Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 30 September 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 30 September 2015[font color=black][/font]

SMW for 29 September 2015

AT THE CLOSING BELL ON 29 September 2015

[center][font color=green]

Dow Jones 16,049.13 +47.24 (0.30%)

S&P 500 1,884.09 +2.32 (0.12%)

[font color=red]Nasdaq 4,517.32 -26.65 (-0.59%)

[font color=green]10 Year 2.05% -0.05 (-2.38%)

30 Year 2.85% -0.04 (-1.38%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)SO BE AFRAID...BE VERY AFRAID....MHAAAA--HAA-AAA!

http://www.marketwatch.com/story/sept-30-is-historically-the-worst-day-of-the-year-for-stock-market-investors-2015-09-29

S&P 500 has posted positive returns just 38% on the last day of September, since 1945

September has been tough for stock investors. But if history is any guide, the last day of September may deliver one more blow to already battered markets, according to the financial blog Bespoke.

Looking at data as far as 1945, the S&P 500 has posted positive returns just 38% on the last day of September, making it one of the worst trading days of the year, according to Bespoke (as the included table illustrates).

Earlier this month, financial blogger Ryan Detrick pointed out that the 38th, 39th and the 40th weeks of the calendar—which fall in September—tend to be the weakest of the year dating back to 1950...

MORE HAND-WRINGING AT LINK

Demeter

(85,373 posts)VIDEO AT LINK

You often hear inequality has widened because globalization and technological change have made most people less competitive, while making the best educated more competitive. There’s some truth to this. The tasks most people used to do can now be done more cheaply by lower-paid workers abroad or by computer-driven machines. But this common explanation overlooks a critically important phenomenon: the increasing concentration of political power in a corporate and financial elite that has been able to influence the rules by which the economy runs.

As I argue in my new book, “Saving Capitalism: For the Many, Not the Few” (out this week), this transformation has amounted to a pre-distribution upward. Intellectual property rights—patents, trademarks, and copyrights—have been enlarged and extended, for example, creating windfalls for pharmaceutical companies. Americans now pay the highest pharmaceutical costs of any advanced nation. At the same time, antitrust laws have been relaxed for corporations with significant market power, such as big food companies, cable companies facing little or no broadband competition, big airlines, and the largest Wall Street banks. As a result, Americans pay more for broadband Internet, food, airline tickets, and banking services than the citizens of any other advanced nation. Bankruptcy laws have been loosened for large corporations—airlines, automobile manufacturers, even casino magnates like Donald Trump—allowing them to leave workers and communities stranded. But bankruptcy has not been extended to homeowners burdened by mortgage debt or to graduates laden with student debt. Their debts won’t be forgiven.

The largest banks and auto manufacturers were bailed out in 2008, shifting the risks of economic failure onto the backs of average working people and taxpayers. Contract laws have been altered to require mandatory arbitration before private judges selected by big corporations. Securities laws have been relaxed to allow insider trading of confidential information. CEOs now use stock buybacks to boost share prices when they cash in their own stock options. Tax laws have special loopholes for the partners of hedge funds and private-equity funds, special favors for the oil and gas industry, lower marginal income-tax rates on the highest incomes, and reduced estate taxes on great wealth.

Meanwhile, so-called “free trade” agreements, such as the pending Trans Pacific Partnership, give stronger protection to intellectual property and financial assets but less protection to the labor of average working Americans.

Today, nearly one out of every three working Americans is in a part-time job. Many are consultants, freelancers, and independent contractors. Two-thirds are living paycheck to paycheck. And employment benefits have shriveled. The portion of workers with any pension connected to their job has fallen from just over half in 1979 to under 35 percent today. Labor unions have been eviscerated. Fifty years ago, when General Motors was the largest employer in America, the typical GM worker, backed by a strong union, earned $35 an hour in today’s dollars. Now America’s largest employer is Walmart, and the typical entry-level Walmart worker, without a union, earns about $9 an hour. More states have adopted so-called “right-to-work” laws, designed to bust unions. The National Labor Relations Board, understaffed and overburdened, has barely enforced collective bargaining.

All of these changes have resulted in higher corporate profits, higher returns for shareholders, and higher pay for top corporate executives and Wall Street bankers – and lower pay and higher prices for most other Americans. They amount to a giant pre-distribution upward to the rich. But we’re not aware of them because they’re hidden inside the market.

The underlying problem, then, is not just globalization and technological changes that have made most American workers less competitive. Nor is it that they lack enough education to be sufficiently productive. The more basic problem is that the market itself has become tilted ever more in the direction of moneyed interests that have exerted disproportionate influence over it, while average workers have steadily lost bargaining power—both economic and political—to receive as large a portion of the economy’s gains as they commanded in the first three decades after World War II.

Reversing the scourge of widening inequality requires reversing the upward pre-distributions within the rules of the market, and giving average people the bargaining power they need to get a larger share of the gains from growth. The answer to this problem is not found in economics. It is found in politics. Ultimately, the trend toward widening inequality in America, as elsewhere, can be reversed only if the vast majority join together to demand fundamental change.

The most important political competition over the next decades will not be between the right and left, or between Republicans and Democrats. It will be between a majority of Americans who have been losing ground, and an economic elite that refuses to recognize or respond to its growing distress.

Demeter

(85,373 posts)John Boehner was a terrible, very bad, no good speaker of the House. Under his leadership, Republicans pursued an unprecedented strategy of scorched-earth obstructionism, which did immense damage to the economy and undermined America’s credibility around the world. Still, things could have been worse. And under his successor they almost surely will be worse. Bad as Mr. Boehner was, he was just a symptom of the underlying malady, the madness that has consumed his party.

For me, Mr. Boehner’s defining moment remains what he said and did as House minority leader in early 2009, when a newly inaugurated President Obama was trying to cope with the disastrous recession that began under his predecessor. There was and is a strong consensus among economists that a temporary period of deficit spending can help mitigate an economic slump. In 2008 a stimulus plan passed Congress with bipartisan support, and the case for a further stimulus in 2009 was overwhelming. But with a Democrat in the White House, Mr. Boehner demanded that policy go in the opposite direction, declaring that “American families are tightening their belts. But they don’t see government tightening its belt.” And he called for government to “go on a diet.” This was know-nothing economics, and incredibly irresponsible at a time of crisis; not long ago it would have been hard to imagine a major political figure making such a statement. Did Mr. Boehner actually believe what he was saying? Was he just against anything Mr. Obama was for? Or was he engaged in deliberate sabotage, trying to block measures that would help the economy because a bad economy would be good for Republican electoral prospects?

We’ll probably never know for sure, but those remarks set the tone for everything that followed. The Boehner era has been one in which Republicans have accepted no responsibility for helping to govern the country, in which they have opposed anything and everything the president proposes. What’s more, it has been an era of budget blackmail, in which threats that Republicans will shut down the government or push it into default unless they get their way have become standard operating procedure.

All in all, Republicans during the Boehner era fully justified the characterization offered by the political analysts Thomas Mann and Norman Ornstein, in their book “It’s Even Worse Than You Think.” Yes, the G.O.P. has become an “insurgent outlier” that is “ideologically extreme” and “unmoved by conventional understanding of facts, evidence and science.” And Mr. Boehner did nothing to fight these tendencies. On the contrary, he catered to and fed the extremism.

So why is he out? Basically because the obstructionism failed.

MORE

Punx

(446 posts)http://www.huffingtonpost.com/2012/04/25/robert-draper-anti-obama-campaign_n_1452899.html

(Note Kevin McCarthy's name on the list. That will tell you what to expect if he is elected speaker)

And Jude Wanniski's "Two Santa Clauses" strategy".

http://www.commondreams.org/views/2009/01/26/two-santa-clauses-or-how-republican-party-has-conned-america-thirty-years

Probably most here are familiar with them, but I recommend that anyone who hasn't heard of these to read them.

It's all about power for the Rethugs, and they couldn't care less about anything or anyone else.

Demeter

(85,373 posts)NO OIL, NO SUCKERS FOR DEVELOPERS

Chain saws and staple guns echo across a $40 million residential complex under construction in Williston, North Dakota, a few miles from almost-empty camps once filled with oil workers.

After struggling to house thousands of migrant roughnecks during the boom, the state faces a new real-estate crisis: The frenzied drilling that made it No. 1 in personal-income growth and job creation for five consecutive years hasn’t lasted long enough to support the oil-fueled building explosion...

Demeter

(85,373 posts)SUCH TOTAL BS---STRONG ECONOMY, MY FOOT!

http://www.bloomberg.com/news/articles/2015-09-29/the-young-people-who-got-screwed-by-a-strong-economy

When the housing market was hot, from the late 1990s to 2006, there were many good jobs that didn’t require a college education. For a certain kind of high school grad, paying tuition started looking like a dodgy proposition.

Then the boom went bust.

For one reason or another, the young construction workers and sales agents who skipped college to enter the workforce never went back, opening a schism between the boom-time workers and the college-going generation that came of age after the economy went splat.

That’s the story sketched out in a new working paper, published by National Bureau of Economic Research, from professors Kerwin Kofi Charles and Erik Hurst at the University of Chicago and Matthew Notowidigdo of Northwestern University. The three used Census Bureau, Department of Education, and Labor Department data to track what they call “college attainment” through the housing cycle.

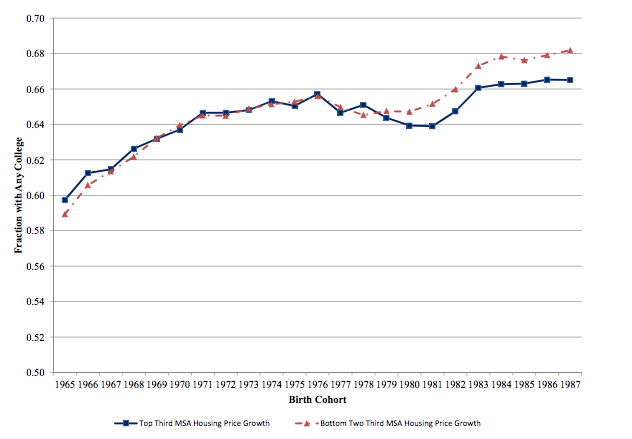

They found that the annual increase in the share of young adults who attended at least some college, which had been steady since the early 1980s, slowed in the late '90s. The slowdown was more dramatic in markets whose home prices were growing fastest, and it was mostly confined to students attending two-year colleges.

That's logical enough. If a strong housing market creates jobs and boosts pay—for people building and selling new homes, as well as for retail clerks, waitresses, and nannies—matriculants pay a greater opportunity cost. It makes even more sense when the researchers drill down on which potential students were ditching class. The percentage of young adults with bachelor’s degrees actually ticked up in some cities, perhaps because the wealth accruing in hot housing markets made it easier for parents to finance their children’s education.

On the whole, however, workers lured away from college during the housing boom didn’t catch up during the bust. “Our evidence suggests that these cohorts have experienced a sort of ‘educational scarring,’ whereby their rates of attainment are permanently lower than would have been true had there been no boom,” the authors wrote. That cohort's lower productivity, the authors suggested, may have contributed to the slow pace of the overall economic recovery.

Millennials are often described as having been thwarted by the bad luck of having had to launch careers in a terrible job market. For some older members of the generation, however, the misfortune seems to have been getting started when the economy was good.

Demeter

(85,373 posts)ON YOUR NICKEL, MIND YOU!

http://www.bloomberg.com/news/articles/2015-09-29/how-congress-helped-save-goldman-sachs-from-glencore-envy

In October 2011, things were looking bleak at Goldman Sachs Group Inc.’s commodities business. Revenue was down, competition was up, employee attrition was at an all-time high and new regulations were on the horizon. Beyond the usual rivalries with Morgan Stanley and JPMorgan Chase & Co., Goldman Sachs executives saw an upstart doing deals they couldn’t do and throwing lots of cash at traders: Glencore Plc. The commodities company wasn’t tied down by rules that applied to banks and had become even more of a presence since a $10 billion initial public offering earlier that year. It boasted strong growth and higher stock multiples than Goldman Sachs was receiving for its commodities unit.

“Glencore competes with GS Commodities but has a broader business mix, including significant production, refining, storing and transport activities,” Goldman Sachs executives said in a presentation that month to the bank’s board later made public by the Senate Permanent Subcommittee on Investigations. “May be model for evolution of commodities trading.”

Four years later, that envious assessment is looking wrong, and Goldman Sachs executives are probably breathing a sigh of relief. Glencore shares plunged 29 percent Monday, extending their decline to 78 percent in the past five months. The Baar, Switzerland-based company is seeking to sell assets and cut debt to avert a credit-rating downgrade. It has sold new stock and scrapped its dividend as part of a $10 billion debt-reduction program amid a broad commodity rout spurred by China’s economic slowdown. Last week, Goldman Sachs analysts said the company’s efforts were inadequate, sending the stock lower.

Goldman Sachs and other banks have the U.S. Congress and the Federal Reserve to thank. While you won’t hear many bankers praising regulation that limits their activities, the Fed’s scrutiny of banks’ physical commodities units came at a fortuitous time for the largest Wall Street firms...The Fed was already overseeing the commodities units of Goldman Sachs and Morgan Stanley as a result of their 2008 conversion to bank holding companies when Senator Sherrod Brown, an Ohio Democrat, held hearings in 2013 on the risks those businesses posed to lenders and markets. He pushed regulators to review banks’ commodities activities and the exemptions that allowed firms to own such businesses...The Senate subcommittee held hearings last year and released findings from a two-year investigation that concluded Wall Street’s role in owning physical commodities provided unfair trading advantages and could threaten the financial system if a bank’s business suffered an industrial catastrophe. While the Fed still hasn’t introduced its promised new rules, banks didn’t wait to act.

MORE

Demeter

(85,373 posts)Germany’s leading company has toyed with the air people breathe. That’s shocking. In historical context, it’s devastating.

The Volkswagen scandal elicits more than dismay. It is one of those moments when the entire culture of a nation — in this case one of scrupulous honesty, acceptance of rules, reliability, environmental sensitivity and atoning dedication to the common good — is called into question.

Germany is never quite what it seems. There is a strain between its order and its urges. Formality may mask frenzy. When things go wrong, they tend to go wrong in a big way...

A DESPITE OUR BEST EFFORTS TO PREVENT IT, IT'S HAPPENED AGAIN!

Demeter

(85,373 posts)IT'S CALLED CRONY CAPITALISM AND NEOCON/NEOLIBERALISM

As it accepted the resignation of Chief Executive Martin Winterkorn on Wednesday, the executive committee of Volkswagen’s supervisory board praised his “towering contributions” to the company that stands to lose much of its $37 billion cash stash making amends for major fraud committed on Winterkorn’s watch.

Such graciousness is a German tradition, and it raises the question whether there’s something fundamentally wrong with the country’s corporate establishment.

In its statement, the committee declares as fact that Winterkorn “had no knowledge of the manipulation of emissions data.” There was no way to establish that in the short time since Volkswagen’s use of special software to cheat emissions tests came to light. The board, which in April backed Winterkorn in a battle with company patriarch Ferdinand Piech, must have taken the chief executive’s word for it. That is amazing leniency on the part of a group of people charged with looking out for shareholders’ interests, given that Volkswagen’s stock is down 28 percent since Sept. 18.

There’s nothing unusual about it, though. When Anshu Jain stepped down as co-chief executive of Deutsche Bank in June, the bank’s stock price was down 17 percent from this year’s high in April, dogged by continuing heavy fines for all sorts of past misdeeds — many committed on Jain’s watch — and a helpless restructuring plan he had proposed. Yet Paul Achleitner, chairman of Deutsche’s supervisory board, expressed his appreciation for the contribution of Jain and the other co-chief executive, Juergen Fitschen, who is leaving at the end of this year, in almost the same words the Volkswagen board used for Winterkorn.

In 2013, the supervisory board of Siemens, Germany’s fifth-biggest company by revenue, announced the resignation of Peter Loescher, whose time as chief executive was marked by costly delays in important projects and woeful strategic errors, noting that “under his leadership, the company achieved a substantially higher level of performance and profitability.” Loescher was credited with cleaning up Siemens after the company was caught bribing officials in a number of countries to land contracts. That scandal was the undoing of his predecessor Klaus Kleinfeld, who was seen off with the message that thanks to his leadership, “Siemens is in better condition than ever before.”

This is not a question of decorum. It may well be that malfeasance of the kind seen at Volkswagen, Deutsche Bank and Siemens over the years, as well as a lack of executive responsibility for it — beyond the nuisance of having to resign and be sorely missed — is built into the German corporate governance system...

IT COULD HAPPEN HERE, IF CONGRESS AND OBAMA'S JUSTICE SYSTEM WEREN'T SO THOROUGHLY CORRUPT. IT COULD HAPPEN ANYWHERE IN THE WESTERN WORLD, OR ASIA. IT'S NOTHING SPECIAL...IT'S THE WAY CAPITALISM HAS ALWAYS BEEN. ASK ROCKEFELLER.

http://www.japantimes.co.jp/opinion/2015/09/27/commentary/world-commentary/something-rotten-state-germany/

Demeter

(85,373 posts)PETITION CAMPAIGN

http://www.signherenow.org/dont-garnish-social-security/pfaw/

Demeter

(85,373 posts)Bankruptcy is supposed to give debtors a fresh start—unless they’re struggling with student loans. But a little-known provision is helping these borrowers take their creditors to court...In 2005, Chuck Stewart’s life had come to a screeching halt. His partner was in the hospital with a terminal illness and he had only $300 in his bank account. He couldn’t find a job, and the $60,000 in student loans he took on for a doctorate in education weren’t going anywhere. That’s when he decided to file for bankruptcy.

“I spoke to two lawyers and they both said the same thing: ‘It’s going to be extremely expensive and you are going to lose,’” he said.

In a typical bankruptcy, Stewart would have to show that his income was below the median level for the state or that his expenses outweighed his disposable income. With a tower of medical bills and unable to find employment, he likely would have qualified. But because his loans were for school, lawyers said it would be impossible.

Historically, U.S. bankruptcy laws have been passed to give debtors a fresh start: If you’re drowning in credit card bills, an underwater mortgage, or even gambling debt, you can file for bankruptcy and start over. Not so if that same money was spent on an education. Today, student loans—which total more than $1.3 trillion—are one of just a few types of debt that do not generally qualify for bankruptcy, putting them in a category with unpaid child support and criminal fines. It wasn’t always like this. Bankruptcy rights for student debtors were slowly eroded over years as legislators enacted law after law to curtail students’ access to bankruptcy. For centuries, Congress has protected debtors by creating relieving bankruptcy codes during economic crises that threatened to throw large portions of the population into nearly inescapable debt. Several bankruptcy laws were passed during the Great Depression alone to aid the ailing population. In 1934, the Supreme Court ruled in Local Loan v. Hunt that bankruptcy “gives to the honest but unfortunate debtor…a new opportunity in life and a clear field for future effort, unhampered by the pressure and discouragement of pre-existing debt.”

But in 1970s, that clear, unhampered field began to change for students. Congress grew concerned about the default rates on federal student loans and government-backed private loans. Between 1973 and 1975, the number of students filing for bankruptcy had jumped from just under 30 percent to nearly 60 percent (though some have argued that the rise in filings was due to an overall increase in students attending college and taking out loans). In 1976, the bankruptcy code was amended to prevent the discharge of student loans during borrowers’ first five years of repayment (they could still be discharged after that). Then, a succession of laws added private student loans to the list of debts ineligible for bankruptcy, and extended and then eliminated the waiting period, permanently blocking students from discharging their debt. Many—including students, lawyers, judges, and representatives of Congress—have called for a revision to the laws, arguing that they are unfair and can be exploitative, especially in the case of private loans. Currently, the only way for debtors like Stewart to start fresh is to make use of a little-known clause that allows debtors to declare bankruptcy if they can prove intolerable economic hardship...

Demeter

(85,373 posts)It’s not just Volkswagen. For years, emissions from cars built by almost every major manufacturer have been higher out on the road than when tested in labs.

In fact, the average gap between real-world emissions and official test results has been growing. A new report by the International Council on Clean Transportation, the research group that first flagged suspicious emissions patterns at Volkswagen, found that under normal conditions the average carbon-dioxide emissions for passenger cars are some 40% higher than the official amounts certified by European lab tests. In 2001, the gap was less than 10%.

And Volkswagen doesn’t show the largest gaps. In German tests, cars from the Daimler stable (Mercedes-Benz and Smart) showed a gap of nearly 50% between what researchers measured on the road and what technicians recorded in official lab tests.

Researchers say that a gap of around 10% is to be expected under normal conditions. And the ever widening gap in recent years suspiciously coincides with the 2009 introduction of mandatory emission-reduction targets for car fleets in the EU. The difficulty of meeting these targets without sacrificing the desired handling and performance is apparent...

Demeter

(85,373 posts)Some strange bedfellows are teaming up to try to get rid of the rules that allow the police to seize your stuff – even if you’re not convicted of a crime. For several months, the 7 Investigators have been exposing the problems with this concept of policing for profit. Now the ACLU and the more conservative think-tank the Mackinac Center for Public Policy are coming together to call for an end to civil forfeiture.

“They’re taking millions from people," Michael Dula told the 7 Investigators in May. "Hard working people, people with jobs, they’re taking millions from people.”

Dula is just one of several people who say police took their money, their cars and their peace of mind - without any sort of criminal conviction. Then in July, Ginnifer Heney told us, “They have had my stuff for 10 months. My ladders, my iPads, my children’s iPads, my children’s phones.”

Under Michigan’s asset forfeiture laws police can seize money and property that they believe is related to drug crimes – even if you’re never even charged or convicted of the crime. During a 12 year period, police seized more than $272 million in forfeiture proceeds. Now the American Civil Liberties Union of Michigan, and the Mackinac Center for Public Policy have released a report on civil forfeiture and both groups want the practice outlawed. They’re saying Michigan should only allow forfeiture through the criminal courts – not the civil courts – and only after a criminal conviction. They also want to reduce the incentive for police to abuse the rules. Right now, the agency that seizes the property gets to keep the proceeds.

“There’s really no cap on what they can use this money for. It is policing for profit,” attorney William Maze told us.

There are several bills on the Senate floor right now. One of them would require agencies that seize property to send detailed reports of what they’ve taken to the state police. The other would change the standard of evidence that police would need to take your property.

Demeter

(85,373 posts)It’s really tough to find a commodity that’s doing well this year.

As the third quarter draws to an end, most commodities have posted losses year to date, with lumber, coffee, and aluminum suffering the largest declines year-to-date.

Rough rice, cocoa, and cotton are among the only major traded commodities to see prices climb since the beginning of the year.

“The commodities asset class continues to be the worst of the worst in a market full of struggling investments,” said Adam Koos, president of Libertas Wealth Management Group Inc. “There just isn’t enough momentum and strength in the commodities sectors to warrant anything other than speculative dollars, at least through the end of the year, if not beyond.”

MORE

Demeter

(85,373 posts)JPMorgan Chase & Co (JPM.N) shareholders on Tuesday won court permission to pursue their securities fraud lawsuit against the bank over the "London Whale" trading scandal, which caused a $6.2 billion loss, as a class action.

U.S. District Judge George Daniels in Manhattan rejected the largest U.S. bank's arguments against class action certification, which often results in higher recoveries because plaintiffs can sue as a group rather than individually.

JPMorgan, Chief Executive Officer Jamie Dimon and former Chief Financial Officer Douglas Braunstein had said shareholders would be unable to show they relied on alleged misstatements about the bank's risk management, or prove damages on a classwide basis.

Brian Marchiony, a bank spokesman, declined to comment...

http://finance.yahoo.com/news/jpmorgan-ordered-face-london-whale-234943066.html

Demeter

(85,373 posts)I believe that Citigroup (NYSE:C) is the best international commercial bank in the world. It is the reason to own the stock. The current management team is one of the best that has ever run this bank, proving disciplined and willing to take tough measures to bring this sprawling organization under control. But, there's one nagging problem: The bank's retail business.

I frankly believe that the bank has continually failed in its retail business — the area that focuses on consumers (banking, loans, etc.) – outside of New York City. And, I think it will continue to fail, despite Citi's best efforts.

Citigroup has tried retail banking under a variety of CEOs in a variety of markets. Former CEO John Reed tried to set up a national retail-banking operation by acquiring savings-and-loan organizations across the country, and Chuck Prince took that a step further, building branches all across the U.S. in markets where Citigroup had a meaningful presence in mortgage lending. Just recently, the bank started shutting down some of these offices.

Reed also had a vision to expand to emerging market economies to capitalize on growing income and wealth, opening branches in 50 to 60 countries. Subsequent CEOs Sandy Weill, Vikram Pandit and Mike Corbat started to unwind these overseas operations and today, there are about two dozen retail-banking operations in foreign countries — less than half of what it used to be. All have failed to produce the results the bank wanted. The company has abandoned its retail strategy in China, Japan, Germany and Turkey. It is out of or getting out of Nicaragua, Peru, and Columbia. The bank is still in Mexico but that operation almost imploded a few years ago amid finding of massive corruption...

And, Citi's experience in the residential mortgage market almost bankrupted the whole organization.

MORE

Demeter

(85,373 posts)I FIND MYSELF LESS WILLING TO PLAY TUG OF WAR WITH CAPITALISTS, AND MORE WILLING TO TURN TO DEMOCRACY BY SOCIALISM--TURNING PROFIT CENTERS INTO PUBLIC UTILITIES, AND SOAKING THE OBSCENELY WEALTHY TO PAY FOR IT

FDR GAVE CAPITALISTS THE OPPORTUNITY TO CONTINUE TO PLAY...AND THEY BLEW IT. NO MORE SECOND CHANCES!

http://www.alternet.org/economy/robert-reich-capitalism-can-be-reformed-americas-wealthy-class-will-fight-it?akid=13525.227380.dmkrH7&rd=1&src=newsletter1043107&t=3

Can American capitalism be saved from its most predatory, selfish instincts?

Could the U.S. economy spread its wealth—if the public and political class understood how today’s unprecedented domination by monopolistic corporations have undermined opportunity, wages and income, and public confidence in the future?

In other words, what would it take to reshape the marketplace so Americans do not feel they are endlessly emptying their pockets almost everytime they access health care, use bank or use credit cards, repay student loans or bills for necessities such as Internet access—which have been steadily ticking upward and outpacing income growth.

This audacious question and challenge is the topic of Robert Reich’s new book, Saving Capitalism: For The Many, Not The Few. In it, the ex-Secretary of Labor and political economy scholar outs “the new monopolists,” debunks their “free-market” ideology and rhetoric, and offers a pragmatic reform-filled path forward...

MORE

Demeter

(85,373 posts)Once the deadwood piles high enough, the random lightning strike ignites a fire so fast-moving and so hot that it cannot be suppressed, and the entire financial system burns to the ground.

In discussing our broken healthcare system with a 22-year college graduate, I opined that Obamacare hadn't fixed anything that was broken. She observed that real reform was impossible due to vested interests and the only real solution was to "start over."

Exactly.

People constantly ask me for solutions to our all-too visible ills. You want solutions? Here's the solution for every systemic, structural problem we face: Avoid getting hurt when it collapses, then start over. Over the nine years I've been writing this blog, I've offered dozens of systemic solutions, and have reprinted dozens more submitted by readers. For example:

Boomers, Prepare to Fall on Your Swords (June 2005)

The "Impossible" Healthcare Solution: Go Back to Cash (July 29, 2009)

Want to Reduce Income/Wealth Inequality? Abolish the Engine of Inequality, the Federal Reserve (January 28, 2014)

Nobody likes these solutions because they disrupt everyone's place at the feeding trough. People get deeply offended when their place at the trough and their complicity in a corrupt, inefficient, wasteful, fraudulent and unsustainable system are challenged.

And furthermore, all these solutions are impossible. As a result, my work draws untold numbers of negative and derogatory comments and commentaries, "Charles is f**king crazy" being one of the kinder ones. A relative handful of insiders who refuse to drink their institution's KoolAid are courageous enough to call it like it is, and these few confirm that the key sectors and institutions of our society and economy are hopelessly corrupt, inefficient, wasteful, fraudulent and unsustainable: Healthcare: broken. Medicare: broke and broken. Higher education: broken. Welfare: broken. Corporate subsidies/welfare: broken. Taxation: broken. War on drugs: broken. The legal system (tort, criminal justice, patents, etc. etc. etc.): broken. Defense procurement: broken. National security state (to anyone who's glanced at the U.S. Constitution): broken. The Imperial Presidency: broken. Congress (i.e. lobbyists and campaign contributions): broken. The financial system: broken.

Do I have to go on? Every major system is fundamentally broken, yet we persist in claiming it isn't broken and only needs a few policy tweaks because our self-interest is served by keeping our place at the feeding trough intact, never mind the consequences. We're collectively horrified and frightened by the notion that the whole travesty of a mockery of a sham is precariously perched on a financial house of cards and so we desperately attempt to marginalize the informed critics, whistleblowers and truth-tellers.

So let me ask you one question: did silencing the informed critic ever solve any fundamental problem? The answer is no: the only possible way to avoid collapse is to listen to the informed critics and whistleblowers. This is a scale-invariant truth: it's the same for marriages, families, communities, enterprises, institutions, nations and empires. I welcome informed criticism, because we learn from failure and fair criticism. I receive thousands of emails every year and do my best to read each one and respond to as many as my over-scheduled workload allows (alas, very few). The critiques I've received fall into a few camps:

1. The Complexity Excuse: All large complex bureaucracies are inefficient, wasteful and corrupted by vested interests and powerful constituencies--it's the nature of the organization. As a result, there's nothing to be done; real reform is impossible. The rules will always be complex and therefore open to being gamed by insiders and monied Elites.

The implicit conclusion: we are powerless, so let go of all ideas of reform. Just enjoy your life and quit tilting at windmills. Fine, but let's not forget that whatever is unsustainable will collapse and vanish from this Earth. To say that large centralized bureaucracies are intrinsically inefficient, wasteful and corrupt suggests an obvious solution: the only real solution is to get rid of all centralized bureaucracies entirely. That is of course "impossible" until the financial firestorm burns down the forest loaded with deadwood, and suddenly all sorts of things that were "impossible" are not just possible but painfully obvious.

2. The Self-Serving Excuse: This is the best possible system, given the alternatives. Those toiling inside these institutions are naturally drawn to defend them as the "best possible system" because to question their role in a broken system is to question their identity, security, self-image as a good person and their role in perpetuating a broken system.

As immortalized by the insider's insider, Larry Summers: Insiders also understand one unbreakable rule: They don’t criticize other insiders.

What is so incredible about the quote above is that it essentially proves correct everything I and many others have been saying about how “things work” in America these days. The statements above describe a petty, childish oligarchy of arrogant fools. This small club of people call all the shots and do not listen to “outside” ideas whatsoever. This is why nothing changes. This is why the same people are recycled through positions of power over and over again no matter how badly they screw up and how many millions of lives they ruin. This is why there is a two-tiered justice system in which the rich and connected never go to jail, while the average citizen can have his home raided by police for a parody Twitter account. This is why the 0.01% have been able to loot all of the nation’s wealth while median inflation adjusted wages have been declining for 40 years.

The reason is because the “status quo” in America consists of a deranged, immoral, arrogant, selfish fraternity of inept children who protect each other at the expense of everyone and everything else. Until the status quo gets the boot, this nation will continue to decline. Forget reforms, the entire status quo needs to be tossed aside once and for all. The insiders must be turned into outsiders.

3. The same Elites have been running the country for X number of years. This is a variation on the Complexity Excuse and it leads to the same implicit conclusion: we are powerless, so let go of all ideas of reform. Just enjoy your life and quit tilting at windmills.

You want solutions, but you don't want anything to actually change? Sorry, you can't have it both ways. Let's jettison all the distracting complexity--the 2,000-page laws, the 40,000-page tax code (or is it 80,000 pages? Does it really matter beyond 1,000 pages?), the arcane financial games that keep the whole fraud afloat (Quantitative Easing, reverse repos, credit default swaps, shadow banking, rehypothecation, etc.)--and distill the choices down to their essence:

1. Embrace your place at the feeding trough of the Status Quo and put your faith in its sustainability, regardless of its inevitable warts. Denounce critics and defend the Status Quo with some variation of the three primary justifications/excuses.

2. Position yourself to avoid getting hurt when the unsustainable mess collapses in a heap of financial over-reach and fraud.

Interestingly, nobody actually believes a few policy tweaks will reform/fix what's broken. Virtually none of the thousands of emails I receive present a few policy tweaks as credible "fixes." We all know the system is broken and the proposed policy tweaks aren't fixing anything, but human nature being what it is, we hope our place at the feeding trough will somehow survive unscathed as the financially unsustainable house of cards collapses around us. In essence, we all know the system is broken and can't be reformed, but we play along with the illusion out of self-interest. There is a peculiar self-referential quality to our predicament. The only way to enable meaningful reform is to listen closely to informed critics, whistleblowers and truth-tellers. But we choose to crucify whistleblowers, mock and denigrate informed critics and marginalize/demonize truth-tellers as threats to our place at the feeding trough. So meaningful reform is impossible--even if vested interests woke up to the fact that their favored place at the trough is precarious.

This entire dynamic has been articulately laid out by Thomas Homer-Dixon in his seminal book The Upside of Down: Catastrophe, Creativity, and the Renewal of Civilization: I highly recommend this work and another long-view book that illuminates the dynamics of our impending financial implosion, The Great Wave: Price Revolutions and the Rhythm of History by David Hackett Fischer. You want solutions? Just do nothing, and the whole rotten financial contraption will collapse, very likely within the next decade. I prefer the analogy of the forest fire: The Yellowstone Analogy and The Crisis of Neoliberal Capitalism (May 18, 2009).

Vested interests are threatened by the losses generated by small financial fires, so these are systemically suppressed. As a result, the fallen deadwood piles ever higher, creating more fuel for the next random lightning strike to ignite. Once the deadwood piles high enough, the random lightning strike ignites a fire so fast-moving and so hot that it cannot be suppressed, and the entire financial system burns to the ground. So go ahead and keep defending the Status Quo as the best system possible, or believe Elites will keep suppressing fires forever because they're so powerful, or whatever excuse, rationalization or justification you prefer. It won't matter, because the firestorm won't respond to words, beliefs, ideological certainties, reassurances or official pronouncements. It will do what fires do, which is burn all available fuel until there's no fuel left to consume.

As I noted last week in A Reader Asks: How to Find Shelter from the Coming Storms?, Centralized systems such as governments and global corporations are either bankrupt and don't yet know it or are bankrupt and are well aware of it but loathe to let the rest of the world catch on. If you want to believe this is the best possible system and it's sustainable, be my guest.

Charles Hugh Smith's website is #7 in CNBC's top alternative financial sites. http://www.oftwominds.com

MORE LINKS AT OP

Demeter

(85,373 posts)AN ENTIRE YEAR LATE, AND SEVERAL $BILLION SHORT

http://www.reuters.com/article/2015/09/29/us-usa-fiscal-idUSKCN0RT1T420150929

Congressional Republican leaders and the White House will launch negotiations soon on a two-year budget deal that would establish new limits for U.S. government spending in 2016 and 2017, Senate Majority Leader Mitch McConnell said on Tuesday. Seeking to bring more fiscal stability to Washington, McConnell said he and House Speaker John Boehner had spoken with President Barack Obama, a Democrat, about the talks. Boehner has announced he will step down at the end of October. After years of lurching from one fiscal crisis to the next, a two-year deal would set top spending levels and permit a more predictable process, McConnell said as lawmakers scrambled to prevent an imminent government shutdown this week.

"The president and Speaker Boehner and I spoke about getting started in the discussions last week and I would expect them to start very soon," he told reporters in the Capitol.

The White House also indicated that bipartisan talks lie ahead now that Congress was moving to keep the government operating beyond Wednesday, when the current fiscal year ends and 2015 spending plans expire. The Senate aims to pass by early Wednesday a stopgap spending bill to run from Oct. 1 through Dec. 11. Afterward, the House was expected to consider it quickly and send it to Obama for signing into law before a midnight Wednesday deadline.

“It does look like Congress is on track to take the steps that are necessary to prevent a government shutdown – at least for now,” White House spokesman Josh Earnest told reporters traveling on Air Force One with Obama.

Congressional Democrats said they also intended to be involved in the budget negotiations. "If there are any talks, I'll be invited," said Senate Democratic Leader Harry Reid. An aide to House Democratic Leader Nancy Pelosi said her staff were in preparations to discuss topline numbers and spending offsets on a bipartisan basis.

Democrats and Republicans disagree over whether spending caps imposed four years ago should be eased, and if so by how much and what the tradeoffs should be. Boehner, who stunned Washington last week by announcing he would leave on Oct. 30, on Tuesday left open the possibility of tackling major fiscal measures during his final month in office, including raising the nation's borrowing limit.

DISGUSTING! AND HERE ENDETH MY POSTING...HAVE A GOOD DAY, EVERYONE! WE PLUNGED RIGHT INTO FALL. HIGH OF 60F, LOW WINDCHILL OF 38F TONIGHT

DemReadingDU

(16,000 posts)9/30/15

Trafigura's founder and top shareholder Claude Dauphin has died, the company said in a statement. He was 64.

"It is with great sadness and regret we have to announce that Trafigura's Founder and Executive Chairman, Claude Dauphin, passed away peacefully in the early hours of this morning in a hospital in Bogota, Colombia after a hard-fought battle with cancer", Trafigura said.

Mr Dauphin founded the company that would grow to become one of the world's top commodity traders in 1993 after leaving Marc Rich AG, writes David Sheppard in London.

He stepped down as chief executive of the company in 2014 shortly after he was first treated for cancer. He remained as chairman involved with the running of the company.

Jeremy Weir, chief executive of Trafigura, said Mr Dauphin would be "greatly missed" by the company and people throughout the commodity industry.

http://www.ft.com/intl/fastft/400171/trafigura-founder-claude-dauphin-dies