Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 3 February 2014

[font size=3]STOCK MARKET WATCH, Monday, 3 February 2014[font color=black][/font]

SMW for 31 January 2014

AT THE CLOSING BELL ON 31 January 2014

[center][font color=red]

Dow Jones 15,698.85 -149.76 (-0.94%)

S&P 500 1,782.59 -11.60 (-0.65%)

Nasdaq 4,103.88 -19.25 (-0.47%)

[font color=black]10 Year 2.65% 0.00 (0.00%)

30 Year 3.60% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Me neither.

Demeter

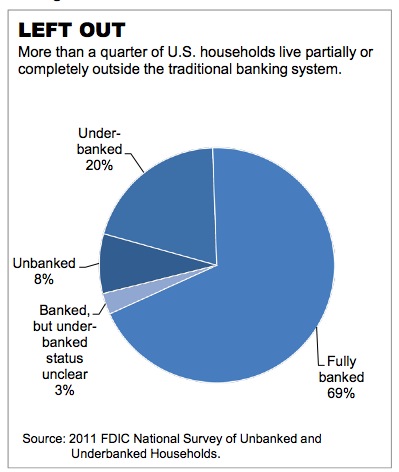

(85,373 posts)Naked Capitalism readers have frequently called for the Post Office to offer basic banking services, as post offices long have in many countries, notably Japan. That idea has gotten an important official endorsement in the form of a detailed, extensively researched concept paper prepared by the Postal Service’s Inspector General. I’ve embedded it and strongly urge you to read and circulate it.

One of the stunning parts in reading the document is to see how wildly successful this program could be, precisely because traditional banks are withdrawing from many of the neighborhoods in which moderate and lower-income people live, and non-banks offer targeted, richly priced services, too often designed to take advantage of desperation or simple lack of alternatives. Even though most of us are aware of this general picture, the USPS IG, dimensions the scale of this problem and the costs to the affected households.

There are 34 million un and underbanked American households, which translates into 28% of the population. And consider what this second-class status translated into in fees and other charges:

The average underserved household has an annual income of about $25,500 and spends about $2,412 of that just on alternative financial services fees and interest. That amounts to 9.5 percent of their income. To put that into perspective, that is about the same portion of income that the average American household spends on food in one year.5 In 2012 alone, the underserved paid some $89 billion in fees and interest...MORE

Demeter

(85,373 posts)NOTHING LIKE THIS ONE, THAT'S FOR CERTAIN

http://moslereconomics.com/2014/01/28/what-a-good-economy-should-look-like/

I just want to say a quick word about what a good economy is because it’s been so long since we’ve had a good economy. You’ve got to be at least as old as I am to remember it. In a good economy business competes for people. There is a shortage of people to work for business. Everybody wants to hire you. They’ll train you, whatever it takes. They hire students before they get out of school. You can change jobs if you want to because other companies are always trying to hire you. That’s the way the economy is supposed to be but that’s all turned around. For one reason, which I’ll keep coming back to, the budget deficit is too small. As soon as they started tightening up on budget deficits many years ago, we transformed from a good economy where the people were the most important thing to what I call this ‘crime against humanity’ that we have today……

So what you do is you target full employment, because that’s the kind of economy everybody wants to live in. And the right size deficit is whatever deficit corresponds to full employment…

tclambert

(11,085 posts)Ideally, they want customers lining up to compete for access to limited products, too. I used to think business people hated competition, but no, they love it! As long as other people do the competing.

Morituri te, salutamus.

Demeter

(85,373 posts)Thomas Piketty’s new book, “Capital in the Twenty-First Century,” described by one French newspaper as a “a political and theoretical bulldozer,” defies left and right orthodoxy by arguing that worsening inequality is an inevitable outcome of free market capitalism.

Piketty, a professor at the Paris School of Economics, does not stop there. He contends that capitalism’s inherent dynamic propels powerful forces that threaten democratic societies.

Capitalism, according to Piketty, confronts both modern and modernizing countries with a dilemma: entrepreneurs become increasingly dominant over those who own only their own labor. In Piketty’s view, while emerging economies can defeat this logic in the near term, in the long run, “when pay setters set their own pay, there’s no limit,” unless “confiscatory tax rates” are imposed.

Piketty’s book — published four months ago in France and due out in English this March — suggests that traditional liberal government policies on spending, taxation and regulation will fail to diminish inequality. Piketty has also delivered and posted a series of lectures in French and English outlining his argument...

MORE

Tansy_Gold

(17,858 posts)"...defies left and right orthodoxy by arguing that worsening inequality is an inevitable outcome of free market capitalism."

Where's the double face palm STNG jpg when you need it? Ah, there it is!

Ghost Dog

(16,881 posts)Nothing new about these propositions for what I'd call the 'anarchist' left.

... Now define more clearly what a 'democratic society' should or could look like...

Demeter

(85,373 posts)and it looks like this:

Replace water in this sketch with money, and you see the problem. The water is accumulating in the clouds, and never returning to the earth, because the Rich and the Government refuse to let go of it.

The Government has to Tax the Rich and Redistribute Wealth in order to complete the cycle.

When those clouds burst (and they must) it will be a bloody mess, ala French Revolution, unless the Hoarders give up their wealth for the betterment of the Economy.

Ghost Dog

(16,881 posts)some real, 'anarchist' because direct, very direct democracy is required. Occupy writ large, if you like; or the civil rights and anti-war and environmentalist 'cultural revolutions' of the last century.

tclambert

(11,085 posts)The true believers in Reaganomics still think it will start raining buckets of money any day now. And jobs. Money and jobs pouring from the heavens (or from the Hamptons).

Meanwhile I STILL hear about massive amounts of cash sitting on the sidelines, not invested, not building new factories or creating new jobs.

The only trickle down I see is campaign contributions from wealthy old villains who want to buy the government. Oh. THAT'S how trickle down works.

Demeter

(85,373 posts)A US judge has approved an $8.5 billion settlement between Bank of America and a group of investors for losses on dodgy mortgage-backed securities whose collapse triggered the 2008 financial crisis.

Justice Barbara Kapnick of the New York State Supreme Court green-lighted the 2011 accord Friday, rejecting demands to void it by some investors, including insurer AIG, who called it inadequate and alleged conflicts of interest, according to the decision seen by AFP.

Kapnick said the Bank of New York Mellon, representing the defrauded investors, "did not abuse its discretion in entering into the settlement agreement and did not act in bad faith or outside the bounds of reasonable judgment" in negotiating the deal with Bank of America.

Hoping to put its disastrous 2008 purchase of mortgage lender Countrywide Financial behind it, Bank of America said in June 2011 it would pay $8.5 billion to a group of large private investment groups that invested in securities which held poorly documented or substandard home loans from Countrywide...

MORE

Demeter

(85,373 posts)That should last.....30 minutes. Maybe.

Ghost Dog

(16,881 posts)By Whitney Kisling Feb 3, 2014 8:27 AM GMT+0000

After U.S. stocks gained 30 percent last year and almost everything went up, measures of Standard & Poor’s 500 Index price momentum are slipping just as concern mounts that emerging markets will snuff out the rally.

Almost 160 companies in the benchmark gauge for American equities traded below their average level over the past 200 days last week, more than any time last year, when stocks posted the biggest rally since the technology bubble, according to data compiled by Bloomberg. A total of 86 stocks set one-year highs as the index hit a record Jan. 15. That’s down from an average of 112 when peaks were reached in the third quarter.

Weakness in the indicators watched by technical analysts is a sign the investor euphoria is waning after 460 companies in the S&P 500 climbed in 2013, according to Bank of America Corp. While slowing momentum has sometimes been bullish when valuations shrink, Thornburg Investment Management Inc.’s Jason Brady says investors should prepare for more months like January, when equities tumbled as manufacturing growth in China slowed.

“You have to have new reasons for prices to go up,” Brady, a money manager at Thornburg who helps oversee $95 billion, said in a Jan. 28 phone interview from Santa Fe, New Mexico. “Maybe there’s no longer these reasons.” ...

/... http://www.bloomberg.com/news/2014-02-03/record-momentum-unwinding-in-s-p-500-as-china-quashes-euphoria.html

Demeter

(85,373 posts)Bloomberg is reporting this morning that former Federal Reserve economist Mike Dueker was found dead in an apparent suicide near Tacoma, Washington.

Dueker, 50, a chief economist at Russell Investments, had been missing since Jan. 29 and was reportedly having troubles at work.

Normally HousingWire wouldn’t cover deaths in the industry, but what’s strange is that Dueker is the third prominent banker found dead since Sunday.

On Sunday, William Broeksmit, 58, former senior manager for Deutsche Bank, was found hanging in his home, also an apparent suicide.

On Tuesday, Gabriel Magee, 39, vice president at JPMorgan Chase & Co’s (JPM) London headquarters, apparently jumped to his death from a building in the Canary Wharf area.

Russell Investments Chief Economist Dueker Found Dead

http://www.bloomberg.com/news/2014-01-30/russell-investments-chief-economist-dueker-found-dead.html

Mike Dueker, the chief economist at Russell Investments, was found dead at the side of a highway that leads to the Tacoma Narrows Bridge in Washington state, according to the Pierce County Sheriff’s Department. He was 50.

He may have jumped over a 4-foot (1.2-meter) fence before falling down a 40- to 50-foot embankment, Pierce County Detective Ed Troyer said yesterday. He said the death appeared to be a suicide.

Dueker was reported missing on Jan. 29, and a group of friends had been searching for him along with law enforcement. Troyer said the economist was having problems at work, without elaborating. Dueker was in good standing at Russell, said Jennifer Tice, a company spokeswoman. She declined to comment on Troyer’s statement about Dueker’s work issues...Dueker worked at Seattle-based Russell for five years, and developed a business-cycle index that forecast economic performance. He was previously an assistant vice president and research economist at the Federal Reserve Bank of St. Louis.

He published dozens of research papers over the past two decades, many on monetary policy, according to the St. Louis Fed’s website, which ranks him among the top 5 percent of economists by number of works published. His most-cited work was a 1997 paper titled “Strengthening the case for the yield curve as a predictor of U.S. recessions,” published by the reserve bank while he was a researcher there.

HE WAS ONLY THE ECONOMIST, FOR PETE'S SAKE...NOT A TRADER OR THE CEO! HE MUST HAVE SEEN HIS WORLD COLLAPSING, OR HE HAD A MENTAL ILLNESS OR A BLACKMAIL THREAT.

Demeter

(85,373 posts)It's 6:30 am and the temperature is back down to 7F...

it's enough to make ordinary people consider suicide...or moving to Florida. Same difference.

Your energy runs hot and cold today, making it tricky to choose your direction. One minute the adrenaline is flowing and you are full of excitement, ready to take on the world. But the next minute you feel like curling up and taking a nap. Carefully monitor your vitality so you don't run out of gas before the day is over. Be sensible and don't push too hard without considering your limitations. After all, you're still human like everyone else.

xchrom

(108,903 posts)The extent of corruption in Europe is "breathtaking" and it costs the EU economy about 120bn euros (£99bn) annually, the European Commission says.

EU Home Affairs Commissioner Cecilia Malmstroem will present a full report on the problem at 11:30 GMT.

Writing in Sweden's Goeteborgs-Posten daily, she said corruption was eroding trust in democracy and draining resources from the legal economy.

For the report the Commission studied corruption in all 28 EU member states.

Demeter

(85,373 posts)so, what else is new? The US is looking more and more like Europe in that respect every day.

xchrom

(108,903 posts)the Official Expressions of Surprise would be hysterical.

Tansy_Gold

(17,858 posts)Demeter

(85,373 posts)

AHA! I HAVE CRACKED THE CODE! THE COMIC WORLD IS MINE! MUHAHAHAHAH!

Demeter

(85,373 posts)

xchrom

(108,903 posts)Eurozone manufacturing grew strongly in January on the back of new orders, a closely-watched business survey suggests, with Germany leading the way.

Markit's Eurozone Manufacturing Purchasing Managers' Index (PMI) rose to 54 in January, its strongest month since May 2011 - a figure above 50 indicates growth.

This compares to December's figure of 52.7 and reflects the overall pickup in eurozone economic activity.

But France failed to break the 50 mark.

xchrom

(108,903 posts)A survey of UK business confidence by the accountancy industry body the ICAEW has recorded its highest reading yet - although a lack of export growth is giving cause for concern.

The survey, which is produced with Grant Thornton, said confidence has increased for six quarters in a row.

The report is the latest to suggest the economic recovery is well established.

However, ICAEW also said there were concerns about the structure of the economy as export growth had failed.

Demeter

(85,373 posts)DON'T KNOW HOW THIS IS SUPPOSED TO HAPPEN, WITHOUT GOVERNMENT ACTION...

http://truth-out.org/opinion/item/21510-a-declaration-of-the-end-of-the-reagan-era

It's 2014, Barack Obama is president, Ronald Reagan is dead, but for 33 years we have continued to live in an era of Reaganomics.

In every meaningful way, Reaganomics is alive and well, and still controlling our economy.

But what has 33 years of failed Reaganomics brought us?

It's brought us record levels of financial instability. It's brought us trade policies that have destroyed the working class, and union policies that have destroyed labor in America.

But most importantly, it's brought us tax policies that have exacerbated inequality, wrecked our economy, and put us at the mercy of boom and bust cycles.

When Ronald Reagan stepped foot inside the White House, the top marginal tax rate was at 74 percent, and a third of the federal government's income came from corporations.

Today, the top tax rate is sitting at 39%, most rich people pay a maximum of 20%, and corporations are only paying around 11% of the total cost of running the federal government.

Thanks to 33 years of failed Reaganomics, many Americans have bought the lie that tax cuts are a cure all for a struggling economy.

But in reality, despite what Conservatives might tell you, it's these tax cuts are one of the major factors keeping our economy in the gutter.

As Larry Beinhart points out over at The Huffington Post, "the truth is that tax cuts cause crashes."

More specifically, when top marginal tax rates are below 50%, they cause cycles of boom, bubble, and bust.

America has witnessed four of these cycles, and the common denominator for all of them were tax cuts.

As Beinart notes, "coming out of World War One we had a top marginal tax rate over 70%."

But between 1921 and 1925, the top marginal tax rate was slashed down to 25%. And as we all know, what followed was the stock market crash of 1929 and the Great Depression.

Now, fast-forward to 1981, when Ronald Reagan came to Washington.

In 1981, the top marginal tax rate stood at 70%.

But then came the Reagan tax cuts.

In 1982, the top marginal tax rate was at 50%. In 1987 it was at 38.5%. And in 1988 it was at 28%.

Just two years later, in 1990, our economy went into another recession.

In 1997, Republicans in Congress forced President Clinton into slashing the capital gains tax from 28% to 20%.

That tax cut coincided with the famous dot.com boom, bubble and ultimate bust in 2000.

Finally, George W. Bush lowered the top marginal tax rate and capital gains rate when he was in office.

Those cuts helped lead America to the crash of 2007.

But as Beinart points out, while tax cuts may lead to cycles of boom, bubble, and bust, tax increases can help improve our economy.

Responding to the Great Depression and crash of 1929, Herbert Hoover raised taxes in 1932, and by 1933, the economy had begun to improve.

In 1991, George H.W. Bush raised taxes in response to the mess left by Reagan. Not surprisingly, the economy improved.

And when Clinton raised taxes during his presidency, the economy thrived, with record levels of employment and growth.

If we want to pull our economy out of the gutter, and restart America's economic engine, it's pretty clear what needs to happen.

While the very mention of a "tax hike" is enough to make a Conservative go crazy, history shows us that tax increases help the American economy.

It's time to roll back the Reagan tax cuts, declare an end to 33 years of failed Reaganomics, and start practicing sensible economics that will improve the lives of all Americans, and not just the wealthy elite.

This article was first published on Truthout and any reprint or reproduction on any other website must acknowledge Truthout as the original site of publication.

Demeter

(85,373 posts)Oh, look, we have another "bipartisan" deal, this time on the Farm Bill, which is the most bipartisan-y thing you've ever seen because everybody has to swallow a small toad, and the only people who really get hurt are people you don't know anyway.

Of course, the allotted amount dropped last November, too, so the invisible people out there are used to making do with less, anyway.

How, precisely, does this particular bill help "businesses create jobs"? Almost a million people will have less money to spend on luxuries like heat and food. That doesn't help you if you're creating jobs in grocery stores or selling heating oil. Teachers will have to cope with dozing, hungry children while their unemployed parents try very hard not to yawn their way through job interviews. But the Republicans didn't get absolutely everything they wanted, and the Democrats agreed to cut twice what they'd proposed, and the deal was struck among people who never will feel its real effects, and that's the way things are supposed to work in this great Republic of ours.

Demeter

(85,373 posts)According to Robert Reich, in a blog entry earlier this month, 2013 was a banner year for the wealthy, as the trickle up of income and asseets continued to gallup along. Reich calls 2013 "the year of the great income redistribution upward]":

The stock market ended 2013 at an all-time high — giving stockholders their biggest annual gain in almost two decades. Most Americans didn’t share in those gains, however, because most people haven’t been able to save enough to invest in the stock market. More than two-thirds of Americans live from paycheck to paycheck.

Even if you include the value of IRA’s, most shares of stock are owned by the very wealthy. The richest 1 percent of Americans owns 35 percent of the value of American-owned shares. The richest 10 percent owns over 80 percent. So in the bull market of 2013, America’s rich hit the jackpot.

Have you hit the jackpot in the last year as income and assets continue a decades-long redistribution to the top? Not me. For 90% of America, we are hitting the bills, not a Las Vegas mega-payoff.

But how is this happening that the lie of "trickle down" promulgated by Reagan is really the reality of not a "trickle up," but rather a "gusher up" of redistribution to the wealthy.

Reich, as BuzzFlash at Truthout has explained many a time, reiterates the basic dynamic that has trapped the worker in stagnant or lower wages and unemployment:

Where did those profits come from? Here’s where redistribution comes in. American corporations didn’t make most of their money from increased sales (although their foreign sales did increase). They made their big bucks mostly by reducing their costs — especially their biggest single cost: wages.

They push wages down because most workers no longer have any bargaining power when it comes to determining pay. The continuing high rate of unemployment — including a record number of long-term jobless, and a large number who have given up looking for work altogether — has allowed employers to set the terms.

For years, the bargaining power of American workers has also been eroding due to ever-more efficient means of outsourcing abroad, new computer software that can replace almost any routine job, and an ongoing shift of full-time to part-time and contract work. And unions have been decimated. In the 1950s, over a third of private-sector workers were members of labor unions. Now, fewer than 7 percent are unionized.

All this helps explain why corporate profits have been increasing throughout this recovery (they grew over 18 percent in 2013 alone) while wages have been dropping.

So once again, one of the largest factors that the wealthy are becoming exponentially wealthier at the expense of 90 percent (including the infamous 99 percent) is the decreasing cost of labor. The working person is getting paid less for producing more (productivity has been steadily climbing over the past few decades) -- and the increased profits are not going back into job creation at a comparable rate of wealth increase for the economically privileged.

MORE

Demeter

(85,373 posts)My post on Americans starting to recognize class realities has brought some predictable reactions, which I’d place under two headings: (1) “But they have cell phones!” and (2) it’s about how you behave, not how much money you have.

My answer to both of these would be to say that when we talk about being middle class, I’d argue that we have two crucial attributes of that status in mind: security and opportunity.

If you don’t have these things, I would say that you don’t lead a middle-class life, even if you have a car and a few electronic gadgets that weren’t around during the era when most Americans really were middle class, and no matter how clean, sober, and prudent your behavior may be.

MORE

Demeter

(85,373 posts)In Manhattan, the upscale clothing retailer Barneys will replace the bankrupt discounter Loehmann’s, whose Chelsea store closes in a few weeks. Across the country, Olive Garden and Red Lobster restaurants are struggling, while fine-dining chains like Capital Grille are thriving. And at General Electric, the increase in demand for high-end dishwashers and refrigerators dwarfs sales growth of mass-market models.

As politicians and pundits in Washington continue to spar over whether economic inequality is in fact deepening, in corporate America there really is no debate at all. The post-recession reality is that the customer base for businesses that appeal to the middle class is shrinking as the top tier pulls even further away.

If there is any doubt, the speed at which companies are adapting to the new consumer landscape serves as very convincing evidence. Within top consulting firms and among Wall Street analysts, the shift is being described with a frankness more often associated with left-wing academics than business experts...

MORE

xchrom

(108,903 posts)Global corporate earnings growth is poised to accelerate this year as higher spending by U.S. consumers and Europe’s gradual rebound from a two-year recession help offset a slower economic expansion in China.

3M Corp. (MMM), which sells consumer, health-care, industrial and safety products around the world, said sales growth may double in the U.S. and demand is improving in Western Europe. Company earnings in Japan may rise about 9 percent in the next fiscal year as the weaker yen aids exporters such as Toyota Motor Corp. (7203), according to estimates compiled by Bloomberg. Even French carmaker Renault SA (RNO) is projected to reverse a three-year slide in earnings this year as European car sales rebound.

“What we’ve got going on for the first time in this recovery is truly global synchronized growth,” said James Paulsen, the Minneapolis-based chief investment strategist at Wells Capital Management, which manages about $340 billion in assets. “It’s still slow by long-ago historic standards, but it will feel pretty good in this recovery.”

Growth for the U.S. and Europe at the same time, even if moderate, is a welcome change for company earnings, Paulsen said. The U.S. economy is projected to expand 2.8 percent, matching 2012 as the fastest pace since 2005, while the euro area is on track for its first annual growth since 2011. Although American retailers have been hurt as lower income families rein in expenses, carmakers are projected to sell more than 16 million cars in the U.S. for the first time since 2007.

Demeter

(85,373 posts)such mockery of the citizens should be a hanging offense. With what money are the consumers supposed to spend us to recovery?

Global synchronized DEPRESSION is more like it. Not growth.

Man-oh-man, there are going to be economists jumping out of windows at home and abroad over this fiasco.

xchrom

(108,903 posts)Rudolf-August Oetker was weeks away from becoming an officer in Nazi Germany’s Waffen-SS when he received word that his mother, two stepsisters and stepfather had been killed by an Allied bomb dropped on their family home in Bielefeld, Germany.

The loss wasn’t just a personal tragedy for the 28-year-old cadet. It was a blow to one of Adolf Hitler’s front-line suppliers, Dr. August Oetker OHG, whose dry goods were being shipped to German soldiers fighting in World War II.

Oetker was granted permanent leave from his duties to take control of the family business in October 1944. Over the next six decades, the former SS officer, who trained at Dachau concentration camp, would add interests in shipping, food, beverages, banking and hotels, creating a conglomerate that has more than 26,000 employees and 10.9 billion euros ($14.8 billion) in annual revenue.

“People at the company still regard him as a hero, who made the company big after the war,” Sven Keller, co-author of an Oetker-commissioned study about the family’s involvement with the Third Reich, said in an interview in Munich. “One needs to see both sides of the person.”

xchrom

(108,903 posts)After U.S. stocks gained 30 percent last year and almost everything went up, measures of Standard & Poor’s 500 Index price momentum are slipping just as concern mounts that emerging markets will snuff out the rally.

Almost 160 companies in the benchmark gauge for American equities traded below their average level over the past 200 days last week, more than any time last year, when stocks posted the biggest rally since the technology bubble, according to data compiled by Bloomberg. A total of 86 stocks set one-year highs as the index hit a record Jan. 15. That’s down from an average of 112 when peaks were reached in the third quarter.

Weakness in the indicators watched by technical analysts is a sign the investor euphoria is waning after 460 companies in the S&P 500 climbed in 2013, according to Bank of America Corp. While slowing momentum has sometimes been bullish when valuations shrink, Thornburg Investment Management Inc.’s Jason Brady says investors should prepare for more months like January, when equities tumbled as manufacturing growth in China slowed.

“You have to have new reasons for prices to go up,” Brady, a money manager at Thornburg who helps oversee $95 billion, said in a Jan. 28 phone interview from Santa Fe, New Mexico. “Maybe there’s no longer these reasons.”

xchrom

(108,903 posts)Gold climbed in London, adding to the first monthly advance since August, as declining equity markets boosted demand for haven assets.

Central bank rate increases in Turkey, India and South Africa last week failed to contain January’s selloff in emerging-market currencies, while a Chinese manufacturing gauge dropped to a six-month low in January. The MSCI All-Country World Index retreated 0.2 percent today.

“We suspect that the global equity markets will likely see more turbulence in February, which likely will mean that gold should be fairly resilient for a little while longer,” Edward Meir, an analyst at INTL FCStone, wrote in a note dated today.

Bullion for immediate delivery rose 0.2 percent to $1,246.68 an ounce in London at 10:31 a.m. in London. Gold gained 3.2 percent last month as stocks fell 4.1 percent.

xchrom

(108,903 posts)Investors are betting Bank of England Governor Mark Carney will lead the charge out of record-low interest rates as central banks pivot from fighting stagnation to managing expansions.

Economists at Citigroup Inc. and Nomura International Plc say the strongest growth since 2007 will prompt the U.K. to lift its benchmark from 0.5 percent as soon as this year. Money-market futures show an increase in early 2015. That’s at least three months before the contracts indicate Federal Reserve Chairman Janet Yellen will raise the target for the federal funds rate. European Central Bank President Mario Draghi and Bank of Japan Governor Haruhiko Kuroda are forecast to maintain or even ease monetary policy.

“Carney and BOE officials will be looking at the domestic recovery, and if that is strong enough, then they will feel comfortable increasing rates before the Fed,” said Jonathan Ashworth, an economist at Morgan Stanley in London and former U.K. Treasury official. “Tightening by the major developed central banks will be gradual, and they will be aware of what everyone else is doing.”

The BOE will lift rates in the second quarter of 2015 and the Fed will increase in 2016, Morgan Stanley predicts.

xchrom

(108,903 posts)Inflation-adjusted interest rates are still too low in developing nations for Citigroup Inc. and Goldman Sachs Group Inc. to foresee an end to the worst emerging-market currency selloff in five years.

One-year borrowing costs in Turkey are 3.6 percent, less than half of the average in the three years before the 2008 global financial crisis, even after the central bank doubled its benchmark rate last week, according to data compiled by Bloomberg. The real yield for Mexico is almost zero, while South Africa’s is 1.4 percent, compared with an average of 2 percent over the past decade.

Central bank rate increases in Turkey, India and South Africa last week failed to contain January’s 3 percent selloff in emerging-market currencies. Citigroup says yields aren’t high enough to attract the capital needed to finance current-account deficits in some of those nations. Competition for capital is intensifying with the Federal Reserve paring monetary stimulus, while the International Monetary Fund is calling for “urgent policy action.”

“When you have low real rates and try to finance your current-account deficits, it usually won’t work,”Dirk Willer, a Latin America strategist at Citigroup, the second-largest currency trader, said in a phone interview from New York on Jan. 31. “If the U.S. is repricing for higher rates, it’s very difficult for you to get away with lower rates. South Africa and Turkey are not safe yet.”

Demeter

(85,373 posts)After proving a miserable failure in domestic economy and civil rights...witness these news items:

US trade deals remain on track, says Froman

http://www.ft.com/intl/cms/s/0/efcd8564-8c23-11e3-9b1d-00144feab7de.html?siteedition=uk

America’s top trade official has sought to reassure European and Asian negotiating partners that the White House can overcome rising dissent in Congress as it tries to keep momentum behind two of the world’s most ambitious regional trade agreements.

Michael Froman, US trade representative, told the Financial Times that the administration was convinced it could secure congressional backing for the deals even after Harry Reid, the Democratic senate majority leader, last week said he would oppose fast-track legislation for any agreements.

His opposition was widely seen as a major blow to President Barack Obama’s plans to strike accords with the EU and 11 Pacific Rim countries. Mr Reid can wield control over the progress of legislation in Congress’s upper chamber.

European and other officials have said that unless the Obama administration secures support for legislation known as “Trade Promotion Authority” they would be wary of making the the concessions that are likely to be needed for either deal. The legislation would prevent Congress from amending any pact and ensure that it would have to consider any accords in a timely fashion. But Mr Froman said he was sure that the support of Congress could be achieved. He also said both negotiations remained “very much on track” for the time being...

ALL I CAN SAY IS, SOMEONE'S DELUSIONAL. OBAMA PISSED OFF HARRY REID (AND IT TOOK LONG ENOUGH!) AND THE PUBLIC IS UP IN ARMS, TOO.

Iranians hope eased sanctions lift economy

http://www.dw.de/iranians-hope-eased-sanctions-lift-economy/a-17398592

An initial round of $550 million for Iran will be released with more relief to come if progress continues to be made in nuclear talks. The break in sanctions could spell the beginning of an economic boom for Iran...

AND THE CARPETBAGGERS ARE OFF. HAVING STARVED IRAN INTO SUBMISSION.

"When sanctions against Iran were partially lifted on January 20 as part of the Geneva agreement, the euphoria on Iran's markets was tangible," Atabak, a trader in the Iranian city of Kerman in the southeast of the country told DW. "But disillusionment soon took over."

So far there has not been a fundamental improvement for the Iranians and experts still expect an inflation rate of 40 percent. "The costs for essential goods are still very high," Atabak said. "Many products the people need are still not available."

The Iranian rial has increased in value compared to the euro. While a euro used to get 4,500 rial, it's now worth well under 4,000 rial. That makes the imports cheaper, which has led some Iranian money traders to complain that their business has been ruined, according to Michael Tockus of the German-Iranian Chambers of Commerce....

U.S., EU Wade Deeper Into Ukraine Standoff With Aid Plan

TRYING TO WEAN UKRAINE FROM RUSSIA....GOOD LUCK, FELLAS.

http://online.wsj.com/news/articles/SB10001424052702304851104579358773435642010?mod=dist_smartbrief

The U.S. and European Union are stepping up efforts to sway the outcome of the political crisis in Ukraine, putting together a short-term financial aid plan in a move to counter pressure from Moscow.

The prospective aid package, which top U.S. and EU diplomats discussed on the sidelines of a security conference in Munich over the weekend, would be the West's most significant move to date to reopen the geopolitical struggle for Kiev since Ukrainian President Viktor Yanukovych turned his back on an EU economic pact and, instead, signed a deal with Russia for $15 billion in aid.

Wary of Mr. Yanukovych's shake-up of his cabinet to placate protesters, Russia last week said it would suspend a tranche of that aid—a move that could present an opening for a renewed Western bid for influence.

At the weekend conference, U.S., Russian and European officials traded barbs over the crisis in Ukraine. A top Ukrainian protest leader, meanwhile, left the country after he said he was kidnapped and tortured by men who accused him of being a U.S. agent...

Demeter

(85,373 posts)The February 2014 issue of Harper's Magazine has an interesting discussion of Europe and the eurozone, "How Germany Reconquered Europe: the Euro and its Discontents." Some of the big questions of European unity, democracy and national sovereignty are debated in broad and direct terms not often seen in other analyses:

"The basic lesson of the past ten, twenty years - even of the past hundred years - is that the upper limit, not only of democracy but of political legitimacy, is the nation-state." (John N. Gray, London School of Economics.)

Then there is the Franco-German relationship, which is central to the eurozone:

From a French point of view, getting out of the euro would be a tremendously good thing. This would imply that our governing classes would start governing again, that we'd have full national responsibility. People tend to be resigned to the idea of the nation as a thing of the past. Yes, nationalism was responsible for violent conflicts across Europe and elsewhere. But the nation itself is not bad. The nation is the place for democracy, for making decisions. What would happen if the euro zone broke up? In France we would have some economic problems, adjustment problems, but being together as Frenchmen, doing things together, being, as we say in French, "in the same shit," would be great! It would be the beginning of a new age, you see? There's nothing terrifying about this." (Emmanuel Todd, National Institute of Demographic Studies, Paris.)

It is a rich discussion, in many ways, of the historical, cultural and practical problems of European unification and to a lesser extent, the eurozone. However, it is missing something that is of central importance, which is implicit in some of James Galbraith's comments but not sufficiently spelled out. That is the neoliberal political project of the eurozone and its policy-makers, the deliberate attempt to remake Europe and move it as far as politically possible away from its prior social-democratic underpinnings...

MORE

Demeter

(85,373 posts)MAYBE THE BANKSTERS WILL DISARM THEIR WEAPONS OF MASS DESTRUCTION

http://www.businessweek.com/articles/2014-01-30/credit-default-swap-market-shrinks-by-half

Five years after almost blowing up the global economy and eight years after making fortunes for Wall Street traders, the credit-default swap market is quietly fading. Rules introduced in the wake of the financial crisis by U.S. and European regulators have led investment banks to withdraw from the market and made trading credit-default swaps and other derivatives more expensive. And with the Federal Reserve keeping interest rates near historic lows, fewer borrowers have defaulted, which means less demand for debt insurance. As a result, outstanding credit-default swaps on individual companies declined by about half, to $13.2 trillion, from 2007 through June 2013, according to the Bank for International Settlements. Dealers once offered $5 billion trades; now $500 million is more typical.

Firms that built their reputations by trading credit-default swaps, such as BlueMountain Capital Management and Saba Capital Management, are struggling to find profitable ways to invest money in the CDS market. Traders at investment banks and hedge funds are abandoning the field for better opportunities. “It did feel like the situation was a bit of a dead end,” says Dmitry Selemir, who left his job trading structured credit at BlueMountain in June to concentrate on Scriggler.com, a website he co-founded to host essays and discussions of ideas. “I found it increasingly difficult to be excited about what I was doing.”

Bankers at JPMorgan Chase (JPM) invented credit-default swaps in the 1990s as a way for investors to protect themselves against loans going bad: One party makes regular payments to another in return for a guarantee to be made whole if a borrower defaults on its debt. What started as a simple hedging tool evolved into a playground for hedge funds and bank proprietary trading desks to speculate on debt, from corporate bonds to subprime mortgages. Banks packaged and traded indexes of the swaps, then sliced up the indexes and traded the slices. Investors made and lost money as the value of the swaps rose and fell, regardless of any actual defaults. “Derivatives were in the center of the storm” that led to the $182.5 billion government bailout of American International Group (AIG) in September 2008, one of the largest credit-swap users at the time, the Financial Crisis Inquiry Commission said in its final report in 2011. The next year, CDS trades made by JPMorgan’s Bruno Iksil—the London Whale—ended up costing his bank $6.2 billion.

Story: Specter of Default Stalks Argentina

Investors who once focused on CDS are diversifying in search of better returns. Boaz Weinstein, who founded Saba in 2009, saw money flood in after he outperformed rivals in the CDS market in 2011 amid Europe’s sovereign debt crisis. Later he profited by trading against Iksil. Since 2011 he’s increased his holdings of commercial mortgage bonds and closed-end funds...BlueMountain co-founder Andrew Feldstein, who helped create the CDS market at JPMorgan, also made money trading against Iksil. Big, profitable opportunities like that one are getting scarce, he says. BlueMountain has been hiring equity traders and putting more money into stocks. The firm has about 60 percent of its assets invested in credit products, down from 80 percent in 2006, according to Feldstein. Trading stocks is not as sexy as big CDS trades, he says, but it isn’t going away anytime soon...The disappearance of CDS would have only minimal impact on the hedge fund business, according to David Kelly, a former risk manager at JPMorgan who is now director of financial engineering at Calypso Technology. “Nobody’s going to cry about it,” he says. “To feel sorry for them because they don’t have toys to play with—who cares?”

Demeter

(85,373 posts)IT'S ALL POLITICS...IF YOU CAN STAND IT, GO READ

http://www.bloomberg.com/news/2014-01-31/fannie-mae-fix-fades-as-senate-democrats-split-on-plans.html

Demeter

(85,373 posts)Kentucky Retirement Systems, which provides retirement benefits for state and county employees, has more than $24 million invested in a private equity fund that was charged Thursday with stealing millions from investors.

The U.S. Securities and Exchange Commission issued civil charges against The Camelot Group of New York and its manager, Lawrence E. Penn III, and obtained an emergency court order to freeze their assets.

Penn, 43, secured capital commitments of about $120 million for his four-year-old fund, according to the SEC, making KRS one of the earliest and biggest investors.

The SEC alleges that Penn "concocted a sham due-diligence arrangement" to keep investor funds that were supposed to be spent for legitimate purposes, such as investigating potential investments made by The Camelot Group. At least $9.2 million was diverted improperly, according to the SEC...

MORE

Demeter

(85,373 posts)SUCKERS...ALTERNATIVELY, OBAMACARE ISN'T "AFFORDABLE" FALSE ADVERTISING ASIDE

http://www.huffingtonpost.com/2014/01/31/florida-medicaid-uninsured_n_4680566.html

Thanks to a Supreme Court ruling and staunch Republican resistance, Marc Alphonse, an unemployed 40-year-old Marine veteran who is essentially homeless, cannot get health insurance under Obamacare. Three years ago, Alphonse learned he has a kidney disorder that will deteriorate into kidney failure, and possibly prove fatal, if left untreated. As it stands now, he suffers from bouts of nausea caused by his dysfunctional kidneys, and he's dogged by an old knee injury that limits his job prospects. He gets by on $400 a month in unemployment benefits, and his family can no longer afford housing in their home city of Miami. Alphonse's 28-year-old wife, Danielle, and three young children are staying with relatives while Alphonse couch surfs...Alphonse is one of nearly 5 million uninsured Americans caught in a cruel gap that renders some Americans "too poor for Obamacare." Obamacare was supposed to make health coverage affordable, or even free, for low-income Americans. The law's official name is the Affordable Care Act. However, the Supreme Court tossed a huge obstacle in the path of that goal in 2012, ruling that the states could opt out of one of Obamacare's crucial provisions: The expansion of Medicaid coverage to anyone making less than 133 percent of the federal poverty level, or about $15,300 a year for a single person. Since the court's ruling, 24 states, including Florida, chose not to expand the program. Under the pre-Obamacare rules, eligibility for the program typically was limited to low-income children, pregnant women, parents caring for children at home, and adults with disabilities. Without the law's expansion, an adult without a disability who isn't living with their children -- like Alphonse -- doesn't qualify for Medicaid, no matter how poor he or she is.

For those who don't qualify for Medicaid coverage, Obamacare offers tax credits for private health plans sold through the law's health insurance exchange marketplaces. But those subsidies are available only to those making between the poverty level, or about $11,500 for an individual, and four times that amount. In states not expanding Medicaid, people who earn less than poverty wages get nothing...In Alphonse's case, his family is trying to survive on his unemployment insurance. It amounts to $4,800 a year -- far below the poverty level, which is $27,570 for a family of five. Even the unemployment benefits will run out in March.

...When the Supreme Court ruled that states could opt out of the Medicaid expansion, Florida, Texas and nearly the entire South turned away billions in federal dollars offered for broadening the program, citing budgetary concerns and resistance to Obamacare itself. The federal government will pay the full cost of the Medicaid expansion through 2016, after which its share will be no less than 90 percent. These decisions by governors and legislators essentially consigned a huge swath of the very poor to a life of extreme insecurity.

"It's very frustrating," said Alphonse, who last worked as a security guard until being laid off 10 months ago. "It's kind of odd where an individual that has an opportunity to help millions of people in their own state, and they just totally refuse to do it."

Florida's legislature is poised to take up the Medicaid expansion again during this year's session, but the political dynamics don't appear to have changed much since last year. Meanwhile, one-quarter of Florida's population (under the age of 65) is without health insurance -- the second-highest of all the states behind Texas. In Miami-Dade County, where Alphonse lives, the uninsured rate was an astonishing 34 percent in 2011, the most recent year county-level data were available...

Tansy_Gold

(17,858 posts)Demeter

(85,373 posts)They've been screwing with that as well, for decades.

Tansy_Gold

(17,858 posts)And the dear goddess knows I'm not trying to defend ACA, but it seems to me that a Marine veteran living in Miami, FL, ought to be able to find some kind of VA care.

I have a friend whose myriad health problems are related to a lifetime of motorcycle riding and heavy equipment operating and have nothing to do with his military service. Though he is far from indigent and has been eligible for Medicare for a number of years, he receives all his health care through VA. As far as I know, he pays nothing for it.

Since this would seem to be at least some option for the subject of the article, shouldn't that have been explored by the person who wrote and, presumably, researched it?

![]() I dunno.

I dunno.

xchrom

(108,903 posts)(Reuters) - Thai anti-government protesters who have been camped out in north Bangkok packed their tents and marched downtown on Monday as they consolidated efforts to topple Prime Minister Yingluck Shinawatra, a day after a disrupted general election.

Some joined protest leader Suthep Thaugsuban on foot and others followed in cars and six-wheel trucks as Thailand's long-running political conflict showed no sign of ending.

Others surrounded a government office in north Bangkok where Yingluck and two senior ministers had been holding a meeting and cut through a barbed-wire fence. They later dispersed.

The protesters closed camps at two of the seven big intersections that they have blockaded since mid-January, at Victory Monument and Lat Phrao, and headed for the fringes of the central oasis of Lumpini Park.

xchrom

(108,903 posts)(Reuters) - Ukrainian President Viktor Yanukovich returned to his desk on Monday after four days of sick leave, while the political opposition pressed for further concessions to end more than two months of street protests.

"He is back at work," a presidential spokesman said.

Yanukovich, caught in a tug of war between Russia and the West, is seeking a way out of a sometimes violent confrontation with protesters who have occupied city streets and public buildings following his decision in November to spurn a trade deal with the EU and accept financial aid from Moscow.

His first urgent task, after returning from an absence that some saw as a tactical gambit to gain time, is to name a new prime minister to succeed Mykola Azarov, who stepped down on January 28 under pressure from the protest movement.

xchrom

(108,903 posts)With Spain still locked in a deep crisis and unemployment soaring toward record levels, the number of suicides in Spain in 2012 jumped 11.3 percent from a year earlier to 3,539, according to figures released Friday by the National Statistics Institute (INE).

Suicide in that year was the main cause of unnatural death, above traffic accidents. Total deaths in 2012 increased by 3.9 percent from 2011 to 402,950.

Taking one's own life was much more frequent among males than females. Of the 3,539 cases registered in 2012, 2,724 were of men and 815 of women. Suicides were also concentrated in the age group 24-34 and were the second most common cause of death after tumors in this category.

However, although the crisis and the spike in the number of suicides coincide in time, experts were reluctant to argue that there is a cause-and-effect phenomenon. Santiago Durán-Sindreua, a psychiatrist who heads the suicide prevention plan at the Santu Pau Hospital in Barcelona said: “There is a coincidence in time between the two factors, but we cannot say there is a cause-and-effect relationship; that would be risky.”

xchrom

(108,903 posts)Ninety-five percent of Spaniards believe corruption is generalized, according to the first continent-wide study on the issue by the European Commission. Only respondents in Greece (99 percent) and Italy (97 percent) outdid Spain. The report, which was presented on Monday in Brussels, underscores the magnitude of the issue in Europe: three out of four EU citizens believe corruption is an institutional problem.

In two areas of the survey Spain topped the charts. Asked if the level of corruption has risen in the past three years, 77 percent said yes, more than in the other 27 member states. Two out of every three respondents said that corruption affected their daily lives, more than in any other nation. The survey was conducted in February and March 2013, when a series of corruption scandals involving the government, labor unions, political parties and the monarchy occupied the front pages in Spain.

Scandinavian countries registered the lowest perception of institutional corruption. In Denmark, 75 percent of people answered that they viewed corruption as exceptional, not the rule, followed by 64 percent in Finland and 54 percent in Sweden.

The report concluded that legal mechanisms in place across the continent to tackle corruption “are not satisfactory,” and that in many cases “political will to eradicate corruption is absent.”

DemReadingDU

(16,000 posts)2/1/14 2014: The Year America Broke The Internet

A recent decision by a US Appeals court ended the regulation of the internet as we know it.

.

.

Net neutrality, or the end of it, has the potential to bring about the end of the internet as we know it. In a practical sense, it opens the doors for companies to manage the traffic across the network as they see most profitable, which means these companies can take measures that not only affect content creators, but end users. The ruling overturns the 20 years of treating the internet as a 'dumb' network that processed packets of information without prioritising them.

.

.

The ruling empowers the cable industry to censor content. It will be a massive threat to internet freedoms. The large multinationals like AT&T, Comcast, and Verizon have just been empowered by the courts to turn the internet into, if they want to, a massive controlled medium like TV and radio. As Professor Christopher Marsden states in his book, Net Neutrality: “ISPs are now allowed a broad measure of independence as to process to achieve the results the government sets out. This is controversial in that it passes powers to control freedom of expression into private hands, often without constitutional protections that govern public authority intervention and censorship.”

more...

http://www.businessinsider.com/2014-the-year-america-ruined-the-internet-2014-2

DemReadingDU

(16,000 posts)video, appx 4 minutes

Something Absolutely Terrible Just Happened To The Internet. Here's Why.

The ruling was terrible, but it was made possible by a chain of events set in motion years before. In order to really understand why this is happening, we'll need to follow the money.

http://www.upworthy.com/something-absolutely-terrible-just-happened-to-the-internet-heres-why?c=ufb1