Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Scuba

Scuba's Journal

Scuba's Journal

December 17, 2013

But if, by contrast, the Great Recession was in material part the product of intentional fraud, the failure to prosecute those responsible must be judged one of the more egregious failures of the criminal justice system in many years. Indeed, it would stand in striking contrast to the increased success that federal prosecutors have had over the past fifty years or so in bringing to justice even the highest-level figures who orchestrated mammoth frauds. Thus, in the 1970s, in the aftermath of the “junk bond” bubble that, in many ways, was a precursor of the more recent bubble in mortgage-backed securities, the progenitors of the fraud were all successfully prosecuted, right up to Michael Milken.

Again, in the 1980s, the so-called savings-and-loan crisis, which again had some eerie parallels to more recent events, resulted in the successful criminal prosecution of more than eight hundred individuals, right up to Charles Keating. And again, the widespread accounting frauds of the 1990s, most vividly represented by Enron and WorldCom, led directly to the successful prosecution of such previously respected CEOs as Jeffrey Skilling and Bernie Ebbers.

In striking contrast with these past prosecutions, not a single high-level executive has been successfully prosecuted in connection with the recent financial crisis, and given the fact that most of the relevant criminal provisions are governed by a five-year statute of limitations, it appears likely that none will be. It may not be too soon, therefore, to ask why.

...

One possibility, already mentioned, is that no fraud was committed. This possibility should not be discounted. Every case is different, and I, for one, have no opinion about whether criminal fraud was committed in any given instance. But the stated opinion of those government entities asked to examine the financial crisis overall is not that no fraud was committed. Quite the contrary. For example, the Financial Crisis Inquiry Commission, in its final report, uses variants of the word “fraud” no fewer than 157 times in describing what led to the crisis, concluding that there was a “systemic breakdown,” not just in accountability, but also in ethical behavior.

The Financial Crisis: Why Have No High-Level Executives Been Prosecuted?

http://www.nybooks.com/articles/archives/2014/jan/09/financial-crisis-why-no-executive-prosecutions/

But if, by contrast, the Great Recession was in material part the product of intentional fraud, the failure to prosecute those responsible must be judged one of the more egregious failures of the criminal justice system in many years. Indeed, it would stand in striking contrast to the increased success that federal prosecutors have had over the past fifty years or so in bringing to justice even the highest-level figures who orchestrated mammoth frauds. Thus, in the 1970s, in the aftermath of the “junk bond” bubble that, in many ways, was a precursor of the more recent bubble in mortgage-backed securities, the progenitors of the fraud were all successfully prosecuted, right up to Michael Milken.

Again, in the 1980s, the so-called savings-and-loan crisis, which again had some eerie parallels to more recent events, resulted in the successful criminal prosecution of more than eight hundred individuals, right up to Charles Keating. And again, the widespread accounting frauds of the 1990s, most vividly represented by Enron and WorldCom, led directly to the successful prosecution of such previously respected CEOs as Jeffrey Skilling and Bernie Ebbers.

In striking contrast with these past prosecutions, not a single high-level executive has been successfully prosecuted in connection with the recent financial crisis, and given the fact that most of the relevant criminal provisions are governed by a five-year statute of limitations, it appears likely that none will be. It may not be too soon, therefore, to ask why.

...

One possibility, already mentioned, is that no fraud was committed. This possibility should not be discounted. Every case is different, and I, for one, have no opinion about whether criminal fraud was committed in any given instance. But the stated opinion of those government entities asked to examine the financial crisis overall is not that no fraud was committed. Quite the contrary. For example, the Financial Crisis Inquiry Commission, in its final report, uses variants of the word “fraud” no fewer than 157 times in describing what led to the crisis, concluding that there was a “systemic breakdown,” not just in accountability, but also in ethical behavior.

December 17, 2013

Colorado cities jail poor who can't pay fines for minor offenses

http://www.denverpost.com/news/ci_24726701/colorado-cities-jail-poor-who-cant-pay-finesCourts throughout Colorado are sending impoverished people to jail, not because they've committed crimes, but because they can't pay fines for violations as small as traffic offenses or dog-leash and pet-licensing laws. It's a practice that critics say violates the U.S. and Colorado constitutions and amounts to a resurgence of debtors' prisons, which were abolished in the 1800s. Civil rights lawyers also argue that it's a waste of resources and ends up penalizing those in poverty.

"Jailing Colorado residents because they are too poor to pay their fines is a bad idea for multiple reasons," said Mark Silverstein, legal director of the American Civil Liberties Union of Colorado. "It doesn't get the fine paid. It wastes resources. It worsens poverty. It unfairly creates a two-tiered justice system."

A 1983 U.S. Supreme Court ruling found that jailing poor people for not paying court-related fines violates the constitution's equal protection clause.

...

But in nine of the largest 16 cities in Colorado, the ACLU found that judges routinely issue "pay-or-serve" warrants against those too poor to pay court fines. In such cases, individuals are given a stark option: Pay up in cash or pay off fines by serving time in jail. Some judges don't give defendants a court hearing before sending them to jail for unpaid fines. When hearings are held, judges routinely ignore signs of indigence, such as notations on the police summons that the defendant is homeless, a review of court files shows.

"Jailing Colorado residents because they are too poor to pay their fines is a bad idea for multiple reasons," said Mark Silverstein, legal director of the American Civil Liberties Union of Colorado. "It doesn't get the fine paid. It wastes resources. It worsens poverty. It unfairly creates a two-tiered justice system."

A 1983 U.S. Supreme Court ruling found that jailing poor people for not paying court-related fines violates the constitution's equal protection clause.

...

But in nine of the largest 16 cities in Colorado, the ACLU found that judges routinely issue "pay-or-serve" warrants against those too poor to pay court fines. In such cases, individuals are given a stark option: Pay up in cash or pay off fines by serving time in jail. Some judges don't give defendants a court hearing before sending them to jail for unpaid fines. When hearings are held, judges routinely ignore signs of indigence, such as notations on the police summons that the defendant is homeless, a review of court files shows.

December 16, 2013

"The One Day" by Donald Hall - a short excerpt

http://writersalmanac.publicradio.org/index.php?date=2001/07/05There are ways to get rich: Find an old corporation,

self-insured, with capital reserves. Borrow

to buy: Then dehire managers; yellow-slip maintenance;

pay public relations to explain how winter is summer;

liquidate reserves and distribute cash in dividends:

Get out, sell stock for capital gains, reward the usurer,

and look for new plunder—leaving a milltown devastated,

workers idle on streetcorners, broken equipment, no cash

for repair or replacement, no inventory or credit.

Then vote for the candidate who abolishes foodstamps.

Or: Buy fifty acres of pasture from the widower:

Survey, cut a road, subdivide; bulldoze the unpainted

barn, selling eighteenth-century beams with bark

still on them; bulldoze foundation granite that oxen sledded;

bulldoze stone walls set with lost skill; bulldoze the Cape

the widower lived in; bulldoze his father's seven-apple tree.

Drag the trailer from the scraggly orchard to the dump:

Let the poor move into the spareroom of their town

cousins; pave garden and cornfield; build weekend houses

for skiers and swimmers; build Slope 'n' Shore; name the new

road Blueberry Muffin Lane; build Hideaway Homes

for executives retired from pricefixing for General Electric

and migrated north out of Greenwich to play bridge

with neighbors migrated north out of Darien. Build huge

centrally heated Colonial ranches—brick, stone, and wood

confounded together—on pasture slopes that were white

with clover, to block public view of Blue Mountain.

Invest in the firm foreclosing Kansas that exchanges

topsoil for soybeans. Vote for a developer as United States

senator. Vote for statutes that outlaw visible poverty.

self-insured, with capital reserves. Borrow

to buy: Then dehire managers; yellow-slip maintenance;

pay public relations to explain how winter is summer;

liquidate reserves and distribute cash in dividends:

Get out, sell stock for capital gains, reward the usurer,

and look for new plunder—leaving a milltown devastated,

workers idle on streetcorners, broken equipment, no cash

for repair or replacement, no inventory or credit.

Then vote for the candidate who abolishes foodstamps.

Or: Buy fifty acres of pasture from the widower:

Survey, cut a road, subdivide; bulldoze the unpainted

barn, selling eighteenth-century beams with bark

still on them; bulldoze foundation granite that oxen sledded;

bulldoze stone walls set with lost skill; bulldoze the Cape

the widower lived in; bulldoze his father's seven-apple tree.

Drag the trailer from the scraggly orchard to the dump:

Let the poor move into the spareroom of their town

cousins; pave garden and cornfield; build weekend houses

for skiers and swimmers; build Slope 'n' Shore; name the new

road Blueberry Muffin Lane; build Hideaway Homes

for executives retired from pricefixing for General Electric

and migrated north out of Greenwich to play bridge

with neighbors migrated north out of Darien. Build huge

centrally heated Colonial ranches—brick, stone, and wood

confounded together—on pasture slopes that were white

with clover, to block public view of Blue Mountain.

Invest in the firm foreclosing Kansas that exchanges

topsoil for soybeans. Vote for a developer as United States

senator. Vote for statutes that outlaw visible poverty.

December 16, 2013

It appears that this Is a very active scam, and evidently quite successful

SCAM ALERT – New VISA scam

http://www.wicrimeprevention.com/?p=960Person calling says – ‘This is (name), and I’m calling from the Security and Fraud Department at VISA. My Badge number is 12460, Your card has been flagged for an unusual purchase pattern, and I’m calling to verify. This would be on your VISA card which was issued by (name of bank). Did you purchase an Anti-Telemarketing Device for $497.99 from a marketing company based in Arizona ?’ When you say ‘No’, the caller continues with, ‘Then we will be issuing a credit to your account. This is a company we have been watching and the charges range from $297 to $497, just under the $500 purchase pattern that flags most cards. Before your next statement, the credit will be sent to (gives you your address), is that correct?’ You say ‘yes’.

The caller continues – ‘I will be starting a Fraud Investigation. If you have any questions, you should call the 1- 800 number listed on the back of your card (1-800-VISA) and ask for Security. You will need to refer to this Control Number. The caller then gives you a 6 digit number. ‘Do you need me to read it again?’

Here’s the IMPORTANT part on how the scam works - The caller then says, ‘I need to verify you are in possession of your card’. He’ll ask you to ‘turn your card over and look for some numbers’. There are 7 numbers; the first 4 are part of your card number, the last 3 are the Security Numbers that verify you are the possessor of the card. These are the numbers you sometimes use to make Internet purchases to prove you have the card. The caller will ask you to read the last 3 numbers to him. After you tell the caller the 3 numbers, he’ll say, ‘That is correct, I just needed to verify that the card has not been lost or stolen, and that you still have your card Do you have any other questions?’

The real VISA told us that they will never ask for anything on the card as they already know the information since they issued the card! If you give the scammers your 3 Digit PIN Number, you think you’re receiving a credit; however, by the time you get your statement you’ll see charges for purchases you didn’t make, and by then it’s almost too late and/or more difficult to actually file a fraud report.

The caller continues – ‘I will be starting a Fraud Investigation. If you have any questions, you should call the 1- 800 number listed on the back of your card (1-800-VISA) and ask for Security. You will need to refer to this Control Number. The caller then gives you a 6 digit number. ‘Do you need me to read it again?’

Here’s the IMPORTANT part on how the scam works - The caller then says, ‘I need to verify you are in possession of your card’. He’ll ask you to ‘turn your card over and look for some numbers’. There are 7 numbers; the first 4 are part of your card number, the last 3 are the Security Numbers that verify you are the possessor of the card. These are the numbers you sometimes use to make Internet purchases to prove you have the card. The caller will ask you to read the last 3 numbers to him. After you tell the caller the 3 numbers, he’ll say, ‘That is correct, I just needed to verify that the card has not been lost or stolen, and that you still have your card Do you have any other questions?’

The real VISA told us that they will never ask for anything on the card as they already know the information since they issued the card! If you give the scammers your 3 Digit PIN Number, you think you’re receiving a credit; however, by the time you get your statement you’ll see charges for purchases you didn’t make, and by then it’s almost too late and/or more difficult to actually file a fraud report.

It appears that this Is a very active scam, and evidently quite successful

December 13, 2013

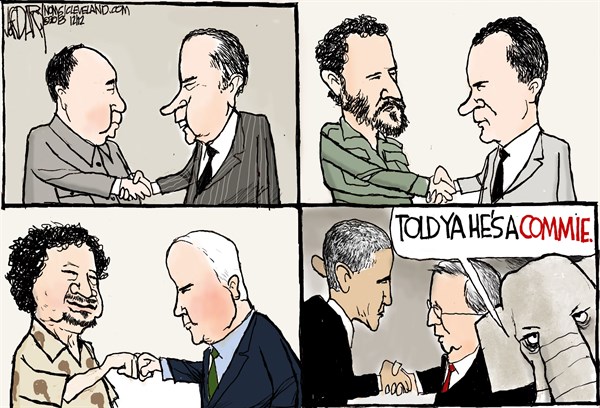

So what's with media dot cagle dot com graphics?

I use Google Chrome and cannot see any of the graphics where media.cagle.com is the URL host. If I copy the url and paste it into the address bar, I might see part of the graphic. Do a refresh, and I see less!

Anybody else have this issue? Know of a solution?

Example....

I see only a small picture icon, not the graphic.

Profile Information

Member since: Thu Apr 29, 2010, 03:31 PMNumber of posts: 53,475