Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 7 April 2014

[font size=3]STOCK MARKET WATCH, Monday, 7 April 2014[font color=black][/font]

SMW for 4 April 2014

AT THE CLOSING BELL ON 4 April 2014

[center][font color=red]

Dow Jones 16,412.71 -159.84 (-0.96%)

S&P 500 1,865.09 -23.68 (-1.25%)

Nasdaq 4,127.73 -110.00 (0.00%)

[font color=green]10 Year 2.72% -0.05 (-1.81%)

30 Year 3.58% -0.03 (-0.83%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

kickysnana

(3,908 posts)New cheap, fast, plentiful service is onboard the newer computer and hooked up to the TV. Now I have to make it easy enough for Auntie to use. I also installed Dragon Speech for her.First I have to stretch my brain a little to figure it out to show her.

Friday night there was a horrific crash within earshot of our apartment. A man, his wife were traveling over 100 mph on the interstate in a Chrysler 300 and run underneath the back of a semi going 55 mph east on I694. They died instantly, she was pregnant. Their almost 2 year old son Bishop was in a car seat in the back seat and was not injured. She had been working in a public school. Sure hope Bishop has a better life than he has had so far and I am sorry for the semi driver too. Gave my grandkids an extra hug today.

DemReadingDU

(16,000 posts)We are to be converted from TW to Comcast by end of year

Demeter

(85,373 posts)xchrom

(108,903 posts)The World Bank has trimmed its growth forecast slightly for China, citing a "bumpy start to the year".

It now expects the Chinese economy to grow by 7.6% in 2014, down from its earlier projection of 7.7%.

A slew of disappointing figures has triggered concerns of a slowdown in the world's second-largest economy.

However, the bank said recent reforms unveiled by China were likely to help it achieve "more sustainable and inclusive" growth in the long term.

xchrom

(108,903 posts)India's main opposition BJP has promised to improve the economy and infrastructure and curb corruption if it wins in the general elections.

The party launched its manifesto on the day millions of Indians began voting to elect a new government.

The polling, to be held in nine phases, ends on 12 May. Votes will be counted on 16 May.

With some 814 million eligible voters, India's election will be the largest the world has seen.

xchrom

(108,903 posts)Nigeria has "rebased" its gross domestic product (GDP) data, which has pushed it above South Africa as the continent's biggest economy.

Nigerian GDP now includes previously uncounted industries like telecoms, information technology, music, online sales, airlines, and film production.

GDP for 2013 totalled 80.3 trillion naira (£307.6bn: $509.9bn), the Nigerian statistics office said.

That compares with South Africa's GDP of $370.3bn at the end of 2013.

Demeter

(85,373 posts)YVES SMITH NOTES:

Writer libbyliberal describes how the Obama Administration’s National Highway Traffic Safety Administration worked with GM for years to cover up the automaker’s ignition system defect that would lead to sudden power system failure. That fault is estimated to have caused at least 13 deaths and over 30 crashes. Lambert described this as a textbook case of crapification:

So some MBA drove the decision making process here, and that’s worse than the engineering that was done.

But there’s an even more cynical layer to this. When GM became aware of the defect, they refused to make the tooling changes because it would cost too much. No proposed remedy “represents an acceptable business case.”

Now consider what that means. In the famed case of exploding Pintos, Ford had calculated the number of deaths that would result from retaining the inadequate gas tank shielding that made it vulnerable to rear-end crashes and the cost per death. Ford concluded it would be cheaper for them to let people die and pay damages in litigation than spend $11 per car more for a redesigned fuel tank.

Now GM is presumably too smart to have a calculation like that in its records. But the logic of the refusing to fix it is exactly the same as with the Pinto. And one of the reasons why is that these GM cars were low-budget cars, presumably purchased by low-income people. The value of a life in a lawsuit depends on the future earning stream of the person who died. So someone with a modest income really is less worth saving to a large company than more affluent customers...

ARTICLE FOLLOWS--READ IT AND WEEP

xchrom

(108,903 posts)HONG KONG (AP) -- A sell-off of Internet and technology stocks that started on Wall Street spread around the globe on Monday, with tech companies in Asia hammered by worries about excessively high valuations.

Mainstays of the Internet economy such as Google and Netflix that have surged over the past year were hammered on Friday as investors had a change of heart and decided prices were too high. The technology-heavy Nasdaq had its biggest one-day drop since February.

"Perhaps the key equity story now is the horrible price action in the growth stocks, especially ones that trade, or at least did trade, on outrageous valuations," Chris Weston, chief strategist at IG Markets in Melbourne, wrote in a commentary.

In early European trading, Germany's DAX sank 1 percent to 9,602.92 and France's CAC 40 slid 0.5 percent to 4,460.49. Britain's FTSE 100 lost 0.3 percent to 6,672.31. U.S. stocks were poised to fall. Dow futures shed 0.2 percent to 16,324 and broader S&P 500 futures dropped 0.3 percent to 1,855.40.

Demeter

(85,373 posts)Yves here. In 2010, at the first Institute of New Economic Thinking conference at Kings College, Cambridge, Dominique Strauss-Kahn spoke at one of the lunches and tried to persuade the assembled group that among other things, the IMF was developing more enlightened policies. One of my lunch companions would have none of it. He said that while the research arm of the IMF was indeed turning out much more enlightened papers than they had in the past, there had been no change in policies.

This update at Triple Crisis paints an even grimmer picture: the IMF has been devising even nastier versions of its austerity hairshirt in recent years.

By Jesse Griffiths, Director of the European Network on Debt and Development (Eurodad). This post is based on the Eurodad report “Triple Crisis

http://www.chicagotribune.com/business/sns-rt-us-imf-conditions-20140402,0,1110797.story

http://www.eurodad.org/Entries/view/1546182/2014/04/02/Conditionally-yours-An-analysis-of-the-policy-conditions-attached-to-IMF-loans

Ukraine is the latest country faced by a debt crisis to be forced into the arms of the International Monetary Fund (IMF). The reality of the situation was pithily expressed by the Ukrainian Prime Minister, Arseniy Yatseniuk, who recently said he “will meet all IMF conditions… for a simple reason… we don’t have any other options.”

The European Network on Debt and Development (Eurodad) has, over the past decade, produced several reports criticising the excessive and often harmful conditions that the IMF attaches to its loans. The IMF claims to have seen the light and limited its conditions to critical reforms agreed by recipient governments. We decided to put that claim to the test in our latest report, published on Wednesday (April 2), and examined all the policy conditions attached to 23 of the IMF’s most recent loans. What we found was truly shocking. The IMF is going backwards—increasing the number of policy conditions per loan, and remaining heavily engaged in highly sensitive and political policy areas.

Here’s what we found:

Demeter

(85,373 posts)The European Central Bank has let it happen. Inflation has been running at an annual rate of minus 1.5% in the eurozone over the past five months, adjusted for austerity taxes.

Prices have been falling at a rate of 5.6% in Italy, 4.7% in Spain, 4% in Portugal and 2% in Holland since September. The rise of the euro against the dollar, yen, yuan and real, accounts for some of this. The eurozone’s trade-weighted index has risen 6% in a year.

But that is the direct consequence of the ECB’s own monetary policy. Frankfurt could force down the euro at any time by switching gears. It has chosen not to do so, hoping that a few dovish words spoken without conviction will turn the global tide.

It is hard to judge at what point deflation becomes embedded in the system. Factory gate prices have been slipping since mid-2012. The pace quickened to minus 1.7% in February, the steepest decline since the Lehman crisis. But this time it is not the one-off effect of a financial crash. It is chronic and insidious.

Prof Luis Garicano from the London School of Economics said the economic models used to predict inflation seem to be breaking down. “They need to take very serious action,” he said.

MORE

xchrom

(108,903 posts)***SNIP

OB GROWTH VS. POPULATION GROWTH

For much of the recovery, the economy suffered from a fundamental problem: We were adding more people than jobs.

Employers hired 2.4 million people in 2012. That sounds decent. But it's less impressive when you consider this: The working-age population swelled by 3.8 million that year, according to the employment report's survey of households. A similar gap existed in 2013.

***SNIP

PRIME-AGE WORKERS ARE RETURNING

After the Great Recession ended in mid-2009, a declining share of 25- to 54-year-olds were working. Roughly 80 percent of this age bracket had been employed before the downturn. The figure sank as low as 74.8 percent toward the end of 2010.

***SNIP

WE'VE ESCAPED WINTER

Perhaps the snow trapped your car on an Atlanta freeway. Or maybe you coped with chronic school closings in Philadelphia. Maybe flight cancellations delayed your business meeting to sign a big contract.

xchrom

(108,903 posts)TOKYO (AP) -- Japan and Australia have agreed on a free trade deal that both sides say will yield windfalls for their economies.

Australian Prime Minister Tony Abbott and his Japanese counterpart, Shinzo Abe, announced the pact, Japan's first with a major agricultural economy, at a news conference Monday.

The deal calls for Japan to gradually phase out its nearly 40 percent tariffs on Australian exports of beef. In turn, Australia is to end its tariffs on Japanese-made vehicles, household appliances and electronics.

"I hope that thanks to this agreement that Australia can be pivotal in assuring Japan's energy security, its resource security and its food security," Abbott told reporters.

xchrom

(108,903 posts)WASHINGTON (AP) -- As a brutal winter yields to spring, the U.S. economy is showing renewed strength just as other major economies appear desperate for help.

Europe is clinging to a fragile recovery. Japan just imposed a tax hike that threatens its shaky economic comeback. And China's troubles are rattling the global economy.

The resilience of the U.S. economy, after a growth-chilling winter, was evident in Friday's jobs report from the Labor Department. It said employers added 192,000 jobs in March and 37,000 more than in January and February than previously thought.

With the economy making steady gains, the Federal Reserve has been scaling back its bond purchases, which have been intended to lower interest rates to spur growth.

Demeter

(85,373 posts)

http://blogs.reuters.com/felix-salmon/2014/04/04/stop-adding-up-the-wealth-of-the-poor/

It’s the meme that refuses to die. It started, back in 2011, with the Waltons: six members of the family, we were repeatedly told, were worth as much as the bottom 30% of all Americans combined. I tried to address this silly stat back then, but now it’s gone global: back in January, Oxfam announced that the world’s 85 richest people had the same wealth as the bottom half of the global population. And now Forbes has come along to say that, actually, it’s not 85 people — it’s a mere 67.

Oxfam does a pretty bad job of footnoting its report, but I did manage to finally track down how it arrived at this conclusion. The 85 (or 67) number is easy: you just start at the top of the Forbes billionaires list, and start counting up the combined wealth until you reach $1.7 trillion. The harder question is: where does the $1.7 trillion number come from?

The answer is that it comes from a pair of tables in Credit Suisse’s 2013 Global Wealth Databook. First of all, you have to find the total wealth in the world, which you can find at the bottom of the fourth column on page 89: it’s $241 trillion. Then, you flick forwards to page 146, where you find the proportion of all global wealth held by each of the world’s income deciles. The top 10% have 86% of the wealth; the next 10% have 7.8%, and so on. Add up the bottom five deciles, and you get 0.7% (not 0.71%, which is the number in the Oxfam report; I have no idea where that extra basis point came from). And if you multiply $241 trillion by 0.7%, you get $1.7 trillion.

All of which makes a certain amount of sense, until you start looking a bit closer. For instance, notice anything odd about this chart?

The weird thing is that triangle in the top left hand corner. If you look at the tables in the Credit Suisse datebook, China has zero people in the bottom 10% of the world population: everybody in China is in the top 90% of global wealth, and the vast majority of Chinese are in the top half of global wealth. India is on the list, though: if you’re looking for the poorest 10% of the world’s population, you’ll find 16.4% of them in India, and another 4.4% in Bangladesh. Pakistan has 2.6% of the world’s bottom 10%, while Nigeria has 3.9%.

But there’s one unlikely country which has a whopping 7.5% of the poorest of the poor — second only to India. That country? The United States. How is it that the US can have 7.5% of the bottom decile, when it has only 0.21% of the second decile and 0.16% of the third? The answer: we’re talking about net worth, here: assets minus debts. And if you add up the net worth of the world’s bottom decile, it comes to minus a trillion dollars. The poorest people in the world, using the Credit Suisse methodology, aren’t in India or Pakistan or Bangladesh: they’re people like Jérôme Kerviel, who has a negative net worth of something in the region of $6 billion...America, of course, is the spiritual home of the overindebted — people underwater on their mortgages, recent graduates with massive student loans, renters carrying five-figure car loans and credit-card obligations, uninsured people who just got out of hospital, you name it. If you’re looking for people with significant negative net worth, in a way it’s surprising that only 7.5% of the world’s bottom 10% are in the US. And as you start adding all those people up — the people who dominate the bottom 10% of the wealth rankings — their negative wealth only grows in magnitude: you get further and further away from zero.

The result is that if you take the bottom 30% of the world’s population — the poorest 2 billion people in the world — their total aggregate net worth is not low, it’s not zero, it’s negative. To the tune of roughly half a trillion dollars...

MORE--SALMON IS A HELL OF A WRITER, AS WELL AS AN ANALYST

xchrom

(108,903 posts)BERLIN (AP) -- France's new finance minister has stressed the need to strike a balance between stronger economic growth and fulfilling Paris' deficit-cutting commitments.

During a visit to Berlin Monday, Michel Sapin stopped short of outlining specific details but advocated "a balance between the necessary respect for commitments and growth higher than today's."

Last week, Sapin said the pace at which France reduces its deficit to 3 percent of the country's annual GDP from last year's 4.3 percent should be discussed. France previously promised to do so by 2015.

Cutting the deficit aggressively by slashing spending could hurt France's growth and stifle efforts to reduce sky-high unemployment.

DemReadingDU

(16,000 posts)4/7/14 Dark markets may be more harmful than high-frequency trading

Fears that high-speed traders have been rigging the U.S. stock market went mainstream last week thanks to allegations in a book by financial author Michael Lewis, but there may be a more serious threat to investors: the increasing amount of trading that happens outside of exchanges.

Some former regulators and academics say so much trading is now happening away from exchanges that publicly quoted prices for stocks on exchanges may no longer properly reflect where the market is. And this problem could cost investors far more money than any shenanigans related to high frequency trading.

When the average investor, or even a big portfolio manager, tries to buy or sell shares now, the trade is often matched up with another order by a dealer in a so-called "dark pool," or another alternative to exchanges.

Those whose trade never makes it to an exchange can benefit as the broker avoids paying an exchange trading fee, taking cost out of the process. Investors with large orders can also more easily disguise what they are doing, reducing the danger that others will hear what they are doing and take advantage of them.

But the rise of "off-exchange trading" is terrible for the broader market because it reduces price transparency a lot, critics of the system say. The problem is these venues price their transactions off of the published prices on the exchanges - and if those prices lack integrity then "dark pool" pricing will itself be skewed.

Around 40 percent of all U.S. stock trades, including almost all orders from "mom and pop" investors, now happen "off exchange," up from around 16 percent six years ago.

more...

http://finance.yahoo.com/news/dark-markets-may-more-harmful-044748628.html

DemReadingDU

(16,000 posts)4/7/14 Dark pools outside exchanges causing concern

What’s worse than high-speed traders who “front-run” normal investors at stock exchanges? Stock traders who cut their deals off the exchanges altogether.

That, at least, is the concern some experts are raising about so-called “dark pools” for off-exchange stock trades, even as high-frequency trading faces increased media and regulatory scrutiny. Brokers and their clients can benefit from dark pools as they sidestep exchange trading fees.

But dark pools have grown so much that publicly quoted prices for stocks on exchanges may no longer properly reflect where the market is, experts say.

This is an issue that could cost investors far more money than any shenanigans related to high-frequency trading, in which super-computers with high-speed network connections are used to siphon away profits from ordinary investors.

Around 40 percent of all US stock trades, including almost all orders from “mom and pop” investors, now happen “off exchange,” up from around 16 percent six years ago, according to Reuters.

This trend is “a real concern,” John Ramsay, former head of the Securities and Exchange Commission’s Trading and Markets division, told the news service. “We have academic data now that suggests that, yes, in fact there is a point beyond which the level of dark trading for particular securities can really erode market quality,” Ramsay said.

http://nypost.com/2014/04/07/dark-pools-outside-exchanges-causing-concern/

mrdmk

(2,943 posts)Who the hell perpetuated this story, trading away from the exchanges

xchrom

(108,903 posts)VATICAN CITY (AP) -- Pope Francis has given his backing to the Vatican Bank to keep operating as it strives to improve compliance with international best banking practices.

The bank, which has been caught up in money-laundering probes, is also known as the Institute for Religious Works (IOR).

In a statement Monday, the Vatican said "the valuable services that can be offered by the Institute assist the Holy Father in his mission as universal pastor."

Referring to reforms sparked by the probes, the Vatican said the bank's executives and managers will finalize plans to ensure the institute can fulfill its mission "as part of the Holy See's new financial structures."

Demeter

(85,373 posts)xchrom

(108,903 posts)(Reuters) - Iran hopes enough progress will be made at talks with major powers this week to let negotiators start drafting an accord to settle a dispute over its nuclear programme, a top Iranian negotiator was quoted as saying by official media.

The Islamic Republic and six world powers will hold a fresh round of talks in Vienna on Tuesday and Wednesday intended to reach a comprehensive agreement by July 20 on how to resolve a decade-old standoff that has stirred fears of a Middle East war.

Iran says its enrichment programme is a peaceful bid to generate electricity and has ruled out shutting any of its nuclear facilities.

But the United States and some other Western countries have accused Iran of working on developing a nuclear bomb capability and Israel has threatened to attack its long-time foe Iran if diplomatic efforts fail.

xchrom

(108,903 posts)(Reuters) - Export credit notes guaranteed by the British government's trade promotion agency will in future be able to be used as collateral at the Bank of England, the central bank said on Monday.

Boosting British exports and reviving securitised capital markets after the financial crisis are aims of both the BoE and Britain's government.

xchrom

(108,903 posts)(Reuters) - Britain's top equity index fell on Monday, retreating from a three-week high as a slide on Wall Street on Friday and concern about valuations weighed on the UK stock market.

The blue-chip FTSE 100 index, which rose 0.7 percent on Friday to reach its highest in around three weeks, fell back by 0.6 percent, or 38.60 points, to 6,656.95 points in mid-session trading.

"It's all being driven by the sell-off we saw on Wall Street," said Prime Wealth Group senior trader Dafydd Davies. Benchmark U.S. equity indexes fell around 1 percent on Friday.

Concern that corporate earnings were not strong enough to justify the ratings of companies on the FTSE 100 also weighed on stocks. The FTSE 100 is trading on a 12-month forward price/earnings ratio of 13.2 times, compared with a five-year average of 11 times, according to Thomson Reuters Datastream.

xchrom

(108,903 posts)(Reuters) - Prime Minister Viktor Orban has won another four years in power, election results showed on Monday, while one in five voters backed a far-right opposition party accused of anti-Semitism.

Orban has clashed repeatedly with the European Union and foreign investors over his unorthodox policies, and after Sunday's win, big businesses were bracing for another term of unpredictable and, for some of them, hostile measures.

But many Hungarians see Orban, a 50-year-old former dissident against Communist rule, as a champion of national interests. They also like the fact that under his government personal income tax and household power bills have fallen.

After 99 percent of ballots were counted from Sunday's parliamentary vote, an official projection gave Orban's Fidesz party 133 of 199 seats, guaranteeing it will form the next government.

Demeter

(85,373 posts)They say that like it's some weird counter-culture fashion....

Demeter

(85,373 posts)1. How much natural gas is the United States currently extracting?

(a) Barely enough to meet its own needs

(b) Enough to allow lots of exports

(c) Enough to allow a bit of exports

(d) The United States is a natural gas importer

Answer: (d) The United States is a natural gas importer, and has been for many years. The EIA is forecasting that by 2017, we will finally be able to meet our own natural gas needs...

2. How much natural gas is the United States talking about exporting?

(a) A tiny amount, less than 5% of what it is currently producing.

(b) About 20% of what it is currently producing.

(c) About 40% of what it is currently producing.

(d) Over 60% of what it is currently producing.

The correct answer is (d) Over 60% what it is currently producing. If we look at the applications for natural gas exports found on the Energy.Gov website, we find that applications for exports total 42 billion cubic feet a day, most of which has already been approved.* This compares to US 2013 natural gas production of 67 billion cubic feet a day. In fact, if companies applying for exports build the facilities in, say, 3 years, and little additional natural gas production is ramped up, we could be left with less than half of current natural gas production for our own use...

3. How much are the United States’ own natural gas needs projected to grow by 2030?

a. No growth

b. 12%

c. 50%

d. 150%

If we believe the US Energy Information Administration, US natural gas needs are expected to grow by only 12% between 2013 and 2030 (answer (b)). By 2040, natural gas consumption is expected to be 23% higher than in 2013. This is a little surprising for several reasons. For one, we are talking about scaling back coal use for making electricity, and we use almost as much coal as natural gas. Natural gas is an alternative to coal for this purpose.

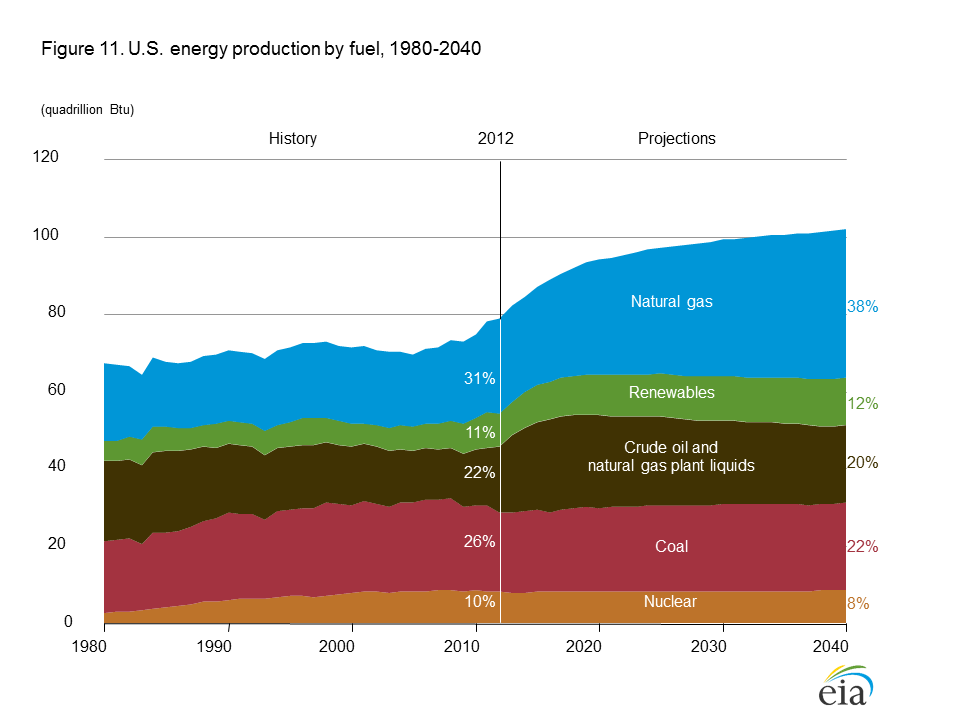

4. How does natural gas’s production growth fit in with the growth of other US fuels according to the EIA?

(a) Natural gas is the only fuel showing much growth

(b) Renewables grow by a lot more than natural gas

(c) All fuels are growing

The answer is (a). Natural gas is the only fuel showing much growth in production between now and 2040. I'LL DEBATE THAT--I THINK RENEWABLE WILL GROW EXPONENTIALLY HERE, AS IT ALREADY IS IN MORE PROGRESSIVE NATIONS.

5. What is the projected path of natural gas prices:

(a) Growing slowly

(b) Ramping up quickly

(c) It depends on who you ask

It depends on who you ask: Answer (c). According to the EIA, natural gas prices are expected to remain quite low. The EIA provides a forecast of natural gas prices for electricity producers, from which we can estimate expected wellhead prices (Figure 5).

?w=640&h=480

?w=640&h=480

In fact, this last year, with a cold winter, we have had a problem with excessively drawing down amounts in storage. There is even discussion that at the low level in storage and current rates of production, it may not be possible to fully replace the natural gas in storage before next fall.

?w=640

?w=640The catch–and the reason for all of the natural gas exports–is that most shale gas producers cannot produce natural gas at recent price levels. They need much higher price levels in order to make money on natural gas. We see one article after another on this subject: From Oil and Gas Journal; from Bloomberg; from the Financial Times. The Wall Street Journal quoted Exxon’s Rex Tillerson as saying, “We are all losing our shirts today. We’re making no money. It’s all in the red.”

Why all of the natural gas exports, if we don’t have very much natural gas, and the shale gas portion (which is the only portion with much potential for growth) is so unprofitable? The reason for all of the exports is too pump up the prices shale gas producers can get for their gas. This comes partly by engineering higher US prices (by shipping an excessive portion overseas) and partly by trying to take advantage of higher prices in Europe and Japan...

MUST READ THE WHOLE THING!

DemReadingDU

(16,000 posts)Anyone else noticed the daily brief animation on the Yahoo financial page? Not sure when it began, but it's different every day. Look in upper left corner at the Yahoo logo!

http://finance.yahoo.com/

Tansy_Gold

(17,858 posts)For several months, at least. I noticed it back in February.

DemReadingDU

(16,000 posts)I have a yahoo mail too, that I haven't checked for months and months. It's the same animation!

Demeter

(85,373 posts)maybe my ad-blocking stops it?

DemReadingDU

(16,000 posts)I use Firefox browser, and I still see the animation

edit

I don't see the animation using IE browser

![]()

Demeter

(85,373 posts)The devastating civil war that has ravaged Libya has undoubtedly altered the power structure of the North African nation. It also revealed that major U.S. and European financial firms, including Goldman Sachs and Societe Generale, actively courted executives of the Libyan Investment Authority (LIA), which, flush with $60 billion of the nation’s oil profits, paid rich fees to invest with Western banks and funds, in some cases losing their whole investment. Now, the LIA is suing Goldman Sachs and Societe Generale in London, while the SEC and the U.S. Justice Department are also scrutinizing the practices of hedge fund Och-Ziff and private equity firm Blackstone.

In 2004, the U.S. lifted commercial sanctions on Libya after Colonel Muammar al-Gaddafi agreed to hand over his chemical weapons. Major U.S. and European names flocked to the oil producing nation for a cut of the potential profits as the reins on global capitalism were loosened. Established in 2006, Libya’s sovereign wealth fund was approached by at least 25 different financial institutions looking to attract its funds, ultimately forging relationships with Goldman Sachs, Societe Generale, HSBC, JPMorgan Chase, the Carlyle Group, Lehman Brothers, and Och-Ziff Capital Management.

Jitters throughout the U.S. mortgage market became an all out meltdown after the collapse of Lehman Brothers in 2008, and along with the global financial system went the investments of the LIA. Goldman Sachs effectively lost 98% of the LIA’s $1.3 billion investment, as I previously reported. Societe Generale reportedly lost half of the $1.8 billion entrusted to it by the Libyans.

Now, after the fall of Gaddafi and armed with new executives, the LIA is on the legal offensive. With London as their battleground, they first sued Goldman Sachs this January, accusing the Wall Street institution of “deliberately exploiting the relationship of trust and confidence it had established with the LIA to cause the LIA to enter into each of the disputed equity derivative trades,” according to the Libya Herald. Goldman is said to have netted $350 million in profit from the trades, which included investments in Citigroup C, Banco Santander , Allianz, Eni, UniCredit, Electricite de France, and a basket of currencies. Initially worth $1.3 billion, the positions acquired between January and June of 2008 saw their value decimated, falling to a meager $25.1 million by February 2010. Goldman described the accusations as “without merit.”

xchrom

(108,903 posts)America’s improving fiscal health is starting to be reflected in the market for Treasuries.

As the Federal Reserve scales back its unprecedented bond buying this year, the ability of the world’s largest debtor nation to attract investors underscores the strides the U.S. has made to strengthen its creditworthiness after the worst financial crisis since the Great Depression. With the budget deficit at a seven-year low and household wealth rising to a record, investors from mutual funds to foreign central banks are buying a greater share of Treasuries at government auctions than ever compared with bond dealers that are obligated to bid.

“This goes a long way to blunting the criticism of investing in the U.S. dollar,” Wan-Chong Kung, a bond manager at Nuveen Asset Management, which oversees more than $100 billion, said in an April 2 phone interview from Minneapolis.

Investors submitted bids for $1.73 trillion of government notes and bonds at auctions held in the first quarter, or 3.07 times the $564 billion that was sold, according to data compiled by Bloomberg. The bid-to-cover ratio rebounded from last year’s 2.87, which was the lowest annual level in four years.

Demeter

(85,373 posts)Warpy

(111,255 posts)but I just finished my 27 pages of taxes and found out my dividends have increased for the first time ever. They'd barely hung on for a few years after Stupid presided over a typical GOP economy, complete with crash.

Now if they raise the minimum wage and pay more attention to the demand side of the equation for a change, we'll all see those dividends.