Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 19 March 2015

[font size=3]STOCK MARKET WATCH, Thursday, 19 March 2015[font color=black][/font]

SMW for 18 March 2015

AT THE CLOSING BELL ON 18 March 2015

[center][font color=green]

Dow Jones 18,076.19 +227.11 (1.27%)

S&P 500 2,099.50 +25.22 (1.22%)

Nasdaq 4,982.83 +45.39 (0.92%)

[font color=green]10 Year 1.92% -0.10 (-4.95%)

30 Year 2.51% -0.06 (-2.33%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)BE STILL, MY BEATING HEART!

http://www.cnbc.com/id/102517452

Bank of America must allow shareholders to vote on a proposal that calls for the company to consider spinning off its investment banking business, after U.S. regulators told the bank it cannot exclude the proposal from its corporate ballot. The March 17 decision by the Securities and Exchange Commission, seen by Reuters Wednesday, marks a victory for Bartlett Naylor, a Bank of America shareholder who works for the non-profit Public Citizen. It also represents a reversal for the SEC, which last year rejected nearly identical resolutions filed by Naylor at Bank of America, as well as JP Morgan Chase and Citigroup. It also has rejected similar plans by other groups in the past.

Bank spokesman Lawrence Grayson said the bank "will respond to the proposal in our proxy statement. We do not believe that creating a separate subcommittee on shareholder value is necessary." He said the board "focuses on shareholder value and regularly analyzes these issues. We have reduced the size of the company by hundreds of billions of dollars as we have streamlined and simplified our business model."

...Naylor's shareholder resolution calls for the Bank of America board to consider appointing a committee of independent directors to develop a plan for divesting all of its "non-core" banking activities. In his supporting statement, Naylor said the plan was inspired by the 2007-2009 financial crisis in which the government bailed out mega banks due to soured mortgages and risky derivatives bets. He said the 2010 Dodd-Frank law did not go far enough to end "too-big-to-fail," and he fears shaky investments and underwriting could put depositors' money at risk in another meltdown.

******************************************************************

The SEC has been shaking things up this proxy season. In January, the agency backed off a ruling concerning a dispute between Whole Foods Market and shareholder James McRitchie. McRitchie was seeking to allow groups of shareholders who collectively owned 3 percent of Whole Foods stock to nominate their own directors on the company's proxy. Whole Foods sought to exclude McRitchie's proposal, saying it could do so because of an SEC rule that lets companies exclude a plan if it "directly conflicts" with a proposal by management. The SEC staff initially ruled in the company's favor. But on Jan. 16, the SEC said it had "reconsidered its position" and would express no views on Whole Foods, and would revisit its rules on conflicting shareholder proposals. Shareholder rights proponents lauded that decision, while trade groups like the U.S. Chamber of Commerce complained.

...Earlier this month, the SEC rejected a bid by Citigroup, Goldman Sachs and Morgan Stanley to block a proposal by the AFL-CIO seeking disclosure of so-called "golden parachutes" executives can earn if they leave for a government job...

Demeter

(85,373 posts)ONE BANK GETS BIGGER, WHILE ANOTHER SEEKS TO SHRINK TO MANAGEABLE SIZE...

http://finance.yahoo.com/news/revealed-jpmorgan-buyer-ocwens-45b-221710543.html

JPMorgan Chase & Co. JPM is set to re-enter the mortgage servicing business in a big way. The banking giant has been revealed as the buyer of Ocwen Financial Corp.’s OCN $45 billion of mortgage servicing rights (“MSRs”). This was disclosed by the newsletter Inside Mortgage Finance citing industry advisers.

Earlier this month, Ocwen announced signing of a letter of intent with a buyer (name not disclosed at that time) for sale of the above-mentioned MSRs. These MSRs formed part of a portfolio which consisted of roughly 277,000 performing agency loans owned by Fannie Mae FNMA. Further, Ocwen expects the deal to close by June-end, while loan servicing transfer will take place over the latter part of 2015. Notably, the transaction still requires approval from Fannie Mae and the Federal Housing Finance Agency as well as fulfillment of other customary conditions.

For JPMorgan, this deal comes as a reversal from its prior stance of doing away with MSRs. The company had sold $15 billion worth of MSRs to Ocwen in 2011, when the major U.S. banks were shedding this business owing to heightened regulatory scrutiny and increasing costs. Further, Basel 3 rules necessitated the presence of additional capital for MSRs held. All these led the banks to shed MSRs. However, as the overall mortgage originations continue to decline, banks are trying to recoup revenues through other channels, and servicing loans is one of them. JPMorgan’s mortgage originations fell 53% year over year to $78 billion in 2014. Further as of Dec 31, 2014, JPMorgan’s third-party mortgage loans serviced totaled $751.5 billion, while the company earned $3.61 billion as servicing-related revenues. Hence, we believe that after the completion of the afore-mentioned deal, JPMorgan will be better positioned to earn more revenues from servicing loan portfolios.

For Ocwen, the deal is in sync with its strategy to downsize the agency servicing portfolio. Previously, the company had announced the sale of $9.8 billion of MSRs backed by Freddie Mac FMCC to Nationstar Mortgage Holdings Inc. Both these deals, amounting to around $55 billion worth of agency loans, are projected to produce around $550 million over the next six months.

Demeter

(85,373 posts)HERBERT HOOVER, IS THAT YOU?

http://www.bloomberg.com/news/articles/2015-03-18/the-central-bank-of-central-banks-says-keep-calm-about-deflation?cmpid=yhoo

The central bank for central banks has some advice for policy makers fretting about deflation: Don’t. In a study bound to prove controversial in the corridors of power and academia, economists at the Bank for International Settlements concluded the connection between economic growth and shrinking prices is weak. Their number-crunching found that since World War II there were more than 100 years of short-term deflation across 38 economies studied, yet the average growth rate in those periods was higher than otherwise at 3.2 percent versus 2.7 percent. When inflation was more long-lasting, average growth was 2.1 percent.

In keeping with past warnings that the easy money now being targeted at sluggish prices risks generating financial market bubbles, the BIS found a stronger link between output growth and sliding asset prices. In the wake of equity and property price peaks, economic expansion is about 10 percentage points lower over five years.

The research “raises questions about the prevailing view that goods and services price deflations, even if persistent, are always pernicious,” said economists led by Claudio Borio, head of the BIS’s monetary and economic department. “There is a case for policy makers to pay closer attention than hitherto to the financial cycle -- that is, to booms and busts in asset prices.”

Deflation Fears

The assumption that deflation spells economic weakness is based on the idea it reflects a slump in demand and can prompt consumers and companies to retrench, pushing prices down further, the BIS economists said. Still, “good” deflation can be driven by supply forces such as cheaper oil or greater competition and can also spur output by increasing spending power and making export markets more competitive, they said. Modern-day deflation fears are rooted in the outlying experience of the Great Depression era of 1929 to 1938 when average growth was 4 percentage points weaker than usual, according to the BIS report.

As for the recent experience of Japan, which is said to have suffered “lost decades” because of deflation, the BIS said on a per capita basis, economic growth actually rose from 2000 to 2013 by 10 percent compared with 12 percent in the U.S. The findings, which echo those of a January report by Deutsche Bank AG, may prove contentious as central bankers from the euro-area to Japan step up monetary stimulus to stop their economies suffering a collapse in prices driven by declining commodity costs and soft economic growth.

Shareholder Reprimand

The BIS, which is owned by central banks and serves as a counterparty for them, has not been shy of crossing its shareholders. After sounding the alarm on asset price excesses which helped trigger the global financial crisis of 2008, it subsequently warned against ultra-loose monetary policy. It last year drew rebukes from central bankers including Federal Reserve Chair Janet Yellen and economists such as Nobel laureate Paul Krugman for declaring rates risked being raised “too slowly and too late” to counter asset-bubbles. Today’s attempt to quell deflation worries suggests it’s sticking to its guns.

“This article simply presents one small piece of additional evidence in a much bigger jigsaw puzzle,” said Borio and colleagues in the written report.

Demeter

(85,373 posts)http://www.nakedcapitalism.com/2015/03/john-helmer-imf-makes-ukraine-war-fighting-loan-allows-us-fund-military-operations-russia-may-repay-gazprom-bill.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

The International Monetary Fund (IMF) has agreed on a scheme of war financing for Ukraine. For the first time, according to Fund sources, the IMF is not only violating its loan repayment conditions, but also the purposes and safeguards of the IMF’s original charter. IMF lending is barred for a member state in civil war or at war with another member state, or for military purposes, according to Article I of the Fund’s 1944-45 Articles of Agreement. This provides “confidence to members by making the general resources of the Fund temporarily available to them under adequate safeguards, thus providing them with opportunity to correct maladjustments in their balance of payments without resorting to measures destructive of national or international prosperity.”

To deter Russian and other country directors from voting last week against the IMF’s loan, and releasing their reasons in public, the IMF board has offered Russia the possibility of, though not the commitment to repayment for Gazprom’s gas deliveries, and the $3 billion Russian state bond which falls due in December.

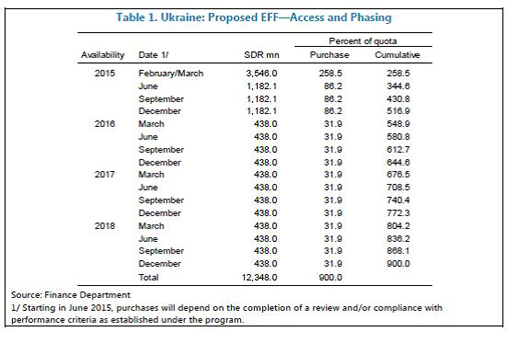

On March 11 the IMF board agreed to approve an Extended Loan Facility (EFF) for Ukraine for a total of 13.4 billion Special Drawing Rights (SDR), currently equivalent to $17.5 billion. Here are the IMF papers spelling out the details. The first tranche agreed for payment amounts to $4.6 billion, and was paid on Friday. According to the IMF, another $4.6 billion may be released in three installments later in the year – in June, September, and December. At the same time, the Ukrainian government is obliged to repay the IMF $840.1 million in past-due loan amounts and charges. The Fund’s managing director Christine Lagarde did not claim in her press release that this is new money. Instead, she said the IMF is making a “change in the IMF-supported program from Stand-By Arrangement [SBA] to Extended Arrangement under the EFF, which is consistent with the more protracted nature of Ukraine’s balance-of-payment needs.” Lagarde also claimed the loan’s purpose is to “support immediate economic stabilization in Ukraine and a set of deep and wide-ranging policy reforms aimed at restoring robust growth.”

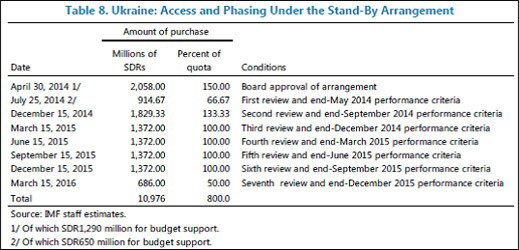

Lagarde implied this money is not for continuing the war in the Donbass, but counts on the February ceasefire becoming a permanent armistice. The EFF loan, she said, “involves risks, notably those stemming from the conflict in the east of the country. I am heartened that the ceasefire agreed last month in Minsk seems to be largely holding for now.” The loan papers don’t say the IMF will stop paying if it doesn’t. Instead, the Fund is saying it will supply cash so long as the war doesn’t exceed the present level of violence, and doesn’t break out of the line of contact towards Odessa in the south, Kharkov in the north, or Kiev. According to Thanos Arvanitis, a deputy director of the Fund’s European Department, “an essential assumption for the [EFF] program is the non-intensification of the conflict. So what we have assumed both for the macro framework and…the growth for 2015 and beyond, is that the ceasefire agreement holds, that the flare-ups that we have seen in recent periods do not repeat themselves and we think that with this the economy not affected directly by the conflict can start being delinked from the conflict.” The EFF is scheduled for disbursement over four years, with repayment stretched out until 2028. It substitutes for the Stand-By Agreement (SBA), the first Ukrainian loan the IMF board agreed to in April of 2014, six weeks after the ouster of President Victor Yanukovich. That loan for 11 billion SDRs ($17.1 billion) was signed for a two-year term. Payout was suspended in October of 2014, after two tranches of $4.5 billion had been paid. Repayment had been scheduled until 2019. Here is the original schedule for the SBA:

Source: http://www.imf.org/external/pubs/ft/scr/2014/cr14106.pdf at page 80

Counting until last week, the IMF had refused to hand over $5 billion of last year’s loan. The IMF Staff Report, just released, claims this wasn’t money withheld because the Kiev government had failed to meet the borrowing conditions, spending limits, and performance targets, but simply because “the funds were not purchased” (page 33). That’s outcome, not explanation.

Here is the new EFF loan schedule:

Source: http://www.imf.org/external/pubs/ft/scr/2015/cr1569.pdf

In the new IMF accounting, the Fund claims the EFF will provide $5.8 billion more than the abandoned SBA. In the old IMF accounting this is much less: subtracting the new EFF total from the old SBA total makes 1.372 billion SDRs, or $1.8 billion. In practice, by extending loan disbursement from March 2016 until December 2018, and by handing out just $4.6 billion to start with, the IMF is cutting back on last year’s promised exposure to the government in Kiev. The board is also reserving the opportunity to cancel the loan a second time, and bring repayments forward. The first tranche is substantially less than the “front-loading” requested by the US minister of Ukrainian finance, Natalie Jaresko. Take a magnifying glass to the tables titled “Ukraine Capacity to Repay Indicators” in last year’s SBA, and in this month’s EFF: it can be seen the newly scheduled repayments to the IMF are significantly larger from now until 2019 in the new scheme than they were in the old one, and of course they go on for much longer – another decade in fact. . For comparison, go to the SBA document, “Assessment of the Risks to the Fund and the Fund’s Liquidity Position”, page 10; for the EFF document, open this link, and go to the similarly titled document, page 13.

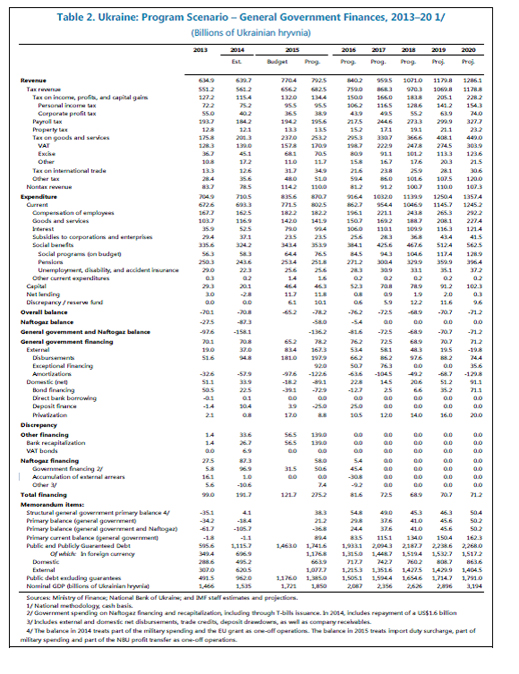

Source: http://www.imf.org/external/pubs/ft/scr/2015/cr1569.pdf at page 48

Look again at footnote 4: “The balance in 2014 treats part of the military spending and the EU grant as one-off operations. The balance in 2015 treats import duty surcharge, part of military spending and part of the NBU profit transfer as one-off operations.” This reveals that past and future spending on the war and the rearmament programme President Petro Poroshenko announced last week are “one-offs”, below the budget line, and not counted by the IMF in the conditions it has set for the release of the scheduled instalments. Since budget funds are fungible, and since the Ukrainian government and Verkhovna Rada (parliament) have agreed to increase military spending substantially, the IMF was asked to say why it is contributing to the war risks by allowing EFF support for military budget outlays at the same time as it is concealing their magnitude in reporting to the IMF board.

...American advocates of Ukrainian repudiation of the Russian bond include George Soros, who made his pitch in January. Click to read.

MORE MADNESS AT LINK

Demeter

(85,373 posts)This report does not bode well for Greece Prime Minister Alex Tsipras’ efforts to resolve what he regards as an impasse over negotiating process, but the IMF and possibly the ECB regards as a more fundamental out-trade. The IMF clearly regards the structural reforms that the previous government agreed to as very much in place, while Greece appears to believe that it had won the right to renegotiate them. Various media reports over the last few week suggest that Greece’s creditor are largely aligned with the IMF view, but that could unduly reflect German and financial services industry bias in reporting. Regardless, the IMF was clearly set forth in the memo as having to approve the reforms package with Greece before any funds could be released. Tsipras’ efforts to reach a “political” solution by going to top European officials ex Lagarde, meaning Merkel, Hollande, ECB chief Draghi, EC head Juncker look unlikely to succeed. Greece has never been an equal party in these talks. As we reported earlier, Greece was not a party to the drafting of the February memo; it was presented to Tsipras as a fait accompli, and the most favorable report says he asked only to have one word changed. Unless Merkel decides Grexit is too big a risk and decides to puts her foot down, Greece is unlikely to get any breaks. Indeed, the meeting could wind up having the European leaders tell Tsipras that he is at the end of his rope and needs to make some tough choices.

As Marshall Auerbach assessed the harsh remarks of the IMF via e-mail:

I guess you can say the deck is really stacked against Greece pour decourager les autres.

From Bloomberg:

In a short and bad-tempered conference call on Tuesday, officials from the IMF, the European Central Bank and the European Commission complained that Greek officials aren’t adhering to a bailout extension deal reached in February or cooperating with creditors, said the people, who asked not to be identified because the call was private.

German finance officials said trying to persuade the Greek government to draw up a rigorous economic policy program is like riding a dead horse, the people said, while the IMF team said Greece’s attitude to its official creditors was unacceptable. The German Finance Ministry didn’t respond to multiple requests seeking comment.

Concern is growing among officials that the recalcitrance of Prime Minister Alexis Tsipras’s government may end up forcing Greece out of the euro, as the cash-strapped country refuses to take the action needed to trigger more financial support. Tsipras is pinning his hopes for a breakthrough on a meeting with ECB President Mario Draghi, German Chancellor Angela Merkel, French President Francois Hollande and European Commission head Jean-Claude Juncker this week in Brussels.

Demeter

(85,373 posts)James Levy March 18, 2015 at 4:49 pm

I think the problem is deeper. You are a highly educated Greek finance minister. You walk into a room. You have some really good ideas about how to help your country both improve its economic conditions and pay off its creditors–two things you see as inextricably linked. But everything you and your Prime Minister says is met with incredulity and hostility. You are not having a discussion. You are not collectively searching for a rational accommodation. You are being lectured to, threatened, and ordered about like a flunky. So you try to get the discussion out of that room. But you find that the room and the media and the Eurozone are all the same place. It’s enough to make any highly intelligent person lose their marbles. It’s Kafkanomics!

BEEN THERE, DONE THAT, GOT THE SCARS TO PROVE IT

Cugel March 18, 2015 at 4:11 pm

Things proceed on course. Greece will be forced to capitulate 100% or else Grexit will be forced upon them amid withdrawal of support for the Greek banking system. They are going to “make the economy howl” as Nixon famously said of Chile before the coup.

The problem here is that there will be blow-back from all this. The Germans can be as smug as they want and wash their hands of the problems. But, it’s unlikely to convince anybody who doesn’t already swallow their propaganda. What it will do is convince the Southern European countries that they have no future in the Eurozone and that the sooner they get out the better. The extremist parties will flourish, especially the Nazis.

There’s been a lot of comment that the Germans prefer Golden Dawn. I doubt they think that way. They have a quasi-religious fixation on austerity, no matter how badly it fails. It’s simply an inability to see alternatives. They aren’t planning rationally at all. They can’t conceive of the concept of real cooperation, even to save themselves, and comfort themselves with the delusion that the crisis can “be contained” because nothing cataclysmic will happen in the next 6 months.

IT'S A FORM OF MENTAL ILLNESS...OR ELITISM

Demeter

(85,373 posts)Things are not looking good for Greece.

When Greece and the Eurogroup signed a four-month deal delineating how Greece could get access to desperately needed, so-called “bailout” funds, our reading of the agreement was that it reaffirmed the so-called Memorandum of Understanding, meaning the structural reforms that were part of the IMF loan program. That was very much a minority view at the time...It has proven to be correct. But Greece, which has a very different interpretation of the same text, is refusing to move forward with the discussion of the reform program, at least as envisaged by the Troika and the Eurogroup. That in turn is pushing already-strained relations to the breaking point. And notice that this is consistent with another early reading, that the two sides had no overlap in their bargaining positions. That meant unless one side or the other decided to capitulate on a key point, the negotiations would fail. That is the current trajectory.

That means the inertial path is that Greece does not in fact get much or any of the bailout funds it had hoped to obtain by the end of April at the latest. While the government is scrambling to find cash to make payments to the IMF and perversely, on a Goldman swap this month, it is borrowing from the pension kitty to do so. That means if tax collections do not improve, it may come up short on pension payments in upcoming months. It is not clear whether Syriza will be able to maintain public support if it fails to meet its pension obligations in full. And there is other evidence of the stress the government is under. Fresh releases of government data show that the government’s primary surplus was revised from an estimate by the previous government for 2014 of 1.5% to 0.3%. Worse, the primary surplus of the last two months was achieved only by virtue of cutting spending even further. Less government spending will only intensify the depression in Greece.

If you’ve been following the negotiations, there have already been signs that they are going pear-shaped. For instance, the Trokia has insisted that Greece submit a much more detailed version of its reform proposals; Varoufakis has not gone beyond a now-seven-page memo. And we have the bizarre contretemps stirred up in the German media over whether Varoufakis gave the finger in a presentation over two years ago when suggesting what posture Greece should take towards its creditors.

Here are some current sightings. From Reuters:

Describing the annoyance that has been building up among euro zone countries with the new Greek government’s approach, one euro zone official said: “For many people the teleconference this afternoon could be something of a last straw.”

Euro zone deputy finance ministers held a teleconference at 1530 GMT to get an “update on the state of play” on Greece, which is running out of cash and time to negotiate and implement reforms that would unblock loans to prevent it from defaulting.

But three sources with knowledge of the call said that, instead of an update, a Greek official had said these issues would be discussed by Prime Minister Alexis Tsipras at the EU leaders meeting in Brussels. Tsipras, whose left-led coalition took power in January, is due to meet German Chancellor Angela Merkel and French leader Francois Hollande as well as top EU officials.

Two sources said that one of the officials on the call, which the sources described as short, said following the Greek refusal to update that the creditors were “riding a dead horse”, suggesting the talks were getting nowhere.

European officials said they did not understand what Greece hoped to achieve by bringing the issue to the summit, where Greece is not on the formal agenda and could only be discussed in meetings on the sidelines and only in broad political terms.

This is at a minimum the second time in which Greece has tried to circumvent the process that it agreed to in the memo of late February, in which it would negotiate a detailed reform list with the Troika, which would then be subject to approval of the Eurogroup. Trying to renegotiate the shape of the table at this juncture is just about certain to fail. And Greece’s moves to proceed with its own reforms in light of the lack of an agreement with the Troika are also being rebuffed. From Paul Mason of Channel 4:

The so-called “humanitarian crisis bill” was set to provide free electricity for some households, and address poverty among pensioners and homeless families.

But in a communication seen by Channel 4 News, Declan Costello, director at the EC’s directorate for economic and financial affairs, has ordered the radical left-led coalition governemnt in Greece to stop. A planned law to allow tax arrears to be paid in instalments, set before the Greek parliament on Thursday, has also been vetoed.

Notice that the letter does not bar the humanitarian reforms per se, but stresses that Greece can’t implement measures willy-nilly but needs to do so as part of an agreed, coherent program. But Mason adds:

And this might also be the reason that Eurogroup head Jeroen Dijsselbloem suddenly started talking about the idea that Greece should impose capital controls. From a second Reuters story:

With tensions still running high, Greece attacked comments by Jeroen Dijsselbloem, head of the Eurogroup of euro zone finance ministers, who said pressure on Athens was growing and an emergency loan depended on real progress on reforms.

He said he wanted no repetition of events in Cyprus in 2013, when “the banks were closed a while, and capital controls – cash flows in the country and out of the country – were tied to all manner of conditions”.

Dijsselbloem is being more than a tad disingenuous. The Cyprus bank closures/bail in weren’t the result of some sort of misstep by Cyrus; it was a plan devised by the ECB. And the weapon that the ECB brandished to force the bank holiday and bail-in was the threat of the removal of the bank lifeline, the ELA...Understand what is happening: if Greece proceeds with its humanitarian relief plan and violates the February 20 memorandum, the ECB would have a ready excuse for withdrawing the ELA. In fact, some former central bankers believe that in the absence of a refinancing deal being at least arguably on track, the ECB would be required to withdraw it. That would force Greece to impose capital controls and nationalize its banks. And to recapitalize them, it’s not clear that Greece could do so adequately with scrip like TANs. If Greece were to reintroduce the drachma, that would amount to a de facto Grexit. How the authorities react to that is very much open to question. Past legal analyses (the most germane is by the ECB) finds that there is not exit mechanism from the Eurozone; it is described as “irrevocable.” The EU, by contrast, does have a sketch of an exit process defined in the Lisbon Treaty: a member can ask to leave, and if the EU and the member can’t negotiate how to do it, it nevertheless becomes official two years later. Needless to say, two years is an eternity in financial time. And the ECB analysis hand-wrings that that provision contradicts other sections of the treaty.

As we have said, the best solution for Greece would be to default but stay in the Eurozone. But it is not clear that its creditors would tolerate that....This is far from the first time we’ve seen this movie, where practical considerations were at odds with the political calculus. And in the cases of Creditanstalt and Lehman, politics won out.

A BIT MORE AT LINK

Demeter

(85,373 posts)Greece, as a country, represents 2% of Europe’s GDP. The country lied in its financial to enter the EU. Since that time, it’s been officially bankrupt since 2010. The country has since gone through a series of “bailouts” and experienced a 25% collapse in GDP (roughly equivalent to what Argentina experienced in its 2001 implosion). And yet, despite all the bailouts and claims that Greece was “fixed,” the country is set to default on some of its debt this Friday. How on earth does this farce continue? How can Greece be broke FIVE years after it was first allegedly “fixed”? The answer is very simple. Greece was never fixed. The Greek bailout was about getting money to German and French banks, many of which would go broke if Greece defaulted on its debts. This story has been completely ignored in the media. But if you read between the lines, you will begin to understand what really happened during the previous Greek bailouts. Remember:

1) Before the second Greek bailout, the ECB swapped out all of its Greek sovereign bonds for new bonds that would not take a haircut.

2) Some 80% of the bailout money went to EU banks that were Greek bondholders, not the Greek economy.

Regarding #1, going into the second Greek bailout, the ECB had been allowing European nations and banks to dump sovereign bonds onto its balance sheet in exchange for cash. This occurred via two schemes called LTRO 1 and LTRO 2 which happened in December 2011 and February 2012 respectively. Collectively, these moves resulted in EU financial entities and nations dumping over €1 trillion in sovereign bonds onto the ECB’s balance sheet. Quite a bit of this was Greek debt as everyone in Europe knew that Greece was totally bankrupt. So, when the ECB swapped out its Greek bonds for new bonds that would not take a haircut during the second Greek bailout, the ECB was making sure that the Greek bonds on its balance sheet remained untouchable and as a result could still stand as high grade collateral for the banks that had lent them to the ECB. So the ECB effectively allowed those banks that had dumped Greek sovereign bonds onto its balance sheet to avoid taking a loss… and not have to put up new collateral on their trade portfolios.

Which brings us to the other issue surrounding the second Greek bailout: the fact that 80% of the money went to EU banks that were Greek bondholders instead of the Greek economy. Here again, the issue was about giving money to the banks that were using Greek bonds as collateral, to insure that they had enough capital on hand. Piecing this together, it’s clear that the Greek situation actually had nothing to do with helping Greece. Forget about Greece’s debt issues, or protests, or even the political decisions… the real story was that the bailouts were all about insuring that the EU banks that were using Greek bonds as collateral were kept whole by any means possible. Thus, the Greek situation is really all about one thing: the BOND BUBBLE… specifically the fact that sovereign bonds are posted as collateral for derivative trades by the big banks.

The ECB doesn’t care about Greece. If it did, this problem would have been resolved five years ago by simply kicking Greece out of the EU until it regained its financial footing. And in fact, the whole issue is not even about Greece… the reality is that SPAIN, ITALY, and ultimately even FRANCE are in or approaching similar financial straits as Greece. At that point you’re talking about well over $3 TRILLION in sovereign debt, which is likely posted as collateral on well over $100 trillion in derivatives trades

The ECB and every other Central Banker/ political leader in the EU knows that what happens with Greece will serve as the template for the much larger, unmanageable problems for Spain, Italy, and ultimately France down the road. This is why the Greek debt crisis continues without end. The minute Greek bondholders have to take a REAL haircut, the wheels come off the EU. That day is approaching. And it will change the investment landscape for the entire globe as the $100 trillion bond bubble finally blows up… triggering a chain-reaction in the $551 trillion derivatives market.

Demeter

(85,373 posts)32 States Now Officially Bankrupt: $37.8 Billion Borrowed From Treasury To Fund Unemployment; CA, MI, NY Worst

http://www.zerohedge.com/article/32-states-now-officially-bankrupt-378-billion-borrowed-treasury-fund-unemployment-ca-mi-ny-w

Courtesy of Economic Policy Journal we now know that the majority of American states are currently insolvent, and that the US Treasury has been conducting a shadow bailout of at least 32 US states. Over 60% of Americans receiving state unemployment benefits are getting these directly from the US government, as 32 states have now borrowed $37.8 billion from Uncle Sam to fund unemployment insurance. The states in most dire condition, are, not unexpectedly, the unholy trifecta of California ($6.9 billion borrowed), Michigan ($3.9 billion), and New York ($3.2 billion). With this form of shadow bailout occurring, one can only wonder how many other shadow programs are currently in operation to fund states under the table with federal money.The full list of America's 32 insolvent states is below, sorted in order of bankruptedness.

California $6,900

Michigan 3,900

New York 3,200

Penn. 3,000

Ohio 2,300

Illinois 2,200

N.C. 2,100

Indiana 1,700

New Jersey 1,700

Florida 1,600

Wisconsin 1,400

Texas 1,000

S.C. 886

Kentucky 795

Missouri 722

Connecticut 498

Minnesota 477

Georgia 416

Nevada 397

Mass. 387

Virginia 346

Arkansas 330

Alabama 283

Colorado 253

R.I. 225

Idaho 202

Maryland 133

Kansas 88

Vermont 33

S.D. 24

Tennessee 21

Virgin Islands 13

Delaware 12

RandySF

(58,913 posts)Up 8% thus far for 2015. It can all go to Hell tomorrow, but so far so good.

corkhead

(6,119 posts)If I could afford one.

RandySF

(58,913 posts)I only needed $1,000 up front if I recall correctly. Even if you can just put in $100 a month it's still worth it.

Demeter

(85,373 posts)1. Barry Minkow

A 15-year-old kid, which makes the story all the more worthy. The guy went from nothing to millionaire, with an IPO and hit the big time. Then, he ended up in prison to pay for the dastardly deed. You have to admire him though. A smooth-talking crook as good as they ever get....He founded ZZZZ Best, a carpet-cleaning and restoration company at the age of 15, in San Fernando Valley. He had trouble making ends meet and despite his idea, he had banks closing down on him at the start because he was under age and minors can’t sign contracts or checks. He joined forces with Tom Padgett and forged documents for carpet restoration, stating that he was working on various projects to make it look like he had business. They set up a company to front the operation, Interstate Appraisal Services. The fake company gave the banks the ‘proof’ that he was raking it in and everybody believed him. Kids don’t lie, do they? The insurance company amounted to some 86% of his revenue. But, that was all fake. The carpet-cleaning company was bone fide, though. He financed his carpet-cleaning business by check-kiting schemes: he wrote checks from account X to finance account Y, and then wrote checks immediately from account Y back to account X and the money (which never existed) just got transferred from one account to another. Child’s play, wasn’t it? Now, don’t go getting any ideas, the banks will find out (one day)!

When Minkow left school, he needed investment and got it by meeting Jack Caitan, a businessman from LA that was involved in organized-crime deals....Within four years, by 1986, Minkow had decided to go public. By some superb twist of fate, the accountant that was involved in the launch on the NASDAQ never visited the insurance restoration sites and so never discovered that they were nothing more than empty mailboxes in San Fernando Valley. Minkow owned 53% of the company that was launched in January 1986. He became a millionaire! But, the company had no money. He couldn’t pay anyone and so decided to raise $15 million through an initial public offering of the company’s stock. He set up fake offices and buildings for the insurance side of things and the financial consultant (Mark Morze) faked thousands of documents. At 21, he became the youngest guy in history to have an IPO!

TV ads were launched and the flash cars were bought. Ambitions and greed shot through the roof of all boundaries of reason. Within just over a year, by February 1987, the company was being traded at $18 per share. It was now worth $280 million. Based on what? Nothing! Minkow was worth an estimated $100 million. He negotiated a deal and merged with the bone fide carpet-cleaners that were used by Sear’s. That was for $25 million, with ZZZZ Best being the surviving company. Apparently, he had hoped to use the cash from the new company to finish the fake business and go legal....The Los Angeles Times was tipped off about $72, 000 in credit-card fraud that Minkow had run up and that was just days before the signing of the merger deal. Shares plunged by 28% after that article. From then on, things just went from bad to worse. Shares tumbled to just $3.50 each by July 1988.Minkow ran off with $23 million in company funds and the company went bankrupt. The police stepped in and found that he had been laundering money and that it was an organized crime-den. At the hearing, there were 54 counts of racketeering. Dummy companies were discovered all over the place and 90% of the company’s activities were now considered as fraudulent. He got 25 years on March 27th 1989 and had to pay $26 million in restitution.

He was sentenced on the following counts:

racketeering

securities fraud

embezzlement

money laundering

mail fraud

tax evasion

bank fraud

credit-card fraud.

It cost the investors that were taken in by his talking to the tune of $100 million. He is considered as the largest one-man show for scams in the history of the stock-market. When he got out of prison in 1995, he had found god and seen the light. He became an Evangelic Pastor. But, he never lasted long. He was later involved in other shady deals, too, but that’s another story!

2. Michael Milken

Milken was known as the ‘Junk Bond King’. He worked for Drexel Burnham Lambert and he was their top man in the 1980s. At the height of his time, he was raking in $1 billion over a four-year period. That might sound like just peanuts today compared to some guys, but back then it was a record. He is still the 48th richest person in the world, according to Forbes and has a net worth of $2 billion. He provided the stock trader at Drexel (Ivan Boesky) with huge sums of money and they split the profits when he used insider knowledge of takeovers to hit the jackpot. Milken was arrested and indicted in March 1989 on 98 counts of racketeering and fraud. He was accused of misconduct, insider trading, stock parking (or the concealing of the real owner of stock) and tax evasion. He had been paid $5.3 million in 1986 for his share in illegal trading profits. He pleaded guilty in April 1990 to:

six counts of securities and tax evasion.

By pleading guilty immediately, he avoided further investigation and the other charges were dropped. He paid $1.1 billion in lawsuits related to these actions (of which there was a fine worth $600 million). He got sentenced to ten years in prison, but served just 22 months. He was banned for life from the securities industry. But, in February 2013, the Securities and Exchange Commission carried out an investigation to determine if he had violated this ruling, since he had allegedly provided consultancy to Guggenheim Partners regarding investment. He turned good and bought himself a couple of years less in purgatory, though. When he got out of prison he set up institutes for medical-research into prostate cancer. He was called ‘The Man Who Changed Medicine’ by Fortune magazine and it seems like prisoners can make it good when they get out of jail. I wonder if the same goes for everyone?

3. Hiromasa Ezoe

Ezoe was at the bottom of the insider trading scandal with a bit of corruption thrown in for good measure at Recruit, a human-resources and classifieds company in Tokyo. As Chairman, he offered shares to politicians and senior executives in a subsidiary company called Cosmos just before it went public in 1986. Cosmos was launched publically, the shares soared and most people ended up making a profit of 66 million Yen each. The Prime Minister of Japan at the time, Noboru Takeshita, and the Deputy Prime Minister, Yasuhiro Nakasone, were involved as well as other prominent members of the government. The government was forced to resign over the scandal.

There were 155 people that were indicted in the insider-dealing scheme.

The Nikkei fell by 40% as a result, rocked by the political scandal.

What happened to Ezoe? His trial lasted 13 years! He was given a suspended sentence after all of that! Just makes you wonder why they even bothered after all.

4. Bernard Madoff

No scammer would look himself in the face unless he pronounced the words Madoff, would he? This guy was the biggest scammer possibly of all. The dark side of Wall Street! He started swindling people way back in 1989, if not well before that. Remember, we probably only know the half of it. Madoff’s fraud was the largest scam ever to have taken place in the world and in history. Primarily because it lasted so long (until 2009). He cheated the world’s investors out of $65 billion. There are 9, 000 claims that have been filed against the guy! What was he offering? Low-risk, high-yield (sounds too good to be true, doesn’t it?). It came to light as early as 1999 when the Securities and Exchange Commission was made aware of the mathematical impossibility as to the gains being made by Madoff (at least the gains that were on paper). The New York SEC ignored the complaints in 2005 and 2007. The Boston SEC did the same as early as 2000 and 2001! Were people blinded? Or were they just turning a blind eye to the scam? False trading reports were being issued in the back office as and when Madoff ordered them for each client. Trades were backdated and manipulated, accounts were falsified. He simply deposited the client’s money into a special bank account at the Chase Manhattan Bank. He never invested it as they had believed he was going to. As clients asked for their money, he removed it from the account. Everything was going fine, at least until people started wanting their money back all at the same time. His was considered as the biggest Ponzi Scheme ever.

He accused his four largest clients in an interview from his prison cell saying that they were at fault: Norman F. Levy, Jeffry Picower, Stanley Chais and Carl Shapiro. They knew, according to Madoff exactly what he was doing and they should have stepped in before! He said that J. P. Morgan was in on it all too! They should have been alerted by the millions that were going into and out of the accounts. Better to blame someone else, isn’t it? In June 2009, he got a ridiculous (ridiculous not because of what he did that didn’t deserve it, but because it will never be served) 150 years in prison at the age of 71 and was found guilty on 8 counts of fraud, money laundering and theft. He had been turned in by his two sons.

5. Anthony Elgindy

Coming after the main-man Madoff, this guy seems like he is just small-fry. He was founder of Pacific Equity. Elgindy was providing stock advice via an internet site in the 1990s to people who were paying up to $600 a month to get his tips. Little did they know he was in actual fact working alongside the FBI agent that was investigating companies and so had inside information. He also used blackmail to extort funds from other companies, telling them that he would reveal negative (false) elements about the companies that his clients would believe. He was charged with stock manipulation and was fined $51, 000 for revealing information about companies. However, this was overturned by the Securities and Exchange Commission that decided that it was not manipulation to reveal information that was indeed true and accurate.

However, by 2005, he had been charged again for fraud, racketeering and other crimes in relation to FBI and SEC investigations that he had revealed to the public. His trial lasted four months and he was accused of revelations concerning 32 different stocks. He ended up with nine years in prison, however. He appealed, but his sentence was upheld in 2008. His total gains came to a measly $66, 000, which if you compare it to what Madoff ended up with and how much he lost for his investors, this guy really looks like he either got used as the scapegoat or got caught with his hand in the bag at the wrong time. Elgindy will go down in history as the short seller that people were afraid of; the guy companies didn’t want mentioning their names with adverse stuff about their companies as it would influence trades that day.

MORE TO COME!

Demeter

(85,373 posts)

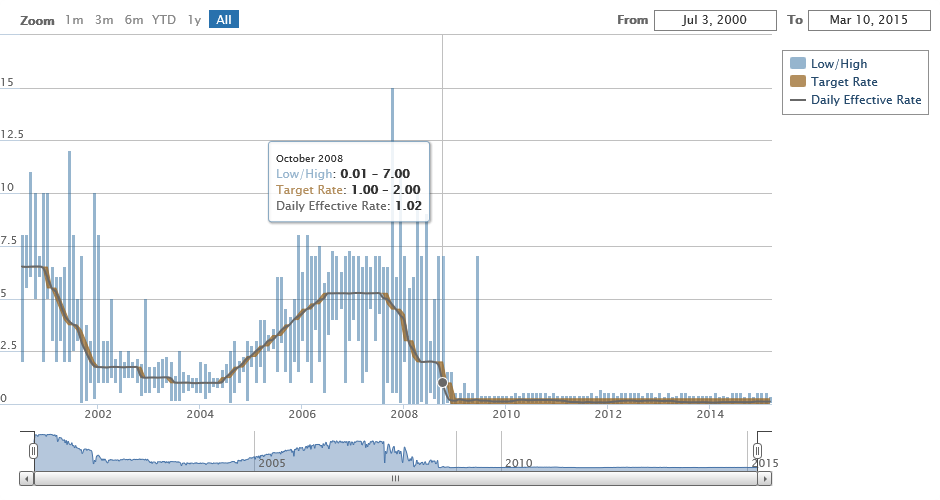

FOMC Debate on Rate Hikes

There is a lot of debate about what the Fed is going to say regarding rates next Wednesday at the FOMC Meeting. Will they change the language, will they signal rate hikes, etc. but pundits haven`t really addressed the main reason the Fed has to raise rates in June.

Consider the Alternative

The real reason is to consider the alternative, that they wait and raise rates at the next major quarterly Fed Meeting in September. If we assume the same continuous trends regarding employment, GDP, retail spending etc. that we have been producing for the last 12 months, then things are going to get real uncomfortable for the Fed and markets come the September FOMC Meeting. For example, the unemployment rate may be close to 5.2% or lower in September, wage inflation and the core inflation readings have been ticking higher. Both measures will only escalate if the current economic trends of small business and consumer optimism continue their current pace, and the gasoline stimulus starts pushing through for consumers from their bank accounts out into the broader discretionary spending landscape.

When Everyone including Financial Markets Realize that the Fed is behind the curve

This could cause the Fed and the markets to realize in retrospect that they are well behind the curve, and the dreaded 50 basis point rate hike comes in September, followed by another 50 basis point rate hike the following month. The turmoil in markets would be considerable to say the least and cause a severe asset reallocation in markets all at once. Those of you who wish for a delayed rate hike, only like that alternative if the Fed never raises rates, which is highly unlikely given the performance of the economy and its current pace of trending growth.

The Trade-off

Therefore if rates are going up even the most dovish market participants want the Fed to raise in June by 25 basis points, and slowly ease into the rate hiking cycle. Sure there will be some market turmoil, but market turmoil is inevitable given ZIRP for 7 years, there is no getting around this, and the Fed knows this fact. What these same dovish participants don`t want is a 50 basis point rate hike in September because the Fed waited way too long when it was obvious they should start raising rates in June. The Fed doesn`t want to cause this kind of market volatility. The tradeoff is a no-brainer, take a little pain now for markets, or a whole bunch of pain by waiting until September.

The September option risks the possibility that everyone knows it is too late to raise rates by slowly getting into the rate hiking cycle with a measly 25 basis point rate hike. That isn`t going to cut it in September with a 5% unemployment reading and a 25 basis point Fed Funds Rate. History and economic theory has proven this is disastrous to say the least.

BUT WAIT! THERE'S MORE!

DemReadingDU

(16,000 posts)3/18/15 Here Is Why The Fed Can't Hike Rates By Even 0.25%

There was a time when Zoltan Poszar was the most important person at the Fed (and Treasury), because he was likely the only person in the government's employ who grasped the enormity and complexity of the then-$30 or so trillion US shadow banking system. A quick refresh of his bio from the Institute for New Economic Thinking:

Mr. Pozsar has been deeply involved in the response to the global financial crisis and the ensuing policy debate. He joined the Federal Reserve Bank of New York in August 2008 in charge of market intelligence for securitized credit markets and served as point person on market developments for senior Federal Reserve, U.S. Treasury and White House officials throughout the crisis; played an instrumental role in building the TALF to backstop the ABS market; and pioneered the mapping of the shadow banking system which inspired the FSB’s effort to monitor and regulate shadow banking globally. Prior to Credit Suisse, Mr. Pozsar was a senior adviser to the U.S. Department of the Treasury, where he advised the Office of Debt Management and the Office of Financial Research, and served as Treasury’s liaison to the FSB on matters of financial innovation. He also worked with the Federal Reserve Board on improving the U.S. Flow of Funds Accounts.

While Zoltan is currently working in the private sector at Credit Suisse, he is perhaps best known for laying out, back in 2009, the full topographical map of the US shadow banking system in all its flow of assets (or is that contra-assets when it is a repo) beauty.

Which is also why we bring him up, because in a much welcome follow up to his previous work title "A Macro View of Shadow Banking" which we will discuss further in the coming days because it is not only Zoltan's shadow banking magnum opus and must read for anyone who wants to get up to speed with all the latest development in the unregulated shadow banking space, but because Poszar also provides perhaps what is the most important chart which explains why the Fed is so very terrified of even the smallest possible incremental rate hike of 0.25%.

more...

http://www.zerohedge.com/news/2015-03-18/here-why-fed-cant-hike-rates-even-025

Roland99

(53,342 posts)And here we thought we really could get by without Glass-Steagall!

Demeter

(85,373 posts)and wait until after the 2016 election....if it doesn't all come crashing down in the meanwhile.

If it DOES come crashing down....the election won't matter. They WILL be sweeping banksters up off the streets of Manhattan and London and Munich, though. So it's a fair exchange.

Demeter

(85,373 posts)Yves here. The lead story at the Financial Times, Europeans defy US to join China-led bank, updates this post. Key sections:

The decision by the three European governments comes after Britain announced last week that it would join the $50bn Asian Infrastructure Investment Bank, a potential rival to the Washington-based World Bank…

The AIIB, which was formally launched by Chinese President Xi Jinping last year, is one element of a broader Chinese push to create new financial and economic institutions that will increase its international influence. It has become a central issue in the growing contest between China and the US over who will define the economic and trade rules in Asia over the coming decades…

Britain hopes to establish itself as the number one destination for Chinese investment and UK officials were unrepentant. One suggested that the White House criticism of Britain was a case of sour grapes: “They couldn’t have got congressional approval to join the AIIB, even if they wanted to.”

By George Washington. Cross-posted from Washington’s Blog.

UK, Australia, New Zealand, Singapore and India All Sign On … South Korea Next?

This week, 2 major U.S. allies – 2 of the “Five Eyes” – have disregarded American please and joined China’s development bank … a new alternative to the US-dominated IMF and World Bank lending order. (A third member of the Five Eyes – New Zealand – previously signed onto the Chinese bank.) Specifically, the UK and Australia signed on this week. The Financial Times reports, quoting a senior US Official:

We are wary about a trend toward constant accommodation of China, which is not the best way to engage a rising power.

The New York Times reported last week:

***

South Korea and Australia, both of which count China as their largest trading partner, have seriously considered membership but have held back, largely because of forceful warnings from Washington, including a specific appeal to Australia by President Obama.

Zero Hedge predicted last week:

An Op-Ed in The Australian argues:

***

Canberra’s move follows similar decisions by Britain, Singapore, India and New Zealand.

Make no mistake — all this represents a colossal defeat for the Obama administration’s incompetent, distracted, ham-fisted diplomacy in Asia.

***

Since then, the Abbott government has felt absolutely zero subjective good will for Obama.

This is an outlook shared by many American allies.

***

The Obama administration has neither the continuous presence, nor the tactical wherewithal nor the store of goodwill or personal relationships to carry Canberra, or other allies, on non-essential matters.

***

Such prestige as the US enjoys in Asia these days rests disproportionately on the shoulders of the US military.

Obama has neglected and mistreated allies and as a result Washington has much less influence than previously.

The saga of the China Bank is almost a textbook case of the failure of Obama’s foreign policy.

***

Obama treats allies shabbily and as a result he loses influence with them and then seems perpetually surprised at this outcome.

***

The consensus is that the Obama White House is insular, isolated, inward-looking, focused on the President’s personal image and ineffective in foreign policy.

mahatmakanejeeves

(57,503 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/eta20150450.pdf

U.S. Department of Labor Employment and Training Administration Washington, D.C. 20210

Release Number: USDL 15-450-NAT

Program Contacts:

Tom Stengle (202) 693-2991

Tony Sznoluch (202) 693-3176

Media Contact: (202) 693-4676

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL

8:30 A.M. (Eastern) Thursday, March 19, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending March 14, the advance figure for seasonally adjusted initial claims was 291,000, an increase of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 289,000 to 290,000. The 4-week moving average was 304,750, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 302,250 to 302,500.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.8 percent for the week ending March 7, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending March 7 was 2,417,000, a decrease of 11,000 from the previous week's revised level. The previous week's level was revised up 10,000 from 2,418,000 to 2,428,000. The 4-week moving average was 2,418,000, a decrease of 1,250 from the previous week's revised average. The previous week's average was revised up by 2,500 from 2,416,750 to 2,419,250.

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending February 28 was 2,859,145, a decrease of 32,496 from the previous week. There were 3,350,028 persons claiming benefits in all programs in the comparable week in 2014.