Demeter

Demeter's JournalNEW STAND-UP ECONOMIST VIDEO

MORE LEGO ART

http://www.newlaunches.com/archives/mindblowing_lego_art.phpONLY A SAMPLE:

Paul Krugman is Wrong about the Rise of the Robots Martin Ford

http://econfuture.wordpress.com/2013/01/18/paul-krugman-is-wrong-about-the-rise-of-the-robots/Paul Krugman has recently taken a keen interest in the rise of robots and automation — an issue that I have been focusing on since the publication of my book on this subject back in 2009.

In a recent post, Krugman says the following:

I think there is a fundamental problem with this way of thinking: as jobs and incomes are relentlessly automated away, the bulk of consumers will lack the income necessary to drive the demand that is critical to economic growth. Every product and service produced by the economy ultimately gets purchased (consumed) by someone. In economic terms, “demand” means a desire or need for something – backed by the ability and willingness to pay for it. There are only two entities that create final demand for products and services: individual people and governments. (And we know that government can’t be the demand solution in the long run). Individual consumer spending is typically around 70% of GDP in the United States.

Of course, businesses also purchase things, but that is NOT final demand. Businesses buy inputs that are used to produce something else. If there is no demand for what the business is producing, it will shut down and stop buying inputs. A business may sell to another business, but somewhere down the line, that chain has to end at a person (or a government) buying something just because they want it or need it.

The point here is that a worker is also a consumer (and may support other consumers). These people drive final demand. When a worker is replaced by a machine, that machine does not go out and consume. The machine may use energy, resources and spare parts, but again, those are business inputs—not final demand. If there is no one to buy what the machine is producing, it will get shut down. Think of on industrial robot being used by an auto manufacturer. The robot will not continue running if no one is buying cars.* So if we automate all the jobs, or most of the jobs, or if we drive wages so low that very few people have any discretionary income, then it is difficult to see how a modern mass-market economy can continue to thrive. (This is the primary focus of my book, The Lights in the Tunnel). There is plenty of evidence that consumers are already struggling with the structural shift occurring in the economy. The years leading up to the current economic crisis were, of course, characterized by people consuming on the basis of debt rather than income. A just-released report shows that an ever increasing number of Americans are raiding their retirement accounts to pay current bills.

Does Paul Krugman really believe that it is possible to have a “society that grows ever richer” while a tiny number of robot owners hoover up more and more of total income — and the jobless masses consume the output by running up their credit cards or cashing in their 401(k)s? The point is that the robot revolution is not just about income inequality. It will ultimately impact the sustainability of economic growth. Innovation requires the existence of a market. New ideas will not receive the necessary backing if investors do not anticipate healthy market demand. A future with a dearth of viable consumers will be a far more zero-sum future. It will mean less of the type of innovation we associate with Steve Jobs — and more of the type you would find at Goldman Sachs. One of the main points I make in my book is that I think we will ultimately have to treat the market itself as a kind of renewable resource. Jobs and wages have historically been the primary mechanism that redistributes income (and purchasing power) from producers back to consumers. Widespread reliance on robots and automation may ultimately cause that mechanism to break down — and that will be a threat to continued prosperity.

So what is the solution? In the long run, I think there will be no alternative except to implement direct redistribution of income. One possibility is a guaranteed minimum income funded by more progressive taxes (on the robot owners), and possibly by other sources (for example, a carbon tax). It goes without saying that implementing such a solution would be an enormous social and political challenge. And it will intertwine with the other major problems we face. Meaningful action on climate change, for example, will become even more difficult in world where much of the population is increasingly focused on individual income continuity. Make no mistake, responding to the impact that accelerating technology has on the job market could turn out to be one of the defining challenges for our generation.

.............................................................................

* Not all robots are used in production, of course. There are also consumer robots. If you own a toy robot, it may “consume” batteries. However, in economic terms, YOU are the consumer — not the robot. You need a job/income or you won’t be able to buy batteries for your robot. Robots do not drive final consumption — people do.

***********************************************************

Martin Ford is the founder of a Silicon Valley-based software development firm and the author of the book The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future. He has over 25 years experience in the fields of computer design and software development. He holds a computer engineering degree from the University of Michigan, Ann Arbor and a graduate business degree from the University of California, Los Angeles.

*********************************************************

OF COURSE, WHEN THE ISSUE OF ROBOTS COMES UP, I TURN TO THE SCI-FI AUTHORS OF THE CLASSIC ERA, ESPECIALLY ASIMOV, WHO DESCRIBED DRONES (ALTHOUGH HE DIDN'T KNOW IT AT THE TIME).

WHEN ROBOTS DO THE EASY STUFF, HUMANS CAN CONCENTRATE ON THE MORE DIFFICULT, UNIQUE STUFF: ART, SCIENCE, PLANNING, GOVERNMENT, EDUCATION..THINGS SEVERAL STEPS ABOVE DAILY SURVIVAL, REACHING INTO EVOLUTION OF THE SPECIES, PERHAPS EVEN THE END OF WAR FOR CONQUEST AND POWER.

Inside the Hostess Bankery- The Movie, Who Keeps the Dough

A SHOCKING EXPOSE OF VULTURES DINING ON THEIR PREY--WORSE THAN YOU COULD IMAGINE!

http://www.dailykos.com/story/2013/01/17/1179708/-Inside-the-Hostess-Bankery-The-Movie-Who-Keeps-the-Dough

The Bakers Union members have had enough of being blamed for the closing of Hostess Bakeries in the mainstream media. The truth is much more complicated and the media has failed to tell the story. In this film you will hear directly from the Local 218 members in Lenexa, Ks. Be informed before it happens to your family too.

VIDEO AT LINK

If you or someone you know can't understand why there was a strike at Hostess, watch this film.

When you hear the media narrative about about Hostess and the Bakers Union strike it is impossible to learn the truth. EVERY media outlet leaves out the details the Hedge Funds don't want the public to know. Here are some examples-

1. The Union SELF-FUNDS a large portion of its pension. Each Lenexa, KS worker contributes $4.25 an hour to the pension fund.

2. The 'Company' had collected that money for over a year under the lie that it would eventually be repaid to the pension fund. A total of $50 Million in one year.

3. This debt to the pension was thrown out in bankruptcy court as a debt the 'Company' could not repay. This money has been forever stolen.

4. The 'Company' or 'Hostess' is actually a pair of Hedge Funds, Monarch and Silver Point. It is a privately held business, it is not on the stock market.

5. As a private company the Union cannot view the accounting books for the 'Company'. In court, when the books were opened it became clear the 'Company' was skimming from the pension for a long time. A total of $186 million.

6. This money was stolen by the 'middle man' and never made it to the pension, therefore the Federal insurance plan- Pension Benefit Guarantee Corporation- will not help us. The PBGC is for failing pension funds. It will not cover theft of money that never made it to the pension.

7. Our pension is NOT a part of the secured debt. When you hear that the 'Company' is on the hook for $1 Billion in secured debt remember that does not include the stolen pension money.

8. The secured debt does include the money 'loaned' to the 'Company' by the Hedge Funds. Including the interest on those loans, as high as 15%. The 'Company' IS the hedge funds. In other words they loaned themselves money at a high interest rate and expect everyone to pay for it but themselves.

9. These Hedge Funds never intended to make Hostess profitable. They were always motivated by selling the brand names and infrastructure at the highest value.

10. Bankrupting the company and closing the doors allows them to strip the Unions from the brand names, driving up the resale value of the brand names. They never had to close, it was done as a mechanism to bust the Unions. The added bonus to the Hedge Funds was the ability to blame the strike for the closure.

11. The 'Company' shopped for a bankruptcy judge and found one to their liking. They chose Judge Drain (no pun intended) in New York, despite the facts that the 'Company' is located in Dallas, was previously in Kansas City, and is not on the stock market.

12. The judge helped write the contract with the 'Company' without any Union involvement. The judge granted permission to impose the contract on us before ANY rank and file Union member had seen the contract 'offer'.

When the sale of 'Hostess Brands' is complete the Hedge Funds will pay back the secured debt of approx $1 Billion and pocket anything above that number without paying the pension funds back. Remember that almost half of that debt is loans and interest to THEMSELVES. They will have already profited tens of millions when they 'break even'. In a just society that would never happen.

Most people assume that if you own a business and it goes bankrupt then you don't get to make millions of dollars on the closing. These Hedge Funds and the Congress members they fund have created a legal framework that protects them from ANY risk and leaves the damages at the front door of workers.

It will happen to you too, if you don't pay attention. Do not assume the law is on your side, even though it may have been in years past.

Aaron's Law: Violating a Site's Terms of Service Should Not Land You in Jail

http://www.theatlantic.com/national/archive/13/01/aarons-law/267247/#A week ago, Aaron Swartz -- social activist, geek genius -- took his own life. Facing the choice between a federal prosecutor who insisted that he either accept the label "felon" and go to jail or fight a million-dollar lawsuit against 13 felony indictments, Aaron took the third option, and hanged himself...Aaron's alleged "crime" was that he used MIT's network to access a database of academic journal articles (JSTOR) and download millions of those articles to his laptop computer. He didn't "hack" the network to secure those downloads: MIT is a famously open network. He didn't crack any special password system to get behind JSTOR's digital walls. He simply figured out how JSTOR was filing the articles that he wanted, and wrote a simple script to quickly gather those articles and then copy them to his machine...What isn't supported are the accounts the government suggested in their breathless and ignorant press releases and indictment. There's nothing to support the idea that Aaron was simply going to "liberate" JSTOR -- Swartz was not a copyright anarchist, and any effective first-world distribution would easily have been taken down. Even more absurd was the suggestion that Swartz was trying to make money with the scholarly articles he had downloaded. Trust me on this: However much academics love articles from the Harvard Law Review, that love does not translate into money...So what he actually intended the public cannot know. And if the public cannot know, the government certainly did not know. But that doesn't matter under the law as it stands. All the government had to show to launch its witch hunt against this young activist was that he had violated JSTOR's "terms of service" and taken (as in copied) something worth more than $5,000. The "terms of service" (TOS) of any website are basically a contract. They constitute an agreement about what you can and can't do, and what the provider can and can't do. Not everything on a website is governed by contract alone: Copyright and privacy law can impose property-like obligations independent of a TOS. But the rules Aaron were said to have violated purported to limit the amount of JSTOR that any user was permitted to download. They were rules of contract. Aaron exceeded those limits, the government charged. He therefore breached the implied contract he had with JSTOR. And therefore, the government insists, he was a felon.

It's that last step that is so odd within the tradition of American law. Contracts are important. Their breach must be remedied. But American law does not typically make the breach of a contract a felony. Instead, contract law typically requires the complaining party to prove that it was actually harmed. No harm, no foul. And in this case, JSTOR -- the only plausible entity "harmed" by Aaron's acts -- pled "no foul." JSTOR did not want Swartz prosecuted. It settled any possible civil claims against Swartz with the simple promise that he return what he had downloaded. Swartz did. JSTOR went away. But the government did not. In the weeks before his death, the government reaffirmed what they had been insisting upon for the 18 months before: jail, a felony conviction, and a bankrupting fine, or else Swartz was going to face a bankrupting trial.

This rule of American law is absurd -- especially in a world where prosecutors can't be trusted to make reasoned and proportionate judgments about who should be labeled a felon and who should not. A breach of contract is a breach of contract. It is not an act of treason. It is not a threat to the realm. If every breach of contract worth more than $5,000 were a crime, Manhattan wouldn't be the world's most amazing city. Manhattan would be a federal penitentiary, with every prominent Wall Street firm very well represented. Fail to execute a trade on time? Two years in jail. Back out on an acquisition? Thirty to life. Computer law is different, however, because Congress didn't really understand this "wild west" (as the network was called when Congress passed the Computer Fraud and Abuse Act in 1986), and because geeks make them uncomfortable. For 25 years, the CFAA has given federal prosecutors almost unbridled discretion to bully practically anyone using a computer network in ways the government doesn't like. It does that by essentially criminalizing the violations of a site's "terms of service" in combination with obtain[ing] anything of" at least $5,000 in value. And even if in the vast majority of cases prosecutors exercised that discretion, well, in this case the abuse of that discretion has ended in tragedy. As Tim Wu so brilliantly describes, we have built a system of criminal law that depends upon our trusting the government. Few civil libertarians from either the right or the left, though, will be surprised that it turns out that the bureaucrats manning the battle stations cannot be trusted. Aaron Swartz is dead -- in my view, as a friend who knew him well for more than a decade --at least in part because of this breach of its duty by the government. Carmen Ortiz, the U.S. Attorney overseeing the prosecution, demonstrated that breach with the ignorance she displayed when this indictment was announced. As she said then, "Stealing is stealing, whether you use a computer command or a crowbar," -- demonstrating she knows nothing about computers, and apparently nothing about crowbars. And the line prosecutor working for her breached that trust when he made it clear that his first priority was not decency or proportionality but one more notch on his prosecutor's belt, for a prosecution that had nothing to do with keeping America safe from "criminals."

But now Congress may actually do something to remedy at least part of this important flaw. Congresswoman Zoe Lofgren (D-CA) has introduced a draft bill -- importantly, first on Reddit, a platform Aaron had helped to build, and, once she gets the Net's feedback, in the United States Congress -- to change this rule of the CFAA and return contract law to its civil home. Her bill, which she calls "Aaron's Law," would limit the scope of the Computer Fraud and Abuse Act and exclude "crimes" that are nothing more than a breach of contract. No more "felonies." No more prosecutions resulting in prison sentences. Violations of the "terms of service" would be a breach, not a crime. Had that change been made before Aaron's death, the government's felony charges would likely have collapsed. Had the government's charges collapsed, Aaron Swartz, in my view, would still be frantically working to make the world a better place. Lofgren should be praised for her quick and smart response to the mess that brought about this tragedy. This isn't the only change that computer and copyright law require. It's not even on the top 10 list of the causes Aaron was fighting for. But it is an important start, and more changes can be added as people review the Reddit draft. And with the bipartisanship demonstrated by Darrell Issa's comments about this tragedy, it may well be an idea that even this Congress could pass.

THIS VERY IMPORTANT ARTICLE CLEARLY AND COMPREHENSIVELY EXPLAINS THE ENTIRE EVENT AND THE TRAGEDY AND THE ERROR

What Is Driving Growth in Government Spending? By NATE SILVER

WAR AND CRONY CAPITALISM: GUNS FOR THE PLEBES, BUTTER FOR THE ARISTOS

http://fivethirtyeight.blogs.nytimes.com/2013/01/16/what-is-driving-growth-in-government-spending/?ref=politics

The first chart, below, documents the growth in federal government spending over the past hundred years as a share of gross domestic product spending is broken down into four major categories:

1. Entitlement programs, under which I classify government expenditures on health care programs; pensions and retirement programs like Social Security; and welfare or social insurance programs like food stamps and unemployment compensation.

2. Military spending

3. Interest on the national debt

4. Infrastructure and services, under which I include everything else — the pot that is often referred to as discretionary spending: education spending; fire services, police and the criminal justice system; spending on physical infrastructure including transportation; spending on science, technology, and research and development; and the category called “general government,” which largely refers to the cost of maintaining the political system (like salaries for public officials).

MORE WORDS AT LINK

Is Jack Lew A Friend to Wall Street?

HE COULD BE A CAPTIVE, LIKE THE REST OF THE 99%...

http://nationaljournal.com/whitehouse/is-jack-lew-a-friend-to-wall-street-20130110

Like Tim Geithner, the new Treasury nominee may owe his views to Robert Rubin. So don't expect him to pursue much in the way of bank reform...It was a little noted event when last fall, during the height of the presidential election campaign, the Treasury Department released Timothy Geithner’s phone records. To the extent anyone paid attention at all—and let’s face it, almost no one did—financial reporters were struck that the Treasury secretary’s most frequent contact was Larry Fink of BlackRock, the world’s largest money manager and Geithner’s principal conduit to his many friends on Wall Street. But the even more telling name of Geithner’s regular confidants, as the Financial Times noted, was the second one on the frequent-contact list: Robert Rubin.

That might seem odd; after all, it’s been nearly a decade and a half since Geithner worked for Rubin, who is long retired from public life. But Bob Rubin was no ordinary employer. The former Treasury secretary under Bill Clinton all but created Timothy Geithner as we know him today, raising him from a junior Tokyo Embassy staffer to undersecretary of the Treasury in the mid-to-late-’90s, and later sponsoring the still-boyish bureaucrat as president of the New York Fed in 2003 (against resistance from the head of the search committee, Paul Volcker, who according to The Wall Street Journal barked: “Who’s Geithner?”). As he almost always has, Rubin prevailed, and for nearly four years his former protégé has lorded over America’s financial system.

Rubinomics: It’s the cult that never quits. Now the nation is faced with a potential new acolyte. Is Jacob Lew, who is expected to be named Thursday as the replacement for Geithner, yet another Rubinite who will largely follow the policies of his predecessor? Calm, brilliant, competent at everything he’s tried—from the Office of Management and Budget to deputy secretary of State to chief of staff—Lew has smoothly run the White House in the year since William Daley left. He has a reputation for unimpeachable integrity and total honesty, as well as a mastery of the budget that will be critical over the next four years of fiscal fights. But many critics fear that the picture is different when it comes to Wall Street. On financial reform, Lew is a virtual cipher who, in his few public pronouncements, has appeared to toe the Rubin-Geithner line of minimal interference with America’s giant banks. And Lew is taking over as Treasury secretary at a critical time. Two and a half years after enactment, the Dodd-Frank financial law is still not fully implemented. Even as the winds of financial turbulence threaten from Europe, financial-industry officials admit the Federal Deposit Insurance Corp. has not developed the capacity to liquidate banks in the event of a crisis. Although it never became a 2012 campaign issue, financial regulation has lagged well behind schedule (no one even seemed to care, for example, when Mitt Romney failed to propose an alternative to Dodd-Frank, even though he had promised to do so). Wall Street’s lobbyists have managed to delay the “Volcker Rule” —the closest thing we have today to a Glass-Steagall law separating federally insured commercial banking from risky investment banking—by six months. The banks are also engaged in a behind-the-scenes effort to escape U.S. oversight of their derivatives activities overseas.

Into this den of super-sophisticated—and savage—lions of finance will walk the gentle-mannered figure of Jack Lew, who is expected to be easily confirmed. Hopes for change—any real progress in containing the power and systemic size of the banks—are not high. “By going with Jack Lew, Obama is making the decision: ‘I don’t want a fight over Treasury secretary. I want someone who’s going to maintain the status quo.’ That’s what Jack Lew represents,” says Jeff Connaughton, who as a senior Senate staffer fought for financial reform and later, in despair, wrote a book titled Wall Street Always Wins.

A Brief History of Rubinomics SEE LINK

The Trillion Dollar Coin: Joke or Game-Changer? By Ellen Brown, Web of Debt

http://www.truthdig.com/report/item/the_trillion_dollar_coin_joke_or_game-changer_20130118/...For centuries, a secret battle has raged over who should create the nation’s money supply – governments or banks. Today, all that is left of the US Treasury’s money-creating power is the ability to mint coins. If we the people want to reclaim that power so that we can pay our obligations when due, the Treasury will need to mint more than nickels and dimes. It will need to create some coins with very large numbers on them.

To bail out the banks, the Federal Reserve, as head of the private banking system, issued over $2 trillion as “quantitative easing,” simply by creating the money on a computer screen. Congress, the White House, and the Treasury all rolled over and acquiesced. When it was proposed that the government bail itself out of its budget woes by minting a $1 trillion coin, the Federal Reserve said it would not accept the Treasury’s legal tender. And the White House again acquiesced, evidently embarrassed to have entertained this “ludicrous” alternative. Somehow we have come to accept that it is less silly for the central bank to create money out of thin air and lend it at near zero interest to private commercial banks, to be re-lent to the public and the government at market interest rates, than for the government to simply create the money itself, debt- and interest-free. The banks obviously have the upper hand in this game; and they’ve had it for the last 2-1/2 centuries, making us forget that any other option exists. We have forgotten our historical roots. The American colonists did not think it was silly when they escaped a grinding debt to British bankers and a chronically short money supply by printing their own paper scrip, an innovative solution that allowed the colonies to thrive.

In fact, the trillion-dollar coin represents one of the most important principles of popular prosperity ever conceived: national debt-free money creation. Some of our greatest leaders, including Benjamin Franklin, Thomas Jefferson, and Abraham Lincoln, promoted the essential strategy behind it: that debt-free money offers a way to break the shackles of debt and free the nation to realize its full potential. We have lost not only the power to create our own money but the memory that we once had that power. With the help of such campaigns as Occupy Wall Street, Strike Debt, and the Free University, however, we are starting to re-learn the great secret of money: that how it gets created determines who has the power in society — we the people, or they the bankers.

It is no secret who has that power today. In the great bailout of 2008, banks were rewarded for making irresponsible and fraudulent gambles in the subprime mortgage scandal, with no one serving time in jail. Then there was the robosigning scandal, in which banks committed criminal fraud and came away with a slap on the wrist. Now we are seeing the LIBOR scandal unfold. While a commoner might get 10-20 years for robbing a bank, bank executives get huge bonuses for robbing us. We may rail against the banks and demand change, but nothing will change until we grasp their fundamental secret, the foundation of their power: that those who create the nation’s money control the nation. By mechanisms explained elsewhere, nearly the entire money supply today is created by banks...We have a chance today to end the charade of big money gridlock politics, as well as the reign of the big banks. We have the power to choose prosperity over austerity. But to do it, we must first restore the power to create money to the people.

**********************************************************

Ellen Brown is an attorney and president of the Public Banking Institute. In Web of Debt, her latest of eleven books, she shows how a private banking oligarchy has usurped the power to create money from the people themselves, and how we the people can get it back. Her book The Buck Starts Here: Restoring Prosperity with Publicly-owned Banks will be released this spring. Her websites are http://WebofDebt.com, http://EllenBrown.com, and http://PublicBankingInstitute.org.

MORE--A MUST READ AND BOOKMARK PIECE!

Weekend Economists Discover the Blue Men January 18-21, 2013

Ah, no, I didn't mean those people....(although they will do for the "art" theme), but these:

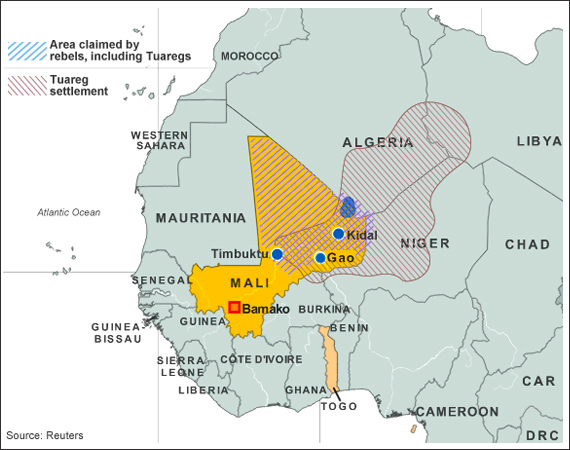

The Tuareg (also spelled Twareg or Touareg) are a Berber people with a traditionally nomadic pastoralist lifestyle. They are the principal inhabitants of the Saharan interior of North Africa.

The Tuareg language, or languages, have an estimated 1.2 million speakers. About half this number is accounted for by speakers of the Eastern dialect (Tamajaq, Tawallammat). Most Tuareg live in the Saharan parts of Niger and Mali but, being nomadic, they move constantly across national borders, and small groups of Tuareg are also found in southeastern Algeria, southwestern Libya and northern Burkina Faso, and a small community in northern Nigeria.

The name Tuareg is derived from Targa, the Berber name of Libya's Fezzan province. The name Tuareg thus in origin designated the inhabitants of Fezzan from the perspective of the Berbers living closer to the Mediterranean coast, and was adopted from them into English, French and German during the colonial period. The Berber noun targa means "drainage channel" and by extension "arable land, garden". It designated the Wadi al-Haya area between Sabha and Ubari and is rendered in Arabic as bilad al-khayr "good land".

The name of the Tuareg for themselves is Imuhagh (Imazaghan or Imashaghen, Imazighan). The term for a Tuareg man is Amajagh (var. Amashegh, Amahagh), the term for a woman Tamajaq (var. Tamasheq, Tamahaq, Timajaghen). The spelling variants given reflect the variety of the Tuareg dialects, but they all reflect the same linguistic root, expressing the notion of "freemen", strictly only referring to the Tuareg "nobility", to the exclusion of the artisan client castes and slaves. Another self-designation of more recent origin is linguistic, Kel Tamasheq or Kel Tamajaq (Neo-Tifinagh ⴾⴻⵍ ⵜⴰⵎⴰⵌⴰⵆ

Also encountered in ethnographic literature of the early 20th century is the name Kel Tagelmust "People of the Veil" and "the Blue People" (for the indigo colour of their veils and other clothing, which sometimes stains the skin underneath).

---wikipedia

One of the classic conflicts amongst people throughout history has been the struggles between settled people who depend on agriculture and ownership of land, and the nomads, who build no cities, own no land, but take their herds from place to place in search of food and water. Trading can also be a way of life for the unsettled peoples....or theft, for those who cannot or will not sustain themselves otherwise...another classic struggle has been between those who manufacture and accumulate wealth, and those who attack to loot and pillage the goods and populations: the pirates.

In the Sahel, as on the seas, or in the financial markets, individuals can play any or all of these roles. Except for our financial markets, the usual end game sees the nomads forcibly settled and the pirates wiped out by the more resourceful, settled people, who accumulate enough wealth and lust for their wealth to create superior armies and defenses.

With the turmoils of the Arab Spring, the rape of Libya and all the blowback, these isolated people have once again crossed the pages of history, and how the story ends, we do not yet know.

I'm betting it will end badly, however. It usually does.

The Problem with the Second Amendment by Mike Kimel

http://www.angrybearblog.com/2013/01/the-problem-with-second-amendment.html#moreA well regulated militia, being necessary to the security

of a free state, the right of the people to keep and bear arms, shall

not be infringed.

I am no constitutional scholar, or even an attorney, but I did take American History in high school, and it seems to me that the reason so many people argue about the Second Amendment to the US Constitution is because nobody, and I do mean nobody, quite likes what it means and how it was intended.

And let's be blunt, we know precisely what the framers, the signers, and ratifiers of the Constitution thought this amendment meant. See, two years after the Constitution took effect, there were rumblings in Western Pennsylvania, mostly about taxes on whiskey, security issues, and navigation along the Mississippi river. Eventually it all came to a head in the so-called Whiskey Rebellion.

President George Washington, with the support of the legislative and judicial branches of government, raised a militia to deal with the problem. (WE HAD NO STANDING ARMY--DEMETER) Before we get to what this militia looked like, bear in mind: a sizable fraction of our legislators at the time had been involved in the drafting, signing, and/or ratification of the Constitution. A Justice of the Supreme Court, James Wilson, himself a signer of the Declaration of Independence and a member of the Committee of Detail which wrote the first draft of the Constitution, signed off on the order raising the militia. So rest assured, what came next is absolutely, precisely how the Framers of the Constitution collectively interpreted the Second Amendment that they had written.

To make a long story short, men from four states were conscripted into a militia (yes, there were volunteers, but not enough) and sent to put down the rebellion.

The next time anyone, on whatever side of the debate, tells you they are firm supporters of the Second Amendment, ask them if they believe it was intended to allow the Federal government to round up citizens against their will, put them in uniforms, and make them march and fire upon other citizens in order to crush revolts and collect taxes.

If they do not, then politely remind them that is the Founding Fathers chose to interpret the Constitution they themselves hashed out, agreed upon, signed and ratified. And then, for grins and giggles, ask them why they are so unpatriotic as to insist on clinging to an un-American belief that the Founding Fathers would certainly have deemed un-Constitutional.

Profile Information

Gender: FemaleHometown: Ann Arbor, Michigan

Home country: USA

Member since: Thu Sep 25, 2003, 02:04 PM

Number of posts: 85,373