Economy

Related: About this forumWeekend Economists Thanksgiving Leftovers November 29-30, 2014

Hard to believe another month is over. Even with my drastically reduced workload, the time flies by. Of course, I've only had a couple of weeks, so far, on the new schedule; not even enough to get the bugs out. And it is the season of rehearsals, performances and spectacles.

I actually did shop one store (at dinner time) on Black Friday. They reported steady, but not overwhelming traffic. And it snowed enough to make life interesting and slippery when we went to the movies:

We went to see "White Christmas", with Crosby, Kaye, Clooney and Vera-Ellen. Our local Michigan Theater, a 1927 Picture Palace lovingly restored, likes to host fun-filled singalong spectacles. We had goody bags, with Santa hats, a blue feather (for the fan dance) a horse for the knight-on-a theme, and these clever slapstick clappers and a candy cane, and sang a bunch of commercial Christmas songs (not carols) before the show with organ accompaniment on the recently restored Barton's pipe organ, which is original to the theater. It even has the tweeting bird feature from the silent film time...

The film itself, released 60 years ago, is creaky...it starts in WWII and lumbers forward. The acting is uneven, the plot ridiculous, and we had fun. It was rather like the Rocky Horror Picture Show, without the toast. The Kid enjoyed it, which is what was important.

One of the plot twists is that the unseasonable weather (in the 60F region) has left Vermont green and snowless....proving that New England weather has been capricious for some time...I spent one Thanksgiving in a convertible with the top down, and no coat...and another shovelling out that completely buried convertible...

The Kid also enjoyed "The Penguins of Madagascar", which I felt didn't live up to the previous Madagascar films. You have been warned...

This is the sequel to the earlier WEE thread, which got too long...keep on posting!

Demeter

(85,373 posts)I THINK THE GOOD DOCTOR SHOULD COUNT HIS BLESSINGS, BECAUSE DESPITE HIS SCOFFING, THERE WILL BE AN ENORMOUS CRASH, AND ALL THE QE IN THE WORLD WON'T PREVENT IT.

http://truth-out.org/opinion/item/27591-still-waiting-for-the-collapse

Sometimes the absurdity of what passes for economic wisdom surpasses even my highly adapted expectations. I really, truly expected that even Wall Street would consider the recent hyperinflation-in-the-Hamptons rant from Paul Singer - the billionaire inflation truther who is sure that the books are cooked - embarrassing and pretend that it never happened. But no. Apparently Mr. Singer's letter to investors is being passed around eagerly by traders and big shots who think it's the greatest thing since sliced foie gras. So what's this about? Jesse Eisinger at ProPublica recently tried to make a case for the rage of the hedgies. Mr. Eisinger argues that while it's foolish to claim that the inflation books are cooked, the government and the Federal Reserve Board have created a fake sense of financial health, so the overall perception that it's some kind of illusion is right.

Sorry, but I don't buy that.

For one thing, if you want to claim that past stress tests were all fake and that the banks were truly insolvent, shouldn't we have seen a reckoning by now? I'd say that, in retrospect, it's clear that many assets really were temporarily underpriced thanks to the market panic, and that once the panic subsided, the big banks were revealed to be in better shape than many people (including me) believed. Beyond that, Mr. Eisinger is imputing a reasonable analysis to the likes of Mr. Singer based on no evidence that I can see. I'd suggest that when Mr. Singer talks about a debased currency and fake economic growth, that's because he really believes that we have a debased currency and fake growth in the United States, not as a metaphor for some other kind of economic deception.

And where is that perception coming from? I still think a recent analysis from the economist Brad DeLong has it right. What we're seeing here are traders who looked at historical correlations - while disdaining macroeconomics - and concluded that low interest rates would surely rise back to historical norms. When those rates did no such thing, they looked at the Fed's intervention - and to them it looked like a big trader distorting markets, London Whale-style, by making huge bets that would surely go bad. So they sat back and waited for the collapse.

And the collapse keeps not happening because the Fed is not a rogue trader and historical norms for interest rates aren't relevant in a persistently depressed, deleveraging economy. But rather than acknowledge that they were wrong, let alone that Keynesian macroeconomics has something to teach them, they lash out and claim, "It's all fake!"

Also, really rich people often have no idea when they look ridiculous. After all, who in their entourage is going to tell them?

EVER THE OPTIMIST...IF ONLY THE ECONOMY WERE DELEVERAGING...INSTEAD, IT'S CRUSHING THE LITTLE PEOPLE. BUT FROM HIS IVORY TOWER, WE LITTLE PEOPLE ARE SMALLER THAN ANTS TO MR. KRUGMAN'S LOFTY VISION...

Demeter

(85,373 posts)I'LL BELIEVE THAT, RIGHT AFTER THEY START TREATING CUSTOMERS WELL...

http://www.theatlantic.com/business/archive/2014/11/a-new-business-strategy-treating-employees-well/383192/

While some companies squeeze staff to make more money, a growing number are testing the theory that they can have both profits and happy workers...Call centers are not, typically, very happy places—especially around the holidays. Workers have quotas to make, and often sit in bleak cubicles, headsets on, plowing through calls from stressed shoppers, as they count down the minutes until lunch.

But the employees in this call center in Vermont are rosy-cheeked and—can it be?—smiling. They field calls about misplaced packages and gluten-free dough, while surrounded by orange and red Thanksgiving decorations and a wall lined with baking gear that they’re allowed to borrow. They still have quotas—10 calls per hour, per agent—but they know they won’t get fired if they spend 45 minutes talking to a woman with cancer about baking, as one agent recently did.

“People just really care about each other and look out for each other,” said Julie Porter, a call center employee. “This is the company where somebody left a dollar bill on the floor, and sent around an email being like, ‘I found your dollar bill in the hallway if you’re looking for it.’”

Welcome to King Arthur Flour, a 225-year-old company that prides itself on treating its employees well. It’s not just lip service: King Arthur is one of a growing number of companies that has incorporated as a new type of business called a benefit corporation, which means its mission is to consider the needs of society and the environment, in addition to profit. There are 27 states that have passed legislation allowing companies to incorporate as benefit corporations since Maryland passed the first such law in 2010. Delaware’s governor signed a benefit corporation law last year, opening up the designation to the thousands of businesses incorporated there, which include nearly half of all publicly-traded companies...

SO, A NEW GIMMICK, OR A NEW WAY OF DOING BUSINESS? DO YOU SEE ANY OF THIS IN YOUR NECK OF THE WOODS?

Demeter

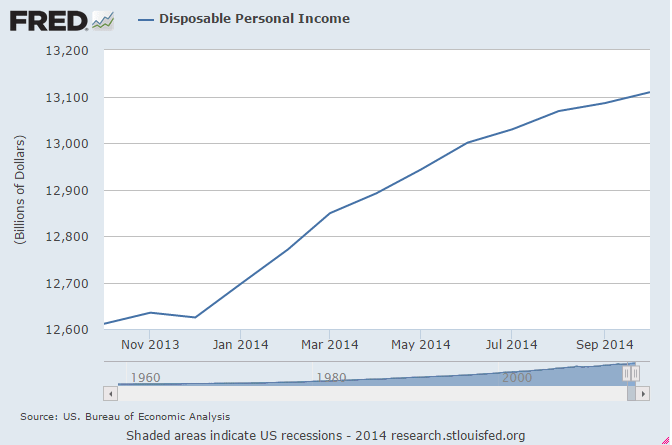

(85,373 posts)This is after tax personal income not adjusted for inflation. Note that there was anticipation of an acceleration from the first quarter, but now it looks like the growth has slowed and rolled over:

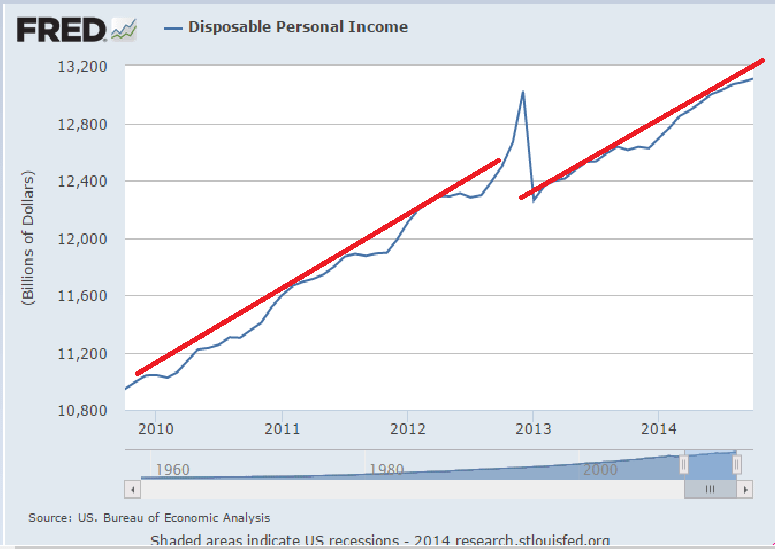

Here you can see how it was growing steadily, then shifted down when my payroll tax holiday expired, sort of resumed growing at the same rate, and now may be falling off, even with what the mainstream call ‘solid’ payroll growth:

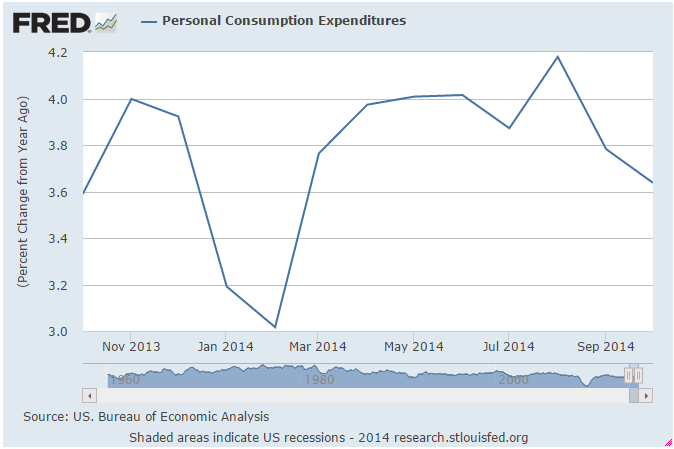

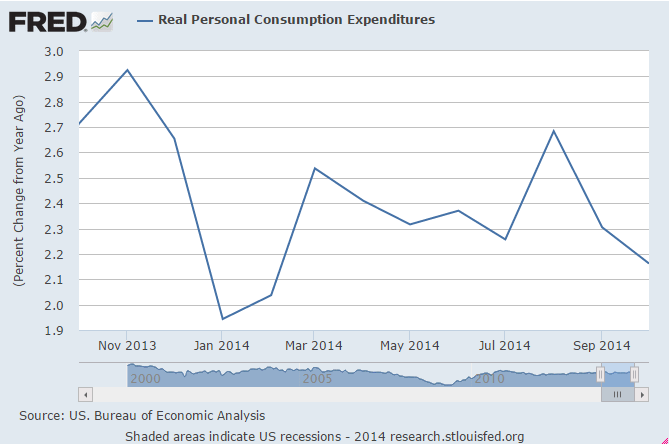

Likewise, there’s been a lid on the growth personal consumption expenditures where the growth rate dipped for the cold winter, recovered, and then fell off some:

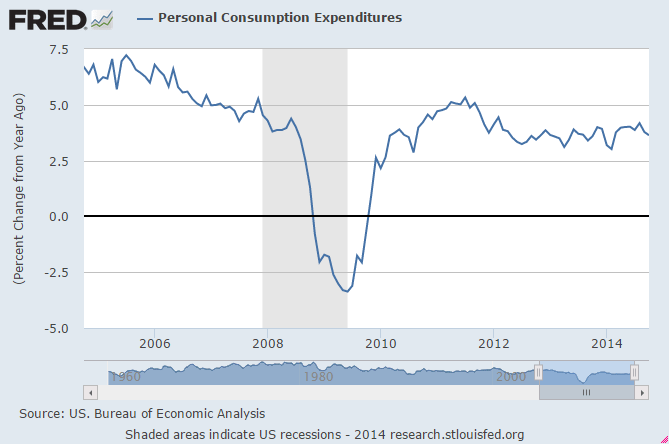

Adjusted for inflation/cpi the pattern is the same:

Oil- Not all that much to it. The Saudis remain price setter as a simple point of logic.

No telling what their price target may be at any time, but they simply set price for their refiners and let them buy all they want at that price. And no one else has the excess capacity to do that.

Possible motives?

Put high priced producers out of business with $trillions of losses to make sure that when they subsequently raise prices to 150(?) new investment in high priced crude will then be considered to risky for anyone to finance? And/or it’s not illegal for insiders to have gotten short for their personal accounts prior to the price cuts and subsequently covering prior to increasing prices, functionally transferring a bit of wealth from the state to private accounts?

Ramifications for the US:

US consumers helped a bit- about $100 billion/year last I heard? Capex gets hurt by at least that much? Trillions in value lost from loans and investments going south? Thousands of high paying jobs lost in North Dakota, etc. due to reduced capex? (EU not so much as they don’t invest nearly as much in high priced energy exploration/production?) Canada, Mexico, Venezuela, Australia etc. economies and related securities/investments toast?

etc.

Demeter

(85,373 posts)Beginning when I was an 18-year-old university student, I took out four Sallie Mae “Tuition Answer” loans worth about $36,000 between 2006 and 2008 – which was more than twice as much as I earned working my way through college – so that I could attend the City University of New York’s Hunter College. It’s a relatively affordable school, but due to the deaths of both of my parents when I was younger and the fact that my job at a local clothing store paid only $7 per hour, I still needed money to make ends meet. I felt uneasy signing the paperwork, but my school’s financial aid office was plastered with posters and pamphlets depicting smiling students whom Sallie Mae had allowed to follow their dreams and I was under the impression that they were benevolent. I had no idea that, without a cosigner, I’d end up with credit card-like interest rates, amongst a multitude of other problems.

Most people think of Sallie Mae as a purveyor of federally-backed student loans with low, government-mandated interest rates, regulated deferred payments and hardship waivers. And, looking back, the differences between the federal student loans and private, bank-backed student loans that Sallie Mae services were definitely blurry – listed in the same pamphlets, referred to as “Sallie Mae” loans, marketed in the same way. You could even say that Sallie Mae bases the reputation of its other, more predatory student loan products on the strength of the reputation of the federal loans everyone knows them for. (Perhaps that’s why reports surfaced in mid-November that the Obama administration may remove Sallie Mae from federal loan-servicing.)

But after I finished my undergraduate degree in 2009 and earned a Masters degree in geography in 2011, I wasn’t able to find work. The field of computerized mapping had previously been booming, but entry-level tech jobs had dried up. I couldn’t even get a job housekeeping at a local motel. And unlike federally-backed student loans – which give borrowers the option of income-based repayment plans or deferring payments altogether in cases of financial hardship – private lenders, like the ones behind the loans Sallie Mae gave me, are under no such obligation and have no incentives to offer any repayment flexibility. So, with no income and my private student loan payments, interest and fees, I was headed for default.

Sallie Mae’s collectors called me up to 10 times per day, even on weekends and holidays. I begged their representatives (and recorded the conversation on camera, as shown in the CNN documentary Ivory Tower) to make my payments affordable so that I could begin to pay them back rather than default. They refused. The only option Sallie Mae offered me to avoid default and subsequent financial ruin was to pay a $150 fee every three months to put my loans in “forbearance”. But interest – more than $1,100 per month on my $36,000 in loans – would still have continued to accrue and that $150 wouldn’t be applied to either the interest or the growing balance. It was mind-boggling.

Bankruptcy wasn’t even an option, thanks to the government’s 2005 “reforms”: you can now only use bankruptcy to discharge student debt in cases of extreme hardship, such as total and permanent disability. It would’ve been easier to get out from under my debt if I’d amassed it through using credit cards irresponsibly or even gambling, rather than taking out student loans to finance my education...

READ ON TO FIND OUT WHAT HAPPENED...

xchrom

(108,903 posts)LONDON (AP) — A government study into the scale of modern slavery in Britain suggests that up to 13,000 people in the country are victims — four times the previous estimate.

The Home Office figures released Saturday aimed to calculate the number of previously unreported victims. They include women forced into prostitution or sexually exploited for profit, domestic workers, and laborers on farms, factories and fishing boats.

The agency says many of the victims are brought in by traffickers from countries including Romania, Poland, Albania and Nigeria.

The report is part of the British government's strategy to tackle trafficking and other forms of modern slavery. Legislation on the topic is being debated in Parliament.

Read more: http://www.businessinsider.com/reportt-13000-people-in-modern-slavery-in-uk-2014-11#ixzz3KSkd1A5G

xchrom

(108,903 posts)DOUGLAS, Wyo. (AP) — Law enforcement officials in east-central Wyoming say they're seeing more crimes committed by workers newly arrived to the area's booming oil fields and don't have enough police and jail space to handle the problem.

Serious crimes including aggravated assault and larceny are up 17 percent in the Douglas area since 2009, according to the Wyoming Division of Criminal Investigation.

Emergency calls are up 9 percent from last year. Drug arrests are up from 37 in 2009 to 64 last year. And police were involved in two vehicle pursuits in September — the first in the city in three years, according to the Douglas Police Department.

"The industry is not picky," police Sgt. Matthew Schmidt said. "They need people who can physically stand the job, so they're not concerned about their conviction records."

Read more: http://www.businessinsider.com/a-crime-surge-has-accompanied-wyomings-oil-boom-2014-11#ixzz3KSlFAQcH

xchrom

(108,903 posts)Oil is still falling.

In afternoon trade on Friday, West Texas Intermediate crude prices in the US dropped more than 10% to settle at $66.15 a barrel, a more than $7.50 drop in just 24 hours.

At one point on Friday, WTI futures briefly breached $66.

Brent crude prices, which are the global benchmark, also cracked $70 a barrel on Friday.

Earlier this week, WTI prices were at around $76 and Brent prices were near $80.

The drop in crude prices is a continuation of the collapse that started on Thursday after the latest OPEC meeting saw the oil cartel maintain its current rate of production. Many in the market expected OPEC to announce production cuts to combat the recent decline in oil prices, which some have blamed on too much global supply.

On Thursday, WTI prices fell more than 6% to below $70 for the first time since June 2010.

http://static2.businessinsider.com/image/5478c367eab8eacc25c46f18-964-450/fut_chart%20(38).png

Read more: http://www.businessinsider.com/crude-oil-breaks-67-2014-11#ixzz3KSlt7Ntp

xchrom

(108,903 posts)Here were some of the biggest losers on Friday:

BP (BP), down 5%

Royal Dutch Shell (RDS.A), down 6%

Total (TOT), down 5%

Statoil (STO), down 14%

Exxon Mobil (XOM), down 5%

ConocoPhillips (COP), down 9%

Marathon Oil (MRO), down 13%

Occidental Petroleum (OXY), down 7%

Anadarko Petroleum (APC), down 14%

Linn Energy (LINE), down 13%

Whiting Petroleum (WLL), down 28%

Oasis Petroleum (OAS), down 32%

Read more: http://www.businessinsider.com/oil-company-stocks-tumble-november-28-2014-11#ixzz3KSmQihyU

xchrom

(108,903 posts)Among the factors Morse cited for why a production cut was unlikely is that Saudi Arabia has enough cash on hand to withstand the decline in oil prices so far.

And following OPEC's announcement on Thursday, Russian oil CEO Igor Sechin said that Russia could withstand a drop in crude prices to $60 a barrel.

Russia is not an OPEC member.

And so as oil prices continue to tumble a number of countries that rely on oil exports to balance their budget will certainly miss this goal in 2014, a few countries really stand out.

Iraq, Iran, Algeria, and Yemen never saw oil prices get above their breakeven price for more than just a few days in 2014.

But Libya looks like it never had a chance.

Read more: http://www.businessinsider.com/oil-production-breakeven-prices-2014-11#ixzz3KSn6nklB

Demeter

(85,373 posts)A huge pay raise under the Affordable Care Act for primary care doctors who treat the nation’s poor covered by Medicaid health insurance is set to expire at the end of the year. And with Republicans taking control of the U.S. Senate and retaining a majority in the U.S. House, maintaining the reimbursement increase is in doubt come January.

“Unless Congress acts to extend and fund this provision, Medicaid’s sudden return to disparate and inadequate payment for primary care services will again shut out people who have come to know and depend on their primary care physicians,” said Dr. Robert Wergin, President of the American Academy of Family Physicians

Under the health law, a primary care doctor – a family physician, a pediatrician or an internist – who treats Medicaid patients has been reimbursed to the generally higher level of the Medicare health insurance program for the elderly for scores of primary care services but only for 2013 and this year. By most estimates, this meant a payment increase of 60 percent or more to the Medicare payment rate. One idea behind the pay increase was to get more doctors to accept Medicaid patients and prevent other physicians from dropping out of a government program that hasn’t historically been well funded through a mix of state and federal tax dollars. Supporters of the law also hoped the new formula, funded with federal dollars from the ACA, would get more doctors to accept Medicaid patients just as the health law expands health insurance to millions more Medicaid beneficiaries who need a primary care physician. Because many doctors are paid by private health plans like Aetna AET +0.38% (AET), Centene (CNC), Humana HUM +0.35% (HUM) and UnitedHealth Group UNH +0.53% (UNH), the insurance industry and its provider networks could also be impacted.

The family doctors including others like the American College of Physicians, are urging Congress to pass the “Ensuring Access to Primary Care for Women & Children Act,” which has been introduced by U.S. Sen. Sherrod Brown, an Ohio Democrat, and U.S. Rep Kathy Castor, a Florida Democrat.

“This legislation maintains Medicaid payment for primary care services at least at Medicare rates and would enable primary care physicians to continue expanding the number of Medicaid patients they can accept,” Wergin added. “Further, to date it enabled family physicians to add employees and infrastructure needed to accommodate newly insured, vulnerable patients. Without this legislation, Medicaid payment will plunge to 2012 levels — as much as 63 percent lower in some states — and force practices to accept devastating financial losses or to decline additional Medicaid patients seeking care.”

WELL, THAT DIDN'T TAKE LONG...OBAMACARE WAS DESIGNED TO SELF-DESTRUCT! WHAT A POS POTUS WE HAVE!

AND MEDICAID, THE RED-HAIRED STEPCHILD OF GOVERNMENT SAFETY NETS, IS BACK TO LITTLE ORPHAN ANNIE WITH NO DADDY WARBUCKS.....

Demeter

(85,373 posts)MIT Professor Jonathan Gruber has inadvertently become a YouTube celebrity as a result of a video of him referring to the public as "stupid." The immediate point of reference was the complexity of the design of the Affordable Care Act (ACA), which Gruber was describing as being necessary politically in order to deceive the public. With the right-wing now in a state of near frenzy after the Republican election victories, the Gruber comment was fresh meat in their attack on the ACA.

Apart from merits of the ACA, there is something grating about seeing a prominent economist refer to the US public as "stupid." ...There is some truth to Gruber's comment in that most people are ill-informed about major public policy issues, including health insurance. This is in large part due to the fact that, unlike Gruber, most people have day jobs. They put in their shift at work and then often have child care and other family responsibilities. Most of them probably don't have much time to read the Congressional Budget Office's latest report on the health care system. But even worse, when people do take the time to get informed, the media let them down badly. Stories even in the best of outlets, like the New York Times and National Public Radio, often present information in ways that are misleading and often meaningless to nearly all readers. The New York Times gave us a great example of misleading reporting this weekend in an article headlined, "Cost of Coverage Under the Affordable Care Act to Increase in 2015." The piece then highlighted a number of plans which are increasing premiums by large amounts in 2015.

Anyone reading this article would likely get the impression that most people are seeing big insurance price increases in 2015. This is 180 degrees at odds with reality. The Kaiser Family Foundation found that the average cost of benchmark plans in the ACA exchanges actually fell slightly in 2015. (The chart accompanying the NYT article would show a story of declining prices or modest increases.) This is remarkable given the fact that insurance costs have been rising sharply for the last half century. Rather than highlighting the fact that for most people in the exchanges premiums are rising little or actually falling, the NYT decided to highlight that some people will pay more, if they don't change plans...

MORE AT LINK ON THE HOUSING BUBBLE AND THE ECONOMISTS WHO MISSED IT..

Dean Baker is a macroeconomist and co-director of the Center for Economic and Policy Research in Washington, DC. He previously worked as a senior economist at the Economic Policy Institute and an assistant professor at Bucknell University. He is a regular Truthout columnist and a member of Truthout's Board of Advisers.

Crewleader

(17,005 posts)

Demeter

(85,373 posts)When Hayward Ferrell of Huber Heights, Ohio, fell behind on his mortgage payments several years ago, his bank did not meet with him to try to work out a plan to make the loan easier to pay, he says.

“They never sat me down and said, ‘It looks like you are going to lose this, so why don’t you do this?’ ” he said. “They never did that.” The lender, U.S. Bank, foreclosed on the house in 2009.

Not engaging with borrowers who have missed payments may not seem like the strongest grounds for litigation against a bank. Yet that is the basis for an innovative lawsuit against U.S. Bank, a division of U.S. Bancorp, one of the largest banks in the country. The legal action could mean fresh legal problems for other big mortgage banks, as well. It is the latest threat to emerge from a barrage of cases that have forced big banks to pay tens of billions of dollars in recent months.

The lawsuit focuses on a popular type of government-guaranteed mortgage that in fact requires that banks take distinct steps — like trying to arrange a meeting — when borrowers stop paying...

!

Demeter

(85,373 posts)'TIS THE SEASON TO BE SQUEEZIN' FA-LA-LA-LA-LA, LA-LA-LA-LA!

Storied weapons maker Colt Defense LLC is in a pickle. But it’s not the only junk-rated company in a pickle. The money is drying up. Selling even more new debt to service and pay off old debt is suddenly harder and more expensive to pull off, and holders of the old debt – your conservative-sounding bond fund, for example – are starting to grapple with the sordid meaning of “junk”: Colt announced on Wednesday that it might not be able to make its bond payment in May.

Colt’s revenues plunged 25% to $150 million for the three quarters this year. It’s spilling liberal amounts of red ink. It has $246.5 million in assets, including $61.5 million in Goodwill and intangible assets. Without them, Colt’s $185 million in assets are weighed down by $416.8 million in liabilities, leaving it a negative “tangible” net worth of -$231.8 million. Cash was down to $4 million. In its 10-Q released on Wednesday, Colt admitted that there was “substantial doubt about the Company’s ability to continue as a going concern.”

Moody’s rates the company a merciful Caa2, reflecting “its very high leverage and weak liquidity position,” with negative outlook. This babe is deep into junk territory – and headed for default.

As is to be expected after this much financial engineering, the company is largely owned by a private equity firm: Sciens Management holds “beneficial ownership” of 87% of Colt’s LLC interests...Last week, it got some reprieve, if you can call it that: Morgan Stanley agreed to provide a $70 million senior term loan. This new money replaces Colt’s existing $42.1 million loan that the company said it would have otherwise defaulted on by the end of December. That’s how that original lender got bailed out: new debt to pay off old debt...The new loan will also permit Colt to make a $10.9 million interest payment. Otherwise, the company would have been in default by December 15. That’s how those bondholders got bailed out (for the moment): more new debt to service old debt...The loan would leave Colt with an additional $4.1 million in cash: new debt to pay for new losses.

YOU JUST KNOW THIS ISN'T GOING TO END WELL

MORE AT LINK

Demeter

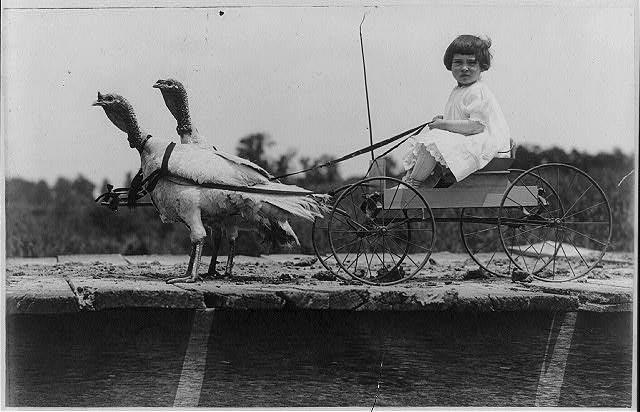

(85,373 posts)

During traditional turkey drives to Boston, children of Vermont farmers typically walked with the turkeys, scattering food to lure them forward -- but perhaps they would have appreciated wagon rides.

..."Turkey drives" were an autumnal tradition from the 1800s to the early 1900s, and involved the overland strolling of flocks of turkeys from all corners of Vermont to their destination — and demise — in Boston.

"We're talking about thousands of turkeys in each trip ... Up to 10,000," Peter Gilbert, chair of the Vermont Humanities Council, tells Vermont Edition. "One of the largest drives in the fall of 1824 involved 40 homesteads ... They went all the way from northern Vermont and the Canadian border by a variety of routes, through Ferrisburgh in the west, down the Connecticut River in the east."

THOSE CONNECTICUT RIVER TURKEYS MUST HAVE BEEN GOING FOR NYC...

Farmers' children often acted as drovers, scattering cracked corn in the turkeys' path to coax them along the route. And the route wasn't always smooth:

"Remember, in 1824 the roads were not very good," Gilbert says. "Sometimes they were just paths, sometimes they made their way across fields. Sometimes they had wagons, but this was a primitive and challenging trip."

The going was slow, Gilbert says — just 10 to 12 miles a day — and not without casualties. "They lost a lot of turkeys on the way — maybe 10 percent of them were drowned in river crossings or taken by foxes or died of natural causes. And one of the natural causes would be ... farmers’ families. As the turkeys walked by the farm, a couple of them might lose their way into a pot in the farm family’s kitchen."

MORE HISTORICAL GLIMPSES AT LINK

Demeter

(85,373 posts)...The economy, after all, is what voters almost always say is their top priority. And Democrats had to be heartened to see eight straight months of more than 200,000 jobs created prior to Nov. 4, an unemployment rate dipping below 6 percent, and a thriving stock market.

The economic picture in the homes of Americans, though, was a far different one. In fact, despite progress at the macro level, Americans' views of their own families' economies were basically unchanged -- even from the doldrums of the economic recession. The chart below tells the tale as well as anything we've seen....

You'll notice that one of these lines slopes upward. The other one -- the one that actually matters when it comes to actual votes -- does not.

The macro number (in red) is up to an average of 29 which, while not good, is still better than the single digits in the earliest days of the recession. It's progress. The personal-finance number, though, as of late October, was stuck at an average of 51. Back at the end of 2009, it was 50, and the lowest it ever got was 44. That's not progress...Even Obama, while trying to pump up the economic progress during his presidency, acknowledged this uneasy dichotomy. "They don't feel it," Obama said of the economic progress he believes his Administration had made in a "60 Minutes" interview in late September. "And the reason they don't feel it is because incomes and wages are not going up."

In the end, this was a big reason Democrats didn't have something to run on in 2014. And without a cogent argument for the success of the Obama Administration, their voters were left unmotivated and their candidates were left twisting in the wind.

DemReadingDU

(16,000 posts)One time we had a movie sing-a-long for The Sound of Music, with appropriate goody bag. That was fun, wish we had more of those.

antigop

(12,778 posts)1969 Tony Awards

Song starts around the 4:00 mark.

From the revival:

Demeter

(85,373 posts)it made me tired, just watching...

Demeter

(85,373 posts)HONESTY IS THE BEST POLICY...

http://thinkprogress.org/justice/2014/11/17/3592964/how-californias-program-to-have-inmates-fight-wildfires-could-be-keeping-people-behind-bars/

Out of California’s years-long litigation over reducing the population of prisons deemed unconstitutionally overcrowded by the U.S. Supreme Court in 2010, another obstacle to addressing the U.S. epidemic of mass incarceration has emerged: The utility of cheap prison labor.

In recent filings, lawyers for the state have resisted court orders that they expand parole programs, reasoning not that releasing inmates early is logistically impossible or would threaten public safety, but instead that prisons won’t have enough minimum security inmates left to perform inmate jobs.

The dispute culminated Friday, when a three-judge federal panel ordered California to expand an early parole program. California now has no choice but to broaden a program known as 2-for-1 credits that gives inmates who meet certain milestones the opportunity to have their sentences reduced. But California’s objections raise troubling questions about whether prison labor creates perverse incentives to keep inmates in prison even when they don’t need to be there.

The debate centers around an expansive state program to have inmates fight wildfires. California is one of several states that employs prison labor to fight wildfires. And it has the largest such program, as the state’s wildfire problem rapidly expands arguably because of climate change. By employing prison inmates who are paid less than $2 per day, the state saves some $1 billion, according to a recent BuzzFeed feature of the practice. California relies upon that labor source, and only certain classes of nonviolent inmates charged with lower level offenses are eligible for the selective program. They must then meet physical and other criteria.

In exchange, they get the opportunity for early release, by earning twice as many credits toward early release as inmates in other programs would otherwise earn, known as 2-for-1 credits. In February, the federal court overseeing California’s prison litigation ordered the state to expand this 2-for-1 program to some other rehabilitation programs so that other inmates who exhibit good behavior and perform certain work successfully would also be eligible for even earlier release.

As has been California’s practice in this litigation, California didn’t initially take the order that seriously. It continued to work toward reducing its prison population. In fact, the ballot initiative passed by voters in November to reclassify several nonviolent felonies as misdemeanors will go a long way toward achieving that goal. But it insisted that it didn’t have to do it the way the court wanted it to, because doing so could deplete the state’s source of inmate firefighters....

UGH--MORE AT LINK

Demeter

(85,373 posts)RATHER LIKE A BUSTER KEATON /KEYSTONE KOPS MARATHON....

http://studiotendra.com/2012/12/29/what-is-actually-going-on-in-iceland/

LONG READ, AND INFORMATIVE

Demeter

(85,373 posts)and I'm cooking, so I'd best get some rest. See you all in the spaces....

xchrom

(108,903 posts)Fifty years ago, President Lyndon B. Johnson made a move that was unprecedented at the time and remains unmatched by succeeding administrations. He announced a War on Poverty, saying that its “chief weapons” would be “better schools, and better health, and better homes, and better training, and better job opportunities.”

So starting in 1964 and for almost a decade, the federal government poured at least some of its resources in the direction they should have been going all along: toward those who were most in need. Longstanding programs like Head Start, Legal Services, and the Job Corps were created. Medicaid was established. Poverty among seniors was significantly reduced by improvements in Social Security.

Johnson seemed to have established the principle that it is the responsibility of government to intervene on behalf of the disadvantaged and deprived. But there was never enough money for the fight against poverty, and Johnson found himself increasingly distracted by another and deadlier war—the one in Vietnam.

Although underfunded, the War on Poverty still managed to provoke an intense backlash from conservative intellectuals and politicians.

Read more: http://www.theatlantic.com/business/archive/2014/01/it-is-expensive-to-be-poor/282979/?single_page=true#ixzz3KYSTueTN

Demeter

(85,373 posts)A nation that cannot meet its dreams, plans, expectations, nor even face its citizens with the truth.

A nation which preys upon its citizens, when it was supposed to be in league with them: of, by and FOR THE PEOPLE.

a nation which betrays every principle it stood for, every promise it ever made.

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)Hope you have a good turnout for the condo Thanksgiving!

Demeter

(85,373 posts)(I've got it in the oven now).

This nostalgic reminiscence of Boston by my favorite Vulcan is very like my own family's story, in different cities and different times...my father was of the same generation as Nimoy, and while he did go to California, too, he didn't like it and returned to Detroit...

Which is why I feel like such a stranger in my own land. I grew up in a city that was 20-50 years behind the East and West coasts. And now, even Detroit is going the way of Boston's West End--stolen to make a billionaire's fortune on the crushed dreams of a million people.

Demeter

(85,373 posts)Vera-Ellen retired from films to marry a Rothschild....they later divorced, their only child dead at the age of 3 months to SIDS. https://en.wikipedia.org/wiki/Vera-Ellen

DemReadingDU

(16,000 posts)and more at the wiki link

Demeter

(85,373 posts)“F*** the EU!”

Victoria Nuland, US assistant secretary of state, commenting on Ukrainian

policy on her mobile phone, as recorded and publicly distributed by the Russian

special services in February 2014

“Treason is a matter of dates.”

Attributed to Prince Charles Maurice

de Talleyrand-Perigord, drawing up European borders at the Congress of Vienna, 1815

The quality of US representation in eastern Europe seems to have declined, sadly, since the days of George Kennan and George Marshall in the 1940s and 1950s. European diplomacy, though, appears to have maintained the tradition of ethical flexibility that Prince Talleyrand embodied...Whatever your opinion of the morality of Russia’s intervention in Ukraine, or whether the Putin government’s larger strategy will have more gains than losses for the Russian state, there is no doubt the Russians have tactically outmanoeuvred the US and Europe in the financial markets. I am told the Pentagon is already studying Russia’s financial market moves in Ukraine to see how similar tactics might be used in future military crises.

The new Ukrainian government ministers, being chosen and sworn in since the new parliament first met on Thursday, have to deal with a collapsing currency, a corrupt energy pricing scheme that has helped bankrupt the state, and large imminent hard-currency payments to enterprises owned by the very state violating its borders with tanks and “volunteer” troops. This is all pretty visible. Yet interestingly, the prices in an actively traded market in Ukraine’s internationally held foreign currency bonds do not reflect these realities. An issue due in September 2015 was priced at around 85 cents last week, for a yield of 28 per cent; another bond due in July 2017 could be bought for 80 cents, for a yield to maturity of 19 per cent.

All of these bonds are “foreign law” issues, which means the terms cannot be altered unilaterally by the Ukrainian government using its own parliament and legal system. Until the end of next year, their interest and principal payments are, effectively, shielded by English law, Scandinavian arbitration boards and the Russian and Russian-backed forces at, and over, Ukraine’s borders. Russian institutions have been quick learners in understanding the uses of international law bonds. The terms under which it sold gas to previous Ukrainian governments reek of corruption, but also good technical lawyering, the effectiveness of which was only slowly understood by people who should have known better, such as the US administration. Take, for example, what the Americans now call “the booby-trap bond”, a $3bn bond issued by Ukraine to Russian holders a year ago, which is due in December 2015. It is not only enforceable under English law, but was registered on an Irish exchange. It has cross default clauses that are triggered if Ukraine misses a payment to any other entity controlled or majority owned by Russia. That includes a $1.6bn payment to Gazprom due at the end of this month. Oh, and Russia can call a default (which triggers a further default on the rest of Ukraine’s roughly $16bn bonded foreign debt) if the country’s debt to GDP ratio rises above 60 per cent – due, perhaps, to extortive Russian gas prices and a Russian-backed invasion and insurgency.

Thanks to a deep devaluation of the Ukrainian hryvnia, as well as the greater impoverishment of the population, Ukraine’s current goods and services account is probably close to balancing. However, its debt service burden is beyond the capacity of its foreign exchange reserves and forex earning capacity over the visible future. So the western countries can either grit their teeth and put up much of the money needed to pay off Ukraine’s maturing debts to Russia, whatever the fairness of the contracts behind them, or watch the economy collapse completely. If such a disaster happens, the US, Europe, the IMF and the other multilaterals will have to compete with Russia to offer humanitarian aid packages, which could be even more expensive. For the next year, official western and multilateral agency funds will support payments on Ukrainian obligations such as that $500m, 6.875 per cent bond. At 85 it is arguably underpriced, since it comes due before the maturity of the Russian “booby trap bond” in December. However, by the time we get to 2017 or 2019, there could be a crushing burden of official and multilateral debt outstanding, which will claim seniority over privately held foreign bonds. At that point, a drastic outright “haircut” or “reprofiling” of maturities into eternity looks a good bet.

The only way for Ukraine to rebuild enough economic strength and earned foreign exchange to avoid the consequent legal and economic mess is to voluntarily impose effective anti-corruption measures and market-based pricing for energy and other goods that end the oligarch model of development. In turn, these reforms would need to evoke not just reductions in wasteful and corrupt use on the demand side, but new production on the supply side. To anyone who has past experience with Ukrainian officials, this would appear to require intervention from, say, an archangel with a flaming sword. In this miserable winter, though, there may be enough popular sentiment against past practices to get the job started.

From the bondholders’ point of view, that is probably the only path to their being paid on schedule after the end of next year.

THIS IS ONLY ONE SIDE OF THE STORY, AND PROBABLY ONLY PART TRUE...I AM WILLING TO BET THAT THE POISON-PILL PROVISIONS IN THOSE BONDS WILL BE ACTIVATED ONLY BECAUSE OF VICTORIA NULAND AND HER CRONIES, OUT TO GOUGE THE UKRAINIANS, MEDDLING IN AFFAIRS THAT THEY WOULD HAVE BEEN WELL-ADVISED TO LEAVE ALONE.

AND AS FOR THE US MILITARY....GOLDMAN SACHS DIVISION....WHERE DO YOU THINK THE RUSSIANS GOT THIS "FINANCIAL TECHNOLOGY" IN THE FIRST PLACE? HOIST ON THEIR OWN PETARDS, THESE YANKS.

I'VE SAID IT BEFORE, AS HAVE MANY OTHERS: RUSSIANS ARE QUICK LEARNERS AND THEY KNOW HOW TO SURVIVE STUFF THE AVERAGE GOOD-OLE-BOY REDNECK OR THE PENTHOUSE ELITIST COULDN'T BEGIN TO IMAGINE...BUT THE AVERAGE BLACK AMERICAN IS WELL-ACQUAINTED WITH SUCH DEPRIVATIONS, IN MANY CASES.

Demeter

(85,373 posts)It went very well, and people stayed to clean up. The turkey and all is nearly gone, enough for a sandwich or two. Everything tasted good, and I am stuffed.

And so too this thread has come to its end. Thanks for participating! See you on SMW ![]()