Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 25 November 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 25 November 2015[font color=black][/font]

SMW for 24 November 2015

AT THE CLOSING BELL ON 24 November 2015

[center][font color=green]

Dow Jones 17,812.19 +19.51 (0.11%)

S&P 500 2,089.14 +2.55 (0.12%)

Nasdaq 5,102.81 +0.33 (0.01%)

[font color=red]10 Year 2.24% +0.02 (0.90%)

30 Year 3.00% +0.02 (0.67%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)U.S. politicians condemned Pfizer Inc's deal with Allergan Plc as a tax dodge on Monday, bringing another round of hand-wringing in Washington over the corporate tax code, though legislative action before 2017 is unlikely.

Democrats heaped the most criticism on the New York-based drug maker, with Hillary Clinton accusing Pfizer of using legal loopholes to avoid its "fair share" of taxes in a deal that she said "will leave U.S. taxpayers holding the bag." The front-runner for the Democratic presidential nomination in the November 2016 election said she will propose steps to prevent more inversions, but she did not provide details. "We cannot delay in cracking down on inversions that erode our tax base," said the ex-U.S. secretary of state and former New York senator in a statement.

Republican front-runner Donald Trump, who has called for a corporate tax overhaul, called the deal "disgusting" in a statement, saying "our politicians should be ashamed."

Pfizer is doing the largest inversion deal of all time. In a $160-billion transaction, it plans to move its tax address from the United States to Ireland, if only on paper, by buying and merging into Allergan, a smaller, Dublin-based competitor. The combined company will be called Pfizer and will be run by Pfizer's CEO, with executive management staying in New York and extensive operations across the United States, but it will no longer be taxed as a U.S. company.

More than 50 similar deals have been done over three decades by well-known companies such as Medtronic Plc, Fruit of the Loom and Ingersoll-Rand Plc. Congressional researchers have estimated inversions, left unchecked, will cost the U.S. Treasury nearly $20 billion in the next 10 years.

The White House declined to comment on Pfizer's deal, but a spokesman told reporters in a briefing that Congress should take action to prevent more such transactions.

The U.S. Treasury Department last week unveiled new rules to clamp down on inversions, its second attempt to do so since a wave of deals peaked in September 2014. But the latest rules amounted to tweaks of existing law and will not impede the Pfizer-Allergan transaction, tax experts said.

Senator Bernie Sanders, Clinton's chief rival for the Democratic nomination, said the deal "would allow another major American corporation to hide its profits overseas."

Perhaps anticipating the deal would draw fire, Pfizer CEO Ian Read sent a letter on Monday to senior senators.

The letter said, "We will maintain our global operational headquarters in New York City. At the time we close the transaction, we will have over 40,000 employees across 25 states ... We will be gaining greater access to resources that will enable us to make significant investments in the U.S."

TAPING OFFSHORE ABROAD

Pfizer holds about $74 billion in profits offshore that, thanks to another loophole, it has not brought into the United States to avoid paying the taxes due under America's worldwide corporate tax system. As an Irish-domiciled company, it will have less costly access to those funds.

Representative Tom Price, one of few congressional Republicans to comment on Monday, said in a statement that more Treasury regulations will not solve the inversions problem. "The only real solution to curbing inversions is tax reform," he said.

But Congress, divided over fiscal issues, is widely seen as unlikely to tackle a tax overhaul before the 2016 elections.

“Pfizer built their business on the back of our research and development tax incentives, our federally supported medical research, our skilled workforce, and our infrastructure," said Democratic Representative Rosa DeLauro in a statement.

"We cannot continue to allow Pfizer and other corporations to pretend that they are American while reaping the benefits this country has to offer, yet claiming to be another nationality when the tax bill comes," she said.

Demeter

(85,373 posts)The U.S. Treasury is going after inversions, but drug companies’ vulnerability is Medicare...

Pfizer and Allergan’s $160 billion merger is funded, in no small part, by the American taxpayer...After all, the estimated 17%-18% effective tax rate the merged company will pay in global taxes saves about $1 billion a year on just the Pfizer Inc. side of the business. The U.S. Treasury is leading the government’s effort to rein in inversions through tax rules, but their proposed rule won’t cover this deal, and the effort doesn’t attack the inversion deal makers where it will hurt them most.

What will stop the biggest inversion deals cold is a regulation steering Medicare and Medicaid’s purchases of drugs and medical devices elsewhere. If you want to sell to government plans, your tax residence has to match where the operating headquarters is, among other tests. It’s a small price to pay for that passage in Pfizer’s annual 10-K report noting the U.S. is the only major world government that doesn’t negotiate on prices for drugs it buys.

Let’s face it: The tax-inversion problem is concentrated in the drug and medical-device industry, which is responsible for more faux Irishness than anything this side of St. Patrick’s Day and Notre Dame football. Three of the six most valuable companies incorporated in Ireland now are device-maker Medtronic, Allergan, and drugmaker Perrigo Co. Along with Alkermes and Jazz Pharmaceuticals which are among the top 20 Irish companies — and, remarkably, are headquartered in the very same Dublin building — all are run from the U.S. This is easy to establish because most of their CEOs have listed home phone numbers here.

There’s not a drug or device company on the planet that can make a go of things without selling into Medicare and Medicaid: Medicare alone buys more than $100 billion of the pharmaceuticals sold in the U.S. each year. While Pfizer doesn’t disclose the percentage of sales it gets from the U.S. government, a look at its list of top drugs tells the story plainly enough: Enbrel (for arthritis), Celebrex (also for arthritis), Lipitor (cholesterol) and Viagra (erectile dysfunction) are in the top six, accounting for about $10 billion of 2014 revenue. Telling Pfizer to pay taxes or else (for now) would not be any disaster for patients. There are plenty of competitors for Lipitor, which Costco Wholesale Corp. sells for as little as $17 a month. No one who watches football is unfamiliar with the bathtub full of Viagra competitors, and Indianapolis-based Eli Lilly & Co. will sell Medicare enough Cialis to, well, write your own naughty jokes. As for Allergan, its top products are Botox, whose biggest uses are cosmetic, and Restasis, which treats dry eyes at a cost 25 times higher than over-the-counter remedies that critics say are just as effective.

To be sure, this form of highly-lawyered tax evasion is mostly specific to one already subsidized industry. The public benefit in New Jersey-based Michael Pearson pretending to run Valeant Pharmaceuticals International Inc. from Quebec, to pay lower taxes on profits generated by Valeant’s $8,900 remedy for toenail fungus, is fairly minimal. Ditto for letting Parsippany, N.J.-based Allergan, whose CEO is in the phone book in nearby Far Hills, pretend to be Irish so it can pay less tax on profits from Restasis and wrinkle-fighting...So the right thing for a lame-duck President Obama to do is issue rules preserving the status quo for his successor. If Restasis’ owners pay more taxes for a year or two, there won’t be a wet eye in the house.

THEREFORE, I PREDICT, OBAMA WILL DO NOTHING....ABSOLUTELY NOTHING....IT'S MONEY IN THE BANK! (HIS BANK, HIS MONEY, EARNED BY SCREWING US ALL)

Demeter

(85,373 posts)By Ellen Brown / Web of Debt

http://www.truthdig.com/report/item/hang_onto_your_wallets_negative_interest_the_war_on_cash_20151121

In uncertain times, “cash is king,” but central bankers are systematically moving to eliminate that fact. Is it really about stimulating the economy? Or is some deeper, darker threat afoot?

...if you’re an ordinary saver with your money in the bank, you may soon be paying the bank to hold your funds rather than the reverse. Four European central banks – the European Central Bank, the Swiss National Bank, Sweden’s Riksbank, and Denmark’s Nationalbank – have now imposed negative interest rates on the reserves they hold for commercial banks; and discussion has turned to whether it’s time to pass those costs on to consumers. The Bank of Japan and the Federal Reserve are still at ZIRP (Zero Interest Rate Policy), but several Fed officials have also begun calling for NIRP (negative rates).

The stated justification for this move is to stimulate “demand” by forcing consumers to withdraw their money and go shopping with it. When an economy is struggling, it is standard practice for a central bank to cut interest rates, making saving less attractive. This is supposed to boost spending and kick-start an economic recovery. That is the theory, but central banks have already pushed the prime rate to zero, and still their economies are languishing. To the uninitiated observer, that means the theory is wrong and needs to be scrapped. But not to our intrepid central bankers, who are now experimenting with pushing rates below zero.

Locking the Door to Bank Runs: The Cashless Society

The problem with imposing negative interest on savers, as explained in the UK Telegraph, is that “there’s a limit, what economists called the ‘zero lower bound’. Cut rates too deeply, and savers would end up facing negative returns. In that case, this could encourage people to take their savings out of the bank and hoard them in cash. This could slow, rather than boost, the economy.”

FORCING PEOPLE TO BUY STUFF COULD ALSO LEAD TO HOARDING VALUABLE ITEMS AND BARTERING. THESE BANKSTERS ARE COMPLETE FOOLS...DEMETER

Again, to the ordinary observer, this would seem to signal that negative interest rates won’t work and the approach needs to be abandoned. But not to our undaunted central bankers, who have chosen instead to plug this hole in their leaky theory by moving to eliminate cash as an option. If your only choice is to keep your money in a digital account in a bank and spend it with a bank card or credit card or checks, negative interest can be imposed with impunity. This is already happening in Sweden, and other countries are close behind. As reported on Wolfstreet.com:

BUT WAIT! THERE'S SO MUCH MORE! HISTORICAL EXAMPLES (IT'S BEEN DONE BEFORE), LOOPHOLES, PRIVATIZATION AND JUST PLAIN LUNACY

IT'S A MUST-READ AND BOOKMARK KIND OF ARTICLE!

Ellen Brown is an attorney, founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt. Her latest book, The Public Bank Solution, explores successful public banking models historically and globally. Her 300+ blog articles are at EllenBrown.com. Listen to “It’s Our Money with Ellen Brown” on PRN.FM.

Hotler

(11,421 posts)If they keep thinking about doing shit like this and even doing it there will be violence in the streets. The longer we wait the harder the fight will be. This spring would be a good time to start the fight in the streets against the oligarchs.

Demeter

(85,373 posts)I have hopes of a peaceful revolution with masses of people spontaneously rising

And with the rest of the world going to hell, the Oligarchs will be preoccupied.

Demeter

(85,373 posts)Two ex-Rabobank Groep traders asked a U.S. court to throw out their convictions for rigging a key benchmark rate.

Anthony Allen and Anthony Conti were found guilty by a Manhattan federal jury this month of manipulating the London interbank offered rate. It was the first such criminal trial in the U.S.

The two said their convictions should be tossed because the government failed to prove their Libor submissions were false or fraudulent. They also said there’s no evidence they had any communications with counterparties to the Libor transactions or that those counterparties were “duped” by the rate submissions.

Allen and Conti, who both worked in Rabobank’s London office, were convicted of partaking in a four-year scheme to rig Libor. Allen, who’d faced one count of conspiracy and 18 counts of wire and bank fraud, was found guilty of all charges. Conti, who was charged with one count of conspiracy and seven counts of bank and wire fraud, was also convicted on all counts.

Demeter

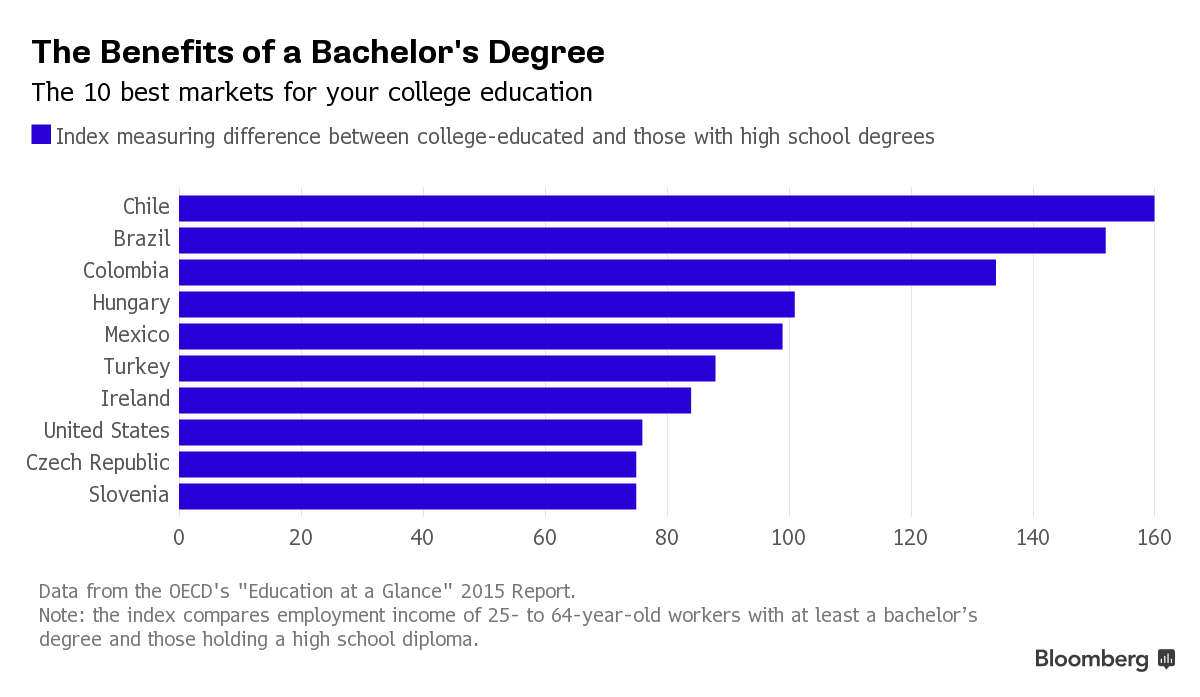

(85,373 posts)It may be time to rethink that move to Manhattan after graduation. South America has the best market for your college degree.

Chile and Brazil are the two countries where it pays the most to have a higher education, according to the Organization for Economic Co-operation and Development. Graduates there can expect to earn more than two and a half times that of their peers who went straight to work after high school. Colombia followed closely behind with the third-largest earnings gap.

Demeter

(85,373 posts)PUTTING THEM ON A STRICT LOW-CALORIE DIET, NO DOUBT

http://www.bloomberg.com/news/articles/2015-11-24/fed-says-it-s-overhauling-standards-for-large-bank-examiners

The Federal Reserve said it’s setting tougher standards for examiners of the biggest U.S. banks, following criticism by lawmakers that the agency has been captured by the Wall Street firms it supervises.

The planned changes include creating a formal process for examiners to express dissenting views on oversight, such as whether lenders are complying with banking rules and appropriately responding to regulators’ requests. The overhaul follows a year-long review that found inconsistency across the Fed’s 12 regional banks tied to supervision practices and reports produced by examiners.

Lawmakers questioned the quality of Fed oversight at Senate hearings last year following complaints by former New York Fed bank examiner Carmen Segarra, who said her ex-employer fired her for refusing to change negative findings about Goldman Sachs Group Inc. The New York Fed oversees several of the largest U.S. banks, including Goldman Sachs, Citigroup Inc., JPMorgan Chase & Co. and Morgan Stanley.

“‘This is long overdue,” said Mayra Rodriguez Valladares, a former New York Fed employee who conducts training for financial regulators as managing principal of consulting firm MRV Associates. “It’s very, very difficult when you work at the Fed to be the person who really sticks out.”

MORE

Demeter

(85,373 posts)It's a cold, sunny day and I have nowhere to go (except tires, and dinner with the kids to celebrate Turkey Day early) so I am going to make pie and try to be productive.

Best of the day to you all!

mahatmakanejeeves

(57,442 posts)It's a day early this week.

Read more: http://www.dol.gov/opa/media/press/eta/eta20152266.pdf

Source: U.S. Department of Labor Employment and Training Administration (ETA)

News Release

Connect with DOL at http://blog.dol.gov

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL 8:30 A.M. (Eastern) Wednesday, November 25, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending November 21, the advance figure for seasonally adjusted initial claims was 260,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 271,000 to 272,000. The 4-week moving average was 271,000, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 270,750 to 271,000.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.6 percent for the week ending November 14, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending November 14 was 2,207,000, an increase of 34,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 2,175,000 to 2,173,000. The 4-week moving average was 2,181,750, an increase of 15,250 from the previous week's revised average. The previous week's average was revised down by 500 from 2,167,000 to 2,166,500.

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending November 7 was 1,955,068, an increase of 4,202 from the previous week. There were 2,120,705 persons claiming benefits in all programs in the comparable week in 2014.