Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 16 October 2015

[font size=3]STOCK MARKET WATCH, Friday, 16 October 2015[font color=black][/font]

SMW for 15 October 2015

AT THE CLOSING BELL ON 15 October 2015

[center][font color=green]

Dow Jones 17,141.75 +217.00 (1.28%)

S&P 500 2,023.86 +29.62 (1.49%)

Nasdaq 4,870.10 +87.25 (1.82%)

[font color=black]10 Year 2.01% 0.00 (0.00%)

30 Year 2.86% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Goldman Sachs Group Inc's (GS.N) profit plunged 38 percent, its second straight quarterly drop, depressed by a steep decline in bond trading revenue triggered by concern about global growth.

With the exception of investment banking, which benefited from a surge in takeovers, revenue fell in all of the bank's major businesses, from investment management to bond, currency and commodities trading.The results are the latest example of how a grim trading environment, exacerbated in the most recent quarter by worries about the global impact of a Chinese economic slowdown, is gutting Wall Street.

"We experienced lower levels of activity and declining asset prices during the quarter, reflecting renewed concerns about global economic growth," Chief Executive Lloyd Blankfein said in a statement on Thursday.

Goldman said revenue from fixed-income, currency and commodity (FICC) trading, fell 33 percent to $1.46 billion, the biggest year-over-year drop since the third quarter of 2013, when it was squeezed by concern about tighter monetary policy...

wordpix

(18,652 posts)I think Monsanto, Dow and others are next, if not happening now. People are starting to get smart about divesting from these $^&)(_)@!@ companies.

Demeter

(85,373 posts)and if there's a goddess, it will take Hillary down, too.

an economic death spiral – contraction leading to banking failure, banking failure leading to contraction...

During the latter part of 2008, central bankers around the world worried secretly that the death spiral was approaching. The concern was that it was too late to stop economies crashing. In the event, concerted international action on both monetary and fiscal policy prevented collapse – although they did get pretty darn close to the precipice.

Interest rates were cut to zero. Banks and even car companies were rescued. Massive amounts of liquidity were made available. There were tax cuts, cash for clunkers and even fridges, along with schemes to help the young unemployed. Plus the collapse came very quickly.

In the UK, then Chancellor Alistair Darling had only a few hours notice that the Royal Bank of Scotland was about to fail. The fear was that cash machines around the world would close, banks would fold and stock markets would tank within hours. This was a once-in-100-year shock: in my view, without such unprecedented intervention, unemployment rates in the US and Europe could well have risen to over 24% – which is where they are already in Greece and Spain.

Stimulus worked, simple as that.

Germany threw wads of cash at the problem, notably through its short-work (or Kurzarbeit) programme, by which companies could temporarily move employees onto shorter work schedules when demand was weak. Companies paid only for the hours worked, while the government provided up to two thirds of the workers' remaining wages. As a result, German unemployment fell, whereas the percentage of jobless in the US reached double digits in October 2009 in the United States.

Other European countries, such as the UK, saw much smaller increases in unemployment than I had expected, given the scale of the shock. But this thing is not over, not by a long way. Unemployment is now falling in the US and rising in many eurozone countries including France, the Netherlands, as well as all the PIIG countries of Portugal, Ireland, Italy and Greece; plus the UK.

Even with all that loosening of macroeconomic policy, output still fell sharply in most countries during 2008 and 2009; and even today, many have not returned to pre-recession levels of output. If we take the first quarter of 2008 as the start of the recession, output is still markedly lower in Denmark (-5.4%); Finland (-2.2%); Greece (-9.4%); Ireland (-12.1%); Italy (-4.4%); Spain (-3.2%) and the UK (-3.8%). Data presented by NIESR last week showed that the current recession in the UK, for example, has lasted longer and is of comparable depth, than the Great Depression and after four years of what JM Keynes called "the long, dragging conditions of semi-slump", not even half of the loss has been recovered. The main countries that have more than recovered their lost output are Canada (+2.9%); Germany (+1.8%); Sweden (+3.7%) and the United States (+0.8%)...

http://www.theguardian.com/commentisfree/cifamerica/2012/feb/13/greece-return-economic-death-spiral

EXCEPT IT DIDN'T WORK...IT JUST MADE THE SPIRAL BIGGER AND DEEPER AND FASTER....

Demeter

(85,373 posts)Over the past few decades, American companies have turned away from pensions and toward 401(k) accounts to help their workers save for retirement. That's been a terrible deal, according to a new analysis released Thursday.

Senior citizens on average drew less than $1,000 from their 401(k)s and similar accounts last year, the left-leaning Economic Policy Institute found when it looked at Census data. By comparison, seniors on average received $6,000 from traditional pensions.

The terrifying reminder that many people are headed for their golden years with hardly enough money to afford cat food for dinner comes at a time when politicians -- well, mostly Democrats and Sen. Bernie Sanders (I-Vt.) -- are talking about Social Security expansion again....

antigop

(12,778 posts)DemReadingDU

(16,000 posts)antigop

(12,778 posts)Of all the people on that stage, I thought only Bernie ACTED Presidential.

antigop

(12,778 posts)Demeter

(85,373 posts)I am questioning the quote, not you.

antigop

(12,778 posts)antigop

(12,778 posts)nt

DemReadingDU

(16,000 posts)and things will not get better during my lifetime

Demeter

(85,373 posts)and join in on his chorus:

Hotler

(11,420 posts)Things will not begin to change until more people feel the pain and that is why a part of me says let the repugs have this presidential election and the pain will start within a year.

A LA LANTERNE!

antigop

(12,778 posts)I feel the same way, Hotler.

Demeter

(85,373 posts)I think the pain numbers are way up there...and I think the online polls after the debate proved it: people are feeling the Bern!

I also think that TPTB are changing soiled pants and buckling on the brass knuckles, after Tuesday.

Fasten your seat belts; it's gonna be a bumpy year!

DemReadingDU

(16,000 posts)Having a senior moment, what is Tuesday?

Demeter

(85,373 posts)You are not alone in that Senior Moment...I wish I was ready and able to retire, so I could concentrate on living while I'm still alive. Maybe next decade...

DemReadingDU

(16,000 posts)Besides, can't change the past, but can study history to prepare for the future.

mother earth

(6,002 posts)Demeter

(85,373 posts)to get anything worthy of Tansy's thread.

Demeter

(85,373 posts)I got to see the Big 4 again: Venus, Jupiter, Mars and Mercury.

Mercury is the hardest to observe...you have maybe 30 minutes from Mercury rising to the Sun blotting it out in the glare of dawn. This website is invaluable for stargazers: http://neave.com/planetarium/

Mars and Jupiter were sufficiently far apart that I could see both this morning. Mars must be on the far side of its orbit, relative to us...it's so dim! I've seen it much brighter.

There's frost on the rooftops, too. Thanks for the early warning, DRDU!

Now, to keep the potted plants alive til spring...and any people and pets that happen to cohabit!

I have three exterior doors arriving Saturday, to be installed, and stop the cold seepage...one for me, two for the Younger Kid...

DemReadingDU

(16,000 posts)They are very bright!

edit to add this link...

Wow! On Saturday morning – October 17, 2015 – Mars and Jupiter will be in conjunction. It’s their first conjunction since July 22, 2013. The next conjunction of Mars and Jupiter won’t be until January 7, 2018. So this is the closest these two worlds will be to one another until 2018 – about half a degree apart, or about one moon-diameter.

They will be wonderful to see as darkness gives way to dawn on Saturday.

To see them, get up a couple hours before sunrise. The brightest object up before dawn is Venus, and Jupiter is second-brightest. Mars is much, much fainter, but you’ll spot it. It’ll be right next to Jupiter in the predawn sky.

Can you see that Mars and Jupiter are different colors? People perceive the colors of stars and planets differently, but most people will agree that Mars – the Red Planet – appears more reddish in color than Jupiter.

At one-half degree apart, these two worlds will easily fit within the same field of view in binoculars or even a low-powered telescope. If you have binoculars, use them! They’ll enhance your view.

After Saturday’s conjunction of Jupiter and Mars, Jupiter will head toward Venus. It’ll have a conjunction with that planet, too, on October 26. Mark your calendar now. Jupiter and Venus are the sky’s two brightest planets, and they’ll be like twin beacons before dawn.

By a wonderful coincidence, as Venus and Jupiter show off their third and final conjunction of 2015 – on October 26 – Venus will reach its greatest western (morning) elongation from the sun.

Moreover, the year’s closest grouping of three planets – Venus, Mars and Jupiter – will also take place on October 26.

That’s a big deal because the next planetary trio won’t occur again until January, 2021!

http://earthsky.org/tonight

and we had frost again. I am not looking forward to a cold snowy winter again.

Hotler

(11,420 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)AND OIL'S LATEST BUBBLE BURSTS....SAME OLD, SAME OLD

http://www.marketwatch.com/story/dollar-claws-back-ground-against-yen-but-drops-versus-euro-2015-10-15?siteid=YAHOOB

The dollar strengthened Thursday, supported by dovish comments from a European Central Bank policy maker and a smattering of U.S. economic data that, while not spectacular, were stronger than expected.

U.S. stocks also rose, snapping a two-day losing streak and forming a trading correlation with the dollar that confused many investors. Typically, the dollar shares an inverse correlation with U.S. stocks.

“It’s a weird positive correlation that doesn’t make a whole lot of sense, right?” said Juan Perez, a currency trader at Tempus Inc.

SIGNS OF RIGGING ALL AROUND...SHAKING HEADS STARE AT THE GROUND

Demeter

(85,373 posts)U.S. stocks rebounded from a two-day drop to reclaim key technical levels Thursday as robust gains by financial shares helped breathe new life into the market.

“Today’s rally is the result of generally better than expected results, especially in the financial sector [and] the belief that interest rates will now not increase until late winter or early spring 2016,” said Kent Engelke, chief economic strategist at Capitol Securities Management.

“Bank loan portfolios are healthy thus increasing the odds of greater lending, hence greater economic activity,” he said.

The run-up in the broader market pushed both the S&P 500 and the Dow industrials to their best closing levels since markets plunged in late August, according to FactSet data...

TIME FOR ANOTHER PLUNGE, THEN. AFTER ALL, IT'S OCTOBER!

Demeter

(85,373 posts)Matt Taibbi at Rolling Stone writes that Hillary is "counting on America's ignorance about the 2008 crash"...It's the bankers who are pulling the strings.

At the Democratic Debate, Anderson Cooper asked a question about how to curb the excesses of Wall St. Here is what Hillary said:

Here Hillary tries to get the banks off the hook and make you look at that shiny object out in the distance. It's clear she has no intention of reinstating Glass-Steagall or of trying to curb the financial sector's abuses.

This squeamishness about criticizing banks is laughable to people in the industry. But of course, that's probably the point – that the average voter won't know how absurd and desperate it is to point to faceless "shadow" financiers as villains when the real bad guys are famed mega-firms that are right out in the open, with their names plastered all over every second city block.

Of course, Barney Frank after being a part of regulating banks in congress, now is working for the banks, making tons of money and daring congress to do anything about it.

We know this, among other things, because it was big banks like JPMorgan Chase and Citigroup that paid the biggest chunks of the $100 billion in fines Hillary later referenced in the debate. There is a vast record of documentary and witness evidence now attesting to the mass fraud, which was of a type that can and probably will happen again. The policy issue is how to curb the impact of that inevitable next crooked scheme.

Bankers bankroll Hillary's campaign, so while it may seem that she's trying to gain employment representing the American people, it's the bankers who are pulling the strings.

Read Taibbi's entire piece. As usual, he breaks things down so that anyone can understand how Hillary's solution to Wall St. abuse leaves the US (and the world) vulnerable to another major economic disaster.

http://www.rollingstone.com/politics/news/hillary-clintons-take-on-banks-wont-hold-up-20151014

Demeter

(85,373 posts)A key government draft proposal that will seek to tackle multinational corporations' tax-avoidance will draw from a latest international tax rule, and is expected to be rolled out by the year-end, a top tax official said...The proposal, which is known within the industry as the No 2 Document, is being closely watched by MNCs in China and tax professionals alike, For it will give detailed guidance on what MNCs call "transfer pricing". The document will define what is "reasonable" transfer pricing and what is not, a term used in transactions among divisions of a company. Authorities believe such intra-company deals have become a front for corporate tax avoidance.

The document has drawn from action plans on base erosion and profit shifting or BEPS, the emerging international tax rule, especially in transfer pricing of intangible assets, interest deductions and overseas subsidiaries. The BEPS Action Plan has offered recommendations on how each nation's tax authority could tackle these issues. Globally, the BEPS Action Plan represents an ambitious effort to modernize and align corporate tax with value creation and economic activity.

MNCs have long exploited loopholes in existing rules to avoid corporate taxes. For example, MNCs have been shifting their profits from locations of their operations to low-tax havens to avoid paying taxes. The resulting revenue losses to national exchequers have grown from $100 billion to $240 billion a year, according to an estimate of the Organization for Economic Co-operation and Development. The OECD considers its own estimate very conservative.

The BEPS Action Plan was released by the OECD on Oct 5 and won strong endorsement from finance ministers of G20 nations. It is expected to be a major achievement at next month's G20 Summit. China is among 61 nations that have engaged in the drafting of the BEPS Action Plan. It has submitted more than 1,000 suggestions to international panels... the focus of China's existing anti-tax avoidance regime is on avoidance of double-taxation. But the BEPS plan focuses on the increasing incidence of double non-taxation as new businesses are increasingly digital, services-based and driven by intangible assets, and it is easier for MNCs to shuffle profits from subsidiaries in high-tax countries to those in low-tax ones.

MNCs also tend to treat what is regarded as debt in one country as equity in another country, to claim two lots of tax deductions. The document, if implemented, would rein in such practices.

Demeter

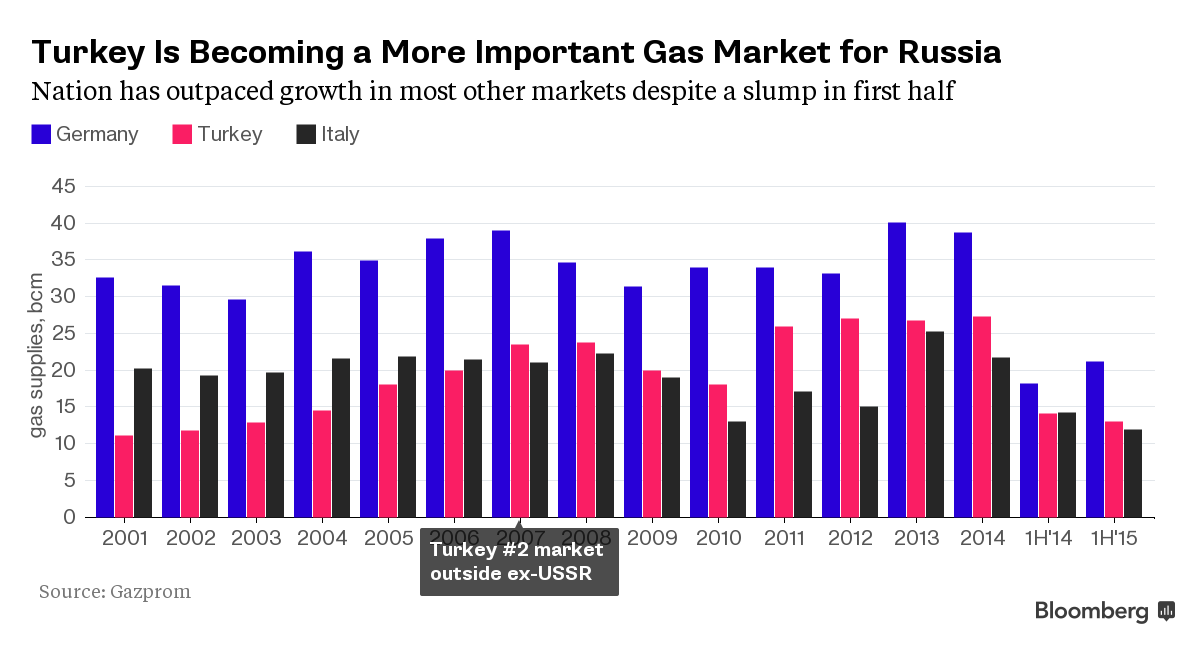

(85,373 posts)It’s taken less than a year for Russian President Vladimir Putin to go from hailing Turkey as a potential linchpin in natural gas supplies to Europe to shunning it. As the nations fall out over the conflict in Syria, Moscow-based Gazprom PJSC, the world’s largest gas producer, said last week it would cut the capacity of a planned link to Turkey and on to Europe by 50 percent. Turkish President Recep Tayyip Erdogan warned Russia last week that energy cooperation could suffer because of the former Soviet nation’s violation of his country’s airspace and military buildup in the region. That’s a far cry from last year, when Putin said Turkey could become an energy hub for southern Europe as the proposed link under the Black Sea would help Russia reduce its dependence on gas transit via Ukraine, the current route for more than 10 percent of Europe’s gas.

Putin feels able to change tack on Turkey, the second-largest customer for Russian gas, because in September he agreed to expand the Nord Stream pipeline that links Russia directly with Germany.

“Putin is betting on Nord Stream, but that bet is risky," Sijbren de Jong, energy security analyst at the Hague Centre for Strategic Studies, said by e-mail. "Can Gazprom really afford to annoy Turkey and forgo gas revenues? Hardly."

I'M SURE AS SOON AS THE MADMAN ERGODAN IS SHOWN THE EXIT, NEGOTIATIONS WILL RESUME. PUTIN IS NOT ONE TO BABY A FOOL (OBAMA, TAKE NOTE)...DEMETER

Russia relies on oil and gas for about half of its budget earnings and is adept at mixing its energy policies with political aims. It stepped up energy cooperation with Turkey and China last year as relations with the EU and the U.S. soured over the Ukraine conflict and profits from gas sales in Europe slumped on weaker commodity prices. Europe receives about a third of its gas from Russia with a third of that volume flowing through Ukrainian pipelines. Gazprom aims to end or at least cut its gas transit through the former Soviet republic after the current transit contract expires in 2019.

Putin said last year that the new Turkey route would help Russia to meet this goal. After talks on the link stalled over the summer, Gazprom said that the Baltic Sea link directly to Germany known as Nord Stream-2 was a priority. Putin’s bet on Nord Stream-2 is risky as the project may face opposition in the EU, De Jong said. EU Energy Commissioner Miguel Arias Canete said last week the link risked concentrating 80 percent of the bloc’s Russian gas imports on one route while eastern European nations have also warned of the risk of circumventing Ukraine. Gazprom said Tuesday that key markets for Nord Stream-2 are boosting gas purchases from Russia, with total European exports in early October gaining almost 36 percent from last year’s level.

*****************************************************

While Nord Stream-2 doesn’t need to be approved by the European Commission, the onshore network may face legislation and political obstacles. Gazprom faces similar problems with the Opal gas pipeline in Germany linked to the existing Nord Stream, which can use only half of its capacity because EU rules require access for competitors.

THE EU WOULD HAVE TO BE SUICIDAL TO FREEZE OUT EUROPEANS...

Demeter

(85,373 posts)Several close associates of Russian President Vladimir Putin may have benefited from Deutsche Bank AG trades that are now coming under the glare of U.S. prosecutors, according to people familiar with the matter.

The U.S. Department of Justice is investigating whether Germany’s biggest bank properly vetted as much as $6 billion in transactions that may have masked the flow of money out of Russia, people familiar with the matter have said.

The bank, which is carrying out its own review of the transactions, is looking into accounts connected to roughly a dozen entities for which it conducted so-called mirror trades between Moscow and London, said people with knowledge of the matter. In several cases, they said, assets in these accounts were said to belong to Putin associates, including a relative of the president and two of his longtime friends, Arkady and Boris Rotenberg, who grew rich from contracts with state-run firms and who are now under U.S. sanctions.

There’s no indication that the Rotenbergs or other individuals allegedly linked to the accounts are under investigation for the trades. The transactions -- in which a client can use money in one market to buy securities, while cashing out of similar securities in another market -- can be done legally. What U.S. prosecutors want to know is whether the bank violated U.S. banking laws, including whether it failed to comply with anti-money-laundering reporting practices...

THE REST IS GOSSIP

Demeter

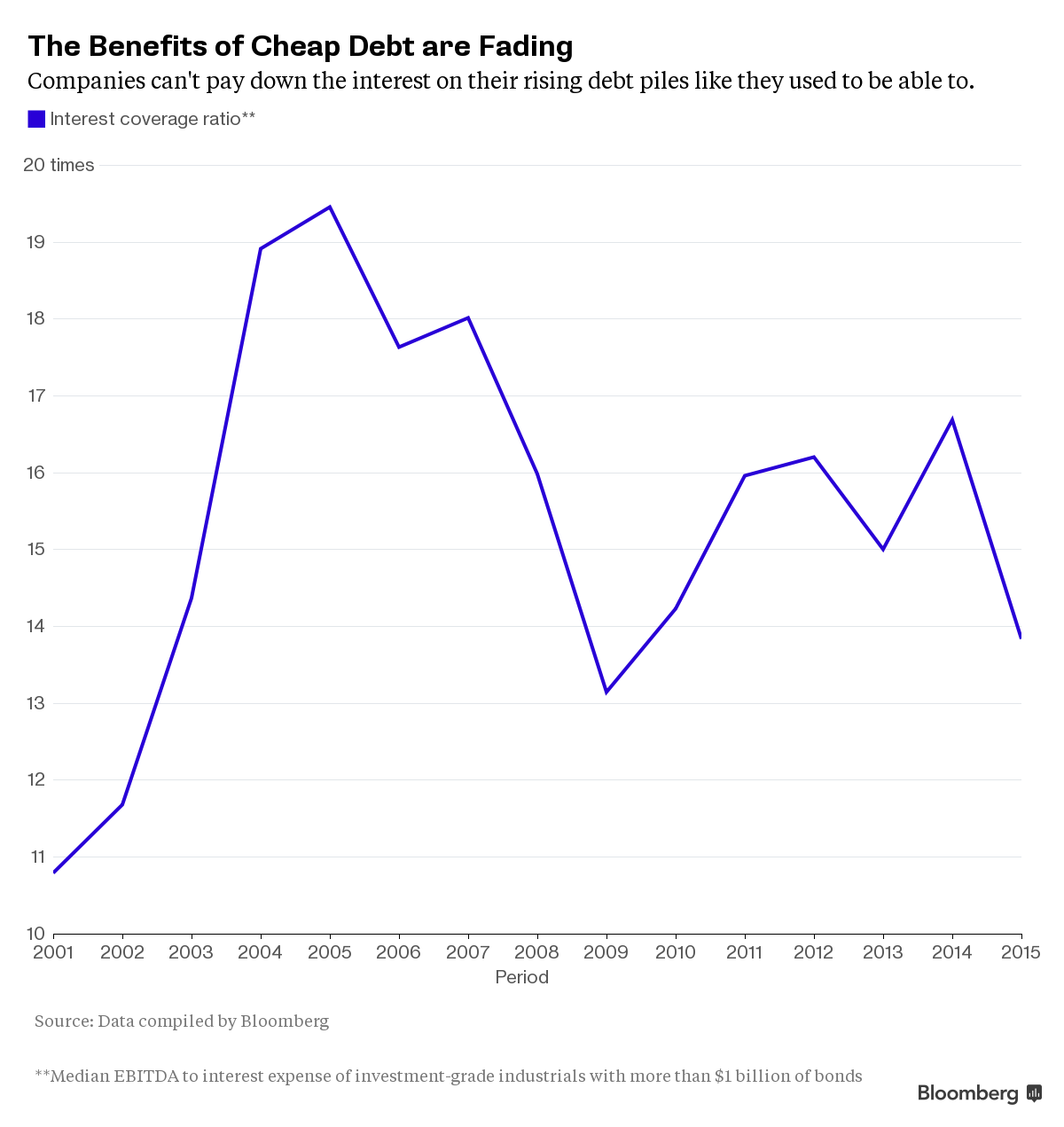

(85,373 posts)The Federal Reserve’s historically low borrowing rate isn’t benefiting corporate America like it used to. It’s more expensive for even the most creditworthy companies to borrow or refinance even as the Fed has kept its benchmark at near-zero the last seven years. Companies have loaded up on debt. They owe more in interest than they ever have, while their ability to service what they owe, a metric called interest coverage, is at its lowest since 2009, according to data compiled by Bloomberg. The deterioration of balance-sheet health is “increasingly alarming” and will only worsen if earnings growth continues to stall amid a global economic slowdown, according to Goldman Sachs Group Inc. credit strategists led by Lotfi Karoui. Since corporate credit contraction can lead to recession, high debt loads will be a drag on the economy if investors rein in lending, said Deutsche Bank AG analysts led by Oleg Melentyev, the bank’s U.S. credit strategy chief.

“The benefit of lower yields for corporate issuers is fading,” said Eric Beinstein, JPMorgan Chase & Co.’s head of U.S. high-grade strategy.

As of the second quarter, high-grade companies tracked by JPMorgan incurred $119 billion in interest expenses over the last year, the most for data going back to 2000, according to the bank’s analysts. The amount the companies owed rose 4 percent in the second quarter, the analysts said. The risk of default is negligible for companies with good credit. Even so, their health isn’t likely to improve when the Fed finally raises the lending rate, and it could worsen even without a hike, said Ashish Shah, the global head of credit strategies at AllianceBernstein Holding. A souring economy or a shocking event such as a prominent terrorist attack could also cause borrowing costs to spike, he said.

Paying Out

The fallout of more borrowing coupled with lower earnings has raised concern among the analysts who track the debt and the money managers who buy it. Yet it seems the companies themselves are acting as if it’s not happening. They’re still paying out record amounts in buybacks and dividends. In the second quarter, the most creditworthy companies posted declining earnings before interest, taxes, depreciation and amortization. Yet they returned 35 percent of those earnings to shareholders, according to JPMorgan. That’s kept their cash-payout ratio -- how much money they give to shareholders relative to Ebitda -- steady at a 15-year high.

The borrowing has gotten so aggressive that for the first time in about five years, equity fund managers who said they’d prefer companies use cash flow to improve their balance sheets outnumbered those who said they’d rather have it returned to shareholders, according to a survey by Bank of America Merrill Lynch. Since May, stocks of companies that have spent the most buying back their shares have performed even worse than the S&P 500 index. That comes after buyback stocks outperformed the S&P 500 each year since 2007, according to data compiled by Bloomberg. Companies have been using low interest rates to refinance more expensive debt, but the new debt isn’t saving them as much as it used to. As recently as 2012, companies were refinancing at interest rates that were 0.83 percentage point cheaper than the rates on the debt they were replacing, JPMorgan analysts said. That gap narrowed to 0.26 percentage point last year, even without a rise in interest rates, because the average coupon on newly issued debt increased.

Lower Yields

Companies saved a mere 0.21 percentage point in the second quarter on refinancings as investors demanded average yields of 3.12 percent to own high-grade corporate debt -- about half a percentage point more than the post-crisis low in May 2013. Servicing the debt got tougher for companies in the second quarter, too, at least on paper. Interest coverage, an estimate of how many times a company could pay off its interest using its Ebitda, fell in the last year to a median 13.8 times from 16.7 times for companies with top credit ratings, excluding financial firms, who’ve issued debt, according to data compiled by Bloomberg. The weakening has been widespread. If they had to, nearly half of companies could only cover their interest expenses between zero and 10 times with the Ebitda they generate. That compares with the 38 percent of companies that had interest coverage ratios between 0 and 10 times in 2006, according to JPMorgan.

“It does make some of these companies more vulnerable to a growth slowdown or any type of shock,” said Jeff Cucunato, head of U.S. investment-grade credit for BlackRock Inc., the world’s biggest money manager, which said it’s taking a “cautious” approach to high-grade debt. “You’ll continue to see some land mines out there.”

More Vulnerable

Looking into the future, UBS AG’s Matthew Mish sees only tightening lending standards. He warned clients in an Oct. 7 research note that borrowing costs will rise for the most creditworthy borrowers in the first three months of next year. It would take a meaningful contraction in earnings along with tighter lending to spark a credit crisis, given that interest coverage remains above its historical average, according to Vanguard Group Inc.

“We’re more concerned than we were two years ago,” said Stuart Hosansky, principal in Vanguard’s fixed-income group. “We still view overall corporate credit quality as adequate.” Hosansky said the last time he felt that way was 2006.

Companies that have already issued $9.3 trillion in new debt since the financial crisis are trying to keep the cheap-debt party raging as long as they can. Some investors are joining them for what may turn out to be a nightcap, according to Stephen Antczak, head of U.S. credit strategy at Citigroup Inc.

“There are more people that want to buy into the bullish argument than I would expect,” Antczak said. “Maybe because the buy-the-dips mentality has worked so many times in the past.”

Demeter

(85,373 posts)Goldman Sachs Group Inc. is dismissing about 20 analysts globally in offices including London and New York after discovering they had breached rules on internal training tests, said people familiar with the matter. The analysts, who had been working in the investment bank’s securities division, have either already been dismissed or are in the process of leaving the bank, said the people, who asked not to be identified as the matter is private.

“This conduct was not just a clear violation of the rules, but completely inconsistent with the values we foster at the firm,” said Sebastian Howell, a Goldman Sachs spokesman in London, who said he couldn’t comment further.

Bankers throughout Wall Street often assist each other on basic training and compliance tests because these are seen as time consuming and repetitive, according to separate people with knowledge of the process. Investment banks have started taking strict measures to prevent this from happening in recent years amid increasing scrutiny from regulators.

Goldman Sachs is among the most selective employers on Wall Street. Last year, the bank hired just 3 percent of 267,000 applicants, and Chief Executive Officer Lloyd C. Blankfein has called his firm “the employer of choice in our industry.” Fortune magazine named Goldman Sachs one of the 100 best companies to work for, a citation it has received every year since the list began in 1984, according to a presentation given by Blankfein in February.

The firings come the same week that the New York-based firm reported quarterly earnings that fell short of analysts’ estimates for the first time in four years.

UH-HUH. ALL RIGHTY, THEN!

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)REASSURING TO KNOW, IT'S NOT JUST ME!

http://www.bloomberg.com/news/articles/2015-10-16/credit-suisse-clients-are-more-confused-than-ever-and-are-cashing-out

Over the past few weeks, the Credit Suisse global equity strategist and his team have met with customers in the U.S., Europe, and Asia. The takeaway is that everyone is baffled by the market.

Sure, the markets have been more volatile lately and nobody can seem to agree on when the Federal Reserve will finally move off of its zero interest rate policy, but there are a number of other reasons investors wanted to move to cash until the future is a bit clearer. Some of the key concerns below.

- China's hard landing: The No. 1 topic, according to Garthwaite. "Clients agree that 'real' data (even on the consumer side) are consistent with just 3-4 percent GDP growth. China has never faced a downturn when it has been this large (32 percent of global GDP growth and circa 30 percent of global capex) and has had such excess in investment, credit and real estate," he notes. Also on the long list of China worries: the degree of zombie capital sloshing around the economy, foreign debt, and the uncertain direction of the renminbi.

- Declining global growth: In Credit Suisse's most recent investor survey regarding growth, pessimism was extremely high, nearing an all-time record, in fact. While much of that has to do with China and emerging markets, Garthwaite said, there is growing worry over the impact on other economies: "China and emerging markets were identified as the main source of growth weakness, however, there were increasing concerns about an inventory-led soft-patch in the developed world, in particular the U.S."

- The effectiveness of quantitative easing: A growing number of investors don't think central bank bond-buying is doing much, if anything, for the global economy at this point. The view that QE is not working and has run out of steam is "consensus," Garthwaite said, though he and his team disagree "on both counts, but agree that a move to QE to finance infrastructure would require more of a growth shock."

- A smaller piggy bank of FX reserves: One of the new concerns that was discussed was the $0.5 trillion decline in FX reserves, with this already being likened (by some) to monetary tightening. Credit Suisse again doesn't think this is the case, since 80 percent of the fall has to due with China and is being sterilized, meaning it's being offset by more domestic liquidity.

- Hostile politicians: A number of clients were worried that politics are becoming "less capitalist-friendly," Garthwaite said. "Ultimately, this needs to be monitored, but we feel that without capital controls or global co-ordination it is hard to unilaterally raise tax rates."

Two things that barely came up? European and U.S. politics. - The Greek, Catalan and Portuguese elections sailed by without a flicker of interest. The need to raise the U.S. debt ceiling and the upcoming U.K. referendum on whether to stay in the E.U. each only had one question. Similarly for Russia's involvement in Syria.

In sum, Garthwaite notes, clients are very focused on risks in global markets which are admittedly "abnormally high." But, the analyst says, so is reward, with the equity risk premium now at 5.8 percent. "We would agree, however, that visibility is abnormally low," Garthwaite concludes.

Which probably doesn't help already confused investors that much.

Demeter

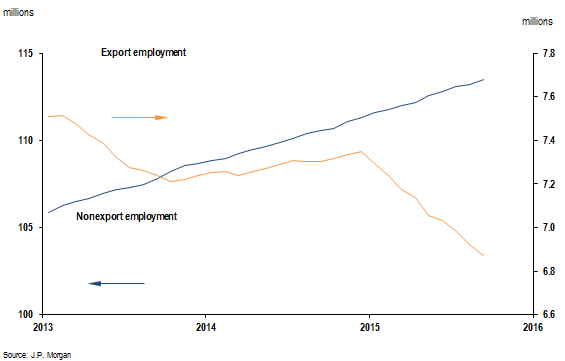

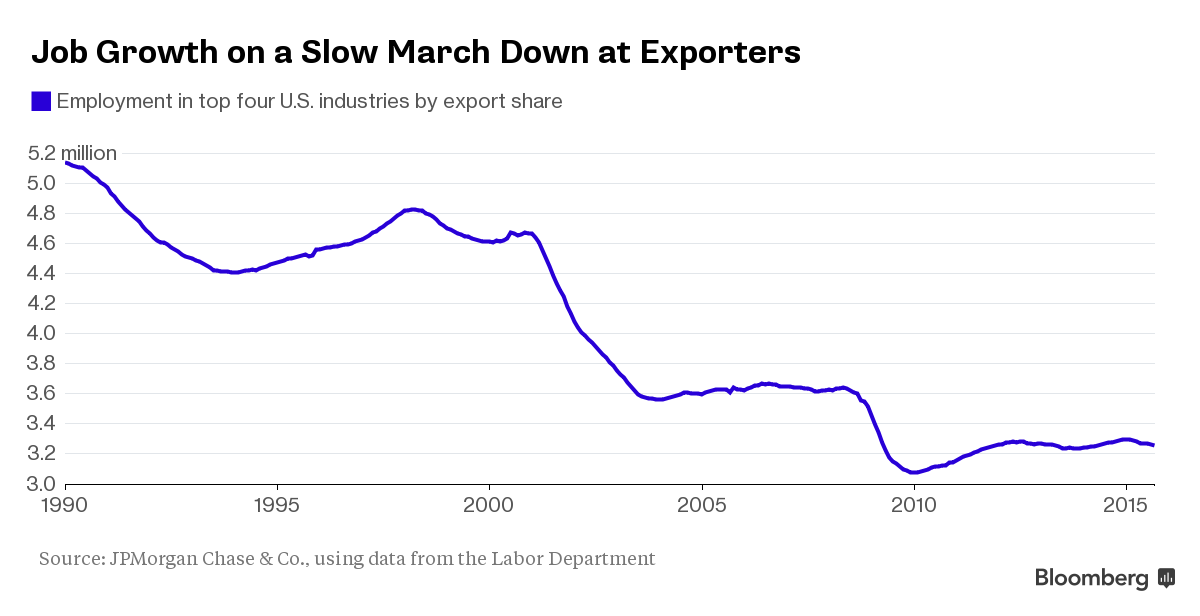

(85,373 posts)Employment is taking a dive in industries that sell a lot of U.S.-made goods abroad, and things could get worse before they get better. The double whammy to exports from the stronger dollar and cooling overseas markets was bound to hit employment in the world's largest economy. JPMorgan Chase & Co. has put numbers to the damage.

Export-oriented industries have been losing about 50,000 jobs a month for most of this year, after adding 9,000 a month on average in 2014, according to JPMorgan economist Jesse Edgerton. Recent manufacturing surveys hint the impact could worsen, and the employment erosion may extend into the first half of 2016, he predicts. In effect, that would mean private payrolls growth takes a step down to around 150,000 a month, from the booming 250,000-plus average of 2014.

"Employment is declining in industries exposed to exports, and we haven’t seen any sign the decline is slowing down," Edgerton said. "The drag from job losses in export industries will linger on for some time at least."

Considering export-oriented jobs are among the better paying ones, that's a pretty sobering forecast. U.S. jobs supported by goods exports, for example, pay as much as 18 percent more than the national average, according to government estimates. At a time of increased concern that growth is losing momentum, a strong labor market backed by jobs that pay well is key to sustaining consumer spending, the biggest part of the economy.

Edgerton has pieced out the hit to employment, which isn't easy to gauge from the Labor Department's monthly payrolls report. He developed a way to measure the share of each industry's output that is exported, both directly and indirectly through sales to other industries that cater to overseas demand. Using that, he worked out how payrolls are faring in those businesses compared with counterparts that focus on the U.S. market. Trends in the top four industries with the largest export share — transportation equipment excluding motor vehicles; machinery; computer and electronic products; and primary metals — offer another reason for concern, Edgerton said. Payrolls have been slowing for decades in capital-intensive manufacturing businesses that dominate exports. So there's little reason to expect export jobs will see a return to positive territory.

One consolation is the job losses are "pretty much confined" to exporters, while "plain vanilla" industries selling to U.S. consumers have been largely shielded, Edgerton said. He found payrolls at non-export employers, typically service providers, are currently posting an average monthly gain of 203,000 . While that marks a downshift from 296,000 as recently as June, it's within the 150,000 to 300,000 range seen since 2013.

THAT'S ALL RIGHT, AS LONG AS THE DOLLAR REMAINS A GLOBAL CURRENCY...WHICH WILL BE ENDING IN THE NEXT 4 YEARS, I'M GUESSING...

Demeter

(85,373 posts)The U.S. job market is steadily improving, yet many Americans are still struggling to get hired. And if they work in dying professions, that may be the case not only today but also in the years ahead. The challenge will be particularly big for job seekers with limited education. Employment opportunities will be fewer for those who lack coveted degrees and training, and the pay will be lower.

We analyzed 784 popular occupations, looking at which jobs have been adding to their ranks over the past decade and which are projected to continue the trend into the next decade. We also looked at recent hiring demand for each occupation. We favored bigger salaries, of course, but also promising careers that require lower levels of education to get started. After all, a good-paying job that doesn't require a college degree saves on student loans and earns you a paycheck faster.

Despite that advantage, jobs calling for just a high school education or less littered the bottom of our rankings. (By contrast, all of our picks for the best jobs for the future require at least an associate's degree to get started.) "It's bad news for people who only have a high school degree," says Anthony Carnevale, director of the Georgetown University Center on Education and the Workforce. He notes that the U.S. economy has moved from being production-based to service-based, with a rising need for professionals in finance, information systems, education and health care—"all of which require high-skill, higher-educated workers," he says.

Take a look at our picks for the 10 worst jobs for the future.

Floral Designer

Ticket Agent

Courier

Office Machine Operator

Reporter

Data Entry Clerk

Electronic Equipment Assembler

Switchboard Operator

Food Batchmaker

Metal and Plastic Grinding Tool Operator

Read more at http://www.kiplinger.com/slideshow/business/T012-S001-worst-jobs-for-the-future-2015/index.html#kkqW3mOuHM7oDAOQ.99

Demeter

(85,373 posts)

Demeter

(85,373 posts)By Rachel Thrasher, a Policy Fellow at the Global Economic Governance Initiative at Boston University and Timothy A. Wise, Policy Research Director at Tufts University’s Global Development and Environment Institute and a Senior Research Fellow at the Political Economy Research Institute at the University of Massachusetts at Amherst.

In 2009, the government of Mozambique put a moratorium on large-scale land acquisitions, a belated response to a wave of protests triggered by so-called “land grabs” by foreign investors. The moratorium, which lasted two years and restricted only land deals larger than 25,000 acres (10,000 hectares), calmed tensions while the government sought to resolve the inconsistencies between the great land giveaway and the country’s progressive land law, which recognizes farmers’ land rights even when they do not hold formal titles. Some of those investors were from the United States, and it is a wonder that they didn’t sue the Mozambican government for limiting their expected profits. They could have under the Bilateral Investment Treaty (BIT) between the United States and Mozambique. As U.S. trade negotiators herd their Pacific Rim counterparts toward the final text of a long-promised Trans-Pacific Partnership Agreement (TPP), the investment chapter remains a point of contention. Like the 1994 North American Free Trade Agreement (NAFTA) and most U.S. trade agreements since, the TPP text includes controversial provisions that limit the power of national governments to regulate incoming foreign investment and give investors rights to sue host governments for regulatory measures, even those taken in the public interest, that limit their expected returns. A host of BITs with a far wider range of countries, including Mozambique, contain similar provisions. The impact of such agreements on land grabs and land governance has received scant attention until recently. As new research from the International Institute for Environment and Development (IIED) and Tufts University’s Global Development and Environment Institute (GDAE) shows, the kinds of investment provisions in the TPP and in most BITs can severely limit a government’s ability to manage its land and other natural resources in the public interest. They can also interfere with the implementation of newly adopted international guidelines on land tenure.

As GDAE’s research shows, there are alternatives to such restrictive investment rules. Mozambique, for example, could withdraw from its BIT with the United States and instead draw on the less constraining investment provisions offered by the Southern African Development Community (SADC). GDAE’s new background paper, “Trade Agreements and the Land,” by Rachel Thrasher, Dario Bevilaqua, and Jeronim Capaldo, examines the implications of proposed agreements, such as the TPP, for regulating land grabs. Lorenzo Cotula of IIED, in his report, “Land Rights and Investment Treaties: Exploring the Interface,” looks beyond land grabbing to consider other important aspects of land governance, including land redistribution. Both identify key provisions common to U.S. investment treaties that constrain land governance.

Perhaps most well known is the Investor-State Dispute Settlement (ISDS) process whereby private investors can sue states in a private arbitral tribunal – a glaring exception to the traditional sovereign immunity granted to states. Land grabs have not yet been the subject of dispute under these treaties, but other land conflicts show how they might in the future. Beyond the onerous ISDS provisions, investment treaties universally require compensation in the case of expropriation. Traditionally, that compensation must be “prompt, adequate and effective.” Countries have faced claims for expropriation in a wide variety of land-related cases – mostly in response to state efforts to correct past injustices or reform land tenure. Zimbabwe, in the wake of its fast-track land-redistribution program, Albania’s privatization in the transition from socialism, and South Africa’s mining legislation to benefit disadvantaged groups after apartheid all faced investor disputes claiming expropriation. The standard for compensation in these treaties is often based on the market value of the investment and does not take into account a fair balance between interests. Indeed, in the draft TPP several negotiating countries have explicit footnotes and annexes specifying that the compensation must be at market value (Art. 11.7, Annex II-C). As Cotula points out, investors can demand such compensation even if they got the land at low prices and even if government action simply interferes with or delays their profit-making activities.

Treaties also often require that foreign investors be treated with “full protection and security.” In some cases, where domestic individuals or groups have taken action against foreign investors, the countries have been on the hook for not acting with “due diligence” to protect them. Many investment agreements also demand “fair and equitable treatment” for foreign investors. In investment jurisprudence this has come to include the “legitimate expectations” of the investor based on negotiations with governments. Any promise of access to land and resources, or even the speedy handing over of such land, can be disputed as a violation by investors. Sometimes, even before an investor enters the country, these investment treaties threaten land governance by extending the “right of establishment” to investors from partner countries. This means that under the TPP and most modern BITs, host countries must treat foreign investors on par with domestic investors, giving no priority to nationals even in sensitive areas such as land, minerals, and other natural resources...

**************************************************************

TPP – No Way Forward

The TPP is expected to be finalized in the coming months. For countries like Viet Nam, which was not previously bound by any international investment treaties, this could create large unexpected obstacles to domestic land regulation. Currently, the United States is negotiating investment treaties with what amounts to 80 percent of global GDP. Between the TPP, the TTIP, and BITs with India and China, U.S. style investment treaties are poised to become the de facto international legal regime for the treatment of foreign investors.

AS GDAE’s background paper shows, there are other investment treaty models out there. The Southern African Development Community drafted a model BIT with some of these threats to governance in mind. Its Model BIT begins by explicitly recommending that countries not extend rights to investors before establishment. Instead, countries are encouraged to admit investments in a good faith application of their laws. The model also limits ISDS provisions, recommending either that disputes should be kept between States, or at the very least, that States should be able to bring counterclaims against the investor in the same tribunal.

Expropriation is approached differently as well. Rather than a standard of non-discrimination and “prompt, adequate and effective” compensation, it acknowledges that almost all expropriations are discriminatory and suggests a “fair and adequate” standard for determining compensation. This is more in line with other approaches looking to create an “equitable balance” between interests in deciding how much compensation is owed. Finally, the language of “full protection and security” and “fair and equitable treatment” is downgraded such that it requires only “fair administrative treatment.” By doing this the SADC text emphasizes that this is a procedural, rather than a substantive standard and reserves the rights of states to make regulatory changes in response to important public policy.

As Cotula concludes, “Protecting the land claims of some, without also taking action to protect different and potentially competing land claims, can entrench imbalances in both legal rights and power relations. In the longer term, solutions should lie less in legal arrangements that insulate foreign investment from shortcomings in national legal systems, and more in establishing fair and effective land governance that can cater for the needs of all.”