Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 18 November 2013

[font size=3]STOCK MARKET WATCH, Monday, 18 November 2013[font color=black][/font]

SMW for 15 November 2013

AT THE CLOSING BELL ON 15 November 2013

[center][font color=green]

Dow Jones 15,961.70 +85.48 (0.54%)

S&P 500 1,798.18 +7.56 (0.42%)

Nasdaq 3,985.97 +13.23 (0.33%)

[font color=black]10 Year 2.70% 0.00 (0.00%)

30 Year 3.80% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Fuddnik

(8,846 posts)I used to play golf with a Scottish stand-up comedian.

Demeter

(85,373 posts)Thanks, Doc. (It makes sense, too, which is probably the scary part).

Wait a minute, you played golf with Robin Williams?

Demeter

(85,373 posts)A lady was picking through the frozen turkeys at the grocery store, but couldn't find one big enough for her family. She asked the stock boy, "Do these turkeys get any bigger?" The stock boy answered, "No ma'am, they're dead."

````````````````````

A vulture boards an airplane, carrying two dead turkeys. The stewardess looks at him and says, "I'm sorry, sir, only one carrion allowed per passenger."

````````````````````

Ducking into confession with a turkey in his arms, Brian said, "Forgive me, Father, for I have sinned. I stole this turkey to feed my family. Would you take it and settle my guilt?"

"Certainly not," said the Priest. "As penance, you must return it to the one from whom you stole it."

"I tried," Brian sobbed, "but he refused. Oh, Father, what should I do?" "If what you say is true, then it is all right for you to keep it for your family." Thanking the Priest, Brian hurried off.

When confession was over, the Priest returned to his residence. When he walked into the kitchen, he found that someone had stolen his turkey.

TURKEY GROANERS:

Why did the turkey cross the road?

It was the chicken's day off.

What did the mother turkey say to her disobedient children?

If your father could see you now, he'd turn over in his gravy!

What sound does a space turkey make?

Hubble, hubble, hubble.

Why do turkeys always go "gobble, gobble"?

Because they never learned good table manners!

If a big turkey is called a gobbler, what do you call a little turkey? A goblet.

How many cooks does it take to stuff a turkey? Only one, but you REALLY have to squeeze to get him in.

Warpy

(111,255 posts)They'd be out there in a blizzard when the holes had been filled in and the flags on the greens were barely visible 20 feet away.

I don't get it, I've always liked the definition of golf as the best way to ruin a nice walk in the park.

I figured out a great way to set up shots in miniature golf when I was a little kid and mortified my parents, "Jesus Christ! She's shooting pool!" Hey, it worked!

And yeah, I played pool when I was a little kid, too. I preferred it.

jtuck004

(15,882 posts)

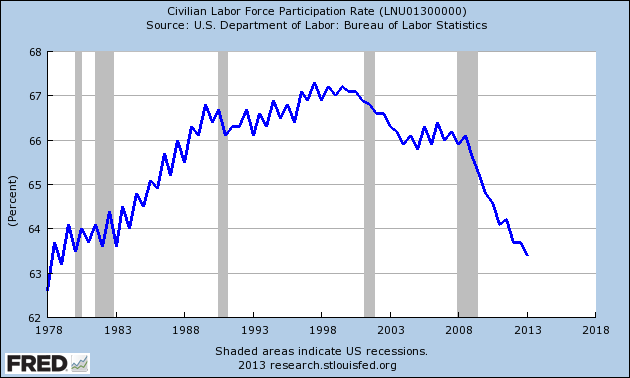

The October unemployment report showed a record low labor participation rate of 62.8%, graphed below. Many dismiss these record low labor participation rates by claiming more people are retiring and young people are just in school. Is this true or is something more sinister going on? Are people simply dropped out of the labor force who in fact really need a job are is it as they say, older Americans are enjoying their golden years, no longer needing to work and all the kids are just lining the higher education halls?

...

In other words, the 30 to 59 year olds, who make up 50% of the population which has the potential to work, account for pretty much all of the labor participation rate plunge since 2007. This same age group accounts for three quarters of the labor participation rate decline of the past year.

Anyone who insists the record low labor participation rate is due to baby boomers and people retiring is flat out wrong. It is clear the labor participation rate is dropping for people in the prime working years. Any way one slices it, the shrinking labor force is not due to baby boomers or magically all young people went off studying their hearts out. Anyone can do the above exercise to prove it. All one needs is a spreadsheet, access to the Internet to obtain BLS data and a hell of a lot of time.

....

Finally, if one still isn't convinced there is a very fast reality check labor participation is declining in the prime working years. The BLS publishes a seasonally adjusted monthly labor participation rate for those between the ages of 25 and 54. For all those people who believe it is perfectly ok to age discrimination against workers in their 50's or believe people can retire early as a rule (they cannot), this is the metric to look at. Since a year ago, the labor participation rate for 25 to 54 year olds has fallen by -1.0 percentage point. From October 2009, the labor participation rate for 25 to 54 year olds declined by -2.0 percentage points and from October 2007 there is a -2.2 percentage points rate drop in the labor participation rate for this age group.

..

More here, and also a link to a post from 2012 showing the same trend with more in-depth data.

One of the reasons this is important is that one of the ways to lower the headline unemployment rate is to classify people as "not in the work force". They get there by no longer looking for work. But when the JOLTS survey shows only 3.9 million open jobs, and 20 million people looking, plus several million more forced to work part-time who want full-time work, plus another 6-7 million among those "not in the work force" yet responding that they do want work, we see about 30 million people vying for those 3.8 million jobs. They are moved into the category of "not in the work force", giving the stats an "improved" shine, but in reality there is no place for them to apply. Even if they wanted to get screwed by McDonalds or Walmart.

And it's not because people are retiring.

Demeter

(85,373 posts)Last edited Mon Nov 18, 2013, 12:51 PM - Edit history (1)

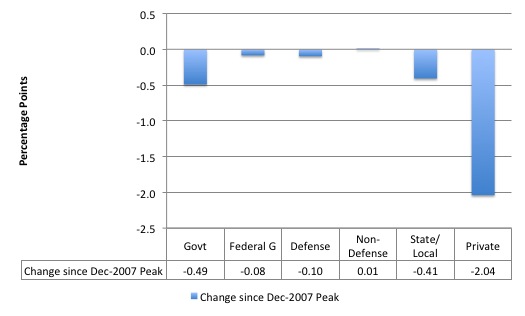

http://bilbo.economicoutlook.net/blog/?p=25993There was an article in the Atlantic yesterday (November 5, 2013) – How Washington Is Wrecking the Future, in 2 Charts – which reports in a related article in the UK Financial Times (November 3, 2013) – US public investment falls to lowest level since war. The essence of the articles is that the political landscape in the US has undermined the US President’s plans to spend more of public “infrastructure, science and education” which will undermine the future growth potential and prosperity of the US economy. A Bloomberg article (November 6, 2013) – Don’t Blame Congress for Cutbacks in Public Investment – criticised both analyses on the grounds that the cutbacks are relatively small and the culprit is state and local government in the US rather than the federal government. There is truth in both sides but neither really grasps the nettle and considers the cutbacks in government spending in the context of what is going on in the non-government sector. The cutbacks in public spending in the US over the last three years are unnecessary (financially) and the fiscal drag is keeping unemployment high and increasing the poverty rates. (SEE SOURCE FOR LINKS TO ARTICLES)

For clarity, the non-government sector is not an equivalent term for the private sector (households and firms). The non-government sector is the sum of the non-currency issuing parts of the economy and includes the private domestic sector (households and firms) and the external sector (exports and imports).

The Financial Times article (which the Atlantic article just puts a spin on) states that:

Public investment in the US has hit its lowest level since demobilisation after the second world war because of Republican success in stymieing President Barack Obama’s push for more spending on infrastructure, science and education.

Gross capital investment by the public sector has dropped to just 3.6 per cent of US output compared with a postwar average of 5 per cent, according to figures compiled by the Financial Times, as austerity bites in the world’s largest economy.

The data is provided by the – US Bureau of Economic Analysis – and so the FT might have better stated that they manipulated the public data rather than suggesting they “compiled” the figures. A small point. The facts:

1. The average from the first-quarter 1947 to the June-quarter 2013 for Total Government Gross Investment is 5 per cent of GDP.

2. The averages for the federal government overall was 2.7 per cent of GDP; for federal defense investment spending 1.8 per cent of GDP; for federal non-defense 0.8 per cent of GDP; for State/Local 2.3 per cent of GDP and for the private sector 17.2 per cent of GDP.

3. The current investment ratios (at June 2013) are: Total government 3.63 per cent; federal government 2.7 per cent of GDP; federal defense 0.96 per cent of GDP; for federal non-defense 0.7 per cent of GDP; for State/Local 1.97 per cent of GDP and for the private sector 15.7 per cent of GDP.

The following graph shows the evolution of the investment ratios for the total US government sector and the private sector since the December-quarter 2007 (the real GDP peak before the crisis). It is clear that both have fallen (the federal ratio by 0.5 points and the private ratio by 2.1 points), although the latter is on the upward move, albeit very slowly indeed.

To put this “recovery” period in context, the next graph shows the change in investment ratios since the December-quarter 2007 in the US by Government and Private and then breaking the government down into Federal (total, defense and non-defense) and State/Local. The results tell us that while the investment ratio for the Federal government has declined in this period (all because of a decline in the defense investment ratio), the overwhelming fall in investment spending as a proportion of GDP have been at the State/Local level.

MORE "GOOD NEWS" AT LINK...AND CONCLUSION:

It doesn’t take much of that to realise the significant potential for very productive public spending in the US.

First – a Job Guarantee.

Second – significant urban renewal.

Third – fix up the public education sector.

Fourth – fix up the environmental decay.

Fifth – get rid of private health insurance industry and introduce a truly universal public health system.

And that is just for starters.

Demeter

(85,373 posts)Unless Congress acts, during the last week of December an estimated 1.3 million people will lose access to an emergency program providing them with additional weeks of jobless benefits. A further 850,000 will be denied benefits in the first quarter of 2014.

Congressional Democrats and the White House, pointing to the sluggish recovery and the still-high jobless rate, are pushing once again to extend the period covered by the unemployment insurance program. But with Congress still far from a budget deal and still struggling to find alternatives to the $1 trillion in long-term cuts known as sequestration, lawmakers say the chances of an extension before Congress adjourns in two weeks are slim.

As a result, one of the largest stimulus measures passed during the recession is likely to come to an end, and jobless workers in many states are likely to receive considerably fewer weeks of benefits.

In all, as many as 4.8 million people could be affected by expiring unemployment benefits through 2014, estimated Gene Sperling, President Obama’s top economic adviser...

ALWAYS WINTER, AND NEVER CHRISTMAS....THE LION, THE WITCH AND THE WARDROBE

xchrom

(108,903 posts)Markets are drifting a little lower in the US and Europe.

And the Nikkei fell slightly.

The big story of the day so far is the big rally in China. The Shanghai Composite gained 2.9% while Hong Kong's Hang Seng Index rallied 2.7%.

These gains came after China released the reform decisions made after the "Third Plenum" late Friday. The reforms included social changes (an end to forced labor camps and a loosening of the one-child policy) as well as economic reforms.

Otherwise, today is a slow day with little big economic news expected to come out.

Read more: http://www.businessinsider.com/morning-markets-november-18-2013-11#ixzz2l0Ca9oXu

xchrom

(108,903 posts)

European Banking Authority (EBA) chief Andrea Enria, shown September 25, 2011 in Washington, DC, says too many European banks survived the financial crisis.

Too many European banks survived the financial crisis, the head of Europe's banking regulator said in a newspaper interview on Monday.

"I'm convinced that too few European banks were dismantled and disappeared from the market," European Banking Authority (EBA) chief Andrea Enria told the daily Frankfurter Allgemeine Zeitung in an interview.

"Barely 40 (disappeared), compared with around 500 in the United States," he said.

"Governments wanted to keep their banks alive and that has hampered the healing process" of Europe's financial system, Enria said.

Read more: http://www.businessinsider.com/europes-banking-regulator-too-many-banks-survived-the-financial-crisis-2013-11#ixzz2l0DgbKkN

AnneD

(15,774 posts)If a small town has one lawyer, the guy starves. But if you have 2 lawyers, they both get rich. I think the same works for banks.

Demeter

(85,373 posts)Faced with a barrage of new questions about the Affordable Care Act, President Obama cut short a White House press conference today, telling the stunned press corps, “You know what? Everybody can keep their damn insurance.”

Glaring at the reporters, the President continued, “You heard me. If your insurance is crappy, then you just go ahead and keep it—the crappier, the better. Let’s pretend this whole thing never happened.”

A vein in his forehead visibly throbbing, the President added, “You know, I really wish I hadn’t spent the last three years of my life on this thing. I should’ve just gone around invading countries for no reason. That would’ve made everybody happy. Well, live and learn.”

As the reporters averted their eyes from the President, many of them looking awkwardly at their shoes, he concluded his remarks: “All those people out there who want to repeal Obamacare? Well, guess what: I’ll make their day and repeal it myself. Really, it’s my pleasure. But I swear that this is the last time I try to do something nice for anybody.”

xchrom

(108,903 posts)Futures were down earlier. But you know how the pattern goes. Dips are to be bought. Selling never lasts.

Futures have now turned positive.

From FinViz:

Read more: http://www.businessinsider.com/us-futures-november-18-2013-11#ixzz2l0FaiSY0

Demeter

(85,373 posts)Center-right governments in Britain and Germany do it. So do the center-left governments in France and Italy. Obama and the Republicans do it, too. They all impose "austerity" programs on their economies as necessary to exit the crisis afflicting them all since 2007. Politicians and economists impose austerity now much as doctors once stuck mustard plasters on the skins of the sick...Austerity policies presume that the chief economic problems today are government budget deficits that increase national debts. Austerity policies solve those problems mainly by cutting government spending, and secondarily, by limited tax increases. Reducing expenditures while raising revenues does cut governments' deficits and their needs to borrow. National debts grow less or drop depending on how much each government's expenditures decrease and its taxes increase. Obama's austerity policies during 2013 started 1 January, when he raised payroll taxes on everyone's annual incomes up to $113,700. Then, on 1 March, the "sequester" lowered federal expenditures. Thus, 2013's US deficit will drop sharply from 2012's.

Obama will likely impose more austerity: cutting social security and Medicare benefits to compromise with Republicans. Similarly, European governments maintain their "austerity" programs. Even France's government, officially "anti-austerity" and "socialist", has a new budget with typical austerity cuts in social expenditures. The accumulated evidence shows that austerity programs usually make economic downturns worse. Why, then, do they remain the preferred policy for most capitalist governments?

When capitalist economies crash, most capitalists request – and governments provide – credit market bailouts and economic stimuli. However, corporations and the rich oppose new taxes on them to pay for stimulus and bailout programs. They insist, instead, that governments should borrow the necessary funds. Since 2007, capitalist governments everywhere borrowed massively for those costly programs. They thus ran large budget deficits and their national debts soared. Heavy borrowing was thus capitalists' preferred first policy to deal with their system's latest crisis. It served them well. Borrowing paid for government rescues of banks, other financial companies, and selected other major corporations. Borrowing enabled stimulus expenditures that revived demand for goods and services. Borrowing enabled government outlays on unemployment compensation, food stamps, and other offsets to crisis-induced suffering.

In these ways, borrowing helped reduce the criticism, resentment, anger, and anti-system tendencies among those fired from jobs, evicted from homes, deprived of job security and benefits, etc. Government borrowing had these positive results for capitalists – while saving them from paying taxes to get those results. Nor is that all. Corporations and the rich used the money they saved by keeping governments from taxing them to provide the huge loans governments therefore needed. Middle- and lower-income people could lend little if anything to their governments. Corporations and the rich, in effect, substituted loans to the government instead of paying more in taxes. For those loans, governments must pay interest and eventually repay them. Government borrowing rewards corporations and the rich quite nicely. It amounts to a very sweet deal for capitalists. Yet, that sweet deal raises a new problem. Where will governments find funds, first, to pay interest on all the borrowing, and second, to pay back the lenders? Corporations and the rich worry that they might still be taxed to provide those funds. They are determined to avoid such taxes – just as they avoided being taxed to pay for stimulus and bailout programs in the first place. Austerity is thus capitalists' preferred second policy, a second way to avoid higher taxes as governments struggle with economic crises....Capitalism's way of dealing with its recurring crises is thus a remarkable two-step hustle. In step one, massive borrowing funds stimulus and bailout programs. In step two, austerity pays for the borrowing...MORE NAUSEA AT LINK

AND CONGRATULATIONS TO THE GUARDIAN...AMERICA'S NEWEST, BRIGHTEST AND BEST NEWS SOURCE!

Demeter

(85,373 posts)PODCAST AT LINK

To listen in live on Saturdays at noon, visit WBAI's Live Stream (LINKS AT ABOVE)

Economic Update is in partnership with Truthout.org

Your radio station needs Economic Update! If you are a radio station, check this out. If you want to hear Economic Update on your favorite local station, send them this.

Visit Professor Wolff's social movement project, democracyatwork.info.

Permission to reprint Professor Wolff's writing and videos is granted on an individual basis. Please contact profwolff@rdwolff.com to request permission. We reserve the right to refuse or rescind permission at any time.

Demeter

(85,373 posts)This is how the middle class dies, not with a bang, but a forced squeeze. After a global corporation posts record profits, it asks the state that has long nurtured its growth for the nation’s biggest single tax break, and then tells the people who make its products that their pension plan will be frozen, their benefits slashed, their pay raises meager. Take it or we leave. And everyone caves.

Well, almost everyone. All went according to script as the Boeing Company showed what to expect in a grim future for a diminished class — the vanishing American factory worker. The threats were issued, the tax giveaways approved, the political leaders warned of the need to buckle to Boeing.

This didn’t happen in a broken town with a broken industrial heart. It took place in one of the most prosperous metropolitan areas on the planet — Seattle — home to Starbucks, Costco, Microsoft, Nordstrom and Amazon.com, which is on its way to becoming the world’s largest retailer.

But then came the final item, a vote of the people who actually assemble the planes. By a 2-1 margin on Wednesday, the machinists of Puget Sound told Boeing to stuff it. With this act of economic suicide, the state could lose up to 56,000 jobs on the new 777X plane. Cue your metaphor — the Alamo, Custer’s Last Stand, Braveheart....

xchrom

(108,903 posts)This has really been the theme of market talk over the last several weeks: People are obsessed with this idea that we must be in a new bubble.

Dan Greenhaus of BTIG shares the latest anecdotes:

It seems there’s no escaping it. This weekend, the WSJ is at it again, both in A Return to Internet Mania? and Is This a Bubble? while the Financial Times asks Is the Fed Brewing Up Bubble Trouble? Anecdotally this weekend, several people this weekend at non-work related functions asked some form of the question “How does this market keep going up?” We understand the infatuation; after all, S&P 500 is up (10%) in nine of the last eleven weeks while its year to date gain is more than 26% even as the economy plods along at a sub-attractive rate and the unemployment rate remains annoyingly elevated.

No idea what this actually means for the market, but it is interesting how much this meme is taking hold.

Read more: http://www.businessinsider.com/people-just-cant-stop-talking-about-how-were-in-a-bubble-2013-11#ixzz2l0GDYHkZ

xchrom

(108,903 posts)

Gutsy, smart, and hyper-articulate, Elizabeth Warren is quickly becoming the voice of progressivism in Washington. Along with departing regulator Gary Gensler, Warren probably did more than anyone in Washington to bulk up Dodd-Frank from its rather flimsy beginnings and turn it into a financial-reform law with some weight. She also speaks out eloquently for the beleaguered middle class and on the deeper problem of income inequality.

But the idea that somehow this growing reputation translates into a competitive bid for the 2016 presidential nomination—The New Republic recently suggested on its cover that Warren represents the "soul" of the Democratic Party more than Hillary Clinton—is pretty over the top.

Here's why. As impressive and quotable as she is as a senator—"I'm really concerned 'too big to fail' has become 'too big for trial,'" Warren memorably declared at her very first Banking Committee hearing—she is basically a one-issue political figure. And that doesn't get you into the White House in this era. (OK, fine, Barack Obama first came to national attention by declaring Iraq a "dumb" war, but more on that later.) Warren's punditocratic boosters, like Jonathan Chait of New York, have tried to compensate for her one-issueness by suggesting that the issue that Warren became famous for is still, as Chait put it, "the most potent, untapped issue in American politics."

And what might Chait be talking about? Get ready: financial reform. That's right. An issue almost no one talks about anymore and far fewer people understand. I ought to know because I've spent tens of thousands of words trying to get people to talk about it since I published a 2010 book called Capital Offense: How Washington's Wise Men Turned America's Future Over to Wall Street. I fully agree that Obama failed miserably to exploit a potential populist issue that, once upon a time, might have made him the second coming of FDR. "Surveys show that both Left and Right, liberals and conservatives, were united in wanting to see fundamental change to Wall Street and big finance," I wrote in 2011. "Yet rather than seizing the chance at the kind of leadership that might have unified a good part of the country, Obama threw himself into an issue that divided Left and Right as never before, and which was not directly related to the historic crisis at hand—health care."

Demeter

(85,373 posts)It's that we need at least 50 and preferably 500 people of her integrity, intelligence, and drive, seeded throughout the country in all branches of government, cleaning up.

What we don't need is Hillary, if she doesn't see this.

xchrom

(108,903 posts)we can't get a warren -- or some equivalent -- for the awfullest of reasons.

right now it's a fight for life and death in the states -- that's where my energies will go.

DemReadingDU

(16,000 posts)Burnt out.

Doesn't seem to matter who is in office, the people are getting screwed.

Demeter

(85,373 posts)Bloomberg

1.“We just get richer and richer.”

In 2013, the wealth of the world’s billionaires reached a record high — helped by 200 newcomers like Facebook founder Mark Zuckerberg. The 2013 Forbes Billionaires List names 1,426 billionaires with an aggregate net worth of $5.4 trillion, up a whopping 17% from $4.6 trillion last year. And that doesn’t include royalty or, um, dictators. Of those, some 442 make their home in the U.S. (there are 386 in the Asia-Pacific region, 366 in Europe, 129 in the rest of the Americas and 103 in the Middle East and Africa combined, according to Forbes). The average net worth of each U.S. billionaire: $10.8 billion, up from $9.1 billion last year, according to a separate survey released this month by private wealth consultancy Wealth-X and UBS...Meanwhile, the rest of the country’s net worth has actually fallen since the Great Recession — and has yet to recover. Adjusting for inflation, real net worth per U.S. household hovered at $652,449 by the end of June 2013, according to the Federal Reserve, or about 95% of its 2007 level of $684,662. If that seems inordinately high, that’s because the majority of U.S. households carry their net worth in their home. That average also is inflated by, well, millionaires and billionaires: In fact, around half of U.S. households have a net worth of no more than $83,000, a Pew Research Center’s analysis of 2010 Federal Reserve survey found.) And while ordinary Americans have seen their net worth fall since the recession, billionaires saw their net worth rise by over 50% from $3.5 trillion in 2007...

2.“One million — or 10 — ain’t what it used to be.”

3. “This is basically a boys’ club.”

4.“I may be smart, but I got a head start.”

5.“It’s like Monopoly money.”

6. “What scares us? Divorce lawyers.”

7.“We didn’t get rich investing in stocks.”

8.“You say evading, we say avoiding.”

9. “My family hates me, loves my money.”

10. “King Lear taught me everything I know.”

Demeter

(85,373 posts)One of the big criticisms of the original team of financial regulators brought in by President Obama is that too many of them had worked in Bill Clinton’s Treasury Department. That, of course, was the Treasury Department run by Robert Rubin and then by Lawrence Summers — an agency with a bias toward deregulation. Those regulators had supported the elimination of Glass-Steagall, the 1930s law that separated investment banks from commercial banks, and were disinclined to regulate derivatives, “those financial weapons of mass destruction,” as Warren Buffett liked to call them.

One of those old Rubin hands was Gary Gensler. An 18-year veteran of Goldman Sachs, Gensler had been the assistant secretary of financial markets under Rubin, and then later undersecretary for domestic finance, and he shared his boss’s deregulatory bias. When President Obama was picking his regulatory team, he chose Gensler to be the chairman of the Commodities Futures Trading Commission. Now, Gensler is about to leave that post. And if people once doubted how tough he would be as a regulator, there is no doubt now: he may well be the single best appointment Obama made.

When he came into office, the C.F.T.C.’s job was to regulate the futures market. It was a small agency, with fewer than 700 employees. Then came the Dodd-Frank reform law, which gave the commission enormous new responsibilities. It was charged with writing dozens of rules to regulate derivatives, and to oversee a $400 trillion market. “I hadn’t realized how much authority was delegated to regulators,” he said. But he embraced the challenge. Derivative trades had always been conducted in the shadows; Gensler brought them into the light... Thanks to the trading commission’s new rules, the government now has a good feel for the derivatives market. And the added transparency has also had the effect of lowering prices, which is what inevitably happens when all the market participants can see what is being bought and sold. Although the banking industry pushed back hard against some of the new rules, Gensler says that there was nothing radical about the new transparency. “Adam Smith wrote that the community at large benefits when you can make information and access free.”

If regulating the derivatives market were all Gensler had done, it would have been plenty. But the C.F.T.C. was also the agency that cracked the Libor scandal. A few months after being sworn in, in May of 2009, he saw an article about Libor — the interest rate banks charge to each other for interbank lending — that piqued his curiosity. “I asked our head of enforcement — should we look into this?” The result, three years later, was the unveiling of an enormous scandal involving traders at more than a dozen financial institutions. .., MORE

Demeter

(85,373 posts)President Barack Obama on Tuesday named Timothy Massad, a lawyer who oversaw the U.S. government's $700 billion bank bailout program, as the next head of one of Wall Street's most powerful supervisors.

If confirmed by the Senate as chairman of the Commodity Futures Trading Commission, Massad would lead an agency that was given vast new regulatory powers after the 2007-09 crisis, and is now tasked with reining in in the relatively uncontrolled trading of complex derivatives - a $630 trillion global market.

The nomination solves a looming leadership vacuum at the regulator, since current CFTC Chairman Gary Gensler's term expires on Jan. 3, 2014....The CFTC, long an unexciting agency overseeing agriculture futures, has only just been put in charge of the swaps markets, and has yet to write some of its planned rules.

LOTS MORE AT LINK--BUT THEY REALLY NEED A BETTER HEADLINE EDITOR

Demeter

(85,373 posts)How much could Obamacare affect the economy?

That’s a question investment strategist Ed Yardeni posed in a newsletter to clients on Friday, and the conclusion is that President Obama’s health-care overhaul could put a damper on the economy — but there could be several side-effects that could boost growth.

“Lots of Americans may get increasingly anxious over the remainder of the year that they will have more out-of-pocket health care costs next year to pay for doctors who aren’t in the networks of the policies available to them as a result of Obamacare,” Yardeni says in a note to clients. “If their concerns are realized, then they might actually have to spend more of their budgets on health care and less on everything else.”

That scenario could prevent stocks from a “melt-up,” or the near-vertical ascent that tends to rattle stock watchers on alert for bubble conditions..,MORE

I THINK IT'S A LOT OF HOOEY...WHAT DO YOU ALL THINK?

xchrom

(108,903 posts)Five years after Federal Reserve Chairman Ben S. Bernanke dropped U.S. interest rates toward zero to end the worst economic crisis since the Great Depression, America’s financial markets have become the envy of the world.

From money-market rates to yields on government and company bonds to equity prices, financial conditions in the U.S. are healthier than before Lehman Brothers Holdings Inc. collapsed in 2008, even as growth falters in Asia and Europe. The U.S. now has the strongest economy among industrialized nations, which would be its highest rank since 2000, according to David Woo, the New York-based global head of interest rate and currency strategy at Bank of America Corp.

“Resilient is the word that comes to mind in regards to the U.S.,” Paul Montaquila, the fixed-income investment officer at BNP Paribas SA’s Bank of the West, which oversees $62 billion in assets, said in a telephone interview from San Ramon, California. The strength of the financial markets demonstrates “the U.S. is still the preferred market of choice for global investors and the most-important engine of growth.”

While the Fed’s decision to push borrowing costs to historical lows in December 2008 helped developing economies recover more quickly as the U.S. housing bust crippled Americans’ ability to spend, investors are now showing greater conviction that the nation will underpin growth globally.

xchrom

(108,903 posts)The Department of Justice and Securities and Exchange Commission are telling a U.S. Senate committee that Bitcoins are legitimate financial instruments, boosting prospects for wider acceptance of the virtual currency.

Representatives from the agencies told the U.S. Senate Committee on Homeland Security and Governmental Affairs ahead of a hearing today that the digital money offers benefits and carries risks, like any other online-payment system, according to letters they released before the meeting.

The committee scheduled the hearing “to explore potential promises and risks related to virtual currency for the federal government and society at large” after the Silk Road Hidden Website was shut down in October. The closing of the marketplace, where people could obtain drugs, guns and other illicit goods using Bitcoins, is helping fuel a rally in the virtual currency as speculators bet that the digital money will gain more mainstream acceptance.

“The FBI’s approach to virtual currencies is guided by a recognition that online payment systems, both centralized and decentralized, offer legitimate financial services,” Peter Kadzik, principal deputy assistant attorney general, wrote in a letter yesterday. “Like any financial service, virtual currency systems of either type can be exploited by malicious actors, but centralized and decentralized online payment systems can vary significantly in the types and degrees of illicit financial risk they pose.”

Demeter

(85,373 posts)Some kind of public screw is about to happen

AnneD

(15,774 posts)then the matta hits the fan.

xchrom

(108,903 posts)Congressional critics looking to cut the nation’s food stamp bill -- which has doubled in the past five years -- are pointing to what some say is a loophole in the law:

If a state gives a resident as little as $1 a year in heating assistance, it allows that person’s household to automatically qualify for an average of $1,080 in additional food stamps annually from the federal government.

That’s what 14 states, including New York and California, and the District of Columbia have done.

“If there are programs available for people, we should use them,” Mary Cheh, a Democratic member of the District of Columbia city council, said. At her urging, the council unanimously approved the “heat and eat” arrangement in 2009, agreeing to make token heating-aid payments so citizens can get more for food.

xchrom

(108,903 posts)The German government spends more than €20 million ($27 million) per year on programs to support German minorities living in Eastern Europe.

The payments are an "expression of special historical responsibility," says the German Interior Ministry, and are intended to compensate people for the injustice they suffered in their countries after World War II.

The figures were made available by the ministry in response to a request from SPIEGEL. They don't include payments made by the Foreign Ministry, the Culture Ministry or Germany's 16 regional state governments.

The government contributes to financing care for the elderly, language tuition and cultural events for some one million people. It also subsidizes the German-Russian children's magazine Schrumdirum, paying €244,000 per year for subscriptions.

Demeter

(85,373 posts)For no good reason except somebody had a bet...?

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)A majority of Americans, especially women and people of color, will spend their final years living in poverty in coming decades unless Social Security is improved and expanded—not cut back as Republicans and President Obama seek—and there are many fair ways to accomplish that, experts told a congressional briefing last week.

“Don’t listen to anyone inside the Beltway,” said longtime Democratic pollster Celinda Lake. She said she’s surveyed voters in every state and found Americans take a completely different view than Washington’s political leadership. “Real people are wildly in favor of Social Security, wildly supportive of it. And this is a voting issue in 2014.”

Lake’s remarks came after a series of stunning presentations describing why the country was on the brink of a staggering retirement crisis unlike anything Americans have heard about from debt-obsessed Republicans or the White House. The takeaway is that there needs to be a new and entirely different political discussion—and congressional response—about what Social Security provides after a lifetime of work or an unexpected tragedy, so WINDof Americans don't become desperately poor.

“There is a retirement income crisis. It’s huge. Two-thirds of working Americans cannot maintain their standard of living in retirement—and that assumes they work until 65,” said Syracuse University’s Eric Kingson, co-director of Social Security Works, which convened the day-long session with Sen. Tom Harkin, D-Iowa. “Somewhere in the discussion about Social Security we forget that its purpose is to assist the American people… The end is the kind of society we want; the kind of support we want.”

MORE BLOWING INTO THE WIND