Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 25 November 2014

[font size=3]STOCK MARKET WATCH, Tuesday, 25 November 2014[font color=black][/font]

SMW for 24 November 2014

AT THE CLOSING BELL ON 24 November 2014

[center][font color=green]

Dow Jones 17,817.90 +7.84 (0.04%)

S&P 500 2,069.41 +5.91 (0.29%)

Nasdaq 4,754.89 +41.92 (0.89%)

[font color=green]10 Year 2.30% -0.03 (-1.29%)

30 Year 3.02% -0.02 (-0.66%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Six years ago the Federal Reserve hit rock bottom. It had been cutting the federal funds rate, the interest rate it uses to steer the economy, more or less frantically in an unsuccessful attempt to get ahead of the recession and financial crisis. But it eventually reached the point where it could cut no more, because interest rates can’t go below zero. On Dec. 16, 2008, the Fed set its interest target between 0 and 0.25 percent, where it remains to this day. The fact that we’ve spent six years at the so-called zero lower bound is amazing and depressing. What’s even more amazing and depressing, if you ask me, is how slow our economic discourse has been to catch up with the new reality. Everything changes when the economy is at rock bottom — or, to use the term of art, in a liquidity trap (don’t ask). But for the longest time, nobody with the power to shape policy would believe it.

What do I mean by saying that everything changes? As I wrote way back when, in a rock-bottom economy “the usual rules of economic policy no longer apply: virtue becomes vice, caution is risky and prudence is folly.” Government spending doesn’t compete with private investment — it actually promotes business spending. Central bankers, who normally cultivate an image as stern inflation-fighters, need to do the exact opposite, convincing markets and investors that they will push inflation up. “Structural reform,” which usually means making it easier to cut wages, is more likely to destroy jobs than create them. This may all sound wild and radical, but it isn’t. In fact, it’s what mainstream economic analysis says will happen once interest rates hit zero. And it’s also what history tells us. If you paid attention to the lessons of post-bubble Japan, or for that matter the U.S. economy in the 1930s, you were more or less ready for the looking-glass world of economic policy we’ve lived in since 2008.

But as I said, nobody would believe it. By and large, policy makers and Very Serious People in general went with gut feelings rather than careful economic analysis. Yes, they sometimes found credentialed economists to back their positions, but they used these economists the way a drunkard uses a lamppost: for support, not for illumination. And what the guts of these serious people have told them, year after year, is to fear — and do — exactly the wrong things. Thus we were told again and again that budget deficits were our most pressing economic problem, that interest rates would soar any day now unless we imposed harsh fiscal austerity. I could have told you that this was foolish, and in fact I did, and sure enough, the predicted interest rate spike never happened — but demands that we cut government spending now, now, now have cost millions of jobs and deeply damaged our infrastructure.

We were also told repeatedly that printing money — not what the Fed was actually doing, but never mind — would lead to “currency debasement and inflation.” The Fed, to its credit, stood up to this pressure, but other central banks didn’t. The European Central Bank, in particular, raised rates in 2011 to head off a nonexistent inflationary threat. It eventually reversed course but has never gotten things back on track. At this point European inflation is far below the official target of 2 percent, and the Continent is flirting with outright deflation.

But are these bad calls just water under the bridge? Isn’t the era of rock-bottom economics just about over? Don’t count on it. It’s true that with the U.S. unemployment rate dropping, most analysts expect the Fed to raise interest rates sometime next year. But inflation is low, wages are weak, and the Fed seems to realize that raising rates too soon would be disastrous. Meanwhile, Europe looks further than ever from economic liftoff, while Japan is still struggling to escape from deflation. Oh, and China, which is starting to remind some of us of Japan in the late 1980s, could join the rock-bottom club sooner than you think...So the counterintuitive realities of economic policy at the zero lower bound are likely to remain relevant for a long time to come, which makes it crucial that influential people understand those realities. Unfortunately, too many still don’t; one of the most striking aspects of economic debate in recent years has been the extent to which those whose economic doctrines have failed the reality test refuse to admit error, let alone learn from it. The intellectual leaders of the new majority in Congress still insist that we’re living in an Ayn Rand novel; German officials still insist that the problem is that debtors haven’t suffered enough.

This bodes ill for the future. What people in power don’t know, or worse what they think they know but isn’t so, can very definitely hurt us.

Demeter

(85,373 posts)Suppose you told an economist these facts and only these facts: Long-term interest rates have fallen sharply over just a few months. Prices for oil and other much-needed commodities have been in free fall in the face of weak demand. Markets are predicting that inflation will be low in the years ahead and that the central bank will keep interest rates lower for longer. Knowing only those facts, the economist would conclude that this country was staring down the barrel of a significant economic slowdown, and maybe even a recession.

What would that economist conclude, though, if stock prices are consistently rising toward record highs, job gains are the best in years, corporate sales and profits are rising, and business surveys and other real-time indicators of the economy point to steady expansion? That country, of course, would seem to have a perfectly strong economic outlook. And as you have surely guessed, both these situations apply to the same country at the same time, which is to say the United States in November 2014.

This is the central paradox of the economy as the year nears its end. And the giant question facing the United States going into 2015 is which set of indicators are giving a more accurate view of where things are headed. In one telling, the nation is on track for the strongest year since the recovery began over five years ago; in another, Americans should brace for yet more sluggishness and uncertainty. Looking solid as well are those pieces of data that usually serve as advance warning that the economy is faltering. The Conference Board’s index of leading economic indicators rose a healthy 0.9 percent in October and hasn’t logged a monthly decline since January. The stock market rally continued Friday after moves by the People’s Bank of China and European Central Bank that signaled easier money ahead. The trouble, if it can be called that, is in the corners of the bond and commodity markets that often presage problems in the economy.

When investors become more concerned about the economic outlook, they tend to shift money into bonds, tolerating lower yields in exchange for safety and the expectation of lower interest rates in the years ahead because of the weak economy. For example, a sharp decline in yields during the second half of 2007 foretold the recession that began in December of that year. The yield on 10-year Treasury bonds has fallen to 2.31 percent as of Friday, from 3 percent earlier in the year. And while the price of oil and other commodities is influenced by many factors other than the overall state of the domestic economy (supply, weather and so on), the steep sell-off since this summer has been an indicator that global demand is considerably weaker than had appeared likely as recently as the spring.

There are three basic ways to resolve the contradictions among these pieces of data, each with different implications for the United States economy in 2015 and beyond...

AND GUESS WHAT? WE HIT THE TRIFECTA, AGAIN! AREN'T WE LUCKY AND CLEVER?

Crewleader

(17,005 posts)Demeter

(85,373 posts)Senate Majority Leader Mitch McConnell unveiled his party’s long-awaited plan on immigration on Wednesday, telling reporters, “We must make America somewhere no one wants to live.” Appearing with House Speaker John Boehner, McConnell said that, in contrast to President Obama’s “Band-Aid fixes,” the Republican plan would address “the root cause of immigration, which is that the United States is, for the most part, habitable.”

“For years, immigrants have looked to America as a place where their standard of living was bound to improve,” McConnell said. “We’re going to change that.”

Boehner said that the Republicans’ plan would reduce or eliminate “immigration magnets,” such as the social safety net, public education, clean air, and drinkable water. The Speaker added that the plan would also include the repeal of Obamacare, calling healthcare “catnip for immigrants.”

Attempting, perhaps, to tamp down excitement about the plan, McConnell warned that turning America into a dystopian hellhole that repels immigrants “won’t happen overnight.” “Our crumbling infrastructure and soaring gun violence are a good start, but much work still needs to be done,” he said. “When Americans start leaving the country, we’ll know that we’re on the right track.”

In closing, the two congressional leaders expressed pride in the immigration plan, noting that Republicans had been working to make it possible for the past thirty years.

Demeter

(85,373 posts)The European Central Bank has started buying asset-backed securities, it said on Friday, in a move to encourage banks to lend and revive the economy.

"Following publication of legal act on the implementation of the ABS purchase programme, the Eurosystem has started the purchases on 21/11/2014," the ECB said on its Twitter feed.

The programme is one plank in a strategy which ECB chief Mario Draghi hopes will increase its balance sheet by up to 1 trillion euros (0.79 trillion pounds). It already buys covered bonds, a secure form of debt often backed by property. The ABS and covered bond programmes will last for at least two years. The ECB will give a weekly updated on its purchases on its website around 1430 GMT on Mondays, as it is already doing with the covered bond purchases. If it falls short of this overall 1 trillion euro mark and fails to boost the economy significantly, pressure to print money to buy government bonds, also known as quantitative easing, will reach fever pitch.

However, expectations among market experts for the programme are muted.

To limit its risk, the ECB will buy only the most secure part of such loans in the hope that others pile in behind it to buy riskier credit.

DOES THIS MAKE SENSE? ANYONE? ANYONE? BUELLER?

Demeter

(85,373 posts)Yves here. This post is consistent with concerns we’ve raised earlier, that the appealing-sounding “bail in” scheme is a non-starter on a practical level. US regulators have not chosen to go this route, and this is one of those occasions where their reasons are sound as opposed to bank-serving. However, that is not to minimize the not-trivial problem that American regulators face: their resolution plans aren’t workable either.

By Silvia Merler, an Affiliate Fellow at Bruegel. Originally published at Breugel.

Since the beginning of the crisis – and more so since 2010 – Europeans have been looking at the sovereign-banking “vicious circle”, tying the dismal fates of States and banks together. This has emerged as a characteristic disease during the euro crisis, and one of the stated objective of the European Banking Union project was precisely to remedy it. The idea was basically to achieve this goal in a twofold way, ex ante and ex post. On one hand, by imposing stronger and harmonised supervisory requirements (e.g. on capital) and by empowering a third-party, independent and hopefully high-quality, supervisor to oversee their fulfillment, thus rebuilding trust in supervision and in the financial sector’s health. On the other hand, if a crisis turned out to be unavoidable, the second principle consisted in limiting recourse to taxpayers’ money as much as possible therefore preventing doubts about the damage that bank rescue would inflict to the state of public finances.

The first principle was translated into practice by the creation of a Single Supervisory Mechanism (SSM) under which, on the 4th of November, the ECB took over supervisory responsibility for banks in the euro area. The second principle concretized by the introduction of the Bank Recovery and Resolution Directive (BRRD) which gives a framework for resolution of troubled banks, and by the creation of a Single Resolution Mechanism (SRM), who should ensure consistent and homogeneous application of it. Among the other provision, the BRRD contains a set of rules for the application of bail-in in bank resolution, strengthening the involvement of private creditor that de facto is already introduced by the amended State Aid framework.

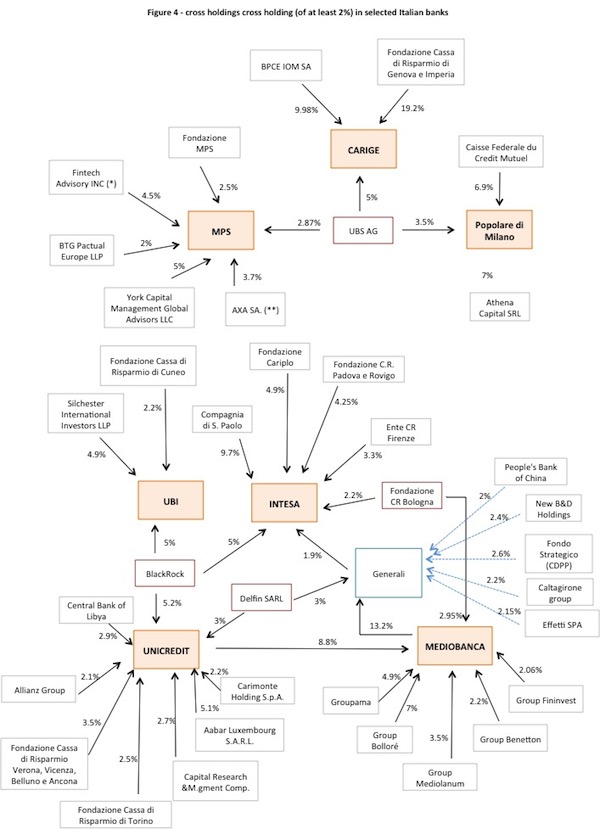

Hence, there has been a remarkable shift in the European mindset about banking crisis, from a first phase in which bail-in was a taboo, to a second one in which it is considered as a new normal and welcome practice. And there is in principle nothing bad about this idea, but the question is whether in rapidly overturning the approach, European policymakers have not overlooked important weaknesses that still exists in the system and could have important consequences in the perspective of applying these new rules. One such point of weakness could be the fact that banks are actually very substantial creditors to other banks, via cross-holdings of share as well as bank bonds. In its latest Financial Stability and Integration Report (April 2014), the European Commission reported that between 2008 and June 2013, out of the €630 bn of banks’ capital increase in aggregate terms, €400 bn correspond to increases in interbank positions and only €230 bn represent fresh capital injected from outside the banking system. Despite declining since the pre-crisis peaks, interconnectedness across banks remains high, and as of December 2013 “the counterparty for 24 percent of Euro area banking assets (or €7,400 bn) is another Euro area bank”.

ECB / Author calculations

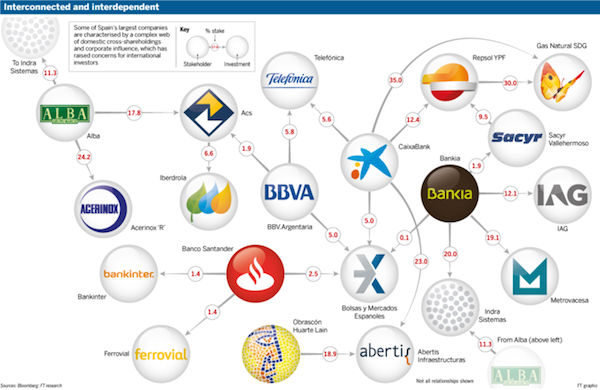

Figure 1 – originally published in this Bruegel post – shows how serious the situation is in the case of Italian banks, who appear to be strongly tied together in a network of cross-holdings. Figure 2 – compiled by the Financial Times back in 2013 – shows that the Spanish system was not immune to the problem either, although less striking. In the case of Italian banks, I pointed out that strong cross holding structure (with political interference) could impede the post-stress test needed reform, but that is not the only problem it raises. As a matter of fact, we could already witness an example of possible implications at the time when the Portuguese Banco Espirito Santo was resolved, last August. The second largest shareholder of BES was in fact another bank, i.e. Credit Agricole, which on the occasion of BES restructuring ended up taking a 708 mn euro hit from its stake in BES, nearly wiping out its second-quarter net profit, which fell 97.5 percent to 17 million euros.

Bloomberg; FT research

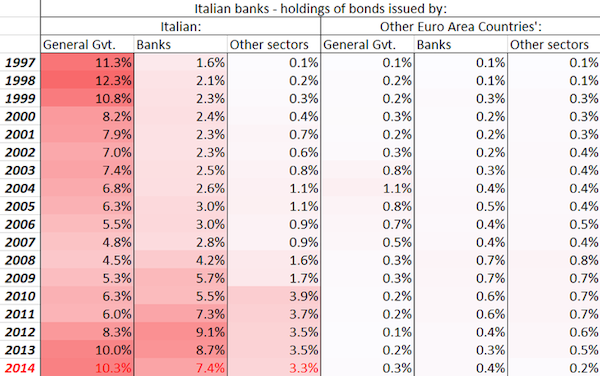

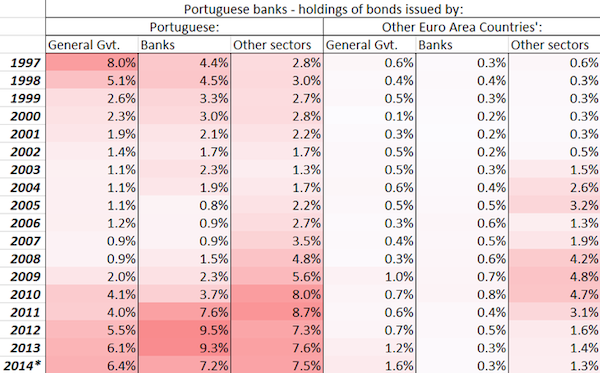

Banks’ bond holdings also represent a possible risk in view of resolution. Almost 40% of securities other than shares issued by banks in the euro area are held by other banks in the euro area at the aggregate level, according to ECB data, and holdings are also affected by home bias. The charts below show Italian and Portuguese banks’ holdings of bonds issued respectively by domestic government, other domestic banks and other domestic sectors. As a comparison, holdings of bonds issued by the corresponding sectors in other euro area countries (i.e. cross border rather than domestic holdings) are also reported. It is clear (and not new) that holdings by banks of bonds issued by the domestic government have increased a lot during the crisis, in same cases reaching back to the level of the 1990s. But what is even more noteworthy is the strong increase of holdings of bonds issued by other fellow domestic banks, which seem to have been traditionally very low but are now between 7 and 9% of total assets in these two countries.

ECB / Author calculations

ECB / Author calculations

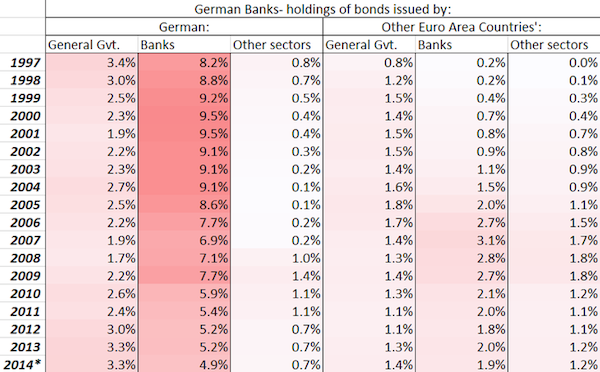

Figure 4 shows that this is not the case for French and German banks, which not only reduced (or at least did not increase significantly) their exposure to the domestic government, but which also decreased their holdings of bonds issued by other domestic banks as percentage of total assets.

.pmg

.pmg

ECB / Author calculations

ECB / Author calculations

It should therefore be clear that this strong interconnectedness makes the European financial system vulnerable in the context of bank resolution and rises concerns for the application of bail-in, which would become very difficult due to the possible systemic implications. In fact, as in the BES case, the creditors targeted by bail in would include to a large extent other banks, which would as a consequence fall in trouble as well. It follows naturally as a conclusion that one of the first priority for the ECB in its brand new role as supervisor should be to weigh possible measures to mitigate these problems. The ECB in its prudential exercise is including a capital add-on of 1 percent to take into account the systemic relevance of banks. This is in line with CRD IV rules, which include mandatory systemic risk buffer of between 1 and 3.5 percent CET 1 of RWAs for banks that are identified by the relevant authority as globally systemically important and also gives the supervisor an option to set a buffer on ‘other’ systemically important institutions, including domestically important institutions and EU-important institutions.

On top of imposing a capital buffer to limit the effect of interconnectedness once it has built up, one possible way to go would be to act on its underlying drivers to foster more diversification ex ante. There has been a lot of talk over the last years about the need to change the framework for the risk-weighting of government bonds in banks’ assets, in order to better reflect their actual degree of risk (which certainly was way above zero, during the crisis). Reports suggest that stricter rules on banks’ exposure to single counterparties could trigger a sovereign debt portfolio rebalancing in the order of €1tn across the region. The data presented here suggest that weakening the drivers of bank-bank national interconnectedness (e.g. by means of risk weights) and fostering portfolio diversification should also rank high on the priorities, in order to foster financial stability in Europe. Otherwise, we might sooner or later discover that by trying to fix the sovereign-bank vicious cycle we have instead fuelled a bank-bank one, no less dangerous.

Demeter

(85,373 posts)Illinois will have to find a new way to fix the worst pension shortfall in the U.S. after a judge struck down a 2013 law that included raising the retirement age. Yesterday’s ruling that the pension changes would have violated the state’s constitution undoes a signature achievement of outgoing Democratic Governor Pat Quinn and hands responsibility for tackling the state’s $111 billion pension deficit to Republican businessman Bruce Rauner, who defeated him in the Nov. 4 election.

State constitutions have been invoked elsewhere to try to prevent cuts to public pensions. In Rhode Island, unions settled with the state over pension cuts before their constitutional challenge could be put to the test. In municipal bankruptcy cases in Detroit and California, judges ruled that federal law overrode state bans on cutting pensions.

Illinois Attorney General Lisa Madigan, a Democrat, said she’ll appeal the ruling by Judge John Belz in Springfield and ask the state Supreme Court to fast-track the review.

“Today’s ruling is the first step in a process that should ultimately be decided by the Illinois Supreme Court,” Rauner said yesterday. “It is my hope that the court will take up the case and rule as soon as possible. I look forward to working with the legislature to craft and implement effective, bipartisan pension reform.”

Crewleader

(17,005 posts)What It Really Means

The Swiss Gold Referendum

by PAUL CRAIG ROBERTS

In a few days the Swiss people will go to the polls to decide whether the Swiss central bank is to be required to hold 20% of its reserves in the form of gold. Polls show that the gold requirement is favored by the less well off and opposed by wealthy Swiss invested in stocks. These poll results provide new insight into the real reason for Quantitative Easing by the Federal Reserve and European Central Bank.

First, let’s examine the reasons for these class-based poll results. The view in Switzerland is that a gold backed Swiss franc would be more valuable, and a more valuable franc would increase the purchasing power of wage earners, thus reducing their living costs. For the wealthy stock owners, a stronger franc would reduce Swiss exports, and less exports would reduce stock prices and the wealth of the wealthy.

The vote is clearly a vote about income shares between the rich and the poor. The Swiss establishment opposes the gold-backed franc, as does Washington.

http://www.counterpunch.org/2014/11/24/the-swiss-gold-referendum/

Demeter

(85,373 posts)It's grim, and I cannot fault his facts nor his conclusion. Makes me want to scream at Krugman, too.

Demeter

(85,373 posts)I was sitting with a friend, doing needlepoint and watching a very funny comic opera and laughing, when the police walk in, ask a couple of stupid questions, imply that the phone is out and taze me.

Usually, such a disturbing dream is my mind's way of waking me up to go to the bathroom, but that wasn't the case.

So I fed the cat, who had no food left, and tried to post this, but the "connection refused" screen came up.

I wonder if it was the cat....

Demeter

(85,373 posts)An FBI investigation led to the indictment of 16 people believed to have duped 290 investors of nearly $20 million with a get-rich-quick Detroit real estate scheme.

The suspects made calls to potential investors across the nation and offered to sell them homes for between $7,500 and $15,000, claiming the purchase price to be significantly less than the market value, when in fact the homes were often blighted and acquired for as little as $500, U.S. Attorney Barbara McQuade's office said in a statement Monday.

"After an investor agreed to purchase one home, the telemarketers caused the investor to believe that it was quickly resold to a hedge fund or foreign buyer for a substantial profit," McQuade's office said. "In reality, the property was transferred to a shell company controlled by the telemarketers for no consideration and there were no profits.

"Based on these sham transactions, which caused investors to believe that there was an established process and market for flipping homes in Detroit, numerous investors purchased multiple additional homes from the telemarketers." MORE

PROVING THAT THERE'S A SUCKER BORN EVERY MINUTE...

Demeter

(85,373 posts)Izhak Halbani (Florida resident)

Antwan Reid (Florida resident)

Scott Amster (Florida resident)

Richard Pierce (Michigan resident)

Matthew Golden (Michigan resident)

Erez Arsoni (New York resident)

Gregory Swarn (New York resident)

Joseph Arsenault (New York resident)

Richard Silverstein (Florida resident)

Michelle Pintado (Florida resident)

John Trumble (Florida resident)

Wayne Scott Simpson (Florida resident)

Theodore Jacobs (Florida resident)

Joseph Haden (Florida resident)

Scott Lipman (Florida resident)

Steven Goldstein (Florida resident)

LOOKS LIKE THE PROVERBIAL FLORIDA SWAMPLAND SCAM, BROUGHT HOME TO MICHIGAN

xchrom

(108,903 posts)Riyadh - OPEC's biggest crude producer Saudi Arabia will have its sights set on the upstart US shale oil business at a crucial cartel meeting to debate possible output cuts on Thursday.

Analysts say the kingdom is content to see shale oil producers -- and even some members of the cartel -- suffer from low prices and will resist pressure to reduce output and shore up the cost of oil.

A barrel of crude has plunged by about one third in value since June to around $80 in an increasingly competitive market.

Saudi Oil Minister Ali al-Naimi was silent about his government's intentions Monday as he arrived in Vienna ahead of the OPEC gathering.

Read more: http://www.businessinsider.com/afp-saudi-sights-set-on-us-shale-at-crucial-opec-meeting-2014-11#ixzz3K58KhyKB

xchrom

(108,903 posts)European stocks are climbing after Germany confirmed that it did not fall into recession in Q3. Here's the scorecard.

France's CAC 40: +0.15%

Germany's DAX: +0.46%

The UK's FTSE 100: +0.11%

Spain's IBEX: +0.45%

Italy's FTSE MIB: +0.59%

Asian markets were mixed: Japan's Nikkei closed up 0.29%, while Hong Kong's Hang Seng ended Tuesday down 0.21%.

US futures are down: ahead of the open, the S&P 500 is down 1.75 points, and the Dow is down 13 points.

Later today the biggest single piece of economic data is the second estimate of US GDP. That's out at 1.30 p.m. GMT, and economists are expecting a 3.3% annualised jump. Consumer spending figures are out at the same time, followed by consumer confidence at 3 p.m. GMT.

Read more: http://www.businessinsider.com/market-update-nov-25-2014-2014-11#ixzz3K58xbQtA

xchrom

(108,903 posts)America has an obesity problem.

It's not overweight people at risk of severe health problems and skyrocketing medical costs. That's a discussion for after the holidays. The problem at hand, which could affect millions, is far more troubling — and it has to do with pigs.

Hogs in the United States are too fat, and ham has never been more expensive than it is right now, which means that traditional hams — a staple of many an American Thanksgiving and Christmas dinner — could be priced off the menu this holiday season.

A new report from Bloomberg says that pigs in the US are the heaviest they've ever been. This may mean more pork per pig, but it's a problem because the hefty hogs' hind legs are too big to produce the 7-pound, spiral-cut half hams that commonly adorn the family holiday table.

The 7-pounders are the most in-demand hams during the holidays, HoneyBaked Ham Co.'s CFO Brian Mariuz told Bloomberg. But the cuts are also in the lowest supply.

Read more: https://news.vice.com/article/these-fat-pigs-could-ruin-your-holidays#ixzz3K59aAmTs

xchrom

(108,903 posts)The falling oil price is costing Russia up to $100bn a year, while Western sanctions have hit the country by $40bn, its finance minister has said.

Anton Siluanov made the comments on Monday at an international financial and economic forum in Moscow.

Reports on Monday suggested Russia could cut its oil production by about 300,000 barrels a day in an attempt to support the oil price.

Opec members meet in Vienna this week where falling prices will be discussed.

xchrom

(108,903 posts)Insufficient policy stimulus could be undermining potential growth, and risks deflation in the area, the market economy group said.

Meanwhile, Japan will grow less than previously expected over the next two years, it said.

The US and the UK are expected to grow more strongly in comparison, it added.

The OECD's report said: "The euro area as a whole, and in particular the vulnerable countries, seems to be most likely to be affected by persistent stagnation tendencies."

xchrom

(108,903 posts)The Joseph Rowntree Foundation (JRF) says there has been a big fall in pensioner poverty over the last decade.

At the same time there has been a rise in the number of adults under 25 who are hard up - and in the working poor.

But the government said poverty was now at its lowest levels since the 1980s.

The report, written for the JRF by the New Policy Institute, says there has been a "vast increase" in insecure work, such as zero-hours contracts, and low-paid self-employment.

DemReadingDU

(16,000 posts)11/24/14 Police investigating death of MassMutual executive

Family and friends of a Massachusetts insurance executive found stabbed to death in Connecticut this week gathered Sunday to hold a vigil in her memory.

Melissa Millan, 54, was found stabbed in the chest on Iron Horse Boulevard in Simsbury, Connecticut, Thursday, according to police.

Millan, a mother of two, was a senior vice president at MassMutual in Springfield. A spokesman for the company said she was a tremendous leader and deeply caring and that she would be missed.

Passing motorists found Millan lying on the ground Thursday at 8:04 p.m., according to Simsbury police. Police said she could have been out jogging but that they did not yet know what happened and are investigating.

Millan was taken to St. Francis Hospital where she died, according to police. Police announced Saturday they were investigating the incident as a homicide.

http://www.wcvb.com/news/police-investigating-death-of-massmutual-executive/29893228

more at Zerohedge

http://www.zerohedge.com/node/498214