Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

In reply to the discussion: STOCK MARKET WATCH -- Thursday, 21 August 2014 [View all]Demeter

(85,373 posts)1. Philip Pilkington: Taxation, Government Spending, the National Debt and MMT

http://www.nakedcapitalism.com/2014/08/taxation-government-spending-the-national-debt-and-mmt.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

The other day my friend Rohan Grey — a lawyer and one of the key organisers behind the excellent Modern Money Network (bringing Post-Keynesian economics to Columbia Law School, yes please!) — directed me to an absolutely fascinating piece of writing. It is called ‘Taxes For Revenue Are Obsolete’ and it was written in 1945 by Beardsley Ruml. Ruml was the director of the New York Federal Reserve Bank from 1937-1947 and also worked on issues of taxation at the Treasury during the war.

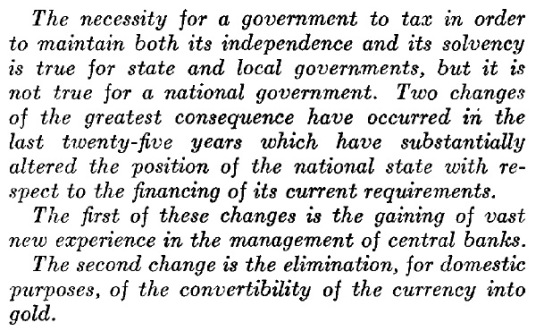

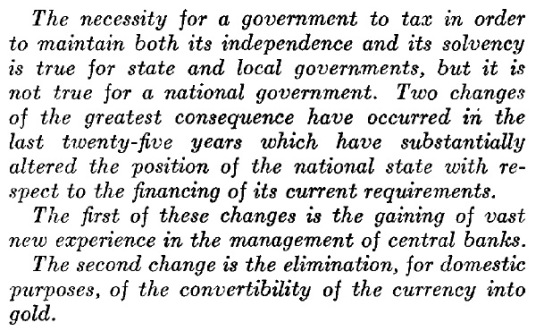

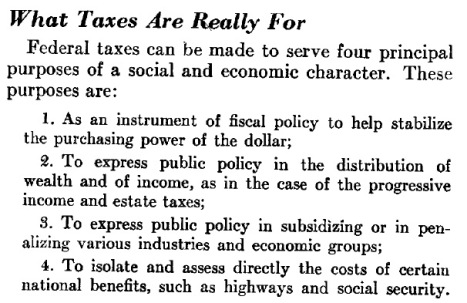

The article lays out the case that taxation should not be focused on revenue generation. Rather, Ruml argues, it should be thought of as serving other purposes entirely. He writes:

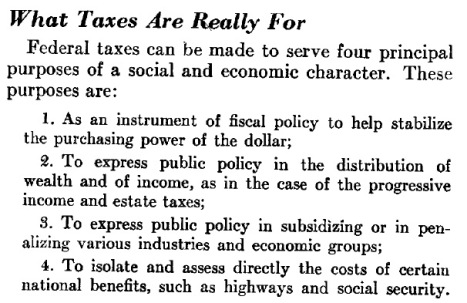

Basically Ruml is making the same case that the Modern Monetary Theorists (MMTers) make: a country that issues its own sovereign currency and is unconstrained by a gold standard does not require tax revenue in order to fund spending. This is because the central bank always stands by ready and able to buy any sovereign debt issued that might lead to the interest rate rising. Indeed, it does this automatically in the way that it conducts its interest rate policy. Ruml then outlines what taxation is really for in such a country.

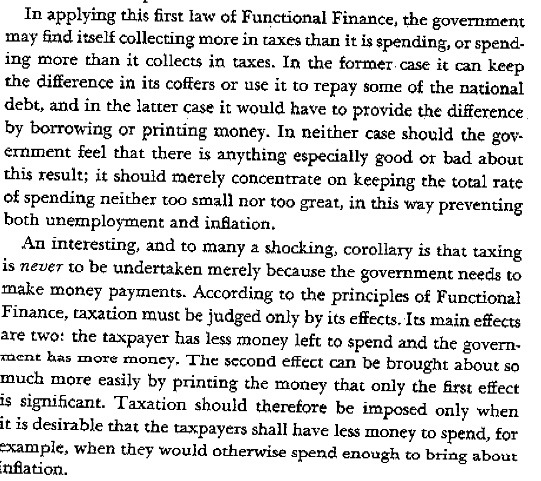

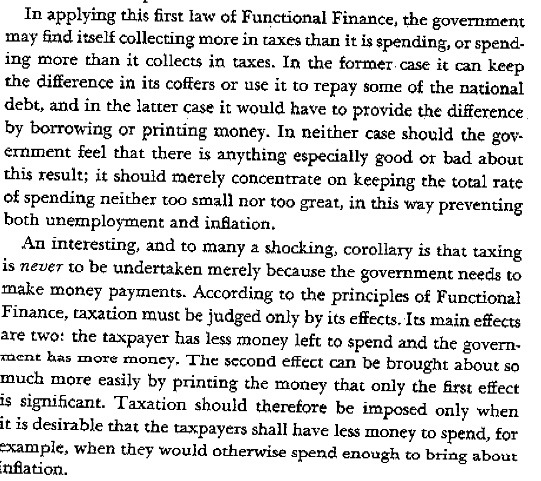

This is a fantastic summary and I really couldn’t put it better myself. The interesting question, however, is why people were making such statements at this moment in history? It should be remembered that the economist Abba Lerner had published a paper entitled ‘Functional Finance and the Federal Debt‘ just two years earlier which made a very similar case. In that classic paper he wrote:

So, what was it about this moment in history that allowed for such a clear-eyed view of government spending and taxation policies? The answer is simple: the war. World War II allowed economists, bankers and government officials to see clearly how the macroeconomy worked because the government was basically controlling the economy. World War II was perhaps the only time in history when capitalist economies were run on truly Keynesian principles. (You can make a case that the Nazi economy in the 1930s was also run on these principles, however, so perhaps it is better to say: a capitalist economy in a democratic state).

FASCINATING, EDUCATIONAL....MUST READ!

The other day my friend Rohan Grey — a lawyer and one of the key organisers behind the excellent Modern Money Network (bringing Post-Keynesian economics to Columbia Law School, yes please!) — directed me to an absolutely fascinating piece of writing. It is called ‘Taxes For Revenue Are Obsolete’ and it was written in 1945 by Beardsley Ruml. Ruml was the director of the New York Federal Reserve Bank from 1937-1947 and also worked on issues of taxation at the Treasury during the war.

The article lays out the case that taxation should not be focused on revenue generation. Rather, Ruml argues, it should be thought of as serving other purposes entirely. He writes:

Basically Ruml is making the same case that the Modern Monetary Theorists (MMTers) make: a country that issues its own sovereign currency and is unconstrained by a gold standard does not require tax revenue in order to fund spending. This is because the central bank always stands by ready and able to buy any sovereign debt issued that might lead to the interest rate rising. Indeed, it does this automatically in the way that it conducts its interest rate policy. Ruml then outlines what taxation is really for in such a country.

This is a fantastic summary and I really couldn’t put it better myself. The interesting question, however, is why people were making such statements at this moment in history? It should be remembered that the economist Abba Lerner had published a paper entitled ‘Functional Finance and the Federal Debt‘ just two years earlier which made a very similar case. In that classic paper he wrote:

So, what was it about this moment in history that allowed for such a clear-eyed view of government spending and taxation policies? The answer is simple: the war. World War II allowed economists, bankers and government officials to see clearly how the macroeconomy worked because the government was basically controlling the economy. World War II was perhaps the only time in history when capitalist economies were run on truly Keynesian principles. (You can make a case that the Nazi economy in the 1930s was also run on these principles, however, so perhaps it is better to say: a capitalist economy in a democratic state).

FASCINATING, EDUCATIONAL....MUST READ!

Edit history

Please sign in to view edit histories.

36 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

JPMorgan, BofA to raise junior banker pay by 20 percent & THEY SAY CRIME DOESN'T PAY!

Demeter

Aug 2014

#3

The Feds Are Finally Going After One Of The Most Infamous Executives Of The Financial Crisis

xchrom

Aug 2014

#7