider the options:

Religion / Philosophy (multiple variations)

Denial (pretty universal if not continuous)

Resignation

"Gather ye rosebuds while ye may"

Procreate

Publish

Distract

In less sophisticated times, people gave Death a lot more thought. They saw on a regular basis how tentative and fragile Life is as a state of being. Death informed their lives.

But in this 21st century, in this wealthy culture, Death has been tidied away, conducted behind closed doors, and never thought about as a reality by any one, not even life insurance salesmen.

Certainly not by our President, who has no difficulty ordering a rain of Death on people half a world away...and doesn't understand why anyone would get upset and want to take his Gameboy away....

Nor by our Bankster Class, who will never see the results of their fiscal crimes.

So, while we wait for Revelation, let's document those crimes....

as we celebrate and mourn our Lost but Loved.

Demeter

(85,373 posts)The two former branches of Bank of Jackson County will reopen as branches of First Federal Bank of Florida at 10 a.m., CDT, Thursday, October 31, 2013...As of June 30, 2013 Bank of Jackson County had approximately $25.5 million in total assets and $25.0 million in total deposits. In addition to assuming all of the deposits of Bank of Jackson County, First Federal Bank of Florida agreed to purchase approximately $23.1 million of the failed bank’s assets. The FDIC will retain the remaining assets for later disposition....The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.1 million. Compared to other alternatives, First Federal Bank of Florida's acquisition was the least costly resolution for the FDIC's DIF. Bank of Jackson County is the 23rd FDIC-insured institution to fail in the nation this year, and the fourth in Florida. The last FDIC-insured institution closed in the state was First Community Bank of Southwest Florida, Fort Myers, on August 2, 2013.

IT IS ODD THAT THESE CLOSINGS ARE HAPPENING IN THE MIDDLE OF THE WEEK...

Demeter

(85,373 posts)http://www.techdirt.com/articles/20131030/11091025070/dark-mail-alliance-lavabit-silent-circle-team-up-to-try-to-create-surveillance-proof-email.shtml

This whole morning, while all these stories of the NSA hacking directly into Google and Yahoo's network have been popping up, I've been at the Inbox Love conference, all about the future of email. The "keynote" that just concluded, was Ladar Levison from Lavabit (with an assist from Mike Janke from Silent Circle), talking about the just announced Dark Mail Alliance, between Lavabit and Silent Circle -- the other "security" focused communications company who shut down its email offering after Lavabit was forced to shut down. Levison joked that they went with "Dark Mail" because "Black Mail" might have negative connotations. Perhaps just as interesting, Levison is going to be releasing the Lavabit source code (and doing a Kickstarter project to support this), with the hope that many others can set up their own secure email using Lavabit's code, combined with the new Dark Mail Alliance secure technology which will be available next year.

As noted, the Alliance is working on trying to create truly secure and surveillance-proof email. Of course, nothing is ever 100% surveillance proof -- and both members of the alliance have previously claimed that it was almost impossible to do surveillance-proof email. However, they're claiming they've had a "breakthrough" that will help.

For the NSA and similar surveillance agencies across the world, it will sound like a nightmare. The technology will thwart attempts to sift emails directly from Internet cables as part of so-called “upstream” collection programs and limit the ability to collect messages directly from Internet companies through court orders. Covertly monitoring encrypted Dark Mail emails would likely have to be done by deploying Trojan spyware on a targeted user. If every email provider in the world adopted this technology for all their users, it would render dragnet interception of email messages and email metadata virtually impossible.

Importantly, they're not asking everyone to just trust them to be secure -- even though both companies have the right pedigree to deserve some level of trust. Instead, they're going to release the source code for public scrutiny and audits, and they're hoping that other email providers will join the alliance.

At the conference, Levison recounted much of what's happened over the last few months (with quite a bit of humor), joking about how he tried to be "nice" in giving the feds Lavabit's private keys printed out, by noting that he included line numbers to help (leaving unsaid that this would make OCR'ing the keys even more difficult). He also admitted that giving them the paper version was really just a way to buy time to shut down Lavabit.

Janke came up on stage to talk about the importance of changing the 40-year-old architecture of email, because it's just not designed for secure communications. The hope is that as many other email providers as possible will join the Alliance and that this new setup becomes the de facto standard for end-to-end secure email, which is where Levison's open sourcing of his code gets more interesting. In theory, if it all works out, it could be a lot easier for lots of companies to set up their own "dark mail" email providers.

Either way, I would imagine that this development can't make the NSA all that happy.

Demeter

(85,373 posts)State legislatures around the country, facing growing public concern about the collection and trade of personal data, have rushed to propose a series of privacy laws, from limiting how schools can collect student data to deciding whether the police need a warrant to track cellphone locations. Over two dozen privacy laws have passed this year in more than 10 states, in places as different as Oklahoma and California. Many lawmakers say that news reports of widespread surveillance by the National Security Agency have led to more support for the bills among constituents. And in some cases, the state lawmakers say, they have felt compelled to act because of the stalemate in Washington on legislation to strengthen privacy laws.

“Congress is obviously not interested in updating those things or protecting privacy,” said Jonathan Stickland, a Republican state representative in Texas. “If they’re not going to do it, states have to do it.”

For Internet companies, the patchwork of rules across the country means keeping a close eye on evolving laws to avoid overstepping. Many companies have an internal team to deal with state legislation. And the flurry of legislation has led some companies, particularly technology companies, to exert their lobbying muscles — with some success — when proposed measures stand to harm their bottom lines.

“It can be counterproductive to have multiple states addressing the same issue, especially with online privacy, which can be national or an international issue,” said Michael D. Hintze, chief privacy counsel at Microsoft, who added that at times it can create “burdensome compliance.” For companies, it helps that state measures are limited in their scope by a federal law that prevents states from interfering with interstate commerce.

This year, Texas passed a bill introduced by Mr. Stickland that requires warrants for email searches, while Oklahoma enacted a law meant to protect the privacy of student data. At least three states proposed measures to regulate who inherits digital data, including Facebook passwords, when a user dies. Some of the bills extend to surveillance beyond the web. Eight states, for example, have passed laws this year limiting the use of drones, according to the American Civil Liberties Union, which has advocated such privacy laws. In Florida, a lawmaker has drafted a bill that would prohibit schools from collecting biometric data to verify who gets free lunches and who gets off at which bus stop. Vermont has limited the use of data collected by license plate readers, which are used mostly by police to record images of license plates. California, long a pioneer on digital privacy laws, has passed three online privacy bills this year. One gives children the right to erase social media posts, another makes it a misdemeanor to publish identifiable nude pictures online without the subject’s permission, and a third requires companies to tell consumers whether they abide by “do not track” signals on web browsers.

But stiff lobbying efforts were able to stop a so-called right to know bill proposed in California this year that stood to hurt the online industry. The bill would have required any business that “retains a customer’s personal information” to share a copy of that information at the customer’s request, as well as disclose which third parties have received the information. The practice of sharing customer data is central to digital advertising and to the large Internet companies that rely on advertising revenue.

“ ‘Right to know’ is an example of something that’s not workable,” said Jim Halpert, a lawyer with the national firm DLA Piper, who leads an industry coalition that includes Amazon, Facebook and Verizon. “It covers such a broad range of disclosures. We advocated against it.”

More than a year ago, the White House proposed a consumer privacy bill of rights, but Congress has not yet taken on the legislation. And a proposed update to the 27-year-old Electronic Communications Privacy Act has stalled. The proposal would require law enforcement agencies to obtain a warrant, based on probable cause, before they could read through emails...

Demeter

(85,373 posts)When WikiLeaks supporters attacked the PayPal site to support Julian Assange, was it a felony?

...the eBay-owned subsidiary PayPal is working with the Justice Department to prosecute a handful of WikiLeaks supporters. The defendants could serve decades in prison, and their convictions could decide if “hacktivism” is free speech or a felony offense.

On Oct. 31, 14 defendants are scheduled to walk into a federal court in San Jose, Calif. They are known as the PayPal 14, and prosecutors will ask them to plead guilty to attacking PayPal, the online payment service based in that city.

In December 2010, PayPal, Visa, Mastercard and major banks became targets of a spate of cyberattacks, but not by criminals who wanted to steal credit card numbers. When the companies stopped processing online donations for WikiLeaks founder Julian Assange, supporters — some associated with the hacker group Anonymous — responded with a novel form of protest. In the case of PayPal, they sent thousands of packets of data to the company’s servers at such a speed, its system nearly crashed.

“It was serious,” said PayPal spokesman Anuj Nayar, who recalled that deflecting the traffic felt like a chess game. PayPal estimates the attacks cost $3.5 million in technology upgrades. The company gave prosecutors a list of the top 1,000 attackers. From that list, the Department of Justice indicted a handful as part of its ongoing crackdown against Anonymous....

DemReadingDU

(16,000 posts)1. Denial

2. Anger

3. Bargaining

4. Depression

5.Acceptance

Kübler-Ross originally developed this model based on her observations of people suffering from terminal illness. She later expanded her theory to apply to any form of catastrophic personal loss, such as the death of a loved one, the loss of a job or income, major rejection, the end of a relationship or divorce, drug addiction, incarceration, the onset of a disease or chronic illness, an infertility diagnosis, as well as many tragedies and disasters (and even minor losses).

Supporting her theory, many (both sufferers and therapists) have reported the usefulness of the Kübler-Ross Model in a wide variety of situations where people were experiencing a significant loss. The application of the theory is intended to help the sufferer to fully resolve each stage, then help them transition to the next – at the appropriate time – rather than getting stuck in a particular phase or continually bouncing around from one unresolved phase to another. The subsections below give a few specific examples of how the model can be applied in different situations. These are just some of the many benefits that Kübler-Ross hoped her model would provide.

more...

http://en.wikipedia.org/wiki/K%C3%BCbler-Ross_model

P.S. Did someone pass away that you were close to?

Demeter

(85,373 posts)Also, I read a lot of political/economic email this morning, and I think it made me a little crazy...I have no illusions left. They are all psychotic. Without exception.

DemReadingDU

(16,000 posts)over and over. Seems like a bad recurring dream.

And sometimes we need to go thru Kubler-Ross stages many times too.

If it weren't for my cyberbuddies, some days I don't think I could pull thru.

Demeter

(85,373 posts)http://www.testosteronepit.com/home/2013/10/30/the-smart-money-denies-theyre-the-smart-money-as-they-franti.html

“It’s a great time to sell,” mused Anthony Breault, senior real estate investment officer at Oregon’s state pension fund. And Blackstone Group, the world’s largest “alternative investment” firm, is doing exactly that, feverishly, relentlessly, hand over fist, at peak valuations, cashing out, maximizing its profits. That's how capitalism is supposed to work.

On the front burner: Brixmor Property, a REIT that owns 522 shopping centers, mostly neighborhood affairs anchored by grocery stores. Its IPO just priced at $20 a share, valuing it at about $6 billion – almost six times 2012 revenues of $1.17 billion. It starts trading on Wednesday. Blackstone will still own 73% of the common stock after the IPO, so the shares need to do well for a while before it can sell them. But it won’t be easy: last year, the REIT lost $61.4 million.

Another crown jewel Blackstone is selling: Hilton Hotels, which filed for a "much anticipated IPO" in September, as the Wall Street Journal called it in its way of hyping IPOs. It could be the largest real-estate IPO this year, and the largest hotel IPO ever. The roadshow might begin early December. Blackstone acquired it in 2007 with over $26 billion in debt. Its shares will be dumped at a hilariously inflated price while the Fed is still printing $85 billion a month to make that feat possible {for a scathing and entertaining analysis of the Hilton LBO, read David Stockman's..... Bernanke’s (Untough) Love Child: The $27 Billion Affair At The Hilton}...Next is La Quinta. Blackstone has already received a number of bids for the hotel chain, with a final round of bids expected in the next few weeks – though it might still get rid of it through an IPO if it brings more money that way...Then there is Extended Stay America, now getting groomed to be slipped into your portfolio as well. One heck of a double-dip saga. Blackstone first bought it in 2004 for $3.1 billion, most of it funded with debt. In June 2007, at the peak of the prior credit bubble, Blackstone sold that over-indebted jewel for $8 billion. The buyer, Lightstone, had obtained $7.4 billion in funding from Wachovia, Bear Stearns, Citi, and other luminaries. “By then the leveraged lending market had finally gone berserk," Stockman explains.

With impeccable timing – because the smart money really knows what it is doing – the deal closed five days before Citi launched the roadshow for Blackstone's own IPO. The $2.1 billion in “profits” from the sale became an inducement to buy into Blackstone’s IPO. In June 2009, exactly two years later, Extended Stay filed for bankruptcy. Much of its toxic debt was shuffled from the collapsing banks to the Fed and ended up saddling all Americans with Blackstone’s detritus. In May 2010, when Extended Stay was discharged from bankruptcy, the new owner was, you guessed it, Blackstone in partnership with John Paulson’s hedge fund, this time for $4 billion. Once again with nearly free money from the Fed, they leveraged it up to the hilt. And now, at the peak of the current credit bubble, Blackstone is dying to unload it, but this time via an IPO because they can get even more money for this jewel [to enjoy Stockman’s take on the entire Extended Stay double-dip scam, start here, then here, here, and here.]

Blackstone has more jewels in its crown that it’s getting ready to sell, including IndCor Properties, a warehouse REIT, and Invitation Homes, the platform Blackstone created that maniacally gobbled up 40,000 single-family homes – inflating home prices along the way – and then tried to rent them out. They might head for your portfolio early next year....Blackstone isn’t the only seller. So far this year, there have been 14 real-estate IPOs, including the Empire State Realty Trust Inc., owner of the Empire State Building, and American Homes 4 Rent. But since May, REITs have hit rough water. Worst loser: since its IPO in May, Ellington Residential Mortgage REIT is down 18%.

So 2013 is shaping up to be a huge year for sellers: "Property-related IPOs, including REITs, real estate operating companies and mortgage trusts, have had their biggest year since 2004 by money raised,” Bloomberg reported, based on data it compiled.

FINANCE IS WORSE THAN POLITICS FOR SAUSAGE-MAKING!

SOUNDS LIKE THE IGNOMINIOUS DEATH OF A BULL MARKET...

Demeter

(85,373 posts)You know something is going wrong when the heads of the largest fund manager in the world and the largest bond management firm simultanously scream ”bubble”. From Bill Gross last night:

And Larry Fink, CEO of Blackrock, from Bloomberg:

Yep. Here, there and everywhere. Here’s a neat enough take on what’s driving it all, from PFP Wealth Management:

The analogy, of course, is with the financial markets under central banking maestros like Alan Greenspan, Ben Bernanke and now “our own” Mark Carney. During the regime of ‘the Greenspan put’, numerous small fires in the market – including the failure of Long Term Capital Management, the dotcom bust, and a property market correction – were doused with plane loads (helicopter loads ?) of easy money. Even then, equity market investors have endured two bear markets over the past decade or so that have seen market valuations halve. Perhaps the mainstream policy response to any hint of likely economic hardship should not simply be to slash interest rates, in the same way that the best response to recalcitrant children should not simply be to smother them with sweets.

There is a glaring hole at the centre of modern economies. It is called central banking. We accept (or should do) that the modern economic world is highly complex, with practically infinite interactions between countries, governments, exchange rates, interest rates, stock markets, corporations, households, entrepreneurs, and consumers. In most areas we also accept that free markets are perfectly capable of driving Adam Smith’s “invisible hand” to ensure that enlightened self-interest benefits the many as opposed to the few. But that one institution – the central bank – is even capable of mastering such complexity and fine-tuning the workings of a highly complex economy through the brute mechanism of dictating the price of money is barely discussed. Of course central banks have now gone far beyond their original mandate of tweaking interest rates; in the words of Jim Grant,

“At the heart of the Fed’s regime is the subordination of freely discovered prices to policy goals.”

....The delay to tapering has triggered a blow off phase in post-GFC global markets. Enjoy it but don’t believe it, stay nimble, and make sure you’re in cash in time.

Demeter

(85,373 posts)

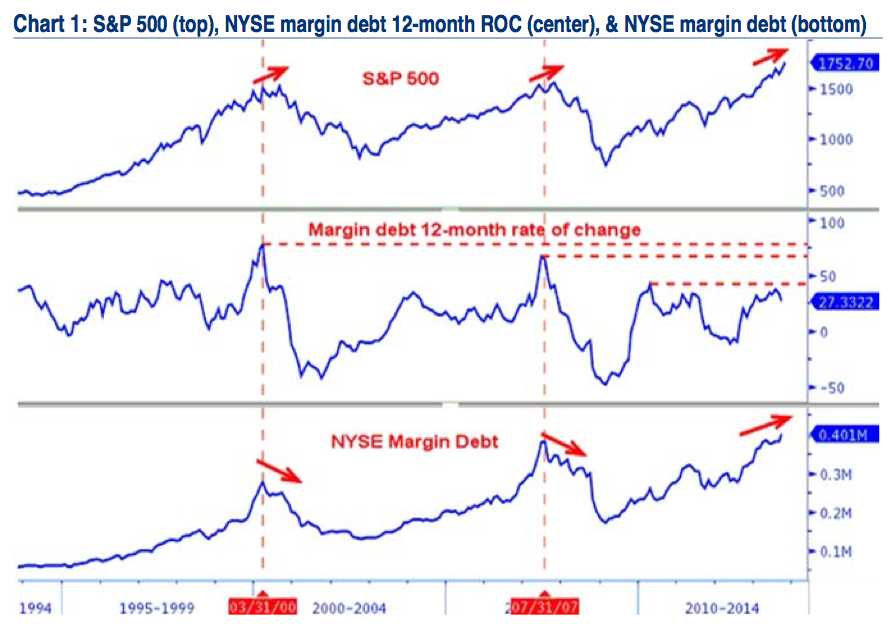

S&P 500 (top), NYSE margin debt 12-month ROC (center), & NYSE margin debt (bottom)

I keep seeing NYSE margin debt showing at record high as somehow a bearish indicator. This may not be supported by the historical data.

Merrill’s Stephen Suttmeier points out that, to the contrary, Margin Debt and S&P500, have often moved together. Indeed, when we look at the rate of change, this has in the past corresponded to a secular breakout in markets.

Here is Suttmeier:

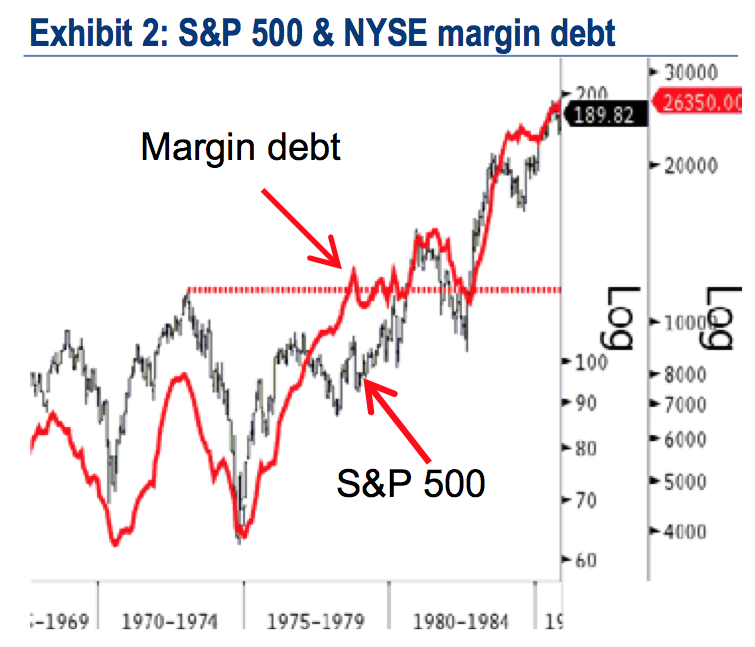

“NYSE margin debt stood at a new record high of $401.2b and exceeded the prior high from April of $384.4b. This confirms the new S&P 500 highs and negates the bearish 2013 set-up that was similar to the bearish patterns seen at the prior highs from 2000 and 2007, where a peak in margin debt preceded important S&P 500 peaks (see Chart 1 on page 2). In addition, a breakout for NYSE margin debt preceded/confirmed the breakout for the S&P 500 in 1980 (Exhibit 2).

In other words, a secular breakout for the US equity market in the early 1980s coincided with a big breakout in the absolute level of NYSE margin debt.

That last sentence is key: If the rate of change data somehow corresponds to past shifts in secular markets from bears to bulls, this is potentially a very significant factor.

http://www.ritholtz.com/blog/2013/10/nyse-margin-debt-at-record-high/

Demeter

(85,373 posts)Although it remains legitimate to speculate the possibility that death is not the end of the road for an individual, I would argue that there is no logical sense in which the reality of death itself can be considered a question. The prospect of not-existing may be inconceivable, but there is nothing objectively problematic or contradictory about it. It leaves no gap in one's understanding, no reason to say 'but what about...?' The empirical reality is a completely self-contained case, no more complicated that 1 - 1 = 0.

Having stated the above, it is another thing altogether to ask whether or not it needs an answer, as human consciousness seems to insist. People seem quite unanimous in regarding it as an issue, and perhaps that can be justified without recourse to vacuous philosophical non-questions. This issue might be answered, and that answer might be that the issue is an illusion.

It is that last line of reasoning that I once held with great confidence. It seemed I was smart enough to see that there was no issue, and thus had I overcome the human struggle with death. I was above it, free from the needless torment of death suffered only by unenlightened minds. Needless to say my attitude was characteristically cocky. Then came a time when the so-called issue seemed to have resurfaced. Things no longer seemed so simple and I found myself struggling once again with what I thought I had settled. I had been humbled back to square one: like most people, it seemed I needed an answer to death.

So what is the answer to death? First of all, to say that one needs an answer is not to say death really is an issue in itself. But it is not enough to simply know or believe that the issue is merely psychological. We have to know what the issue actually is before it can be resolved, real or not. Therein lies the problem. We confuse distinct issues all the time, with the consequence that the relevant issues often get bypassed by our solutions. My problem was I had failed to notice that death can, in fact, be considered an issue in more ways than one.

As I see things, there are no less than three issues we can have with death, such that each one may need a unique answer, and that solving one does not necessarily resolve one's struggle with death on the whole:

The 'badness' of death,

The fear of death, and

The pain of death.

The first of these is by far the easiest and most convenient to set aside. This is because it is, as far as I see, completely and utterly illusory. I can honestly think of no real logical reason that death, in itself, should be considered a bad thing (that is, from the perspective of the dying; the perspective of loved ones etc. is a whole other matter). Personally, I do not resent it in the slightest. This leaves us with only two serious issues to tackle: the fear and the pain.

While the fact of death itself is really ok, the fear of death is a terrible thing indeed. Ironically, it can deprive you of life. That is to say, it is only when one has dealt adequately with the fear of death that one can learn to really live. To such an end, of course, losing the fear of death is only one part of a much larger picture. It goes with the lifelong struggle against fear itself: fear of losing, or fear of never living to gain, love, acceptance, security and so on. To live in happiness is to live without fear, and to realize that happiness is possible independent of any possession, be it love, prosperity, and ultimately even God Itself if one is so inclined.

So what if one has attained such a life? Suppose that one has overcome both the 'badness of death' illusion and the fear of death, and has learned to genuinely enjoy life without fear, anger, or depression. Does this mean that death would simply cease to be an issue? The answer, I believe, is no, because the pain of death still remains. This relates to another point: if there is nothing wrong with death, and if one can overcome fear of it, and live a happy life without religion, then atheism would seem ideal. But in fact, Christianity traditionally does not rely on an assumption that death is bad. Nor does it most appropriately serve as an answer to the fear of death, contrary to the common assumption that religion is about providing 'consolation' or 'hope'. It is rather the pain of death that it most correctly seeks to address. Similarly, while God may not be necessary for the purpose of happiness, that is not to say that one does not still need It in one way or another. (It should be noted that saying we need God is by no means a concession to Its actual existence; atheism need not deny the itch, just that there is a real limb there to scratch)

So what is this 'pain of death'? To begin with, I don't imagine that such a notion is terribly alien to most people. After all, death can be depressing, and I'm sure at least some readers could vouch that they have been depressed about death without being afraid of it at the same time. The fact that love is not forever, that all things must pass, can take a grievous toll on us. This is the power of attachment, our tendency to cling onto things and people. We cannot bear to part with them but know we have to one day. And the memory of things we once had and even of times past in general can really break our hearts. Needless to say, it is wise not to surrender to the toxic lures of the past, for it will never surrender to you in return.

Of course, this is only the more normal experience, and like most normal depression, is does not need to be. A measure of one's happiness, if ever there was one, is the ability to enjoy things, including people, without becoming dependent on them in the process. The pursuit of happiness invites us to overcome the pain of death, at least in the genuinely despairing form outlined above. Too many of us are vulnerable to despair because we are chronically addicted to hope, and many no doubt imagine mistakenly that the only alternative to hope is despair. In reality, dependence upon hope is exactly what makes despair possible in the first place. Hope feeds attachment, is an attachment itself, and for this reason I have completely rejected it as any object of ultimate value. I have very much the same attitude toward consolation, for it is difficult indeed to be happy when we let our happiness depend upon believing things are as we would like them to be.

Let's return once again to our hypothetical happy person, who neither fears death nor resents it. We can now add that she does not depend on hope and consolation, and so is not in danger of despair. For her, the pain of death is not the sort of hopeless depression described above, but that is not to say it is not there. The pain of death can remain, albeit in a much more benevolent form. It is not a form of misery, but a pain which, like a mild headache, is actually compatible with a genuine good mood. So what is it?

It is the psychological effect of the finiteness of time. There is something about the fact that life has a time limit, that a conscious mind finds unsatisfactory. This is simply the ultimate manifestation of what we experience when we go to a fun social event, or go on holiday. We arrive with excitement when it is all ahead of us, but very soon begin to feel the relentless suck of time pulling us through to the other end. Likewise, we develop a sense of dread as we watch the years of our life ticking by, sending many into a hedonistic panic ("life is short man, don't waste it!"

So is there a solution to this problem? The religious answer, as we know, is yes. I think it is accurate to say that this answer is summed up in the word 'eternity'. But there is a hidden hiccup: eternity does not necessarily mean what people think it means. As I once pointed out to a psychology of religion student doing a thesis on Christians' fear of death, the 'eternity' that theologians speak of is NOT an endless amount of time, or time without end. It rather means something utterly incomprehensible: timelessness. Eternity is not time with the terminal points removed, resulting in an infinite number of days. It is the complete transcendence of time, as I understanding it, an ultimate now freed from its railed movement along the space-time continuum. According to the ancient orthodox Christian tradition, the afterlife is not some time based sequel to life, but a process of divinisation where death becomes the doorway out of time altogether; we become fully restored to God's image, existing beyond time.

Many people hear things like this and comment on how 'new age' it sounds. This is because most of us live in a mythology that people in pre-modern times were thick as bricks (simple example, the roundness of the earth was NOT established by Christopher Columbus, it has been the general consensus of western civilization since before Christ). Ideas like those above were not invented by the moderner, nor merely imported from the far-east. We don't associate them with Christianity because the Christianity we normally see in the modern west has been utterly dumbed-down. This tells me that there may be some justification in the scathing new age attitude toward modern western thinking, but their prejudiced belief that Christians in history are nothing but the same narrow minded wankers that taught them to hate themselves and fear hellfire is absolutely bogus.

This is why I say that Christianity is not meant to be an answer to the fear of death. But the problem with most normal Christians is that they tend to think more like Jehovah's Witnesses, looking forward to an imagined continuation of time beyond death, made right, and guaranteed to last forever. This could not contrast more than with the practicing ascetic, who hardly gives a damn about the afterlife, but rather aims at experiencing Eternity, or timelessness, within the span of his life. The goal of the mystic is not to live forever, rather, it is to live eternally, for the rest of his life.

In traditional theology, salvation occurs both in the present and in the future. From this perspective, Jehovah's Witness style afterlifism probably qualifies as a heresy, committed by Christians oblivious to what traditional orthodoxy actually entails. I, however, readily admit the converse heresy: whatever truth lies in religion, lies within our lifespans; it is the present aspect of salvation that is real, and the future aspect that I reject. A lot of people like to attribute religion to false consolation, hope and of course lies. I don't see much support for this view in history. But replace the word 'religion' with the word 'afterlifism', and I fear it may be true.

In conclusion, the answer that I favor for the pain of death is that of the mystic, nourishing oneself on the experience of timelessness or Eternity, which I choose to identify with God. It has been said by theologians that of the various words used to describe God, Eternity is about the only one that really paints a truthful picture. I enjoy my life tremendously. But I still go through life acutely aware that I am walking in the valley of the shadow of death for every waking moment that I am not part of Eternity. When not living in God I am living in Death, and it hurts me without interfering with happiness. But even without God, simply understanding this fact rather than distracting oneself from it is itself a form of salvation, allowing one to live in a way that many people will never get to know.

jtuck004

(15,882 posts)h/t to The Big Picture.

Demeter

(85,373 posts)Detroit is the battleground chosen by Wall Street to crush the last vestiges of American democracy by creating “the template for direct corporate rule.” Finance capital recognizes that it can no longer coexist with democratic institutions, which are most easily destroyed by attacking Black rule in the cities.

A half-century after the man once known as Detroit Red spoke those words, the last grains of sand are trickling from the hour glass of what has passed for democracy in America. The principle of one-person, one vote – or any meaningful franchise, at all – is no longer operative for the majority of Black people in the state of Michigan, whose largely African American cities are run by emergency managers accountable to no one but Rick Snyder, the venture capitalist in the governor’s mansion. The same bell is tolling for every urban center in the land, as hegemonic finance capital creates the template for direct corporate rule through the systematic destruction of Detroiters’ citizenship rights.

The 82 percent Black metropolis has been reduced to a Bantustan in both the economic and political senses of the term. Surrounded by some of the richest counties in the nation, the impoverished city exemplifies a national racial wealth gap that is more profound than that which existed in South Africa at the height of apartheid, as detailed by Jon Jeter in this issue of BAR (See “Worse Than Apartheid: Black in Obama’s America”). The Emergency Manager law, passed by the Republican state legislature after rejection by voters in a referendum, makes the Bantustan analogy complete, with a Black corporate lawyer overseeing the dismantling of every mechanism of local democracy. Kevyn Orr’s ascension as plenipotentiary of Wall Street is also the ultimate logic of the most vulgar current of African American politics, which seeks only Black representation at the highest levels of power, no matter whose interests are served. Wall Street long ago scoped this Black weakness, and has exploited it at every political level.

“The same bell is tolling for every urban center in the land.”

...Kevin Orr, ensconced in a $5,000 pH er month luxury penthouse condominium paid for by one of Governor Snyder’s private slush funds with contributions from secret corporate donors, is building the template for urban democratic dissolution from scratch. He is a crude and unimaginative man, doing Wall Street’s bidding with little finesse in the bright light of day. His arrogance is buttressed by the certainty that he is backed by the real rulers of the American State, Wall Street, and that the outcome in Judge Steven Rhodes’ federal bankruptcy court will create precedent to render all of America’s cities servile and neutered. Orr is also aware that his coloration provides perfect cover for his mission – added value for his services, well worth the luxury suite. (The judge ruled that Orr’s accommodations were irrelevant to the case.).... Wall Street recognizes that it cannot effectively consume the public sphere as long as the public retains the electoral democratic mechanisms to stop it. In other words, concentrated capital can no longer coexist with even the thin gruel of American democracy.... MORE

DEATH OF A GREAT AMERICAN CITY--CITY OF MY BIRTH, INCIDENTALLY

DemReadingDU

(16,000 posts)bread_and_roses

(6,335 posts)... though reading the above it is perfectly obvious and I am ashamed of my denseness and lack of insight.

I apologize to everyone for being absent - we had family issue and I have been away a week. Am still extremely exhausted and so after just a few minutes of reading or writing, have to go rest.

I'll never catch up but just reading down this far in this thread has given me more than enough food for thought to last a goodly while ...

Demeter

(85,373 posts)They will go down, but the city like the Mary Ellen Carter, will rise again.

I hope that your family issues are resolved and that you'll have something to be thankful for, this Nov. 27th.

goddess, I hope we ALL have something to be thankful for by then....the country needs it!

Demeter

(85,373 posts)Website glitches are a sideshow. Young people aren't signing up because the plans are expensive. The US needs a public option. Though this should come as no surprise: based on the early returns on Obamacare enrollments, many of the predictions of failure, including those made by both Howard Dean and Warren Buffet back in 2010, are becoming reality. And it has nothing to do with website glitches. The glitches and problems with the website are actually, for the moment a blessing for Democrats and Obama himself. They serve as a temporary smoke screen to the real problems which will soon become evident and which were inherent in the law itself, a law for those not aware, that was primarily written by the insurance industry (see the PBS documentary on Frontline) after Obama gave in to their demands and dropped the public option. Obamacare won't be the signature accomplishment of his presidency as his supporters like to trumpet, but his signature failure.

What was needed and what would have been real reform was the public healthcare option. Indeed, before her own capitulation to Obama and betrayal of her conscience, Nancy Pelosi called the public option "the centerpiece of healthcare reform". A public option had the votes in the Democratically-controlled Congress to pass, was backed by the American people in poll after poll by large majorities and would have given Americans the choice of leaving their insurance companies for a government run program similar to Medicare. Obamacare is just the opposite and is predicated on trying to force 32 million uninsured people to run to the insurance companies to purchase policies despite the fact that these same insurance companies were part of the problem in the first place...Remember that immediately after Obamacare passed the Senate, when Democratic Senator Tom Harkin (Iowa), a public option supporter, was asked how he felt about passing the bill his answer was "it's better than nothing ". If asked the same question today, he might not be so generous.

What will soon be apparent once the glitches with the web sites are fixed is that Obamacare will not get remotely close to the 32 million needed to make the program work (or even the 7 million the government predicts will sign up by March 2014). And that will have nothing to do with the website, but what people see on the site once they get there. As Robert Frank pointed out in the business section of the New York Times, for Obamacare to succeed, millions of young, healthy uninsured people need to buy into the program and purchase insurance. All of them. One look at the proposed premiums for the bottom tier plans designed to attract those millions and anyone not blinded by wishful thinking could have seen that Obamacare was going to fail. The cost alone of these "low end" policies are producing sticker shock when people see them. It gets worse when people see what the insurance companies are actually offering for these premiums. That's when they get the second shock. Many uninsured are finding that the bronze or lowest end policies are being priced in the range of $250 a month and up on average and that they come with $6,000 yearly deductibles(pdf) to be paid out of pocket before they get full coverage. Until then, they pay 40% in co-pays until the $6,000 out-of-pocket is reached in addition to the monthly premiums. And again, this is for the bottom tier polices for a single person, not a family. Costs to a family are higher.

It doesn't take Warren Buffet's financial savvy to figure out that young, healthy uninsured Americans, who are largely uninsured because they can't afford health insurance in the first place, are not going to be flocking to buy these policies for the privilege of having a health insurance card in their wallets that requires another $6,000 out-of-pocket before their expenses are fully covered and includes co-pays of 40% of all initial costs until that $6,000 is reached. What most of them will do is what they have been doing – live without insurance and go to an emergency room if they need medical care where the law says they have to be treated whether they have insurance or not. The returns so far on Obamacare bear this out and spell disaster. It's not about glitches on the website. The percentage of people who get to the site who are filling out applications is miniscule – as of this writing approximately 6m hits resulting in about 700,000 applications, or a little better than 10% of those visiting the site. And remember, applications are not enrollments, they are only people filling out a required general application before they are even able to see what's being offered and does not obligate an applicant to choose a plan. While the White House is so far refusing to release figures showing actual enrollments, (that will come in mid-November), the estimates are based on state run exchanges as well as data from Healthcare.gov and estimates from health insurance industry experts and companies processing enrollments. Based on the numbers and the need for all 32 million young healthy uninsured people to purchase policies for Obamacare to work, it's not going to work.

Yes it's early, but not that early since enrollment has to occur before the end of December (now extended to end of March 2014) to avoid the $95 penalty for not having insurance, and so far the actual number of enrollments is about 0.01% of what is needed. A healthcare industry analyst has said that he believes that so far, most of those who are actually signing up are not the young, healthy target market, but older and sicker people and people signing up for expanded Medicaid...

.........................................................................................................................................

Obama has said a number of times in response to the problems with Obamacare, "I'm willing to work with anyone, on any idea, who's actually willing to make this law perform better". The best way, maybe the only way to fix it is to do what Howard Dean said to do – junk it. And replace it with a public option.

DEATH OF A REALLY, REALLY BAD IDEA AND POORLY EXECUTED SCAM

Demeter

(85,373 posts)Senate Democrats facing reelection next year aren't just fretting about a balky website and President Barack Obama's misleading campaign statements on health care. Now they've begun worrying about another deadline a year away.

According to an Affordable Care Act timetable established by administration officials, early next October insurance companies will announce their new menu of health care plans for the ACA marketplaces -- plans that may be more varied and numerous than those offered this year, but that almost certainly will come with higher prices.

The likely price hikes will hit the individual and small-business insurance markets only weeks before Election Day on Nov. 4, 2014.

"What genius came up with that timetable?" asked one key Democrat, who declined to be quoted by name because he is involved in private White House talks.

MORE (IT NEVER ENDS, DOES IT?)

Demeter

(85,373 posts)Are they trying to pull a fast one on their customers?

As a follow-up to this post, I want to talk about the thing that spawns some of these phony Obamacare victim stories: the letters that insurers are sending to people in the individual market. People all over the country are getting these letters, which say "We're cancelling your current policy because of the new health-care law. Here's another policy you can get for much more money." Reporters are doing stories about these people and their terrifying letters without bothering to check what other insurance options are available to them.

There's something fishy going on here, not just from the reporters, but from the insurance companies. It's time somebody did a detailed investigation of these letters to find out just what they're telling their customers. Because they could have told them, "As a result of the new health-care law, your plan, StrawberryCare, has now been changed to include more benefits. The premium is going up, just as your premium has gone up every year since forever." But instead, they're just eliminating those plans entirely and offering people new plans. If the woman I discussed from that NBC story is any indication, what the insurance company is offering is something much more expensive, even though they might have something cheaper available. They may be taking the opportunity to try to shunt people into higher-priced plans. It's as though you get a letter from your car dealer saying, "That 2010 Toyota Corolla you're leasing has been recalled. We can supply you with a Toyota Avalon for twice the price." They're not telling you that you can also get a 2013 Toyota Corolla for something like what you're paying now.

I'm not sure that's what's happening, and it may be happening only with some insurers but not others. But with hundreds of thousands of these letters going out and frightening people into thinking they have no choice but to sign up for a much more expensive plan, it's definitely something someone should look into. Like, say, giant news organizations with lots of money and resources.

Now, it should be said that when President Obama said during the debate over the Affordable Care Act in Congress that if you like your health coverage you can keep it, he was only half right. The reason he repeated it so many times was that he and his advisors firmly believed that one of the main reasons Bill Clinton's health-care reform failed was that it changed things too much for too many, and people fear change. In Clinton's plan, pretty much everybody not on Medicare or Medicaid would have had to go into a new insurance plan. That those plans might be better than what they had didn't matter; the idea frightened people. So the Obama administration took pains to emphasize that the government would not require anyone to change their insurance. That didn't mean they were guaranteeing that no insurance company would ever make changes to anyone's plan, because insurance companies do that all the time. But the law wouldn't mandate that, say, you leave Aetna and join Blue Cross. The more complex reality is that because the law imposed new requirements on insurers for what they have to cover and what they can charge, the insurers were inevitably going to make changes to their existing plans in response. And yes, that means many people's insurance is going to change. In most cases it will change for the better, and the effect all this is going to have on premiums is yet to be seen. But it sure looks like insurance companies are trying to make sure anyone who's displeased aims their ire at the government, and if they can get people to buy a more expensive product along the way, they'll be happy to do that.

Demeter

(85,373 posts)Throughout human history, people have refused to accept the finality that death brings to life. Death brings an unacceptable, sudden interruption to one’s work, plans, and relationships. Though the inscription on many tomb stones often reads "Rest in Peace," the truth of the matter is that most people do not welcome the peaceful rest of the grave. They would rather be alive and productive. Thus, it is not surprising that the subject of death and afterlife always has been a matter of intense concern and speculation. After all, the death rate is still one per person. Each of us at the appointed time will face the grim reality of death.

Today we live in a death-denying culture. People live as if death did not exist. Doctors and hospital personnel generally think that death is something that should not happen. Regardless of how miserable people may feel, they usually respond to "How are you?" with an artificial smile, saying: "Just fine." When we can no longer maintain the facade, we begin to wonder, "What is going to happen to me now?"

Even at the end of life, we tend to deny the reality of death by embalming the dead and using cosmetics to restore the corpse to a natural, healthy look. We dress the dead in suits and gowns as if they were going to a party instead of returning to dust. A special mourning color that has been prevalent in most countries, such as white or black, is gradually disappearing, because people do not want to believe that death is an intrusion that terminates their life.

In recent years, courses on death and dying have been introduced in many colleges and high schools. Some colleges and universities also offer courses on the occult and other phenomena such as near-death experiences which allegedly offer scientific evidence for life beyond death. All of these trends suggest there is a renewed interest today to unravel the mystery of death and to gain reassurance about some form of life after death....

Demeter

(85,373 posts)Nasdaq OMX Group Inc (NDAQ.O) halted its second largest options market for much of Friday after a spike in volume hampered the exchange's ability to accept orders and distribute quotes on some symbols, in the latest glitch to hit the market operator.

The Nasdaq Options Market (NOM), which had around 8 percent of U.S. options volume last month, was halted at 10:36:57 a.m. EDT (1436 GMT) and will remain shut through the close on Friday, Nasdaq said.

Nasdaq said it would cancel all open orders on the all-electronic NOM book.

Equity options trading is still taking place on 11 other venues, including Nasdaq's PHLX and BX Options exchanges. Equities trading has not been affected.

On August 22, all Nasdaq stocks, including names like Apple Inc (AAPL.O), Google Inc (GOOG.O), and Facebook (FB.O), were halted for three hours after a spike in volume triggered a software flaw in a Nasdaq-run system that receives all traffic on quotes and orders for the exchange operator's stocks.

The U.S. Securities and Exchange Commission called the heads of all of the exchanges to Washington on September 12 to discuss ways to strengthen critical market infrastructure and improve its resilience when technology fails.

Demeter

(85,373 posts)DEATH OF A GAME PLAN?

http://thinkprogress.org/economy/2013/10/30/2860571/aei-safety-net/

Speaking at the Right To Rise: Education as America’s 21st Century Ticket to Social Mobility event on October 18, Arthur Brooks, president of the conservative think tank the American Enterprise Institute, told the audience that conservatives need to stop their attacks on government programs that help the very poorest survive.

He told moderator Jeb Bush:

&feature=player_embedded

Brooks describes talking to the very needy — homeless people, drug addicts, and ex-felons — and asking them, “What do you need?” He says that to improve their situations, they answer they need three things: transformation (on a cultural level), relief, and opportunity, “in that order.” But he went on to say, “Relief really matters.”

His fellow conservatives in Congress may not agree, however. Republicans have been pushing deep spending cuts that impact social safety net programs since 2010, mostly getting their way. Sequestration, which has hampered programs that help the vulnerable such as heating assistance in winter, housing vouchers, homelessness services, and unemployment benefits, was at first equally undesirable for Democrats and Republicans, with the latter trying to pin the blame on President Obama. But Republicans have since reversed course and are claiming the steep automatic cuts as a victory.

The latest battle is over food stamps, with Republicans in the House pushing a $40 billion cut to the Supplemental Nutrition Assistance Program over the next decade that could kick as many as 6 million people off of the rolls. That cut comes on top of an automatic drop in benefits on Friday that will reduce the average benefit to $1.40 per person per meal, impacting 900,000 veterans and millions of children, people with disabilities, and the elderly.

Meanwhile, at the state level many Republican lawmakers have been erecting barriers between those who need assistance and getting on the Temporary Assistance for Needy Families program, formerly known as welfare. At least eight states require applicants to be drug tested. The value of those benefits has also eroded to the point where they are worth less than in 1996.

Demeter

(85,373 posts)The Affordable Care Act's early travails are yielding some lessons for future presidents and lawmakers. Here are three:

1) Presidents can't be too careful about making high-profile promises. President Obama dented his credibility significantly by repeatedly promising that the Affordable Care Act would allow Americans with insurance they liked to keep those policies. That turns out not to be true in many cases for those in the individual insurance market, leading to the conclusion that the president didn't understand the legislation's effects, that he intentionally misled, or that he way oversimplified his message for broad consumption. None of those put him in a particularly good light. And the hit to his credibility as he closes in on the end of his fifth year in office could very likely wind up harming other parts of his agenda, like immigration, as opponents repeatedly ask: "How can we trust him?"

Health care experts have said they were surprised when they first heard the president's vow, since they knew Obamacare would invariably result in many private insurance plans being dropped — and thus people not being able to keep those plans. An obvious question is how the president's senior aides allowed him to keep making the promise.

2) Someone needs to tell the president bad news. It's a truism that aides are loath to bring presidents bad news. But even worse than telling a president bad news is allowing him to be surprised by it. Health and Human Services Secretary Kathleen Sebelius testified this week, however, that the president was caught off-guard by the health care exchange website's meltdown. That was despite the failure of HealthCare.gov when it was tested before its Oct. 1 launch and couldn't handle a minuscule fraction of the traffic it was expecting. There were plenty of warnings that the site was troubled. According to the administration, they just never flowed to Sebelius' level or to the president's. Future presidents might want to have a trusted, top-level White House aide whose sole job is to sniff out the bad news in the administration.

3) Democrats can forget about Republicans helping them fix Obamacare. Democrats have argued that the GOP should take a page from how Democrats acted after Republicans passed the Medicare drug benefit program in 2003. In recent congressional hearings about the ACA, Democrats have reminded Republicans that even though Democrats voted against the drug-benefit program because of the hole in its coverage, its ballooning of the deficit and its failure to rein in pharmaceutical company profits, they helped fix it. Democrats by and large didn't threaten to undo the Medicare program once it became law. But the dynamics were totally different. When Karl Rove, President George W. Bush's political strategist, persuaded Republicans to create a new entitlement program, he argued that it would help Republicans capture ground from Democrats on the health issue. It also put Democrats in a trick bag since, as a party, they tend to support entitlements, not oppose them.

By contrast, the central premise of the health care law — the federal government mandating the purchase of a product and penalizing people who don't buy it — is anathema to many conservatives. It's why the repeal and defund argument appeals to so many Republicans.

THIS CENTRAL PREMISE DOESN'T WARM THE COCKLES OF THIS DEMOCRAT'S HEART, EITHER...

Demeter

(85,373 posts)Energy stocks fell Friday, with Chevron Corp. the worst hit after it reported disappointing third-quarter earnings.,,,

Demeter

(85,373 posts)Thanks to decades of stagnant wages and the Great Recession, more than half of American working-class households are at risk of being unable to sustain their standard of living past retirement. Duncan Black is trying to change that...

The elderly doctor’s message spread like wildfire. “Townsend clubs” sprang up across the nation, gathering at least 1.5 million members in the first couple of years. By 1935, 56 percent of Americans favored adoption of the so-called Townsend plan—influencing the establishment of the Roosevelt administration’s Social Security Act that same year.

Years after the Press-Telegram letter made him famous, Townsend recounted the (possibly apocryphal) circumstances that inspired its writing. He had been gazing out his window in Long Beach one morning, he said, when he saw three old women rooting through the garbage for food. The sight made him snap. “A torrent of invectives tore out of me,” he recalled. When his wife told him to quiet down lest the neighbors hear, he thundered back: “I want all the neighbors to hear me! I want God Almighty to hear me! I’m going to shout till the whole country hears!”

Duncan Black’s neighbors probably can’t hear him tapping away on his laptop in his Philadelphia row house, but he has been doing his best to become Townsend’s modern heir. An economist and former college professor, Black—who goes by the pseudonym “Atrios” online—is one of America’s most popular political bloggers; his typical output consists of short, snarky quips on the news from a liberal perspective. But in late 2012 he embarked on a sustained crusade, on his blog and in a series of columns for USA Today, to inject a single idea into America’s policy discourse: “We need an across-the-board increase in Social Security retirement benefits of 20 percent or more,” he declared in the opening of a column for USA Today. “We need it to happen right now.”

The proposal was not exactly attuned to the political winds in Washington. Indeed, for anyone inclined to think in terms of counting potential votes in Congress—especially this Congress—the idea of expanding Social Security is the epitome of a political non-starter. Black’s proposal was attuned, however, to a mounting pile of research and demographic data that describes a gathering disaster. The famously large baby boom generation is heading into retirement. Thanks to decades of stagnant wages and the asset collapse of the Great Recession, more than half of American working-class households are at risk of being unable to sustain their standard of living past retirement. To put it even more starkly, according to research by the economists Joelle Saad-Lessler and Teresa Ghilarducci, 49 percent of middle-class workers are on track to be “poor or near poor” after they retire. There is very little safety net left to break this fall. The labor market for older workers is bleak. Private pensions are largely a thing of the past. Private savings are so far gone that some 25 percent of households with 401(k) and other retirement plans have raided them early to cover expenses, and a growing number of Americans over age 50 find themselves accumulating, not settling, debt. On the whole, 401(k)s have proved a “disaster,” as Black puts it, one that has enriched the financial sector but lashed the country’s retirement security to a volatile stock market—and left 75 percent of Americans nearing retirement age in 2010 with less than $30,000 in their accounts.

What’s left? Social Security. Though it was never meant to be a national retirement system all by itself, that’s increasingly what it has become. For Americans over age 65 in the bottom half of the income distribution, Social Security makes up at least 80 percent of retirement income. And yet, when Social Security has been in the news in recent years, it has usually been because someone wants to cut it. With Republicans in Congress ever more devoted to dismantling government, and the Congressional left doing everything it can just to fight the erosion of social programs, the center in American politics has increasingly come to be defined by deficit scolds preaching the “hard choices” of austerity. And the deficit reduction industry, a network of people in both parties who tend to enjoy favorable media attention for being “serious minded,” has long painted Social Security cuts as responsible fiscal policy—never mind that the program is funded outside the budget and does not add to the deficit.

All of this is especially surreal when you consider one additional fact: About 75 percent of Americans say we should consider increasing Social Security benefits, according to a survey by the National Academy of Social Insurance. Increasing Social Security is an idea that’s popular, concrete, and arguably necessary to forestall mass poverty among the elderly. But because it’s not “serious,” it hasn’t even been on the table in Washington. In a fit of quixotic energy, Black set out to change this. What’s remarkable is that his fool’s errand seems to be working....

Demeter

(85,373 posts)As America moves more deeply into its growing systemic crisis, it is becoming increasingly important for activists and theorists to distinguish clearly between important projects and "institutional elements," on the one hand, and systemic change and systemic design, on the other. The recent economic failure of one of the most important units of the Mondragón cooperatives offers an opportunity to clarify the issue and begin to think more clearly about our own strategy in the United States.

Mondragón Corporation is an extraordinary 80,000-person grouping of worker-owned cooperatives based in Spain's Basque region that is teaching the world how to move the ideas of worker-ownership and cooperation into high gear and large scale. The first Mondragón cooperatives date from the mid-1950s, and the overall effort has evolved over the years into a federation of 110 cooperatives, 147 subsidiary companies, eight foundations and a benefit society with total assets of 35.8 billion euros and total revenues of 14 billion euros...Each year, it also teaches some 10,000 students in its education centers and has roughly 2,000 researchers working at 15 research centers, the University of Mondragón, and within its industrial cooperatives. It also actively educates its workers about cooperatives' principles, with around 3,000 people a year participating in its Cooperative Training program and 400 in its Leadership and Team Work program.

Mondragón has been justly cited as a leading example of what can be done through cooperative organization. It has evolved a highly participatory decision-making structure, and a top-to-bottom compensation structure in a highly advanced economic institution that challenges economic practices throughout the corporate capitalist world: In the vast majority of its cooperatives, the ratio of compensation between top executives and the lowest-paid members is between three to one and six to one; in a few of the larger cooperatives it can be as high as around nine to one. Comparable private corporations often operate with top-to-median compensation ratios of 250 to one or 300 to one or higher. Although it has been criticized for violating its cooperative principles through somewhat "imperial" control of some of its foreign operations, for its use of non-cooperative labor, and for a less-than-active concern with environmental problems, in recent years Mondragón has begun to address deficiencies in these areas.

Bankruptcy for Fagor Electrodomésticos

Mondragón Corporation's historically most important unit is Fagor Electrodomésticos Group, which makes consumer appliances - "white goods" such as dishwashers, cookers and other related household items. It is the fifth-largest manufacturer of such products in Europe. It employs roughly 2,000 people in five factories in the Basque region and has and additional 3,500 in eight factories in France, China, Poland and Morocco. Its direct predecessor (ULGOR) was the first-ever Mondragón cooperative - established in 1956 by five young students of José María Arizmendiarrieta, the spiritual founder of Mondragón cooperative network. Mondragón recently announced that Fagor was failing and that the company would be filing for bankruptcy protection. Ultimately, Fagor was unable to find financing to pay off debts of around $1.5 billion related to a 37 percent slump in sales since 2007 that resulted from Spain's economic crisis and housing market collapse. Under Spanish law, the company now has four months to negotiate with its creditors - which include the Basque government, banks and others - and formulate a restructuring plan. As part of any restructuring or liquidation, Mondragón will provide jobs and income security for a certain period for some its workers in Spain. This is one of the cooperative network's great advantages. It has announced that its internal insurance company Lagun Aro will pay 80 percent of the cooperative member's salaries for two years and the corporation will strive to relocate as many employees as possible to other cooperatives in the network.

The fate of the roughly 3,500 non-Spanish wage laborers (i.e. not cooperative members) in other countries, however, is unclear.

Some Specific Problems

Given its importance, we are certain to see any number of economic reports on the specific problems that created the failure of Fagor. The larger questions posed by the failure, however, are the relationship of large-scale economic institutions to the market in any system, and the lessons for long-term systemic design for people concerned with moving beyond the failings of corporate capitalism and traditional socialism. Mondragón itself, and proposals for systemic change based on larger-scale cooperatives in general, have only occasionally directly confronted some of the larger challenges that the market poses to cooperative institutional forms. Mondragón's primary emphasis has been on effective and efficient competition. But what do you do when you are up against a global economic recession, on the one hand, or radical cost challenges from Chinese and other low-cost producers, on the other? The same challenges face anyone who hopes to project a new system based on cooperative ownership in any country. There is nothing inherently wrong with such a system; far from it, the principle is one to be advanced and supported. The question of interest, however - and especially to the degree we begin to face the question of what to do about larger industry - is whether trusting in open market competition is a sufficient answer to the problem of longer-term systemic design.

The Fagor failure is a strong reminder that ignoring the question can have consequences.

MORE---SORRY, TANSY!

jtuck004

(15,882 posts)that mfg is being rebuilt in this country. It's not. It's morphing into something new, and less. Those pitifully few jobs GE is bringing back from China and other places aren't coming back just because of "market forces". They are back because the corporations and government worked together to destroy unions, to undercut the economics of the family and individual, and to move a greater portion of the profit into the pockets of GE shareholders.

So now they can pay them a third of what they used to make, employ fewer of them because of technology, and keep a greater portion of the results of their labor.

At the same time those "market forces" have made housing more expensive, education and/or training for their kids more expensive, the rebuilding of the infrastructure that makes their lives better more expensive, their health care more expensive and certainly less adequate to the task.

I think the cooperative model is still the most useful, and when things go bad a much larger group is still associate that can work them out, but along with it now is going to have to come a realization that if they try to continue to play by the same rules as before, and live in a hyper-financed society which isn't producing what it used to, it may not matter WHAT the business structure is. They HAVE to get the membership to understand that unless changes are made that they are going to fail, and then they need to set about living without the kind of debt that sunk Fagor, and is strangling every one of us in a far slower and insidious manner.

Demeter

(85,373 posts)the world will be safe for democracy. And people without an all-consuming greed.

Demeter

(85,373 posts)The United States has likely reached a grim but historic milestone in the war on terror: 1 million veterans injured from the fighting in Iraq and Afghanistan. But you haven't heard this reported anywhere else. Why? Because the government is no longer sharing this information with the public....

VA ceased to disclose this data despite President Obama’s second-term campaign pledge that his administration would be open and transparent. Absent information about the number of soldiers that have sought government medical help and about the types of injuries they had, policymakers, Capitol Hill and health care professionals may be hamstrung in making decisions about funding for crucial veterans' health programs and the treatments and diagnostic tools that should be researched and targeted. The reliability of future military strategies could be in jeopardy as well.

VA's actions are "a gross injustice to veterans and the taxpaying public," says Anthony Hardie, a Gulf War veteran and veterans' advocate who has testified before the House Veterans' Affairs Subcommittee on Oversight and Investigations. Hardie suggests that Congress should tackle the problem, perhaps even legislatively, noting that withholding the data "reflects a VA pattern of abuse and lack of transparency."

Demeter

(85,373 posts)....our nation has been lied to about what are the real objectives of the NSA and America's massive surveillance apparatus build-up since the Cold War. Hundreds of billions of dollars are being spent to find a few terrorists? If you believe that, we've got a three dollar bill to sell you....

Demeter

(85,373 posts)A BLOW-BY-BLOW, DAY BY DAY BY WEEK ACCOUNT...TRYING TO LOG ON TO OBAMACARE

http://www.nakedcapitalism.com/2013/10/michael-olenick-how-my-experience-with-health-gov-shows-better-software-may-not-be-the-solution.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

This piece about my attempts to enroll on healthcare.gov runs the risk of being long, frustrating, and potentially repetitive, but that simply reflects the experience itself. But it also gives a taste of the nature of the problems and where the remedies might lie.

Much has been written about the rightfully maligned healthcare.gov website though little of that involves people, on the federal exchange, who actually try purchasing health insurance. Unlike contractors and federal employees who do not use the site, I have the misfortune of falling into this category. Since I’m also a software developer, I thought it worthwhile to document this strange experience.

I initially tried to sign up October 1, the day the exchange site opened, and every day after. Initially I’d sometimes get to the third screen of the account creation process – the one that asks security questions – but the questions were blank so I was thwarted from creating a login. One time the questions were there and I did create a login but I was never able to use it again.

Coming to the conclusion that the system reserved the username but lost the password – which later came out in the popular press but was never acknowledged by the government – I tried a new username. Finally, after weeks, I could log in. My sense of accomplishment was palpable: soon I could view unaffordable mandatory health insurance plans that cover 60-70% of my costs but include guaranteed insurance industry profits. This is progress!

After answering some odd questions to verify my identity the system told me I might not be who I say I am. My hopes were raised – maybe a random person wanted to purchase health insurance for my family and pay the full price – but I had to call a phone number to progress. After an hour on hold with Equifax a phone operator confirmed the system actually did verify my identity but, for whatever reason, told me to call in anyway. Apparently this is a common “glitch.” I’ll admit that the Equifax rep displayed the patience of Buddha, single-handedly increasing my feelings of goodwill toward Equifax, which was not hard because I had no goodwill toward Equifax before the call. However, I never figured out why a credit bureau is involved in taking applications for health insurance....

BUT THAT'S NOT ALL--MUST READ

jtuck004

(15,882 posts)Last edited Sat Nov 2, 2013, 06:31 AM - Edit history (2)

I did some further reading, just for context, and found this one interesting, about the beginning of Medicare...

When Medicare launched, nobody had any clue whether it would work < Title

...

The American Medical Association vehemently opposed the law. Two months before President Lyndon B. Johnson signed Medicare into law, the American Medical Association ran ads across the country denouncing the program as "the beginning of socialized medicine."

Johnson signed Medicare into law July 30, 1965. Benefits would become available July 1, 1966. That gave the Johnson administration less than a year to reach 19 million seniors. Medicare was, as the New York Times put it in April 1966, bracing "for M-Day."

...

There were still concerns about whether the enrollment efforts would actually work. The seniors who needed the program the most, Washington Post columnist William Raspberry wrote, tended to be the hardest to reach. The program came with a $3 monthly premium, and Raspberry worried that "those who will have trouble coming up with the $3 a month are precisely those who can least afford not to enroll."

On the whole, however, the enrollment effort worked. Of the 19 million seniors eligible for Medicare, 93 percent enrolled by the summer of 1966. Social Security Administration Commissioner Robert Ball "enlisted the U. S. Forest Service to send Forest Rangers out into the woods in search of elderly hermits whom he might be able to enroll." And, much to Wonkblog's liking, he held news conferences with charts that showed Medicare's enrollment levels.

...

Here.

Huh. So they signed up roughly 17,670,000 people in a year. With 3x5 cards. Then again, they didn't have a mangled bunch of software and dozens of people making excuses in the way...amazing what we put ourselves through to guarantee a 15% return for insurance companies when working people can hardly find 1% on their savings, much less find any money to save.

__________________

Enough of that...soon we will look back on all this and laugh. But why wait?

http://www.youtube.com/watch?feature=player_detailpage&v=7InS-xW1LCI

Demeter

(85,373 posts)Probably the stupidest, most gratuitously insulting and invasive step in the process.

bread_and_roses

(6,335 posts)... and it seems to me this is largely the result of all the privatization that "smaller gubmt" has meant ... and as for the credit bureau and DHS - WTF? I am beyond aghast. Has anyone posted this in GD? I would but I am too tired. I don't want to go into why I was away, but it was grueling - I have to go rest again after this.

Demeter

(85,373 posts)but then, I decided I didn't want to be tombstoned, nor pestered, and if they can't be bothered to drag their lazy asses over here, they don't deserve to know.

I think the scales are finally falling from the eyes of the Cultists. I haven't seen too much from them recently...either that, or I've got them all on Ignore.

I would rather hang with people I trust than take brickbats from the great unwashed and uneducated and born yesterday...it must be a sign of age or disgust.

You kids, get off my lawn!

bread_and_roses

(6,335 posts)xchrom

(108,903 posts)In an article about congressional negotiations aimed at reducing the deficit and eliminating jobs, the Washington Post explained that there had been a sharp drop in the size of the deficit since the Republicans took over Congress in 2011:

"Since then [January, 2011], a series of budget deals — and an improving economy — have dramatically slowed federal borrowing. On Wednesday, the White House budget office announced that the government recorded a $680 billion deficit in the fiscal year that ended in September, less than half the size of the shortfall President Obama inherited in 2009 when measured as a percentage of the economy."

Actually, the sharp drop in the deficit cannot be explained by economic growth over the last three years. In January of 2011, the Congressional Budget Office projected year over year growth for 2011, 2012, and 2013 of 2.7 percent, 3.1 percent, and 3.1 percent, respectively. In fact growth was 1.8 percent in 2011, and 2.8 percent in 2012. We don't yet have full year data for 2013, but GDP growth is virtually certain to be under 2.0 percent.