2016 Postmortem

Related: About this forumReport: Bernie Sanders proposes $15T in tax increases, hitting most taxpayers .

Last edited Fri Mar 4, 2016, 09:39 PM - Edit history (2)

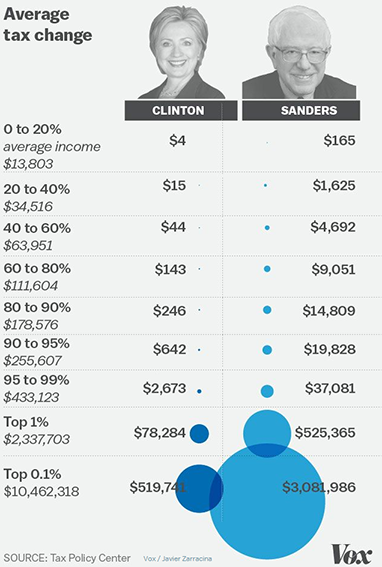

Democratic presidential candidate Bernie Sanders has proposed $15.3 trillion in tax increases, according to a new report, and would raise rates on virtually everyone, including the politically all-important middle class.

Not surprisingly for a candidate who has made income inequality his central issue, Sanders’s plan would wallop the rich, an analysis released Friday by the Tax Policy Center shows.

The top 0.1 percent would see their tax bills go up by more than $3 million, the report said, which would cut their after-tax incomes by almost half.

But Sanders, going where few politicians dare, would also raise taxes on middle- and low-income families, with those in the dead center of the income spectrum facing a $4,700 tax increase. That would reduce their after-tax incomes by 8.5 percent, the report said.

Read more: http://www.politico.com/story/2016/03/bernie-sanders-tax-increases-220267#ixzz41xbGl1Yw

ETA: The funniest part about thread responses are that BERNIE ADMITTED MIDDLE CLASS TAXES WILL GO UP. Some of you just arent hearing it though.

https://lettertosanders.wordpress.com/2016/02/17/open-letter-to-senator-sanders-and-professor-gerald-friedman-from-past-cea-chairs/

litlbilly

(2,227 posts)JaneyVee

(19,877 posts)UglyGreed

(7,661 posts)

amborin

(16,631 posts)JaneyVee

(19,877 posts)TheBlackAdder

(28,193 posts)drokhole

(1,230 posts)Not to mention the potentially enormous/endless (yet intangible) benefits and efficiencies of what a healthier, better educated, less indebted, infrastructurally reinforced country might bring (along with, you know, a planet that's actually inhabitable)...but, yeah, boo to that plan.

JaneyVee

(19,877 posts)Alfresco

(1,698 posts)jillan

(39,451 posts)JaneyVee

(19,877 posts)jillan

(39,451 posts)JaneyVee

(19,877 posts)Bernie Sanders isnt an economist.

MattSh

(3,714 posts)CoffeeCat

(24,411 posts)JaneyVee

(19,877 posts)2pooped2pop

(5,420 posts)It says you are mistaken.

JaneyVee

(19,877 posts)2pooped2pop

(5,420 posts)JaneyVee

(19,877 posts)I know it sounds vague https://en.wikipedia.org/wiki/Unit_production_manager

TM99

(8,352 posts)that you are not an economist.

You are a type of manager - you deal with budgets, resources, and scheduling. In military parlance, you are a glorified quarter master.

JaneyVee

(19,877 posts)I have 2 economic degrees and a film degree, they dont just give these jobs to "glorified quarter masters".

TM99

(8,352 posts)You pretend that you are one. But your position is highly specialized for the film industry. Your economic degrees are still about managing resources, like a quarter master, in a large production environment, in this case film projects.

You are not qualified by your job title to speak to international trade. You are not qualified to speak to federal taxation and government spending. You are not qualified beyond giving an opinion like the rest of us do, some more qualified there than others, to speak on these topics pretending you have authority when you do not.

JaneyVee

(19,877 posts)Trust me, Im overqualified.

TM99

(8,352 posts)Guess what? So am I and many others. I hold an MBA with a concentration in economics.

But you have been dishonest and suggest that you have the professional experience as well. Saying you are an economist when you are not.

I have no problem with you speaking from educational knowledge. So do I and others. But some here actually are economists. That is their day-job every month and every year. You are not one of them.

Gothmog

(145,218 posts)I trust Prof. Krugman on this http://krugman.blogs.nytimes.com/2016/01/19/weakened-at-bernies/?_r=0

On health care: leave on one side the virtual impossibility of achieving single-payer. Beyond the politics, the Sanders “plan” isn’t just lacking in detail; as Ezra Klein notes, it both promises more comprehensive coverage than Medicare or for that matter single-payer systems in other countries, and assumes huge cost savings that are at best unlikely given that kind of generosity. This lets Sanders claim that he could make it work with much lower middle-class taxes than would probably be needed in practice.

To be harsh but accurate: the Sanders health plan looks a little bit like a standard Republican tax-cut plan, which relies on fantasies about huge supply-side effects to make the numbers supposedly add up. Only a little bit: after all, this is a plan seeking to provide health care, not lavish windfalls on the rich — and single-payer really does save money, whereas there’s no evidence that tax cuts deliver growth. Still, it’s not the kind of brave truth-telling the Sanders campaign pitch might have led you to expect.

Again, as noted by Prof. Krugman this plan does not add up.

Nonhlanhla

(2,074 posts)But it is unfortunately the kind of stuff the GOP will throw up against Bernie in the GE if Bernie were the nominee, and it will be very effective, especially if coupled with the word "socialist." Hillary also has negative (I'm not one to deny that), but let's not fool ourselves into thinking that Bernie has none. This is one of them.

JaneyVee

(19,877 posts)jillan

(39,451 posts)JaneyVee

(19,877 posts)And that was an awful "debunking", America has 330 million people. Denmark has 8 million.

jillan

(39,451 posts)The rest of the tax increases are on wall street speculation - same thing Hillary proposes.

Closing tax loopholes - also proposed by Hillary.

Here is a simple chart to make it simple for you.

Obviously whoever wrote this has no clue on Bernie's plans to pay for everything he proposes, which is pathetic because it is all at BernieSanders.com

JaneyVee

(19,877 posts)Which has been thoroughly debunked here: https://lettertosanders.wordpress.com/2016/02/17/open-letter-to-senator-sanders-and-professor-gerald-friedman-from-past-cea-chairs/

jillan

(39,451 posts)tore apart that op-ed.

![]()

dana_b

(11,546 posts)to smear Bernie's plans and promote - what - more of the SAME from Hillary. More of what is NOT working for the majority of us. We don't want the status quo anymore. We want the actual change that we were sold years ago but that still hasn't happened. I'll admit that Obama at least tried to do SOME good but we need much, much more now.

oasis

(49,383 posts)Armstead

(47,803 posts)oasis

(49,383 posts)Armstead

(47,803 posts)What I like about Sanders campaign, win or lose, is that crucial issues and good Liberal ideas are being brought out into the fresh air again after being AWOL from the Democratic Party and the overall public discourse since Reagan (and the Clintons) .

At the very least it may pave the way for these in the future (hopefully near future)

oasis

(49,383 posts)Hillary, I believe, will serve her country and party well during her first term. However, I do see the possibility of a challenge to her second term by an emerging progressive.

scscholar

(2,902 posts)The people all support those things, and those things are all paid for by the people that have more than they need.

dana_b

(11,546 posts)It's not. It doesn't discuss the savings that the middle class family will get with Medicare for all. See post #22

It seems like this article is another "vote for Hillary" ad - more than an actual article.

Gore1FL

(21,132 posts)Just like we had when the country was an economic powerhouse and we were doing great things.

EndElectoral

(4,213 posts)JaneyVee

(19,877 posts)jillan

(39,451 posts)Maybe you should look at it.

Vinca

(50,270 posts)I'm now on Medicare, but the cost for health insurance when I was 65 was in excess of $8,000 a year (and that was Obamacare - before that it was $12,000). If I had a choice between paying $4,700 in taxes or $8,000 for an insurance policy, I'd giddily pay the taxes. The side benefit is the person preparing my food at a restaurant will also have health coverage and I don't have to worry that he or she can't seek treatment for hepatitis, the flu, TB or a myriad of other communicable diseases.

jillan

(39,451 posts)medical issues. Everytime I want to take her to a new specialist, I have to get a referral from her doctor so her insurance company will cover it. It takes weeks. In the meantime, I have to make several trips with her to urgent care.

It's insane because it ends up costing the insurance companies more money in the long run.

I wanted single payer as part of the ACA. But the ACA is better than nothing, outrageous deductibles and all.

dirtydickcheney

(242 posts)I will now have to pay the gov't an extra $1,000 a year vs. the $5,000 I now pay to the health-insurance company!

If the US Taxpayers pay an extra $15 Trillion (assuming that's a correct figure) what would the corresponding amount be if we get the same services he's planning on giving us but instead give it to a private (for-profit) enterprise?

What? $30 Trillion? Because I know they aren't 2x as efficient as the gov't as judged by the 401k fees....

HooptieWagon

(17,064 posts)Hillarians are like Wile E Coyote.

![]()

yodermon

(6,143 posts)JaneyVee

(19,877 posts)NurseJackie

(42,862 posts)msanthrope

(37,549 posts)NurseJackie

(42,862 posts)On the plus-side: Bernie WILL BE defeated in the primaries.

![]() Go, Hillary! We love you!

Go, Hillary! We love you! ![]()

msanthrope

(37,549 posts)DefenseLawyer

(11,101 posts)Everyone pays more taxes and then Bernie and his cronies are going to set that big pile of cash on fire and roast marshmallows. Taxes are for suckers! Don't they know that we should be drowning the government in the bathtub? That it's our money and not the government's and hard working families know best how to spend their hard earned cash? Ronald Reagan told us many times that CUTTING taxes raises revenue. Apparently some of Sanders' pie in the sky followers just don't understand that.

p.s. This is ![]()

CoffeeCat

(24,411 posts)They throw up their accusations, and all it takes is a few DUers with the truth to completely obliterate their

talking points.

What a joke.

Sander's healthcare proposal will raise our family's annual tax bill $167. I'd complain about that, but wait--we won't be paying $500 for health insurance every month.

JaneyVee

(19,877 posts)redstateblues

(10,565 posts)Walter Mondale- He won exactly ONE state. His home state MN

dana_b

(11,546 posts)and how did all of those Reagan policies work out for us?? People are willing to try it the Democratic Socialist's way. We HAVE to do it differently because THIS is not working for the majority of people.

redstateblues

(10,565 posts)on the middle class. It's foolish

Fast Walker 52

(7,723 posts)Because single payer healthcare is an off-setter that gives those taxes a lot less of a bite and actually ends up being a net saver.

Lans

(66 posts)[img] [/img]

[/img]

I don't mind paying a bit extra to be sure that even unemployed I'd be covered.

http://www.vox.com/2016/3/4/11161616/bernie-sanders-tax-policy-center

raging moderate

(4,305 posts)This ploy was once used to fight against government-regulated health insurance, back when Hillary Clinton was trying to get Congress to enact it, in the nineties. Please do not dishonor her efforts back then by using it in this context. When you fight a monster, you must take care that you do not become the monster.

Response to JaneyVee (Original post)

Name removed Message auto-removed

JaneyVee

(19,877 posts)vdogg

(1,384 posts)Last edited Sat Mar 5, 2016, 07:38 AM - Edit history (1)

1%, go for it. Even a marginal increase on the upper middle would be ok. Middle and lower, you'll lose 49 states. It doesn't matter how much you tell them they'll get for this increase, even if it's small, nobody middle class and under will accept that.

JaneyVee

(19,877 posts)Tax the damn rich instead.

redstateblues

(10,565 posts)Gothmog

(145,218 posts)pdsimdars

(6,007 posts)No BS is too far, no disinformation is too low.

We really need to cleanse the system. . . isn't there a political laxative so we can flush all this sh*t out of the system?

thesquanderer

(11,986 posts)I have a feeling that did not allow for the fact that they would no longer be making mandatory private health insurance payments. That would reduce (or could even possibly eliminate) their reduction in after-tax income... in some case, people will actually come out ahead. A more comprehensive view is required.

JaneyVee

(19,877 posts)The ones who dont probably get Medicaid.

thesquanderer

(11,986 posts)BTW, your 90% figure is way, way off. It's 49%. Where did you get 90% from?

JaneyVee

(19,877 posts)Kittycat

(10,493 posts)Deductibles, copays and exclusions. We cap our plan every year. This year we calculated that it would save us to switch to a high deductible HSA. We hit the high deductible on Feb 4th, all pharmaceutical except 2 Dr visits. So yes, I'm happy to pay more in taxes and less in health insurance.

PaulaFarrell

(1,236 posts)around 11% of people are uninsured. Around 20% of people who do have insurance pat for it fully themselves. only 43% have employer insurance.

http://www.gallup.com/poll/186047/uninsured-rate-third-quarter.aspx

Jitter65

(3,089 posts)If you don't go to college because you don't want to or because you have to work to support your parents etc., you miss out!

If you already get subsidized health insurance and pay virtually nothing because you are poor or near poor, you miss out!

And the people in the middle class who are helping family members still get hit with the tax increase although that money may very well have gone to that help.

Just the sound of this tax burden, no matter what might happen to the projected economy will drive people to the GOP. And if we withdraw from the international economy while this is going on, the US consumer will be taking triple whammy. Nothing happens in a vacuum. And the economists who have supported this plan are doing so ASSUMING a 5% growth rate that absolutely will not happen if we foul up our moves on trade.

PaulaFarrell

(1,236 posts)in so many ways.

oh, i was going to try to respond to this post but it hurts my brain...

Nanjeanne

(4,960 posts)Notice I said "pretending" because I refuse to believe that real honest to goodness Democrats really do stand beside Republican talking points.

So - why do people have a problem with paying taxes? As Biden once said "it's patriotic to pay taxes". And Republicans laughed. Now, sadly, Democrats do too. Why do Democrats of today use the Republican fear mongering about taxes? OH NO. TAXES ARE GOING TO BE RAISED!!!! We can't have that.

But where is the Democrats outrage that their taxes RIGHT NOW are going to support the Walton family? To subsidize profitable health insurance companies. To subsidize profitable fossil fuel companies. To subsidize companies that keep their profits overseas?

*crickets*

BUT - paying a little bit more in taxes and receiving healthCARE (yes you heard me - CARE, not INSURANCE). Joining the rest of the world and having PAID FAMILY LEAVE. Yes that's right - PAID FAMILY LEAVE - for maternity leave, or an aging parent--something perfectly normal and acceptable in other countries. PUBLIC COLLEGE tuition free. Yes it can be done. It's being done in dozens of countries very successfully. In fact Americans are going to colleges in foreign countries without paying tuition - or in some cases, paying extremely low tuitions. But for some reason, Democrats think this is horrible and we shouldn't be able to do this here in our own country.

This OP is exactly why I no longer want to be associated with the Democratic Party. I haven't a clue what they stand for but until those who claim to be Democrats stop using Republican language and fear tactics to mislead people into thinking paying a little more for taxes but getting healthcare for everyone including the 12 million currently without, tuition free college, family paid leave, Social Security expansion and security and more is HORRIFYING -- I will continue to be one of those Democrats working very very very hard to change the Party from one of Corporatism to something that really reflects the needs of the American people.

Kittycat

(10,493 posts)This kind of talk would have been insane here 8-10 years ago. It's really disheartening. Thank you for sharing.

pdsimdars

(6,007 posts)Probably something like this is what this is based on. Bernie is the only candidate who has put out specific proposals and also told how he will fund them. If you look closely, these are mostly taken from the rich and corporations. All things that most of us agree on.

Taxing corporate off shore income, Wall Street speculation tax, etc. look down the list. Most people will be paying less, saving anywhere from $2500 to $5000.

Here are the facts.

Look it over and see if the OP reflects the reality or is merely just deceptive to perpetuate a lie.

Doctor_J

(36,392 posts)Count me in.

What do you have against the filthy rich paying taxes like the rest of us? Why do you post limpballs talking points? Are hillarians actually republicans?

Svafa

(594 posts)Unlike many, I get very good health insurance from my employer, so for me personally, the increased taxes won't be offset by health insurance savings. I am finished with school and have no debts. However, I still support Sanders' plan. I recognize that most people will benefit from his proposals. I want to live in a world where everyone has access to affordable health care and education.

fredamae

(4,458 posts)Dollar investment-to make Sure you, me and everybody else has good services, clean water, air, safe infrastructure etc, etc, etc...I. AM. All. In.

Aren't you?

Yo_Mama_Been_Loggin

(107,972 posts)Back in 1984. He lost pretty badly.

UglyGreed

(7,661 posts)