Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 9 September 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 9 September 2015[font color=black][/font]

SMW for 8 September 2015

AT THE CLOSING BELL ON 8 September 2015

[center][font color=green]

Dow Jones 16,492.68 +390.30 (2.42%)

S&P 500 1,969.41 +48.19 (2.51%)

Nasdaq 4,811.93 +128.01 (2.73%)

[font color=red]10 Year 2.19% +0.01 (0.46%)

[font color=black]30 Year 2.95% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)China's Shanghai and Shenzhen Stock Exchanges and the China Financial Futures Exchange plan to introduce a 'circuit breaker' on one of the country's benchmark stock indexes to "stabilise the market", the Shanghai exchange said in a statement on its website late on Monday.

The exchange is proposing that a 5 percent rise or fall in the CSI300 index from the previous day's close would trigger a 30-minute suspension of all the country's equity indexes if the move occurs before 2:30 p.m. After that time, a 5 percent move would prompt a suspension until the market close.

Moves of 7 percent from the previous close would trigger a trade suspension for the rest of the day.

The exchanges are seeking comment from market participants on the proposals before Sept. 21.

The CSI300 index comprises the largest listed companies in Shanghai and Shenzhen.

BECAUSE IT WORKS SO WELL HERE....

OR BECAUSE THEY REALLY EXPECT THE STHTF IN A BIG WAY.

Demeter

(85,373 posts)THIS ONE'S FOR FUDDNIK

http://www.reuters.com/article/2015/09/08/us-usa-trains-safety-exclusive-idUSKCN0R80BS20150908?feedType=RSS&feedName=businessNews

U.S. railroads may not be obligated under federal law to carry freight including crude oil and hazardous materials from Jan. 1 if they fail to meet a year-end deadline for implementing new train safety technology, according to a top federal regulator. In a Sept. 3 letter to the Senate Commerce Committee, U.S. Surface Transportation Board Chairman Daniel Elliott says the common carrier obligation requiring freight railroads to honor reasonable requests for service from shippers "is not absolute, and railroads can suspend service for various reasons, including safety."

The letter, reviewed by Reuters, presents the most tangible sign yet of what could lie ahead for rail carriers and their customers, if Congress fails to extend its Dec. 31 deadline for railroads to implement positive train control, or PTC. The National Transportation Safety Board, which has been calling on railroads to adopt PTC since the late 1960s, says the technology would prevent major rail accidents such as the May 12 Amtrak derailment that killed eight people and injured more than 200 others.

The approaching deadline has prompted at least one major railroad company to look seriously at suspending service: billionaire investor Warren Buffett's BNSF Railway Co (BRKa.N), the No. 2 freight railroad operator and the leading carrier in the $2.8 billion U.S. crude-by-rail market.

"BNSF confirmed that it will not meet the deadline and offered the possibility that neither passenger nor freight traffic would operate on BNSF lines," Elliott said in the letter, which was addressed to the committee's Republican chairman, Senator John Thune of South Dakota...

SO MUCH MORE AT LINK....NICE TO HAVE A LOOPHOLE, EH, WARREN?

Demeter

(85,373 posts)JPMorgan Chase & Co. is cutting prices for a group of its credit card customers and getting Visa Inc to shoulder at least some of the burden of the lost revenue, underscoring how the largest U.S. bank's size can help it hang onto business in fiercely competitive markets.

At stake are the billions of dollars that banks receive annually from consumer use of a credit card to pay a retailer. Chase, which generated roughly $3.6 billion of revenue last year from those fees, is increasingly occupied with fending off banking rivals like Citigroup Inc, as well as Silicon Valley companies such as Paypal Inc and Square Inc. Chase's revenue from those fees is showing signs of eroding. In the first half of 2015, fee income in the bank's credit and debit card business fell 2 percent from the same period a year earlier, even as the bank processed a higher volume of transactions. A person familiar with the matter said lower processing fees were a critical part of that decline.

JPMorgan CEO Jamie Dimon pledged in an April letter to shareholders "to be very aggressive in growing this business." At a conference with securities analysts in February, he cited the credit card operation as an example of how JPMorgan has to cut prices and upgrade products to keep from falling behind competitors.

"In a capitalist world," Dimon said, "you've got to be giving the client more, better, faster, quicker, or you lose."

Credit card fees generated about 4 percent of the bank's revenue in 2014, but analysts said that much of that money has historically fallen to the bottom line, making it a critical support for the bank's $22 billion of annual profits...

SNEAKY DETAILS AT LINK

Demeter

(85,373 posts)Greek banks' bad loans, which peaked after capital controls were imposed in late June, have dipped to around 45 percent of their loan books and are likely to fall further, daily newspaper Kathimerini said on Tuesday, citing bankers' estimates.

The figure for bad loans - defined as credit more than 90 days in arrears or likely to fall into that category - was 40.8 percent at the end of the first quarter, according to latest official figures.

The picture worsened in July, when in addition to capital controls banks were closed for a week, and when only about 15 percent of borrowers who had been repaying their loans normally in the past made monthly payments, the paper said.

But 80 percent resumed timely repayments in August and bankers are expecting further improvement this month, it said.

Under Greece's third bailout, which it agreed in July, up to 25 billion euros ($28 billion) were allocated to recapitalize the banks. Insiders say the sum required is more likely to be in the 10 billion to 15 billion euro range.

DemReadingDU

(16,000 posts)WEDNESDAY, SEPTEMBER 9; 7 PM

TED RALL, award-winning political cartoonist, will introduce his graphic novel, Snowden. As many as ¼ million U.S citizens with security clearance saw some or all of the same documents revealed by Edward Snowden. Why did he, and no one else, decide to step forward and take on the risk associated with becoming a whistleblower and then a fugitive? In Snowden, Rall delves into Snowden’s early life and work experience, his personality, and the larger issues of privacy, new surveillance technologies, and the recent history of government intrusion. Rall describes Snowden’s political vision and hopes for the future. In a way, the book tells two stories: Snowden’s and a larger one that describes all of us on the threshold of tremendous technological upheaval and political change. SEVEN STORIES

Rall is a nationally syndicated political cartoonist, opinion columnist, graphic novelist and occasional war correspondent. He is twice the winner of the Robert F. Kennedy Journalism Award and a Pulitzer Prize finalist.

http://www.booksandco.com/calendar.html

The book

“Snowden” by Ted Rall (Seven Stories Press, 224 pages, $16.95)

How to go

What: A book-signing with Ted Rall for the release of “Snowden”

Where: Books & Co., at The Greene, 4453 Walnut St., Beavercreek

When: 7 p.m. Wednesday, Sept. 9

More info: 937-429-2169 or www.booksandco.com

Demeter

(85,373 posts)After the Fed admitted over a year ago that the US unemployment rate (which in 2012 was supposed to be a rate hike "threshold" once it hit 6.5% and is now at 5.1%) has become irrelevant in a country where a record 94 million people have left the labor force, and with the Fed poised to hike rates even though US hourly wages have not only not increased for the past 7 years, but for the vast majority of the labor force continue to decline, some have asked - is there any labor-related chart that matters any more?

The answer: a resounding yes, only it is none of the conventional charts that algos and sometimes humans look at.

The one chart that matters more than ever,has little to nothing to do with the Fed's monetary policy, but everything to do with the November 2016 presidential elections in which the topic of immigration, both legal and illegal, is shaping up to be the most rancorous, contentious and divisive.

The chart is the following, showing the cumulative addition of foreign-born and native-born workers added to US payrolls according to the BLS since December 2007, i.e., since the start of the recession/Second Great Depression.

The chart is especially important because what it shows for just the month of August will be enough to provide the Trump - and every other - campaign with enough soundbites and pivot points to last it for weeks on end: namely, that in August a whopping 698,000 native-born Americans lost their job. This drop was offset by 204,000 foreign-born Americans, who got a job in the month of August...

InkAddict

(3,387 posts)Demeter

(85,373 posts)

Demeter

(85,373 posts)IF YOU SAY SO, MR. BUFFETT==YOU ARE RIGHT, THOUGH, IT MAKES $$$$$ NOT CENTS

www.huffingtonpost.com/entry/warren-buffett-us-poverty_55ef2df8e4b03784e276c478?utm_hp_ref=business&ir=Business§ion=business

"You really shouldn't have an economy with over $50,000 in GDP per person and have lots of people living in poverty who are willing to work."

TCHA!

antigop

(12,778 posts)outsourcing?

You know, the company you have so much invested in?

Well, Warren?

Demeter

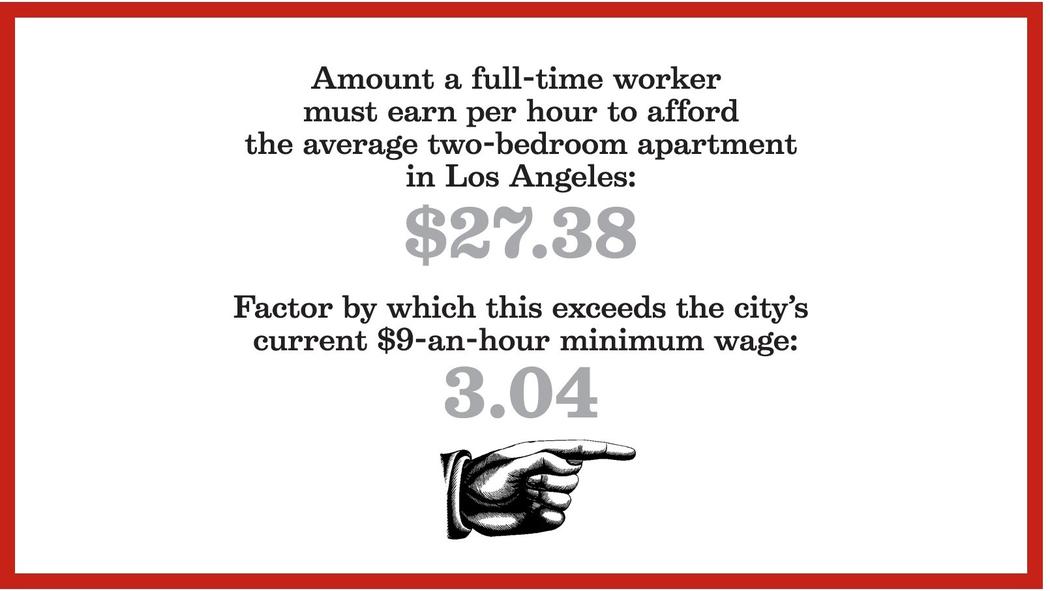

(85,373 posts)AT $9.07/HOUR, NO DOUBT

http://www.marketwatch.com/story/us-likely-to-keep-pumping-out-steady-flow-of-new-jobs-through-end-of-year-2015-09-08?siteid=YAHOOB

The economy is likely to create a steady supply of new jobs over the next four months and push the unemployment rate below 5%, according to an index that tracks the health of the U.S. labor market.

The Employment Trends Index rose sharply in August to 128.82, marking the second straight gain, the Conference Board said Tuesday. The survey is compiled from eight key labor-market indicators such as job openings, applications for unemployment benefits and the number of people who can only find part-time work, among other things.

“The large increase in the employment trends index in August suggests that a significant moderation in employment growth is unlikely to occur in the coming months,” said Gad Levanon, managing director at the board. “With solid job growth expected to continue, the unemployment rate is likely to go below 5% by year’s end.”

Last Friday the government reported that the U.S. created 173,000 jobs in August, down from 245,000 in the prior two months. Yet few economists believe the drop-off in hiring last month is a sign of things to come...

Demeter

(85,373 posts)Goldman Sachs Group Inc (GS.N) on Tuesday won the dismissal of a class-action lawsuit accusing it of defrauding investors in subprime mortgage offerings that some U.S. senators faulted after investigating causes of the 2008 financial crisis.

U.S. District Judge Victor Marrero in Manhattan, who had certified a class action in January 2014, said investors led by hedge fund Dodona I LLC failed to show that Goldman structured two collateralized debt obligations, Hudson Mezzanine Funding 2006-1 and 2006-2, to fail.

In April 2011, the U.S. Senate Permanent Subcommittee on Investigations cited the Hudson CDOs as evidence that Goldman tried to profit at clients' expense ahead of the financial crisis by shedding exposure to subprime mortgages. It said Goldman "took 100% of the short side" of the Hudson 2006-1 CDO, and "made a $1.7 billion gain at the direct expense of the clients to whom it had sold the securities." But Marrero said that while Goldman used the Hudson CDOs in 2006 and 2007 to hedge against other subprime mortgage investments, evidence that it structured the CDOs to fail or hid material risks was "crucially absent" from the plaintiffs' case.

Marrero also dismissed related claims against two former employees in Goldman's structured products trading group: Derryl Herrick, a vice president, and Peter Ostrem, who reported to him.

ONE MAY ASK HOW THE F*** ONE IS SUPPOSED TO BE ABLE TO PROVE SUCH A THING...

BARRING A WHISTLEBLOWER WITH A PILE OF EMAILS AND SUCH.

Demeter

(85,373 posts)For proof that the U.S. stock market is in trouble, look no further than the presidential candidates running for a place in the 2016 election, says Marc Faber, editor and publisher of the Gloom, Boom & Doom Report.

Faber, who has earned the nickname "Dr. Doom" from his longtime bearish stance on U.S. stocks, said most candidates are "relatively questionable" in integrity and quality.

"Going into the year end and the next year, I only have to look at the presidential candidates and then I know I have to be bearish," Faber said Tuesday on CNBC's "Trading Nation." "It's a pity that a country like the U.S., with so many highly intelligent and educated people, can only produce the kind of candidates we have."

A September national poll from Monmouth University shows Hillary Clinton as the front runner for the 2016 Democratic nomination by a wide stretch, followed by Joe Biden and Bernie Sanders. Leading the polls for the Republican nomination is Donald Trump, followed by Ben Carson and Jeb Bush.

While Faber admitted that he is not a close follower of American politics, he said Republican candidate Ted Cruz would be the best choice for U.S. markets to prosper....

GOD HELP US!

Demeter

(85,373 posts)Today, I should like to focus on two observations by Ludwig von Mises. According to Mises, “True, governments can reduce the rate of interest in the short run. They can issue additional paper money. They can open the way to credit expansion by the banks. They can thus create an artificial boom and the appearance of prosperity. But such a boom is bound to collapse soon or late and to bring about a depression.”

I wished central banks would understand this issue clearly.

Mises also noted that, “Inflationism, however, is not an isolated phenomenon. It is only one piece in the total framework of politico-economic and socio-philosophical ideas of our time. Just as the sound money policy of gold standard advocates went hand in hand with liberalism, free trade, capitalism, and peace, so is inflationism part and parcel of imperialism, militarism, protectionism and socialism.”

I believe that inflationism is not only part and parcel of socialism but also of increased regulation, diminishing personal freedom and, therefore, of lower economic growth potential.

MORE

Demeter

(85,373 posts)Step by step, Russia is undoing the budget policy assembled during the past decade as it tries to ride out turmoil on the energy market.

The government is halting the so-called budget rule a week after announcing plans to drop three-year fiscal plans in favor of a one-year program for 2016. That rule, which went into effect in 2013 and sought to cap public spending based on average long-term oil prices, may be modified, reinstated or dropped entirely, Economy Minister Alexey Ulyukayev told reporters Tuesday in Paris.

The world’s biggest energy exporter is tearing down its fiscal mechanisms as it contends with fluctuations in the price of oil, which together with gas accounts for about half of budget revenue. Crude is down more than 25 percent from this year’s closing peak in May, helping deepen Russia’s first recession since 2009 and putting the budget on course for its widest deficit in five years. Finance Minister Anton Siluanov has blamed turbulence on energy and financial markets for forcing the government to shorten its fiscal-planning horizon.

“There’s a clean slate now,” Ulyukayev said. “We’re in a situation with different options, there’s nothing predetermined.”

MEANWHILE, THE US CONTINUES TO TIES ITS OWN HANDS WITH THAT STUPID SEQUESTER...AND NO BUDGET BILLS IN SIGHT! EVEN DEFUNDING THE IRS, SO THAT IT'S IMPOSSIBLE TO COLLECT TAXES. AND THE ABOMINATION OF OBAMACARE, MAKING EVERYTHING NOT WORK AT ALL...

Tatiana Orlova, the chief Russia economist for Royal Bank of Scotland Group Plc in London, said by e-mail. “It’s better to be flexible than to have your hands tied.”

Demeter

(85,373 posts)...Strategic Hotels' properties include the Four Seasons Washington, D.C. on Pennsylvania Avenue, the Westin St. Francis on Union Square in San Francisco and the beach-front Ritz-Carlton Laguna Niguel in Orange County, California. The company's shares rose to as much as $14.10 on Tuesday, just below the offer price of $14.25 per share. Blackstone shares rose as much as 4.5 percent to $35.17.

"There are buyers who are looking for more than just economic returns and might be willing to pay a lot more (for each of Strategic Hotels' properties) than what Blackstone paid for the whole portfolio," Canaccord Genuity Inc analyst Ryan Meliker told Reuters.

Blackstone has been on a property buying spree, snapping up everything from single-family homes in the United States to distressed commercial real estate in Europe. Real estate overtook private equity as Blackstone's most high-profile and lucrative business in 2014, accounting for 43 percent of its economic net income in the year.

Strategic Hotels owns 17 hotels operated by top hospitality chains including Hyatt Hotels Corp (H.N), InterContinental Hotels Group Plc (IHG.L) and Marriott International Inc (MAR.O). Strategic Hotels' Hotel del Coronado in Southern California is among its landmark properties that are sightseeing attraction in themselves, RBC Capital Markets analyst Wes Golladay said. The beach-front hotel opened in 1888 and was designated a national historic landmark in 1977. Comedian Charlie Chaplin and U.S. President Franklin Roosevelt were among its celebrity guests.

Strategic Hotels said on Tuesday that Blackstone would also buy all outstanding membership units of its division Strategic Hotels Funding LLC for $14.25 per unit. The deal, which includes debt, is expected to close by the first quarter of 2016. Strategic Hotels had long-term debt of about $1.81 billion as of June 30...

Demeter

(85,373 posts)"NORMAL" IS WHATEVER WE SAY IT IS

http://www.reuters.com/article/2015/09/08/us-china-forex-c-bank-idUSKCN0R81DD20150908

China's central bank flagged the chance of further fluctuations in its foreign exchange reserves on Tuesday, but said these would be "normal" as it defended a new regulation imposed on its currency forwards market earlier this month.

Official data on Monday showed China's foreign exchange reserves, the world's largest, dropped by a record $93.9 billion in August to $3.557 trillion, reflecting the government's attempts to stem a slide in the yuan CNY=CFXS following a surprise currency devaluation. Analysts have said China's efforts to prop up the yuan were futile as its reserves are not bottomless, and market forces will have to hold sway at some point. But in an oblique response to comments that the world's second-largest economy was burning through its reserves, the People's Bank of China (PBOC) countered that "China has sufficient reserves". It said the Chinese economy can sustain its mid- to high-speed growth in the long run, and will continue to run a current surplus - which should help grow future reserves.

The PBOC conceded that the drop in reserves in August was due partly to its intervention in the foreign exchange market, but noted fluctuations in other currencies also played a part. It said a growing preference among households and companies for foreign currencies also reduced China's stockpile, and a drawdown in entrusted loans funded by the reserves had exacerbated the decline. As China continues to refine its foreign exchange system and increase international use of the yuan, "future rises and falls in the foreign exchange reserves would also be normal," it said.

NOT A CAPITAL CONTROL OF COURSE NOT, DEAR

In a separate statement late on Tuesday, the PBOC addressed concerns about a new control requiring banks to set aside 20 percent in foreign exchange reserves on behalf of clients trading currency forwards. The measure was unveiled as the yuan experienced its most volatile year in a decade. The shock August devaluation preceded a sharp fall in the yuan, followed by an unexpected period of gains as authorities moved to shore up the currency to deflect accusations they had triggered competitive devaluations between nations. The new rule, effective Oct. 15, has not been announced by the PBOC, but has been widely leaked by sources in the financial sector. Countering talk that the regulation is a type of capital control, the PBOC said it "obviously" wasn't as banks are not prohibited from trading currency forwards. Instead, it said the new regulation was necessary as the volume of transactions in currency forwards in China trebled last month from the monthly average in January-July, in a sign that "speculative trading" was in play. Such "herd mentality response" affected financial market order, and regulatory action was needed to curtail "excessive volatility" and prevent financial risks, the bank said, especially as more companies are likely to suffer losses on the back of a choppy currency market.

WHATEVER

Demeter

(85,373 posts)Sen. Elizabeth Warren (D-MA) said on Tuesday that while she believes Donald Trump's positions on immigration should disqualify him from becoming president, she supports his call to raise taxes on the wealthy.

"There are a lot of places where he gets out and talks about important things," Warren said of Trump on ABC's "The View." "Like Donald Trump and I both agree that there ought to be more taxation of the billionaires, the people who are making their money on Wall Street."

She said that it's not a "liberal position," but the "right" one.

However, Warren did not exactly endorse Trump, and made sure to bash his immigration proposals.

"Because he’s the one who said he wants to rip 11 million people who live in this country right now, rip them out of their families, take them away and deport them. For me, that just scratches his name off the list. You can’t be president of the United States if that’s your view about how we’re going to solve immigration reform. That’s wrong," she said.