Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumGermany bows to Keynes, again

Say it quietly, but Germany has learnt the lessons of Keynes. Would that others had done so too.

https://www.socialeurope.eu/germany-bows-to-keynes-again

Thorvaldur Gylfason

The hallmark of Germany’s Wirtschaftswunder since World War II has been the unwavering pursuit of price stability, underwritten by an independent central bank—first the Bundesbank and then the European Central Bank. Control of inflation was considered paramount, an understandable priority in view of Germany’s disastrous bout of hyperinflation following the first world war. Less understandable was Germany’s postwar aversion to Keynesian stabilisation, as practised in France, Italy, the United Kingdom, the United States and elsewhere. This aversion, partly ideological, was to prove inconsequential, at least domestically. Germany’s dynamic, export-driven economy performed well by several measures—even if since 1990 its unemployment rate has fluctuated more than in France, Italy, the UK and the US, as assessed by the standard deviation. German austerity proved more consequential abroad, though, as Greece was to discover after the financial crisis of 2007-09.

Domestically, Germany managed that crisis remarkably well, experiencing a much smaller drop in output than the above four comparators. Unemployment fell gradually from 11 per cent in 2005 to 3 per cent in 2019, with only a minor uptick in 2009. How did Germany do this? Through fiscal stimulus, with encouragement from the International Monetary Fund. John Maynard Keynes had arrived in Germany. At the same time, ideological opposition to fiscal stimulus from Conservatives in the UK (as with Republicans in the US) bent on austerity wrought a much larger decline in output than on the European continent, as well as increased unemployment. They had turned their backs on Keynes.

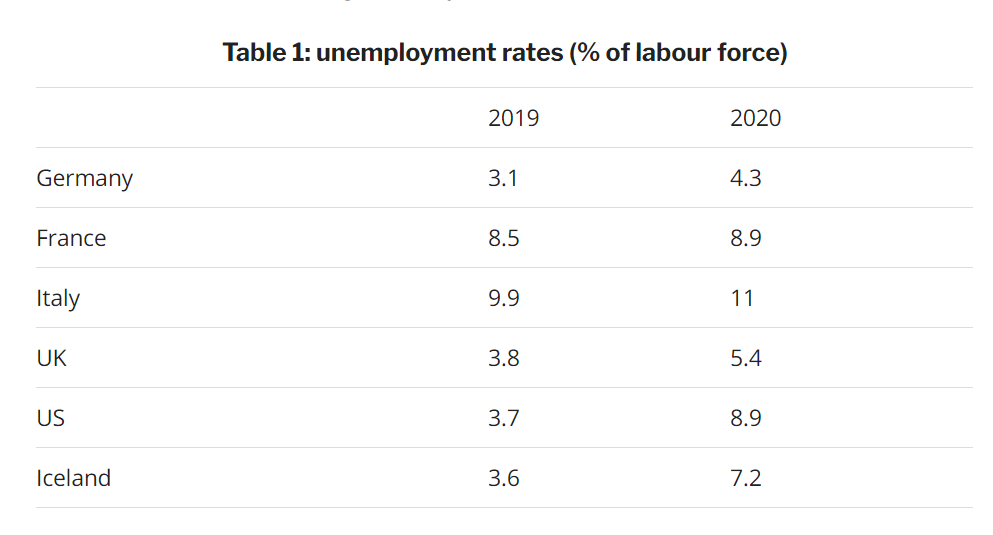

History repeating itself

History is repeating itself. With brute force, the pandemic has brought home a basic economic law: Ivan’s expenditure is Olga’s income. As incomes have collapsed, unemployment has risen (Table 1). In Germany, as well as in France and Italy, the increase in unemployment has been modest, while in the US the unemployment rate has more than doubled—doubling too in my native Iceland. How did this happen? Germany resorted again to aggressive, well-targeted fiscal stimulus—enough to keep unemployment rising by no more than one percentage point, from 3 to 4 per cent, compared with an unemployment rate of 7 per cent on average since 1990. At the beginning of the pandemic last March, the German authorities launched an ambitious rescue operation (Soforthilfe), designed to safeguard public health, jobs, firms and social cohesion. To finance the stimulus, the German government would borrow nearly €300 billion, equivalent to close to 10 per cent of German gross domestic product and €3,600 per capita. Keynes would have been impressed.

Source: IMF World Economic Outlook (October 2020)

Output, not input

This rescue operation—the most ambitious in German history—needs to be assessed not in terms of the magnitude of the fiscal and financial injection of public funds into private hands but rather in its overall economic effectiveness. The output is what matters, not the input. The monies offered by the German authorities reached the intended recipients promptly. Self-employed persons—artists, for example—and businesses with up to five employees received up to €9,000 and self-employed persons and businesses with up to ten employees received up to €15,000, to cover the first three months of the pandemic and keep impatient creditors and landlords at bay. The payments were made without time-consuming means-testing. France launched its own rescue plan, at a cost of €235 billion in fiscal outlays, augmented by nearly €330 billion in public loan guarantees. Italy’s rescue plan has thus far cost about €110 billion plus €400 billion in loan guarantees. All three countries have also benefited from a loosening of the ECB’s monetary-policy stance.

Complex cocktail.............

snip

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

3 replies, 1187 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (9)

ReplyReply to this post

3 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Germany bows to Keynes, again (Original Post)

Celerity

Jan 2021

OP

pdxflyboy

(675 posts)1. Bookmarking this.

Great article. Thank you Celerity.

Laelth

(32,017 posts)3. Excellent article. Recommended. k&r n/t

-Laelth