Economy

Related: About this forumWeekend Economists' Devil Nights October 30-November 1, 2015

Such a weekend we have in store! Devil's Night, Hallowe'en or All Hallow's Eve, All Saints' Day, and el Dia de Los Muertes...

all derived from the ancient Celtic Festival Samhain (pronounced /ˈsɑːwɪn/ SAH-win or /ˈsaʊ.ɪn/ SOW-in Irish pronunciation: [sˠaunʲ])

(DON'T FORGET THAT EUROPE WAS CELTIC IN ROMAN TIMES!--DEMETER)

Samhain is believed to have pagan origins and there is evidence it has been an important date since ancient times. The Mound of the Hostages, a Neolithic passage tomb at the Hill of Tara, is aligned with the Samhain sunrise. It is mentioned in some of the earliest Irish literature and many important events in Irish mythology happen or begin on Samhain. It was the time when cattle were brought back down from the summer pastures and when livestock were slaughtered for the winter. As at Beltane, special bonfires were lit. These were deemed to have protective and cleansing powers and there were rituals involving them.

Like Beltane, Samhain was seen as a liminal time, when the boundary between this world and the Otherworld could more easily be crossed. This meant the Aos Sí, the 'spirits' or 'fairies', could more easily come into our world. Most scholars see the Aos Sí as remnants of the pagan gods and nature spirits. At Samhain, it was believed that the Aos Sí needed to be propitiated to ensure that the people and their livestock survived the winter. Offerings of food and drink were left outside for them.

The souls of the dead were also thought to revisit their homes seeking hospitality. Feasts were had, at which the souls of dead kin were beckoned to attend and a place set at the table for them. Mumming and guising were part of the festival, and involved people going door-to-door in costume (or in disguise), often reciting verses in exchange for food. The costumes may have been a way of imitating, and disguising oneself from, the Aos Sí. Divination rituals and games were also a big part of the festival and often involved nuts and apples. In the late 19th century, Sir John Rhys and Sir James Frazer suggested that it was the "Celtic New Year", and this view has been repeated by some other scholars.

In the 9th century AD, Western Christianity shifted the date of All Saints' Day to 1 November, while 2 November later became All Souls' Day. Over time, Samhain and All Saints'/All Souls' merged to create the modern Halloween. Historians have used the name 'Samhain' to refer to Gaelic 'Halloween' customs up until the 19th century.

Since the latter 20th century, Celtic neopagans and Wiccans have observed Samhain, or something based on it, as a religious holiday. Neopagans in the Southern Hemisphere often celebrate Samhain at the other end of the year (about 1 May).

MUCH MORE AT https://en.wikipedia.org/wiki/Samhain

Demeter

(85,373 posts)Devil's Night is a name associated with October 30, the night before Halloween. It is related to the "Mischief night" practiced in other parts of the United States, but is chiefly associated with the serious vandalism and arson seen in Detroit, Michigan from the 1970s to the 1990s, finally prompting the "Angels' Night" community response.

Devil's Night dates from as early as the 1930's. Traditionally, city youths engaged in a night of mischievous or petty criminal behavior, usually consisting of minor pranks or acts of mild vandalism (such as egging, soaping or waxing windows and doors, leaving rotten vegetables or flaming bags of Canine feces on front porch stoops, or toilet papering trees and shrubs) which caused little or no property damage.

However, in the early 1970s, the vandalism escalated to more destructive acts such as arson. This primarily took place in the inner city, but surrounding suburbs were often affected as well.

The crimes became more destructive in Detroit's inner-city neighborhoods, and included hundreds of acts of arson and vandalism every year. The destruction reached a peak in the mid- to late-1980s, with more than 800 fires set in 1984, and 500 to 800 fires in the three days and nights before Halloween in a typical year.

Decline of Devil's Night arson

By the early 1990s, Detroit saw little decline in Devil's Night arson. After a brutal Devil's Night in 1994, then-mayor Dennis Archer promised city residents arson would not be tolerated. In 1995, Detroit city officials organized and created Angels' Night on and around October 29–31. Each year as many as 50,000 volunteers gather to patrol neighborhoods in the city. As a result of the efforts, fires plunged to near-ordinary levels in the first decade of the 21st century. In 2010 the number of reported fires climbed to 169, a 42 percent increase over the previous year. However, in the early 2010s, the totals again declined to the low 90s for the three-day period. This average of about 32 fires per day is somewhat higher than the expected 26 fires per day through the year.

Angels' Night

Angels' Night is an event that is designed to mitigate criminal acts associated with Devil's Night in Detroit, Michigan. After a brutal Devil's Night in 1994, then new mayor Dennis Archer promised city residents arson would not be tolerated. In 1995, Detroit city officials organized and created Angels' Night on and around October 29–31.

Currently as many as 40,000 Detroiters volunteer to keep the city safe on these nights. Many volunteers keep a high profile patrolling neighborhoods with magnetic-mount flashing amber beacons, on their personal vehicles, along with communicating with command centers via CB radios or by cellular phones to report any suspicious activity. In recent years, arson and other crimes have fallen, much to success of the Angels' Night volunteers. The drop in reported fires for the year 2008 has been credited to be because of the Angels' Night program.

Only once has Angels' Night been cancelled since it began. This cancellation took place in 2005 due to the death of Rosa Parks. Most Angels' Night and Devil's Night activities occurred that year in Flint and Lansing, Michigan, as well as in Toledo, Ohio.

THERE IS ONE SILVER LINING TO THIS SMOKY CLOUD....MONEY IS SPENT EVERY YEAR TO TEAR DOWN ABANDONED AND DERELICT BUILDINGS...SORT OF A GRASS-ROOTS URBAN RENEWAL.

Demeter

(85,373 posts)"Burn baby burn" was not just a saying....

Demeter

(85,373 posts)TALK ABOUT RAISING THE DEAD!

http://www.marketwatch.com/story/greece-outlines-bank-recapitalization-plan-2015-10-30-171033118?siteid=YAHOOB

Greece unveiled its bank recapitalization framework Friday and is expected to vote it into law Saturday evening, hours after the European Central Bank releases results of its health check on the country’s four big banks. This will be the third capital increase of the country’s battered lenders since Greece’s debt crisis erupted in 2010 and has to be completed by the end of the year, before the deposit bail-in instrument becomes effective at the beginning of 2016. According to the draft bill, the lenders will be able to use common or preferred shares, as well as other financing instruments to be bailed in.

The country’s state-owned recapitalization fund, the Hellenic Financial Stability Fund, will cover any part of the capital shortfall that isn’t covered by private investors via a combination of new shares and contingent convertible bonds that banks will issue. The new shares will have full voting rights. The bill states that the stability fund will participate in the recapitalization of the banks over the coming months with significant funds. The fund owns majority stakes in all Greek banks except Eurobank, in which it holds a 35.4% stake.

“The government aims to attract foreign investment, with the participation of the private sector in the recapitalization, but also the state to maintain a significant stake in banks, so it can increase its profit when growth comes,” a finance ministry official said.

“The participation of the public should not be unlimited, as control in banks is needed but not at a stake that would prevent individuals to invest capital,” the official added.

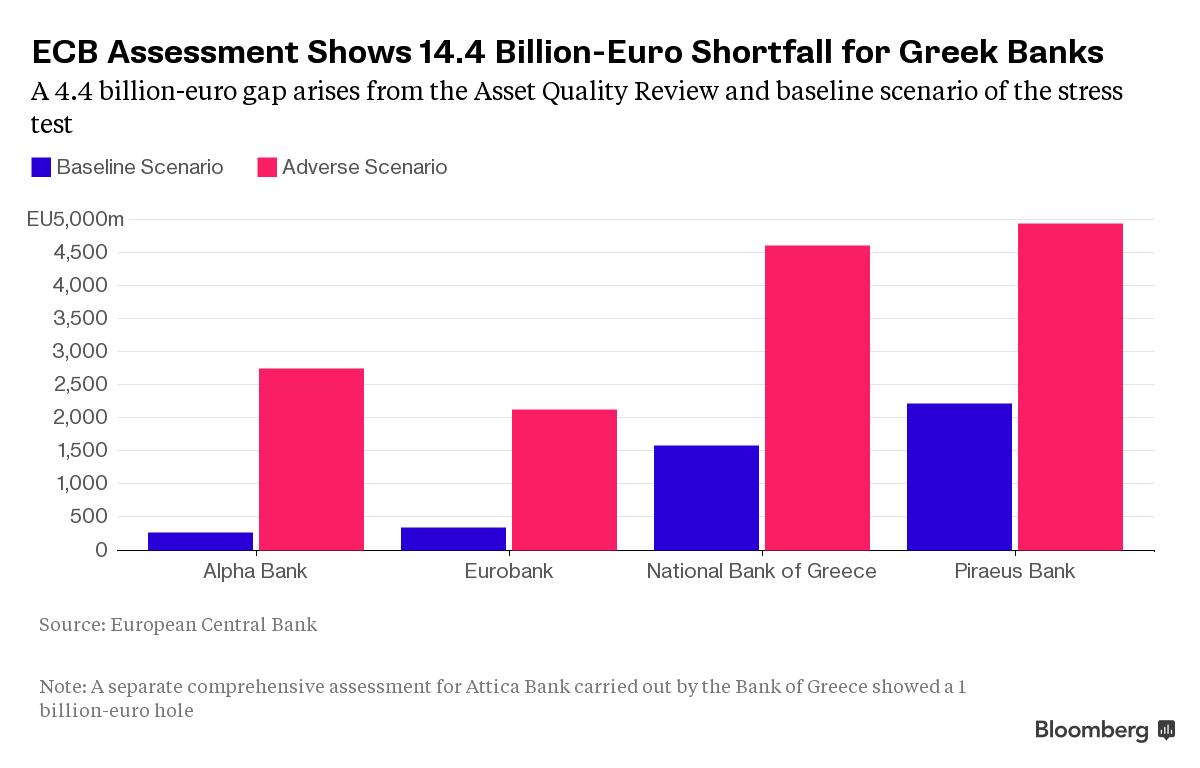

Under the country’s third bailout agreement reached in mid-July, some EUR25 billion, or about $27 billion, of public money was earmarked to recapitalize Greece’s banks, which suffered major depot flight during the six-month-long negotiations between the Greek government and the country’s international creditors...The ECB is expected to announce Saturday the results of the stress test for Greece’s four largest banks-- National Bank of Greece SA, Piraeus Bank SA, Eurobank Ergasias SA and Alpha Bank AS--which will determine how much capital they need following the recent downturn in the Greek economy.

“Overall capital requirements are expected to be at around EUR15 billion, with the banks aiming to raise EUR5-EUR6 billion of that from private investors,” said Wolfango Piccoli, managing director of advisory firm Teneo Intelligence, in a note.

“Another EUR3 billion may come from bond swap offers. This would leave the total size of the required recapitalization from public funds at a manageable EUR7-EUR8 billion,” he said.

WHAT IF THEY GAVE A RECAPITALIZATION, AND NOBODY SUBSCRIBED?

Demeter

(85,373 posts)The European Central Bank is expected to say on Saturday that Greek's battered banks need up to 14 billion euros ($15.4 billion) in fresh capital in order to survive.

It comes after years of economic decline in Greece - bailed out three times by international lenders - that has forced some 42 billion euros to be set aside against bad loans.

Although the banks are currently been kept afloat by access to money through the euro zone monetary system, there is a rush to get recapitalization completed.

If it is not done by the end of the year, new European Union rules mean large depositors such as companies may have to take a hit in their accounts...MORE

Demeter

(85,373 posts)Six big U.S. banks need to raise an additional $120 billion, most likely in long-term debt, under a rule proposed on Friday by the Federal Reserve. The requirements are aimed at ensuring that some of the biggest and most interconnected banks, which include Goldman Sachs Group Inc,, JPMorgan Chase & Co,, and Wells Fargo & Co, can better withstand another crisis by turning some of their debt, particularly debt issued by their holding companies, into equity without disrupting markets or requiring a government bailout.

The banks are expected to meet the $120 billion shortfall by issuing debt, which is usually more cost-effective than issuing equity, according to Federal Reserve officials speaking at a background press briefing Friday. The rule proposed Friday, largely in line with banks' expectations, concerns the lenders' total loss-absorbing capacity. It is one of a series of rules aimed at reducing risk in the banking system by determining how much debt and equity banks should use to fund themselves. In a procedural vote, the Fed's governors approved a draft of the proposal, meaning it will be submitted for public comment.

During a public meeting with Fed officials, one staffer who worked on the rule said banks should have an easy time complying, because many requirements overlapped with existing rules. Further, the bulk of the debt requirements can be fulfilled by refinancing existing debt, the staffer said. Some requirements must be met by Jan. 1, 2019, while more-stringent requirements must be met by Jan. 1, 2022. The requirements are most stringent for JPMorgan, followed by Citigroup Inc. After that come Bank of America Corp, Goldman Sachs and Morgan Stanley, all of which have the same requirement. Wells Fargo & Co's requirement is the next highest, followed by State Street Corp and finally Bank of New York Mellon Corp.

JPMorgan has more than $2 trillion in total assets, making it the largest U.S. bank by that measure. The officials declined to say which two banks already meet the long-term debt requirements under Friday's proposal. The rules also apply to U.S. operations of foreign globally systemically important banks, establishing roughly parallel requirements as those for U.S. banks, Fed officials said. Also announced was a draft final rule establishing minimum margin requirements for swaps that are not cleared through an exchange. The rule is identical to one proposed by other regulators.

Demeter

(85,373 posts)U.S. stock indexes finished with their strongest monthly performances in four years on Friday, even as they dipped for the day amid a mixed bag of earnings reports.

For October, all three major indexes posted their biggest percentage increases since October 2011, with the S&P 500 rising 8.3 percent, led by energy and materials, while a measure of volatility fell...The S&P 500 energy index .SPNY was the best performing sector, rising 0.7 percent...

Investors will be looking at data over the next several weeks, including next Friday's employment report, for clues about the economy's health. The Fed signaled on Wednesday a rate hike in December was still possible.

"The market is being held a little bit hostage," said Jeff Buetow, chief investment officer at Innealta Capital in Austin. "It would be nice to have some clarity once and for all of what monetary policy is going to do over the foreseeable future."

The Dow Jones industrial average .DJI fell 92.26 points, or 0.52 percent, to 17,663.54, the S&P 500 .SPX lost 10.05 points, or 0.48 percent, to 2,079.36 and the Nasdaq Composite .IXIC dropped 20.53 points, or 0.4 percent, to 5,053.75.

For the month, the Dow gained 8.5 percent, while the Nasdaq rose 9.4 percent.

MORE

Demeter

(85,373 posts)Chevron Corp (CVX.N) is slashing 10 percent of its workforce and sharply paring back its budget, with Chief Executive Officer John Watson giving a downbeat view on Friday of an industry beleaguered by low oil prices. A more than 55 percent decline in crude oil since last year has rippled through the global energy industry, forcing producers and their suppliers to make tough decisions. For Chevron, that means cutting its budget by 25 percent next year by spending less in Australia, Angola and the U.S. Gulf of Mexico, where the No. 2 U.S. oil company has major growth projects.

"We need to be more efficient at what we do," Watson said on a conference call with analysts and investors. While he said prices should rise eventually, he is "sober about the current realities of lower prices" for the next few years.

The news came as Chevron also reported a sharp drop in third-quarter earnings that still beat Wall Street's expectations due to cost cuts and strong refining margins.

The company's pain was all the more stark given that larger rival Exxon Mobil Corp (XOM.N) not only posted stronger-than-expected results on Friday but also had not announced any massive layoffs.

Chevron plans to spend $25 billion to $28 billion next year and expects to further slash spending in 2017 and 2018, an acknowledgment that it does not expect oil prices to rebound soon. The San Ramon, California-based company also said it would lay off 6,000 to 7,000 workers. Under pressure from Wall Street, Watson committed to keeping Chevron's dividend, now at $1.07 a share...MORE

Demeter

(85,373 posts)Decades of financial discipline that honed Exxon Mobil Corp. into the leanest, most-efficient oil company in the world are paying off as it navigates the worst market slump since the 1980s.

As industry job cuts top 200,000 worldwide, Exxon has kept its 75,300-strong workforce intact with none of the sweeping layoffs seen at other oil companies, including its biggest U.S. rival Chevron Corp.

“Exxon is just stronger financially than anyone else out there,” Brian Youngberg, an analyst at Edward Jones & Co. in St. Louis, said in an interview. “They were running a leaner ship to begin with.”

Exxon posted higher-than-expected third-quarter earnings Friday thanks to soaring profit at its refineries that process oil into fuel. The business has blunted the impact of crude’s collapse. Exxon hasn’t needed to record any of the restructuring charges associated with job eliminations amid the 16-month downturn, and doesn’t expect to do so any time soon, Jeff Woodbury, vice president of investor relations, told analysts during a conference call.

MORE

Demeter

(85,373 posts)Some big U.S. retailers are stepping up efforts to use personal identification numbers, or PINs, with new credit cards embedded with computer chips in a bid to prevent counterfeit card fraud. But they are being resisted by the banking industry, which sees no need to invest further in PIN technology, already used with debit cards, resulting in halting adoption and widespread confusion.

A small band of retailers with the clout to call the shots on their branded credit cards is leading the charge. Target Corp is moving ahead with a chip-and-PIN rollout, and Wal-Mart Stores Inc plans to do the same. But Wal-Mart said it faces obstacles because its credit card partner, Synchrony Financial, is not yet able to handle PINs on credit cards. Synchrony declined comment.

Broadly, U.S. banks are unprepared or resisting the change...MORE

Demeter

(85,373 posts)THE HITS JUST KEEP ON COMING

http://100r.org/2015/10/clinton-foundation-faces-revisions-and-possible-reckoning/

The Clinton Foundation has gotten a good deal of unflattering attention as of late, which isn’t surprising given that its best known namesakes are Bill, a former president and Hillary, who hopes to be the nation’s next leader. The foundation portrays itself as do-gooder nonprofit organization but a cursory look reveals questionable and incomplete disclosures of its activities and accounts, as well as misspending of donor money, virtually since its inception. Those lapses appear set to catch up with the foundation (now formally known as the Bill, Hillary, & Chelsea Clinton Foundation), which has until November 16 to amend more than ten years’ worth of state, federal and foreign filings. According to Charles Ortel, a financial whistleblower, it will be difficult if not impossible for the foundation to amend its financial returns without acknowledging accounting fraud and admitting that it generated substantial private gain for directors, insiders and Clinton cronies, all of which would be against the law under an IRS rule called inurement.

While inurement may sound obscure to the layman, it’s an ancient legal principle and the IRS is very clear that it is verboten. If you are familiar with it, it becomes immediately clear that Bill Clinton – and arguably Hillary and daughter Chelsea as family members and fellow Clinton Foundation trustees – could have big problems come November 16. So, too, could Clinton cronies like Ira Magaziner (see below) and Doug Band, a Clinton administration and former foundation insider who subsequently became a founding partner of a bipartisan business swamp called Teneo Holdings.

The Clinton Foundation’s returns show revenues of $359.3 million between 2001 and 2006 and claim spending of $164.5 million on all program services, which includes its spending to provide relief to victims of the Tsunami in Asia and of Hurricane Katrina. The same pattern of taking in vast sums from donors and spending far less to help victims has continued ever since.

“It’s illegal to set up a foundation whose primary purpose is to create financial gain,” said Ortel – who helped expose massive financial fraud by GE, GM and AIG, thereby helping trigger the 2008 financial collapse. “That’s bright line illegal.” (Ortel wrote an article at Breitbart.com earlier which showed how “associates of Bill and Hillary Clinton may have attempted to monetize their participation in Clinton family philanthropic activities.”) Ortel, a former managing director of Dillon, Read & Co, said that under New York law tax authorities don’t have to show criminal intent to get convictions against foundation officials, they need only show that the foundation filed materially misleading financial information and kept fundraising nonetheless.

“The essence of what a charity does is take your money and show you how they spend it,” he told me. “The Clinton Foundation takes your money and obscures how they spend it.” (Note that the Clinton Foundation only started disclosing its donors in 2008, following years of pressure.)

MORE...THIS IS A NUCLEAR BOMB! READ IT ALL!

Ken Silverstein, a member of 100Reporters, is an investigative journalist focusing on corporate and government corruption. His stories on ties between the government of Equatorial Guinea and major U.S. companies led to the convening of a federal grand jury and investigations by the United States Senate and the Security and Exchange Commisssion.

PADemD

(4,482 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Coverage: In 2014, the first full year of Obamacare’s coverage expansion, the uninsured rate fell to 10.4 percent, or 33 million people, from about 41.8 million people the prior year, according to a September 2015 Census survey considered the gold standard for data in the field. At the end of June, about 9.9 million people were covered under the ACA’s individual private health plans. Through August about 13.6 million people had gained health insurance through Medicaid and its related children’s program since the health law, which expanded Medicaid eligibility, took effect, boosting enrollment to 72.4 million. Some of these people had prior insurance, but the Obama administration said in September that the ACA had extended coverage to 17.6 million people who were previously uninsured. Cost of coverage: For people covered through their employers, premium increases for 2015 averaged about 4 percent, with deductibles climbing as well. On individual marketplaces, there’s a wide variation in premium changes. The cost of mid-level health plans is going up about 7.5 percent, on average, the U.S. Department of Health and Human Services has said. Government subsidies help many people afford the coverage. About 84 percent of enrollees on the ACA’s exchanges are subsidized, receiving an average $270 a month. Medical spending: National spending on health care has slowed, a phenomenon that started shortly before passage of the law. Economists say at least part of that change may be attributed to Obamacare, which encourages shorter hospital stays and limits on unneeded procedures. The White House estimates that the Affordable Care Act has shaved at least a half of a percentage point annually from the growth of health-care costs. Still, healthcare spending is projected to account for 19.6 percent of the economy in 2024, up from 17.7 percent in 2014. Litigation: In June 2015, the Supreme Court upheld the nationwide tax subsidies that are a core component of Obamacare, rejecting a challenge that had threatened to gut the measure.

Source: Health Reform Monitoring Survey

The Background

The dilemma in shaping Obamacare was how to preserve the country’s system of employer-based insurance for the bulk of the population while ensuring access to coverage for people too sick or poor to afford it. Making it work required a combination of subsidies for middle-income workers, increased spending on Medicaid to cover more low-wage workers, and the so-called individual mandate to make sure health exchanges for individual policies had enough healthy customers to balance out the cost of sicker ones. Working through private companies reduced disruption and kept the insurance industry on board, but also meant the plan did not have the kind of powerful tools used to hold down costs in countries with government-run systems.

The Argument

Polls show that Obamacare remains unpopular with many Americans, although as insurance coverage has expanded outright opposition has declined, and more people now have a favorable view of the law than an unfavorable one. Republicans are still pushing to undo the law. But without enough votes to override a veto, Republican leaders in Congress have focused on smaller issues with the law, like efforts to repeal a tax on medical device makers and one on high-cost health plans. The party’s 2016 presidential candidates are putting forward their own proposals to get rid of the law as well. Many of the law’s specific provisions have substantial support and a majority of Americans opposes repeal. Repeal also carries new political risks now that benefits are in place and the Supreme Court has upheld the law’s subsidies. “We’ve got more work to do,” President Barack Obama said after the court’s decision, “but what we’re not going to do is unravel what has now been woven into the fabric of America.”

Demeter

(85,373 posts)THIS PLAYER PIANO VERSION IS SO COOL, AND I JUST REALIZED WHY I HAVE SUCH TROUBLE READING CHORDS...MUSIC IS WRITTEN LIKE HEBREW...RIGHT TO LEFT AND BACKWARDS!

ORCHESTRAL VERSION

https://en.wikipedia.org/wiki/Danse_Macabre

The story behind "Devil's Trill" starts with a dream. Tartini allegedly told the French astronomer Jérôme Lalande that he dreamed that The Devil appeared to him and asked to be his servant. At the end of their lessons Tartini handed the devil his violin to test his skill—the devil immediately began to play with such virtuosity that Tartini felt his breath taken away. The complete story is told by Tartini himself in Lalande's Voyage d'un François en Italie (1765 - 66):

"One night, in the year 1713 I dreamed I had made a pact with the devil for my soul. Everything went as I wished: my new servant anticipated my every desire. Among other things, I gave him my violin to see if he could play. How great was my astonishment on hearing a sonata so wonderful and so beautiful, played with such great art and intelligence, as I had never even conceived in my boldest flights of fantasy. I felt enraptured, transported, enchanted: my breath failed me, and - I awoke. I immediately grasped my violin in order to retain, in part at least, the impression of my dream. In vain! The music which I at this time composed is indeed the best that I ever wrote, and I still call it the "Devil's Trill", but the difference between it and that which so moved me is so great that I would have destroyed my instrument and have said farewell to music forever if it had been possible for me to live without the enjoyment it affords me."

antigop

(12,778 posts)antigop

(12,778 posts)Demeter

(85,373 posts)I didn't think it could be done...I want to go see it! But how?

Maybe it will come to Detroit Fox Theater?

antigop

(12,778 posts)Hotler

(11,421 posts)antigop

(12,778 posts)antigop

(12,778 posts)hamerfan

(1,404 posts)Season Of The Witch by Donovan:

Demeter

(85,373 posts)from the toxic-trade-deal dept

As far as trade agreements are concerned, the recent focus here on Techdirt and elsewhere has been on TPP as it finally achieved some kind of agreement -- what kind, we still don't know, despite promises that the text would be released as soon as it was finished. But during this time, TPP's sibling, TAFTA/TTIP, has been grinding away slowly in the background. It's already well behind schedule -- there were rather ridiculous initial plans to get it finished by the end of last year -- and there's now evidence of growing panic among the negotiators that they won't even get it finished by the end of President Obama's second term, which would pose huge problems in terms of ratification.

One sign of that panic is that the original ambitions to include just about everything are being jettisoned, as it becomes clear that in some sectors -- cosmetics, for example -- the US and EU regulatory approaches are just too different to reconcile. Another indicator is an important leaked document obtained by the Guardian last week. It's the latest (29 September) draft proposal for the chapter on sustainable development. What emerges from every page of the document, embedded below, is that the European Commission is now so desperate for a deal -- any deal -- that it has gone back on just about every promise it made (pdf) to protect the environment and ensure that TTIP promoted sustainable development. Three environmental groups -- the Sierra Club, Friends of the Earth Europe and PowerShift -- have taken advantage of this leak to offer an analysis of the European Commission's real intent in the environmental field. They see four key problems:

The environmental provisions are vaguely worded, creating loopholes that would allow governments to continue environmentally harmful practices. The chapter lacks any obligation to ratify multilateral agreements that would bolster environmental protection and includes a set of vague goals with respect to biological diversity, illegal wildlife trade, and chemicals.

The leaked text includes several provisions that the European Commission may claim as "safeguards," such as a recognition of the "right of each Party determine its sustainable development policies and priorities" but none would effectively shield environmental policies from being challenged by rules in TTIP.

There is no enforcement mechanism for any of the provisions mentioned in the text. Even if one were included, it would still be weaker than the enforcement mechanism provided for foreign investors either through the investor-state dispute settlement mechanism or the renamed investment court system.

The environmental groups have produced a detailed five-page document (pdf) that goes through each of these points in turn, and it's well-worth reading. But it's striking that the central problem is Techdirt's old friend, corporate sovereignty, aka investor-state dispute settlement (ISDS):

In other words, at the heart of the European Commission's philosophy is the implicit acceptance that investors' rights take precedence over the public's rights -- in this case, those concerning the environment. Everything in the leaked sustainable chapter is couched in terms of aspirations -- the US and EU are encouraged to do the right thing as far as sustainable development is concerned, but there are few, if any, obligations or enforcement mechanisms. When it comes to protecting investors, on the other hand, everything is compulsory, backed up by supranational tribunals that can impose arbitrarily large fines, payable by the public. Although it is true that governments are given the "right" to legislate as they wish when it comes to the environment, investors are given the "right" to sue those governments black and blue if they attempt to do so. Nor is this mere theory. Research carried out last year by Friends of the Earth Europe shows that of the 127 known ISDS cases that have been brought against 20 EU member states since 1994, fully 60% concern environment-related legislation. In other words, if the European Commission's proposals or something like them became part of the final TTIP agreement, it would almost guarantee a torrent of litigation aimed at blocking or neutering environmental legislation on both sides of the Atlantic.

This is an important leak because it reveals, once more, that a central problem of TAFTA/TTIP is the corporate sovereignty that is inherent in ISDS -- the fact that companies are allowed to place the preservation of their future profits above any other consideration, such as the environment, health and safety or social goals. The EU's sustainability chapter -- an area that is widely recognized as increasingly important in a world where lack of sustainability poses all kinds of problems -- is framed entirely in outdated, 20th-century terms: boosting trade and maximizing profits are the only metrics that matter. The European Commission's willing embrace of that approach confirms both its contempt for the 500 million Europeans it supposedly serves, and the fact that, far from protecting the environment, TAFTA/TTIP is shaping up to be a very toxic trade deal.

DOCUMENTS AT LINK

Demeter

(85,373 posts)Inspired by Russian literary works and legend, Mussorgsky composed a "musical picture", St. John's Eve on Bald Mountain (Russian: Иванова ночь на лысой горе, Ivanova noch' na lysoy gore) on the theme of a witches' sabbath occurring on St. John's Eve, which he completed on that very night, June 23, in 1867.

...In 1886, five years after Mussorgsky's death, Rimsky-Korsakov published an arrangement of the work, described as a "fantasy for orchestra." Some musical scholars consider this version to be an original composition of Rimsky-Korsakov, albeit one based on Mussorgsky's last version of the music, for The Fair at Sorochyntsi:

I need hardly remind the reader that the orchestral piece universally known as 'Mussorgsky's Night on the Bare Mountain' is an orchestral composition by Rimsky-Korsakov based on the later version of the Bare Mountain music which Mussorgsky prepared for Sorochintsy Fair.

— Gerald Abraham, musicologist and an authority on Mussorgsky, 1945

It is through Rimsky-Korsakov's version that Night on Bald Mountain achieved lasting fame. Premiering in Saint Petersburg in 1886, the work became a concert favourite. Half a century later, the work obtained perhaps its greatest exposure through the Walt Disney animated film Fantasia (1940), featuring an arrangement by Leopold Stokowski, based on Rimsky-Korsakov's version. Mussorgsky's tone poem was not published in its original form until 1968. Although still rarely performed, it has started to gain exposure and become familiar to modern audiences.

THE DISNEY VERSION

antigop

(12,778 posts)Idina Menzel (and Kristen Chenoweth) at the Tony awards:

Demeter

(85,373 posts)This comes at the totally wrong time. Trucking had been booming. 2014 had been a banner year. Capacity was squeezed, and rates were rising, so trucking companies went on a buying binge, ordering everything in the book in preparation for red-hot demand in 2015 and more banner years down the road. But then came 2015.

Among businesses, over-ordering and tepid sales caused inventories to rise and the inventory-to-sales ratio to spike to Financial Crisis proportions. And now businesses are trying to bring them down by trimming orders because they’re having trouble selling more to the middle class, the over-indebted modern proletariat whose stagnant incomes are being eaten up by skyrocketing costs of housing, healthcare, college, and the like – and they simply can’t spend that much on shippable items.

And now this is ricocheting through the industry.

Monday after hours, the largest US truckload carrier, Swift, announced earnings. And on Tuesday, it clarified the debacle. It’s suffering from indigestion. The high costs from its red-hot capacity increase – average truck count jumped by 831 trucks in the third quarter from a year earlier – are now slamming into swooning freight demand.

Operating revenue declined 1%, which Swift blamed on the disappearing fuel surcharge, though it didn’t explain why it is getting away with still charging $109 million in fuel surcharges when diesel prices have plunged to rock-bottom.

So it’s cutting back. In its previous disclosure, it announced that its average truck count for 2015 would grow by 700-1,100 trucks. Now it cut the growth down to 500-600 trucks, “given that the freight environment is softer than we originally expected, and peak volumes have not yet materialized as in years past,” it said.

September is the beginning of the holiday shipping season. Volume should be sharply higher. But it’s not happening ... MORE

MattSh

(3,714 posts)Way too many of you are staying out late causing mischief!

Not Demeter, of course. She's at DU causing mischief!

Demeter

(85,373 posts)Although it's probably evening there....Happy Halloween!

Any equivalent Slavic customs for the season?

MattSh

(3,714 posts)At least when I started this response...

While there are no doubt slavic traditions, from what I've seen Halloween is similar to that in the west, but on a much smaller scale. In other words, it's an adapted western tradition. Definitely no "trick or treat" but there is some dressing up, but mostly for parties or clubs. No dressing up for school or work. And getting anything resembling a halloween pumpkin is difficult in the extreme. Most of what they call pumpkins here are shaped like zucchini or cucumbers, maybe a foot long at the max, and are not all that orange.

Having said all that, I came across an article on Russia Insider (RI) this week stating Russia is looking to ban Halloween. Hey RI, if I'm looking for an article that makes Russia look stupid, I can go to the western press for that. Apparently one region in Russia is looking to ban Halloween and some guy took that as an omen that it would happen throughout Russia. Although it actually is a possibility because Russia, except in Soviet times, does not have a tradition of separation of church and state. Oh great, I'm thinking. The USA has a stupid "war on Christmas," now some idiots in Russia want to counter with a "war on Halloween." Just goes to show that every country has more than it's fair share of idiots.

If you're interested, here's info on Kiev events this weekend. You'll need to do a translation. Google may decide it's Ukrainian, if it's not very readable, select Russian instead. The translation will be rough anyway.

http://kiev.vgorode.ua/news/dosuh_y_eda/272921-vykhodnye-v-kyeve-20-samykh-yarkykh-sobytyi-etoho-uyk-enda

http://kiev.vgorode.ua/news/dosuh_y_eda/272818-v-muzee-zooparke-y-na-parade-kak-neobychno-otprazdnovat-khellouyn-v-kyeve

http://kiev.vgorode.ua/news/dosuh_y_eda/272696-vedmy-karlyky-y-zomby-top-10-mest-dlia-prazdnovanyia-khellouyna-v-kyeve

Well, it looks like there's more going on than I was aware of. But you won't find this kind of stuff in the English language Kiev Post. Or Kyiv Post as they call themselves. They're too busy kissing State Department ass to keep you informed about stuff like this.

Well, enough of that...

RI had another really stupid post this week, basically claiming that Putin thought that Global Climate change was a plot by the west to lower the demand for Russian gas and oil. Now I don't know where Putin stands on a lot of things, but this one struck me as stupid. And no wonder. It was sourced from the Daily Caller, which apparently is a side project of Tucker Carlson. Any number of commenters said they thought this was shit, including probably the most prominent American scholar of Russia currently in Russia, Mark Sleboda. To their credit, RI appears to have taken it down, but maybe they need to explain publicly how something like this was approved in the first place.

MattSh

(3,714 posts)Demeter

(85,373 posts)Couple of news bits to bring you up to speed...

Before the War on Christmas victimization program, the whacko religious did have a War on Halloween running concurrently with the denunciation of Harry Potter books. They gave it up when their children revolted, I suppose. Or maybe because the series is complete. It's been quiet on the "witchcraft" front, lately.

Also, pumpkins are coming in a variety of colors, these days. Besides the standard orange, there are red (quite lurid), ghost white (very designer-stylish) green and yellow. Haven't seen any striped ones, yet...but that's probably in the works.

Saw some painted Blue and Maize though...a local fetish. Go Blue!

This whole Syria thing is going to boil over in a most ugly way. It has managed to take the attention from Ukraine quite nicely (instead of the other way around).

We need to have the election early so we can finally throw the Neocons out of State Dept. and purge the military. This could blow up into WWII without even trying.

Demeter

(85,373 posts)Bond market liquidity may shrink if rule changes as proposed requiring banks to hold more capital to offset losses in their trading books are implemented, according to JPMorgan Chase & Co.

Global regulators are finalizing tougher guidelines after the financial crisis revealed that buffers against trading losses were insufficient. The changes may require banks to set aside 60 percent more capital for U.S. Treasury holdings and 90 percent more for Japanese government bonds, said Vanessa Le Lesle, head of regulatory affairs in the Asia-Pacific region for JPMorgan.

“We are talking about quite liquid sovereign bonds that would be quite impacted, so even worse for emerging markets,” Le Lesle said at a conference organized by International Swaps and Derivatives Association in Tokyo on Thursday. “All of that points to some reasons why banks would be less willing to provide liquidity.”

Investment banks are pulling back from businesses that aren’t sufficiently profitable as stricter rules hike up costs. Capital charges for market risk may increase by more than four times if regulators press ahead with the Fundamental Review of the Trading Book proposals, industry groups said Oct. 21. Credit Suisse Group AG last week decided to stop making a market in government bonds across Europe and Deutsche Bank AG is quitting trading agency residential mortgage-backed securities.

MORE WHINING AT LINK

Demeter

(85,373 posts)Bank of America Corp has reached a $335 million settlement of a federal lawsuit accusing it of misleading shareholders about its exposure to risky mortgage securities and its dependence on an electronic mortgage registry known as MERS. The second-largest U.S. bank disclosed the accord in its quarterly report filed on Friday with the U.S. Securities and Exchange Commission. It said it set aside enough reserves for the settlement as of June 30, and that final documentation and court approval are still needed.

Shareholders led by the Pennsylvania Public School Employees' Retirement System claimed they had been misled into buying Bank of America stock in 2009 and 2010, including stock sold to repay $45 billion of federal bailout money. They said the Charlotte, North Carolina-based lender knew it could not raise enough capital had it revealed it might have to buy back billions of dollars of securities backed by risky loans, including from the former Countrywide Financial Corp. Shareholders also said the bank knew that record keeping in Merscorp Inc's private Mortgage Electronic Registration Systems registry was so poor that it would not be able to legally foreclose on thousands of delinquent mortgages.

MERS was established in 1995 to circumvent the often cumbersome process of transferring ownership of mortgages and recording changes with county clerks.

Spokesmen for Bank of America did not immediately respond to requests for comment. The pension fund and its in-house counsel did not immediately respond to similar requests. An outside lawyer for the fund declined to comment. The bank has spent more than $70 billion since the financial crisis to resolve legal and regulatory matters, including those tied to its purchases of Countrywide in July 2008 and Merrill Lynch & Co six months later.

Demeter

(85,373 posts)In Tennessee, the state insurance commissioner approved a 36 percent rate increase for the largest health insurer in the state’s individual marketplace. In Iowa, the commissioner approved rate increases averaging 29 percent for the state’s dominant insurer.

Health insurance consumers logging into HealthCare.gov on Sunday for the first day of the Affordable Care Act’s third open enrollment season may be in for sticker shock, unless they are willing to shop around. Federal officials acknowledged on Friday that many people would need to pick new plans to avoid substantial increases in premiums.

But, they said, even with a number of companies leaving the marketplace for health insurance under President Obama’s signature health care law, most people around the country will still be able to choose from three or more insurers in 2016.

“Shopping can save you money,” said Richard G. Frank, an assistant secretary of health and human services, who unveiled a huge collection of data on health plans that will go on sale on Sunday in the 38 states served by HealthCare.gov.

MORE FATUOUS CLAPTRAP AT LINK

MattSh

(3,714 posts)Everyday is Halloween

This is Halloween

Dead Man's Party

Alternate video for Dead Man's Party

Both "This is Halloween" and "Dead Man's Party" were written by Danny Elfman, who also wrote the Simpsons theme along with like 10,000 other things.

Demeter

(85,373 posts)

Demeter

(85,373 posts)someday, I must give up this mad, carefree existence!---Snoopy

antigop

(12,778 posts)antigop

(12,778 posts)Ghost Dog

(16,881 posts)

Demeter

(85,373 posts)We saw the Minions (2nd time, free movie) and it still held me enthralled. I wish I had some minions...I am grateful to everyone who posted, especially the holiday music! Chocolate kisses for all of you!

And we stopped at the Farmer's Market on the way home...It's getting late in the season, but apples, pears, lovely celery and more were there. I didn't buy roses, now that I'm growing my own. Even the Knockout rose outside is full of buds and blooming!

I made a kettle of my special chicken stew...my version of Jewish penicillin, and baked apples from the market. I have started supplemental C and D vitamins; starting to feel better. The ad in the theater says the immune system slows down after 50, so I am thinking of getting pneumonia vaccine (if I ever feel healthy enough) in light of my sister's bout this summer...and more vitamins and exercise. Time to take care of myself better.

The trick-or-treaters have started arriving, in spite of the dank, damp cold weather. Not many houses in the neighborhood are supporting the holiday this year...what a bunch of losers! But we knew that already.

Happy Hallowe'en, all! See you in the morning!

DemReadingDU

(16,000 posts)Maybe I would get better pears at a fruit market. I bought some at the grocery that looked great on the outside, but inside they were brown and mushy. ![]()

I have concluded that what I eat makes me feel good or bad.

Anything fast-food or highly processed is bad.

Fresh vegs, fruit, eggs and cheese are good.

![]()

I get enough exercise getting up and down to let the dogs in and out of the house, dozens of times every day.

![]()

Demeter

(85,373 posts)Senior U.S. officials said on Thursday they hoped to see the U.S. Congress approve reforms to the International Monetary Fund which will give emerging markets a bigger say at the global lender. Reforms agreed in 2010 would put Brazil, China, India and Russia among the fund's top 10 shareholders but have been held up in Congress, which must back them.

A source familiar with IMF discussions said there appeared to be a chance of a deal to pass the reforms before Group of 20 leaders meet in Turkey on November 15-16. U.S. Treasury Under Secretary for International Affairs Nathan Sheets said the Obama administration was focused on getting the deal done, although he did not specify a timeframe.

"The case has been effectively made on the Hill. Senior legislators from both parties recognize the importance and I remain hopeful that we will see it," he said at the Center for Strategic and International Studies.

White House G20 adviser Caroline Atkinson said the IMF reform was very important and she continued to press for it. The Senate appropriations committee has approved a funding bill that would also implement the IMF reforms, although the House version of the bill excludes them. News agency Bloomberg reported on Thursday that Republican lawmaker Kay Granger, who is responsible for shepherding the House bill, said she was optimistic the two chambers could work out a compromise.

SO, THE IMF HASN'T EVEN A FIG LEAF OF DENIAL THAT IT IS WHOLLY A CREATURE OF THE USA, AND MUST BOW TO ITS WISHES....I NEVER KNEW THAT BEFORE!

Demeter

(85,373 posts)Financial transactions using shares or other assets to secure credit will come under greater scrutiny after the European Parliament approved a new law on Thursday to shine a light on the so-called shadow banking sector. Shadow banking refers to the creation of billions of euros of credit outside mainstream banking by allowing asset managers, pension funds and others to access secured funding by temporarily lending out assets like shares. Borrowers of securities can include hedge funds who have sold shares short and need to cover their positions. The law introduces mandatory reporting of securities financing transactions to help regulators spot the build up of overly risky positions.

"Today's rules will increase transparency in securities financing markets," said Jonathan Hill, financial services chief at the EU's executive European Commission, which proposed the law in 2014.

"They will allow market participants to use them for financing the economy, while making it easier to monitor and assess the risks involved," Hill said.

Under the new law, investment funds will have to disclose to investors the returns they make on the transactions. EU states are due to formally rubber stamp the legislation soon and it will start taking effect in 2016.

Shadow banking was seen as a problem during the 2007-09 financial crisis but the sector has since been seen in a different light. As banks rein in lending to focus on rebuilding their core capital levels, policymakers like Hill have been promoting markets as a source of funding for the economy. The European Central Bank said on Thursday that shadow lenders like investment funds have driven growth in euro zone financial assets.

"The shadow banking sector is an increasingly important provider of funding to the euro area economy," the ECB said.

YEAH, THAT'S WHY THEY ARE IN TROUBLE. SILLY RABBITS! FUNDING AN ECONOMY VIA PAWNSHOPPING...

Demeter

(85,373 posts)U.S. economic growth braked sharply in the third quarter as businesses cut back on restocking warehouses to work off an inventory glut, but solid domestic demand could encourage the Federal Reserve to raise interest rates in December. Gross domestic product increased at a 1.5 percent annual rate after expanding at a 3.9 percent clip in the second quarter, the Commerce Department said on Thursday. The inventory drag, however, is likely to be temporary and economists expect growth to pick up in the fourth quarter given strong domestic fundamentals.

IT'S CALLED CHRISTMAS, THAT ECONOMIC MIRACLE DRUG. WHO EVER HEARD OF EXCESS INVENTORY BEFORE BLACK FRIDAY? THEY MUST FIGURE CHRISTMAS ISN'T COMING, THIS YEAR.

"The guts of the report were healthy, they still show strong underlying momentum in the economy and that puts a December rate hike firmly on the table," said Thomas Costerg, a U.S. economist at Standard Chartered Bank in New York.

The Fed on Wednesday described the economy as growing at a "moderate" pace and hinted at a December rate increase by making a direct reference to its next policy meeting. The U.S. central bank has kept benchmark overnight interest rates near zero since December 2008. Stocks on Wall Street and prices for U.S. Treasury debt fell on the data. The dollar weakened against a basket of currencies.

The economy has struggled to sustain a faster pace of growth since the end of the 2007-2009 recession, with average yearly growth failing to break above 2.5 percent. This year, it has faced headwinds from a strong dollar and deep spending cuts by energy firms following a collapse in oil prices. Businesses accumulated $56.8 billion worth of inventory in the third quarter, the smallest since the first quarter of 2014 and down sharply from $113.5 billion in the April-June period. There were declines in manufacturing, wholesale and retail inventories. The small inventory build sliced off 1.44 percentage points from third-quarter GDP growth, the largest since the fourth quarter of 2012.

"That inventory drawdown represents a bit of a healthy purge that should set the economy up for stronger growth in the coming quarters," said Jim Baird, chief investment officer for Plante Moran Financial Advisors in Kalamazoo, Michigan.

CONSUMERS SAVE THE DAY

The blow from inventories was, however, blunted by bullish consumers, who are getting a tailwind from cheaper gasoline and firming housing and labor markets. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, grew at a 3.2 percent rate after expanding at a 3.6 percent pace in the second quarter. A measure of private domestic demand, which excludes trade, inventories and government spending, rose at a sturdy 3.2 percent pace. Spending is likely to remain supported by a fairly healthy labor market and low inflation, which is boosting household purchasing power. Income at the disposal of households increased 3.5 percent in the third quarter after rising 1.2 percent in the prior quarter.

"The consumer remains the main engine of economic growth. We expect this dynamic to remain in place," said Jesse Hurwitz, an economist at Barclays in New York.

A separate report from the Labor Department showed new applications for unemployment benefits last week hovering near levels last seen in late 1973.

With the dollar strengthening, export growth decelerated in the third quarter. The drag was, however, offset by a slowdown in imports, especially automobiles, leaving trade's impact on growth neutral. Ongoing spending cuts in the energy sector also undermined growth...The personal consumption expenditures price index rose at a 1.2 percent rate after rising 2.2 percent in the second quarter. Excluding food and energy, prices increased at a 1.3 percent pace, slowing from a 1.9 percent rate in the second quarter.

Demeter

(85,373 posts)IF LIBOR DIDN'T EXIST, THEN THEY WOULD HAVE TO INVENT ONE...

http://www.reuters.com/article/2015/10/28/uk-boe-markets-salmon-idUKKCN0SM0XL20151028

The Bank of England will spell out next year how markets can migrate to a new "risk-free" interest rate benchmark after banks were fined billions of dollars for trying to rig Libor, the existing benchmark, a senior BoE official said on Wednesday. Chris Salmon, the BoE's executive director for markets, said Libor, or the London Interbank Offered Rate, a benchmark for interest rates that banks charge each other, remains too prevalent. Formerly overseen by the British Bankers' Association (BBA), Libor rates have come under scrutiny after a number of traders were accused of colluding to rig the rate. The rates are calculated through an "honor system" in which a panel of banks report their estimated costs of borrowing from each other in different currencies over differing periods.

In the first trial of a defendant accused of Libor rigging, a former trader for UBS, Tom Hayes, was convicted in August 2015 and sentenced to 14 years in jail.

Some 250 billion pounds of corporate loans reference sterling Libor and it is still the key interest rate in sterling derivatives markets, where it is a reference for contracts with a notional value of about 25 trillion pounds.

"Yet in many of these contracts, users are looking to hedge the general level of interest rates, for which a near-risk free rate would be a more appropriate reference rate than Libor, which contains a bank credit risk component," Salmon told an Association of Corporate Treasurers conference.

The BoE has been working for the past year on an alternative near risk-free reference rate, he said.

"The aim of this work is to transition a significant portion of new derivatives contracts to the alternative reference rate, moving to a world where Libor is used when it is appropriate to account for bank credit risk, but not otherwise," Salmon said.

"The working group has made good progress and I expect that a concrete timetable for making a reality of this change should become clear during the course of next year."

Corporate treasurers will have to decide whether and how to adapt their use of reference rates once this transition is underway, he said.

Echoing speeches from two BoE deputy governors over the past week, Salmon cautioned that companies who want to raise money on fixed income markets may find it harder given increased volatility. There was no "free lunch" for companies who shift from banks to bond markets for raising funds as the latter can be fickle as well.

"The risk is that this volatility could make it more difficult for corporates to issue new debt," Salmon said.

"Issuers have to ensure that they understand the risks, as well as the benefits, of increased usage of market-based finance – not least those new issuers that have only experienced exceptionally supportive conditions."

WHY DOES THIS SOUND LIKE "HOW MANY ANGELS DANCE ON THE HEAD OF A PIN"?

Demeter

(85,373 posts)...The two-year budget provision provides new top-line spending levels for Congress for the fiscal year that began Oct. 1 and the one starting Oct. 1, 2016. It loosens budget caps, allowing an additional $80 billion in spending on military and domestic programs over the two years. But lawmakers still need to allocate that money among thousands of budget-line items. They face a Dec. 11 deadline, when existing spending authority by government agencies expires, and a spirited fight is expected.

Obama called on Congress to build on the budget "by getting to work on spending bills that invest in America’s priorities without getting sidetracked by ideological provisions that have no place in America’s budget process." Conservative Republicans are likely to try to attach controversial policy add-ons, such as prohibiting funding for women's healthcare provider Planned Parenthood to punish the group for an abortion-related controversy involving fetal tissue. Some may also try to undo Dodd-Frank Wall Street reforms enacted after the 2008-09 financial crisis or prohibit new regulations on carbon emissions.

During Senate debate on Thursday, conservatives railed against the budget and debt limit bill.

Republican Senator Rand Paul, who is running for the Republican nomination for president, complained in a floor speech: "The right's going to get more military money. The left's going to get more welfare money. The secret handshake goes on and the American public gets stuck with the bill."

Senator Ted Cruz, a rival Republican presidential hopeful, returned to Washington from the campaign trail to accuse Republican majorities in Congress of "handing the president a blank credit card for the remainder of his tenure."

Senate Majority Leader Mitch McConnell, a Republican who helped negotiate the bill, praised the measure for rejecting tax increases and noted that the added spending would be offset by savings elsewhere in the government.

He also said it would "enact the most significant reform to Social Security since 1983." The estimated $168 billion in long-term savings from the program would be achieved by clamping down on medical fraud and excess claims associated with disability benefits.

Demeter

(85,373 posts)It was good while it lasted. But all good things — especially those which lawmakers regard as an unintended loophole — must come to an end. Congress has agreed to, and the president is expected to sign into law, a bill that 1) averts a government shutdown and 2) shuts down two popular Social Security claiming tactics: the-file-and-suspend and the restricted-application Social Security strategies. And now, millions of Americans who were planning to use these strategies to boost their household’s lifetime benefits must figure out what to do instead. Here’s what experts had to say:

Business as usual… for a little while

It’s business as usual during the phase-in period, said Elaine Floyd, a certified financial planner and director of retirement and life planning at Horsesmouth, a New York firm that provides financial education to advisers. Between now and six months after the bill is enacted, file-and-suspend is still in effect, she said. Plus, it will still be possible to file for a spousal benefit based on a spouse’s suspended benefit. And, individuals who will be over 62 as of Dec. 31, 2015 can still plan on filing a restricted application for spousal benefits when they turn FRA over the next four years.

What’s changing? Deemed filing

The first big change is to the “deemed filing” rule, said Mike Piper, author of Social Security Made Simple: Social Security Retirement Benefits and Related Planning Topics Explained in 100 Pages or Less. “But this change only affects people who will not yet have attained age 62 by the end of 2015,” he said. Specifically, he said, the new law would make it so that deemed filing applies beyond full retirement age rather than only applying before full retirement age. This, in effect, kills off the “restricted application” strategy in which a person files for spousal-benefits-only at full retirement age while allowing their own retirement benefit to continue growing. “But for people who will be 62 or older at the end of 2015, the restricted-application strategy is still available,” Piper said.

What else is changing?

The second big change deals with suspension of benefits, said Piper. Specifically, it says that, for people who suspend benefits more than 180 days after enactment of the bill, the following things will be true:

There will no longer be the option to retroactively unsuspend benefits (i.e., get a lump sum for benefits that would have been receiving during the period of suspension if you decide to unsuspend).

You will no longer be able to receive benefits on anybody else’s work record while your benefits are suspended.

Nobody else will be able to receive benefits on your work record while your benefits are suspended.

“In other words, the typical file-and-suspend strategy in which Spouse A files for retirement benefits and immediately suspends, to allow Spouse B to file for spousal benefits while Spouse A’s retirement benefit continues growing, is eliminated,” said Piper. “However, it’s only eliminated for people who have not yet suspended within 180 days of enactment of the bill.”

File and suspend benefit is still an option

The law allowing the voluntary suspension of benefits at FRA, however, hasn’t changed, according to Floyd. “It will now be used for its original intent: to enable a person who has filed for benefits and later goes back to work or otherwise changes his mind to suspend the benefit and accumulate 8% annual delayed credits to age 70, she said.

Survivor strategies haven’t changed

Deemed filing never did apply to survivor benefits, and it doesn’t now, said Floyd. “Widows and widowers can still file a restricted application for survivor benefits while their own benefit builds delayed credits,” she said.

ON THE WHOLE, THIS IS A GOOD THING, IMO. IT SHUTS DOWN SOME FANCY-PANTS SKIMMING BY THE WEALTHY OFF THE SOCIAL SECURITY POT. HOW MUCH THAT WILL AFFECT THE POT ISN'T CLEAR.

Demeter

(85,373 posts)http://angrybearblog.com/2015/10/vsps-get-their-way-with-budget-deal-social-security-benefits-are-cut.html

All the Very Serious People are jumping up and down and cheering. We have a budget deal in the House and the debt ceiling is being raised and there will be no more artificial budget crises until after the new president is in office, hurray hurray hurray! Not only that, all the Dems in the House voted for it, with everybody gushing gratitude to John Boehner for making it possible by resigning as Speaker to turn it over to reasonable Paul Ryan once Boehner could get this deal through the House, thwarting the evil Tea Party/Freedom Caucus bomb throwers who want to have a big crisis with the government shut down and indeed bankrupt outright. We are saved!

Well, indeed there certainly are these benefits. But without much publicity, Paul Ryan is reported to be behind slipping into the deal something that he has long supported, entitlement benefit cuts, which have been heavily featured in past budgets he has proposed. The particular cut is the ending in Social Security of the ability of couples to “file and suspend” with this being replaced by “deemed filing.” File and suspend allowed someone to get Social Security benefits prior to retiring, while not having to accept the lower benefits one gets if one retires at 62 or 66. One can get the higher benefits later. This will now not be allowed, so one must accept the lower benefits if one starts getting benefits early. This has only been possible for married couples with this involving one getting spousal benefits and then their own through some semi-complicated maneuvers that have been allowed since 2001.

So, while most commentators have simply ignored this item, or focused on some other changes that have involved propping up the disability part of Social Security (which has needed some propping), this is indeed a benefit cut and one that will affect people who are on the verge of retiring (those already doing it I think are grandparented in), not non-voting Gen-Xers or millennials down the road, as would be the case for most of the proposals being made by the GOP presidential candidates (e.g. gradually raising the retirement age as has been going on for several decades thanks to the 1983 Greenspan commission). Most of those who have noted this, particularly the VSP types, have applauded it, saying this has been sort of a scam and has been available mostly to higher income people. There is something to this, but there is no doubt it is a benefit cut, and we did not see any cuts to any other programs, when in fact defense spending being allowed to rise. Even though Cruz claimed this deal would raise the deficit during the latest GOP debate, it will not. The bottom line is that Social Security benefits are being cut while DOD spending is increasing, and this was unanimously supported by Dems in the House, and probably will be also be in the Senate. What a farce.

Regarding Ryan, Paul Krugman and Dean Baker have done a good job of pointing out how off the wall the budgets he has proposed in the past have been, filled with asterisks, while he has somehow been praised over and over as this responsible Republican in the House. Of course he has national recognition due to being Romney’s VP candidate, and he has some favorable qualities, including even his desire to spend time with his family. He looks like a reasonable person until one looks too closely. However, it is a bit ironic that the VSP crowd is so enamored of him. Their fave commission was the failed Bowles-Simpson one, with the long favored VSP deal being cutting entitlement benefits in exchange for a tax increase. It should be remembered that the reason it failed (and its “report” was simply a document issued by Bowles and Simpson themselves, not the whole commission) was that some of the Republicans on the commission voted against its recommendations. One of those who did so was Paul Ryan. Why did they do so? Because it proposed tax increases. So, Paul Ryan is just great on cutting Social Security (and Medicare and Medicaid) benefits, but he is not in favor of that crucial other piece of the VSP deal, tax increases. But that has not restrained their enthusiasm for him.

Oh, and WaPo in particular has continued to look like itself earlier today in a column by Charles Lane. He mostly wastes time blaming Obama for all the failures of the VSP dreams to come true, “kicking the can” down the road, although he mostly focuses in particular on Obama’s “failure” to implement cuts to Social Security and healthcare, shame on him. Lane mentions in passing these cuts in Social Security in the budget deal, but basically dismisses them, “too little, too late.” Only near the end does he mention in passing the unwillingness of GOPsters to raise taxes, with his focus overwhelmingly on the “need” to cut those darned entitlement benefits, gosh darn it!

AND GET OFF HIS LAWN, WHILE YOU ARE AT IT...

Demeter

(85,373 posts)BAD WEATHER AND GOOD PLANNING

http://www.wxyz.com/news/region/detroit/detroit-has-quietest-angels-night-in-20-years-with-only-11-fires

The city of Detroit said it has had its quietest Angels' Night in 20 years.

According to the city, there were only 11 fires on Oct. 30, with only 28 fires during the first two nights. Last year, there were 66 fires through the first two nights.

On Thursday night, the city reported 17 fires, seven of which were suspicious. That broke down to three occupied structure fires, two of which were suspicious; Six vacant structure fires, four of which were suspicious, one garage fire which was suspicious, and seven trash/outdoor fires.

On Friday night, seven of the 11 fires were suspicious. Three of which were occupied structures, all were suspicious; Five vacant structure fires, four of which were suspicious and three trash/outdoor fires.

More than 3,500 volunteers have been out the past two nights for active street patrols. The city said that has helped reduce the number of fires the city has experienced.

The breakdown of fires through the years is below:

1984 - 810 fires

1994 - 354 fires

2010 - 169 fires

2011 - 94 fires

2012 - 93 fires

2013 - 95 fires

2014 - 97 fires

2015 - 28 fires (after two nights)

Demeter

(85,373 posts)There’s much wailin’ an’ a gnashin’ of the teeth in my native UK as a result of a finding that 6 million people make less than the Living Wage. The reason this is a bizarre finding is that there’s actually no such thing as a “Living Wage”, not in any sense of reality there isn’t. It’s simply an entirely made up number, concocted by a group of activists, with no particular grounding in rhyme nor reason. More than that, the particular problem they are trying to address is being approached from the wrong direction. What they want to get everyone believing is that Britain suffers from some amount of low wage poverty. This is not in fact true, even by their own calculations. What Britain suffers from is high taxation poverty. Something that I have been regularly pointing out to these campaigners for near a decade now.

Here’s the BBC on the subject:

The data showed a “worrying trend” of part-time, female and young workers being most likely to earn below the figure, researchers found.

The living wage, promoted by the Living Wage Foundation, is currently £7.85 an hour and £9.15 in London. It is not compulsory for employers to pay it.

Well, yes, it will be predominantly the young, part-time and female (because the vast majority of part-time workers are female) who get low wages. This will be true in any society: for the obvious reason that it’s the young and untrained who get low wages, and part-timers are entirely naturally paid less than full-timers.

Others are carrying much the same information in their stories:

The report was published ahead of new figures being published on Monday for the hourly rate, which are expected to show an increase from the current £7.85 an hour and £9.15 in London.

The current figures are well above the national minimum wage and more than the new living wage of £7.20 an hour for over 25-year-olds the Government has announced will come into force next April.

KPMG said its research revealed that the proportion of workers earning less than the voluntary living wage had risen for three years in a row.

Well, yes, that’s quite obvious too. There’s been very little real wage growth in the UK in recent years (you have heard about the recession?). And yet the Living Wage has been rising each year because it is linked to living standards, not other wage incomes. So, the campaigners keep raising the Living Wage, real incomes aren’t rising much, so obviously more people are falling below that Living Wage. There really is no great mystery here.

We’ve even got The Observer weighing in (at which point this does look like something of a coordinated campaign, which of course it is sa next week is Living Wage Week):

Recommended by Forbes

So, a political campaign being run by the usual suspects over on the left. At which point we might want to examine their claims. And to be fair to them their original calculation isn’t all that bad.

What they do is go around and ask focus groups well, OK, what must you be able to do, within your income, in order not to be regarded as being in poverty in today’s UK? This is a reasonable method of judging poverty as it’s very similar to Adam Smith’s linen shirt example. Not having a linen shirt does not make you poor. Yet if you live in a society where not being able to afford a linen shirt is regarded as a sign of poverty then, if you can’t afford one then in that society it’s reasonable enough to regard you as poor. So, the focus groups answer that people should be able to go out with the Missus for a couple of pints each week, eat out at a pub style restaurant once a month and so on. All entirely reasonable adjudications of what is poverty, as it is defined by the Brits themselves, in today’s Britain.

However, note that’s what it is: it’s what people define as the poverty line (not to be confused with any official definition of that, which in the UK is 60% of median household income adjusted for housing costs and family size). What it isn’t in fact is a living wage, nor even a Living Wage. Because people who do not get these wages are not starving, they’re not unable to support themselves and their families. They’re just in relative poverty (we have no absolute poverty in the UK, absent the usual addiction or mental health problems). However, that’s not where the crucial error lies. This Living Wage is calculated as a pre-tax number. And while things have been getting better (and yes, this is as a result of my shouting about it for the best part of a decade, no, really, I can track how the proposal moved from me shouting to it being implemented into current law) it is still true that we tax low incomes much too highly in the UK. In fact, the difference between this Living Wage and the country’s current minimum wage, post tax, is almost entirely the amount of tax that is charged to these miserably low wages. That is, if the current minimum wage were untaxed then it would be about the same as the Living Wage is post the current tax system. Meaning that it’s not in fact low wages which are the problem. It’s high taxes which are.

At which point it becomes obvious how we create that Living Wage for all who are indeed working. Just raise the income tax and national insurance (akin to Social Security for the US) allowances to being the same as the full year, full time, minimum wage. At which point all are earning the same, or within pennies per hour, as that post tax Living Wage. Hurrah! we’re done, we’ve abolished working poverty. But note that we’ve done it by lowering taxes: because taxes are the current problem. After all, if you want the working poor to have more money the solution is pretty simple: just stop taxing them so damn much.

NOT A BAD PLAN, IMO....NO TAXATION ON INCOME BELOW A CERTAIN LEVEL...WE SHOULD TRY IT.

Demeter

(85,373 posts)NOW, IF ONLY THIS COULD BE DONE TO CORPORATIONS...

http://www.forbes.com/sites/irswatch/2015/11/01/irs-offshore-programs-produce-billions-come-in-and-participate-or-else/

The IRS recently released IR-2015-116 announcing its offshore compliance programs have generated $8 Billion. More than 54,000 taxpayers subject to U.S. worldwide income and disclosure requirements have come in from the cold to participate in IRS offshore remediation disclosure programs since 2009. The IRS also urged taxpayers with non-compliant offshore accounts to “strongly consider existing paths established to come into full compliance with their federal tax obligations.” Over 30,000 of the 54,000 taxpayers took advantage of the non-willful Streamlined Filing Compliance Procedures with approximately 20,000 participating after the procedure requirements were relaxed in June 2014. In addition to the results from taxpayers proactively coming forward to the IRS, the announcement emphasized that the IRS has conducted thousands of offshore-related civil audits resulting in the collection of tens of millions of dollars. The announcement also touts that the IRS has pursued criminal charges resulting in billions of dollars in criminal fines and restitution. Amazingly, all this activity has been occurring during a time of budget reduction for the agency.

THE CARROT

The Offshore Voluntary Disclosure Program (OVDP) (for taxpayer’s who willfully failed to comply) and the Streamlined Filing Compliance Procedures (for taxpayer’s whose failure to comply was not willful) are two pathways for taxpayers to correct prior noncompliance while providing some certainty regarding penalty exposure in each case. If a taxpayer discloses under the OVDP before their foreign financial institution is publicly identified by the Department of Justice, the OVDP non-disclosure “miscellaneous” penalty will not escalate. The escalation of the OVDP penalty under these circumstances is driving non-compliant U.S. taxpayers to disclose sooner rather than later. Additionally, non-compliant taxpayers may take advantage of the Delinquent FBAR Procedure and the Delinquent International Information Return Procedure as well.

THE STICK

“The groundbreaking effort around automatic reporting of foreign accounts has given us a much stronger hand in fighting tax evasion,” said IRS Commissioner, John Koskinen. “People with undisclosed foreign accounts should carefully consider their options and use available avenues, including the offshore program and streamlined procedures, to come back into full compliance with their tax obligations.” Between the Foreign Account Tax Compliance Act (FATCA) and the network of intergovernmental agreements (IGAs) between the U.S. and partner jurisdictions, automatic third-party account reporting is currently a reality. It is much more difficult, if not impossible in most scenarios, to conceal unreported offshore accounts from the IRS in today’s environment. Additionally, the Department of Justice’s Swiss Bank Program continues to ink non-prosecution agreements with Swiss financial institutions which are admitting they facilitated past non-compliance by certain of their U.S. Taxpayer customers. The non-prosecution agreements include that the bank will disclose information regarding potential non-compliance by U.S. taxpayers. The IRS is also mining data from other voluntary disclosures and using that data to uncover non-compliant taxpayers. The announcement warns that recalcitrant taxpayers who continue to hide offshore accounts from the IRS risk criminal prosecution upon detection.

FINAL THOUGHT