Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 20 May 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 20 May 2015[font color=black][/font]

SMW for 19 May 2015

AT THE CLOSING BELL ON 19 May 2015

[center][font color=green]

Dow Jones 18,312.39 +13.51 (0.07%)

[font color=red]S&P 500 2,127.83 -1.37 (-0.06%)

Nasdaq 5,070.03 -8.40 (-0.17%)

[font color=red]10 Year 2.29% +0.02 (0.88%)

30 Year 3.08% +0.01 (0.33%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Yo-yo weather.

Demeter

(85,373 posts)37.8F, though

Demeter

(85,373 posts)Cash is a MAJOR problem for the Central Banks...The reason for this concerns the actual structure of the financial system. As I’ve outlined previously, that structure is as follows:

1) The total currency (actual cash in the form of bills and coins) in the US financial system is a little over $1.36 trillion.

2) When you include digital money sitting in short-term accounts and long-term accounts then you’re talking about roughly $10 trillion in “money” in the financial system.

3) In contrast, the money in the US stock market (equity shares in publicly traded companies) is over $20 trillion in size.

4) The US bond market (money that has been lent to corporations, municipal Governments, State Governments, and the Federal Government) is almost twice this at $38 trillion.

5) Total Credit Market Instruments (mortgages, collateralized debt obligations, junk bonds, commercial paper and other digitally-based “money” that is based on debt) is even larger $58.7 trillion.

6) Unregulated over the counter derivatives traded between the big banks and corporations is north of $220 trillion.

When looking over these data points, the first thing that jumps out at the viewer is that the vast bulk of “money” in the system is in the form of digital loans or credit (non-physical debt). Put another way, actual physical money or cash (as in bills or coins you can hold in your hand) comprises less than 1% of the “money” in the financial system. As far as the Central Banks are concerned, this is a good thing because if investors/depositors were ever to try and convert even a small portion of this “wealth” into actual physical bills, the system would implode (there simply is not enough actual cash).

Remember, the current financial system is based on debt. The benchmark for “risk free” money in this system is not actual cash but US Treasuries. In this scenario, when the 2008 Crisis hit, one of the biggest problems for the Central Banks was to stop investors from fleeing digital wealth for the comfort of physical cash. Indeed, the actual “thing” that almost caused the financial system to collapse was when depositors attempted to pull $500 billion out of money market funds. A money market fund takes investors’ cash and plunks it into short-term highly liquid debt and credit securities. These funds are meant to offer investors a return on their cash, while being extremely liquid (meaning investors can pull their money at any time). This works great in theory… but when $500 billion in money was being pulled (roughly 24% of the entire market) in the span of four weeks, the truth of the financial system was quickly laid bare: that digital money is not in fact safe.

To use a metaphor, when the money market fund and commercial paper markets collapsed, the oil that kept the financial system working dried up. Almost immediately, the gears of the system began to grind to a halt. When all of this happened, the global Central Banks realized that their worst nightmare could in fact become a reality: that if a significant percentage of investors/ depositors ever tried to convert their “wealth” into cash (particularly physical cash) the whole system would implode.

As a result of this, virtually every monetary action taken by the Fed since this time has been devoted to forcing investors away from cash and into risk assets. The most obvious move was to cut interest rates to 0.25%, rendering the return on cash to almost nothing. However, in their own ways, the various QE programs and Operation Twist have all had similar aims: to force investors away from cash, particularly physical cash. After all, if cash returns next to nothing, anyone who doesn’t want to lose their purchasing power is forced to seek higher yields in bonds or stocks.

The Fed’s economic models predicted that by doing this, the US economy would come roaring back. The only problem is that it hasn’t. In fact, by most metrics, the US economy has flat-lined for several years now, despite the Fed having held ZIRP for 5-6 years and engaged in three rounds of QE. As a result of this… mainstream economists at CitiGroup, the German Council of Economic Experts, and bond managers at M&G have suggested doing away with cash entirely.

This is just the beginning. Indeed… we've uncovered a secret document outlining how the US Federal Reserve plans to incinerate savings....

SALES PITCH AT LINK FOLLOWS

DemReadingDU

(16,000 posts)Cashless is a horrible idea.

![]()

Demeter

(85,373 posts)A breath-taking, hair-raising idea. It would undermine the entire global economy, in the short term.

In the long term, it would undermine capitalism.

But at a cost of how many generations of suffering?

Without computers, none of this would be possible. Most of "paper wealth" would not exist as a concept. Derivatives on actual paper? Can't see it happening.

It's all quat-loos to the 1%.

Demeter

(85,373 posts)I have thoroughly enjoyed working with you, but to answer the question many of you have asked: No, I will not be teaching at Assumption College again next year. Although I did receive an offer to return, the conditions that led me to decline that offer are most likely unfamiliar to many of you and your families. This letter aims to remedy that.

I am an adjunct (part-time) instructor. As such, I receive drastically less pay than full-time faculty members, and I receive zero benefits. Assumption College pays me $3,500 per course, which is more than many other institutions pay. But “more,” in this case, is still not even close to “good.” According to my own conservative calculations, I devote roughly 220 hours to every course I teach – including construction, delivery, administration, and evaluation – which means that my compensation equates to $15.91 per hour (less at other colleges). At Assumption, the department for which I teach typically has very few courses available for adjuncts (at other institutions, the number of adjunct-taught courses is often far higher), so I have never taught more than two courses per semester there. (With special administrative approval, I once taught four courses at another college in one semester.)

Because I earn so little, I must seek adjunct employment at more than one institution. This semester, for example, I taught at three different colleges. This is not atypical for many adjuncts. In central and eastern Massachusetts, securing adjunct work at multiple institutions is far easier to do, however, than in most other regions, given the number of colleges and universities here. But teaching more courses is incredibly taxing and time consuming.

In the past year, for example, I have taught 14 college courses for various institutions (equating to far more than 40 hours per week), and my total income barely touched $30,000, with zero benefits. By comparison, full-time instructors at various institutions typically teach eight to 10 courses per year, with starting salaries in the $50,000-$60,000 range or much higher, depending on the institution.

I know all too well, however, that I am one of the “lucky” ones. My personal situation (with a working spouse, and with access to more regional opportunities) is far different than that of many adjuncts. It is estimated that 25 percent of adjunct instructors nationwide receive some sort of public assistance. The issue of adjunct working conditions has achieved “hot-button” status in recent years, but little meaningful change has occurred. Two years ago, at another institution where I teach, the trustees responded to adjunct complaints by bumping the pay up roughly $200, to $2,900 per course, and my academic dean mailed me a miniature duffel bag with the school’s name on it. This is what passed as a morale boost!

Some part timers have joined adjunct faculty movements nationwide, conducting marches and launching protests such as boycotting teaching for a day. I personally have not attached myself to such movements, as their motives and methods strike me as oddly miscalculated and misguided. But I fully acknowledge that I am one of the lucky adjuncts, which is also why I feel compelled to make this principled stand in a public manner, in solidarity with those who cannot.

So why would a person do such work for pay that is frankly insulting? I truly believe that most of us do it because of our love for our academic disciplines and for teaching itself. Some adjuncts have retired from other jobs and seek only part-time work. Others, like me, started teaching as adjuncts in the hope that it would be a path toward a full-time position. In fact, I have been a finalist for a full-time faculty position on several occasions, so I’ve come very close (again, I’m lucky).

But the humiliation is too much at this point, and I’ve decided that I’m not going to do it anymore. Plenty of full-time faculty members agree. Department chairs are typically responsible for hiring new adjunct instructors, and on nearly every occasion in which I have been hired, the chair has awkwardly delivered the bad news regarding pay in similar fashion. To paraphrase: “The pay is abysmal. I’m almost embarrassed to tell you what it is.” My humorous deflective response has always been, “Well, let’s just keep that between us, so I won’t have to endure embarrassment as I wait in line with my colleagues for the copy machine.”

But it’s not funny anymore. Truly, it never was. Administrations, not department chairs, are responsible for making decisions about the pay of adjunct instructors. And for most, it’s not a priority. Surely, though, the marketing brochures you received from colleges and universities did not highlight their cost-cutting methods in staffing classrooms. They’re strangely quiet on this growing issue, which suggests a lack of pride in their own policies.

I already miss being in the classroom. And I always will. It’s what I need to do. But I need to find an alternative that doesn’t degrade my expertise and passion on a daily basis. For now, I’ll be teaching only online courses. Without having to worry about a 45-minute commute and gas money, my meager profit margin is looking brighter already.

David J. McCowin has taught survey, advanced, and graduate courses in history, religion, and interdisciplinary studies as an adjunct at seven colleges since 2000.

Demeter

(85,373 posts)What happens when you’ve been kicking the fiscal can down the road for years, but the road suddenly hits a dead end? That’s what Chicago – and the state of Illinois – are about to find out.

Chicago’s immediate problem is yesterday’s credit downgrade by Moody’s Investors Services, which turned its debt to junk and could force the city to immediately come up with $2.2 billion to satisfy debts and other obligations.

It’s not clear how – or if – the city could come up with that money.

When big cities have had debt crises – such as Detroit’s recent problems or New York City’s epic problems in the 1970s – states typically rode to the rescue in one way or another. But Illinois, which has the lowest credit rating of any state in the nation, says it can’t help the stricken city....

THAT HAS TO BE A JOKE...MICHIGAN DIDN'T SULLY ITSELF RESCUING DETROIT IN THE SLIGHTEST. THERE WAS NO KNIGHT RIDING TO THE RESCUE...JUST RICK SNYDER AND HIS PET BANKRUPTCY LAWYER.

THE ONLY HELP DETROIT GOT WAS AN HONEST AND COMPASSIONATE JUDGE WHO PUT THE SCREWS ON THE CREDITORS, ESP. THE BANKS.

Demeter

(85,373 posts)Curbing mainstream banking links to "shadow banks" will bolster confidence in the financial system while still allowing funding for the economy, European Union regulators said on Monday. The 2007-09 financial crisis prompted policymakers to shine a spotlight on the hitherto largely unregulated sector, which creates credit as do banks. The European Banking Authority (EBA) was responding to criticism that its proposed guidelines to limit banking exposures to shadow banks are too broad to be workable. It includes securitisation vehicles and alternative funds, a sector industry officials said is now being regulated.

Isabelle Vaillant, the EBA's director of regulation, said the guidelines will ensure banks hold enough capital to withstand spillovers from problems at shadow banks.

"There is no negative in being in the shadow-banking definition," Vaillant told a public hearing on the draft guidelines. "We are trying to push for confidence."

The guidelines are due to take effect around early 2016 when a bank's exposure to shadow banking should be no more than a quarter of its total capital buffers.

A financial lawyer who attended the hearing said this limit would be quickly breached at many banks given how many assets have moved from now heavily regulated banking to asset managers. Money market funds, currently in the EBA definition, could be removed once a draft EU law regulating them is approved, EBA officials said. The definition includes vehicles used by banks for securitised debt, a sector now a priority in EU plans for a capital markets union (CMU) to boost financing for companies as banks rein in lending.

A Deutsche Bank official said including securitisation was at "cross purposes" to the CMU plans. But Alexander Hodbod, a financial stability expert at the European Central Bank, an EBA member that supervises top euro zone lenders, said the guidelines were not some "huge clampdown" on market based finance. The sector that can play a "spare tyre" role when banking is under stress, he said.

"You need to have boundaries between the two sides," Hodbod said, adding that such boundaries mean both sides don't fail in a crisis.

Hodbod said funds were now getting large amounts of money from banks and he needed convincing as to why some asset managers should be excluded from the EBA definition. Regulators don't want to see such large amounts of credit moving from core banking into shadow banking and the 25 percent limit was a relatively light step to cut risk, Hodbod added.

I'M OF THE OPINION OF A PLAGUE ON BOTH THEIR HOUSES....UNTIL BANKING BECOMES A BORING PUBLIC UTILITY, THERE WILL BE DANGEROUS RISKS DE FACTO. BANKING SHOULD NOT BE A PROFIT CENTER. IT SHOULD BE A SERVICE, LIKE WATER, ELECTRICITY, SEWERS...

Demeter

(85,373 posts)ANOTHER RECORD BROKEN. YIPPEE. ALL THAT'S LEFT IS THE PLUNGE WHEN THE QE GOES AWAY.

http://www.reuters.com/article/2015/05/18/us-markets-stocks-us-idUSKBN0O312F20150518

The Dow Jones industrial average and S&P 500 ended at record highs on Monday, helped by a rally in Apple as well as tepid economic data suggesting the Federal Reserve may wait to raise interest rates. The S&P 500 racked up its third straight all-time high close, gaining 6.47 points, or 0.3 percent, to end at 2,129.2 points. The Dow .DJI rose 26.32 points, or 0.14 percent, to end at 18,298.88, beating its previous record close of 18,288.63 from March 2. The Nasdaq Composite .IXIC added 30.15 points, or 0.6 percent, to end at 5,078.44...With Monday's advances, the Dow is up 2.7 percent year to date, the S&P 500 is 3.4 percent higher and the Nasdaq is 7.2 percent stronger. The S&P now trades at 17 times expected earnings, expensive compared to its 10-year median of 15...Relatively light trading volume suggests recent gains may not be resilient, especially as the market approaches summer months when many on Wall Street takes time off, said Brunner. About 5.3 billion shares changed hands on U.S. exchanges, below the 6.4 billion average this month, according to BATS Global Markets.

U.S. homebuilder sentiment fell in May although most builders view market conditions as favorable, the National Association of Home Builders said on Monday. Slowing economic expansion in recent months, stemming partly from a stronger dollar and sluggish wage growth, has led many investors to push back expectations about when the Fed will begin raising interest rates for the first time since 2006.

"It's becoming more of the collective thought that the Fed can wait, because you really don't see any blistering growth," said Kurt Brunner, a portfolio manager at Swarthmore Group in Philadelphia.

Apple's (AAPL.O) shares rose 1.10 percent to $130.19 after Carl Icahn, one of the iPhone maker's top 10 shareholders, said the stock was "still dramatically undervalued" and that it should be trading at $240. Apple's rise was the biggest factor for the rise in the three major indexes.

Seven of the 10 major S&P 500 sectors were higher, with the financial index's 0.56 percent gain leading the way. Sentiment got a boost from talk of mergers and acquisitions...During the session, advancing issues outnumbered declining ones on the NYSE by 1,577 to 1,428, for a 1.10-to-1 ratio on the upside; on the Nasdaq, 1,719 issues rose and 1,014 fell for a 1.70-to-1 ratio favoring advancers. The S&P 500 posted 34 new 52-week highs and 2 new lows; the Nasdaq Composite recorded 111 new highs and 39 new lows.

Demeter

(85,373 posts)U.S. Bancorp and Bank of America Corp won a dismissal of claims in lawsuits accusing them of breaching their duties as trustees for residential mortgage-backed securities that suffered losses tied to the global financial crisis. The dismissals came in three decisions late Monday by U.S. District Judge Katherine Forrest in Manhattan.

In the first, Forrest rejected an attempt by funds from BlackRock Inc, Allianz SE's Pacific Investment Management Co and TIAA-CREF to hold US Bancorp liable for alleged defects in 843 RMBS trusts collateralized by $778.6 billion of loans, causing tens of billions of dollars of losses. The judge said the funds pleaded their claims incorrectly as to 33 trusts, and said she lacked jurisdiction over the other 810 trusts in light of a December ruling by the federal appeals court in Manhattan concerning Bank of New York Mellon Corp.

Separately, Forrest said the National Credit Union Administration lacked standing to sue US Bancorp and Bank of America over 74 RMBS trusts from which five corporate credit unions that later failed had bought certificates, because the certificates had been re-securitized.

In the third case, Forrest dismissed claims by several Ireland- and Cayman Islands-based entities against US Bancorp and Bank of America, also saying the plaintiffs lacked standing.

The judge gave all plaintiffs a chance to amend their complaints.

Blair Nicholas, a lawyer for the BlackRock, Pimco and TIAA-CREF plaintiffs, declined to comment. A lawyer for the NCUA and foreign plaintiffs did not immediately respond to requests for comment. US Bancorp spokesman Dana Ripley and Bank of America spokesman Lawrence Grayson declined to comment.

Bond issuers appoint trustees to ensure that payments are funneled to investors, as well as to handle much of the back-office work after securities are sold. Trustees have in recent years become a growing target for investors seeking to recoup losses on shoddy mortgages. They accuse the trustees of breaching their duties by failing to force lenders and bond issuers to buy back troubled loans. Investors have had mixed success suing trustees. Bank of America and US Bancorp last November agreed to pay $69 million to settle a lawsuit over their role as trustees for RMBS backed by loans from the failed Washington Mutual Inc.

Demeter

(85,373 posts)The New York Federal Reserve’s lead supervisor of Goldman Sachs Group Inc. has quit for a job advising other financial firms, triggering concerns within the Wall Street bank that some of its business secrets might not stay so secret. After learning last month that the examiner, Lance Auer, was joining the financial services practice of PwC, Goldman Sachs asked the firm whether he faced any restrictions on working for other banks, said two people familiar with the discussion. Auer, Goldman Sachs pointed out, had gleaned insights into operations and risk-management strategies that could be useful to competitors, the people said.

Goldman Sachs’s anxiety is a new twist on the debate over the revolving door where the usual complaint is that Wall Street benefits from hiring government insiders. Still, the issues raised by the bank highlight a growing focus on whether regulations that bar departing Fed examiners from sharing sensitive information are too vague and hard to police.

“You are never going to have rules that capture every form of behavior,” said Edward Kane, a professor of finance at Boston College. “It really comes down to the character of the individual firm and the character of the person.”

The concerns over conflicts of interest come as bank supervisors -- criticized for oversight failures before the financial crisis -- are making unprecedented demands for data and documents and even grilling board members. Ironically, the stepped-up scrutiny is fueling private-sector demand for consultants with Fed experience. PwC, which is also Goldman Sachs’s auditor, has worked to assure the bank that its proprietary information will remain confidential, said the people who asked not to be named because the discussions were private. PwC “is committed to the highest ethical standards and requires that all new hires, including those previously employed by a regulator, abide by the confidentiality obligations arising out of their prior employment,” Dan Ryan, head of the firm’s financial services advisory practice, said in a statement.

Auer, who is scheduled to start at PwC in June, was stationed inside Goldman Sachs’s headquarters. He declined to comment, as did spokesmen for the Fed, the New York Fed and Goldman Sachs.

While the New York Fed is charged with monitoring the biggest banks, it has long been accused of being too cozy with Wall Street. Its current president, William Dudley, is a former Goldman Sachs partner. Fed staff must adhere to federal rules and laws when they leave their jobs. Senior examiners are prohibited for a year from having substantive business contacts with the Fed and its regional banks. They also face a one-year ban on working for a bank they supervised. During and after their employment, Fed staff also are prohibited from disclosing examination or supervision records, non-public business data and strategic plans. Sharing such materials can be a federal crime.

Goldman Sachs itself fired two bankers last year after one of them allegedly shared confidential documents from the New York Fed within the firm. The New York Fed also terminated the employee it suspected of leaking the information. Yet, drawing the line between general knowledge of the industry and business details picked up as a supervisor is often difficult, former regulators and others who study banking said. Consultants argue that the experience of working at a regulator makes them better at keeping banks on the straight and narrow.

“There’s nothing like actually having been a bank examiner and knowing where to go look for the skeletons,” said Mayra Rodriguez Valladares, a former New York Fed employee who is now managing principal at consulting firm MRV Associates.

The recent boom in the financial-consulting business has been fueled by the 2010 Dodd-Frank law and the Fed’s emphasis on annual stress tests to determine the health of big banks. Lenders have complained that the stress tests are opaque, making Fed supervisors with knowledge of the process a valuable commodity. Many consulting firms, with a stable of former government officials, market themselves as having vital insight into the regulatory process. Promontory Financial Group, one of the largest and best-known advisory shops, promotes its consultants’ “deep and varied expertise gained through decades of experience as senior leaders of regulatory bodies.” Since its 2001 founding, the firm has snapped up at least two dozen former Fed employees.

“We require and expect all employees with prior public service to adhere scrupulously to their post-employment confidentiality obligations,” Promontory spokesman Mark Paustenbach said.

Along with Auer, 50, PwC recently hired Michael Alix, an ex-New York Fed senior vice president. In an October press release, the firm touted his “senior leadership positions” at the regional bank, including “oversight of supervisory stress testing and capital plan assessments.” Auer, too, wasn’t shy about detailing his knowledge of Goldman Sachs, according to a copy of his resume posted online.

“Lead the supervisory team responsible for analyzing and overseeing key business developments and changes to Goldman Sachs’s risk profile,” he wrote. “Engage in regular communication with C-Suite executives and Goldman Sachs’s board of directors to ensure that the Federal Reserve’s supervisory priorities are being addressed.”

Demeter

(85,373 posts)Chinese were once eager to latch onto the massive trade pact as a lever for internal reform. But with harsh U.S. rhetoric rising, that ship has sailed.... the U.S-led Trans-Pacific Partnership (TPP) accord, a project behind which U.S. President Barack Obama has thrown his full support, would originally join together 12 countries bordering the Pacific Ocean. Significantly, China isn’t on that list; in fact, in the months leading up to fast-track voting, U.S. officials have been selling the pact internationally and domestically as a deal to counter Chinese influence. But whether TPP becomes reality or not, China has already moved on. And the anti-China rhetoric the United States has deployed has ultimately done more harm than good.

TPP is more than just a trade agreement, at least to hear the Obama administration tell it. In recent months, U.S. officials seeking to win domestic support among skeptical Democrats have promoted it as a geostrategic cudgel to fend off a rising China. In an interview with The Wall Street Journal on April 27, President Barack Obama asserted, “If we do not write the rules, China will write the rules out in that region,” meaning the Asia-Pacific. “We will be shut out.” When Japanese Prime Minister Shinzo Abe met President Obama to discuss TPP, their explicit and implicit messages were “all about China,” according to Patrick L. Smith, a long-time correspondent in Tokyo. By continuing and intensifying the anti-China rhetoric in TPP discourse, administration officials have only made it more likely that the trade regime, if it becomes reality, will alienate China.

None of this was inevitable. As recently as two years ago, China was nervous about being shut out of the TPP. Li Xiangyang, dean of the Global Strategy Institute at the Chinese Academy of Social Sciences, a top government-linked think tank, remarked in 2012 that “TPP represents the gravest challenge China faces” on its upward trajectory, given its popularity in Asia and its exclusion of China. Scholar Fan Libo also argued in an article published in December 2012 that “the benefits of joining TPP outweigh the costs for China.” In May 2013, the Chinese Ministry of Commerce announced that China would “assiduously study” the pros and cons of TPP. Then in March 2014, at the conclusion of China’s National Party’s Congress and National People’s Congress, an annual event that directs major policy moves, Minister of Commerce Gao Hucheng spoke to domestic and international reporters. “We think the TPP is an important negotiation, and also a high-quality trade regime,” Gao said. “China is always open and accommodating to regional cooperation.” He also made it clear that China was well-informed of TPP negotiations through Sino-U.S bilateral dialogue mechanisms.

*****************************

Of course, China was not going to wait for the United States to come around. Quietly, China began searching for new ways to bolster its influence in Asia. In late 2013 Xi publicly announced for the first time what he called the “Silk Road Economic Belt” and the “21 Century Maritime Silk Road,” comprising what was later known as China’s New Silk Road in Eurasia. Things have been moving fast since. In Kazakhstan, China has signed economic projects in the areas of trade, industry, energy, technology, and finance, totaling $23.6 billion. In Belarus, in addition to a massive Sino-Belarus Industrial Park, modeled after the Suzhou Industrial Park near Shanghai, eight Chinese provinces and seven localities in Belarus have signed development projects with each other. In Russia, China has just finalized 30 economic projects, with a total worth of around $20 billion. China’s confidence in regional politics has also been boosted by its progress assembling the charter member ranks for its Asia Infrastructure Investment Bank, or AIIB. China proposed the AIIB in October 2013; a year later, 21 nations, all Asian, gathered in Beijing and signed the memorandum establishing the bank. Six months later, the membership has expanded to 57, including traditional U.S allies in the United Kingdom, Australia, and South Korea. Embarrassingly, U.S efforts to stop close allies like the United Kingdom from joining have failed. With these recent successes in their proverbial back pockets, Chinese officials and scholars no longer care as much about TPP. Li Xiangyang, a dean at CASS who was deeply concerned about TPP two years ago, now spends most of his time promoting the Silk Road. The initiative is “diverse and open,” he said; in contrast, “TPP uses high-standards to exclude nations,” and is “not real openness.” Scholars also argue that TPP imposes United States-drafted terms on others. “It has too much politics,” they noted, “while AIIB was driven by market principles.” Of course, the future is critically uncertain. China has been generally silent as the TPP debate goes on in America.

There’s a lesson here for U.S. policymakers: there are profound merits to staking trade standards on solid policy grounds, as opposed to the very different terrain of realpolitik. When the U.S speaks for labor, environment, and small inventors, it attracts reform-minded Chinese who can do much of the internal sales job themselves. When it lards initiatives like TPP with geopolitical significance, it only pushes China to focus on the same. After all the exhaustive back-and-forth on fast-track authority, the years of negotiation, and the recent, coordinated drum-beating about containing a rising China, the TPP may ultimately come to pass. But it’s too late to win hearts and minds in China. The world’s largest country has already moved on.

IN OTHER WORDS...OBAMA HOLDS A BUSTED FLUSH, AND CHINA AND RUSSIA HAVE CALLED...

HELLOFA POKER PLAYER!

Demeter

(85,373 posts)Soon Ukraine, its creditors and the international community will have to decide how that nation’s debt is to be handled in the context of its ongoing aid program. The case for debt reduction is as strong as any that I have encountered over the past quarter-century. How the issue is resolved will say much about the extent of the global community’s commitment to Ukraine and to resisting Russian aggression. Failure to achieve debt reduction would also confirm the view of those who believe that private financial interests disproportionately influence public policy.

Ukraine is in a quasi state of war with Russia, which has annexed Crimea and achieved a significant measure of control over swaths of eastern Ukraine. Other republics of the former Soviet Union and even the nations of central Europe are watching anxiously. How this episode is ultimately regarded by history will depend as much on what is done for Ukraine as on what is done to Russia. This is especially true because Ukraine has its best, most-reform-oriented economic team since it became independent at the beginning of the 1990s. Ukraine has shown real political courage in combatting corruption and especially in moving aggressively to curb energy subsidies that were generating vast waste, allowing the domestic price of gas to rise tenfold in the past year. Ukraine has done more in 12 months to reform such subsidies than most nations do in 12 years.

The moral, geopolitical and economic case for giving Ukraine strong support is compelling. The International Monetary Fund has done as much as can reasonably be asked of it by providing a heavily front-loaded program totaling more than $17 billion. While bilateral support from the United States and Europe could be increased and the World Bank is missing a major opportunity to make a difference, ultimately Ukraine’s viability depends on what happens to its debts. The question of debt rescheduling or reduction always arises when the international community steps in to support a country. It can always be argued that partially delaying or canceling debt-service obligations would be better than providing new money. Usually, as in the case of European countries recently, or Asian countries during the 1997 financial crisis, this argument is rejected on the grounds that, with proper economic reforms, countries can meet their obligations, maintain access to the global market and restore growth. There is also the broader consideration that without the possibility of temporary financing when countries face a financial shock, there will be little lending to emerging markets and, as a consequence, reduced economic growth. And certainly a world in which countries were willy-nilly encouraged to default on their obligations in order to meet budget obligations would be inimical to the effective flow of capital.

The international norms that have evolved over time point to the factors that determine when debt should be reduced. Most important, when a country’s debts are so large, and its economic prospects so poor, that there is no realistic prospect of its debt being paid back in full, it is accepted that debt reduction is appropriate as a matter of burden sharing and as a way to reduce the effect of overhanging debt on growth. Things become clearer in cases when debt reduction would not be a source of systemic risk to the global financial system or license widespread defaults. This suggests a compelling case for debt reduction in Ukraine. The IMF has made clear that for its finances to be sustainable, Ukraine needs both to reduce its debt service payments and avoid an excessive buildup of debt over the next five years. On even optimistic assumptions about Ukrainian economic performance and the avoidance of further conflict, this is not possible without debt reduction. Ukrainian debt is not nearly large enough for debt reduction to threaten the global financial system. And why not set a precedent that if you lend money to a country that is subsequently invaded, you should not expect the world’s taxpayers to mobilize resources so you can be repaid in full?

So Ukraine’s debt should be reduced. Will it happen? Despite the merits, it is not clear. Ukraine’s creditors, led by the investment firm of Franklin Templeton with the support of a number of major U.S. fund managers who are sufficiently embarrassed by their selfish and unconstructive position that they avoid public identification, are playing hardball and refusing to write off any of their debt. Understandably, if there are a substantial group of such free riders, other debt holders, including the Russians, will not accept write-downs. It should be unacceptable to taxpayers around the world that their money be put at risk on loans to Ukraine so that its creditors can be paid back in full. The IMF and national authorities should call out the recalcitrant creditors on their behavior. If necessary, Ukraine should be prepared to go into default, while the international community should make clear that it will continue to provide support if that happens. That would leave creditors with little choice but to accept the economic reality.

There is much in Ukraine’s situation that the rest of the world cannot control. But we can make sure that the scarce resources that Ukraine commands are put to use restoring its economy rather than paying off those who made loans they now regret. And we can seize the opportunity to make clear that the world financial system will be operated to support the global economy, not the other way round.

MAKES ONE WONDER HOW GREECE CAN GET INTO A STATE OF WARFARE, FOR HUMANITARIAN CONSIDERATIONS BY BANKSTERS....

Demeter

(85,373 posts)Ukraine’s parliament has passed a bill granting the government the authority to suspend foreign debt payments. The bill’s stated aim is to protect state assets in case of an “attack” from dishonest lenders, and to help the ailing economy out of crisis.

The bill passed by a 246-4 vote just hours after it had been submitted to parliament. The bill still needs to be signed by Ukraine’s President Petro Poroshenko to come into effect.

"To protect the interests of Ukrainian people, the Government of Ukraine submits to the Verkhovna Rada today the draft laws, those enabling the Government to suspend payments on certain external public debts and guaranteed by the government debts, as specified in the Annex to the relevant Regulation of the Cabinet of Ministers. And in case of an attack from unscrupulous creditors to Ukraine, the moratorium will protect the assets of the state and of the public sector," a statement on the Cabinet website said Tuesday.

In its statement the current Ukrainian government blamed the cabinet of ousted President Viktor Yanukovich for increasing Ukraine’s debt by $40 billion. The people of Ukraine never saw the money, which was wasted, the document added.

http://twitter.com/jason_corcoran/status/600594985151528960/photo/1

MORE DETAILS

Demeter

(85,373 posts)HSBC (HSBA.L) is to start charging other banks for depositing money in currencies of countries that have negative interest rates.

Europe's biggest bank will join a number of other U.S. and European banks to charge their peers for holding deposits - effectively passing on the cost of holding money where interest rates have turned negative.

The move will affect deposits from banks in euros, Swiss francs, Danish crowns and Swedish crowns. A European Central Bank’s bond-buying programme has depressed interest rates across Europe.

"HSBC charges banks for deposits they hold with us in currencies where negative interest rates apply. Banks affected have been notified and we continue to monitor the situation," HSBC said. It will start applying the charges in August.

The bank declined to say how much it had in deposits in the affected currencies. It will not affect the deposits of individual or corporate customers.

Demeter

(85,373 posts)JPMorgan Chase shareholders approved a controversial $20 million pay package for chief executive Jamie Dimon Tuesday, although fewer than two-thirds voted in favor. Support for the bank's executive compensation plan was 61 percent, according to preliminary results released at JPMorgan's annual meeting in Detroit. That is below the 77.9 percent support for the compensation package in 2014 and 92.4 percent in 2013. Dimon's 2014 compensation was the same overall level as in 2013, but the structure of the package came in for criticism from shareholder advisory firms Institutional Shareholders Services and Glass Lewis.

The two objected to the inclusion of a $7 million cash incentive bonus in the pay package, which replaced Dimon receiving comparable pay in stock during the last two years. JPMorgan said the cash award "reflects the board’s desire to return Mr. Dimon’s pay mix to market-competitive levels," and the board said his compensation overall was appropriate given the bank's strong performance. But ISS said substituting cash for stock eliminates an executive retention incentive, adding that the size of the award "appears arbitrary."

"While provision of cash incentives to top executives is standard compensation practice, the lack of strong rationale for reverting to substantial cash awards that have no connection to attainment of preset goals raises significant concern," ISS said.

In another sign of greater disenchantment of investors, a significant minority of shareholders (36 percent) also supported a proposal backed by ISS and Glass Lewis to require an independent chairman for the bank once Dimon retires. Dimon is one of a handful of chief executives at large banks who also serves as chairman. Critics say the presence of a chairman independent of the CEO would guard against conflicts of interest and ensure stronger risk-management. The board had defended the dual roles for Dimon as the best structure under the circumstances, and said it could change course down the road as needed.

JPMorgan reported $21.7 billion in earnings in 2014, up 21.4 percent from the prior year. However, the bank has continued to rack up huge legal bills which have hit shareholder returns.

On Wednesday, it is expected to join four other banks in a criminal settlement of charges it conspired to rig the foreign exchange market. Combined penalties on the five banks are expected to total in the billions of dollars.

Demeter

(85,373 posts)No wonder Washington never changes – 79 members of Congress have been there since Bill Clinton’s first term in the White House. This list includes names such as Reid, Feinstein, McConnell, McCain, Pelosi, Boehner, Rangel and Boxer. In this article, I am going to share with you a complete list of the members of Congress that have been “serving” us for at least 20 years. They believe that they are “serving” us well, but without a doubt most Americans very much wish that true “change” would come to Washington. In fact, right now Congress has a 15 percent approval rating with the American people, and that approval rating has been consistently below 20 percent since mid-2011. So of course we took advantage of the 2014 mid-term election to dump as many of those Congress critters out of office as we possibly could, right? Wrong. Sadly, incumbents were re-elected at a 95 percent rate in 2014. This just shows how broken and how corrupt our system has become. The American people absolutely hate the job that Congress is doing, and yet the same clowns just keep getting sent back to Washington again and again.

Our founders never intended for service in Congress to become a career, but that is precisely what it has become for many of our “public servants”. As of this moment, there are 79 members of Congress that have been in office for at least 20 years, and there are 16 members of Congress that have been in office for at least 30 years.

No wonder so many Americans are advocating term limits these days. When there are dozens of members of Congress that know that they are going to be sent back to Washington over and over again no matter how the American people feel about things, that can cause them to become extremely callous toward the will of the people. Instead, often these politicians become increasingly responsive to the needs of their big donors, because it takes big money to win campaign after campaign. I am sure that if George Washington, John Adams and Thomas Jefferson were running around today, they would be absolutely disgusted by how our system has evolved.

The following is a list from rollcall.com of the Republicans in the U.S. Senate that have served for at least 20 years and the dates when they first took office…

Orrin G. Hatch, Utah Jan. 4, 1977

Thad Cochran, Miss. Dec. 27, 1978

Charles E. Grassley, Iowa Jan. 5, 1981

Mitch McConnell, Ky. Jan. 3, 1985

Richard C. Shelby, Ala. Jan. 6, 1987

John McCain, Ariz. Jan. 6, 1987

James M. Inhofe, Okla. Nov. 30, 1994

The following is a list from rollcall.com of the Democrats in the U.S. Senate that have served for at least 20 years and the dates when they first took office…

Patrick J. Leahy, Vt. Jan. 14, 1975

Barbara A. Mikulski, Md. Jan. 6, 1987

Harry Reid, Nev. Jan. 6, 1987

Dianne Feinstein, Calif. Nov. 4, 1992

Barbara Boxer, Calif. Jan. 5, 1993

Patty Murray, Wash. Jan. 5, 1993

The following is a list from rollcall.com of the Republicans in the U.S. House of Representatives that have served for at least 20 years and the dates when they first took office…

Don Young, Alaska March 6, 1973

Jim Sensenbrenner, Wis. Jan. 15, 1979

Harold Rogers, Ky. Jan. 5, 1981

Christopher H. Smith, N.J. Jan. 5, 1981

Joe L. Barton, Texas Jan. 3, 1985

Lamar Smith, Texas Jan. 6, 1987

Fred Upton, Mich. Jan. 6, 1987

John J. Duncan Jr., Tenn. Nov. 8, 1988

Dana Rohrabacher, Calif. Jan. 3, 1989

Ileana Ros-Lehtinen, Fla. Aug. 29, 1989

John A. Boehner, Ohio Jan. 3, 1991

Sam Johnson, Texas May 18, 1991

Ken Calvert, Calif. Jan. 5, 1993

Robert W. Goodlatte, Va. Jan. 5, 1993

Peter T. King, N.Y. Jan. 5, 1993

John L. Mica, Fla. Jan. 5, 1993

Ed Royce, Calif. Jan. 5, 1993

Frank D. Lucas, Okla. May 10, 1994

Rodney Frelinghuysen, N.J. Jan. 4, 1995

Walter B. Jones, N.C. Jan. 4, 1995

Frank A. LoBiondo, N.J. Jan. 4, 1995

Mac Thornberry, Texas Jan. 4, 1995

Edward Whitfield, Ky. Jan. 4, 1995

The following is a list from rollcall.com of the Democrats in the U.S. House of Representatives that have served for at least 20 years and the dates when they first took office…

John Conyers Jr., Mich. Jan. 4, 1965

Charles B. Rangel, N.Y. Jan. 21, 1971

Steny H. Hoyer, Md. May 19, 1981

Marcy Kaptur, Ohio Jan. 3, 1983

Sander M. Levin, Mich. Jan. 3, 1983

Peter J. Visclosky, Ind. Jan. 3, 1985

Peter A. DeFazio, Ore. Jan. 6, 1987

John Lewis, Ga. Jan. 6, 1987

Louise M. Slaughter, N.Y. Jan. 6, 1987

Nancy Pelosi, Calif. June 2, 1987

Frank Pallone Jr., N.J. Nov. 8, 1988

Eliot L. Engel, N.Y. Jan. 3, 1989

Nita M. Lowey, N.Y. Jan. 3, 1989

Jim McDermott, Wash. Jan. 3, 1989

Richard E. Neal, Mass. Jan. 3, 1989

José E. Serrano, N.Y. March 20, 1990

David E. Price, N.C. Jan. 7, 1997 Also served 1987-95

Rosa DeLauro, Conn. Jan. 3, 1991

Collin C. Peterson, Minn. Jan. 3, 1991

Maxine Waters, Calif. Jan. 3, 1991

Jerrold Nadler, N.Y. Nov. 3, 1992

Jim Cooper, Tenn. Jan. 7, 2003 Also served 1983-95

Xavier Becerra, Calif. Jan. 5, 1993

Sanford D. Bishop Jr., Ga. Jan. 5, 1993

Corrine Brown, Fla. Jan. 5, 1993

James E. Clyburn, S.C. Jan. 5, 1993

Anna G. Eshoo, Calif. Jan. 5, 1993

Gene Green, Texas Jan. 5, 1993

Luis V. Gutierrez, Ill. Jan. 5, 1993

Alcee L. Hastings, Fla. Jan. 5, 1993

Eddie Bernice Johnson, Texas Jan. 5, 1993

Carolyn B. Maloney, N.Y. Jan. 5, 1993

Lucille Roybal-Allard, Calif. Jan. 5, 1993

Bobby L. Rush, Ill. Jan. 5, 1993

Robert C. Scott, Va. Jan. 5, 1993

Nydia M. Velázquez, N.Y. Jan. 5, 1993

Bennie Thompson, Miss. April 13, 1993

Sam Farr, Calif. June 8, 1993

Lloyd Doggett, Texas Jan. 4, 1995

Mike Doyle, Pa. Jan. 4, 1995

Chaka Fattah, Pa. Jan. 4, 1995

Sheila Jackson Lee, Texas Jan. 4, 1995

Zoe Lofgren, Calif. Jan. 4, 1995

As you looked over those lists, you probably noticed that they contain many of the members of Congress that Americans complain about the most....

mother earth

(6,002 posts)Demeter

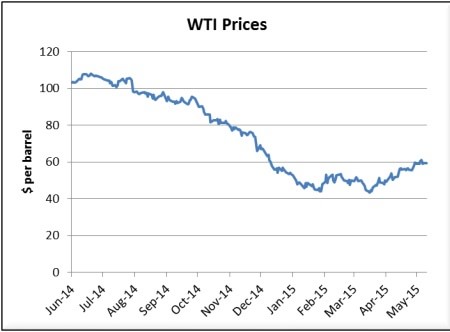

(85,373 posts)Yves here. Conventional wisdom for some time has been that weakness in oil prices would be short-lived, with prices rallying in the second half (and arguably, the current rally representing the financial markets correctly anticipating a much improved supply/demand picture soon).

Goldman breaks with this consensus, arguing that prices will fall again as drilling will pick up again quickly. Their argument is similar to that of John Dizard, who at the outset of the oil price swoon, said it would not be over until the US shale players ran out of financial rope and money for oil plays became more scarce and costly.

By James Stafford, editor of OilPrice. Originally published at OilPrice

Oil prices have rebounded with surprising speed in recent weeks, with WTI prices bouncing by more than a third from March lows. There are good reasons for this. Rig counts are down by nearly 1,000 (or nearly 60 percent) since hitting a high in October 2014. Spending on some of the world’s largest projects has been cut by a combined $129 billion, a figure that could balloon to $200 billion by 2016. The spending and drilling contraction is finally leading to some small production declines. The downturn in activity sparked optimistic sentiment among oil traders that the markets have adjusted, and could be on their way back up.

Not so fast, says Goldman Sachs. The investment bank argues in a new report that not only is the oil rally a bit premature, but that the rally itself will be “self-defeating.” The rally could bring drillers back, but that would merely contribute to a reversal in price gains. More drilling and more production worsen the glut that has not yet been resolved, and prices could be in for a double dip (or triple dip if you count the price declines from February to March 2015). The Goldman Sachs report says that the problem is not just from a surplus of crude, but also a surplus of capital. Access to cheap finance has allowed production companies to stay in the game and continue to drill new wells. Even companies that have seen their cash flows dry up or have run into liquidity problems have still been able to find investors willing to pony up fresh capital.

For example, in January and February, the world’s largest oil companies issued $31 billion of new debt, the highest quarterly total on record. Part of the reason for new debt is the need to raise capital – in other words, it is evidence of distress. But new debt was only made possible by the ultra-low interest rate environment. The Federal Reserve has kept interest rates low for many years, hoping to stimulate the economy. But that also has investors struggling to find yield, inducing more risk taking. With safer assets not offering the returns that investors are looking for, large levels of investment and lending are being funneled into oil companies, including some that are in precarious financial positions. With a financial lifeline in hand, many companies that would have otherwise cut back more drastically are instead kept alive. Some may even begin drilling again. But the recent rise in oil prices is predicated on the fact that a real, authentic balancing is underway. In short, the only way prices stay in the $60 per barrel range, or even rise above that level, is if global oil production is materially reduced. That hasn’t yet happened in a significant way, and if output rebounds because of higher prices, the glut will not be resolved.

Goldman Sachs thinks the pieces are in place for another decline in oil prices, perhaps as low as $45 per barrel by October. “We find that the global market imbalances are in fact not solved and believe that the rally will prove self-defeating as it undermines the nascent rebalancing,” Goldman analysts wrote in an investor’s note.

If another round of price declines set in, the oil industry will be forced to make fresh cuts to their drilling fleets, spending programs, and workforces. These swings in prices, and the fortunes of oil companies, will continue until a much more lasting reduction in supplies is realized. In short, as we discussed in a previous article, a much more robust shake out probably needs to take place, with weaker drillers forced out and more production taken offline. That could still be several months away.

Demeter

(85,373 posts)I'd rather post about beginnings, of new and improved, but it isn't fated to be.

DemReadingDU

(16,000 posts)Things cycle around. Good to bad, bad to good.

Demeter

(85,373 posts)Fuddnik

(8,846 posts)Hotler

(11,421 posts)FRSP for deez guys.

Bernie Sanders Exposes 18 CEOs who took Trillions in Bailouts, Evaded Taxes and Outsourced Jobs

http://www.politicususa.com/2012/10/25/bernie-sanders-exposes-18-ceos-trillions-bailouts-evaded-taxes-outsourced-jobs.html#.VVkMEMPMRsh.facebook

I apologize if this has been post in SMW earlier.