Demeter

Demeter's JournalMove to Amendís proposed 28th Amendment: WE THE PEOPLE AMENDMENT

House Joint Resolution 48 introduced April 29, 2015

Section 1. (Artificial Entities Such as Corporations Do Not Have Constitutional Rights)

The rights protected by the Constitution of the United States are the rights of natural persons only.

Artificial entities established by the laws of any State, the United States, or any foreign state shall have no rights under this Constitution and are subject to regulation by the People, through Federal, State, or local law.

The privileges of artificial entities shall be determined by the People, through Federal, State, or local law, and shall not be construed to be inherent or inalienable.

Section 2. (Money is Not Free Speech)

Federal, State, and local government shall regulate, limit, or prohibit contributions and expenditures, including a candidate’s own contributions and expenditures, to ensure that all citizens, regardless of their economic status, have access to the political process, and that no person gains, as a result of their money, substantially more access or ability to influence in any way the election of any candidate for public office or any ballot measure.

Federal, State, and local government shall require that any permissible contributions and expenditures be publicly disclosed.

The judiciary shall not construe the spending of money to influence elections to be speech under the First Amendment.

*****

Initial Co-Sponsors are: Rick Nolan (MN), Mark Pocan (WI), Matthew Cartwright (PA), Jared Huffman (CA), Raul Grijalva (AZ), Keith Ellison (MN).

Here’s a press release with more details:

https://movetoamend.org/press-release/release-we-people-amendment-introduced-114th-congress-today

Trapped in a Bubble By Golem XIV

http://www.golemxiv.co.uk/2015/06/trapped-bubble/I think our ruling and wealthy elite are worried that they are stuck in their own ponzi scheme or bubble and are suffering from the general problem of all ponzis and bubbles – how to get out. You see, bubbles and Ponzi’s are fine as long as they keep going. As long as there are ever more suckers to recruit and as long as enough of those already in remain confident and choose to stay in, there is no real reason a ponzi cannot go on and on. A perfect example is Madoff’s scheme. The weakness of all bubbles, ponzi or otherwise, is that all it takes is a rumour that it might be time to get out, that it might soon get difficult to get out, or that someone ‘in the know’ wants out, and a ponzi scheme pops like a soap bubble. They are notoriously unstable.

So, if you are in one how do you get out?

I think this question is worrying our wealthy Over Class because stock markets around the world are over-valued and its their wealth which is most tied up in the markets. I think some of them are now rather worried that they have built themselves a luxury tower of paper wealth from which, when it catches fire, they will not all escape. I think they are right.

So, first, are the markets a bubble or ponzi?

Well if we look at the real economies of the West and then at the stock markets, the later have the look of a ponzi. I’m certainly not alone in thinking this. In Europe, the U.S. and Japan, over the last 6 years, in what we might call the ‘real economy’ of people making things, earning money and spending it to buy things other people have made, we have had either anaemic growth, no growth or outright contraction. And yet all the time the stock markets have roared ever higher.

On the ‘real’ side of things lets look at Caterpillar (CAT), the american heavy construction equipment manufacturer. It is often seen as a bellwether. CAT, as recently reported over at ZeroHedge, is now in its 28th consecutive month of declining sales.

And yet its share price is $86 not far off its record highs, up from a low of $23 to which it fell in March 2009. $86 or thereabouts ever since 2010 despite 28 months of declining sales.

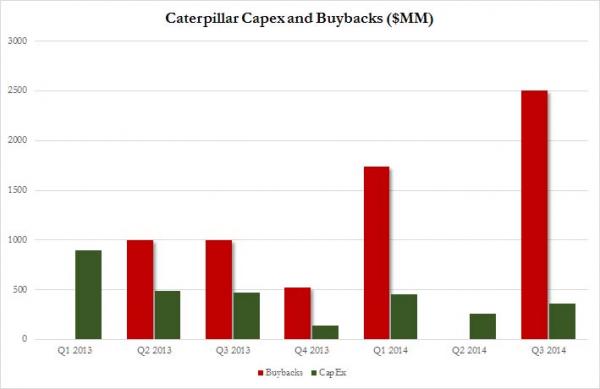

Is this supply and demand? I think not. Part of an explanation for this levitating share price is, as the ZeroHedge article points out, that the corporation has been buying back its own shares.

CAT had been using more and more of its cash (the red bar) to buy back its own shares inflating the apparent demand for them and therefore their price. It’s not illegal, but what does it do for the idea that share price indicates what a company is worth? And where was CAT getting the money with which to buy those shares? I doubt it was from profits given the long cumulative decline in sales. More likely it was from selling bonds i.e. using borrowed money. And indeed that seems to be the case. In May of 2014 CAT sold $2 billion of debt some of it dated as long as 50 years. So let’s take a look at what we have. In May of 2014, despite having already suffered a year of declining sales, CAT shares were the second best performing shares on the Dow Jones. Who was so keen to buy all their shares? Who knows. But CAT itself had just spent 175 million in buying their own shares in the first quarter (when it was the second best performing share on the DOW) and in the last quarter of the year went on to buy another 250 million dollars worth. In fact, and perhaps most critically, in January the CAT board had authorized $12 billion for buy-back. So the market knows that a lot of shares were going to be bought up…by CAT. And not at bargain basement price either. Take a look at the record of their share price above and you’ll see that the board had authorized using borrowed money to buy their shares at around the highest price they had ever been. Hmm. Did buying all those shares encourage others to do likewise, especially knowing that CAT had a war chest of $12 billion earmarked for buying shares? Any ‘investor’ would know there was a buyer in the market who would be ready and willing to buy them back from him. The upshot would be a guaranteed buoyant market in CAT shares at a time when without such a buoyant demand a year of declining sales might just possibly have led to a steep decline in share price....

...If you can’t get out and you are afraid there are not enough new buyers to keep your ponzi/bubble going what do you do? I think the answer is you and your friends do the buying yourself. If you and your friends are big enough players with enough to lose that defecting is really dangerous, then you actually have a workable incentive to keep playing. You buy the shares I sell and I buy yours (It doesn’t just have to be just buy-backs as per the CAT example). And I think this is what has been happening. Of course it only works of you are able, as a group, to have a really serious effect on the over all market. But if you think of the top 10% they certainly have that. I buy your shares and pay you your asking price. You do the same for me. Tomorrow we do it again and each time we ramp the price a little. The limiting factor, of course, is that we will not have enough money to buy all the shares as their price goes up and up. But that little problem can be easily solved if we have a friendly banker who will accept our shares as collateral for a loan. If our banker will extend us a loan and increase that loan periodically in line with the increase in value of the shares then all is good. Because the bank can just magic new money in to existence.

And if anyone get a creeping feeling that the banks are getting stretched a little thin or their margins – the interest they charge us for our loans above what they pay for borrowing – are too small for their comfort, then we all just tell the central bank that some new very low interest money is needed to juice the whole system. And since most of them are former us (bankers and financiers) they will understand. Plus they don’t want a systemic crash. It’s bad for their reputation and their personal wealth...The point, however, is that there is an air of conspiracy about it. The companies (which includes financial ones) are playing around on the border between creative accountancy and fraudulent misrepresentation and the analysts and auditors are not correcting them. Much as we saw in the figures for all the banks in the run up to the crash. All of the big 4 accountancy firms were signing off on the robust financial health of banks sometimes mere weeks before said bank then collapsed. All of the big 4 auditors subsequently found themselves in court. So to suggest that companies, analysts and auditors might be not just allowing and enabling dangerous misrepresentations but even endorsing them is not really conspiracy theory, more painful experience.

BUT WAIT! THERE'S MORE! AND IT'S WORSE! SEE LINK

The tyranny of the friendless Michael O. Church

https://michaelochurch.wordpress.com/2015/04/27/the-tyranny-of-the-friendless/... I’ve recently come to the realization that organizational decay is typically dominated by a single factor that is easy to understand, being so core to human sociology. While it’s associated with large companies, it can set in when they’re small. It’s a consequence of in-group exclusivity. Almost all organizations function as oligarchies, some with formal in-crowds (government officials or titled managers) and some without. If this in-crowd develops a conscious desire to exclude others, it will select and promote people who are likely to retain and even guard its boundaries. Only a certain type of person is likely to do this: friendless people. Those who dislike, and are disliked by, the out-crowd are unlikely to let anyone else in. They’re non-sticky: they come with a promise of “You get just me”, and that makes them very attractive candidates for admission into the elite. Non-stickiness is seen as desirable from above– no one wants to invite the guy who’ll invite his whole entourage– but, in the business world, it’s negatively correlated with pretty much any human attribute that could be considered a virtue. People who are good at their jobs are more likely to be well-liked and engaged and form convivial bonds. People who are socially adept tend to have friends at high levels and low. People who care a lot about social justice are likely to champion the poor and unpopular. A virtuous person is more likely to be connected laterally and from “below”. That shouldn’t count against a person, but for an exclusive club that wants to stay exclusive, it does. What if he brings his friends in, and changes the nature of the group? What if his conscience compels him to spill in-group secrets? For this reason, the non-sticky and unattached are better candidates for admission. The value that executive suites place on non-stickiness is one of many possible explanations for managerial mediocrity as it creeps into an organization. Before addressing why I think my theory is right, I need to analyze three of the others, all styled as “The $NAME Principle”.

The “Peter Principle” is the claim that people are promoted up to their first level of incompetence, and stay there. It’s an attractive notion, insofar as most people have seen it in action. There are terminal middle managers who don’t seem like they’ll ever gain another step, but who play politics just well enough not to get fired. (It sucks to be beneath one. He’ll sacrifice you to protect his position.) That said, I find the Peter Principle, in general, to be mostly false because of its implicit belief in corporate meritocracy. What is most incorrect about it is the belief that upper-level jobs are harder or more demanding than those in the middle. In fact, there’s an effort thermocline in almost every organization. Above the effort thermocline, which is usually the de facto delineation between mere management roles and executive positions, jobs get easier and less accountable with increasing rank. If the one-tick-late-but-like-clockwork Peter Principle were the sole limiting factor on advancement, you’d expect that those who pass the the thermocline would all become CEOs, and that’s clearly not the case. While merit and hard work are required less and less with increasing rank, political resistance amplifies just because there are so few of the top jobs that there’s bound to be competition. Additionally, even below the effort thermocline there are people employed below their maximum level of competence because of political resistance. The Peter Principle is too vested in the idea of corporate meritocracy to be accurate.

Scott Adams has proposed an alternative theory of low-merit promotion: the Dilbert Principle. According to it, managers are often incompetent line workers who were promoted “out of harm’s way”. I won’t deny that it exists in some organizations, although it usually isn’t applied within critical divisions of the company. When incompetents are knowingly promoted, it’s usually a dead-end pseudo-promotion that comes with a small pay raise and a title bump, but lateral movement into unimportant work. That said, its purpose isn’t just to limit damage, but to make the person more likely to leave. If someone’s not bad enough to fire but not especially good, gilding his CV with a fancy title might invite him to (euphemism?) succeed elsewhere… or, perhaps, not-succeed elsewhere but be someone else’s problem. All of that said, this kind of move is pretty rare. Incompetent people who are politically successful are not known to be incompetent, because politics-of-performance outweighs actual performance ten-to-one in terms of making reputations, and those who have a reputation for incompetence are those who failed politically, and they don’t get exit promotions. They just get fired. The general idea that people are made managers to limit their damage potential is false because the decision to issue such promotions is one that would, by necessity, be made by other managers. As a tribe, managers have far too much pride to ever think the thought, “he’s incompetent, we must make him one of us”. Dilbert-style promotions occasionally occur and incompetents definitely get promoted, but the intentional promotion of incompetents into important roles is extremely rare.

Finally, there’s the Gervais Principle, developed by Venkatesh Rao, which asserts that organizations respond both to performance and talent, but sometimes in surprising ways. Low-talent high-performers (“eager beavers” or “Clueless”) get middle management roles where they carry the banner for their superiors, and high-talent low-performers (“Sociopaths”) either get groomed for upper-management or get fired. High-talent high-performers aren’t really addressed by the theory, and there’s a sound reason why. In this case, the talent that matters most is strategy: not working hard necessarily, but knowing what is worth working on. High talent people will, therefore, work very hard when given tasks appropriate to their career goals and desired trajectory in the company, but their default mode will be to slack on the unimportant make-work. So a high-talent person who is not being tapped for leadership will almost certainly be a low performer: at least, on the assigned make work that is given to those not on a career fast track...The Gervais/MacLeod model gives the most complete assessment of organizational functioning, but it’s not without its faults. Intended as satire, the MacLeod cartoon gave unflattering names to each tier (“Losers” at the bottom, “Clueless” in middle-management, and “Sociopaths” at the top). It also seems to be a static assertion, while the dynamic behaviors are far more interesting. How do “Sociopaths” get to the top, since they obviously don’t start there? When “Clueless” become clued-in, where do they go? What do each of these people really want? For how long do “Losers” tolerate losing? (Are they even losing?) Oh, and– most importantly for those of us who are studying to become more like the MacLeod Sociopaths (who aren’t actually sociopathic per se, but risk-tolerant, motivated, and insubordinate)– what determines which ones are groomed for leadership and which ones are fired? If there’s an issue with the Gervais Principle, it’s that it asserts too much intelligence and intent within an organization. No executive ever says, “that kid looks like a Sociopath; let’s train him to be one of us.” The Gervais model describes the stable state of an organization in advanced decline, but doesn’t (in my opinion) give full insight into why things happen in the way that they do.

So I’m going to offer a fourth model of creeping managerial mediocrity...

GO READ ABOUT IT AT THE LINK!

4 Ways the One Percent Is Trying to Buy Their Immortality By Larry Schwartz / AlterNet

http://www.alternet.org/personal-health/4-ways-one-percent-trying-buy-their-immortality?akid=13210.227380.yLknXU&rd=1&src=newsletter1037764&t=2Tech oligarchs are deathly serious about buying off the grim reaper...Humankind has long dreamed of immortality. Surely, somewhere, Ponce de Leon’s Fountain of Youth awaits, allowing us to escape our inevitable fate of non-existence. Not surprisingly, some very wealthy tech executives are determined to buy their way out of that inevitability. These guys are living the high life and they don’t want it to stop.

The ethics behind the search for immortality are dicey, to say the least. “There will be breakthroughs in the next 15 or 20 years that will have to do with aging itself—actually stopping the biological clock,” Dychtwald told Time. “And I think that really rich people are going to get access to it… Imagine a time when ten thousand really rich people get to live forever, or not have to get dementia.” Here are four prominent proposed pathways to immortality whose research is being supported by the modern tech oligarchy.

1. Avatars and artificial brains. Russian scientist Dmitry Itskov, 31, believes that immortality can be achieved by the year 2045. On his website, 2045.com, Itsky solicits money from the wealthy and in return promises the end of death within 30 years. He states the goal is, “to create technologies enabling the transfer of a individual’s personality to a more advanced non-biological carrier, and extending life, including to the point of immortality.” His plan involves four steps. First, the development of a robot or “avatar” that is linked to our present selves by way of a computer chip. This is to be achieved by 2020. Following this, the human brain will be transplanted into the avatar. The target date for this achievement is 2025. By the year 2035, human consciousness will be transferred or downloaded into an artificial brain within the avatar, replacing the biological brain. And finally, by 2045, consciousness will evolve into a sort of Internet of global consciousness, with no need for a physical presence at all. Robots that have developed their own artificial intelligence will carry out necessary physical tasks. Humanity will have transformed into something else entirely...If it sounds farfetched, that’s because it is. But the world’s tech sector has bought into the idea that humanity’s knowledge, because of the technology they have developed, will continue to grow exponentially, and what we know now will be dwarfed by what we know in five or 10 or 30 years.

2. Ending death by disease. Brian Singerman, a venture capitalist and partner in the Founders Fund, and his partners, including Peter Thiel and Sean Parker, are placing their faith and their wallets in the hands of biotech companies that are busily studying ways to cheat death. These companies are looking for ways to cure cancer and end the scourge of aging. Says Singerman in Inc. Magazine: "We have a company that's charged with curing all viral disease, we have a company that's charged with curing several types of cancer. These are not things that are incremental approaches. It's all fine and good to have a drug that extends life by a certain amount of months or makes living with a disease easier. That's not what we're looking for. We are not looking for incremental change. We are looking for absolute cures in anything we do." Singerman believes that within 10 years all viral disease will be curable, and within that same time frame we will have a clearer understanding of what aging is, what causes it, and how to begin to stop it.

3. Genetic tinkering. Human beings are not roundworms. But breakthroughs in human life extension might have started with the lowly roundworm. In 2001, scientists burrowed down to the cellular level and added an extra gene (known as SIR2) to the roundworm. Normally, the roundworm’s lifespan is about two weeks. The roundworms with the extra gene lived for three weeks. This result mimicked the results obtained with calorie restriction, another way scientists have prolonged life in test animals. That may not sound like much, but if scientists manage to add a comparable increase to the normal human lifespan, we’d all live a third longer life. And that’s just the beginning. Ultimately, there are scientists who believe we can genetically turn off the aging process altogether.

4. Cryogenics. No, Walt Disney is not frozen in some secret vault, waiting for the day when he can lead his Mickey Mouse empire again. But Ted Williams, baseball legend, is. Called cryogenics, the theory is they freeze your body (or, if you are feeling a bit short of change, since the process can cost up to $200,000, just your head), wait until science discovers a cure for what killed you, and then thaw the body out, revive and cure you. Critics of this method point out that at our current level of technology, by freezing the body, we are damaging the cells beyond repair. Imagine, for instance, a bag of frozen strawberries. Once defrosted, the formerly plump firm fruit is now soft and mushy. That is pretty much how the defrosted body would turn out...But true believers dissent. Alcor, a leading cryogenics firm (and one of the recipients of Peter Thiel’s largesse), states on its website, “We believe medical technology will advance further in coming decades than it has in the past several centuries, enabling it to heal damage at the cellular and molecular levels and to restore full physical and mental health.”

Larry Schwartz is a Brooklyn-based freelance writer with a focus on health, science and American history.

Has the U.S. Learned Anything From Edward Snowden's NSA Revelations?

http://www.alternet.org/news-amp-politics/has-us-learned-anything-edward-snowdens-nsa-revelations?akid=13210.227380.yLknXU&rd=1&src=newsletter1037764&t=16...On the second anniversary of Snowden's historic act of civil disobedience, it is worth reviewing what has changed -- and what has not.

On the change side of the ledger, there is the politics of surveillance. For much of the early 2000s, politicians of both parties competed with one another to show who would be a bigger booster of the NSA's operations, fearing that any focus on civil liberties risked their being branded soft on terrorism. Since Snowden, though, the political paradigm has dramatically shifted.

The most illustrative proof that came last month, when the U.S. Senate failed to muster enough votes to reauthorize the law that aims to allow the NSA to engage in mass surveillance. Kentucky Republican Sen. Rand Paul's prominent role in that episode underscored the political shift -- a decade after the GOP mastered the art of citing 9/11-themed arguments about terrorism to win elections, one of the party's top presidential candidates proudly led the fight against one of the key legislative initiatives of the so-called war on terror.

There has also been a shift in public opinion, as evidenced by a new ACLU-sponsored poll showing that almost two thirds of American voters want Congress to curtail the NSA's mass surveillance powers. The survey showed that majorities in both parties oppose renewing the old Patriot Act.

Monumental as those congressional and public opinion shifts are, though, far fewer changes are evident in the government's executive branch...

BECAUSE THE SEAT OF OUR GOVERNMENT IS ON THE BANKS OF DE NIAL......

David Sirota is the author of the books "Hostile Takeover," "The Uprising" and "Back to Our Future." Email him at ds@davidsirota.com, follow him on Twitter @davidsirota or visit his website at www.davidsirota.com.

Abolish Secretive Special Ops Forces By Sheldon Richman

http://sheldonfreeassociation.blogspot.com/2015/06/abolish-special-ops-forces.htmlIt’s time to disband the Navy’s SEAL Team 6 and all other secretive, unaccountable units of the U.S. imperial military. As is said about lawyers, if we didn’t have these units, we wouldn’t need them. The New York Times reported recently:

Team 6 has successfully carried out thousands of dangerous raids that military leaders credit with weakening militant networks, but its activities have also spurred recurring concerns about excessive killing and civilian deaths.

Afghan villagers and a British commander accused SEALs of indiscriminately killing men in one hamlet; in 2009, team members joined C.I.A. and Afghan paramilitary forces in a raid that left a group of youths dead and inflamed tensions between Afghan and NATO officials. Even an American hostage freed in a dramatic rescue has questioned why the SEALs killed all his captors.

We are expected to trust the government that those operations kill bad guys only. But why should we, when it has done so much to earn our distrust? It has long downplayed the civilian deaths inflicted by drones, bombers, and ground operations. The Times writes:

Even the military’s civilian overseers do not regularly examine the unit’s operations. "This is an area where Congress notoriously doesn’t want to know too much," said Harold Koh, the State Department’s former top legal adviser, who provided guidance to the Obama administration on clandestine war.

Here we have a super-secretive unit of killers that is protected from accountability by its own.

William C. Banks, a Syracuse University expert on national-security law, told the Times, "If you’re unacknowledged on the battlefield, you’re not accountable." Members of Congress pretend to keep an eye on the military to prevent criminal behavior—but in fact they are integral to the corrupt system: with eyes turned away, they keep it going with large sums of money. "Waves of money have sluiced through SEAL Team 6 since 2001," the Times writes, "allowing it to significantly expand its ranks—reaching roughly 300 assault troops, called operators, and 1,500 support personnel—to meet new demands." And this is just one unit—though it is the most glamorized, having conducted the raid that reportedly killed Osama bin Laden in Abbottabad, Pakistan, in 2011...The Times quotes James G. Stavridis, retired admiral and former NATO Supreme Allied Commander, who said, "If you want these forces to do things that occasionally bend the rules of international law, you certainly don’t want that out in public." By "bend the rules," Stavridis means, in the Times’ words, "going into undeclared war zones."

So politicians need secretive military units to fight undeclared wars—which would seem to violate the Constitution. The existence of secretive military units conducting private lethal operations should bother anyone who aspires to live in a free society. Their very nature offends common decency. Yet a propagandized population takes for granted that secrecy is legitimate and necessary for our safety in a terrorism-plagued world. Beyond the obvious objections to secretive military units, there is also this: U.S. intervention in the Muslim world makes people want to kill Americans, as government officials widely acknowledge. Secretive military units allow the national-security elite to engage in actions that provoke violence against Americans confident that Team 6 and the Army’s Delta Force will neutralize any retaliatory threat. For our own safety, we must disband these squads of killers.

STOP THE BLOWBACK BY CUTTING OUT THE BLOW AND THE BLOWS....

Why the Super-Rich Pay Taxes on a Much Tinier Fraction of Their Income Than You Do

http://www.alternet.org/economy/why-super-rich-pay-taxes-much-tinier-fraction-their-income-you-do?akid=13188.227380.yWEHz7&rd=1&src=newsletter1037542&t=2Why don't the rich pay their fair share in taxes?

TODAY'S MUST READ AND SPREAD TO FRIENDS AND FAMILY---A RIGHTEOUS SCREED AND RALLYING CRY---BERNIE'S CAMPAIGN PLATFORM AND THE ONLY POSSIBLE SALVATION THAT COULD SAVE THE NATION.

Weekend Economists Watch the Stars Falling June 12-14, 2015

This is a year of losses great and small. I suppose all years are years of loss, but these are especially poignant losses for a lot of people.

First, there is our personal loss in this little band of economic newshounds:

Our popular, star member Xchrom has been located at last.

The card that I sent was forwarded to his cousin in California and she called me. He passed on May 1st, and was buried in California where he is from. He has a few cousins in Cali and some in Iowa. His mom is still alive and is 105 yrs. young. She said he had tons of character and lots of friends in Durham North Carolina where he lived till he passed. He was 61."

Rest in peace, dear friend.

There have been some losses on the big screen:

Actor Ron Moody, who played Fagin in the hit film version of Oliver!, has died aged 91, his family says. The British character actor was nominated for an Oscar and won a Golden Globe for his performance in the 1968 Charles Dickens adaptation.

He appeared in EastEnders as Edwin Caldecott, an old nemesis of Jim Branning, and played wizard Merlin in Disney's A Kid in King Arthur's Court...Moody was born Ronald Moodnick in Tottenham, north London, on 8 January 1924, the son of Jewish immigrants. His father anglicised the family name to Moody several years later. He had originally planned to be an economist and did not take up acting seriously until his late 20s. His big break came in the 1960s when he was given the part of Fagin, the leader of a band of juvenile rogues and pickpockets, in Oliver!, the musical version of Dickens's Oliver Twist.

"Fate destined me to play Fagin. It was the part of a lifetime," he said.

http://www.bbc.com/news/entertainment-arts-33094914

And then, there was Sir Christopher Lee, the thinking man's monster:

If Sir Christopher Lee had just been a movie star, he would still have been an icon. But the late actor, who passed away last week, had an amazing life even beyond his incredible body of work. Whether you’re still lamenting his passing or unsure why his death is such a loss, here’s 22 reasons why Christopher Lee will always be a legend.

1) He was entered into the Guinness Book of World Records in 2007 for most screen credits, having appeared in 244 film and TV movies by that point in his career— at which point he made 14 more movies, with a 15th due later this year (titled Angels in Notting Hill). He also holds the record for the tallest leading actor — he stood 6’ 5” — but also for starring in the “most films with a sword fight” with 17.

2) He mother was an Italian contessa, and through her Lee descended from the Emperor Charlemagne of the Holy Roman Empire and was related to Robert E. Lee, the Confederate general.

3) He met Prince Yusupov and Grand Duke Dmitri Pavlovich, the assassins of the Russian monk Rasputin. He didn’t do this as research for his later film role as Rasputin (in the 1966 Hammer film Rasputin the Mad Monk), but just as a child in the 1920s....MORE

And I expect we are still grieving the loss of this man, who played the ultimate outsider:

LOCAL CURRENCY: The innovators: the Bristol pound is giving sterling a run for its money

TRY IT HERE, AND THE TREASURY DEPT. WILL PUT THE SECRET SERVICE ON YOUR BACK SO FAST...

http://www.theguardian.com/business/2015/jun/07/the-innovators-the-bristol-pound-is-giving-sterling-a-run-for-its-money

The success of the community currency – with the equivalent of £700,000 in circulation – has put the spotlight on attempts to keep money in local economies...When his firm was going up against national companies for contracts to manage waste, Jon Free needed an edge to win the pitches. The answer he found was in the sense of community that existed among small businesses like his.

By using his local currency, the Bristol pound, he saw companies were more willing to give their business to him and keep money flowing in the area. Launched almost three years ago, the community currency aims to keep money circulating among independent retailers and firms by encouraging people to use the local ‘cash’ instead of sterling, an idea that has inspired other towns and cities to take up similar schemes in the UK and abroad.

“To be able to drop in and create a link to make the money a circular thing is a big part of it,” the managing director of Waste Source said. “To say that we are registered with the Bristol pound shows that we are more community based.”

In use since 2012, the system operates as both notes and in electronic form with each Bristol pound equal to one pound sterling. Some 800 businesses in the Bristol area now use the community currency, with coffees, meals, council tax and even pole-dancing lessons paid for with it.

“The practical vision was to get something which would connect local communities with their businesses in a way which kept money building up in their local communities,” the currency’s co-founder, Ciaran Mundy, said. “What happens is that if you spend it at a large supermarket chain, 80% of that will exit the economy very quickly.”

While community currencies have a history (IN UK) going back to Victorian times, there has been a resurgence in recent years, with Bristol emerging as the standard-bearer in the UK...

INTERESTING IDEA, THOUGH....WE SHOULD KEEP IT IN MIND, WHEN THE PETRODOLLAR COLLAPSES...

The Era of Breakdown

THE DESTRUCTION OF CAPITAL IS WELL UNDERWAY--TAKE DETROIT AS THE POSTER CHILD FOR THAT!

http://thearchdruidreport.blogspot.com/2015/06/the-era-of-breakdown.html

The fourth of the stages in the sequence of collapse we’ve been discussing is the era of breakdown. (For those who haven’t been keeping track, the first three phases are the eras of pretense, impact, and response; the final phase, which we’ll be discussing next week, is the era of dissolution.) The era of breakdown is the phase that gets most of the press, and thus inevitably no other stage has attracted anything like the crop of misperceptions, misunderstandings, and flat-out hokum as this one.

The era of breakdown is the point along the curve of collapse at which business as usual finally comes to an end. That’s where the confusion comes in. It’s one of the central articles of faith in pretty much every human society that business as usual functions as a bulwark against chaos, a defense against whatever problems the society might face. That’s exactly where the difficulty slips in, because in pretty much every human society, what counts as business as usual—the established institutions and familiar activities on which everyone relies day by day—is the most important cause of the problems the society faces, and the primary cause of collapse is thus quite simply that societies inevitably attempt to solve their problems by doing all the things that make their problems worse.

The phase of breakdown is the point at which this exercise in futility finally grinds to a halt. The three previous phases are all attempts to avoid breakdown: in the phase of pretense, by making believe that the problems don’t exist; in the phase of impact, by making believe that the problems will go away if only everyone doubles down on whatever’s causing them; and in the phase of response, by making believe that changing something other than the things that are causing the problems will fix the problems. Finally, after everything else has been tried, the institutions and activities that define business as usual either fall apart or are forcibly torn down, and then—and only then—it becomes possible for a society to do something about its problems.

It’s important not to mistake the possibility of constructive action for the inevitability of a solution. The collapse of business as usual in the breakdown phase doesn’t solve a society’s problems; it doesn’t even prevent those problems from being made worse by bad choices. It merely removes the primary obstacle to a solution, which is the wholly fictitious aura of inevitability that surrounds the core institutions and activities that are responsible for the problems. Once people in a society realize that no law of God or nature requires them to maintain a failed status quo, they can then choose to dismantle whatever fragments of business as usual haven’t yet fallen down of their own weight...That’s a more important action than it might seem at first glance. It doesn’t just put an end to the principal cause of the society’s problems. It also frees up resources that have been locked up in the struggle to keep business as usual going at all costs, and those newly freed resources very often make it possible for a society in crisis to transform itself drastically in a remarkably short period of time. Whether those transformations are for good or ill, or as usually happens, a mixture of the two, is another matter, and one I’ll address a little further on.

SPECIFICS FOLLOW: USA TODAY VS. DURING THE PREVIOUS DEPRESSION

FDR AND NAPOLEON

PEAK ENERGY

JUNK SCIENCE

AND MORE

A COMPREHENSIVE ORIENTATION TO THE PRESENT AND THE PROBABLE FUTURE--MUST READ!

Profile Information

Gender: FemaleHometown: Ann Arbor, Michigan

Home country: USA

Member since: Thu Sep 25, 2003, 02:04 PM

Number of posts: 85,373