Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 2 September 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 2 September 2015[font color=black][/font]

SMW for 1 September 2015

AT THE CLOSING BELL ON 1 September 2015

[center][font color=red]

Dow Jones 16,058.35 -469.68 (-2.84%)

S&P 500 1,913.85 -58.33 (-2.96%)

Nasdaq 4,636.10 -140.40 (-2.94%)

[font color=green]10 Year 2.15% -0.01 (-0.46%)

[font color=black]30 Year 2.92% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)That's 22 that have left the tree, at least. I am losing track. It looks like there are 30 left. This is incredible!

The ones falling are less green, less hard. The ones on the tree are still hard. I don't get it. Maybe the crazy weather has something to so with it. The next week is 90's all the way...including today. Hotter than the whole summer.

Demeter

(85,373 posts)It's still a gamble, but the odds are much better.

With all the swimming I've been doing after work, I have no interest in anything...except peaches!

magical thyme

(14,881 posts)and then last November we had 2 snowfalls -- one on the 1st and one toward the end of the month -- 1-foot each of heavy, heavy wet snow. It still had its leaves due to the warm fall, and lost 2 of its major producing branches.

Too much loss too late in the season....tree is hanging by a thread this year. ![]()

Otoh, my apple trees produced nothing last year because it was so wet all summer. The mini-drought this year has caused a massive, massive number of apples. They're just starting to ripen now. Even the big, ancient tree that was overrun by a fungus when I first moved here and has slowly recovered with some tlc early on, has lots of apples this year!

Demeter

(85,373 posts)I can't get Santa Rosa plums at the farmer's market, because the farm that grew them lost all their trees. I have to wait for the little tree I planted last year to get going...

My roses are hanging by a thread...I've planted more this year (on clearance) because I refuse to live in a world without them. Last year's roses are doing okay....the older ones have a lot to recover.

magical thyme

(14,881 posts)but the hanging by a thread yellow rose that I discovered a few years back was done in once and for all by my plower. ![]()

I had put up a reflector to keep him from plowing over it yet again, and instead he took that out too. I expect next he's going to take out the shed that the rose was leaning against. ![]()

I'm praying for a most rain winter this year -- we had a couple running before last winter -- which El Nino may deliver. Then I'll be able to take care of the snow myself...

Demeter

(85,373 posts)Some yokel on staff "pruned" (let's be frank, it was a massacre, and totally unwanted) my yellow climber rose down to the red climber rose base that it was grafted on. The winter practically killed that, too, and it's over 15 years old. Like starting from scratch.

I've heard all kinds of forecasts for the winter. I think they truly don't know, because all the weathermen who went by personal observation and experience are gone now, and the computer models are still worthless....and the people using them even more so.

magical thyme

(14,881 posts)when do the horses shed their summer coats, and how fast and heavy is the shed. This year it's been intermittant, but although it started early August the heaviest shed was late.

And Jake, my lab cross, has hardly been shedding. He did drop some last night.

I think climate change has created and intensified too many opposing forces to make it clear which force will predominate.

MattSh

(3,714 posts)A nice crop of cherries, though we lost a lot of them because we had to be in the city at the time.

Our first ever crop of apricots! Yay!

Our first ever crop of blackberries! Yay!

Very good raspberries and apples.

Plus neighbors gave us plenty more apricots and plums.

But the veggies? Meh! The only thing that came in strong were the tomatoes. Corn and peppers were average. The cukes, zucchini, okra, beans, eggplant? Yecch! No so good.

But it's been a very dry year. That's the last thing this country needed this year.

Oh, the roses have been good too...

Demeter

(85,373 posts)The riveting writer, Michael Hudson, has read our collective minds and the simmering anger in our hearts. Millions of American have long suspected that their inability to get financially ahead is an intentional construct of Wall Street’s central planners. Now Hudson, in an elegant but lethal indictment of the system, confirms that your ongoing struggle to make ends meet is not a reflection of your lack of talent or drive but the only possible outcome of having a blood-sucking financial leech affixed to your body, your retirement plan, and your economic future.

In his new book, “Killing the Host,” Hudson hones an exquisitely gripping journey from Wall Street’s original role as capital allocator to its present-day parasitism that has replaced U.S. capitalism as an entrenched, politically-enforced economic model across America.

This book is a must-read for anyone hoping to escape the most corrupt era in American history with a shirt still on his parasite-riddled back.

Hudson writes from his most powerful perch in chapters describing how these financial parasites have tricked our society into accepting them as a normal, productive part of our economy. (Since we write about these thousands of diabolical tricks four days a week at Wall Street On Parade, poignant examples came springing to mind with every turn of the page in “Killing the Host.” From the well-placed articles in the Wall Street Journal to a front group’s pleas for more Wall Street handouts in a New York Times OpEd, to the dirty backroom manner in which corporate speech was placed on a par with human speech in the Supreme Court’s Citizens United decision, to Wall Street’s private justice system and the Koch brothers’ multi-million dollar machinations to instill Ayn Rand’s brand of “greed is good” in university economic departments across America — America has become a finely tuned kleptocracy with a sprawling, sophisticated public relations base.)

How else to explain, other than kleptocracy, the fact that Wall Street’s richest mega banks collect the life insurance proceeds and tax benefits on the untimely deaths of their workers – all codified into law by the U.S. Congress – making death a profit center on Wall Street. Or, as Frontline revealed, that two-thirds of your 401(k) plan over a working lifetime is likely to be lost to financial fees....

MORE

Demeter

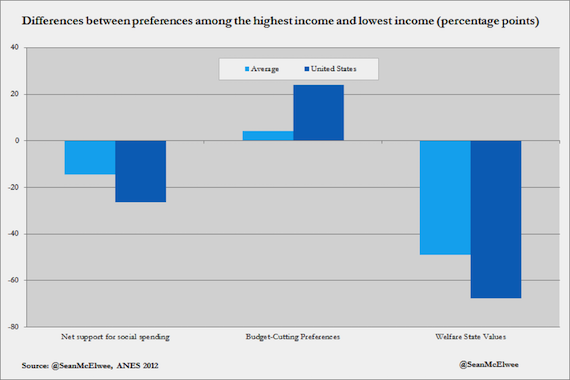

(85,373 posts)We already know that American government only responds to the wishes of the few. But what about other nations? Since the beginnings of democracy, debate has raged as to how responsive politicians are to their constituents. Though such debates stretch back centuries, only recently have academics gotten the ability to use data to test how well legislatures represent the people they ostensibly serve. So far, the evidence hasn’t been kind, with two leading academics arguing recently that, “the preferences of the average American appear to have only a minuscule, near-zero, statistically non-significant impact upon public policy.”

That’s academic for: “American democracy is a joke.”

Much of the academic work, and nearly all of the press coverage of the field, has focused solely on the United States. In a new working paper, a luminary in the field, political scientist Larry Bartels, expands his analysis to explore the relationship between policy and public preferences to the international arena. First, Bartels finds increasing demand for a stronger safety net across in many countries where data stretch back more than two decades, including the United States. (Indeed, support for more social spending has increased the most dramatically in the US). He does so by using a question that asks individuals to indicate where they would like more government spending. (The question notes that tax increases may be necessary to boost government spending.) Although there are eight spending areas in the International Social Survey Programme (ISSP) data, Bartels focuses in on four: pensions, health, unemployment benefits, and education.

While it initially appears that policymakers respond to changes in public preferences, Bartels shows that in fact the changes are endogenous. When Bartels controls for economic growth and unemployment, the apparent relationship between public opinion and public spending is eliminated. (See the dashed line in the figure below.)

MORE

Demeter

(85,373 posts)The stash of previously-secret correspondence about the Trade In Services Agreement (TISA) that EFF obtained and published this week speaks volumes about the extent to which technology companies such as IBM and Google, and trade lobby groups such as the Computer and Communications Industry Association (CCIA) and Internet Digital Economy Alliance (IDEA), have bought into the dangerous idea that trade agreements should be used to govern the Internet.

In the 124 pages of documents that we obtained under the Freedom of Information Act (FOIA), industry groups assert that trade agreements can “maximise the economic potential of data in the networked economy and support the Internet as the world’s trading platform”, and “significantly boost the growth prospects for this vital sector of the global economy.” Sadly missing, however, are demands for improved transparency or for the exclusion of Internet-related issues that have little to do with "trade" such as net neutrality and personal data protection.

Perhaps we should not be surprised by the complicity of some tech companies in the ongoing mission-creep of trade negotiations, given their earlier support for Fast Track Authority, which cleared the way not only for TISA but also for other agreements that threaten user rights, such as the Trans-Pacific Partnership (TPP) and the Trans-Atlantic Trade and Investment Partnership (TTIP).

Comparing TISA with WCIT

But in fact we are surprised. These companies seem to to be taking a remarkably relaxed attitude towards a closed-door process in which governments could rewrite the rules for information flows on the global Internet. It also marks a stark contrast with their attitude towards another process that could have been described in almost identical terms—the 2012 World Conference of International Telecommunication (WCIT) of the International Telecommunications Union (ITU). As you may recall, tech companies joined EFF and thousand of other organizations from around the world in a massive uprising against the secretive WCIT negotiations over revisions to an ITU treaty called the International Telecommunication Regulations (ITRs). Google was amongst the tech companies leading this charge, launching its own campaign that warned of the dire consequences of allowing governments to make decisions that would affect the Internet:

The ITU is also secretive. The treaty conference and proposals are confidential.

MORE

Demeter

(85,373 posts)A judge has ruled that billionaire David Murdock and one of his top lieutenants at Dole Foods conspired to rig the company’s 2013 buyout, enabling Murdock to buy the company at a lower price.

Following a trial in February, Vice Chancellor J. Travis Laster found that the $13.50 a share price for Dole was far too low–and that the figure was based on faulty numbers provided by Murdock’s camp. The judge has ordered Murdock, Dole’s chairman and chief executive, and C. Michael Carter, Dole’s former chief operating officer, to pay shareholders $148 million, adding $2.74 a share to the final tally.

While the judge praised the independent board committee tasked with orchestrating the buyout, which convinced Murdock to raise his offer from $12 a share to $13.50 a share, he found fault with the way Murdock and Carter put together one set of low company projections for the committee and then distributed more realistic–and more optimistic–data to Murdock’s potential advisers and lenders. The judge stopped short of finding Deutsche Bank , which advised and financed Murdock, liable, too.

In addition, the judge found that Carter had underestimated how much Dole could make from selling parts of itself and ended a stock buyback program, moves that lowered the company stock and again made it easier for Murdock to offer a small sum for Dole.

Demeter

(85,373 posts)IT DEPENDS ON YOUR DEFINITION OF POOR

http://www.counterpunch.org/2015/08/28/the-myth-of-the-middle-class-have-most-americans-always-been-poor/

One of the most firmly entrenched myths of the American Ideology is that the U.S. is a “middle class society,” a “land of opportunity” where anyone who works hard has the opportunity to achieve the standard of living which has made America “the envy of the world.” A common, and spot on, rejoinder has been to remind us that America has always had a sizable class of permanently poor people and that it is just factually false that those ready, willing and able to work are on the path to middle class status.

But does this reply concede too much? Has there ever been a substantial middle class in America? Or has a poor working class been able to mask its condition by accessing an institution that has disguised a large portion of a poor working class as a middle class? The best place to start is with the history of the modern American middle class.

The First Working-Class Middle Class: the Roaring Twenties

Of course not everyone can get rich, for roughly the same reason that not everyone can be very tall. But most of us are supposed to be able to enjoy the comforts that many Americans enjoyed after the Second World War and earlier, in economically pubescent form, during the Roaring Twenties. That decade was the first in history when any population enjoyed the comforts of a “consumer society.” The remarkable growth rates of that decade were driven entirely by Americans’ purchases of automobiles, ranges, radios, phonographs, toasters, refrigerators, electric fans and more. The whole world saw the miracle of the first genuine non-professional middle class. These new luxuries were not restricted to the very rich and doctors and lawyers; wage workers were the majority consumers of these “consumer durables.”

But during the Great Depression many radical Leftists argued that the short-lived prosperity (for white people) of the 1920s was a fluke, a temporary aberration from capitalism’s default condition in which the working class was flat-out poor. Sure, the war ended the Depression, but if that was so, it was feared that once the war ended, the economy would revert to normal, with high unemployment and widespread poverty once again the order of the day. This was a major concern in the mid-forties of a great many economists of every political stripe...MORE

Demeter

(85,373 posts)This ruling, handed down today by the Second Circuit, may spell the end of one phase of the NML litigation. For some time, the plaintiffs have been trying to find a way to seize assets held by Argentina's central bank. Their latest effort sought an order declaring that Banco Central is an alter ego of Argentina, at least insofar as U.S. law is concerned. The effect of such an order would be to eliminate the bank's claim to be treated as a separate legal entity, making it liable for the government's debts. I understand that Banco Central has already moved most if not all of its assets out of the U.S., and earlier Second Circuit rulings already protect funds held at the Federal Reserve Bank of New York. But the plaintiffs could have taken the order to another country where Banco Central has assets and (conceivably) parlayed it into an order allowing them to attach bank funds.

This was always a long shot for the plaintiffs. Even if they had gotten their requested relief, officials in other jurisdictions would not be obliged to let them seize bank funds. After today's ruling, though, the plaintiffs face additional practical and legal barriers. Their complaint alleged that Argentina effectively controlled Banco Central by determining who served as an officer of the bank, by borrowing from the bank, and by coordinating with the bank in implementing an inflationary monetary policy. The Second Circuit held that these allegations, even if true, didn't establish that the bank was the government's alter ego. The slippery slope here is fairly obvious. It is common, after all, for there to be a degree of coordination between governments and central bankers. I doubt the Second Circuit was eager to create a precedent that might imply that central bank assets in the United States are at risk. Technically, today's ruling doesn't prevent the plaintiffs from raising the alter ego theory in other jurisdictions (perhaps where the standard for alter ego liability is different). But given today's ruling I would imagine the fight will shift to other fronts.

Demeter

(85,373 posts)Demeter

(85,373 posts)Kmart Corp has paid $1.4 million to settle U.S. allegations that it violated the federal False Claims Act by inducing Medicare beneficiaries to fill prescriptions at its pharmacies, the Department of Justice said on Tuesday.

The government said the accord resolves allegations that Kmart, a unit of Sears Holdings Corp (SHLD.O), let beneficiaries use drug manufacturers' coupons to reduce or eliminate prescription co-payments. It said this caused people to seek out brand-name drugs rather than cheaper generics, boosting the government's costs. Kmart was also accused of improperly offering discounts on gasoline purchases at participating gas stations based on the number of prescriptions filled.

The government said Kmart's improper activity lasted from June 2011 to June 2014, and violated a federal prohibition against offering benefits to Medicare beneficiaries to influence their decisions about which pharmacies to use. Tuesday's settlement resolved claims first brought in a 2013 whistleblower lawsuit by Joshua Leighr, a former Kmart pharmacist from Kansas City, Missouri. He will receive about $248,500 of the payout, the Justice Department said.

Kmart has about 780 in-store pharmacies, and settled without any determination of liability, the Justice Department said...

Demeter

(85,373 posts)Oil prices plummeted on Tuesday, settling 8 percent lower, as weak Chinese data extended a roller-coaster run that knocked oil to its lowest in 6-1/2 years last week before frenzied short-covering fueled a 25 percent three-session surge.

The past few weeks have been among the most volatile in the modern oil market's three-decade history, with prices plunging early last week as worries about China's economic strength sent shivers through risk markets, only to bounce back fiercely as bearish traders rushed to cash in short positions.

Traders took flight on Tuesday after seeing China's official Purchasing Managers' Index (PMI) drop to 49.7 in August and U.S. manufacturing sector growth slow to its weakest pace in more than two years, reinforcing fears of slowing global growth and weaker fuel demand.

"It was primarily the China fear factor," Carsten Fritsch at Commerzbank in Frankfurt told the Reuters Global Oil Forum.

Some also wondered if the 25 percent three-day surge through Monday, the biggest since Iraq's invasion of Kuwait in 1990, was overdone given a persistent global supply glut....

Demeter

(85,373 posts)Oil prices fell as much as over 2 percent in early Asian trade on Wednesday, as a stronger than expected build in U.S. crude oil stocks and weaker U.S. manufacturing data fueled a rout in prices that started in the previous session.

Brent and U.S. crude finished around 8 percent lower on Tuesday to end a 25-percent three-session surge, the largest three-day gain since 1990.

That came after oil prices dropped to their lowest level in 6-1/2 years last week.

This rollercoaster volatility could continue especially if there are similar wild swings in the equity markets, said Ric Spooner, chief market analyst at Sydney's CMC Markets...

Demeter

(85,373 posts)Oil prices fell on Wednesday as concerns about the global economy exacerbated worries that an oversupply of crude could last longer than expected.

Weak manufacturing reports from China, the United States and Europe undermined global equities, while a stronger-than-expected build in U.S. crude stocks drove oil market sentiment down, analysts said.

Wednesday's fall compounded an 8 percent drop in Brent and U.S. crude prices on Tuesday, which ended a 25 percent three-session surge, the largest three-day gain since 1990.

"A rise of around 25 percent in three consecutive days was not going to be sustained," BNP Paribas oil analyst Harry Tchilinguirian said. "The underlying fundamentals are bearish."

*******************************

...Oil prices retreated after data from industry group the American Petroleum Institute on Tuesday showed U.S. crude stocks surged by 7.6 million barrels to 456.9 million in the week to Aug. 28. Analysts in a Reuters poll had expected just a 32,000-barrel gain.

The market is expected to hold steady until official inventory data is released by the U.S. Energy Information Administration later on Wednesday, analysts said...

MORE

Demeter

(85,373 posts)THIS A****** HAS THE CART BEFORE THE HORSE--THE ONGOING DEPRESSION IS TAKING THE BUBBLE OUT OF OIL PRICING....BUT HE'S A KNOWN IDIOT. POSTED FOR ENTERTAINMENT PURPOSES ONLY. LET THE DEATH SPIRAL CONTINUE! GOD FORBID, WE SHOULD HAVE AN FDR JOBS PROGRAM....FIX INFRASTRUCTURE, LET TEACHERS DO TEACHING, ETC.

http://www.bloombergview.com/articles/2015-09-02/if-oil-prices-keep-slipping-recession-could-follow?cmpid=yhoo

If oil prices take another dramatic slide, as I believe they will, who wins and who loses? And could plummeting oil prices sow the seeds of the next recession?

Oil-importing countries are obvious winners from falling crude prices. That includes the U.S., where -- despite a surge in domestic production -- imports still account for nearly 50 percent of petroleum consumption. The net oil-importing countries of western Europe and Asia also benefit from falling crude prices. India and Egypt, which subsidize domestic energy use, will surely benefit. Some of that, however, will be offset because crude oil is priced in U.S. dollars, and those countries' currencies have grown weaker against the greenback.

The windfall for U.S. consumers is considerable, with average gasoline prices down 24 percent to $2.47 a gallon from $3.77 in June 2014. No doubt, prices will fall even more when the summer driving season ends after Labor Day.

YEAH, I'M STILL WAITING FOR THAT WINDFALL....I DO SO MUCH LESS DRIVING THESE DAYS, INTENTIONALLY.

Most forecasters believe consumers will spend the windfall, and thus boost the economy. But almost all of the savings from lower pump prices so far have been used to rebuild household assets and reduce debt. Consumers tend to increase their savings in tough times; they've been doing so during the six-year recovery, even as real wages and median household incomes remain flat.

ALL THOSE SLURPIES, BOOSTING THE GDP

Lower oil prices, however, could come with a downside. As they work their way through the system, deflation could follow. Already, 10 of the 34 largest economies in the world have seen year-over-year declines in consumer prices. The risk is that deflationary expectations could follow, encouraging consumers to withhold purchases in anticipation of even lower prices. If that happens, excess capacity and inventories would build, forcing prices down more. When buyers' suspicions are confirmed, they further delay consumption, in a vicious downward cycle. The result is little if any economic growth, as deflation-prone Japan has seen over the last two decades.

WHAT DOES THIS IDIOT THINK IS HAPPENING NOW IN CHINA, THE EUROZONE, THE US? HIS TRAIN OF THOUGHT IS AT LEAST ONE YEAR BEHIND EVENTS

The losers from declining oil prices obviously include producers and oil-services companies, especially those that are highly leveraged. U.S. shale-oil frackers are taking a hit, and yet they stubbornly refuse to leave the business. One reason is that well-drilling costs are also declining. Another is that oil prices are still above frackers' marginal costs, which encourages them to increase output to make up for falling revenue. Employees in the U.S. oil- and gas-extraction industry make up just 0.14 percent of total payrolls, but they were paid an average of about $41 in July -- almost twice what other U.S. workers are paid. Since late last year, jobs are down only 4 percent in the sector and weekly pay has declined just 3 percent. With another big leg down in oil prices, vacancy signs may soon appear in the once-booming North Dakota fracking fields.

Further drops in oil prices will add to the woes of African exporters Ghana, Angola and Nigeria. Oil exports finance 70 percent of Nigeria's budget. Ditto for economic basket case Venezuela, where the bolivar has collapsed from 103 per U.S. dollar in November to 701 on the black market. (The official rate remains a fanciful 6.29 to the greenback.) Russia depends heavily on oil exports to finance imports and government spending. With Western sanctions over Ukraine squeezing the economy and Russian banks unable to borrow abroad to service their foreign debts, another drop in oil prices could precipitate a rerun of the country's 1998 default. The ruble has dropped to 66 per dollar from 49 per dollar in May, inflation is running at a 16 percent annual rate, and the economy contracted by 4.6 percent in the second quarter versus a year earlier...

YEAH, THINGS ARE TOUGH ALL OVER. WHY, EVENT THE RICHEST MEN IN THE WORLD ARE LOSING MONEY ON A DAILY BASIS.

THERE'S MORE, IF YOU CAN STOMACH IT.

Demeter

(85,373 posts)THERE'S ALWAYS ONE IN THE BUNCH

http://www.cnbc.com/2015/09/01/cramer-buckle-up-oil-could-skyrocket.html?__source=yahoo|finance|headline|headline|story&par=yahoo&doc=102963508

A horrendous piece of manufacturing data from China sent the U.S. stock market tumbling yet again Tuesday, taking the price of oil lower along with it. Jim Cramer is hoping the price of crude heads higher, because many oil companies could be in real danger if it sinks any further.

"Like I keep telling you, there is roughly $200 billion of debt from these oil companies on the high yield bond market, and when the price of crude is plummeting everyone starts getting scared that something terrible could be lurking in the world of fixed income," the "Mad Money" host said.

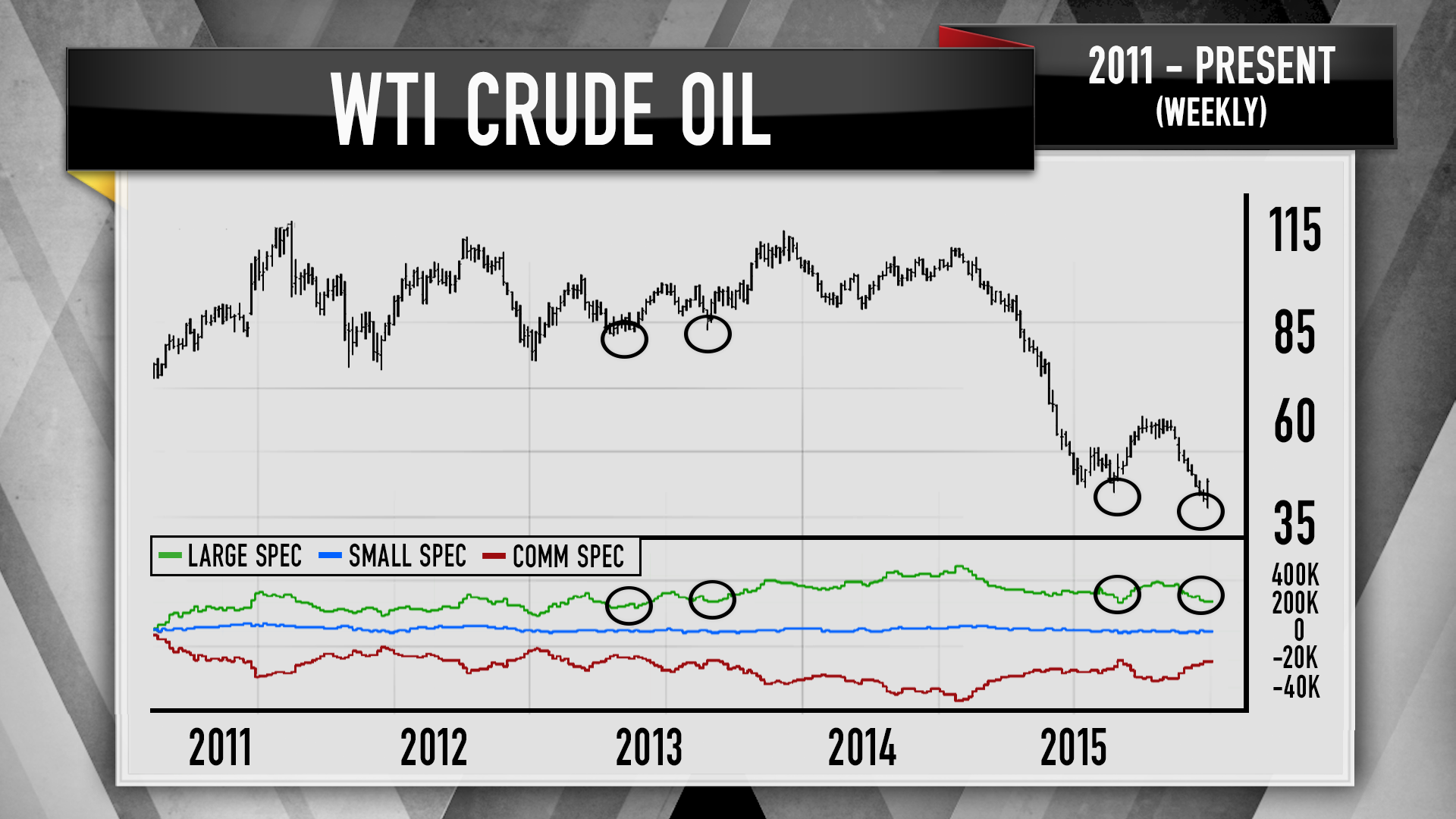

That is why Cramer sought the insight of Carley Garner. She is a technician, co-founder of DeCarley Trading and colleague of Cramer's at RealMoney.com. Garner has a successful history of predicting the trajectory of crude on "Mad Money" and spotted the bottom in crude and the volatile events following afterward.

So where does Garner think oil is heading next?

Looking at the weekly chart of West Texas Intermediate Crude and the Commodity Futures Trading Commission's weekly Commitment of Traders report, Garner came up with a pretty stunning revelation. The CFTC report tells investors exactly how the major players are betting in the oil futures market, including the big institutional money managers who tend to drive the markets.

Garner pointed out that during the recent decline in oil, large speculators unloaded approximately 40 percent of their bullish holdings. This is a good thing because back in July, big money was way too bullish on oil with a net long position of 328,000 contracts. Last week that dropped down to roughly 200,000 futures contracts.

Garner thinks this is a wonderful sign for oil, as in recent years when net long positions on crude drop to that level the selling will dry up and prompt a rebound.

"The fact that the big boys were throwing in the towel and capitulating right near the bottom is exactly why Garner now believes the path of least resistance for oil is higher," Cramer said.

SURE, IF YOU WANT A BUBBLE, SOMEBODY, USING OTHER PEOPLE'S MONEY, WILL BLOW IT

MORE MADNESS AT "MAD MONEY" AT LINK

Demeter

(85,373 posts)The Canadian economy shrank again in the second quarter, putting the country in recession for the first time since the financial crisis, with a plunge in oil prices spurring companies to chop business investment.

The confirmation on Tuesday of a modest recession will figure heavily into the election campaign as Canadians head to the polls Oct. 19 and poses a challenge to Conservative Prime Minister Stephen Harper, who is seeking a rare fourth consecutive term.

Still, there was a silver lining as growth picked up for the first time in six months in June, underscoring expectations the recession will be short-lived.

Harper was quick to downplay what some supporters and economists have dismissed as a "technical" recession, pointing to the upbeat June figures during a campaign stop. "The Canadian economy is back on track," he said...

WE SHALL SEE, WON'T WE?

Hotler

(11,421 posts)the rich may start getting their margins called in and I bet there are a lot of them that don't have the cash to pay up. The horror.![]()

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)9/2/15 Stock Market Now "Too Big to Fail"? Charles Hugh Smith

.

.

The stock market is now the signal everyone follows: if stocks are rising, we're told that means the economy is healthy. Conversely, if stocks decline sharply, the implication is the economy is weak.

In other words, it's not just valuations that make stocks integral to the economy and Status Quo--the market's signaling is now the key to sentiment. In economist Michael Spence's work, the information available to participants is asymmetric: roughly speaking, those on the "inside" have better information than those on the "outside."

The stock market addresses this asymmetry by signaling what's really going on via price: if the market sells off, that tells even those with little other information that all is not well in the economy.

A rising market sends the opposite signal: everything's going well. If the participant isn't experiencing good times himself, he will still defer to this signal, reckoning that his own financial stagnation is an anomaly rather than the norm.

This explains why a rising stock market is now essential to the Status Quo: if the market reverses, everyone who sees mostly stagnation in their corner of the economy will realize that is the norm, not a local aberration.

If the stock market is now too big to fail, the Federal Reserve will have to prop it up whatever the cost. Ultimately, this may require direct purchases of stocks--an action that other central banks are already pursuing.

more...

http://www.oftwominds.com/blogsept15/TBTF-stocks9-15.html

Demeter

(85,373 posts)How much land and goodies can even the sickest of them hold onto?

They shuffle paper to "make money" and plead (okay, buy with bribes) for welfare from the federal government, and because they do, we cannot get useful financial products nor service from our elected officials.

The crash is getting quite near, based on the level of panic and kvelling and the frantic machinations....

Demeter

(85,373 posts)Recent volatility in global financial markets shows how rapidly risks can spill over from one economy to the next, the managing director of the International Monetary Fund (IMF) said in Jakarta on Wednesday.

"What has been demonstrated in the last few weeks is how much Asia is at the core of the global economy, and how much disruption in one market in Asia can actually spill over to the rest of the world," Christine Lagarde told a conference in Indonesia's capital. World stock markets and the currencies of many emerging markets have seen large swings since China's decision last month to devalue its currency.

Lagarde said the world economy was facing headwinds from China's rebalancing, Japan's slow growth, falling commodity prices and uncertainties surrounding higher U.S. interest rates. Policies need to be tailored to each country, Lagarde said, but mostly they would involve strengthening defences with prudent fiscal policy, reining in excessive credit growth, aligning exchange rates to act as shock absorbers, maintaining adequate foreign exchange reserves, and strengthening regulation.

"The authorities and the supervisors constantly have to remain vigilant particularly when there are those new and innovative products...those risks have to be under the watch of the supervisors, be they in traditional banking, be they in these disruptive banking systems or in these shadow banking systems," Lagarde said.

The IMF managing director, who is attending a conference on the future of financing for development, said international institutions, such as China's Asia Infrastructure Investment Bank (AIIB), the Asian Development Bank and the World Bank, should work together to meet the region's large infrastructure financing needs.

WHAT'S ALL THIS "MANAGING DIRECTOR" STUFF? AND WHAT SHOCKED HER INTO COHERENCE? SHE'S ACTUALLY MAKING SENSE.

THE SACRIFICE OF THE GREEK PEOPLE...IT HAS A SILVER LINING.

Demeter

(85,373 posts)Survive, at least! ![]()