Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 13 March 2014

[font size=3]STOCK MARKET WATCH, Thursday, 13 March 2014[font color=black][/font]

SMW for 12 March 2014

AT THE CLOSING BELL ON 12 March 2014

[center][font color=red]

Dow Jones 16,340.08 -11.17 (-0.07%)

[font color=green]S&P 500 1,868.20 +0.57 (0.03%)

[font color=black]Nasdaq 4,323.33 0.00 (0.00%)

[font color=green]10 Year 2.73% -0.02 (-0.73%)

30 Year 3.67% -0.01 (-0.27%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)You have been warned.

We got nearly 6 inches of heavy white stuff, all before 11 AM. Then the sun came out and the temperature dropped like a stone. It's down to 13F at 10 PM. And so it goes.

Look out $1400! Here comes gold!

Friday is Euchre Night. If they served alcohol, I would get sloshed, which means I'd be drooling on the cards in my sleep. If ever there were a week for alcoholism, this is it. I have had enough, and it's only Weds. night as I type this.

jtuck004

(15,882 posts)And I 'm pretty sure I speak for everyone...

![]()

Not much, but the alternative was "pictures" of Jack Daniels, and that just didn't seem right ![]()

I did find this video concerning the effects of our economic policies on too many people...since it's snowing maybe you have time to watch. That might be Ben Bernanke in one of his now $250,000 speaking appearances, not sure.

Demeter

(85,373 posts)I appreciate the thought....I think.

jtuck004

(15,882 posts)jtuck004

(15,882 posts)reason I saw some connection between that turtle and the Bernanke. It was weird ![]()

He was speaking, for $250,000 (I bet they bought his meal too - wonder if he claims that on income tax?) and said now that he was unfettered he could say whatever he wished. So he said, in part...

...

He also said he found it hard to find the right way to communicate with investors when every word was closely scrutinized. "That was actually very hard for me to get adjusted to that situation where your words have such effect. I came from the academic background and I was used to making hypothetical examples and ... I learned I can't do that because the markets do not understand hypotheticals."

He concluded that he should "try to simplify the message, but not simplify too much".

Condescending ass...

...

“My natural inclinations, even if it weren’t for the legal mandate, would be to try to help the average person,” Bernanke said today in his first public remarks since leaving the Fed in January, referring to the central bank’s mandate from Congress to ensure full employment and stable prices. “The complexity though arises because in order to help the average person, you have to do things -- very distasteful things -- like try to prevent some large financial companies from collapsing.”

“The result was there are still many people after the crisis who still feel that it was unfair that some companies got helped and small banks and small business and average families didn’t get direct help,” Bernanke said. “It’s a hard perception to break.”

...

Here.

So in an economy in the toilet, which is made from 70% consumer spending, he gives money to people who, generally, don't consume so much, who then use it to skim more money from the labor of others. Says he wold have helped "the average person", but you know, can't let the betters fall down...

He will be tied around the neck of this administration (who gladly put him around their neck) forever, as our inequality continues and grows even worse in the years ahead. And I suspect as a few more stats are available in the next couple of years, it will show a direct line to the poor and largely unchanging economic conditions of at least 40-50 million people, as he showered boatloads of money on this friends at the banks. And then people who are more concerned about their Master's house burning down than their neighbors will do what they do.

dixiegrrrrl

(60,010 posts)what with Rove, bush and ALL his sleazy minions, Geithner. They are crowding Nixon out.

I'm gonna need a bigger wall.

xchrom

(108,903 posts)(Reuters) - The European Central Bank's forward guidance on interest rates means that real interest rates for borrowers should fall as inflation rises and the ECB is ready to act if this does not happen, ECB policymaker Benoit Coeure said on Thursday.

"The Governing Council of the ECB expects interest rates to stay at present or lower levels for an extended period of time, while inflation should rise towards 2 percent over our projection horizon," Coeure said in the text of a speech for delivery in Paris.

"This implies that real interest rates for borrowers will progressively fall as inflation rises," he added. "And we stand ready to act if this scenario does not materialise."

Coeure expected the ECB's health check of banks across the euro zone to prompt corrective action to restructure banks and address capital shortfalls. This in turn would help the ECB's monetary policy gain traction across the bloc.

Demeter

(85,373 posts)Interest rates rise as inflation rises. Every dumkopf knows that.

They are going to wait a long time, if they think they can suspend a basic law of money.

xchrom

(108,903 posts)(Reuters) - Chinese Premier Li Keqiang warned on Thursday that the economy faces "severe challenges" in 2014 - comments that came as weak data fanned speculation the central bank would relax monetary policy to support stuttering growth.

Li, speaking at a news conference on the final day of China's yearly parliament, hinted Beijing would tolerate slower economic expansion this year while it pushes through reforms aimed at providing longer-term and more sustainable growth.

Data released shortly after his comments suggested that tolerance may face an early test. Growth in investment, retail sales and factory output all slumped to multi-year lows, suggesting a marked slowdown in the first two months of the year.

"A storm is coming," said Gao Yuan, an analyst at Haitong Securities in Shanghai, while Hao Zhou, the China economist for ANZ said "policy easing should be imminent."

xchrom

(108,903 posts)(Reuters) - Protesters battled soldiers in the streets of Caracas again on Wednesday as three more fatal shootings raised to 25 the death toll from a month of demonstrations against Venezuela's socialist government.

Thousands of supporters and foes of President Nicolas Maduro took to the capital's streets for rival rallies marking a month since the first bloodshed in the recent unrest around the South American OPEC nation.

Violence began when National Guard troops blocked opposition marchers from leaving Plaza Venezuela to head to the state ombudsman's office. Students threw stones and petrol bombs while security forces fired teargas and turned water cannon on them.

Reuters witnesses saw dozens of people leaving injured.

xchrom

(108,903 posts)LONDON (AP) -- Further disappointing Chinese economic figures kept market sentiment in check Thursday, after a volatile week that has been dominated by concerns over the world's number 2 economy.

Markets largely brushed aside the move by the Reserve Bank of New Zealand to raise its main interest rate by a quarter of a percentage point to 2.75 percent. Though other central banks have raised rates since the global financial crisis of 2008, such as increases in 2011 by the European Central Bank and Sweden's Riksbank, analysts said the move by the New Zealand central bank may represent a milestone in the global recovery.

Craig Erlam, market analyst at Alpari said the move marked "the beginning of a new chapter for the recovery in the global economy."

In Europe, the FTSE 100 index of leading British shares was flat at 6,620 while Germany's DAX rose 0.2 percent to 9,209. The CAC-40 in France was 0.2 percent higher, too, at 4,313.

Demeter

(85,373 posts)That is, until the Corporations shipped the American economy, lock, stock, and barrel, to China...

xchrom

(108,903 posts)PARIS (AP) -- A grouping of the world's most developed countries says it's provisionally halting accession talks with Russia in a move many will see as a direct response to the country's takeover of Ukraine's Crimean peninsula.

The Organization for Economic Cooperation and Development, which promotes good governance and economic policy initiatives among its 34 mainly rich world members, says it has "postponed activities related to the accession process" with Russia "for the time being." No explanation for the decision was provided in the statement Thursday.

Russia has been in talks to join the since May 2007. As of last June Russia had concluded five of 22 reviews required for accession.

The OECD also said it would "respond positively to Ukraine's request" for closer ties with the Paris-based OECD.

xchrom

(108,903 posts)BEIJING (AP) -- China will keep this year's economic expansion strong enough to create new jobs but will emphasize market-opening reform and cleaning up smog-choked cities over hitting its official growth target, the premier said Thursday.

Li Keqiang's comments reinforced the ruling Communist Party's pledge to shift to cleaner, more sustainable growth based on domestic consumption and service industries instead of trade and investment.

Speaking at a news conference, Li said Beijing will keep growth in the world's second-largest economy strong enough to fulfill plans to create 10 million jobs. But he said Chinese leaders are "not preoccupied" with hitting their official target of 7.5 percent growth in gross domestic product.

"What we care more about is the livelihood of our people," Li said. "The GDP growth we want brings real benefits to our people, helps raise the quality and efficiency of economic development and contributes to energy conservation and environmental protection."

xchrom

(108,903 posts)ATHENS, Greece (AP) -- Official figures show the unemployment rate in Greece increased to 27.5 percent in the fourth quarter of 2013 as the economy struggled to emerge from a protracted recession.

Thursday's figures from the statistics agency showed the jobless rate increasing from 27 percent in the third quarter of 2013 and from 26 percent in the same three months of 2012.

Greece, a country of about 10 million people, has 1.36 million people out of work, the figures showed. Young people are the most severely affected, with 57 percent of those aged 15-24 jobless.

Greece, which has been affected by a financial crisis since late 2009, depends on rescue loans from the International Monetary Fund and other European countries. In return, it has had to impose deep spending cuts and tax increases.

xchrom

(108,903 posts)LAGOS, Nigeria (AP) -- Nigeria's president is ordering a forensic audit into some $20 billion allegedly missing from the petroleum earnings of Africa's biggest oil producer.

President Goodluck Jonathan's announcement follows weeks of outrage expressed online by Nigerians complaining that previous investigations of billions in missing public funds have been shelved with no one held accountable and no money recovered.

Jonathan also denied charges by ousted Central Bank Gov. Lamido Sanusi that the money has gone to a cabal to fund the February 2015 presidential and legislative elections.

A statement from Jonathan's office dated Wednesday repeated that Sanusi's suspension last month was unconnected to his whistle-blowing and insisted his charges about the "phantom missing funds" are unfounded. Sanusi alerted Jonathan to the missing funds in a September letter that was leaked to the press.

dixiegrrrrl

(60,010 posts)in repeated emails.![]()

xchrom

(108,903 posts)Ireland raised 1 billion euros ($1.4 billion) in its first bond auction since September 2010, cementing its return to international credit markets.

The Dublin-based National Treasury Management Agency sold the 2024 bonds to yield 2.967 percent, the organization said on its website. That’s the lowest on record for a 10-year auction. Investors bid for 2.9 times the amount of debt sold.

Ireland exited an international bailout plan in December, the first euro-area nation to emerge from a rescue, boosting confidence in the region’s recovery from its four-year debt crisis. Investors are returning to the markets they shunned during the financial woes. The average yield to maturity on bonds from Greece, Ireland, Italy, Portugal and Spain fell to 2.438 percent this week, the lowest in the currency bloc’s history, according to Bank of America Merrill Lynch indexes.

In January, Moody’s Investors Service restored Ireland’s investment grade, after a revival from the banking collapse that had threatened to destroy the economy and forced the nation to seek a bailout in November 2010.

xchrom

(108,903 posts)The Bloomberg Dollar Spot Index headed for its lowest close this year while Standard & Poor’s Index futures rose and gold advanced before U.S. retail-sales and jobless-claims data. Copper fell after China’s industrial-output growth missed estimates.

The U.S. currency weakened 0.4 percent to $1.3952 per euro at 7:26 a.m. in New York and touched a more-than-two-year low of $1.3967. Standard & Poor’s 500 Index futures added 0.2 percent and the Stoxx Europe 600 Index swung between gains and losses. The Hang Seng China Enterprises Index dropped 0.4 percent after earlier rising 1.8 percent. Russian stocks, the world’s worst performers this year, slid as people with knowledge of the matter said the country was readying itself for Iran-style sanctions. Gold climbed to the highest price in almost six months while copper slipped 0.4 percent.

Stanley Fischer, nominee to be Federal Reserve Chair Janet Yellen’s deputy, said the U.S. economy still needs stimulus to combat unemployment before a report projected to show jobless claims increased last week. China’s industrial output expanded 8.6 percent through January and February, less than the 9.5 percent predicted by analysts in a Bloomberg survey, official data showed.

xchrom

(108,903 posts)A bipartisan U.S. Senate plan to dismantle Fannie Mae (FNMA) and Freddie Mac must clear many political hurdles in a short time if it is to become law, leaving narrow chances of a housing-finance overhaul being enacted this year.

Senate Banking Committee leaders said the proposal, which they plan to release later this week, would replace the two U.S.-owned mortgage financiers with government bond insurance that would kick in only after private capital suffered severe losses.

It remains unclear whether the measure can gain the support it would need in the next four months, before lawmakers’ attention shifts to midterm elections. A Democratic Senate aide said leadership is currently unenthusiastic about legislation that would eliminate the companies.

“It’s possible, but it’s certainly not probable,” said Mark Calabria, a former aide on the Senate banking panel who now directs financial regulation studies at the Cato Institute, a Washington-based research organization that supports free markets. “You’re looking at maybe a 10 percent chance of a bill getting to the president’s desk.”

xchrom

(108,903 posts)For bus driver Jorge Polo, the protests in Venezuela’s capital city are an irritation, not an attraction.

Every day, Polo has to navigate around the protesters’ makeshift barricades in the wealthy parts of Caracas. He is never tempted to join them and blames hoarders -- and the demonstrators themselves -- for the soaring cost of living and mounting shortages.

“What’s going on down there in the valley is not our fight,” Polo said, while drinking a beer in the slum of Petare overlooking eastern Caracas. “It’s rich people trying to get back lost economic perks. The slums won’t join them.”

After a month of protests, the demonstrations in Caracas remain confined to wealthier areas with limited support from the poor. Many residents of Petare say President Nicolas Maduro should be given more time to turn around the economy after taking over following the death of Hugo Chavez a year ago. For now, the protesters are only making life harder, Polo says.

xchrom

(108,903 posts)European stocks were little changed, after closing at a one-month low, as a slump in Wm Morrison Supermarkets Plc (MRW) led retailers lower. U.S. stock-index futures and Asian shares climbed.

Wm Morrison Supermarkets Plc plunged 6.3 percent after forecasting a profit decline and saying it will sell property. Adecco SA (ADEN) fell 6.9 percent after its largest investor sold about 16 percent in the world’s largest provider of temporary workers. Deutsche Lufthansa AG jumped 5.4 percent after it reinstalled dividend payments and maintained a target to triple operating profit within two years.

The Stoxx Europe 600 Index gained 0.2 percent to 328.58 at 9:34 a.m. in London. The gauge declined 1.1 percent yesterday amid stake sales in companies, while Russia and Ukraine continued a standoff over Crimea. Standard & Poor’s 500 Index futures added 0.3 percent, and the MSCI Asia Pacific Index rose 0.2 percent.

“Investors will be reluctant to take large positions before the weekend with the Crimea referendum,” said Jean-Paul Jeckelmann, who helps manage $1.5 billion in equities as chief investment officer at Banque Bonhote & Cie. in Neuchatel, Switzerland. “The background remains uncertain. We don’t know what the international reaction will be. Sanctions, military interventions will all weigh on markets.”

xchrom

(108,903 posts)JPMorgan Chase & Co. (JPM) and HSBC Holdings Plc (HSBA) face a European Union complaint as soon as next month as the bloc’s antitrust chief races to fine a quartet of financial companies that snubbed rate-rigging settlements.

Joaquin Almunia, whose term ends on Oct. 31, is determined to punish the two banks as well as Credit Agricole SA (ACA) and interdealer broker ICAP Plc (IAP) before he leaves office, said three people familiar with the probe who asked not to be named because the process is private. To meet the target, he plans to send so-called statements of objections in the Euribor and Libor cases close to Easter, two of the people said.

“He will want to end on a high note,” Pierre-Henri Conac, a professor specializing in banking at the University of Luxembourg, said in an interview. “He’ll be happy to say: ‘I did it.’”

Almunia, 65, sees the fines as unfinished business after the four holdouts ruined his attempt to get a clean sweep of settlements in rate-rigging cases, part of a global scandal that tarnished the reputation of some of the world’s biggest lenders. The next seven months are the last chance for the former Spanish economist to burnish his legacy after he pledged to quit political life when he leaves the European Commission.

xchrom

(108,903 posts)

xchrom

(108,903 posts)Sweden’s Prime Minister Fredrik Reinfeldt is adding his voice to billionaire investor George Soros’s in cautioning against complacency as he warns of a “very weak” recovery in Europe.

The region’s failure to deliver a convincing rebound from its debt crisis is hampering trade growth and threatening export-reliant nations like Sweden, Reinfeldt said yesterday in an interview outside Stockholm.

The development is “absolutely a threat to Sweden,” the 48-year-old said. “We’re still seeing very weak growth numbers, demand continues to be low.”

Soros warned yesterday that Europe is at risk of sinking into a Japanese-style cycle of economic stagnation that could last 25 years unless more is done to coordinate economic and financial policies. Reinfeldt urged Europe’s leaders to “deal with structural changes and get growth back in order” to avoid such an outcome.

xchrom

(108,903 posts)Japanese labor unions said they clinched their biggest raises in years as Prime Minister Shinzo Abe calls for companies to boost wages to help put the world’s third-largest economy on a path to sustainable growth.

Based on negotiations across 43 union groups, companies agreed to increase base wages by an average of 1,950 yen ($19) a month in the coming year, the Japanese Trade Union Confederation, known as Rengo, said yesterday in Tokyo. The union group, the nation’s biggest, said the increment was significant enough to rank as the biggest raises won since at least the turn of the century.

The agreements come as Abe calls on companies that benefited from his policies -- Toyota Motor Corp. (7203) to Nippon Paper Industries Co. are headed for record profits -- to help reverse more than 15 years of deflation. Still, the pay bump is unlikely to keep up with projected inflation, much less a looming sales tax increase, meaning workers risk falling behind as Abe wants them to help drive economic growth.

“The raise is not enough to lift the country out of deflation,” said Taro Saito, director of economic research at NLI Research Institute in Tokyo. “Considering price increases and the coming sales tax hike, base salaries in real term actually fall this year.”

xchrom

(108,903 posts)New Zealand raised its key interest rate, the first developed nation to exit record-low borrowing costs this year, and said it plans to remove stimulus faster than previously forecast to contain inflation.

“It is necessary to raise interest rates toward a level at which they are no longer adding to demand,” Reserve Bank of New Zealand Governor Graeme Wheeler said in a statement in Wellington after increasing the official cash rate by a quarter percentage point to 2.75 percent, as forecast by all 15 economists in a Bloomberg News survey. The Kiwi gained after Wheeler said further increases are likely in coming months and the OCR may rise by a total of 125 basis points this year.

Soaring dairy prices, the NZ$40 billion ($34 billion) rebuild of earthquake-damaged Christchurch and the strongest immigration in 10 years are fueling growth in the South Pacific economy. Wheeler is departing from global peers as surging house prices in the nation’s biggest city of Auckland stoke concerns of a bubble and add to inflationary pressures.

“We’re on a different planet,” Stephen Toplis, head of research at Bank of New Zealand Ltd. in Wellington, said in an interview. “New Zealand’s environment is fundamentally different to most of our peers” because of record-high commodity prices and construction, he said.

xchrom

(108,903 posts)The largest U.S.-based companies added $206 billion to their stockpiles of offshore profits last year, parking earnings in low-tax countries until Congress gives them a reason not to.

The multinational companies have accumulated $1.95 trillion outside the U.S., up 11.8 percent from a year earlier, according to securities filings from 307 corporations reviewed by Bloomberg News. Three U.S.-based companies -- Microsoft Corp. (MSFT), Apple Inc. and International Business Machines Corp. -- added $37.5 billion, or 18.2 percent of the total increase.

“The loopholes in our tax code right now give such a big reward to companies that use gimmicks to make it look like they earn their profits offshore,” said Dan Smith, a tax and budget advocate at the U.S. Public Interest Research Group, which seeks to counteract corporate influence.

Even as governments around the world cut tax rates and try to keep corporations from shifting profits to tax havens, the U.S. Congress remains paralyzed in its efforts. The response of U.S.-based companies over the past few years has been consistent: book profits offshore and leave them there.

xchrom

(108,903 posts)It used to be that Spaniards would stop paying all their other bills before defaulting on their mortgage payments. But after seven years of crisis, that is no longer the case.

Between 2012 and 2013, the banks listed on the blue-chip Ibex 35 index – Santander, BBVA, CaixaBank, Bankia, Banco Popular, Sabadell and Bankinter – saw their bad loans for home purchases rise from €17.2 billion to €24.5 billion. This 42-percent rise represents an unprecedented spike since the crisis broke out in 2008.

Back then, mortgage non-payment rates were 0.5 percent, and this figure remained steady at 2.4 percent until the end of 2010. But by 2012 the rate had jumped to 4.5 percent, while December 2013 registered a historic high of 6.5 percent.

Experts consulted by EL PAÍS noted that if all the homes that banks had repossessed due to the impossibility of recovering their loans – which have already come off the non-payment lists – were also added, the default rate would really be closer to 10 percent.

xchrom

(108,903 posts)Finance Minister Cristóbal Montoro has announced a rise in tax receipts, which the government is keen to portray as further evidence of an incipient economic recovery.

Fiscal revenues for the first two months of the year grew nearly six percent, said Montoro at a business gathering in Madrid on Wednesday.

If this trend keeps up, it could mean additional revenues of nearly 10 billion euros by year’s end, although the Tax Agency is treating these figures with caution.

In his optimistic speech, Montoro also failed to mention the 2013 deficit, alleging he needs to inform Brussels about it before revealing more. He did say, however, that receipts for value-added tax (VAT) grew six percent in February.

xchrom

(108,903 posts)In L. Frank Baum's novel, "The Wonderful Wizard of Oz," the wizard turns out to be a big phony — just an eccentric old guy sitting behind a curtain, using his booming voice to spew nonsense in a vain effort to fool people.

But now, a century after Baum's fictional Oz, a real-life incarnation of the phony wizard has been discovered, hiding behind not one, but two curtains. He's recently been booming out his nonsense in full-page newspaper ads that are hyperbolic screeds against economists who favor raising the minimum wage to something workers can actually live on.

The ads direct readers to a website named MinimumWage.com, implying that it's the site of independent, unbiased, non-radical economists. But, no — it's not a group of economists at all, just a curtain. What's hiding behind it? An outfit that goes by the name of the Employment Policies Institute, which sounds rock solid, but it, too, is just another curtain.

The Employment Policies Institute, which is run by this wizard, gets millions of dollars in tax-exempt donations from fast-food chains and other corporate interests trying to kill the wage increase, and then funnels that money into the wizard's for-profit PR firm, which also, coincidentally, represents the restaurant industry. The Employment Policy Institute's ad in newspapers was meant to alert the public and policymakers that an impressive group of some 650 economists, all of whom are supporting an increase in America's minimum wage, includes many economists who are "radical researchers." The institute's message in this ad is that no one should listen to, much less respect, this group of economists.

mahatmakanejeeves

(57,439 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/ui/eta20140388.htm

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS REPORT

SEASONALLY ADJUSTED DATA

In the week ending March 8, the advance figure for seasonally adjusted initial claims was 315,000, a decrease of 9,000 from the previous week's revised figure of 324,000. The 4-week moving average was 330,500, a decrease of 6,250 from the previous week's revised average of 336,750.

The advance seasonally adjusted insured unemployment rate was 2.2 percent for the week ending March 1, unchanged from the prior week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending March 1 was 2,855,000, a decrease of 48,000 from the preceding week's revised level of 2,903,000. The 4-week moving average was 2,915,750, a decrease of 19,500 from the preceding week's revised average of 2,935,250.

UNADJUSTED DATA

The advance number of actual initial claims under state programs, unadjusted, totaled 302,218 in the week ending March 8, a decrease of 15,614 from the previous week. There were 317,526 initial claims in the comparable week in 2013.

....

The total number of people claiming benefits in all programs for the week ending February 22 was 3,450,757, an increase of 12,282 from the previous week. There were 5,619,860 persons claiming benefits in all programs in the comparable week in 2013.

AnneD

(15,774 posts)could we keep a running tall of bankers (or maybe even brokers or fund managers) that have died in say...the last two years. We can title it death by mischievous means.

Demeter

(85,373 posts)It doesn't hit the papers like movie stars or politicians, unless there's a spate of spectacular suicides.

AnneD

(15,774 posts)the total is twenty. They were discussing it because of the spectacular ones in London, one in Singapore and several here in the us. We can post to the tally when we hear of it.

xchrom

(108,903 posts) ?1394646033

?1394646033

A diamond from Juína, Brazil, containing a water-rich inclusion of the olivine mineral ringwoodite.

Credit: Richard Siemens/University of Alberta

A battered diamond that survived a trip from "hell" confirms a long-held theory: Earth's mantle holds an ocean's worth of water.

"It's actually the confirmation that there is a very, very large amount of water that's trapped in a really distinct layer in the deep Earth," said Graham Pearson, lead study author and a geochemist at the University of Alberta in Canada. The findings were published today (March 12) in the journal Nature.

The worthless-looking diamond encloses a tiny piece of an olivine mineral called ringwoodite, and it's the first time the mineral has been found on Earth's surface in anything other than meteorites or laboratories. Ringwoodite only forms under extreme pressure, such as the crushing load about 320 miles (515 kilometers) deep in the mantle.

What's in the mantle?

Most of Earth's volume is mantle, the hot rock layer between the crust and the core. Too deep to drill, the mantle's composition is a mystery leavened by two clues: meteorites, and hunks of rock heaved up by volcanoes. First, scientists think the composition of the Earth's mantle is similar to that of meteorites called chondrites, which are chiefly made of olivine. Second, lava belched by volcanoes sometimes taps the mantle, bringing up chunks of odd minerals that hint at the intense heat and pressure olivine endures in the bowels of the Earth.

dixiegrrrrl

(60,010 posts)Consequences be damned.

xchrom

(108,903 posts)Demeter

(85,373 posts)Tomorrow is the Weekend...and we are going to Ireland and St. Patrick's Day. Wear your green...

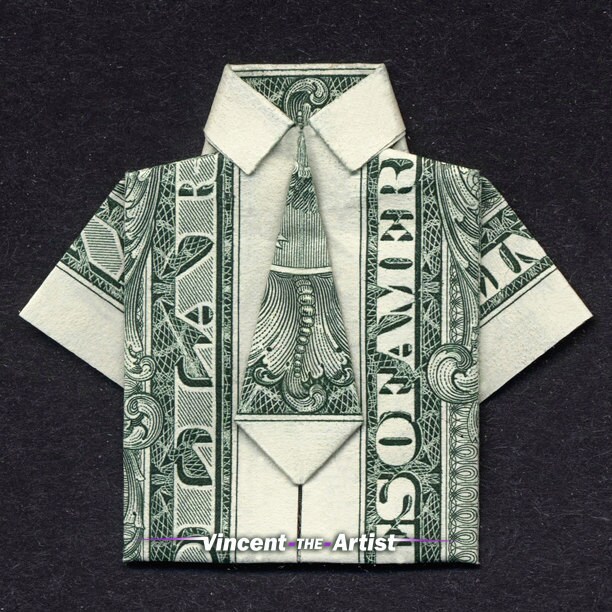

https://www.etsy.com/listing/89518896/dollar-bill-origami-shirt-w-tie-gift

This is an origami shirt and tie, available from the artist. Amazing what Google can find!

Drop Kick Murphy's......among others.

Warpy

(111,255 posts)Religious types go to church and that's about it. They joke in the pubs over the enormous fuss Americans make over it.

Turd in the punchbowl? I was about to ask about the Fed--who farted?

Something triggered all those computers to sell, sell, sell.