Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

marmar

marmar's Journal

marmar's Journal

June 3, 2015

This Creative Commons-licensed piece first appeared at Climate News Network.

LONDON, 2 June, 2015—The glaciers of the Everest region of the Himalayan massif—home to the highest peak of all—could lose between 70% and 99% of their volume as a result of global warming.

Asia’s mountain ranges contain the greatest thickness of ice beyond the polar regions. But new research predicts that, by 2100, the world’s highest waters—on which billions of people depend for their water supply—could be at their lowest ebb because of the ice loss.

Many of the continent’s great rivers begin up in the snows, fed by melting ice in high-peak regions such as the Hindu Kush, the Pamir and the Himalayas.

Joseph Shea, a glacial hydrologist at the International Centre for Integrated Mountain Development in Kathmandu, Nepal, and French and Dutch colleagues report in The Cryosphere journal that they used more than 50 years of climate data and sophisticated computer models of predicted climate change to study the pattern of snowpack and seasonal melt in the Everest region.

Temperature increase

They found a decrease of 20% since 1961, and signs that most, if not quite all, of the stored ice could disappear in the next 85 years.

http://www.truthdig.com/report/item/glacier_loss_raises_high_concern_over_water_supplies_20150603

Glacier Loss Raises High Concern Over Water Supplies

This Creative Commons-licensed piece first appeared at Climate News Network.

LONDON, 2 June, 2015—The glaciers of the Everest region of the Himalayan massif—home to the highest peak of all—could lose between 70% and 99% of their volume as a result of global warming.

Asia’s mountain ranges contain the greatest thickness of ice beyond the polar regions. But new research predicts that, by 2100, the world’s highest waters—on which billions of people depend for their water supply—could be at their lowest ebb because of the ice loss.

Many of the continent’s great rivers begin up in the snows, fed by melting ice in high-peak regions such as the Hindu Kush, the Pamir and the Himalayas.

Joseph Shea, a glacial hydrologist at the International Centre for Integrated Mountain Development in Kathmandu, Nepal, and French and Dutch colleagues report in The Cryosphere journal that they used more than 50 years of climate data and sophisticated computer models of predicted climate change to study the pattern of snowpack and seasonal melt in the Everest region.

Temperature increase

They found a decrease of 20% since 1961, and signs that most, if not quite all, of the stored ice could disappear in the next 85 years.

http://www.truthdig.com/report/item/glacier_loss_raises_high_concern_over_water_supplies_20150603

June 3, 2015

Jamie Dimon, who helped assemble Citigroup Inc. and then improved on the experiment with JPMorgan Chase & Co., is responsible for two of the biggest banks the world has ever seen. His life’s work also made him rich.

With JPMorgan shares near a record high, Dimon’s net worth is about $1.1 billion, according to the Bloomberg Billionaires Index. Dimon’s fortune derives from a $485 million stake in New York-based JPMorgan, where he’s been chief executive officer since the end of 2005, and an investment portfolio seeded by proceeds from Citigroup stock sales.

Dimon’s status is unusual because, with the exception of former mentor Sanford “Sandy” Weill, few bank managers accumulate that much wealth. Most finance-industry billionaires start businesses or investment firms, such as hedge-fund tycoon George Soros, who is worth $28.5 billion, or Blackstone Group LP co-founder Steve Schwarzman, worth $13.4 billion.

“The odds are much, much lower for a bank CEO becoming a billionaire than a guy going to a hedge fund or private equity,” said Roy Smith, a professor at New York University Stern School of Business and a former Goldman Sachs Group Inc. partner who started on Wall Street in 1966. “The real lucre in this business has always been on the transactional side. The CEOs of Wall Street have to deal with litigation, regulation and the relatively short tenures you have at the top of the pile.” ..................(more)

http://www.bloomberg.com/news/articles/2015-06-03/jamie-dimon-becomes-billionaire-ushering-in-era-of-the-megabank-iagiwwl8

Crime does pay: Jamie Dimon is officially a billionaire

Jamie Dimon, who helped assemble Citigroup Inc. and then improved on the experiment with JPMorgan Chase & Co., is responsible for two of the biggest banks the world has ever seen. His life’s work also made him rich.

With JPMorgan shares near a record high, Dimon’s net worth is about $1.1 billion, according to the Bloomberg Billionaires Index. Dimon’s fortune derives from a $485 million stake in New York-based JPMorgan, where he’s been chief executive officer since the end of 2005, and an investment portfolio seeded by proceeds from Citigroup stock sales.

Dimon’s status is unusual because, with the exception of former mentor Sanford “Sandy” Weill, few bank managers accumulate that much wealth. Most finance-industry billionaires start businesses or investment firms, such as hedge-fund tycoon George Soros, who is worth $28.5 billion, or Blackstone Group LP co-founder Steve Schwarzman, worth $13.4 billion.

“The odds are much, much lower for a bank CEO becoming a billionaire than a guy going to a hedge fund or private equity,” said Roy Smith, a professor at New York University Stern School of Business and a former Goldman Sachs Group Inc. partner who started on Wall Street in 1966. “The real lucre in this business has always been on the transactional side. The CEOs of Wall Street have to deal with litigation, regulation and the relatively short tenures you have at the top of the pile.” ..................(more)

http://www.bloomberg.com/news/articles/2015-06-03/jamie-dimon-becomes-billionaire-ushering-in-era-of-the-megabank-iagiwwl8

June 3, 2015

By Joe Firestone, Ph.D., Managing Director, CEO of the Knowledge Management Consortium International (KMCI), and Director of KMCI’s CKIM Certificate program. He taught political science as the graduate and undergraduate level and blogs regularly at Corrente, Firedoglake and New Economic Perspectives. Originally published at New Economic Perspectives

So, on May 22, the Trade Promotion Authority (TPA) (“Fast Track”) Bill passed the Senate 62 – 37, with 14 Democrats defecting to the pro-Fast TracK/Trade-Pacific Partnership (TPP) forces. However, all was not wine and roses for the Administration and Fast Track/TPP proponents in the Senate.

First, the pro-TPP forces sustained a temporary defeat on May 12, when the Senate would not approve debating Fast Track, introducing delay into the process. The problem was quickly fixed with agreements to consider and vote on related issues such as Trade Adjustment Assistance, forced child labor, and currency manipulation outside of Fast Track. But nevertheless the glitch was unanticipated, and looked bad for an Administration wanting clear sailing in the Senate for Fast Track.

Second, an amendment to Fast Track unexpectedly snuck through the Senate providing for banning or throwing out nations practicing human trafficking. This amendment is regarded as a “poison pill” that will prevent Malaysia from being included in the TPP, with unknown impact on other possible signators.

At a minimum, the Administration, if it is successful in getting Fast Track through the House, will want this amendment eliminated from the bill, making it necessary to either send Fast Track back to the Senate for further amendment bringing it into agreement with the House, or, alternatively, to go to a Conference committee of the two Houses of Congress, where the “poison pill” would be dissolved. Even if one of these alternatives is successful, the result will be harmful to the Administration in two ways.

First, will weaken the confidence of the TPP negotiating partners that the President can deliver approval of the final TPP agreement by the Congress. And, second, it will delay getting to a final up or down vote in the Congress which the Administration is anxious to get before the end of this calendar year. .................(more)

http://www.nakedcapitalism.com/2015/06/joe-firestone-get-ready-to-call-em-out-on-the-tpp.html

Get Ready to Call ‘Em Out On the TPP!

By Joe Firestone, Ph.D., Managing Director, CEO of the Knowledge Management Consortium International (KMCI), and Director of KMCI’s CKIM Certificate program. He taught political science as the graduate and undergraduate level and blogs regularly at Corrente, Firedoglake and New Economic Perspectives. Originally published at New Economic Perspectives

So, on May 22, the Trade Promotion Authority (TPA) (“Fast Track”) Bill passed the Senate 62 – 37, with 14 Democrats defecting to the pro-Fast TracK/Trade-Pacific Partnership (TPP) forces. However, all was not wine and roses for the Administration and Fast Track/TPP proponents in the Senate.

First, the pro-TPP forces sustained a temporary defeat on May 12, when the Senate would not approve debating Fast Track, introducing delay into the process. The problem was quickly fixed with agreements to consider and vote on related issues such as Trade Adjustment Assistance, forced child labor, and currency manipulation outside of Fast Track. But nevertheless the glitch was unanticipated, and looked bad for an Administration wanting clear sailing in the Senate for Fast Track.

Second, an amendment to Fast Track unexpectedly snuck through the Senate providing for banning or throwing out nations practicing human trafficking. This amendment is regarded as a “poison pill” that will prevent Malaysia from being included in the TPP, with unknown impact on other possible signators.

At a minimum, the Administration, if it is successful in getting Fast Track through the House, will want this amendment eliminated from the bill, making it necessary to either send Fast Track back to the Senate for further amendment bringing it into agreement with the House, or, alternatively, to go to a Conference committee of the two Houses of Congress, where the “poison pill” would be dissolved. Even if one of these alternatives is successful, the result will be harmful to the Administration in two ways.

First, will weaken the confidence of the TPP negotiating partners that the President can deliver approval of the final TPP agreement by the Congress. And, second, it will delay getting to a final up or down vote in the Congress which the Administration is anxious to get before the end of this calendar year. .................(more)

http://www.nakedcapitalism.com/2015/06/joe-firestone-get-ready-to-call-em-out-on-the-tpp.html

June 3, 2015

Published on Jun 2, 2015

In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss economies faking it for so long, they’ve forgotten what ‘making it’ even looks like. With trickle down Potemkinism, formerly employed workers go to fake jobs and fake companies, selling fake goods where everything is fake, except for the losses. In the second half, Max interviews Mitch Feierstein of PlanetPonzi.com about make believe economic growth and real debt problems as economies around the world shrink, housing bubbles blow and the war sector grows.

Keiser Report: Fake It 'Til You Make It

Published on Jun 2, 2015

In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss economies faking it for so long, they’ve forgotten what ‘making it’ even looks like. With trickle down Potemkinism, formerly employed workers go to fake jobs and fake companies, selling fake goods where everything is fake, except for the losses. In the second half, Max interviews Mitch Feierstein of PlanetPonzi.com about make believe economic growth and real debt problems as economies around the world shrink, housing bubbles blow and the war sector grows.

June 3, 2015

Published on May 30, 2015

In this episode of the Keiser Report, Max and Stacy discuss the ‘gone people’ of Greece and beyond, as austerity meets an immoveable force of the bankers ever expanding black hole of debt. In the second half, Max continues his interview with Liam Halligan of BNE.eu about the economic situation in Europe, the EU referendum and Scottish independence.

Keiser Report: We Are All Greeks Now

Published on May 30, 2015

In this episode of the Keiser Report, Max and Stacy discuss the ‘gone people’ of Greece and beyond, as austerity meets an immoveable force of the bankers ever expanding black hole of debt. In the second half, Max continues his interview with Liam Halligan of BNE.eu about the economic situation in Europe, the EU referendum and Scottish independence.

June 3, 2015

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

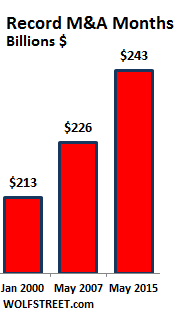

Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record.

There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per month in the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch.

And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to the Financial Times. And so in May, M&A deals hit an all-time record of $243 billion.

US-M-A-record-months-May-2015-May-2007-Jan-2000The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results. ....................(more)

http://www.nakedcapitalism.com/2015/06/wolf-richter-last-two-times-this-happened-stocks-crashed.html

Last Two Times This Happened, Stocks Crashed

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

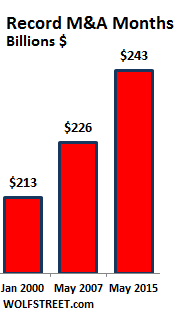

Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record.

There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per month in the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch.

And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to the Financial Times. And so in May, M&A deals hit an all-time record of $243 billion.

US-M-A-record-months-May-2015-May-2007-Jan-2000The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results. ....................(more)

http://www.nakedcapitalism.com/2015/06/wolf-richter-last-two-times-this-happened-stocks-crashed.html

June 2, 2015

http://www.truthdig.com/cartoon/item/fifa_corruption_20150601

FIFA corruption (cartoon)

http://www.truthdig.com/cartoon/item/fifa_corruption_20150601

June 2, 2015

MO: St. Louis County Faces Steep Odds Getting MetroLink on Expansion Track

STEVE GIEGERICH ON JUN 2, 2015

SOURCE: ST. LOUIS POST-DISPATCH

June 01--ST. LOUIS COUNTY -- For all the passion stirred by a discussion of MetroLink expansion, it may be instructive to remember that the children of today will be the adults of tomorrow before light rail service reaches deep into suburban St. Louis County.

If it happens at all.

Even so, County Executive Steve Stenger last week took the initial step toward expanding light rail by authorizing $1 million to determine where MetroLink tracks may lead in the future.

Mass transit proponents praise Stenger for what they call an important gesture toward weaning the region from dependency on cars.

"It's very welcome news," said John Nations, president and CEO of Metro St. Louis Transit. "We commend the county executive for taking this step because we believe in (light rail) expansion for our region." ....................(more)

http://www.masstransitmag.com/news/11994482/st-louis-county-faces-steep-odds-getting-metrolink-on-expansion-track

MO: St. Louis County Faces Steep Odds Getting MetroLink on Expansion Track

MO: St. Louis County Faces Steep Odds Getting MetroLink on Expansion Track

STEVE GIEGERICH ON JUN 2, 2015

SOURCE: ST. LOUIS POST-DISPATCH

June 01--ST. LOUIS COUNTY -- For all the passion stirred by a discussion of MetroLink expansion, it may be instructive to remember that the children of today will be the adults of tomorrow before light rail service reaches deep into suburban St. Louis County.

If it happens at all.

Even so, County Executive Steve Stenger last week took the initial step toward expanding light rail by authorizing $1 million to determine where MetroLink tracks may lead in the future.

Mass transit proponents praise Stenger for what they call an important gesture toward weaning the region from dependency on cars.

"It's very welcome news," said John Nations, president and CEO of Metro St. Louis Transit. "We commend the county executive for taking this step because we believe in (light rail) expansion for our region." ....................(more)

http://www.masstransitmag.com/news/11994482/st-louis-county-faces-steep-odds-getting-metrolink-on-expansion-track

June 2, 2015

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

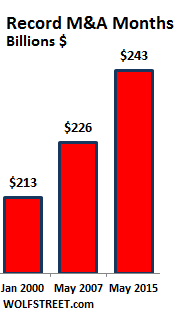

Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record.

There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per month in the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch.

And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to the Financial Times. And so in May, M&A deals hit an all-time record of $243 billion.

US-M-A-record-months-May-2015-May-2007-Jan-2000The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results. ....................(more)

http://www.nakedcapitalism.com/2015/06/wolf-richter-last-two-times-this-happened-stocks-crashed.html

Last Two Times This Happened, Stocks Crashed

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

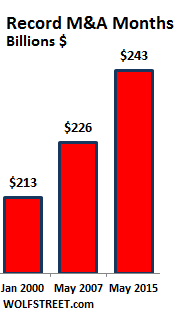

Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record.

There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per month in the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch.

And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to the Financial Times. And so in May, M&A deals hit an all-time record of $243 billion.

US-M-A-record-months-May-2015-May-2007-Jan-2000The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results. ....................(more)

http://www.nakedcapitalism.com/2015/06/wolf-richter-last-two-times-this-happened-stocks-crashed.html

June 2, 2015

from In These Times:

6 Lessons for the U.S. from Spain’s Democratic Revolution

How Spain’s 15M movement went from occupying city squares to city halls—without compromising its independence

BY ERICA SAGRANS

When tens of thousands of people occupied city squares across Spain in the spring of 2011 as part of the 15M movement, their demand was simple: ¡Democracy Real Ya!—“a real democracy,” instead of the corrupt, top-down system that had failed to address the country’s skyrocketing foreclosures and unemployment.

On Sunday, May 24, Spain took a huge step towards the kind of radical democracy that the occupiers envisioned. In municipal elections, Barcelona, Madrid and several other cities elected new mayors or governments from progressive platforms that have emerged out of the 15M movement.

In Barcelona, the new mayor is Ada Colau, co-founder of the anti-foreclosure group called the PAH (Plataforma de Afectados por la Hipoteca/Platform of People Affected by Mortgages), which has moved families that need housing into empty, bank-owned buildings. Colau was elected with the backing of Barcelona En Comú, a citizen platform that includes groups that came directly out of the 15M movement, as well as Podemos, the insurgent left party that has risen to national prominence. And in Madrid, Ahora Madrid’s “popular unity” candidate Manuela Carmena, a well-respected former judge and labor lawyer, is poised to become mayor once a coalition government is formed.

.....(snip).....

1) Movements should keep pushing for radical and participatory democracy by engaging directly with electoral politics—while also maintaining their independence from established parties.

In advance of Spain’s municipal elections, movement activists worked with existing political parties to create new “convergence” platforms of “popular unity” specifically for May 24. Barcelona En Comú and Ahora Madrid were not traditional parties, but rather a mix of groups working together—including Podemos and more local efforts that had come out of 15M and the activism that preceded it—while maintaining their own structures and decision-making process.

.....(snip).....

3) Create physical spaces for local organizing outside of existing institutions

An important part of progressives’ recent electoral success can be traced to a strong network of locally organized “social centers” across Spain. These are spaces where community members can interact and share ideas, whether that means organizing a demonstration, taking Zumba classes or checking out library book. Many subsist on small membership fees or income from a bar or café. Many served as gathering places for organizing 15M after the movement decided to end its large-scale occupations and focus on building neighborhood-level power. .......................(more)

http://inthesetimes.com/article/18001/6-lessons-for-the-u.s.-from-spains-democratic-revolution

6 Lessons for the U.S. from Spain’s Democratic Revolution

from In These Times:

6 Lessons for the U.S. from Spain’s Democratic Revolution

How Spain’s 15M movement went from occupying city squares to city halls—without compromising its independence

BY ERICA SAGRANS

When tens of thousands of people occupied city squares across Spain in the spring of 2011 as part of the 15M movement, their demand was simple: ¡Democracy Real Ya!—“a real democracy,” instead of the corrupt, top-down system that had failed to address the country’s skyrocketing foreclosures and unemployment.

On Sunday, May 24, Spain took a huge step towards the kind of radical democracy that the occupiers envisioned. In municipal elections, Barcelona, Madrid and several other cities elected new mayors or governments from progressive platforms that have emerged out of the 15M movement.

In Barcelona, the new mayor is Ada Colau, co-founder of the anti-foreclosure group called the PAH (Plataforma de Afectados por la Hipoteca/Platform of People Affected by Mortgages), which has moved families that need housing into empty, bank-owned buildings. Colau was elected with the backing of Barcelona En Comú, a citizen platform that includes groups that came directly out of the 15M movement, as well as Podemos, the insurgent left party that has risen to national prominence. And in Madrid, Ahora Madrid’s “popular unity” candidate Manuela Carmena, a well-respected former judge and labor lawyer, is poised to become mayor once a coalition government is formed.

.....(snip).....

1) Movements should keep pushing for radical and participatory democracy by engaging directly with electoral politics—while also maintaining their independence from established parties.

In advance of Spain’s municipal elections, movement activists worked with existing political parties to create new “convergence” platforms of “popular unity” specifically for May 24. Barcelona En Comú and Ahora Madrid were not traditional parties, but rather a mix of groups working together—including Podemos and more local efforts that had come out of 15M and the activism that preceded it—while maintaining their own structures and decision-making process.

.....(snip).....

3) Create physical spaces for local organizing outside of existing institutions

An important part of progressives’ recent electoral success can be traced to a strong network of locally organized “social centers” across Spain. These are spaces where community members can interact and share ideas, whether that means organizing a demonstration, taking Zumba classes or checking out library book. Many subsist on small membership fees or income from a bar or café. Many served as gathering places for organizing 15M after the movement decided to end its large-scale occupations and focus on building neighborhood-level power. .......................(more)

http://inthesetimes.com/article/18001/6-lessons-for-the-u.s.-from-spains-democratic-revolution

Profile Information

Gender: MaleHometown: Detroit, MI

Member since: Fri Oct 29, 2004, 12:18 AM

Number of posts: 77,086